Copying and pasting the Bee Movie script is a niche internet meme that originated on Tumblr and quickly spread to Reddit, YouTube, Facebook, and other social media platforms.

Rocket Pool Stands To Reap Big From Ethereum’s Dencun Upgrade, RPL Flying

The Ethereum liquidity staking protocol Rocket Pool is on the brink of a massive transformation with the incoming Dencun upgrade. As one community advocate points out, this change is primarily due to the enhancements the Houston upgrade will tag.

Eyes On Dencun Upgrade

In a recent post on X, the advocate explained that the Dencun upgrade, scheduled to go live in mid-March 2024, will pave the way for the implementation of the Houston upgrade. The Houston upgrade, in turn, aims to improve Rocket Pool’s scalability and efficiency.

The Dencun upgrade must first be successfully implemented so that the Houston enhancements can take effect and improve Rocket Pool’s performance.

This hard fork update requires all Ethereum node operators to upgrade their software. Once the network is updated, developers predict that transaction costs, particularly in layer-2 networks, will decrease significantly.

EIP-4788 And Why It Is Crucial For Rocket Pool

However, the Dencun upgrade will also execute a crucial enhancement, Ethereum Improvement Proposal (EIP) 4788. This proposal is designed to optimize communication between the execution layer, where all smart contracts and transactions occur, and the consensus layer, which includes validators like Rocket Pool.

A crucial aspect of this proposal is enabling the execution layer to access consensus layer information without needing third-party oracles, thereby enhancing the mainnet’s security and efficiency.

With the activation of the Houston upgrade, Rocket Pool users can anticipate a series of enhancements designed to improve their experience.

Once Houston goes live, the protocol will automatically lower the minimum ETH staking amount, allowing more users to stake. Additionally, introducing a delegated mini-pool contract will streamline the distribution of fees and rewards. In Rocket Pool, a mini pool is a virtual pool combining all the ETH from stakers.

However, over time, the activation of EIP-4788 allows Rocket Pool to innovate on ETH staking. Looking at the price chart, this expectation has been well received.

So far, RPL, the native token of the liquidity staking platform, has been ripping higher. On March 6, the token broke above February highs above $33. Traders expect bulls to build on recent gains, pushing the token towards January 2024 highs of around $40.

When written on March 7, the token was up nearly 110% from its October 2023 lows. Even so, RPL has yet to recover from the bear run of 2022. In April 2023, the token rose to as high as $65.

Bitcoin ETF Frenzy: BlackRock Smashes Expectations With $788 Million Inflows In One Day

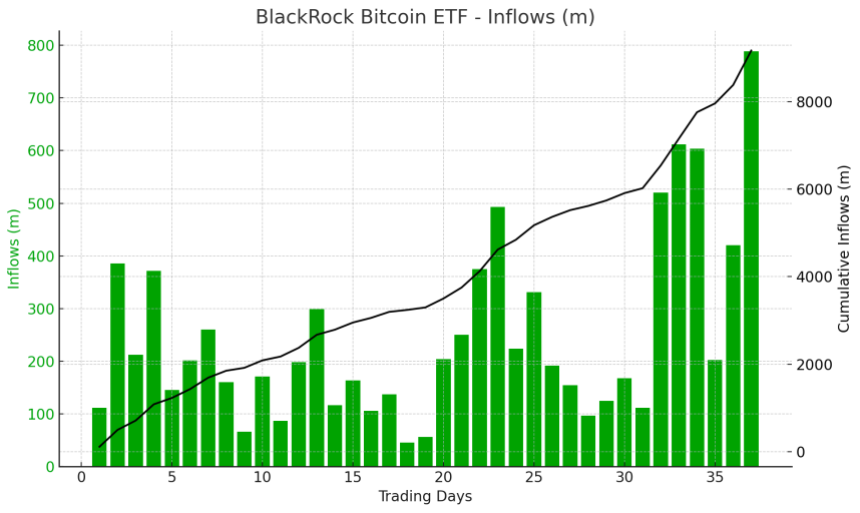

BlackRock’s Bitcoin ETF, IBIT, achieved a remarkable milestone on March 5. Attracting a staggering $788 million, it exceeded its previous record of $612 million in inflows in a single day. This surge in investment coincided with Bitcoin reaching a new all-time high (ATH) of $69,300, surpassing its previous ATH set in 2021.

Bitcoin ETF Trading Volumes Reaches Record $10 Billion

Shortly after Bitcoin hit its new milestone, the market experienced a notable price correction, dropping below $60,000. However, this dip seemed to entice ETF buyers who saw it as an opportunity to accumulate Bitcoin at a discounted price.

As a result, the Bitcoin price has quickly recovered and reached the $65,200 level, positioning itself for further price gains and consolidation above its ATH.

According to Bloomberg ETF expert Eric Balchunas, the ten Bitcoin ETFs traded a staggering $10 billion in volume on the same day, breaking the previous record set just a week ago.

The expert noted that this surge in trading activity is not entirely unexpected, as volatility and volume often go hand in hand with ETFs. Balchunas also highlighted that several ETFs, including Blackrock’s IBIT, Fidelity (FBTC), Bitwise (BITB), and Arkham (ARKB), achieved record-breaking trading volumes.

Interestingly, while the Bitcoin ETFs experienced a surge in inflows, the Grayscale Bitcoin Trust (GBTC) continued its trend of outflows since the ETFs launched on January 11.

Balchunas noted that GBTC has seen nearly $10 billion in outflows, yet its total assets under management remain unchanged since its launch. This phenomenon can be attributed to the bull market subsidy, wherein investors continue to hold assets despite outflows, generating revenue for the trust.

A Temporary Halt Before Further Gains?

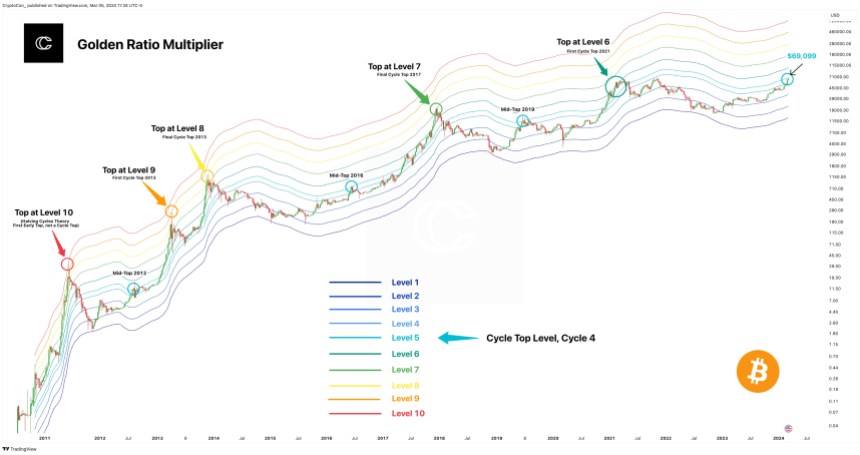

Bitcoin’s recent price action has encountered resistance at its ATH level of $69,000, signaling a temporary rejection from this crucial point. This coincides with the activation of the Golden Ratio Multiplier, the first and only cycle top indicator to have fired thus far.

The Golden Ratio Multiplier, an indicator often used in technical analysis, has seen its cycle top band (level 5) rise to $69,099, aligning perfectly with Bitcoin’s recent peak. However, considering this is the sole indicator predicting a cycle top, some analysts, including Crypto Con, believe that a significant market correction may not have occurred yet.

According to Crypto Con, this current phase represents a temporary resting place for Bitcoin’s early parabolic ascent. Crypto Con suggests that once Bitcoin breaks through the ATH, it will begin a new phase characterized by heightened market activity and potential price gains.

Featured image from Shutterstock, chart from TradingView.com

Uniswap’s UNI Gains 20% as Token Reward Proposal Inches Closer to Approval

Uniswap’s UNI gained 20% as a governance proposal to distribute protocol revenues among token holders gets overwhelming support in a temperature check before voting.

Solana DeFi Landscape Thrives With Record $11 Billion Trading Volume

The Solana decentralized finance (DeFi) sector is experiencing a period of phenomenal growth, with decentralized exchanges (DEXes) witnessing record-breaking trading volumes and the native token, SOL, reaching a new 20-month high. However, amidst the euphoria, experts advise caution due to potential market risks.

Solana: ‘Greed’ Index

While Solana’s DeFi landscape flourishes, it’s crucial to acknowledge the potential risks associated with the current market sentiment.

Market data from CFGI indicates that the current sentiment is characterized by “Greed,” implying a scenario where the market might be overbought. This raises concerns about the possibility of sharper price corrections in the near future.

DEXes Drive The Surge

Data from DeFiLlama reveals that between February 25th and March 2nd, Solana-based DEXes processed a staggering $11.24 billion in cumulative trading volume, marking a significant milestone in weekly activity.

This surge surpasses previous benchmarks and outpaces major blockchains, including Ethereum. NewsBTC analysis shows a remarkable 177% increase in Solana’s DEX activity over a single week, solidifying its position as a major player in the DeFi arena.

This growth is a stark contrast to the subdued performance during the recent bear market. However, the fourth quarter of 2023 witnessed a reversal of fortunes, culminating in December with the highest-ever monthly DEX volumes, exceeding $28 billion.

Jupiter, the largest DEX on Solana, has been instrumental in this surge. CoinGecko reports that Jupiter executed $1.5 billion in trading volumes within the last day, temporarily surpassing the established leader, Uniswap V3.

Related Reading: Bitcoin On The Brink, Price Soars Above $68,000 – Will BTC Break Its 2021 Record?

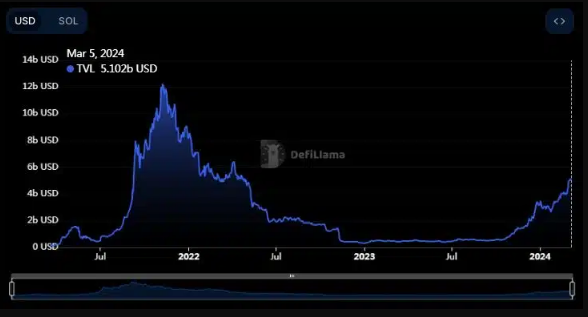

Beyond Trading: TVL And SOL Price Rally

The growth extends beyond trading volumes. Solana’s Total Value Locked (TVL), which represents the combined value of all cryptocurrencies deposited in its DeFi protocols, has surged by an impressive 52% in the last month, reaching $5.13 billion. This growth can be partly attributed to the remarkable gains observed in SOL, Solana’s native token.

SOL’s price performance has been exceptional, currently trading at $132, marking a 4% increase from the previous day. This upward trend includes a 30% surge in the past week and a stellar 37% increase in the last 30 days.

This price appreciation signifies a significant breakthrough, reaching a new peak not seen since November 2021, placing it 20 months removed from its all-time high of $260.

Featured image from Freepik, chart from TradingView

If Bitcoin Clears $70,000, How Fast Will Ethereum Ease Past $5,000?

As Bitcoin surges towards its all-time high (ATH) of nearly $70,000, analysts are closely watching Ethereum, the world’s second-largest cryptocurrency, wondering how quickly it will follow suit and break its record ATHs of approximately $5,000 printed in late 2021.

How Will Ethereum React When Bitcoin Breaks Above $70,000?

One analyst, posting on platform X, highlights the difference in the two coins’ positions compared to the last time Bitcoin broke above 2017 highs of $20,000 in December 2020. Then, Ethereum was trading at $600, a full 57% below its previous ATH of about $1,400.

As Bitcoin nears its record peak of around $70,000 registered in December 2021, Ethereum is approaching $4,000. However, the difference between then and now is that ETH is about 36% shy of its ATH of around $5,000.

The question in the analyst’s mind is, considering historical performance, how fast ETH will ease past $5,000. When Bitcoin broke above $20,000 in late December 2020, the analyst notes that it took approximately two months for ETH to sweep past $1,400 and record new highs.

The boom after this breakout lifted ETH to around $5,000, accelerated mainly by retail activities cycling around decentralized finance (DeFi) and non-fungible token (NFT) minting.

Looking at the Ethereum price action in the daily chart, it is clear that buyers are in control. ETH prices, CoinMarketCap data reveals, are up roughly 7% in the past 24 hours and 15% in the previous week. However, how quickly ETH might repeat the prior 2020-2021 feat remains to be seen.

Exploring ETH’s Chances

Like in the past, the Ethereum price action benefits from the Bitcoin expansion. The revival in Bitcoin prices has seen capital flow to Ethereum, priming its broader ecosystem comprising DeFi and NFT protocols. DeFiLlama data shows that Ethereum manages over $56 billion worth of assets.

Notably, almost all top DeFi protocols in Ethereum, including Lido, Maker, Uniswap, and EigenLayer, have posted strong inflows in the past day, week, and month.

Aside from market-related factors, Ethereum prices are also steadied by hopes around the eventual approval of a spot Ethereum exchange-traded fund (ETF). BlackRock is among the leading asset managers to file with the United States Securities and Exchange Commission (SEC).

However, the agency postponed a ruling on BlackRock’s application for a spot Ethereum ETF, citing concerns about the network’s new proof-of-stake consensus mechanism. The SEC expressed worries that staking, a core aspect of proof-of-stake, could create opportunities for manipulation.

The clear reservation regarding proof-of-stake cast a shadow on Ethereum’s near-term outlook despite the current uptick in prices. Still, the community finds relief realizing that the Commission rejected approving a spot Bitcoin ETF for roughly ten years before January 2024.

Bernstein Expects DeFi to Make a Big Comeback

Six out of the top ten revenue-generating protocols are DeFi applications, the report said.

Seeking Yield on $37M Ether Treasury, JPEG’d DAO Mulls Airdrop Farming

“There are possibilities to solidify the treasury at low risk,” pseudonymous JPEG’d contributor 0xTutti told CoinDesk.

Ether’s Bitcoin Beating Rally Not Just Because of Potential ETF Approval: Bernstein

The amount of ether held on exchanges is at an all-time low of 11%, a sign that more of the cryptocurrency is being locked up for DeFi, the report said.

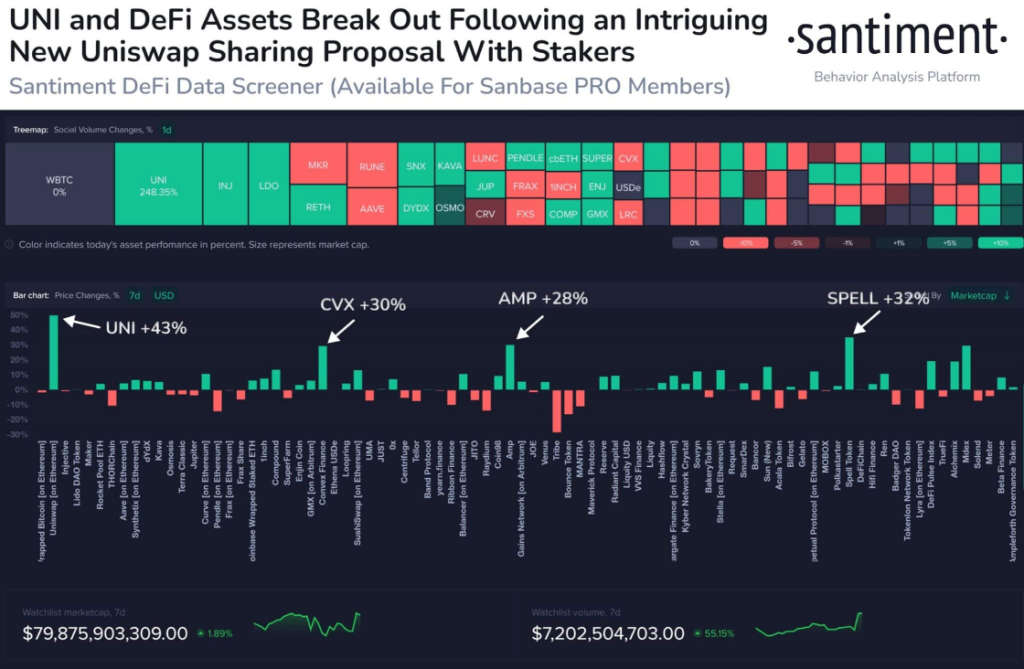

Uniswap 71% Single-Day Rally Raises Eyebrows – Can DeFi Maintain Momentum?

The cryptocurrency market witnessed a significant shift in momentum on February 23rd, as Uniswap native token, UNI, skyrocketed by an impressive 71%. This surge marks the token’s highest price point since March 2022, sending shockwaves through the crypto landscape and reigniting interest in the decentralized finance (DeFi) sector.

Uniswap Proposes Fee-Sharing Feast For Stakers

The primary catalyst behind this astronomical rise appears to be a pivotal proposal unveiled by the Uniswap Foundation. This proposition advocates for the implementation of a novel fee-sharing mechanism, fundamentally altering the token’s utility and incentivizing long-term participation within the Uniswap ecosystem.

Under the proposed system, UNI holders who stake their tokens will be rewarded with a portion of the fees generated by the Uniswap protocol. This not only grants them a direct financial incentive but also empowers them to choose delegates who vote on governance proposals, shaping the future direction of Uniswap.

This revolutionary approach resonates with a broader trend of resurgent interest in DeFi. According to on-chain data provider Santiment, assets associated with decentralized lending, borrowing, and cryptocurrency exchange, like $COMP, $SUSHI, and $AAVE, have all experienced notable value increases, mirroring UNI’s upward trajectory.

Trade Volumes On A Roll

Further bolstering this trend, trading volumes across these protocols have also seen explosive growth. For instance, the COMP price jumped alongside a staggering 400% increase in trading volume, reaching over $175 million.

Similarly, SushiSwap (SUSHI) witnessed a 27% price surge coupled with a 153% increase in trading volume. This shift in investor focus is further underscored by a corresponding decline in the value of AI-related coins, indicating a potential capital rotation within the market.

Uniswap v4 Upgrade On The Horizon: Efficiency And Customization Beckon

Adding fuel to the fire is the impending arrival of the highly anticipated Uniswap v4 upgrade, slated for release in Q3 2024. This transformative update promises to enhance the protocol’s efficiency and customizability, catering to the evolving needs of the DeFi space.

While the direct impact of v4 on the current price surge remains debatable, its potential to revolutionize the Uniswap experience undoubtedly contributes to the overall bullish sentiment surrounding UNI.

Beyond Uniswap: DeFi Dominance On The Rise?

The Uniswap fee-sharing proposal and upcoming v4 upgrade have not only revitalized the UNI token but also cast a spotlight on the broader DeFi landscape. Analysts predict that other DeFi protocols like Blur and Lido Finance could witness similar surges in the wake of Uniswap’s bold move.

This potential domino effect underscores the growing importance of DeFi within the cryptocurrency ecosystem, attracting investors seeking innovative financial solutions beyond traditional centralized systems.

Featured image from Adobe Stock, chart from TradingView

The Protocol: Restaking Tokens Are Exploding, and Restaking Isn’t Even Live

In this week’s issue of our weekly blockchain tech newsletter, Sam Kessler explores how “liquid restaking tokens” or LRTs are remaking decentralized finance. PLUS: Starknet’s STRK airdrop, Stellar’s smart-contract facelift and bitcoin’s supply crunch.

DeFi Platform Earning Yield by Shorting Ether Attracts $300M

Ethena offers a 27% annualized reward to holders of its USDe stablecoins, a yield mostly generated by shorting ether futures.

Crypto Money Laundering Plummets By 29% In Latest Chainalysis Findings

According to a recent report published by crypto analytics firm Chainalysis, money laundering involving crypto assets has experienced a notable decline compared to the previous year. However, the report highlights that illicit actors have started adapting their tactics to evade detection and further obscure the movement of illicit funds.

Evolving Tactics In Crypto Money Laundering

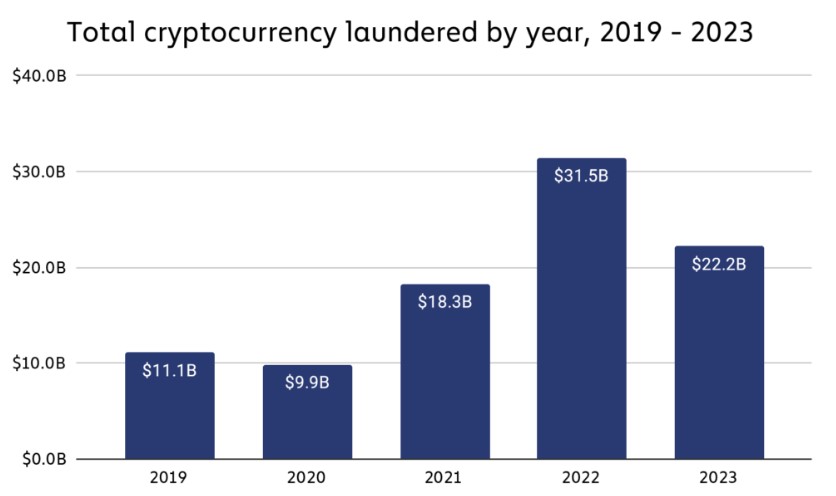

According to the report, illicit addresses sent approximately $22.2 billion worth of cryptocurrency to various services in 2023, a significant decrease from the $31.5 billion sent in 2022.

While part of this decline can be attributed to an overall decrease in legitimate and illicit crypto transaction volume, the report reveals that money laundering activity witnessed a steeper drop of 29.5%, compared to the 14.9% decrease in total transaction volume.

Centralized exchanges remain the primary destination for funds originating from illicit addresses, with this trend remaining relatively stable over the past five years. However, the report indicates a shift in the distribution of illicit funds, with a growing share being directed towards decentralized finance (DeFi) protocols.

Chainalysis suggests that this can be attributed to DeFi’s overall expansion during the same period, although the transparent nature of DeFi platforms makes them less favorable for obfuscating fund movements.

While the breakdown of service types used for money laundering in 2023 resembled that of the previous year, there were noticeable changes in specific types of crypto criminals’ money laundering practices.

The report highlights a significant increase in the volume of funds sent to cross-chain bridges from addresses associated with stolen funds, indicating a shift towards utilizing bridge protocols for money laundering purposes. Additionally, there was a substantial rise in funds sent from ransomware attacks to gambling platforms and bridges, showcasing the “adaptability and resourcefulness” of cybercriminals.

North Korean Hackers And Cross-Chain Bridges

The concentration of money laundering at fiat off-ramps, where criminals convert their crypto into cash, remains a significant concern. While thousands of off-ramping services operate, most money laundering activity is concentrated in a few services.

In 2023, 71.7% of illicit funds sent to off-ramping services went to just five services, a slight increase from 68.7% in 2022. The report also reveals an increase in deposit addresses receiving large sums of illicit cryptocurrency, indicating a more diversified approach by criminals to evade detection and mitigate the impact of frozen accounts.

Furthermore, the report highlights the changing tactics of “sophisticated” crypto criminals, particularly in the case of North Korean-affiliated hacking groups like Lazarus Group.

According to Chainalysis, these actors have demonstrated an ability to adapt their money laundering strategies in response to law enforcement actions. The report cites the shutdown of mixer services, such as Sinbad, and the subsequent rise of replacements like YoMix, which has become a preferred mixer for North Korea-affiliated hackers.

Moreover, cross-chain bridges have seen substantial growth in money laundering activities, with illicit actors leveraging these protocols to move funds between blockchains. North Korean hackers, in particular, have been prominent users of bridge protocols for money laundering purposes.

Ultimately, the report emphasizes the need for increased diligence and understanding of “interconnectedness” in fighting crypto crime by targeting money laundering infrastructure.

Featured image from Shutterstock, chart from TradingView.com

U.S. Federal Reserve Gov. Waller Says DeFi Could Boost Dollar’s Global Strength

Crypto critics often warn of digital currencies’ potential to destabilize the U.S. dollar, but Federal Reserve Gov. Christopher Waller argued that stablecoins’ dependence on the dollar could actually strengthen the U.S. fiat currency as decentralized finance (DeFi) catches on.

Fordefi Raises $10M to Make Crypto Safer With Institutional-Grade Wallet to Retail-Facing Platforms

The company has onboarded institutional investors such as Pantera Capital, DeFiance Capital, Keyrock and Flare Network to its MPC wallet, and secured over $3 billion in blockchain transaction volume.

As Tokenization Takes off, Look to DAOs

Australian Judge Hands Split Decision in Market’s Regulator vs Block Earner

An Australian court has given a split decision in a case brought by Australia’s markets regulator against Sydney-based crypto start-up Block Earner.

What Is Sui (SUI) Network?

[toc]

What Is SUI?

Sui (pronounced “Swee”) is a decentralized Layer 1 proof of stake blockchain, meaning it serves as the foundational infrastructure for verifying and processing transactions, similar to Bitcoin and Ethereum. Layer 1 blockchains are the backbone that supports a specific token or a network of different tokens.

Sui was developed by Mysten Labs, a group of former Meta employees. It is designed to limit how long it takes to execute smart contracts and support scalability for decentralized applications (dApps). The network believes it has cracked the code on smart contract execution in terms of speed, high security, and low gas fees. This is possible because of the programming language it was designed with called “Move”. Move is a Rust-based programming language that prioritizes fast and secure transaction executions.

According to the whitepaper, the network is named after the element water in Japanese philosophy, a reference to its fluidity and flexibility that developers can use to shape the development of Web3. The network is focused on low latency and super scalability. This has seen it termed by supporters as “the Solana Killer.”

The Sui project was announced by Mysten Labs in September 2021, and in December 2021, Mysten Labs invested $36 million into the project. This was followed by a $300 million series B announcement led by a $140 million commitment by FTX in 2022, valuing the startup at $2 billion.

Reasons Why Sui Network Was Created

In the words of Sui Co-Founder and CEO, Evan Cheng, the current Web3 infrastructure is slow, expensive, and notoriously unreliable. Given this, Cheng said the network was created to change the Web3 game with some 5G level upgrades that would allow developers to create blockchain-powered applications with scalability that you can only associate with centralized technology hubs that dominated Web 2.0.

In other words, the Sui network was created to solve Web3 problems by simplifying and improving the creation of various applications and functions in the Web3 ecosystem, solving the most common problems in the Web3 industry: speed, security, and stability.

How Does The Blockchain Work?

Sui operates as a Layer 1 blockchain focused on optimizing fast blockchain transfers. It places a high level of importance on immediate transaction finalization, making Sui an ideal platform for on-chain applications such as decentralized finance (DeFi), gaming, and other real-time use cases.

Unlike the existing Layer 1 blockchains where transactions are added one after the other, which makes it slow as more transactions are being added to the blockchain, Sui does not make every transaction go through all the computers in the network. Instead, it picks the relevant part of the data it needs to check, which eliminates the problem of congestion on the blockchain and drastically reduces gas fees to carry out transactions.

The Sui network uses a permissionless set of validators to reduce latency and a protocol called the Delegate Proof of Stake system. It has epochs (each consisting of 24 hours), during which Sui holders select a set of validators with whom they store their staked tokens. The validators are then in charge of transaction selection and approval.

Who Are The Brains Behind The Sui Network?

Co-Founder and CEO Evan Cheng: Cheng previously worked at Apple for 10 years, and he was also the former Head of Research and Development at Novi and Technical Director of Meta.

The Chief Scientist George Danezis: Former researcher at Novi, Meta, and previously worked at Chainspace, Microsoft.

Adeniyi Abiodun, CPO: Former Head of Product Development at Novi, Meta. Previously worked at VMware, Oracle, PeerNova, HSBC, and JP Morgan.

Kostas Chalkias: Former leading cryptographer at Novi. He previously worked at R3, Erybo, Safemarket, and NewCrypt.

Sam Blackshear, CTO: Former Chief Engineer at Novi, specializing in the Move programming language.

Investors and Institutions Backing The Network

Sui was valued at $2 billion after FTX Ventures committed $140 million to the project. However, Sui also has other credible investors who also committed, like Binance Labs, the largest centralized crypto exchange by daily trading volume, and Coinbase Ventures, the largest crypto exchange in the United States.

Other investors included Franklin Templeton, a global leader in asset management with more than seven decades of experience, and Jump Crypto, an experienced team of builders, developers, and traders. Apollo, Lightspeed Venture, Circle Ventures, Partners, Sino Global, Dentsu Ventures, Greenoaks Capital, and O’Leary Ventures also invested in the blockchain.

Uses of Sui Coin

SUI coin plays a crucial role within the ecosystem and serves various functions:

- Governance: Sui coin holders can participate in governance decision-making, which includes parameter adjustments, protocol upgrades, and other key network changes. This means SUI holders have a say in the direction and development of the Sui Network.

- Transaction Fees: SUI coin is used to pay for transaction fees within the network. The coin acts as the medium of exchange to cover all associated fees, whether you are interacting with smart contracts, transferring assets, or participating in any Sui on-chain activity.

- Utility: The native coin will be used in various decentralized applications (dApps), gaming applications, and other projects built on the network. It will be used to purchase in-game accessories and NFTs.

- Staking: Staking SUI coin helps network security and consensus. SUI coin holders who stake their coins are being rewarded and given incentives for participation and engagement.

- Investment: Investors can buy and hold or trade SUI coins as an investment on centralized exchanges, just like Bitcoin, Ethereum, Solana, Cardano, BNB, and all other blockchains with good use cases.

Sui Network Plans To Improve The Web3 Ecosystem

Transaction Speeds

Sui Network aims to solve the slow transaction problems on Web3. The network was built on a Rust-based programming language called Move, which prioritizes fast and secure transaction executions. Transactions on the Sui network are validated in epochs of 24 hours, each epoch can be validated independently rather than in blocks like it’s done on traditional blockchains.

The parallel execution of transactions increases Sui network transaction speed to 297,000 transactions per second and 400 milliseconds time of finality compared to Ethereum’s 20 transactions per second and 6 minutes time of finality or Solana’s 10,000 transactions per second and 2.5 seconds time of finality.

Focus On Web3 And Asset Ownership

The Sui network is focused on improving Web3 and Web3 experience by catering to the needs of millions of users, which includes speed and security. Sui allows users to create, upgrade, and deploy decentralized applications and non-fungible tokens (NFTs)

Scalability

Sui Network aims to make Web3 more scalable through parallel processing or execution. This means that the Sui network identifies independent transactions and processes them simultaneously. The implication is that transaction times are reduced, and it accommodates larger transactions loaded per time. It is made possible because of the Sui implementation of the Move programming language and the Narwhal-Bullshark-Tusk Consensus algorithm, which focuses on the details of a transaction rather than the entire chain of transactions.

The Tokenomics Of SUI coin

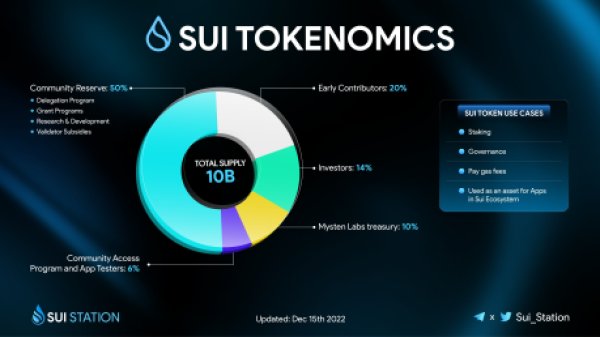

Sui’s native token is called SUI, which has several use cases. According to Coingecko, the max and total supply of SUI is capped at 10 billion coins with a current circulating supply of 1.2 billion, and it is ranked number 48 based on market cap value.

A share of the total supply of SUI was made liquid at the launch of its mainnet on May 3, 2023. Sui’s all-time high was on the day it was launched at $2.16. However, it is currently trading at $1.51, which is a 320% pump from its all-time low of $0.364 last year on October 19.

The tokenomics included 6% going to its Community Access Program and App Testers, 10% of the supply went to the Mysten Labs Treasury, 14% went to its Investors, and 20% went to Early Contributors. The vast majority of the supply, 50%, is kept in its Community Reserve. The purpose and distribution of the Community Reserve include a Delegation Program, Grant Programs, Research & Development, and Validator Subsidies, as shown in the illustration below:

Only about 5% of SUI coins were already in use when the Sui Mainnet launched, while the rest will be gradually released according to their planned schedule, as shown below:

Conclusion

Sui Network aims to improve Web3 by giving every Web3 user a much better Web3 experience without the struggles of slow transaction speeds. The network uses parallel execution for transactions to ensure lightning-fast speed, high security, and low gas fees.

What Is ERC-404? The Experimental Standard Whose First Token Has Rocketed 12,000% in One Week

ERC-404 allows multiple wallets to directly own a single NFT, and, in the future, create a use case where that specific exposure can be tokenized and used to take out loans or stake holdings.

DeFi Platform Pendle Nears $1B in Total Value Locked

Pendle crossed the $100 million TVL mark in mid-June 2023.