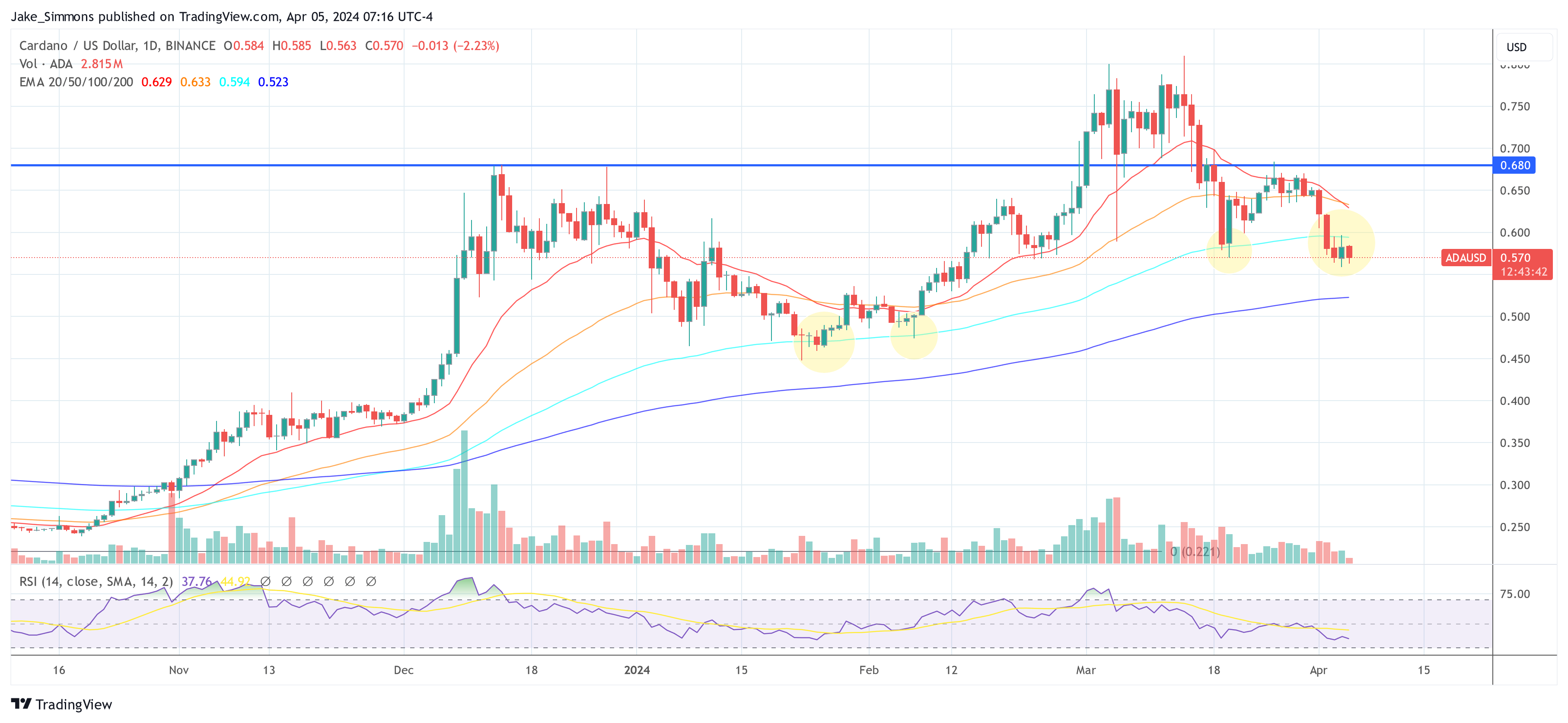

Cardano suffered a massive price crash over the last two weeks. However, with the market recovery, the ADA price has begun to see some positive headwinds. Analysts expect this recovery to continue, with one crypto analyst in particular, who goes by CobraVanguard, expecting a bullish continuation toward $1.

Cardano Completes The ABC Wave

The crypto market crash, led by Bitcoin, saw the prices of Cardano and other altcoins plunge into a dreaded ABC wave. This wave is notorious for causing massive dips to the tune of 50%, leaving investors in losses in its wake.

The crypto analyst revealed that Wave A had taken place when Cardano had fallen from $0.8 to $0.57, and then Wave B saw the recovery from $0.57 to $0.68. The third and final wave, Wave C, saw the price crash from $0.77 to $0.4 before bouncing upward once again, signaling the completion of the ABC wave.

As with all other crashes, there comes a time when the ABC wave is over, and the price of an altcoin can recover, and it seems Cardano has entered this range. The price of the altcoin has since recovered above $0.5, with the bulls now taking control.

From here, the analyst expects the recovery to continue and rally with a new wave. “After the fifth bullish wave, Cardano has completed his corrective waves (ABC) and now he has reached the end of the wedge, now it is time to start the five bullish waves,” CobraVanguard said.

ADA Price Targets

CobraVanguard outlines a number of reasons why they believe that the Cardano price is going to be bullish. Firstly, they outline an ascending structure of the chart, which suggests a bullish continuation. Next is the bullish wedge that is forming in the chart. Also, high-potential areas are becoming clearer in the chart, as the analyst outlined.

In the first wave, the analyst outlines a possible jump to $0.77. From here, they expect that the price will retrace a bit to $0.64 before resuming the uptrend. However, the analyst takes a more conservative stance compared to other analysts about the top, putting it somewhere around $1.09.

The analyst further pointed out that in a situation where the wedge were to break down, it could invalidate this, and possibility lead to a decline in price. “Note that if the WEDGE is broken down with the power of descending candles, our analysis will fail,” CobraVanguard concluded.