The new MPI license comes one year after Coinbase’s initial in-principle approval in Singapore, enabling it to expand digital payment token services.

Cryptocurrency Financial News

The new MPI license comes one year after Coinbase’s initial in-principle approval in Singapore, enabling it to expand digital payment token services.

Cryptocurrency exchange Coinbase this week announced that it had received regulatory approval to list perpetual futures on its international exchange.

Coinbase and a group of crypto entrepreneurs went to Washington, D.C. to convince lawmakers to provide regulatory clarity for the industry.

The recent regulatory approval for Coinbase’s international subsidiary comes within a month of getting the NFA nod to offer crypto derivatives services to institutional clients in eligible U.S. states.

The company has been looking to expand globally and announced its international exchange in May this year.

Coinbase CEO Brian Armstrong has been actively pursuing the exchange’s expansion ambitions in the United Kingdom amid mounting legal issues in the United States.

The list of top censorship offenders is populated by popular platforms such as Binance, Celsius Network, Bitfinex, Ledger Live, Huobi (HTX) and Coinbase.

Bitcoin price is up 30% versus Ethereum (ETH) in 2023, and bulls appear not to be slowing down, looking at the performance in the weekly chart. BTC is on the brink of pushing ETH lower at spot rates, registering new 2023 lows and extending gains from early this year.

Bitcoin bulls are in the driving seat. Candlestick arrangement in the weekly chart shows that BTC pushed on, extending its rally against the second most valuable coin despite attempts for higher highs in mid-August.

In the second week of August, ETH added roughly 7% versus BTC. Notably, this expansion was after a period of horizontal consolidation as momentum shifted in favor of ETH. However, bears reversed gains and continued the primary trend established since the beginning of the year.

The medium trajectory seems to be guided by events in mid-March 2023. Then, ETH prices devalued drastically versus Bitcoin, forming a bearish engulfing bar marked by a spike in trading volume. The surging demand for BTC saw prices reverse progress in late October 2022.

Bitcoin bulls have since extended gains versus Ethereum. However, one notable formation is that BTC is rallying at the back of light trading volume. Since the rally of BTC in Q1 2023 versus ETH, trading volume has been contracting despite prices printing lower lows.

It cannot be immediately ascertained whether the current draw-down will continue. The level of participation has significantly decreased in the last six months as sentiment dipped.

Over the past two quarters, the involvement of regulators, including the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), seems to have negatively impacted activity.

In early June, the SEC sued Coinbase and Binance, two of the world’s leading cryptocurrency exchanges. The regulator cited various claims, accusing Coinbase of listing unregistered securities and Binance of, among other charges, manipulation and violating different securities laws. Binance and Coinbase plan to defend themselves against the SEC.

Besides regulations, the broader community remains cautious, considering the number of hacks targeting multiple exchanges and decentralized finance (DeFi) protocols. Some of these exploits have been linked to the Lazarus Group, a notorious cell allegedly sponsored by North Korea.

Despite the general market lull, traders look forward to the upcoming Bitcoin halving event in 2024. The event will create a supply shock, making BTC scarcer. Whether this will see BTC press ETH even lower back to June 2022 lows is yet to be seen.

Binance’s liquid staking ether (ETH) saw a sudden $500 million burst of inflows over the weekend, pushing its total locked value (TVL) to $1.2 billion.

Cointelegraph talks with Coinbase protocols lead and Base creator Jesse Pollak about the company’s new blockchain, which is already a force to be reckoned with.

Coinbase CEO Brian Armstrong and chief legal officer Paul Grewal issued a joint statement questioning the SEC’s reasoning in its Sept. 22 objection.

The firm has registered as a crypto exchange and custody wallet provider.

Coinbase’s layer 2 scaling solution, called Base, has seem a meteoric rise in popularity recently. In just six short weeks since its launch, Base’s total value locked (TVL) has skyrocketed to nearly $400 million. This rapid rise in use and popularity has even seen it recently overtake the Solana blockchain in TVL.

Base operates as a layer 2 network on Ethereum launched by Coinbase in collaboration with Optimism to offer a safe, low-cost, developer-friendly way to build on-chain. Since its launch, Base has managed to find a strong market fit, allowing it to quickly penetrate the crypto market. However, this hasn’t been without some hiccups.

Before its public launch, Base had some glitches, which developers were able to rectify quickly. Earlier this month, the network faced another setback as block production unexpectedly stopped for 45 minutes. According to DeFi TVL aggregator DefiLlama, Base’s TVL has risen +111% in the past month to now holding more than $370.29 million.

Last week, Base’s growth saw it blow past the Solana blockchain in terms of transaction volume. This growth has continued, and the Layer-2 network has now moved ahead of Solana whose total value locked (TVL) dropped by 12.22% in the last month to $310 million. Also, this places Base’s TVL ahead of other popular chains like Cronos, Bitcoin, and Cardano.

Base’s growth kickstarted with Aerodrome, a decentralized exchange, which deposited $190 million on the network after its launch. Base’s growth can also be attributed to the popularity of Friend.tech, a decentralized social app. With a current TVL of $38.6 million, Friend.tech is one of the projects native to Base with a the largest stake. Other projects with a considerable stake in TVL include Stargate, Curve DEX, and Compound V3.

At the moment, Ethereum continues to lead the pack in terms of TVL. However, the coming months will be crucial in determining whether Base can sustain its momentum and continue gaining mainstream traction. At its current trajectory, Base could surpass $500 million in TVL in the coming weeks and solidify itself as a leader in layer-2 scaling networks.

According to BaseScan, the number of daily transactions on Base reached a new high of 1.88 million on September 14, as reported by BaseScan. The layer-2 network has now processed more than 40.31 million transactions at the time of writing.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock

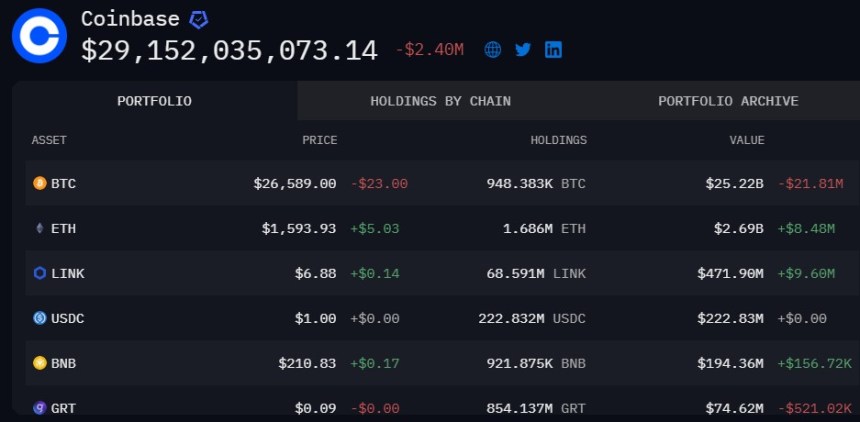

In a notable discovery, Arkham Intel, a leading blockchain intelligence platform, has identified $25 billion worth of Bitcoin (BTC) reserves held by Coinbase, the prominent US-based cryptocurrency exchange.

This revelation puts Coinbase at the forefront of the Bitcoin landscape, positioning it as the largest Bitcoin entity in the world alongside the enigmatic Satoshi Nakamoto. The uncovered reserves amount to nearly 5% of the total Bitcoin supply.

Arkham Intel’s comprehensive analysis has successfully tagged over 36 million Bitcoin deposits and holding addresses associated with Coinbase. Remarkably, Coinbase’s largest cold wallet alone contains around 10,000 BTC, serving as a testament to the scale of their holdings.

However, Arkham Intel suggests that Coinbase’s actual Bitcoin reserves may extend beyond the identified addresses. Based on Coinbase’s recent financial reports, it is highly likely that the exchange possesses thousands more BTC that have yet to be tracked and labeled.

Moreover, Arkham Intel’s platform reveals that Coinbase holds substantial amounts of other cryptocurrencies beyond Bitcoin.

The US-based exchange is reported to possess approximately 1.68 million ETH (Ethereum) valued at around $2.69 billion. Additionally, Coinbase holds 68.59 million LINK (Chainlink) tokens, estimated at $471 million.

The stablecoin USDC (USD Coin), pegged 1:1 to the US dollar, is also part of Coinbase’s portfolio, with holdings totaling 222 million USDC. Lastly, Coinbase holds a 921,000 BNB (Binance Coin) valued at approximately $194 million.

In a noteworthy development for the exchange and its new Layer-2 (L2) blockchain, Base has emerged as a formidable contender, surpassing Solana in terms of Total Value Locked (TVL).

According to the latest statistics from Defillama, Base, Coinbase’s L2 solution boasts a TVL of $370 million, surpassing Solana’s $310 million. This achievement signifies an important milestone for Base, highlighting its growing prominence and influence in the industry.

Notably, Base’s TVL positions it ahead of prominent blockchains such as Cronos, Kava, Defichain, Bitcoin, Fusion, Pulsechain, and Cardano. With its current TVL, Base accounts for approximately 0.96% of the overall $38.14 billion TVL in the DeFi space.

Base has secured its place among the top protocols regarding TVL, ranking just behind Mixin, Polygon, Avalanche, Optimism, Arbitrum, BSC, Tron, and Ethereum. This accomplishment highlights the growing prominence of Coinbase’s L2 blockchain within the DeFi landscape.

Data from Dune Analytics reveals that since its L2 launch, Base has successfully bridged a total value of $426.81 million. Of this, 54.4% or $232.19 million comprises 143,467 ether, demonstrating strong support and adoption from the Ethereum community. Additionally, approximately 27.2% of the bridged assets to Base consist of 115,993,548 USDC stablecoins.

However, it is not all good news for the firm. Coinbase stocks, traded under the name COIN, are experiencing a significant decline that has been ongoing since July 20.

The stocks have declined from the $111 level, followed by the lawsuit filed by the US Securities and Exchange Commission (SEC) against the firm and Binance. Presently, the exchange’s stocks are trading at $71.78.

Featured image from iStock, chart from TradingView.com

To expand its derivatives business overseas, Coinbase attempted to acquire FTX Europe twice since it filed for bankruptcy in November 2022.

Former U.S. Sen. Pat Toomey, who tried and failed to push his own crypto legislation through Congress before leaving at the start of the year, can’t see how the current Senate will have any better luck, despite recent progress in the House of Representatives.

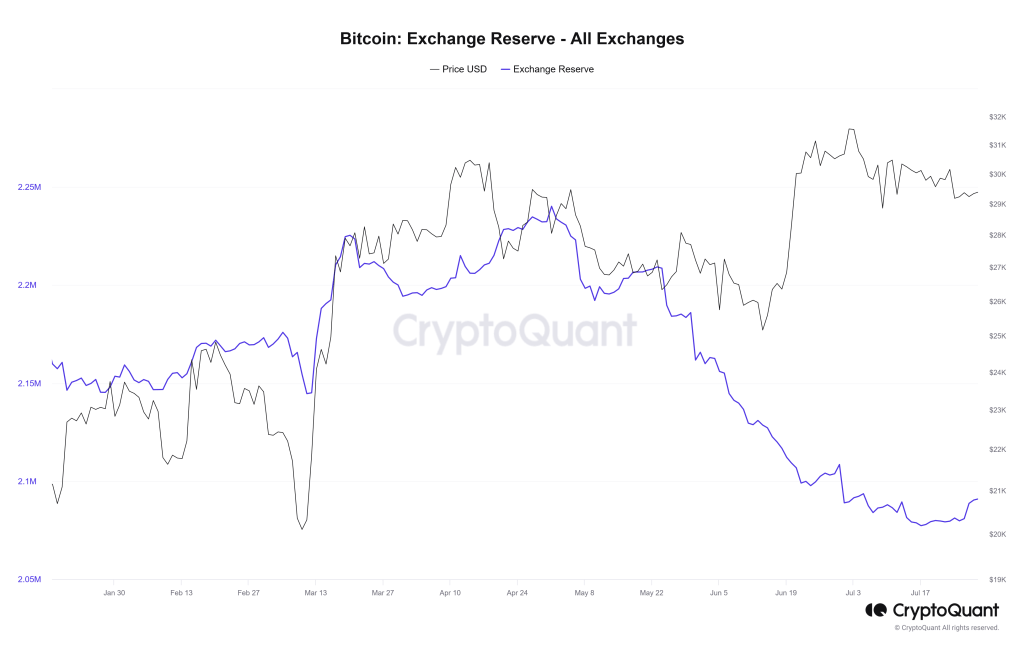

Bitcoin (BTC) held by leading crypto exchanges like Coinbase, Binance, and Kraken are near a six-year low, CryptoQuant data on September 20 reveals.

The contraction was recorded when the broader market steadied after posting sharp losses in the better part of August and the first half of September. As of September 20, BTC prices are still below $30,000, but with important sideways movement over the past few weeks.

According to trackers, exchanges control 2.09 million BTC when writing. In total, the Bitcoin network will issue 21 million coins.

However, as of 2023, over 19.7 million are in circulation, and public firms such as Tesla—the electric car automaker—and MicroStrategy—the business intelligence firm—have been loading up. Generally, entities can hold cryptocurrencies in non-custodial wallets or exchanges like Binance or Coinbase.

Exchanges offer custodial wallets where users can store their coins to trade or even HODL. Users who hold their coins on exchanges can easily swap them for USDT or other altcoins. As mentioned, the number of coins held in exchanges continues to contract—which, while on the surface can be bullish, doesn’t necessarily mean prices will recover.

Typically, coin outflows from exchanges can signal a firming market and expectation of price expansion. However, considering the current regulatory environment, traders and Bitcoin holders might prefer taking control of their coins as fear sets in.

Accordingly, more holders secure their coins in their non-custodial wallets as a protective measure, possibly explaining the dropping Bitcoin exchange reserves.

The number of Bitcoin held in exchanges has been falling throughout 2022 but appeared to have dropped faster in late 2022. Around that time, FTX, a popular crypto exchange, collapsed, locking billions worth of clients’ funds.

Outflow slowed down in Q1 2023 following the collapse of some regional banks in the United States but has since continued falling. The dip can be attributed to the bear market but primarily because the United States Securities and Exchange Commission (SEC) is cracking the whip on Binance and Coinbase, accusing them of non-compliance.

In June, Binance and Coinbase were sued by the SEC. The regulator claimed that the two exchanges were issuing unregistered securities, citing some, like Cardano (ADA), as examples.

Amid this crackdown, Binance US became a focal point. Since then, there have been major staff resignations, layoffs, and disruption of operations. Trading volume in Binance US is now down by over 95%.

The U.S. Securities and Exchange Commission (SEC) isn’t done chasing down crypto exchanges and decentralized finance (DeFi) projects it sees as violating securities laws in the same vein as Coinbase Inc. (COIN) and Binance, said David Hirsch, head of the agency’s Crypto Assets and Cyber Unit.