The second-largest crypto token by market cap, Ethereum (ETH), looks set to make a massive market recovery following recent buys suspected to be made by Tron’s founder, Justin Sun. Sun’s accumulation spree again highlights crypto whales’ recent bullishness on Ethereum despite fluctuating prices.

Sun Allegedly Buys $405 Million Worth Of ETH

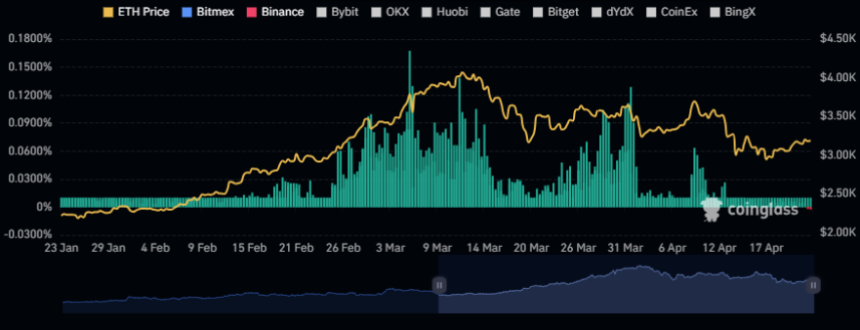

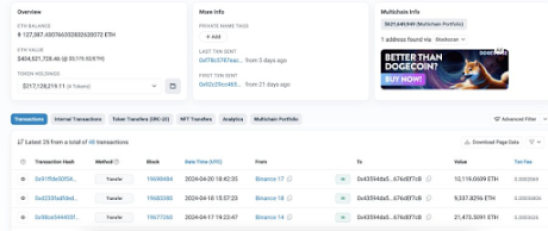

In an X (formerly Twitter) post, the on-chain analytics platform Lookonchain drew the crypto community’s attention to a mysterious wallet suspected to belong to Justin Sun. This wallet is said to have bought 127,388 ETH ($405.19 million) from Binance and decentralized exchanges (DEXs) since April 8 at an average price of $3,127.

Meanwhile, Lookonchain tried to prove further its theory that this wallet likely belonged to Justin Sun. The platform alluded to a previous tweet mentioning that a suspected Justin Sun wallet bought 168,369 ETH at $2,894 from Binance and a DEX between February 12 and 24. It noted that the “transaction behavior” of both wallets was similar, which suggests that they are both likely owned by Justin Sun.

If indeed both wallets are owned by Justin Sun, that means the Tron founder has accumulated 295,757 ETH ($891 million) at an average price of $3,014 since February 12. Like every whale activity, Sun’s alleged transactions have caught the crypto community’s attention, with many wondering why he is gaining so much exposure to the second-largest crypto token.

Ethereum Whales Are Bullish

Sun’s actions highlighted the bullish sentiment that Ethereum whales have towards the crypto token despite its recent unimpressive price action. Bitcoinist recently reported about an Ethereum whale who, despite already losing $4.5 million, opened another long position on the second-largest crypto token.

This whale also borrowed 17.3 million USDT just to increase their exposure to the crypto token. In a recent X post, Lookonchain again highlighted how Ethereum whales are still making bullish moves in the market. On-chain data shows a fresh wallet (0x9EB0) that withdrew 7,182 ETH ($23.06 million) from Binance, which suggests long-term holding by this whale.

Another wallet (0x1958) withdrew 5,181 ETH ($16.28 million) from Binance and put their ETH holdings to work by staking it into Bedrock and Pendle while anticipating further price gains in the crypto token.

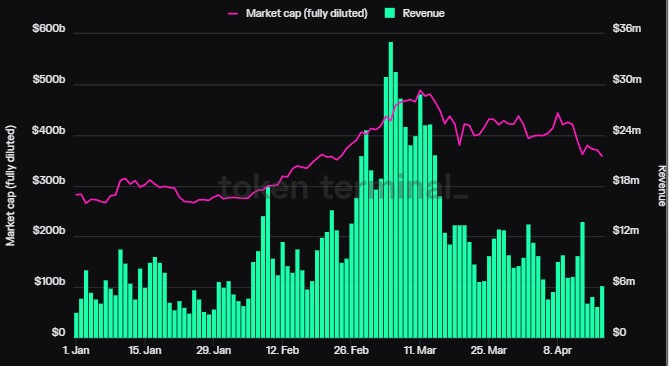

Such bullish sentiment towards Ethereum could be good for ETH’s price as whales are known to have a significant impact on a token’s price discovery. It could also prove crucial during this period when Ethereum is experiencing declining network growth, which means that the rate at which new users come into the ecosystem has slowed.

At the time of writing, Ethereum is trading at around $3,170, down over 1% in the last 24 hours, according to data from CoinMarketCap.