The recent approval and launch of spot Bitcoin ETFs have brought about notable changes in market dynamics. Among the most significant players affected is Grayscale, a leading institution in the crypto space.

Grayscale’s Bitcoin Holdings Experience Decline

Grayscale, known for its Bitcoin Trust (GBTC), held the highest BTC market capitalization among institutions. However, an in-depth analysis reveals a decline in its Bitcoin holdings over recent months.

From nearly 620,000 BTC in January, Grayscale’s holdings have dwindled to a little over 300,000 BTC at the time of reporting. This decline raises questions about the factors influencing institutional investment strategies in the crypto sector.

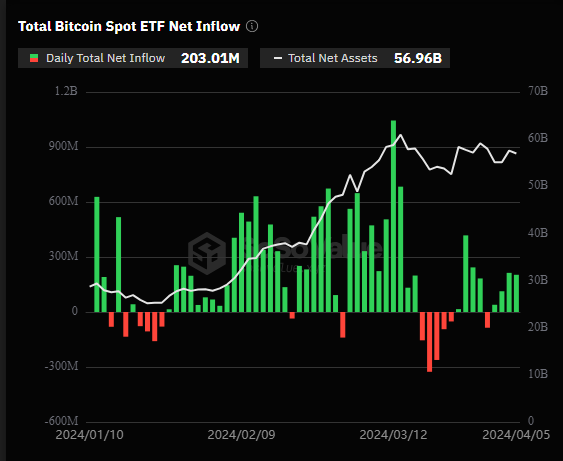

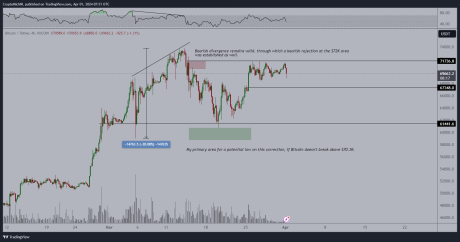

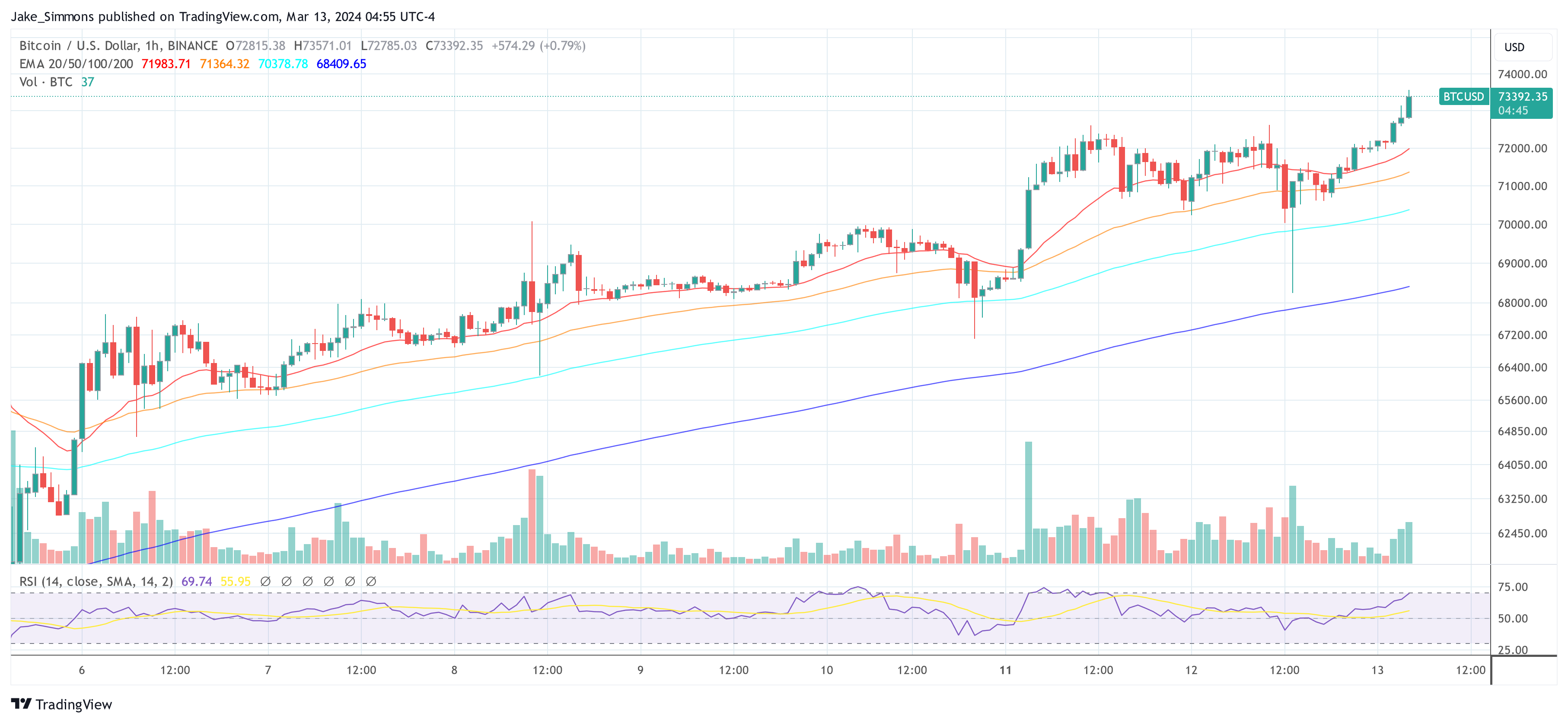

Spot Bitcoin ETFs Witness Fluctuating Flows

Following the launch of spot Bitcoin ETFs, the market has witnessed fluctuating flows across various platforms. While certain ETFs have experienced significant volume, others have recorded zero flows, indicating a mixed response from investors. BlackRock’s IBIT and Grayscale’s GBTC have been among the few to register notable flows, with both inflows and outflows observed in recent days.

A closer look at the data reveals consecutive outflows in Bitcoin spot ETFs over the past few days, reminiscent of similar trends observed in March. On the 15th and 16th of April, outflows amounted to nearly $27 million and $58 million, respectively.

Despite these outflows, analysts point out that such fluctuations are not uncommon in the ETF market and may not necessarily indicate product failure.

Analysis Of Flow Patterns Provides Insight

Examining specific flow patterns offers valuable insights into investor behavior and market sentiment. While Grayscale’s GBTC experienced consecutive outflows, BlackRock’s IBIT saw inflows on certain days. This variance underscores the diverse strategies adopted by investors in response to the evolving crypto landscape.

It’s important to note that zero inflows on certain days are considered normal for ETFs, according to analysts. They emphasized that such occurrences are commonplace across various ETFs and should not be interpreted as a sign of product failure. Instead, they reflect the ebb and flow of investor interest in a rapidly evolving market.

Future Outlook For Bitcoin ETFs

As Bitcoin ETFs continue to gain traction, the market is poised for further evolution. While some platforms may experience fluctuations in flows, the overall trajectory of institutional investment in the crypto sector remains optimistic.

The approval and launch of spot Bitcoin ETFs have sparked shifts in market dynamics, impacting institutions like Grayscale and prompting fluctuations in ETF flows. Despite the volatility, analysts remain optimistic about the long-term prospects of Bitcoin ETFs and their role in shaping the future of finance.

Featured image from DataDrivenInvestor, chart from TradingView