Bitcoin educator Anita Posch tested the Blixt, Green, Mutiny, Phoenix and Zeus Lightning wallets while traveling in Zimbabwe.

Jack Dorsey’s Block Bitkey Bitcoin Wallet Comes to Market in More Than 95 Countries

Jack Dorsey’s company’s new self-custody wallet consists of an app, hardware device and recovery tools.

Ethereum Surges Ahead Of Bitcoin In Active Addresses, What Does This Mean?

Since its inception, Ethereum has continuously been compared to Bitcoin with the former being hailed as a better option to the latter in some cases. As the years have flown by, the competition has gotten even fiercer, especially with ETH growing rapidly. Eventually, Ethereum seems to be catching up with Bitcoin, especially in terms of active addresses.

Ethereum Active Addresses Surpass Bitcoin

On Thursday, September 14, on-chain data tracker Santiment revealed a surprising update on the fierce rivalry between Bitcoin and Ethereum. In the X post, the tracker revealed that the number of unique addresses that were transaction on the network had reached its second-highest daily figure of all time.

While this is significant on the part of the blockchain alone, it is also significant in terms of the competition between the two largest assets in the space. To put this in perspective, the 1,089,893 figure reported by Santiment puts Ethereum ahead of Bitcoin in terms of this metric alone.

The last time that the daily unique active addresses on the network hit its new all-time high was back in December 2022. So it has been almost a year since the metric was this high, suggesting a unique driving factor behind it.

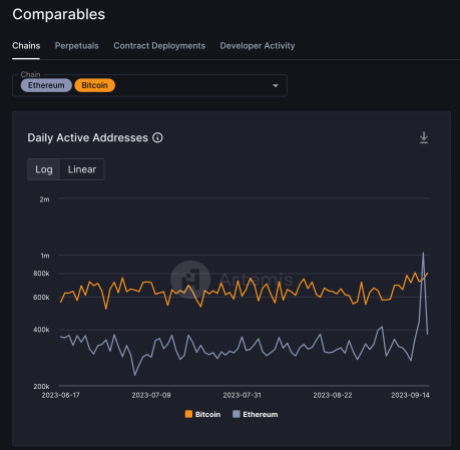

This report is also in line with the report from Artemis Terminal that shows that Ethereum was right in front of Bitcoin in terms of daily active addresses.

Artemis reports that on September 13, Ethereum saw a total of 1.03 million daily addresses compared to Bitcoin’s 743,800 addresses in the same time period. However, this figure has since retracted and Bitcoin has pulled in front of Ethereum once more as of September 14.

What Does This Mean?

While Ethereum’s surge on Wednesday was impressive, it does not mean much since the network has been unable to sustain the growth. Also, the surge could be easily explained by the rise in the popularity of the Friend.Tech decentralized finance social media platform based on the Ethereum blockchain.

Friend.Tech had seemingly come back from the death to reach a new all-time high in its number of daily users. Since an ETH address is required to participate in the platform, it is no surprise there was an uptick in the number of ETH addresses active on the network.

The spike in the number of daily active addresses also seems to have had little impact on the price of the cryptocurrency itself. ETH’s price is still struggling to hold above $1,600, with small gains of 0.35% in the last day and losses of 1.15% in the last week.

Bitcoin Wallet Activity Touches 5-Month High, Will BTC Price Follow?

Despite the less-than-impressive performance over the last few months, Bitcoin investors are still digging their heels deeper into the digital asset. This is evidenced by the continuous rise in wallet activity that has been recorded during this time.

Bitcoin Wallet Activity Hits Highest In 5 Months

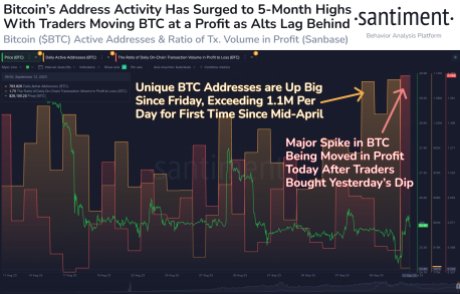

In a Tuesday post, on-chain data aggregator Santiment revealed that there has been a significant uptick in Bitcoin wallet activity despite the BTC price downtrend. Apparently, while the market had fluctuated heavily due to regulatory uncertainties, Bitcoin investors held their own, especially in terms of new wallet address activity.

The Santiment reports show fluctuations in this metric over the months. However, the one consistent thing was the tendency to jump back up even after dipping significantly. In September alone, the metric has moved from a low of around 860,000 to over 1.1 million unique daily Bitcoin addresses active.

Interestingly, this figure is the highest this metric has been since April, proving that the BTC price downtrend has not served as a deterrent for Bitcoin investors. Rather, it looks as if investors are using the current low prices as a way to increase their footprint.

The uptick can also be explained by the euphoria triggered by asset manager Franklin Templeton filing for a Spot Bitcoin ETF. While the hype around the filing was short-lived, it triggered a brief uptick in the price of the digital asset, and likely aided the rising wallet activity rate as investors rushed to take advantage of the growth.

Will BTC Price Follow Wallet Activity?

Even though wallet activity is up, the BTC price is still straining below $26,000. This could suggest that this metric does not really have much bearing on the price of Bitcoin. Rather, it just points to investors not slowing down usage of the network despite low prices.

Presently, investors are still eagerly awaiting a decision on the numerous Spot BTC ETFs that have been filed by fund managers. The outcome of these filings, whether rejected or accepted, will likely be the defining factor for the Bitcoin price going forward.

For now, there are no big moves to be expected for the digital asset, especially given the fact that it is still ranging below its 50-day and 100-day moving averages. Mounting resistance between $26,000-$27,000 suggests that Bitcoin might continue to trade sideways for the better part of September.

At the time of writing, Bitcoin is treacherously holding above $26,000 with meager gains of 0.64% in the last day.

Mutiny’s New Browser-Based Bitcoin Wallet on Lightning Avoids App Store Restrictions

The company says it’s the “first self-custodial lightning wallet that runs on the web” – a design feature that may avoid any restrictions that might be placed on the technology from app stores run by the likes of Apple or Google.

Number Of Bitcoin Millionaires On The Rise As Accumulation Continues

Bitcoin millionaires are now a widely understood term. This has grown from the massive surge in the price of the digital asset which has continued to decrease the number of BTC required to be a millionaire. A number of bitcoin millionaires had lost their status when the price of the digital asset had declined. However, as bitcoin is recovering, these millionaires have been growing in number but data shows that the increase in price is not the only driver.

Accumulation Is The Name Of The Game

The price of bitcoin had declined significantly following the Russian invasion of Ukraine. This had seen a considerable number of bitcoin millionaires lose their status. But since then, there have been more investors being added to the millionaires’ list.

Related Reading | Bitcoin Futures Basis Nears One-Year Lows, How Will This Affect BTC?

Santiment notes in a new report that the number of bitcoin addresses had been on a steady increase since the way between Russia and Ukraine had started. Not only had the number of addresses been on the rise but whale addresses have been rising. These addresses which hold between 10 to 100k BTC on their balances which were either existing or new had been able to reclaim their millionaire status.

The number of #Bitcoin addresses has been increasing since the #RussianUkrainianWar began. Since then, there are 1,629 shark and whale addresses holding between 10 to 100k that are either new or have returned to this millionaire (or above) status.

The number of #Bitcoin addresses has been increasing since the #RussianUkrainianWar began. Since then, there are 1,629 shark and whale addresses holding between 10 to 100k that are either new or have returned to this millionaire (or above) status.  https://t.co/08ytC3aMhW pic.twitter.com/9Ts70gdfHJ

https://t.co/08ytC3aMhW pic.twitter.com/9Ts70gdfHJ

— Santiment (@santimentfeed) April 27, 2022

Usually, the obvious culprit for the number of bitcoin millionaires growing can be a surge in price. This drastically increases the value of the tokens held. However, with the price of BTC now making any significant recoveries recently, there is another reason for this and that has been accumulation.

The chart from Santiment shows that these investors have been accumulating BTC at an accelerated rate. This accumulation had seen a sharp increase at the end of March before falling but the whales are once again picking up momentum as the month of April draws to a close.

So instead of regaining their millionaire status by waiting for the price of BTC to go up, these whales have been buying more coins. This also follows the recent trend of daily active addresses picking up on the network. Network transaction volume is also up in this regard.

Bitcoin Turning Bullish

Bitcoin had lost its footing at $40,000 earlier in the week. This had caused a stir among bears as they tried to drag down the price of the asset. BTC had continued to hold above its $36,000 support level, serving as a bounce point for its recent recovery.

BTC trading in the mid $39,000s | Source: BTCUSD on TradingView.com

Currently, bitcoin is trading above the 5-day moving average. An indicator that proves that investors are now willing to purchase the digital asset higher than the prices they bought days ago. This can often spell a shift in sentiment for investors but only for the very short term.

Related Reading | Bitcoin Drops To $38K After Amazon Retraction On Accepting BTC Payments

BTC still needs to hold above $39,500 though as this remains a critical spot for it. A failure to secure the price above this point could see the digital asset retest the $35,000 in the coming days before any sign of recovery is registered.

Featured image from Altcoin Buzz, chart from TradingView.com

Electrum Developers Apply Fix After Apple Update Bricks Bitcoin Wallets

Apple’s most recent Mac update is causing major problems for one of Bitcoin’s oldest wallets.

Brainwallets: The Bitcoin Wallet You Probably Shouldn’t Use (Unless You Have To)

A “brainwallet” refers to a private key that is stored in the user’s memory in the form of a seed phrase or a passphrase.

Bitcoin ‘Young Investment’ Wallets at Highest Level Since February 2018

New investors are entering the bitcoin market at a faster pace and possibly creating upward pressure on prices, on-chain data shows.

Maker of Coldcard Bitcoin Wallet Rolls Out an Extra-Strength ‘USB Condom’

CoinKite, maker of the Coldcard hardware wallet, has introduced two accessories that underscore the near-paranoia required to safely hold bitcoin.

Maker of Coldcard Bitcoin Wallet Rolls Out an Extra-Strength ‘USB Condom’

CoinKite, maker of the Coldcard hardware wallet, has introduced two accessories that underscore the near-paranoia required to safely hold bitcoin.

BitMEX Is Making Bitcoin Network More Expensive for Everyone, Researcher Finds

Average fees paid by bitcoin users spike at a certain time every day due to the actions of one firm, derivatives exchange BitMEX, a researcher found.

Bitcoin Wallets Are Adopting This Tech to Simplify Lightning Payments

Bitcoin’s Lightning network has a long way to go in terms of user experience. To tackle this problem, a standard known as lnurl is quietly gaining ground.

Retail Accumulation? Number of Bitcoin Addresses With One or More Coins Sees Solid Rise

A key on-chain metric has witnessed solid growth over the past 12 months, possibly indicating steady accumulation of bitcoins by retail traders.

Bitcoin App Bottle Pay Shuts Down Over Impending EU Money-Laundering Laws

Bottle Pay is shutting down, citing the EU’s new AML rules, which could compel crypto wallet providers to collect KYC info from users starting next month.

Maker of Wasabi Bitcoin Wallet Valued at $7.5M in First Equity Round

The privacy-centric Wasabi Wallet, launched by zkSNACKs in 2018, just raised its first equity investment from Cypherpunk Holdings, a publicly-traded Canadian fund.

The ‘Bitcoin Rich List’ Has Grown 30% in the Last Year, But Why?

The number of bitcoin addresses holding more than 1,000 BTC has grown in the past 12 months, possibly reflecting an influx of wealthy investors.

Lightning Sucks, But It Could Help Build a Bitcoin Economy

At least a dozen startups are now betting on the profitability of bitcoin birthing a “Lightning Economy.” Is it too soon?

Bitcoin Lightning Wallets Are Gaining Traction in 2019

Lightning usage is growing steadily in 2019, with several startups now offering retail-friendly wallets.

Protestors Set Alleged Bitcoin Ponzi Scheme Perpetrator’s Home on Fire

Before shutting down, Bitcoin Wallets’ “manager” promised 100-percent returns on investors’ money in just two weeks. Then they burned down his house.