Traditional financial firms are increasingly connecting services, portfolios and operations with digital assets.

Cryptocurrency Financial News

Traditional financial firms are increasingly connecting services, portfolios and operations with digital assets.

The SEC rejected Coinbase’s petition for crypto rulemaking, marking yet another refusal to provide regulatory clarity for an industry that badly wants it.

The existing laws are sufficient, and the agency is already doing what it considers necessary, according to Chair Gensler.

U.S. crypto exchange Coinbase’s petition to the Securities and Exchange Commission (SEC) to prod it toward a system of tailored rules for digital assets was rejected by the regulator on Friday.

The firm has sold over $150 million worth of stake in COIN since Dec. 5.

On Monday, a New Hampshire state representative asked a mostly-filled room at an industry campaign event to raise their hands if they were visiting from another state. More than half the people in the room raised their hands. These visitors had come to hear from industry representatives, state lawmakers and – perhaps most importantly – three presidential candidates talk about the upcoming election.

On Monday, a New Hampshire state representative asked a mostly-filled room at an industry campaign event to raise their hands if they were visiting from another state. More than half the people in the room raised their hands. These visitors had come to hear from industry representatives, state lawmakers and – perhaps most importantly – three presidential candidates talk about the upcoming election.

Bitwise Invest, an investment firm specializing in the crypto space, recently unveiled its anticipated crypto predictions for 2024.

These projections provide a glimpse into the future of the cryptocurrency industry, highlighting major milestones and potential breakthroughs for the largest cryptocurrencies such as Bitcoin (BTC), and Ethereum (ETH), and exchanges like Coinbase.

Bitwise’s first prediction suggests that Bitcoin will surpass previous records and trade above $80,000, setting a new all-time high. The firm attributes this bullish outlook to two key catalysts: the imminent launch of a spot Bitcoin exchange-traded fund (ETF) early in 2024 and the anticipated halving of new Bitcoin supply by the end of April.

Furthermore, Bitwise expects the spot Bitcoin ETFs to be approved and to collectively become the most successful ETF launch in history.

Interestingly, Bitwise also forecasts that Coinbase, one of the largest cryptocurrency exchanges, will witness its revenue double, surpassing Wall Street expectations by at least 10 times.

The firm points out that Coinbase’s trading volumes typically surge during bull markets, and they anticipate a similar trend in 2024. Additionally, Bitwise highlights Coinbase’s successful launch of various new products that have gained traction in the market.

On the other hand, the investment firm predicts that more money will settle using stablecoins compared to traditional payment giant Visa. Bitwise highlights stablecoins as one of crypto’s “killer apps” and notes their remarkable growth from virtually zero to a $137 billion market in just four years. Bitwise anticipates 2024 to be another significant year for stablecoin expansion.

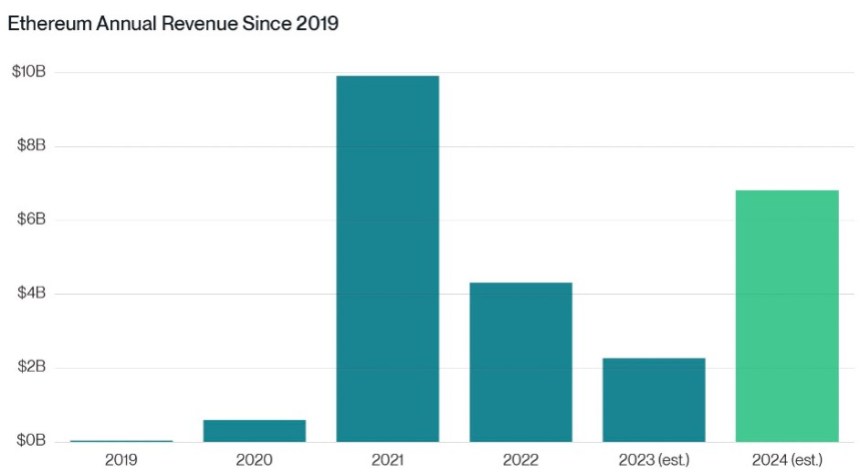

Bitwise expects Ethereum’s revenue to more than double from $2.3 billion in 2023 to $5 billion in 2024. The firm attributes this growth to the increasing number of users flocking to crypto applications. Bitwise emphasizes Ethereum’s potential as one of the fastest-growing large-scale tech platforms globally.

Furthermore, Bitwise anticipates a major upgrade to Ethereum, labeled EIP-4844, which could reduce average transaction costs to below $0.01. This significant cost reduction is expected to pave the way for mainstream adoption and the development of groundbreaking applications within the crypto ecosystem.

Bitwise’s bonus prediction suggests that by the end of 2024, one in four financial advisors will allocate funds to cryptocurrencies in their clients’ accounts. The firm foresees increased adoption by financial advisors once Bitcoin becomes easily accessible and mainstream.

In summary, Bitwise Invest’s crypto predictions for 2024 paint an exciting future for the cryptocurrency market. With expectations of a new all-time high for Bitcoin, the successful launch of spot Bitcoin ETFs, and revenue growth for industry giants like Coinbase and Ethereum, the crypto space is poised for significant advancements in the coming years.

As of the current update, ETH is trading at $2,200, reflecting a 1.4% increase over the past 24 hours. This positive movement follows a similar trend set by BTC. However, Ethereum has experienced a slight decline of 2.4% in the past seven days.

Featured image from Shutterstock, chart from TradingView.com

tktk

Recent reports have revealed that Bitcoin (BTC) is experiencing a significant surge in whale activity, which has since caused quite a stir in the entire crypto community.

According to Whale Alert, Bitcoin has been displaying a surge in whale transactions over the past 24 hours. The crypto tracker recently revealed several whale transfers from unknown wallets to crypto exchanges such as Binance and Coinbase.

The report shows that Binance amassed a whale inflow of over $67 million from the transfers. Meanwhile, Coinbase amassed a whale inflow valued at over $310 million from the transfers.

A recent transaction of 781 BTC was reported by Whale Alert, which came from four distinct cryptocurrency wallets. However, about 658 BTC were seen transferred directly to Binance.

In addition, early on Wednesday morning, a different unknown wallet sent 499 BTC to Binance. This move is worth almost $20.6 million as of the time of the transaction.

The most recent whale activity reported by the crypto tracker shows that about 500 BTCs were transferred into Binance. As of the time of the report, the transaction was valued at $20.5 million.

For Coinbase, the tracker revealed a whopping 7,515 Bitcoin that was transferred by unknown wallets to the crypto exchange. The first transaction saw about 2,510 BTC, valued at $104.2 million sent from an unknown wallet 1xkfCoJyCZ…Ur7bZJWuXJ to Coinbase. The second whale transaction witnessed 2,494 BTC transferred by another different wallet to the crypto platform.

Meanwhile, the last whale transaction from the anonymous wallet 15LhEQYPdK…88T9kLM55m transferred 2,511 BTC to Coinbase. Nonetheless, the crypto tracker has reported that these BTCs have been moved from the exchange to several wallets.

So far there is no solid evidence that these whale transactions have had any effect on the price of Bitcoin.

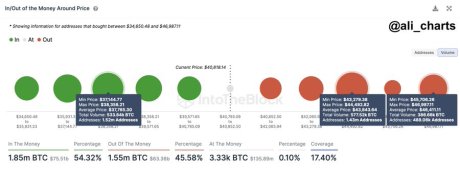

Cryptocurrency analyst Ali Martinez has recently shared key levels to watch out for concerning the crypto asset. The analyst took to X (formerly Twitter) to share these crucial support levels for the crypto community and investors.

Ali asserted that BTC will find solid support between $37,150 and $38,360 should in case a deep correction occurs. He further added that the zone is backed by 1.52 million addresses holding about 534,000 BTC.

Furthermore, he highlighted two resistance walls that could oppose the crypto asset’s upward rally. The first resistance wall is $43,850, while the second wall is $46,400.

Currently, BTC is sitting at $41,380, indicating a 1% decline in the last 24 hours as of the time of writing. Its market capitalization is currently valued at approximately $809 billion, indicating the same percentage decline, according to CoinMarketCap.

Crypto exchange Coinbase will soon be offering the option to spot trade cryptocurrencies outside of the U.S. as part of its global expansion efforts, the company announced in a blog post Wednesday.

Institutional clients on the Coinbase International Exchange will be able to trade Bitcoin and Ether against USD Coin starting on Dec. 14.

Institutional clients on the Coinbase International Exchange will be able to trade Bitcoin and Ether against USD Coin starting on Dec. 14.

The investment firm has sold the crypto exchange’s stock on all but two trading days this month.

The investment firm has sold the crypto exchange’s stock on all but two trading days this month.

The investment firm has sold the crypto exchange’s stock on all but two trading days this month.

Coinbase’s Project Diamond lets institutions create and trade digital native versions of financial instruments such as debt using Base in a regulated manner.

Coinbase’s Project Diamond lets institutions create and trade digital native versions of financial instruments such as debt using Base in a regulated manner.

Major Coinbase shareholders have sold over $14 million of stocks over the past 48 hours.

Major Coinbase shareholders have sold over $14 million of stocks over the past 48 hours.