Some surprise winners in Drift’s road to decentralization include MetaDAO.

Crypto Exchange Figure Markets Has a Plan to Democratize Finance

What appears to be another post-FTX trading and custody play with institutions in mind, is really all about visionary disruption.

Solana Leapfrogs Ethereum on DEX Volume

The meme coin frenzy seems to have catalyzed higher volumes on the Solana blockchain, which also boasts greater capital efficiency than Ethereum.

Billion-Dollar Volumes and Then a Steep Drop Prompts Allegations of Wash Trading on Aevo

In response, Aevo says customers suddenly traded more on its decentralized exchange to try to get some of its airdrop.

PancakeSwap Decentralized Exchange Unveils Version 4 to Make Trading More Efficient

The platform is adding four features designed to make trading faster, cheaper and more customized.

What Is Sei (SEI) Network?

The Sei (SEI) Network is a Cosmos-based layer-1 blockchain that aims to change the world of digital asset trading, especially in the decentralized exchange (DEX) ecosystem. It was specifically designed for the world of trading, featuring various sectors of the cryptocurrency space spanning GameFi, NFTs, and, most especially, decentralized finance (DeFi). Sei is positioned as the “Decentralized NASDAQ,” as it offers a seamless blend of centralized finance (CeFi) trading experiences with decentralized finance tools.

Since its inception, it has established itself as a major player in the cryptocurrency space by providing cutting-edge features and advantages over rivals. With its innovative technology stats and passionate community, it has become one of the fastest-growing Layer 1 blockchains for trading and other purposes.

At its core, the SEI token is designed to optimize and streamline business operations and interactions. It is expected to be not just a cryptocurrency but a comprehensive solution that addresses several challenges in the contemporary blockchain ecosystem.

Who Are The Founders Of Sei Network?

Sei (SEI) network founders and brains behind the SEI are Jayendra Jog, Dan Edlebeck, and Jeffrey Feng. Jayendra Jog was the former lead software engineer at Robinhood, a popular centralized crypto exchange.

Dan Edlebeck is the co-founder and CEO of Exidio, a decentralized VPN application in the Cosmos ecosystem. Lastly, Jeffrey Feng brought his investment experience from his role at Goldman Sachs.

Investors And Institutions Backing the SEI Token

The Sei network has a lot of credible investors and institutions backing it, such as Coinbase, which is one of the largest centralized exchanges (CEX) in the world; Jump, Muitcoincapital, Layer Zero, GSR, and many more, as shown in the screenshot from the website below.

What Sei Network Aims To Achieve In The Crypto Space And Beyond

Sei aims to foster smart, efficient, and sustainable enterprises, and it does so by leveraging the power of blockchain technology to automate processes, reduce costs, and eliminate intermediaries. This makes Sei tokens a frontrunner in the race toward a decentralized future.

Sei token is unique in its approach and functionality as it goes beyond the standard features of cryptocurrencies and offers a sophisticated governance model encouraging active community participation. It takes the decentralization aspect a notch higher by ensuring fair and transparent decision-making.

The token is designed for compatibility and scalability, allowing seamless integration with new and existing business systems. This means whether you are a large corporation like Blackrock, which manages $10 trillion in assets, or a small business startup, the Sei token is designed to fit right into your operations, providing you with the benefits of blockchain without the hassle of overhauling your business system.

How Does Sei (SEI) Work?

One of the major problems with decentralized exchange (DEXs) is that orders are either not processed on-chain or are processed on-chain on a fast blockchain at the expense of decentralization and security.

Given this bottleneck, the Sei network has implemented several innovative features to resolve the challenges faced by decentralized exchanges (DEXs) by combining off-chain speed with on-chain security. It aggregates orders at the end of the block and executes them all at once rather than executing them one at a time, and in this way, it prevents the persistent problem of front-running in decentralized trading.

The Sei network also makes use of native price oracles that minimize external dependencies while offering trustworthy data feeds. It handles the placement and execution order of a single transaction as opposed to doing so in two (2).

What Makes The Network Unique?

The Sei network stands out from the rest due to its self-executing smart contracts with the terms of the agreement directly written into code lines. The code and the agreement contained therein then exist across a distributed blockchain network.

This means that the transactions are irreversible and trackable, and they do not require a third-party intermediary. This automation process drastically reduces costs and increases efficiency, making transactions smooth and very easy.

Sei tokens also utilize a decentralized infrastructure, which means any single central entity or authority does not control it. Instead, control is spread out amongst many different nodes or computers that participate in the network to ensure that even if one node goes down, the entire network continues running smoothly.

The decentralized nature of the SEI token fosters a sense of community and mutual trust among its users. It boasts a democratic system that encourages active participation and promotes transparency and fairness.

Notable Features Of The Sei (SEI) Network

Twin-Turbo Consensus Mechanism: The Sei network leverages the Cosmos SDK and Tendermint Core to provide decentralized trading apps with speed, security, capital efficiency, and decentralization.

Parallelization: The Sei blockchain divides work into smaller chunks, processing and executing them simultaneously to prevent front-running.

Native Order Matching: The Native Order Matching feature ensures that decentralized exchanges (DEXes) are able to have their own central limit order book (CLOB).

Order Bundling: Sei offers order bundling at the client and chain level to enhance user experience and efficiency.

Price Oracles: It’s integrated into a native system for trustworthy assets with real-time oracles provided by validators, meaning that Sei provides users with an Oracle module that functions as a token price reference.

Lightning Speed Transactions: Sei claims to offer 600 milliseconds in transaction finality, making it highly scalable compared to other crypto projects like Bitcoin, Ethereum, and even Solana.

Fee Structure: At launch, SEI tokens have no chain-level trading fees; however, decentralized exchanges (DEX) may introduce their transaction fees through smart contracts.

Potential Applications Across Various Industries

Banking and Financial Industry: The Sei blockchain technology is designed to streamline operations, eliminating the need for intermediaries and reducing transaction costs. This will bring a new level of transparency to the banking and financial industry, with every transaction recorded and traceable on the blockchain.

Medical and Healthcare Industry: The Sei network offers an efficient way to manage and share patient data securely. This can help eradicate fraudulent activities, improve patient care, and enhance data interoperability.

Supply Chain (Import and Export) Industry: The Sei blockchain network token can ensure the authenticity and traceability of products, from the raw materials to the end consumers. Every step can be recorded on the blockchain, providing full visibility and reducing the emergence of counterfeit goods and products.

Impact on the Environment: Sei’s eco-friendly consensus mechanism significantly reduces energy consumption compared to traditional cryptocurrency. Its smart contracts can automate carbon credit trading, supporting businesses in their sustainability efforts.

Digital Identities: The Sei network can be employed to develop a secure decentralized solution for managing digital identities and protecting individuals’ privacy and digital data.

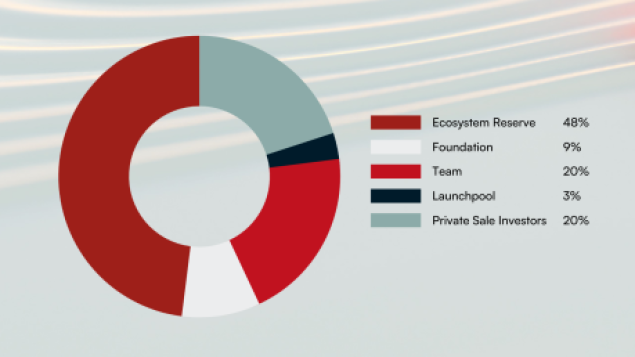

The Tokenomics Of SEI Coin

Sei’s native cryptocurrency, SEI, does not have a maximum supply of tokens to be mined. However, it has a total supply of 10 billion coins. This means all of the tokens in circulation have been free-mined on the blockchain, including those that are locked or reserved. The token has a circulating supply of 2.4 billion at the time of publication.

According to its website, 48% of the supply is in an Ecosystem Reserve, with Private Sale Investors and the Team receiving 20% of the supply, respectively. 9% of the supply went to the Sei Foundation and the Launchpool received 3% of the supply.

Sei token is up 619% since its all-time low of $0.09536 on October 19, 2023, and its latest all-time high of $0.8778 was recorded on January 3, 2024. With a market cap of $1.5 billion, it is currently the 48th-largest cryptocurrency in the industry.

Conclusion

The Sei network aims to solve issues not only in the crypto industry but also in other industries. This includes the likes of the banking and financial industry, where it aims to reduce the costs of transactions by eliminating the use of intermediaries and providing top-notch security measures to protect user privacy and identities.

The blockchain is energy-efficient compared to the likes of Bitcoin as it doesn’t consume as much energy. Its super-fast 600-millisecond transaction finality makes it highly scalable on a scale comparable to Kaspa, whose full confirmation transactions are at an average of 10 seconds.

Crypto Trading Platform Avantis Opens Perpetual Swaps DEX on Base Network

Jupiter’s JUP Rallies On With Solana Supporters Leading the Charge

One of the most-anticipated airdrops faced social media ire over its novel token distribution plan.

Fintech Provider Portal Raises $34M Seed Round for Bitcoin-Based Decentralized Exchange

Portal aims to offer a decentralized infrastructure for peer-to-peer swapping of BTC across different blockchains without the need for intermediaries, which heighten the risk of hacks.

Solana Trading Aggregator Jupiter Sees Trading Volumes Jump Ahead of JUP Issuance

The decentralized exchange settled over $500 million in trades on Sunday, briefly becoming the biggest DEX platform.

How To Buy, Sell, And Trade Crypto Tokens On The Cardano (ADA) Network

[toc]

The Cardano Network is a decentralized proof-of-stake blockchain platform with smart contract support and uses its own native token ADA, just like the Ethereum blockchain. Cardano is often described as the Ethereum killer. However, Cardano also considers itself the updated version of Ethereum, which is currently the king of all altcoins, including ADA.

Cardano (ADA) The Supposed Ethereum Killer

It has been said that Cardano has anointed itself as a third-generation crypto platform which it regards to Ethereum as the second generation. Cardano has deemed itself fit to be a threat or competitor to Ethereum as they are both similar in so many ways, including the fact that Cardano (ADA) was created by one of the co-founders of Ethereum, Charles Hoskinson.

As Ethereum is having a hard time with high gas fees issues and slow transaction times, Cardano is all set up to take their share and make a name for themselves in the NFT, DeFI, and Stablecoin market. Cardano aims to be scalable and low-cost for users compared to Ethereum, its major competitor.

It enables owners of their native token ADA to help operate the network and vote on changes to the software roles. A lot of developers now use the Cardano Blockchain for Smart contracts and building decentralized applications (dApps).

Cardano Continues To Evolve: Hard Forked From Byron To Shelley

Cardano has been releasing its blockchain in stages with the aim of releasing better, cleaner, and more secure codes. They continued to evolve as the Cardano blockchain hard forked from Byron, a federated and static model, to Shelley, a more dynamic and decentralized model

A hard fork means or is described as a radical change in the blockchain, but in the case of Cardano, The blockchain hard fork was unique because instead of the blockchain radical change, it ensured a smooth transition from the old protocol to a new protocol while saving the history of the previous blocks. This means the Cardano blockchain contains the Byron blocks and after a certain transaction period, it adds the Shelley blocks.

Shelley was upgraded, and the Shelley protocol upgrade added a new feature that enabled different kinds of Smart contract use cases, which included the creation and transactions with multi-asset tokens. It also established support for the Voltaire voting mechanism. The Shelley protocol hard fork upgrade of March 2021 called “Mary” introduced native token and multi-asset support on the Cardano Blockchain.

Mary allows users to create their own tokens that run on the Cardano network natively, just like Cardano’s native token ADA. Similar to the ERC20 tokens that can be created and transacted on the Ethereum network, Native tokens will open up this same functionality to Cardano.

How Does Cardano (ADA) Work?

The Cardano (ADA) Blockchain is made up of two main components, which are the Cardano Computational Layer (CCL) and the Cardano Settlement Layer (CSL).

The Cardano Computational Layer (CCL):

The Cardano Computational Layer (CCL) consist of the Ouroboros consensus protocol and Proof of stake, which are the backbone of the Cardano blockchain. They help to run smart contracts, it also ensures compliance and security. Lastly, allow other key advanced features and functionalities such as identity recognition and blacklisting.

The Cardano Settlement Layer (CSL):

The Cardano Settlement Layer (CSL) serves as the accounting layer of the Cardano blockchain where its native token holders can send and receive their ADA immediately with minimal transaction fees.

Blockchain Industry Issues Cardano Aims To Solve

- To create a secure voting mechanism for token holders.

- To Separate accounting and computation layers.

- To create an infinitely scalable consensus mechanism.

- To use mathematics to provide a provably secure blockchain that is less susceptible to attacks.

Benefits And Advantages of Cardano (ADA) Blockchain

Decentralization: The Cardano network is designed to promote decentralization, and the founder of ADA Charles Hoskinson, is confident that the network would be 50 to 100 times more decentralized than Bitcoin.

High scalability: The recent Cardano Blockchain Vasil hard fork solves scalability issues as it introduced critical updates that streamline transaction processing, ultimately increasing the transactions per second (tps) Cardano’s blockchain can handle to significantly boost transaction processing speeds, unlike Ethereum.

Multilayer security measures: Cardano has a multilayer architecture that separates the computation layer from the accounting layer and also the Ouroboros proof of stake algorithm reduces the surface attack and ensures good security without falling short on decentralization.

Low gas fees: Unlike Ethereum, Cardano has low transaction or gas fees which makes it more appealing to users and developers.

Environmentally friendly ecosystem: Cardano is designed to be accessible to all persons, no matter their level of skill, from novices to advanced users.

Strong Community: A project is as strong as its community and Cardano has a strong community of active users, developers, researchers, and founders all work together to make the project a very good one.

How To Buy, Sell, And Trade Crypto Tokens On The Cardano (ADA) Network

To see a full picture of the Cardano ecosystem, go to CardanoCube. CardanoCude has information on the applications on the Cardano Blockchain, ranging from DEXes to Liquidity to Wallets, Marketplaces, DeFI, Infrastructure, and Launchpads, in case you want to launch a project on the Cardano Blockchain. There are also Metaverse platforms, Gaming platforms, AI tools, Community & DAO, Developer Tools, Meme Coin, and so many more.

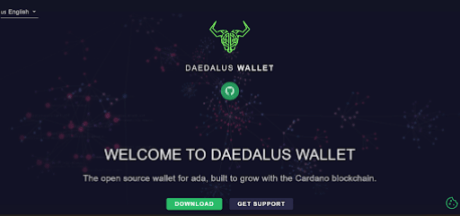

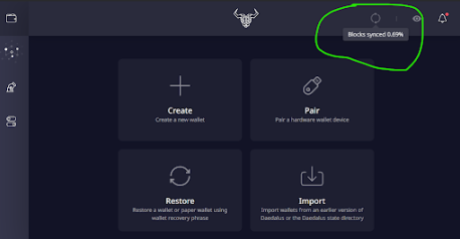

To buy and sell tokens on the Cardano (ADA) network, you need to get a wallet. The official wallet created by the Cardano developer IOG is called DAEDALUS. DAEDALUS is a desktop or PC secure wallet for the ADA cryptocurrency that downloads a full copy of the Cardano Blockchain, and it independently validates every transaction in its history, ensuring maximum security.

How To Install, Set Up, and Use DAEDALUS Wallet

Make sure you download the installation file from the DAEDALUS official website daedaluswallet.io. Once the website is open, click on “Download” and then choose your operating system: either macOS, Linux, or Windows. Start the downloading process by clicking on “Download DAEDALUS.”

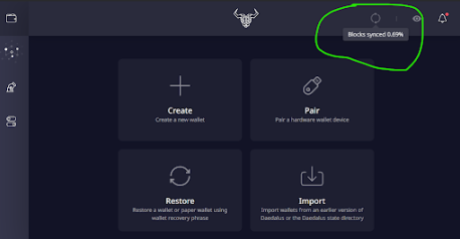

Install it, and once DAEDALUS is launched, you will need to configure the general settings and click on “Continue.” Read, and accept the terms and conditions.

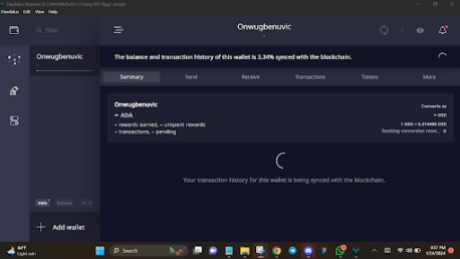

Please note that the blockchain must be completely synced before you can use your wallet.

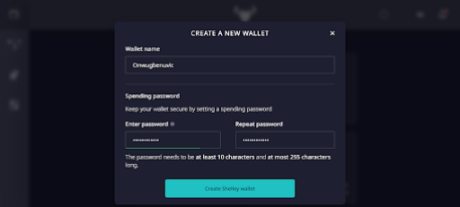

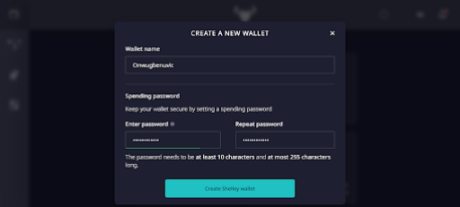

To create a new wallet, click on the “Create” button, give your wallet a “Name,” and Create your “Spending password”. You will need your spending password later to make transactions. It will also Encrypt your wallet file in the dataless directory.

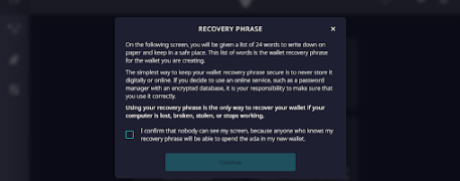

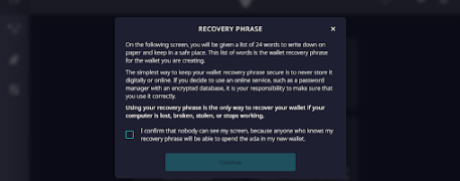

After the setup, the “Recovery phase” page will pop up, and you will be given the 24-word secret phrase that you can use to recover your account in case your laptop is stolen or broken.

Ensure to write down your secret phrase and keep it in a safe place, after verifying your secret phrase your wallet is all set up.

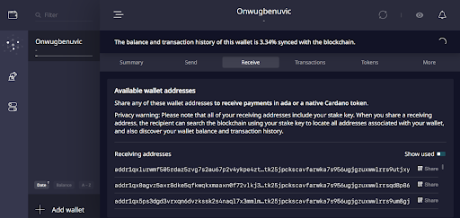

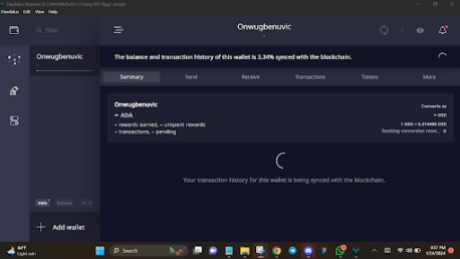

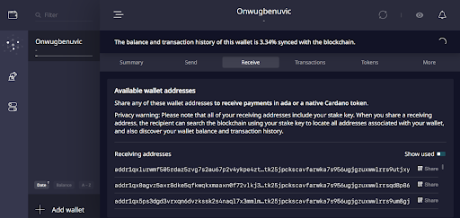

Click on “Send” to send coins and Click on “Receive” to receive coins, select one of the automatic recipient addresses to receive your coins for other exchanges.

How To Use The Wallet Function On Minswap Instead Of Daedalus

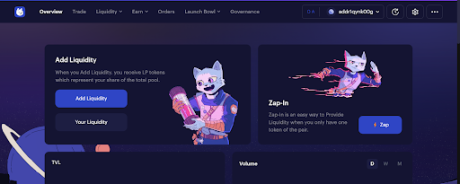

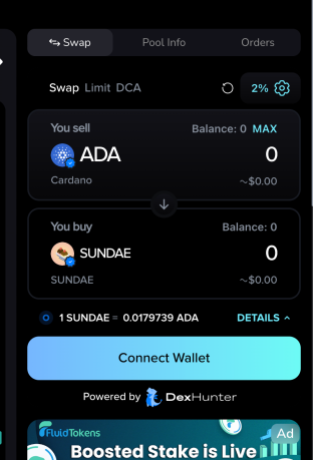

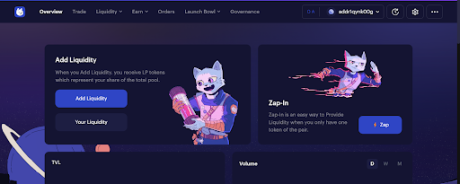

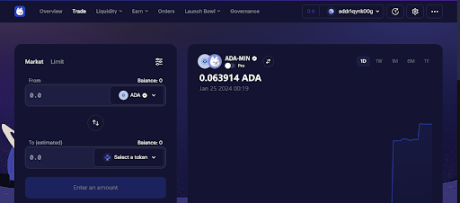

Minswap is a multi-pool decentralized exchange (DEX) on Cardano (ADA) where you can swap tokens with minimal time, cost, and maximum ease.

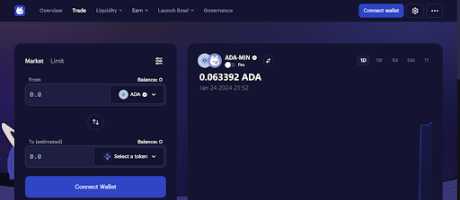

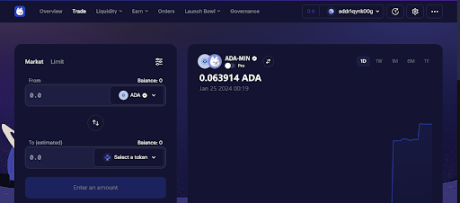

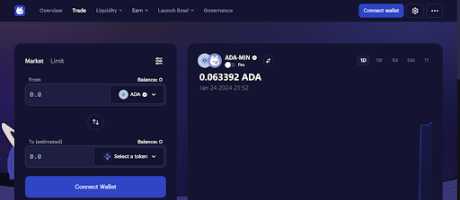

The Minswap website is user-friendly and easy to trade on. Go to the website, click on “Trade,” then click on “Connect wallet.”

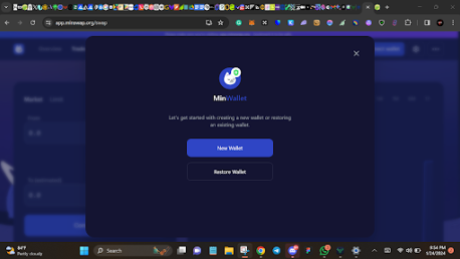

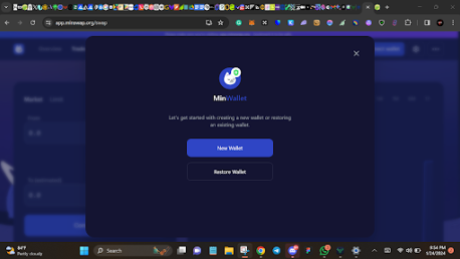

You might not see the DAEDALUS wallet there, so just create a “MinWallet” by clicking on it, then click on “New Wallet.” Copy your 24-word secret phrase down, write it down in a safe place, verify your secret phrase, create your MinWallet password, Now your MinWallet is ready to be used.

How To Buy ADA On Centralized Exchanges And Send To Your MinWallet

You need some ADA tokens in your wallet to make your transactions. You can buy your ADA from centralized exchanges (CEX) like ByBit, Binance, OKX, and MEXC, etc. In this case, we will use Binance.

Once the ADA is purchased, copy your MinWallet address, go to Binance, buy your ADA, and then go to “Withdraw.” Paste the MinWallet address you copied in the box to input your address, and Cardano will be automatically filled as your transfer network. Input the amount of ADA you want to transfer, then click on the “Withdraw” button.

How To Trade Crypto Tokens On MinSwap

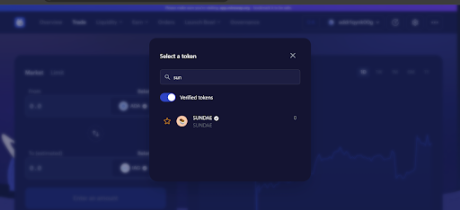

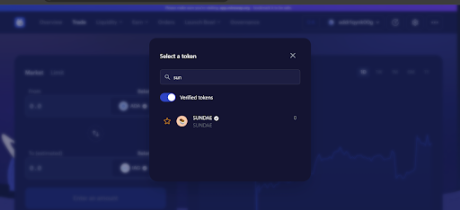

To buy tokens, go to Coingecko and search for the token on the Cardano Blockchain Network you want to buy. Alternatively, you can go to the social media pages of the token you want to make sure you have the correct coin. Go back to MinSwap, click on the denominator token button, input the name of the token you want to buy, and select it.

Input the amount of ADA you want to swap for that token and swap it. If you want to sell, just switch their positions and swap.

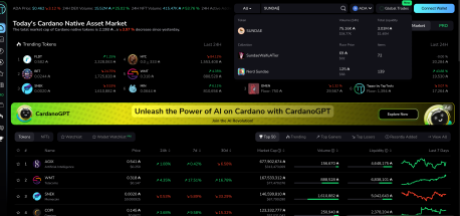

Checking Prices Of Cardano-Based Tokens

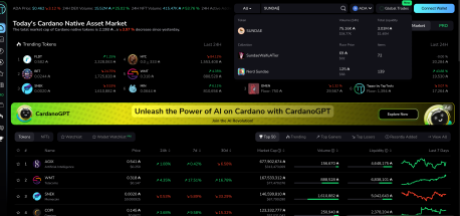

Knowing how to check the price action of tokens when trading on blockchains such as Cardano is important for investors to make the best decisions. For the Cardano network, data trackers such as TapTools is the one-stop-shop for all things Cardano charts.

Just go to TapTools, click the Search bar, and input the name of the token you want to check. In this case, we’re using SUNDAE.

Choose the correct token and click on it, and TapTools will show you the price chart for that token. By using TapTools, you will be able to keep track of the price and follow how your token is doing, as shown below:

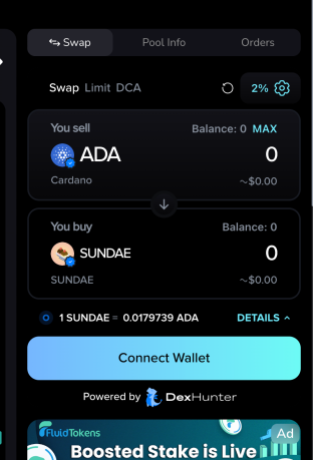

Interestingly, TapTools also has its own inbuilt decentralized exchange (DEX) for those who want to do everything in the same place. All you have to do is connect your wallet similarly to connecting to MinSwap as illustrated above, pick the token you want to swap to, enter the amount of ADA you want to swap, and click “Swap”. The DEX is visible on the right-hand side when you open the chart of a token.

Conclusion

Trading on the Cardano (ADA) network is quick and seamless due to its fast transaction speeds and low fees. However, like with any crypto trading, it does carry its own risk, which could be a partial or total loss of capital.

How To Buy, Sell, And Trade Crypto Tokens On The Cardano (ADA) Network

[toc]

The Cardano Network is a decentralized proof-of-stake blockchain platform with smart contract support and uses its own native token ADA, just like the Ethereum blockchain. Cardano is often described as the Ethereum killer. However, Cardano also considers itself the updated version of Ethereum, which is currently the king of all altcoins, including ADA.

Cardano (ADA) The Supposed Ethereum Killer

It has been said that Cardano has anointed itself as a third-generation crypto platform which it regards to Ethereum as the second generation. Cardano has deemed itself fit to be a threat or competitor to Ethereum as they are both similar in so many ways, including the fact that Cardano (ADA) was created by one of the co-founders of Ethereum, Charles Hoskinson.

As Ethereum is having a hard time with high gas fees issues and slow transaction times, Cardano is all set up to take their share and make a name for themselves in the NFT, DeFI, and Stablecoin market. Cardano aims to be scalable and low-cost for users compared to Ethereum, its major competitor.

It enables owners of their native token ADA to help operate the network and vote on changes to the software roles. A lot of developers now use the Cardano Blockchain for Smart contracts and building decentralized applications (dApps).

Cardano Continues To Evolve: Hard Forked From Byron To Shelley

Cardano has been releasing its blockchain in stages with the aim of releasing better, cleaner, and more secure codes. They continued to evolve as the Cardano blockchain hard forked from Byron, a federated and static model, to Shelley, a more dynamic and decentralized model

A hard fork means or is described as a radical change in the blockchain, but in the case of Cardano, The blockchain hard fork was unique because instead of the blockchain radical change, it ensured a smooth transition from the old protocol to a new protocol while saving the history of the previous blocks. This means the Cardano blockchain contains the Byron blocks and after a certain transaction period, it adds the Shelley blocks.

Shelley was upgraded, and the Shelley protocol upgrade added a new feature that enabled different kinds of Smart contract use cases, which included the creation and transactions with multi-asset tokens. It also established support for the Voltaire voting mechanism. The Shelley protocol hard fork upgrade of March 2021 called “Mary” introduced native token and multi-asset support on the Cardano Blockchain.

Mary allows users to create their own tokens that run on the Cardano network natively, just like Cardano’s native token ADA. Similar to the ERC20 tokens that can be created and transacted on the Ethereum network, Native tokens will open up this same functionality to Cardano.

How Does Cardano (ADA) Work?

The Cardano (ADA) Blockchain is made up of two main components, which are the Cardano Computational Layer (CCL) and the Cardano Settlement Layer (CSL).

The Cardano Computational Layer (CCL):

The Cardano Computational Layer (CCL) consist of the Ouroboros consensus protocol and Proof of stake, which are the backbone of the Cardano blockchain. They help to run smart contracts, it also ensures compliance and security. Lastly, allow other key advanced features and functionalities such as identity recognition and blacklisting.

The Cardano Settlement Layer (CSL):

The Cardano Settlement Layer (CSL) serves as the accounting layer of the Cardano blockchain where its native token holders can send and receive their ADA immediately with minimal transaction fees.

Blockchain Industry Issues Cardano Aims To Solve

- To create a secure voting mechanism for token holders.

- To Separate accounting and computation layers.

- To create an infinitely scalable consensus mechanism.

- To use mathematics to provide a provably secure blockchain that is less susceptible to attacks.

Benefits And Advantages of Cardano (ADA) Blockchain

Decentralization: The Cardano network is designed to promote decentralization, and the founder of ADA Charles Hoskinson, is confident that the network would be 50 to 100 times more decentralized than Bitcoin.

High scalability: The recent Cardano Blockchain Vasil hard fork solves scalability issues as it introduced critical updates that streamline transaction processing, ultimately increasing the transactions per second (tps) Cardano’s blockchain can handle to significantly boost transaction processing speeds, unlike Ethereum.

Multilayer security measures: Cardano has a multilayer architecture that separates the computation layer from the accounting layer and also the Ouroboros proof of stake algorithm reduces the surface attack and ensures good security without falling short on decentralization.

Low gas fees: Unlike Ethereum, Cardano has low transaction or gas fees which makes it more appealing to users and developers.

Environmentally friendly ecosystem: Cardano is designed to be accessible to all persons, no matter their level of skill, from novices to advanced users.

Strong Community: A project is as strong as its community and Cardano has a strong community of active users, developers, researchers, and founders all work together to make the project a very good one.

How To Buy, Sell, And Trade Crypto Tokens On The Cardano (ADA) Network

To see a full picture of the Cardano ecosystem, go to CardanoCube. CardanoCude has information on the applications on the Cardano Blockchain, ranging from DEXes to Liquidity to Wallets, Marketplaces, DeFI, Infrastructure, and Launchpads, in case you want to launch a project on the Cardano Blockchain. There are also Metaverse platforms, Gaming platforms, AI tools, Community & DAO, Developer Tools, Meme Coin, and so many more.

To buy and sell tokens on the Cardano (ADA) network, you need to get a wallet. The official wallet created by the Cardano developer IOG is called DAEDALUS. DAEDALUS is a desktop or PC secure wallet for the ADA cryptocurrency that downloads a full copy of the Cardano Blockchain, and it independently validates every transaction in its history, ensuring maximum security.

How To Install, Set Up, and Use DAEDALUS Wallet

Make sure you download the installation file from the DAEDALUS official website daedaluswallet.io. Once the website is open, click on “Download” and then choose your operating system: either macOS, Linux, or Windows. Start the downloading process by clicking on “Download DAEDALUS.”

Install it, and once DAEDALUS is launched, you will need to configure the general settings and click on “Continue.” Read, and accept the terms and conditions.

Please note that the blockchain must be completely synced before you can use your wallet.

To create a new wallet, click on the “Create” button, give your wallet a “Name,” and Create your “Spending password”. You will need your spending password later to make transactions. It will also Encrypt your wallet file in the dataless directory.

After the setup, the “Recovery phase” page will pop up, and you will be given the 24-word secret phrase that you can use to recover your account in case your laptop is stolen or broken.

Ensure to write down your secret phrase and keep it in a safe place, after verifying your secret phrase your wallet is all set up.

Click on “Send” to send coins and Click on “Receive” to receive coins, select one of the automatic recipient addresses to receive your coins for other exchanges.

How To Use The Wallet Function On Minswap Instead Of Daedalus

Minswap is a multi-pool decentralized exchange (DEX) on Cardano (ADA) where you can swap tokens with minimal time, cost, and maximum ease.

The Minswap website is user-friendly and easy to trade on. Go to the website, click on “Trade,” then click on “Connect wallet.”

You might not see the DAEDALUS wallet there, so just create a “MinWallet” by clicking on it, then click on “New Wallet.” Copy your 24-word secret phrase down, write it down in a safe place, verify your secret phrase, create your MinWallet password, Now your MinWallet is ready to be used.

How To Buy ADA On Centralized Exchanges And Send To Your MinWallet

You need some ADA tokens in your wallet to make your transactions. You can buy your ADA from centralized exchanges (CEX) like ByBit, Binance, OKX, and MEXC, etc. In this case, we will use Binance.

Once the ADA is purchased, copy your MinWallet address, go to Binance, buy your ADA, and then go to “Withdraw.” Paste the MinWallet address you copied in the box to input your address, and Cardano will be automatically filled as your transfer network. Input the amount of ADA you want to transfer, then click on the “Withdraw” button.

How To Trade Crypto Tokens On MinSwap

To buy tokens, go to Coingecko and search for the token on the Cardano Blockchain Network you want to buy. Alternatively, you can go to the social media pages of the token you want to make sure you have the correct coin. Go back to MinSwap, click on the denominator token button, input the name of the token you want to buy, and select it.

Input the amount of ADA you want to swap for that token and swap it. If you want to sell, just switch their positions and swap.

Checking Prices Of Cardano-Based Tokens

Knowing how to check the price action of tokens when trading on blockchains such as Cardano is important for investors to make the best decisions. For the Cardano network, data trackers such as TapTools is the one-stop-shop for all things Cardano charts.

Just go to TapTools, click the Search bar, and input the name of the token you want to check. In this case, we’re using SUNDAE.

Choose the correct token and click on it, and TapTools will show you the price chart for that token. By using TapTools, you will be able to keep track of the price and follow how your token is doing, as shown below:

Interestingly, TapTools also has its own inbuilt decentralized exchange (DEX) for those who want to do everything in the same place. All you have to do is connect your wallet similarly to connecting to MinSwap as illustrated above, pick the token you want to swap to, enter the amount of ADA you want to swap, and click “Swap”. The DEX is visible on the right-hand side when you open the chart of a token.

Conclusion

Trading on the Cardano (ADA) network is quick and seamless due to its fast transaction speeds and low fees. However, like with any crypto trading, it does carry its own risk, which could be a partial or total loss of capital.

dYdX Tops Uniswap as Largest DEX by Volume

The decentralized exchange, which last year moved over to the Cosmos blockchain, just saw $757 million of volume over a 24-hour period.

How To Buy, Sell, And Trade Tokens On The BSC Network

The captivating Binance Smart Chain (BSC) Network has morphed into a powerful force within the blockchain ecosystem, offering various benefits and opportunities for users and developers alike. Introduced by Binance, a top player in the global cryptocurrency exchange realm, BSC provides a robust and efficient infrastructure for decentralized applications (dApps) and digital asset transactions.

The key advantage of the BSC network is its high-speed and low-cost transactions. With its standout consensus mechanism, BSC achieves fast block confirmations, enabling quick and seamless transfers of digital assets. This scalability advantage makes BSC an attractive choice for users who value speed and efficiency in their transactions.

Advantages Of The Binance Smart Chain (BSC) Network

The Binance Smart Chain (BSC) offers several advantages that have contributed to its popularity and growth within the blockchain ecosystem. Here are some key advantages of the BSC network:

High Speed and Low Transaction Fees: BSC is known for its fast block confirmations, which result in quick transaction processing times. This speed is achieved through its unique consensus mechanism. Additionally, BSC’s low transaction fees have made it a preferred platform for developers and users.

Compared to other popular blockchain networks, BSC offers significantly lower transaction costs, making it more accessible for individuals and businesses of all sizes. This cost-effective system has aided the exponential growth of decentralized finance (DeFi) applications on the BSC network by providing a wide range of financial services to users around the world.

Scalability: BSC has been designed to handle high transaction volumes, allowing for the smooth and efficient execution of decentralized applications (dApps). This advantage enables BSC to accommodate the growing demands of users and developers without compromising performance.

Compatibility with Ethereum: The compatibility of BSC with the Ethereum Virtual Machine (EVM) has made it easy for developers to port their existing Ethereum-based projects to BSC, expanding the pool of available applications.

This opens up a world of possibilities, as it expands the range of applications available on BSC, offering users a greater selection of innovative and diverse decentralized applications to choose from. This interoperability has fostered innovation and attracted a diverse range of projects, including decentralized exchanges, yield farming platforms, and NFT marketplaces.

The close integration between BSC and the Binance exchange also creates a host of advantages for users. The seamless connection between these two platforms facilitates effortless token swaps and transfers.

Related Reading: Celestia Network: How To Stake TIA And Position For 5-Figure Airdrops

This integration enhances overall liquidity, ensuring that users have quick and convenient access to a diverse range of digital assets. Whether it’s trading, diversifying portfolios, or exploring new investment opportunities, the close relationship between BSC and Binance empowers users with a seamless and detailed experience in the world of digital assets.

Trading On The BSC Network

Decentralized exchanges (DEXs) on the Binance Smart Chain (BSC) network provide traders with a range of features and opportunities to enhance their trading experience. Here’s an elaboration on the features of DEXs on BSC:

Automated Market Makers (AMM): DEXs on BSC leverage AMM protocols to enable token swaps. AMM algorithms automatically set token prices based on supply and demand dynamics within liquidity pools. This feature eliminates the need for traditional order books and enables continuous liquidity, allowing traders to execute swift and efficient trades.

Yield Farming: Yield farming is a popular practice in the decentralized finance (DeFi) space, and many BSC DEXs offer yield farming opportunities where traders provide liquidity to specific token pairs by depositing their assets into smart contract-based liquidity pools. In return, they receive liquidity provider (LP) tokens, which represent their share of the pool.

Traders can then stake these LP tokens in yield farming programs to earn additional tokens or rewards. Yield farming enables traders to earn passive income by utilizing their idle assets effectively.

Liquidity Pools: These are fundamental components of DEXs on BSC which consist of pairs of tokens that are used for trading. Traders can contribute their assets to these pools and become liquidity providers.

By providing liquidity, traders help ensure that there is sufficient liquidity available for trading. In return for their contribution, liquidity providers earn a portion of the trading fees generated by the DEX. This incentivizes traders to provide liquidity, as they can earn fees from the trading activity in the pool.

Token Trading: DEXs on BSC offer traders the ability to trade a wide range of tokens. These tokens can include native tokens of projects built on the BSC network, as well as tokens that have been bridged from other blockchains, including Ethereum.

Traders have access to various trading pairs, allowing them to buy and sell tokens directly from their wallets. The availability of diverse tokens and trading pairs provides traders with abundant opportunities to explore various markets and investment opportunities.

Additionally, the Binance Smart Chain (BSC) is a modified Ethereum fork which simply means that it is compatible with the Ethereum network. Both of these blockchain networks have similar infrastructure, which is why they have the same address in your wallet.

This is to ensure that your funds are not permanently lost when you send them via the wrong network. Simply put, if you send a token to your ETH via the BSC network, the funds will still be on the blockchain and you’ll be able to retrieve them.

How To Get Started On The BSC Network

To buy and sell tokens on the Binance Smart Chain (BSC) network, you will first need to get a Metamask wallet and fund it with BNB tokens. MetaMask is a popular browser extension wallet commonly used for interacting with blockchain networks like Ethereum and Binance Smart Chain (BSC). It is available as a browser extension for popular browsers such as Google Chrome.

Ensure your Metamask Wallet has been added to your browser as an extension by clicking on the “Add to Chrome” icon on the top right as shown below:

Once installed and set up, MetaMask allows users to manage their cryptocurrency wallets, interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks directly from their browsers. (Make sure to write down your seed phrase on a piece of paper and keep it safe. Do not store it online).

Next, add the BSC network to your Metamask wallet by following the instructions provided on the Metemask website here.

Getting BNB Tokens To Trade On The BSC Network

Once that is done, you need to fund your wallet with BNB before you can begin trading on the BSC network. You can buy BNB on centralized exchanges such as Binance, copy your wallet address from Metamask, and then send the BNB from Binance to your Metamask wallet.

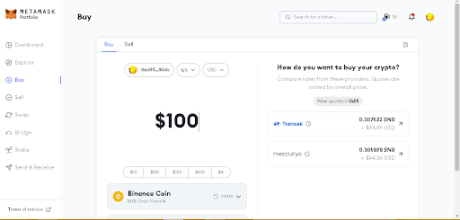

You can also purchase BNB directly within the Metamask wallet using traditional payment methods such as credit or debit cards, PayPal, bank transfer, CashApp, etc.

Just click on the “Buy/Sell” button within Metamask which will open up the interface. Here, you can put how much BNB you want to buy in terms of dollar terms, pick your payment method, and then click “Buy”.

Note that to buy crypto directly within Metamask, you will need to provide info such as your country and state. However, it is a straightforward process that only takes a minute.

It’ll only take a couple of minutes at most for your BNB to arrive in your wallet. Once the BNB arrives, you are all set to begin trading tokens on the BSC network. So head over to Pancakeswap to get started on your trading journey.

How To Trade Tokens On The BSC Network Using PancakeSwap

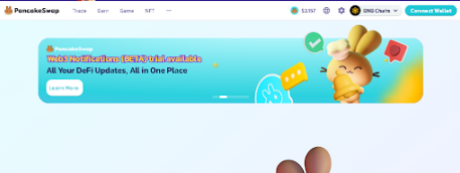

PancakeSwap is the leading decentralized exchange on the BSC network. Here, users are able to buy and sell a large range of tokens, and it is a straightforward process.

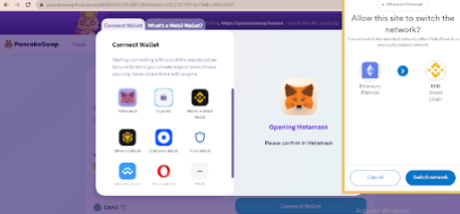

Make sure you are on the correct Pancakeswap website to prevent your wallet from being drained. The next step is clicking on the “Connect Wallet” option on Pancakeswap at the top right corner as illustrated below:

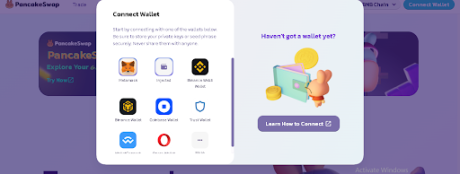

Connect to your preferred wallet as shown below. (In this case, it’s Metamask):

Once connected, switch Metamask to the BSC network. (If you’re already on the BSC network, you do not need to switch):

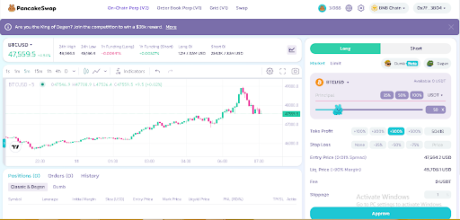

With MetaMask connected to the BSC network, go to PancakeSwap, then you can start trading on the BSC network using PancakeSwap. Search for the token you want to purchase using the name or the contract address.

Set slippage to auto to avoid having to manually set it with each swap. Once done, pick how much BNB (at the top) you want to convert to the new token (at the bottom), click on “Swap,” and confirm the transaction in your Metamask wallet.

Once the transaction is confirmed, the tokens will be sent to your wallet. To convert your tokens back into BNB, repeat this process by putting the new token at the top and picking BNB at the bottom. Click Swap and BNB will be sent to your wallet.

Buying And Selling Tokens With The Metamask Wallet

BSC Network users can also buy and sell tokens using the Metamask extension wallet already connected to the BSC network.

To do this, make sure you’re connected to the BSC network and have BNB to swap and pay for gas fees. Then navigate to the “Swap” button as shown below. This will take you to the Swap interface inside Metamask.

Here, you can also search for tokens using the name or the contract address, just like on Pancakeswap. Input the amount of BNB you want to swap, confirm that you have the correct token, and then click “Swap.” Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

Tracking Token Prices On The BSC Network

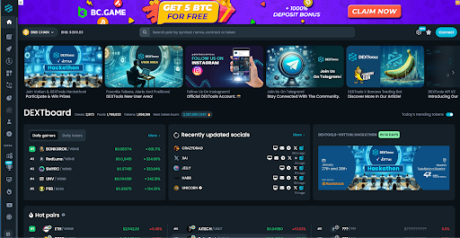

BSC network users can leverage on-chain tools such as Dextools to access detailed market insights about a particular token such as price and contract information to enable them to make informed trading decisions.

Dextools offers a range of features that are particularly beneficial for users on the BSC network. One notable feature is the ability to check charts, providing real-time and historical price data for various tokens. These charts enable users to analyze price trends, trading volumes, and other relevant metrics, helping them identify potential entry or exit points for their trades, as shown below:

In addition to charting capabilities, Dextools provides a “Contract Audit” feature that is especially valuable for BSC users. This feature allows users to check the audit score of a smart contract before investing in a token. Audits assess the security and reliability of a contract’s code, highlighting potential vulnerabilities or risks.

By accessing the audit score through Dextools, users can evaluate the level of trustworthiness and credibility of a token’s underlying smart contract, minimizing the chances of falling victim to scams or vulnerabilities.

Conclusion

The BSC network has become popular within the blockchain ecosystem due to its advantages and has attracted a diverse range of projects and users. BSC’s compatibility with Ethereum facilitates seamless token transfers between the two networks, enhances diversification of development and usage, and promotes collaboration within the broader blockchain ecosystem.

Additionally, it offers interoperability, allowing developers to easily port existing Ethereum-based applications and assets to BSC. This compatibility grants access to the extensive Ethereum ecosystem, enabling users to leverage the infrastructure and liquidity of Ethereum while benefiting from BSC’s faster transactions and lower fees.

BSC’s combination of interoperability, accessibility to liquidity, and enhanced transaction efficiency makes the BSC network a compelling choice for both developers and users, solidifying its position as a prominent player in the evolving blockchain landscape.

Nansen’s Crypto Crystal Ball: AI Integration And A Potential Plot Twist In 2024?

As 2024 approaches, crypto analytics firm Nansen offers insightful predictions for the crypto sector, anticipating significant developments and shifts. Despite cautious optimism, they acknowledge a 10-20% chance of inflation resurgence after the US Federal Reserve (Fed) pivot, potentially impacting crypto prices.

Related Reading: Ethereum Price Close Below $2,120 Could Spark Larger Degree Decline

As of this writing, the total crypto market capitalization is $1.5 trillion on the daily chart and seems poised for further upside in the long run.

AI As Primary Use Case: The New Hot Thing In 2024?

According to the firm, a key high-conviction bet for 2024 is the emergence of Artificial Intelligence (AI) agents as primary blockchain users. Integrating AI and blockchain is expected to “advance rapidly, enhancing blockchain performance and broadening use cases.”

This development signifies a crucial step in the blockchain world, potentially transforming how transactions and interactions are processed on the network.

Another focus area is the intent-centric applications that address user experience (UX) challenges in the crypto space. These applications are designed to simplify user interactions with networks, removing complexities and making the technology more accessible to a broader audience.

As seen in the chart below, the integration between AI and crypto is already paying off for early investors. Despite the persistent downside pressure recorded across the board, the AI tokens sector has been among the best-performing in the nascent industry.

2024 is also projected to be a pivotal year for decentralized exchanges (DEXs). Nansen forecasts that DEXs will gain significant market share from centralized exchanges (CEXs), driven by monetary incentives and innovative features.

This shift could mark a fundamental change in the crypto trading landscape, emphasizing the growing importance of decentralized financial systems. Since 2020 and 2021, DEX has been gaining ground over CEX, and the trend might favor the former in 2024.

Finally, Nansen believes that the largest and most trusted cryptocurrency, Bitcoin, is expected to secure a broader range of use cases beyond simple transactions. This expansion could open new avenues for Bitcoin and highlight its versatility and robustness as a digital asset.

Use cases such as non-fungible tokens (NFTs) already gained popularity in 2023, and this trend might continue. However, some Bitcoin community members are fighting the change, which could hinder its adoption and implementation.

Nansen: Market Scenario Analysis For 2024

The potential scenarios for the crypto market in 2024 depend a lot on the macroeconomic situation. In a “soft landing” situation, where inflation slows without drastically increasing unemployment, crypto prices are expected to grow steadily.

However, there’s also the possibility of a re-acceleration of inflation or a recession, which would pose challenges for crypto prices and change the bullish narrative. Nansen’s analysis also acknowledges structural drivers likely to influence the crypto market, such as the statistical boost around Bitcoin’s halving.

These structural drivers also include the adoption of blockchain by major traditional players and regulatory clarity, particularly around a BTC spot Exchange Traded Fund (ETF) in the US. However, unknowns like geopolitical events and macroeconomic shifts could significantly impact the market.

In conclusion, Nansen’s research presents a nuanced view of the crypto market in 2024, highlighting potential growth areas like AI integration and DEXs while remaining aware of the challenges ahead. The year promises to be crucial for the crypto sector, with significant developments expected in technology integration, market structures, and regulatory landscapes.

Cover image from Unsplash, chart from Tradingview

OKX DEX suffers $2.7M exploit after proxy admin contract upgrade

The OKX DEX suffered an exploit resulting in a loss of around $2.7 million worth in cryptocurrencies after a proxy admin upgraded a contract that allowed a hacker to compromise the private key.

OKX DEX suffers $2.7M exploit after proxy admin contract upgrade

The OKX DEX suffered an exploit resulting in a loss of around $2.7 million worth in cryptocurrencies after a proxy admin upgraded a contract that allowed a hacker to compromise the private key.

Lifinity USDC pool drained by arbitrage bot

A bug on an Immediate-or-Cancel order led to the drainage of nearly $700,000 from Lifnity’s LFNTY-USDC pool.

KyberSwap DEX Hacked for $48 Million, Attacker Teases Negotiations

Decentralized Exchange had over $80 million in total value locked before the incident.

KyberSwap DEX exploited for $46 million, TVL tanks 68%

The DEX aggregator has been exploited across multiple blockchains with millions in wrapped Ether and other assets stolen.