Flare, which calls itself “the blockchain for data,” gives developers access to decentralized data via its Oracle system..

Injective Protocol’s Social Activity Rising: Is INJ About To Explode?

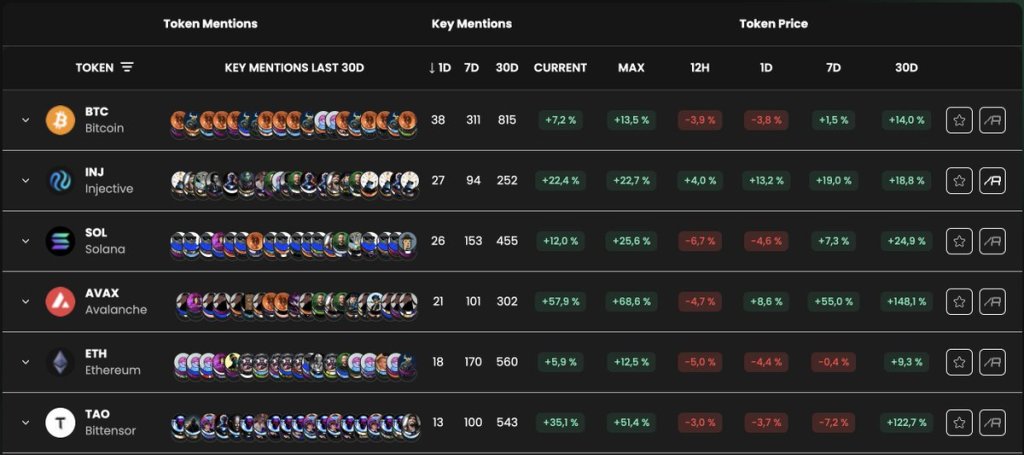

According to AlphaScan data on December 12, social media activity on Injective Protocol (INJ) has steadily increased in the past day and week. This surge in interest has propelled INJ to the second-most mentioned token on social media, trailing only Bitcoin (BTC).

Injective Social Media Activity Rising

Specifically, data reveals that INJ received nearly 30% of its weekly mentions in the past 24 hours alone. Furthermore, 37% of all monthly mentions of INJ occurred in the past seven days, further highlighting the growing attention surrounding the project.

While this is impressive for the project, it seems like INJ is also popular, looking at the very short-term data over the past trading day. Looking at weekly and monthly mentions, Solana, Avalanche, and Ethereum are ahead.

The uptick in Injective Protocol’s social activity also coincides with expanding prices. Based on Alpha Scan data, INJ has outpaced Bitcoin and other top 10 crypto assets in the last data. If the spike in social activity is behind rising prices, INJ may likely extend gains in subsequent sessions.

From the INJ daily chart, the coin is at 2023 highs, ripping even higher. As it is, the coin is within a bullish breakout formation, comprehensively easing past November 2023 resistance levels. Of note, the rally is with expanding trading volumes, meaning the leg up is supported and could continue, further drawing more social activity to the project.

Injective Protocol is a decentralized exchange (DEX) platform that operates on a layer-2 solution, allowing faster and more scalable trading than traditional DEXs. It supports various decentralized finance (DeFi) applications, including derivatives trading and synthetic asset issuance.

Is INJ On The Cusp Of Exploding Above $25?

The growing interest in Injective Protocol is likely due to a combination of factors. Beyond the project’s unique features, like near-gasless transactions and growing adoption, improving crypto sentiment and strategic partnerships might have supported prices and revived social media activity.

To illustrate, Injective recently joined Google Cloud, encouraging developers to build on the platform.

Despite the current optimism, it is not immediately clear whether the spike in social media activity could be a precursor to more price gains for INJ. Even so, with the coin trending at new 2023 highs and trading volumes expanding amid a broader recovery across the crypto scene, it is likely that INJ may explode to record new all-time highs above $25.

Injective Protocol’s Social Activity Rising: Is INJ About To Explode?

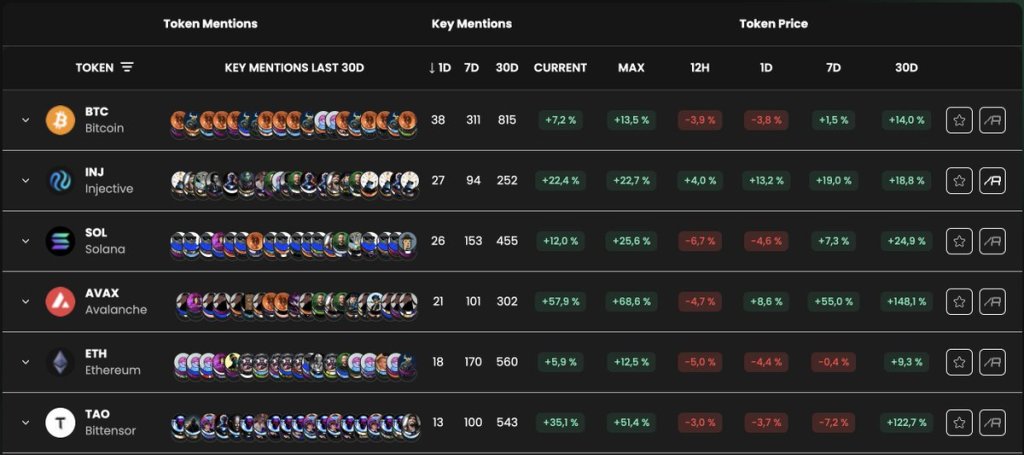

According to AlphaScan data on December 12, social media activity on Injective Protocol (INJ) has steadily increased in the past day and week. This surge in interest has propelled INJ to the second-most mentioned token on social media, trailing only Bitcoin (BTC).

Injective Social Media Activity Rising

Specifically, data reveals that INJ received nearly 30% of its weekly mentions in the past 24 hours alone. Furthermore, 37% of all monthly mentions of INJ occurred in the past seven days, further highlighting the growing attention surrounding the project.

While this is impressive for the project, it seems like INJ is also popular, looking at the very short-term data over the past trading day. Looking at weekly and monthly mentions, Solana, Avalanche, and Ethereum are ahead.

The uptick in Injective Protocol’s social activity also coincides with expanding prices. Based on Alpha Scan data, INJ has outpaced Bitcoin and other top 10 crypto assets in the last data. If the spike in social activity is behind rising prices, INJ may likely extend gains in subsequent sessions.

From the INJ daily chart, the coin is at 2023 highs, ripping even higher. As it is, the coin is within a bullish breakout formation, comprehensively easing past November 2023 resistance levels. Of note, the rally is with expanding trading volumes, meaning the leg up is supported and could continue, further drawing more social activity to the project.

Injective Protocol is a decentralized exchange (DEX) platform that operates on a layer-2 solution, allowing faster and more scalable trading than traditional DEXs. It supports various decentralized finance (DeFi) applications, including derivatives trading and synthetic asset issuance.

Is INJ On The Cusp Of Exploding Above $25?

The growing interest in Injective Protocol is likely due to a combination of factors. Beyond the project’s unique features, like near-gasless transactions and growing adoption, improving crypto sentiment and strategic partnerships might have supported prices and revived social media activity.

To illustrate, Injective recently joined Google Cloud, encouraging developers to build on the platform.

Despite the current optimism, it is not immediately clear whether the spike in social media activity could be a precursor to more price gains for INJ. Even so, with the coin trending at new 2023 highs and trading volumes expanding amid a broader recovery across the crypto scene, it is likely that INJ may explode to record new all-time highs above $25.

Injective Protocol’s Social Activity Rising: Is INJ About To Explode?

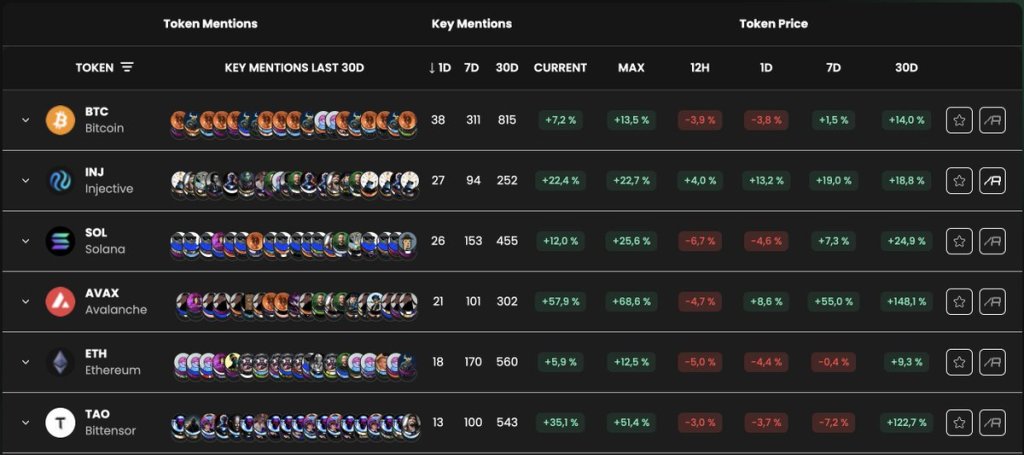

According to AlphaScan data on December 12, social media activity on Injective Protocol (INJ) has steadily increased in the past day and week. This surge in interest has propelled INJ to the second-most mentioned token on social media, trailing only Bitcoin (BTC).

Injective Social Media Activity Rising

Specifically, data reveals that INJ received nearly 30% of its weekly mentions in the past 24 hours alone. Furthermore, 37% of all monthly mentions of INJ occurred in the past seven days, further highlighting the growing attention surrounding the project.

While this is impressive for the project, it seems like INJ is also popular, looking at the very short-term data over the past trading day. Looking at weekly and monthly mentions, Solana, Avalanche, and Ethereum are ahead.

The uptick in Injective Protocol’s social activity also coincides with expanding prices. Based on Alpha Scan data, INJ has outpaced Bitcoin and other top 10 crypto assets in the last data. If the spike in social activity is behind rising prices, INJ may likely extend gains in subsequent sessions.

From the INJ daily chart, the coin is at 2023 highs, ripping even higher. As it is, the coin is within a bullish breakout formation, comprehensively easing past November 2023 resistance levels. Of note, the rally is with expanding trading volumes, meaning the leg up is supported and could continue, further drawing more social activity to the project.

Injective Protocol is a decentralized exchange (DEX) platform that operates on a layer-2 solution, allowing faster and more scalable trading than traditional DEXs. It supports various decentralized finance (DeFi) applications, including derivatives trading and synthetic asset issuance.

Is INJ On The Cusp Of Exploding Above $25?

The growing interest in Injective Protocol is likely due to a combination of factors. Beyond the project’s unique features, like near-gasless transactions and growing adoption, improving crypto sentiment and strategic partnerships might have supported prices and revived social media activity.

To illustrate, Injective recently joined Google Cloud, encouraging developers to build on the platform.

Despite the current optimism, it is not immediately clear whether the spike in social media activity could be a precursor to more price gains for INJ. Even so, with the coin trending at new 2023 highs and trading volumes expanding amid a broader recovery across the crypto scene, it is likely that INJ may explode to record new all-time highs above $25.

MultiversX’s EGLD Token Rallies on Partnership With Google Cloud

EGLD ticked up nearly 10% to just over $26 during European morning hours on Friday.

MATIC Price Downtrend Halted As Google Cloud Joins Polygon Network

Google Cloud, the renowned cloud computing service provided by Google, has made a significant move by becoming a validator on the Polygon (MATIC) network.

This collaboration aims to bolster the security of the Polygon Proof-of-Stake (PoS) network, with Google Cloud employing its infrastructure, which powers popular platforms like YouTube and Gmail, to contribute to the network’s integrity.

Google Cloud Strengthens Polygon Network Security

Polygon Labs, the team behind the Polygon protocol, recently announced that Google Cloud has joined their validator set. This move brings Google Cloud into the fold of over 100 validators responsible for verifying transactions on the Layer 2 Ethereum (ETH) network offered by Polygon.

In a statement shared on X (formerly known as Twitter), Polygon highlighted the significance of Google Cloud’s involvement, emphasizing utilizing the same infrastructure that underpins YouTube and Gmail to safeguard the fast and cost-effective Ethereum-based Polygon protocol.

According to the announcement, by joining forces with over 100 other validators, Google Cloud adds to the collective efforts to secure the Polygon PoS Network.

Including reputable and security-focused validators like Google Cloud provides an additional layer of confidence for Heimdall, Bor, and the Polygon PoS ecosystem users.

The collaboration between Google Cloud and Polygon Labs extends beyond a validator partnership. It is described as an ongoing strategic collaboration, indicating a long-term commitment to advancing the adoption and development of Web3 technologies.

As part of their joint efforts, Google Cloud APAC released a YouTube video titled “Polygon Labs is solving for a Web3 future for all,” further underscoring their shared vision for a decentralized web. The Google Cloud team further stated:

Is there an easier way to build and grow Web3 products? That’s the mission of Polygon Labs, and with the help of Google Cloud, it’s one step closer to making this vision a reality. We are now serving as a validator on the Polygon PoS network, contributing to the network’s collective security, governance, and decentralization alongside 100+ other validators.

Overall, the involvement of Google Cloud, a prominent player in the cloud computing industry, as a validator on the Polygon network brings increased credibility and expertise to the ecosystem.

This collaboration is expected to enhance Polygon’s network infrastructure’s overall security and reliability, benefiting users who rely on the platform for seamless and efficient blockchain transactions.

MATIC Breaks Free From 3-Month Downtrend

Polygon’s native cryptocurrency, MATIC, has successfully broken a 3-month downtrend that had pushed the token to reach a yearly low of $0.5040 on Wednesday.

However, in the past 24 hours, there has been a notable rebound in MATIC’s price, experiencing a 1.7% surge and currently trading at $0.5240.

This upward movement is further supported by the Squeeze Momentum Indicator, which has broken the downtrend pattern, indicating the initiation of a recovery phase for MATIC since Friday.

It is important to note that MATIC’s ADX indicator displays a spike downwards, suggesting low volatility and a neutral battle between bullish and bearish forces in the cryptocurrency market.

Looking ahead, MATIC faces obstacles around the $0.5442 zone, which it failed to surpass on September 21. Conversely, if the uptrend continues, the next significant hurdle lies at $0.5951 before reaching the $0.6000 level, which has not been achieved since late August.

The sustainability of MATIC’s uptrend and its ability to strive towards its yearly high of $1,569, reached in February, remains uncertain and will require further observation.

Featured image from Shutterstock, chart from TradingView.com

The Protocol: Google Pushes Deeper into Blockchain

Google’s cloud-computing division is increasingly involved in blockchain, with plans to add 11 networks including Polygon, Optimism, and Polkadot to its ‘BigQuery’ program for public datasets.

Google Cloud adds 11 blockchains to data warehouse ‘BigQuery’

Google’s BigQuery added 11 new public datasets for blockchain networks, allowing users to obtain a variety of data from these networks.

Google Cloud Pushes Deeper Into Blockchain Data, Adding 11 Networks Including Polygon

Google’s cloud-computing business has stored historical data on Bitcoin since 2018, claiming the service provides faster access than can be obtained directly from the blockchain.

Web3 is about solving business problems, not token prices: Google Cloud exec

While TradFi is the main source of demand for blockchain tech, digital identity and supply chain are exciting areas too, according to Google Cloud Head of Web3 James Tromans.

Google Cloud Is Running a Validator on Celo Network

The cloud service joins Deutsche Telekom and other ecosystem contributors to participate in validating the Celo platform.

Fireblocks Adds Support for Amazon Web Services, Google Cloud Platform and Alibaba Cloud

Cryptocurrency custody technology provider Fireblocks has started offering support for cloud service providers Amazon Web Services (AWS), Google Cloud Platform, Alibaba Cloud, Thales and Securosus, the company announced Tuesday.

AIs and fries: Wendy’s to trial chatbot drive-thru operator

Wendy’s says its “FreshAI” bot reduces costs allowing funds to be focused elsewhere, others worry that eventually, those less skilled will be jobless.

Crypto Biz: Google bullish on blockchain, UK’s $125M AI pledge, Voyager and Binance

This week’s Crypto Biz explores Google expanding its Web3 program, the U.K.’s $125 AI pledge, FTX selling LedgerX and Binance.US backing out of its Voyager purchase.

Web3 News From Consensus

A special edition of The Airdrop on the ground in Austin at CoinDesk’s festival.

Google Cloud to optimize Polygon zkEVM scaling performance

Polygon Labs and Google Cloud will team up in a multi-year agreement to drive the development and adoption of the Ethereum scaling protocol’s infrastructure and developer tools.

Google Cloud to Help Accelerate Polygon’s Growth Via New Agreement

The tech giant will be “strategic cloud provider” for Polygon protocols.

Google Cloud to Offer Workshops, Cloud Computing Services for Builders on Celo

Participants of Celo’s Founders in Residence program and developers on the Layer-1 protocol will receive guidance and services.

First Mover Americas: Google Cloud Joins Tezos

The latest price moves in bitcoin (BTC) and crypto markets in context for Feb. 22, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Google Cloud to Become Validator on Tezos Network

Google Cloud’s corporate customers will be able to deploy Tezos nodes in order to build Web3 applications on the network.