The upgrade seeks to solve congestion issues, and will officially launch in May.

How the Bitcoin Halving Will Drive Action to Layer 2s

Market Expert Predicts New Paradigm For Bitcoin: ‘Days Under $100,000 Numbered’

As the Bitcoin (BTC) Halving event concluded for the fourth time, the cryptocurrency market witnessed notable changes in key metrics.

These developments have led Charles Edwards, a market expert and founder of Capriole Invest, to issue bold predictions that hint at a paradigm shift in the BTC market.

Bitcoin Trading At ‘Deep Discount’

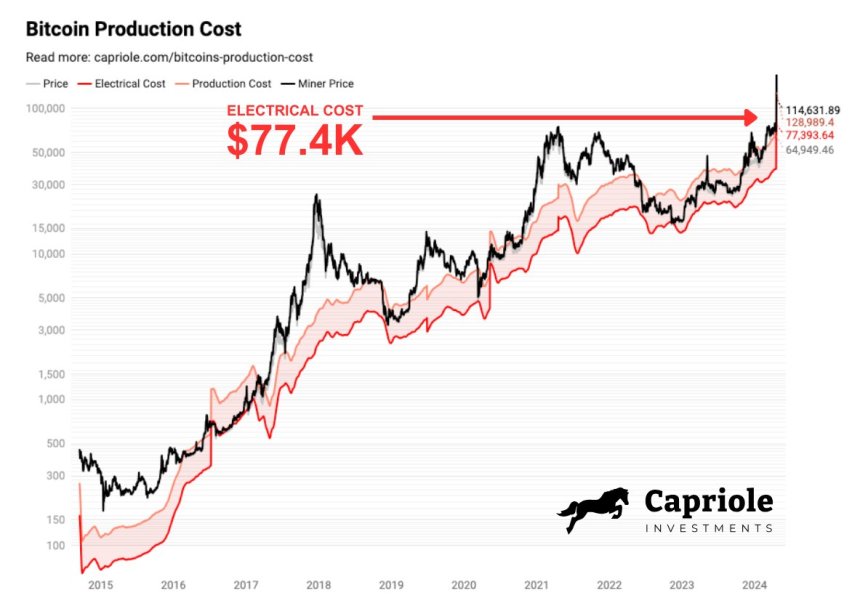

One of the key metrics highlighted by Edwards is the staggering electrical cost associated with mining a single Bitcoin. Edwards reveals that this cost has now reached an astonishing $77,4000. This figure represents the raw electricity expenses required to power the Bitcoin network for every newly mined BTC.

Another significant metric that Edwards draws attention to is the Bitcoin Miner Price, which soared to $244,000 on Saturday. This metric encompasses the block reward and fees miners receive for every Bitcoin they successfully mine.

Notably, this surge in miner price coincided with transaction fees skyrocketing to $230, marking a four-fold increase compared to the previous all-time high of $68 set in 2021.

Considering the metrics above, Edwards suggests that BTC currently trades at a “deep discount.” This is because BTC’s price is lower than the electrical costs of mining it.

Typically, this situation only lasts for a few days every four years, suggesting that the price will only take a short time to catch up and surpass this price level, which is slightly below BTC’s all-time high (ATH) of $73,7000, reached on March 14th.

Edwards outlines three possible outcomes in the wake of these developments. First, he anticipates a scenario in which the price of Bitcoin experiences a significant surge.

Secondly, there is a likelihood that approximately 15% of miners may be forced to shut down due to unfavorable economics. Finally, Edwards suggests that average transaction fees are expected to remain substantially higher.

Based on the analysis of these metrics and the potential scenarios, Edwards boldly predicts that Bitcoin’s days under the $100,000 mark are “numbered.” While it remains to be seen which of the three outcomes will prevail, Edwards expects a combination of all three factors to contribute to Bitcoin’s price appreciation.

Optimal Buying Opportunity?

Bitcoin has demonstrated significant price consolidation above the $60,000 mark since Friday, following temporary drops below this threshold amid mounting anticipation for the Halving event.

Crypto analyst Ali Martinez recently analyzed Bitcoin’s current price state, suggesting that a potential bottom may have formed above these levels, increasing the likelihood of surpassing upper resistance levels shortly.

According to Ali Martinez’s analysis, Bitcoin strives to establish the $66,000 price level as a crucial support zone. Data reveals that approximately 1.54 million addresses collectively purchased 747,000 BTC at this level. If Bitcoin successfully secures this support, it may pave the way for further upward movement.

Martinez identifies Bitcoin’s next critical resistance levels, between $69,900 and $71,200. These levels represent significant price barriers for BTC bulls, and Bitcoin may encounter selling pressure at these levels.

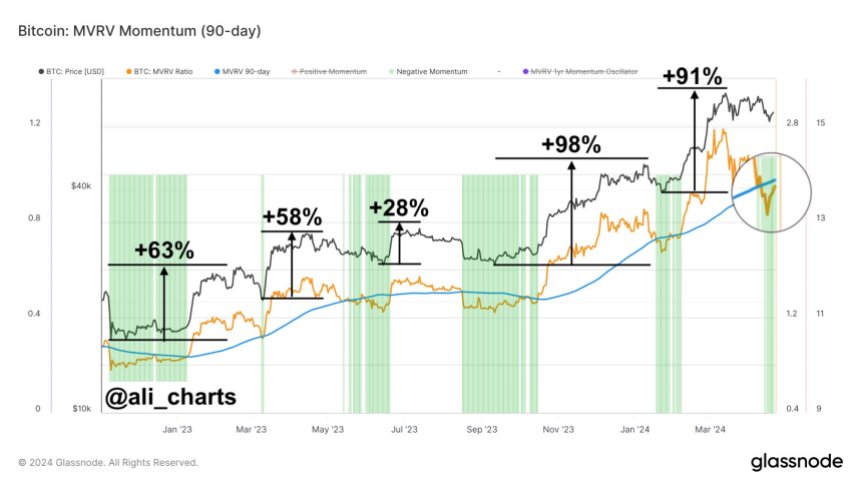

In addition, the analyst points out that the Bitcoin MVRV ratio, a metric that compares the market value of Bitcoin to its realized value, has shown a promising pattern, as seen in the chart below.

Martinez highlights that whenever the MVRV ratio falls below its 90-day average since November 2022, it historically indicates an optimal buying opportunity for Bitcoin. Interestingly, such buying opportunities have resulted in average gains of approximately 67%.

According to Martinez, based on current market conditions and an analysis of the MVRV ratio, now may be an opportune time to consider buying Bitcoin. The historical data and the potential for significant price appreciation support this view.

BTC is trading at $66,100, up 1.6% in the past 24 hours.

Featured image from Shutterstock, chart from TradingView.com

Ethereum Spot ETFs Approval Skepticism Persists, As ETH Recovers

Ethereum Spot Exchange-Traded Funds (ETFs) approval odds continue to witness notable pessimism as the cryptocurrency space awaits the United States Securities and Exchange Commission’s (SEC) decision on the products scheduled for May.

The expectation surrounding the SEC’s decision highlights how important ETF approval is in terms of giving conventional investors more convenient access to Ethereum’s spot market. Presently, data from Polymarket, the world’s largest prediction market, shows that ETH ETF approval odds have fallen to a mere 11%.

Pessimism Deepens As Ethereum ETFs Remain Uncertain

As the May deadline draws near, doubt and skepticism loom large on the horizon, casting a dark shadow for the products. One of the most recent figures to voice doubts about the SEC’s willingness to approve the exchange-traded products this May is Nate Geraci, the president of ETF Store.

According to Geraci, the regulatory watchdog is eerily silent on Ethereum spot ETFs. He further suggested that the products might not be approved due to the SEC’s significantly lower level of engagement with ETF issuers than in previous interactions.

“Logic says that is correct, but also wonder if SEC learned a lesson from clown show with spot Bitcoin ETFs,” he added. Thus, he has pointed out two possible options for the products, which are either an approval or lawsuit from the Commission.

Commenting on the president’s insights, a pseudonymous X user questioned if there is a possibility that activities are taking place behind closed doors in order to avoid disrupting the pre-launch market. Geraci responded, saying he believes that could be possible, drawing attention to Van Eck CEO Jan Van Eck’s review, which might prove otherwise.

It is worth noting that Van Eck is one of the earliest firms to submit its application for an Ethereum exchange product. Even though the company was the first to file for an application, Jan Van Eck is pessimistic about the approval of the ETPs, saying they will probably be rejected in May.

He stated:

The way the legal process goes is the regulators will give you comments on your application, and that happened for weeks and weeks before the Bitcoin ETFs. And right now, pins are dropping as far as Ethereum is concerned.

In light of this, investors prepare for an unpredictable result while managing market swings and modifying their investment plans in the face of changing regulations.

ETH Price Sees Positive Movement

While Ethereum ETFs might be experiencing negative sentiment, ETH, on the other hand, has witnessed a positive uptick lately. ETH has revisited the $3,000 level again after falling as low as $2,888 during the weekend.

Today, ETH price rose by over 4%, reaching around $3,234, indicating potential for further price recovery. At the time of writing, Ethereum was trading at $3,215, demonstrating an increase of 1.40% in the past day.

Also, the asset’s market cap and trading volume are up by 1.40% and 5.96% in the last 24 hours. Given the anticipated impact of the recently concluded Bitcoin Halving on cryptocurrencies, ETH could be poised for noteworthy moves in the coming months.

Bitcoin Miner Hut 8’s Post-Merger Prospects Look Good: Benchmark

The new Hut 8 (HUT), resulting from the merger with US Bitcoin Corporation (USBTC) that closed last November, features a diversified business model with multiple revenue streams, broker Benchmark said in a research report on Monday.

Is The Bitcoin Bloodbath Over? Analysts Say $60,000 Is The Cycle’s Bottom

Bitcoin enthusiasts around the globe can now breathe a collective sigh of relief as the world’s premier cryptocurrency, Bitcoin, rebounds from a recent downturn.

Last week witnessed Bitcoin, akin to the broader market, sliding below the $60,000 mark, primarily due to risk aversion, the US tax season, and escalating geopolitical tensions in the Middle East. However, in a surprising turn of events, Bitcoin has not only recovered but has surged past the $66,000 mark, reigniting optimism and sparking discussions about its future trajectory.

This recent resurgence in Bitcoin’s price comes on the heels of a significant price correction that coincided with April’s highly anticipated Bitcoin halving event. The halving event, a recurring phenomenon in Bitcoin’s protocol, entails a reduction in the rate at which new Bitcoins are mined, effectively halving the supply.

20% drawdown would fit the current bull’s pattern: pic.twitter.com/usNxQz1t92

— Tuur Demeester (@TuurDemeester) April 18, 2024

Historically, this event has been associated with heightened market volatility, as some analysts feared that the supply shock could trigger a prolonged sell-off.

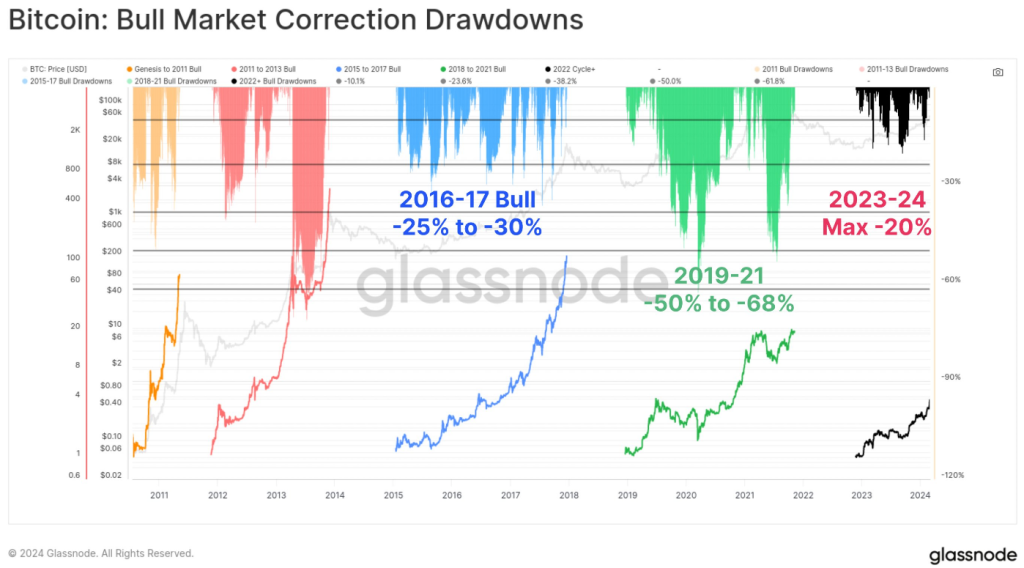

Nevertheless, prominent figures in the cryptocurrency space, such as Tuur Demeester, offer a more sanguine perspective. Demeester suggests that the recent dip to $60,000 might signal the floor of the correction, aligning with historical patterns observed during bull markets.

According to Demeester, a 20% drawdown from highs is considered a typical correction for Bitcoin, and thus, there is a strong possibility that $60,000 could serve as a support level moving forward.

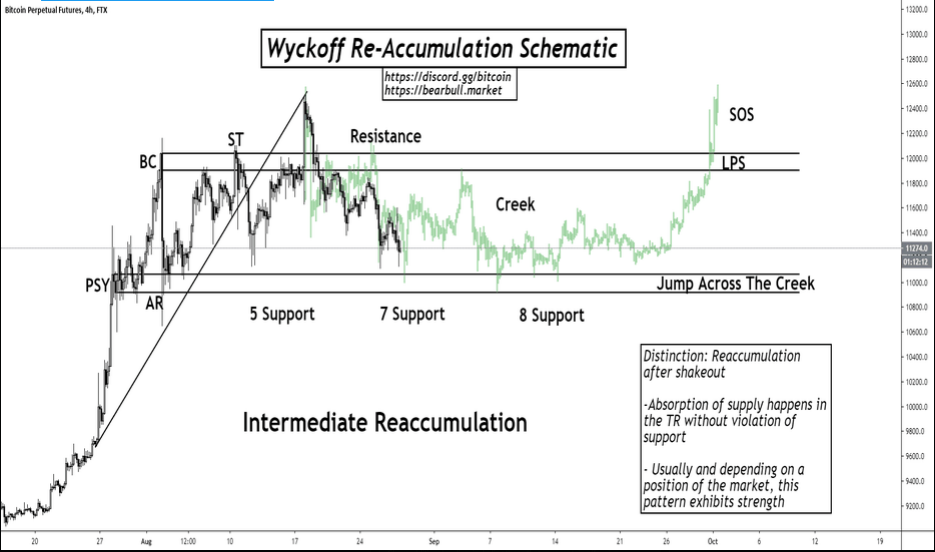

While Demeester advocates for stability in Bitcoin’s price, anoother analyst, McKenna, foresee a period of sideways movement. McKenna agrees with Demeester regarding the $60,000 floor but predicts that Bitcoin may enter a re-accumulation phase, characterized by prolonged sideways price action.

I think there is a high probability that the bottom for the halving selloff is in but simultaneously think there is an equal high probability that we are forming a re-accumulation range.

Meaning expect sideways price action for longer than expected. #BTC pic.twitter.com/K24Md0TKXH

— McKenna (@Crypto_McKenna) April 21, 2024

Interestingly, McKenna believes that this sideways movement could present an opportune moment for alternative cryptocurrencies, known as altcoins, to shine in the short term.

The recent resurgence in Bitcoin’s price has sparked optimism among investors and analysts alike. As attention turns to May, all eyes are on whether Bitcoin’s sideways movement materializes and if the effects of the halving event truly dissipate.

With cautious optimism prevailing, the current price range between $60,000 and $71,000 could become a pivotal zone for future price dynamics, ushering in a new era of prosperity in the cryptocurrency markets.

Featured image from Pxfuel, chart from TradingView

First Mover Americas: Bitcoin Layer 2s Have Their Moment

The latest price moves in bitcoin (BTC) and crypto markets in context for April 22, 2024. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Brazil Wants BTC: 7,400 Bitcoin Futures Contracts Created On First Day Of Trading

After announcing in March its plans to include Bitcoin futures in its offerings, B3, a Brazilian stock exchange, has officially opened up trades, achieving a significant milestone on its very first day of trading Bitcoin futures.

B3 Bitcoin Futures Sees Surge In Demand

Following its launch of Bitcoin futures on April 17, B3 experienced a massive wave of demand and interest from cryptocurrency enthusiasts eager to trade the newly listed Bitcoin futures. The stock exchange reported that on the debut trading day, more than 7,400 Bitcoin futures contracts were actively traded.

This unprecedented trading volume underscores investors’ strong interest in cryptocurrency derivatives as well as the increasing demand for BTC exposure among Brazilian cryptocurrency traders and enthusiasts.

Notably, B3 disclosed that the demand for Bitcoin futures on its exchange was so profound that it had hit 111,000 buy or sell orders on the trading screen. The market had displayed intense participation in the newly launched contracts, with the Director of Listed Products at B3, Marcos Skistymas, affirming that the heightened demand resulted from B3’s introduction of its first-ever derivative linked to a cryptocurrency.

The introduction of Bitcoin futures marks a significant step forward for the stock exchange, aligning with its vision to expand its offerings to cater to users’ needs. Skistymas has also indicated that the market’s response to the recently listed Bitcoin futures was overwhelmingly positive, reflecting a significant potential for these contracts within the Brazilian market.

BTC Futures To Act As A Hedge Against Market Volatility

According to Skistymas, Bitcoin futures were a “suitable instrument” that could become a hedge against Bitcoin, potentially providing Brazilian investors a means to manage the flurry of risks associated with Bitcoin’s price fluctuations.

For more clarity, a Bitcoin future is a contract between investors who wager on the future price of the pioneer cryptocurrency, providing exposure to Bitcoin without the need to purchase it. Given btc’s high volatility and price fluctuations during certain market conditions, accurately predicting the price of the cryptocurrency can be challenging. Additionally, only a handful of crypto analysts and investors have managed to forecast Bitcoin’s price actions with precision.

At the beginning of the year, the price of BTC surged from below $50,000 to an all-time high of more than $75,000 in March 2024. As of writing, the cryptocurrency is trading at $66,129 after witnessing a major price correction and plummeting by 0.09% over the past month, according to CoinMarketCap.

Irrespective of BTC’s unpredictability and price variations, the launch of Bitcoin futures on B3 has the potential to bring in a new era of adoption among Brazilian investors, providing them with fresh opportunities to diversify their portfolios with these regulated financial instruments.

Bitcoin Miners Have Raked in Abnormal Transaction Fees Since Halving: Bernstein

The spike in network fees was driven by speculative activity to mint new meme tokens following the launch of the Runes protocol, the report said.

Bitcoin’s Unique Volatility Profile in Focus as VIX and MOVE Spike

Bitcoin’s implied or expected volatility remains positively correlated with its price as traditional market fear gauges spike amid broad-based risk aversion.

Bitcoin Miners Strike Gold: $107 Million Profit From Runes-Fueled Minting Spree

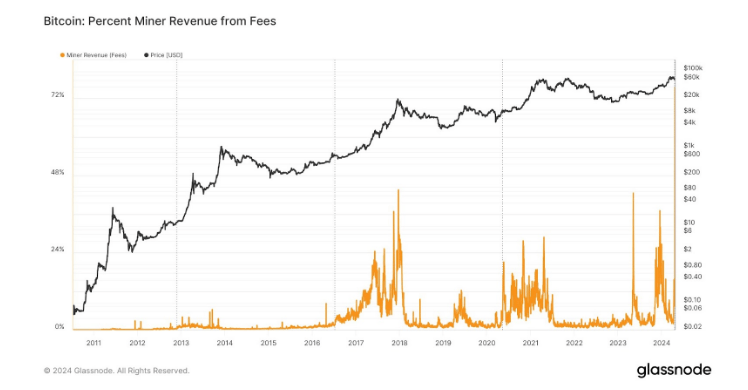

Bitcoin miners have struck a proverbial goldmine, reaping an astonishing $107 million in profits, according to data from Glassnode, a leading analytics platform. This unprecedented windfall, amassed on April 20th, underscores a significant shift in the revenue dynamics of Bitcoin mining operations.

The meteoric rise in transaction fees serves as a bellwether for the evolving economic landscape of Bitcoin mining. As the network adapts to new market demands and technological advancements, transaction fees have emerged as a crucial revenue stream for miners. This trend is particularly noteworthy given the scheduled reductions in block rewards, highlighting the resilience and adaptability of Bitcoin’s economic model.

According to glassnode, affected by the Runes minting activity, on April 20, Bitcoin miner revenue reached US$106.7 million, of which 75.444% came from network transaction fees, both reaching record highs. https://t.co/lVSyqn1UaE pic.twitter.com/xjkkTor2I9

— Wu Blockchain (@WuBlockchain) April 21, 2024

Runes-Fueled Minting Spree Boosts Miner Revenue

Driving this surge in profitability is a recent minting spree focused on Runes, a pivotal development that has left a tangible mark on the network’s dynamics. Reports indicate that a staggering 75% of the total profits stemmed from transaction fees, marking a new pinnacle in the distribution of revenue among BTC miners.

Runes is similar to Ordinals; they both let users permanently store data directly on the Bitcoin blockchain, like an inscription etched in stone. But there’s a key distinction in what they store: Ordinals are one-of-a-kind digital collectibles, similar to fancy trading cards.

Runes, on the other hand, are designed to act more like meme coins, those widely tradable and often humorous tokens that have been a recent craze in the crypto world.

This paradigm shift in income composition underscores the growing importance of transaction fees as a vital income source, especially as block rewards face planned reductions in the context of Bitcoin’s halving system.

This financial triumph comes amidst ongoing debates surrounding the sustainability and profitability of mining activities. With escalating energy demands and mounting regulatory scrutiny, the viability of mining operations has been called into question. However, the recent data paints a reassuring picture of the economic vitality of Bitcoin mining, demonstrating its resilience in the face of external pressures.

Implications For Bitcoin’s Future

Beyond the immediate financial gains, the surge in transaction fees holds profound implications for the future trajectory of Bitcoin. The unprecedented collection of fees signifies robust network activity and user engagement, indicating strong demand and utilization of the Bitcoin blockchain.

This bodes well for the long-term sustainability and development of Bitcoin as a prominent digital currency, bolstering confidence among stakeholders and enthusiasts alike.

Featured image from VistaCreate, chart from TradingView

Bitcoin Miners May Shift Focus to AI After Halving, CoinShares Says

Miners will be faced with substantial cost increases as a result of the halving, with electricity and bitcoin production costs almost doubling, the report said.

Bitcoin Layer 2 Coins, STX, ELA, SAVM, Outperform BTC After Halving

Bitcoin Transaction Fees Come Crashing Down Post Halving

After the halving, fees spiked to $146 for a medium-priority transaction and $170 for a high-priority transaction.

Bitcoin Price Approaches Breakout, Can BTC Pump Above $66K?

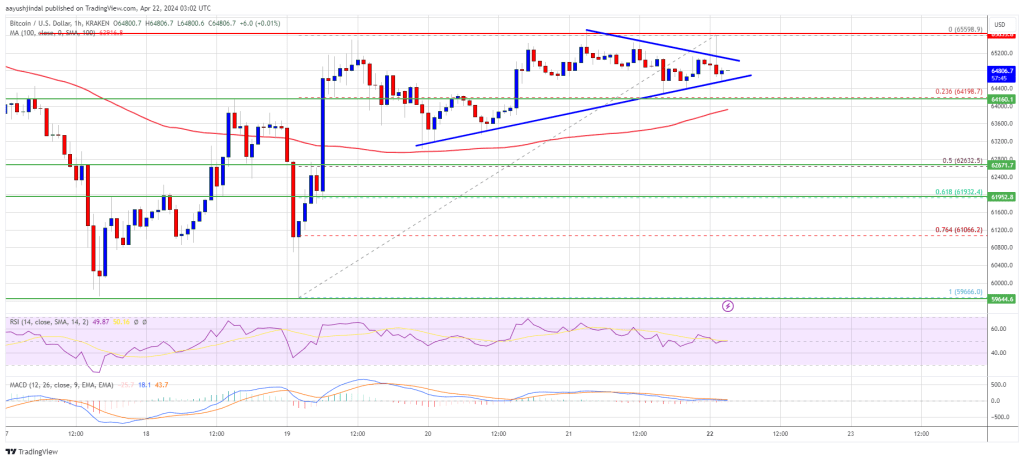

Bitcoin price recovered and climbed above the $64,000 resistance zone. BTC is now facing hurdles near the $65,500 and $66,000 levels.

- Bitcoin is now struggling to gain pace for a move above the $65,500 resistance zone.

- The price is trading above $64,000 and the 100 hourly Simple moving average.

- There is a key contracting triangle forming with resistance at $65,100 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a fresh surge if it clears the $65,500 resistance zone.

Bitcoin Price Starts Increase

Bitcoin price found support above $60,000 and started a fresh increase. BTC climbed above the $62,500 and $63,500 resistance levels. The bulls even pushed the price above the $65,000 level.

However, the bears seem to be active near the $65,500 zone. The recent high was formed at $65,598 and the price is now consolidating gains. There was a drop below the $65,000 level, but the price is still above the 23.6% Fib retracement level of the upward move from the $59,666 swing low to the $65,598 low.

Bitcoin price is trading above $64,000 and the 100 hourly Simple moving average. Immediate resistance is near the $65,100 level. There is also a key contracting triangle forming with resistance at $65,100 on the hourly chart of the BTC/USD pair.

The first major resistance could be $65,500. The next resistance now sits at $66,000. If there is a clear move above the $66,000 resistance zone, the price could continue to move up. In the stated case, the price could rise toward $67,500.

Source: BTCUSD on TradingView.com

The next major resistance is near the $68,500 zone. Any more gains might send Bitcoin toward the $70,000 resistance zone in the near term.

Downside Correction In BTC?

If Bitcoin fails to rise above the $65,500 resistance zone, it could start a downside correction. Immediate support on the downside is near the $64,500 level.

The first major support is $64,000. If there is a close below $64,000, the price could start to drop toward the 50% Fib retracement level of the upward move from the $59,666 swing low to the $65,598 low at $62,500. Any more losses might send the price toward the $61,200 support zone in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $64,500, followed by $64,000.

Major Resistance Levels – $65,100, $65,500, and $66,000.

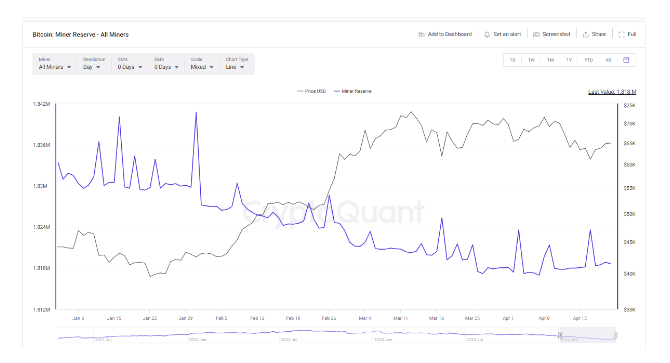

Were Bitcoin Miners Behind The BTC Price Crash Below $60,000?

The price of Bitcoin fell drastically towards the $60,000 mark in the days leading up to the just concluded halving. On-chain data has shed light on what could very well be the reason for this price dip in the middle of all the excitement around the halving.

Particularly, data has revealed that some miners have been selling their holdings in the days leading up to the halving event, with the entire BTC holdings of miners hitting a 12-year low.

Miners’ Bitcoin Holdings Hit 12-Year Low

On-chain analytics platform IntoTheBlock noted this interesting trend amongst Bitcoin miners. According to the platform’s “Miners’ Bitcoin Holdings,” the collective BTC reserve across various miners has now dropped below 1.9 million BTC, its lowest in over 12 years.

Interestingly, the metric shows that miner reserves have been on a continued trend of outflows since the beginning of the year, just after the approval of Spot Bitcoin ETFs. This means the outflow from miner wallets can be linked to increased demand from the various Bitcoin ETF wallets, with the latter now controlling over 4.27% of the total circulating wallets.

As Bitcoin goes into the halving, miners’ BTC holdings hit 12 year low. This indicates that miners have been net sellers leading up to the halving. pic.twitter.com/WNi74RkluG

— IntoTheBlock (@intotheblock) April 19, 2024

At the time of writing, CryptoQuant data puts the total number of miner reserves at 1.818 million BTC, a decrease of 22,000 BTC from 1.84 million on January 3. Additionally, this outflow from the miner reserves was exacerbated in the days leading up to the halving, as noted by IntoTheBlock.

“This indicates that miners have been net sellers leading up to the halving,” IntoTheBlock said in a social media post.

The persistent selling pressure exerted by miners may have been a contributing factor in Bitcoin’s stagnant pace between $65,000 and $70,000 over the past weeks. This outflow of BTC from miner wallets into the market seems to have flooded the market with more than enough BTC, which in turn contributed to a crash to $60,000 during the week.

What’s Next For Bitcoin?

The practice of Bitcoin miners selling their holdings in the days leading up to the halving is not unusual, as demonstrated by their actions in past halving events. At the time of writing, Bitcoin is trading at $64,978, up 8% after rebounding up at $60,000. The much anticipated fourth Bitcoin halving has now been completed and the industry looks forward to its effect over the next few months.

The halving is ultimately a balancing act for miners. Although miners’ revenues are cut in half, the reduced Bitcoin supply and possible price increase can help offset some of the losses over time. According to a report, Bitcoin miners could sell up to $5 billion worth of BTC after the halving, with the price of the cryptocurrency potentially falling to $52,000.

Featured image from Pexels, chart from TradingView

Bitcoin Tipped To Attain Six-Figure Value Following Fourth Halving – Details

With the Bitcoin halving event now completed, analysts and market experts turn their attention to a much-anticipated bull run based on historical trends in the BTC market. In particular, a crypto analyst with the X handle ecoinometrics has tipped the maiden cryptocurrency to at least achieve a six-figure in the current bull cycle.

How High Can Bitcoin Rise Post Halving?

In an X post on Saturday, econometrics shared a strong bullish prediction of Bitcoin price following the fourth halving event on April 19. The crypto analyst stated that if BTC produced a similar growth pattern seen in previous bull cycles, its market price would likely range between $140,000 – $4,500,000.

For context, the bull run, which forms the latter part of the Bitcoin bull cycle, occurs in the months following the halving event, according to BTC’s price history. During this period, the market leader is known to record massive price gains, as seen after previous halvings in 2012 (7,592.30%), 2016 (1,818.8%), and 2020.

Price range for Bitcoin in the 4th halving cycle:

upper bound ~ $4,500,000

lower bound ~ $140,000That is *if* Bitcoin ends up following a growth trajectory in the range of the previous cycles. pic.twitter.com/s93yldJEI0

— ecoinometrics (@ecoinometrics) April 20, 2024

Econometrics stated that a repeat of such positive performance could see Bitcoin trade as high as $ 4,500,000 per unit. However, other speculators have attacked this prediction, believing BTC will likely soon experience some level of diminishing returns. Thus, such a high price level seems unfeasible.

In response, econometrics stated that Bitcoin currently operates similarly to “megacap tech stocks”, which have shown notable defiance to this economic theory. However, the analyst acknowledged that $4,500,000 may be an unrealistic price target for BTC, but there is much confidence that the digital asset will achieve a mid-six-figure value.

Bitcoin Price Overview

Bitcoin is currently trading at $65,043, with a modest 2.21% gain over the last 24 hours. However, its daily trading volume has declined massively, falling by 52.88% to a substantial $21.62 billion, underscoring decreased market activity and investor interest.

Over the past week, Bitcoin has also shown fair improvement resulting in a total gain of 1.86%. However, despite these recent gains, the monthly chart reflects a decline of 4.16%, following some significant price dips and massive liquidations in the past week.

On a larger scale, Bitcoin remains quite impressive, with its year-to-date growth percentage of 131.69%. With a market cap value of $1.28 trillion, the premier cryptocurrency remains the largest digital asset in the world.

BTC trading at $65,270.47 on the daily chart | Source: BTCUSDT chart on Tradingiew.com

Featured image from iStock, chart from Tradingview

Battle For The Halving Block: Bitcoin Users Spend Record $2.4 Million On Block 840,000

With Bitcoin finally completing its fourth-year halving cycle, many users are aggressively competing for halving blocks, paying exorbitant amounts of fees to mine a single block.

Bitcoin Mining Pool Pays Over $2.4 Million In Block Fees

Earlier today, the 840,000th block was added to the Bitcoin blockchain, triggering the onslaught of the highly anticipated halving event. While the price of BTC did not witness a dramatic change following the halving, transaction fees spiked to unprecedented highs.

Amidst the massive competition, a mining pool identified as ViaBTC had successfully mined the 840,000th Bitcoin block. Cumulatively, BTC users had spent a staggering $37.7 BTC in mining fees, equivalent to $2.4 million, recording the highest fee ever paid for a Bitcoin block.

According to reports from mempool, after ViaBTC had produced the 840,000th block, the protocol had initiated an automated reduction of miners’ reward by half, from 6.25 BTC to 3.125 BTC per block. In addition to the fees, ViaBTC had received a total payout of 40.7 BTC, valued at approximately $2.6 million, for mining the historic block.

While it may seem that Bitcoin miners had thrown caution to the wind by spending over $2.4 million on a single block, the 840,000th block had a major significance within the cryptocurrency space. The historic Bitcoin block is said to hold the first Satoshis, ‘sats,’ the smallest units of BTC following the halving.

There are several of these “epic sats,” that appear after the halving event, coveted as a rare collector’s item among cryptocurrency enthusiasts. Some even speculate that these Bitcoin fragments could be potentially worth millions of dollars.

Including the hype surrounding these fragmented BTC, much of the competition for the Bitcoin blocks, following the halving has been attributed to the new Runes Protocol which launched at the same time as the Bitcoin halving.

Degens Rush To Secure Infamous Rune Tokens

The Runes Protocol, created by Casey Rodamor, a Bitcoin developer, has sent shockwaves through the cryptocurrency community, as degens are avidly competing to etch and mint tokens directly on the Bitcoin network.

While mining pools were mining new Bitcoin blocks, degens had paid over 78.6 BTC valued at $4.95 million to mint the rarest Runes. This exponential surge in fees has been an unprecedented event, highlighting the increased adoption and participation of the Bitcoin network.

According to reports from Ord.io, a Rune labeled as ‘Decentralized’ was acquired for a fee of 7.99 BTC, equivalent to $510,760. While another titled ‘Dog-Go-To-The-Moon’ was obtained for a fee of 6.73 BTC, worth approximately $429,831.

Leonidas, protocol developer and host of the groundbreaking Ordinals, a system for numbering “epic sats,” has declared the Runes Protocol a remarkable success as degens have “single-handedly offset the drop in miner rewards from the halving.” He concluded that Runes have significantly impacted Bitcoin’s security budget, potentially playing a major role in ensuring the network’s sustainability.

Fourth Bitcoin Halving Completed – Here Are The Implications

The long-awaited fourth Bitcoin halving finally occurred after BTC posted its 840,000th block. This event is significant as it is expected to have several implications for the Bitcoin ecosystem and the crypto market going forward.

What To Expect Following The Bitcoin Halving

The Bitcoin halving slashed miners’ rewards from 6.25 BTC to 3.125 BTC for each block mined. This means that Bitcoin miners are set to earn a reduced income of 450 BTC instead of the 900 BTC they earned before the fourth halving. This development is expected to have a dire effect on their operations, as NewsBTC reported that they could lose a whopping $10 billion following the halving.

While the effects of the halving are not so pleasant for BTC miners, the halving is deemed necessary for the growth of the Bitcoin ecosystem. It makes Bitcoin (BTC) deflationary by reducing the rate at which more tokens come into circulation. This could make the flagship crypto more scarce and ultimately drive up its value, as it has done in the past three halvings.

In anticipation of history repeating itself, crypto analysts and experts have made several predictions about how high Bitcoin could rise this time post-halving. So far, the most bullish price prediction remains by Samson Mow, the CEO of Jan3 and Bitcoiner, who predicts that the flagship crypto could rise to $1 million this year.

He added that this unprecedented price surge was possible considering that BTC’s demand is expected to continue outpacing the supply, with more institutional investors recently getting on board through the Spot Bitcoin ETFs. The imbalance between Bitcoin’s supply and demand is also why crypto analyst MacronautBTC believes Bitcoin could rise to $237,000.

Billionaire Tim Draper also agrees that Bitcoin could attain such heights based on his prediction that the flagship crypto will hit $250,000 in 2025.

Implications On The Broader Crypto Market

Crypto analyst Michaël van de Poppe recently predicted a narrative shift post-halving. He expects Bitcoin to take months to consolidate while altcoins significantly move to the upside during this period. This is plausible, considering Bitcoin doesn’t experience that parabolic price surge until about six months after the halving.

During this period, altcoins like XRP and Cardano (ADA), which have underperformed up until now, will be closely monitored as investors wait to see if they will show any sign of bullish momentum in them. Ethereum (ETH) will also be the focus of many in the crypto community as they watch how the second-largest crypto token by market cap will perform while Bitcoin (BTC) consolidates.

Interestingly, Van de Poppe expects the narrative to shift to Ethereum and projects in the Decentralized Physical Infrastructure Networks (DePIN) and Real World Assets (RWA) sector. Therefore, such projects are also worth keeping an eye on.

Grayscale Reveals 0.15% Fees For Its Bitcoin Mini Trust ETF

Bitcoin ETF provider Grayscale has provided some illustrative details of its spin-off fund, the Bitcoin Mini Trust (BTC), including a more competitive 0.15% fee than the uplisted mothership GBTC product, according to a pro forma financials in its latest filing.