With hot competition between layer-2 technology providers like Optimism, Polygon and Matter Labs, Celo’s choice is being closely watched by the blockchain industry.

Coinbase warns customers about subpoena in apparent CFTC Bybit probe

Cryptocurrency exchange Bybit restricts use in the United States, although it may be possible to get around it.

Coinbase CEO Says Binance Settlement Will Turn the Page on Crypto’s ‘Bad Actors’

Coinbase CEO Brian Armstrong says the industry can finally close the chapter of bad actors after the recent settlement between Binance and the U.S. Department of Justice.

ARK Invest Sells $5.26M Coinbase Shares as Price Hits 19-Month High

The Ark Fintech Innovation ETF sold 43,956 COIN shares and bought $1.2 million worth of Robinhood stock.

Coinbase shares hit 18-month high after Binance charges

The price high comes after rival exchange Binance pleaded guilty and traders seemingly priced in Coinbase’s custodian agreements for a slate of spot crypto ETFs.

Coinbase Is Dominating a Key Bitcoin ETF Service. Can Anyone Else Join the Race?

The race to provide a key bit of infrastructure for bitcoin [BTC] ETFs – custody services – hasn’t actually been much of a race so far. Crypto exchange Coinbase has dominated so far, winning the job from the majority of applications from the likes of BlackRock, WisdomTree and Valkyrie.

Blast Surpasses Cardano And Base – Here’s How Much DeFi Investors Have Locked

Blast is the latest Layer 2 network to burst into the scene in the last week and has taken the decentralized finance (DeFi) world by storm already. This network which seemingly came out of nowhere has backing from Paradigm, and as its popularity has risen, it has surpassed Base and Cardano’s Total Value Locked (TVL) in less than a week after launch.

Blast TVL Crosses $565 Million

The Blast network was officially announced on November 21 and it quickly garnered support from crypto investors. In the first day, the network saw over $81 million in crypto locked. And in two days, the figure had quickly grown above $123 million.

Despite some of the FUD (Fear, Uncertainty, and Doubt) that has followed the launch of the network, investors have continued to bridge their assorted into it. By Sunday, November 26, the total value locked on the Blast network had officially crossed $544 million, according to data from DeFi tracker DeFiLlama.

This figure puts the network’s TVL ahead of older competitors such as Coinbase’s Base. While Blast’s TVL sits at $544 million, the Base TVL is at $338.26 million. This means that Blast’s TVL is currently 60% higher than that of Base.

In the same vein, the Blast TVL is also way ahead of that of Cardano. Presently, the Cardano TVL sits at around $330.07 million, just a little lower than Base, and around 61% lower than that of Blast.

New L2 Draws Criticism From DeFi Investors

Amid the rapid growth that Blast has enjoyed, it has also drawn criticism from DeFi investors. The concerns have ranged from security to how the network is being run. One of the most pertinent criticisms has stemmed from the fact that all of the crypto being bridged to the network will be locked until next year.

The network revealed that investors will not be able to access their locked funds until February 2024. In addition, Blast promises users yield on their Ethereum (ETH) and stablecoins being bridged to the network, but with no readily discernible way of how this yield will be earned.

Some members of the crypto community have, however, figured out that the funds were being deposited into the Lido DAO protocol. Apparently, Blast is currently earning around $1.5 million a month by depositing the bridged funds into Lido. This has further raised concerns about the growing dominance of Lido, which is headed toward 33.3% and could pose a risk for the Ethereum network.

Nevertheless, Blast continues to dominate conversations around DeFi on social media. There is now a total of 266,130 ETH locked on the network, with the expectations of an airdrop happening in 2024.

Binance’s Bitcoin Reserves Drop as Retail Flow Moves to Coinbase: CryptoQuant

The move appears to be in anticipation of the approval of spot bitcoin ETFs.

Coinbase cites SEC action against Kraken in push for crypto rulemaking

The Nov. 22 letter claimed that “only mandamus will impel the [SEC] to fully, finally acknowledge that Coinbase’s petition for rulemaking was pocket-vetoed long ago.”

Binance charges prove ‘following the rules’ was the right decision: Coinbase CEO

Brian Armstrong reflected on the announcement of criminal charges against Binance, stating that Coinbase’s decision to get licenses was correct.

‘Buy the Rumor, Buy the News,’ on Spot BTC ETF, Says One Expert, While Another Warns on Coinbase

With two months to go before the U.S. Securities and Exchange Commission (SEC) faces another set of deadlines to decide on a large number of applications to form spot bitcoin exchange traded-funds (ETFs), analysts are speculating on how approval of such vehicles would impact the crypto industry.

Crypto lobby spending in U.S. set to beat 2022 record: Report

With more than a month left before the end of 2023, the United States crypto industry has already spent $20 million on lobbying efforts.

South Korea’s Pension Fund Bought $20M Coinbase Shares in Q3, Made 40% Profit: Report

The fund snapped up COIN at an average price of $70.5 in the third quarter, achieving a 40% profit from investment.

Crypto Tax Proposal Open for Revision, IRS Officials’ Questions Suggest

While crypto representatives and lawyers cautioned the U.S. Internal Revenue Service (IRS) that its crypto tax proposal is a dangerous and improper overreach, questions posed by a panel of IRS and Department of the Treasury officials at a Monday hearing may reveal some flexibility in the rule as it’s still being written.

Mysterious Wallet Transfers 18 Million MATIC To Coinbase – What’s Going On?

A mysterious wallet surfaced from the shadows and masterminded a significant transfer of 17,895,970 MATIC—which translates to a staggering $14.7 million—directly into Coinbase, in a crypto twist that sent shockwaves through the digital landscape.

The surge in significant transaction volume has caused the MATIC price to rise above $0.80 for the first time since July. The market capitalization of MATIC has grown by 62% during the last four weeks due to increased turnover and acquisition by whales.

MATIC Mysterious Financial Maneuver Unveiled

During this enigmatic financial maneuver, the cryptocurrency universe witnessed Polygon’s MATIC token commence a bullish journey. It became more complicated as MATIC rose above the $0.75 resistance level, only to face a strong barrier at the $0.89 support.

At the time of writing, MATIC was trading at $0.88, up 8.5% in the last 24 hours, and tallied an impressive 27% rally in the last seven days, data from CoinMarketCap shows.

The recent increase in value is occurring in conjunction with a revitalized cryptocurrency market, propelled by a rising sense of confidence surrounding Bitcoin.

Nevertheless, the increase in MATIC’s price cannot be only attributed to general market sentiment. Empirical evidence indicates that the aggregation of large investors and significant collaborations have played a crucial role in driving MATIC’s breakout.

Institutional and whale demand has picked up strongly, with Bitcoin seeing an 80% increase in the volume of transactions of over $100k, Ethereum 170%, and Polygon over 3,800% compared to 30 days ago. pic.twitter.com/ElM1CDZ3wA

— IntoTheBlock (@intotheblock) November 11, 2023

According to IntoTheBlock, an on-chain analytics company, institutional and whale demand for the cryptocurrency space has significantly increased. In this sense, during the past 30 days, the amount of transactions involving over $100,000 has increased by 3,800% according to Polygon, an Ethereum scaling solution.

Based on data provided by the analytics platform Santiment, it has been seen that large-scale investors, commonly referred to as whales, with holdings ranging from 100,000 to 10 million MATIC tokens, have accumulated an excess of 42 million more tokens during the latter part of October.

Strong Buying Activity

In a 24-hour timeframe, a total of 161 transactions involving MATIC were executed, each surpassing a value of $100,000. This notable buying activity serves as a testament to the strong desire of significant stakeholders to accumulate MATIC holdings. The accumulation of assets has had a direct impact on the favorable movement of prices.

Increased Whale Appetite

Meanwhile, Coinbase has received over 55 million Polygon [MATIC] tokens, according to three different posts made by Whale Alert on X (previously Twitter).

The transfers were coming from unidentified addresses, according to the whale tracking handle.

19,896,435 #MATIC (16,443,201 USD) transferred from unknown wallet to #Coinbasehttps://t.co/dCSA4N6H3m

— Whale Alert (@whale_alert) November 12, 2023

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Freepik

BlackRock’s Ethereum ETF Plan Is Confirmed in Nasdaq Filing

The world’s largest asset manager already made waves by seeking to list a bitcoin ETF

Proof of Stake Alliance updates recommendations for staking providers

The POSA updated its staking principles to say that providers should communicate clearly and should not control the amount of liquidity a user must provide.

Blockchain Staking Firms Update Best Practices Amid ‘Increased Scrutiny’

The new “staking principles,” published by the Proof of Stake Alliance, aim to ensure consumer protections and promote innovation. Signers include Lido, Coinbase, Rocketpool, Blockdaemon.

U.S. Crypto Stocks Ride BTC Momentum in Pre-Market Trading

COIN, MSTR, HOOD and mining stocks were all showing upward movement in pre-market trading after BTC rose to its highest level in 18 months.

Coinbase Driving Solana Bull Run: Will SOL 2X To $80?

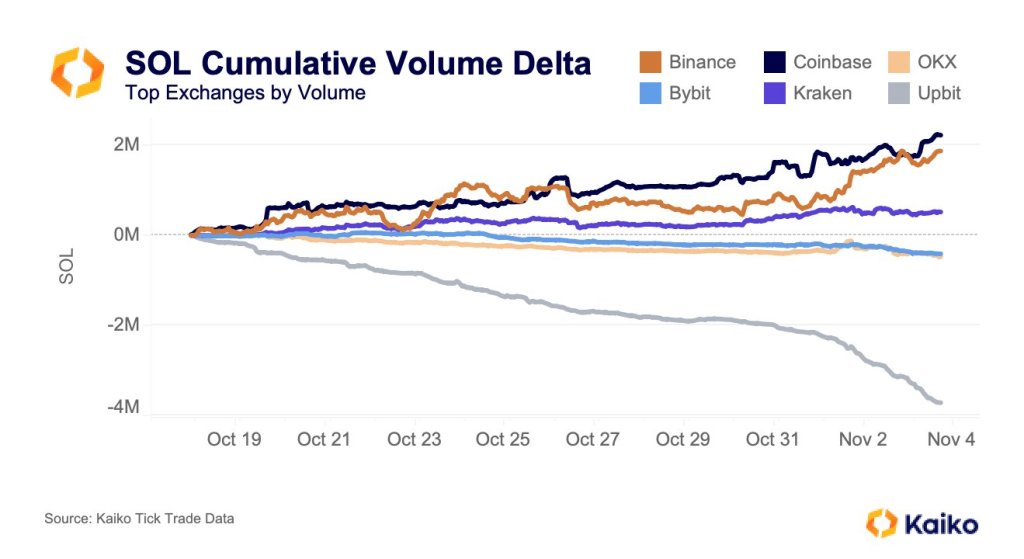

Solana (SOL) is one of the top performers, looking at price action in the weekly chart. According to Kaiko, SOL’s net buying, measured via cumulative volume delta (CVD), has been led by Coinbase, one of the most active cryptocurrency exchanges in the past few trading weeks. To illustrate, since October 18, the blockchain analytics platform notes that 2.2 million SOL have been purchased, an indicator of rising demand as the broader crypto market thaws.

Coinbase Leading The Solana Buying Wave

At over 2.2 million SOL purchased, Coinbase leads the wave of buying pressure. However, closely behind, Binance, the world’s largest cryptocurrency by client count, follows. There are around 2 million SOL bought through Binance from October 18, highlighting the role of the exchange in funneling liquidity to SOL. Even so, specific drivers forcing users to opt for Coinbase over Binance couldn’t be laid out.

While at it, there is rising demand for SOL on Kraken. Even so, demand for SOL has been fizzling on Bybit, Upbit, and OKX over the same period. It couldn’t be ascertained why the trajectory on these exchanges has been trending lower. However, what’s clear is that all of these exchanges allow derivatives trading of multiple assets, including SOL.

When writing on November 7, SOL is a top-10 coin by market cap. Perched at seventh in the leaderboard, Solana has flipped Cardano, Dogecoin, and Tron, cementing its position considering the over $7 billion gap between the seventh and eighth projects in the market cap ranking.

The CVD measures the difference between buying and selling volume over a period. The tool can be used to identify trends. When rising, the uptrend might continue while a falling CVD points otherwise.

SOL Trending At New 2023 Highs: Will The Uptrend Continue?

At spot levels, SOL is also changing hands at around $43, trending at around 2023 highs after breaking above the resistance level at $32 in late October. The uptrend could continue, considering the surging interest Solana continues to garner. This may push the coin 2X to $80, a critical resistance, looking at the candlestick arrangement in the weekly chart.

This demand is primarily because of improving investor confidence and Solana Labs’ decision to roll out new features and strike strategic partnerships, pulling more capital to SOL. Rising CVD could suggest that institutions might be eying SOL, aiming to ride the uptrend.

On November 6, the FTX estate transferred 750,000 SOL to Binance and Kraken. Although it couldn’t be verified that they sold, SOL prices retraced from recent highs. FTX, the defunct crypto exchange, controlled over $1.1 billion worth of SOL, and the estate manager has been gradually selling the coin and other crypto assets to repay creditors.