The new BTC supply added to the market could drop to $30 million per day, according to Bitfinex.

Is The Bitcoin Bloodbath Over? Analysts Say $60,000 Is The Cycle’s Bottom

Bitcoin enthusiasts around the globe can now breathe a collective sigh of relief as the world’s premier cryptocurrency, Bitcoin, rebounds from a recent downturn.

Last week witnessed Bitcoin, akin to the broader market, sliding below the $60,000 mark, primarily due to risk aversion, the US tax season, and escalating geopolitical tensions in the Middle East. However, in a surprising turn of events, Bitcoin has not only recovered but has surged past the $66,000 mark, reigniting optimism and sparking discussions about its future trajectory.

This recent resurgence in Bitcoin’s price comes on the heels of a significant price correction that coincided with April’s highly anticipated Bitcoin halving event. The halving event, a recurring phenomenon in Bitcoin’s protocol, entails a reduction in the rate at which new Bitcoins are mined, effectively halving the supply.

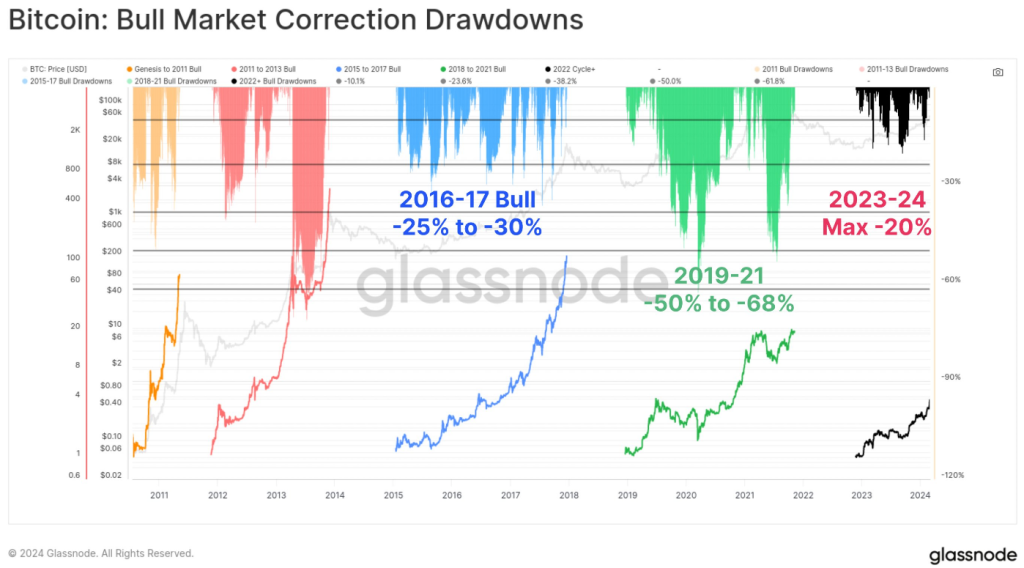

20% drawdown would fit the current bull’s pattern: pic.twitter.com/usNxQz1t92

— Tuur Demeester (@TuurDemeester) April 18, 2024

Historically, this event has been associated with heightened market volatility, as some analysts feared that the supply shock could trigger a prolonged sell-off.

Nevertheless, prominent figures in the cryptocurrency space, such as Tuur Demeester, offer a more sanguine perspective. Demeester suggests that the recent dip to $60,000 might signal the floor of the correction, aligning with historical patterns observed during bull markets.

According to Demeester, a 20% drawdown from highs is considered a typical correction for Bitcoin, and thus, there is a strong possibility that $60,000 could serve as a support level moving forward.

While Demeester advocates for stability in Bitcoin’s price, anoother analyst, McKenna, foresee a period of sideways movement. McKenna agrees with Demeester regarding the $60,000 floor but predicts that Bitcoin may enter a re-accumulation phase, characterized by prolonged sideways price action.

I think there is a high probability that the bottom for the halving selloff is in but simultaneously think there is an equal high probability that we are forming a re-accumulation range.

Meaning expect sideways price action for longer than expected. #BTC pic.twitter.com/K24Md0TKXH

— McKenna (@Crypto_McKenna) April 21, 2024

Interestingly, McKenna believes that this sideways movement could present an opportune moment for alternative cryptocurrencies, known as altcoins, to shine in the short term.

The recent resurgence in Bitcoin’s price has sparked optimism among investors and analysts alike. As attention turns to May, all eyes are on whether Bitcoin’s sideways movement materializes and if the effects of the halving event truly dissipate.

With cautious optimism prevailing, the current price range between $60,000 and $71,000 could become a pivotal zone for future price dynamics, ushering in a new era of prosperity in the cryptocurrency markets.

Featured image from Pxfuel, chart from TradingView

Bitcoin Miners Have Raked in Abnormal Transaction Fees Since Halving: Bernstein

The spike in network fees was driven by speculative activity to mint new meme tokens following the launch of the Runes protocol, the report said.

Bitcoin Miners Strike Gold: $107 Million Profit From Runes-Fueled Minting Spree

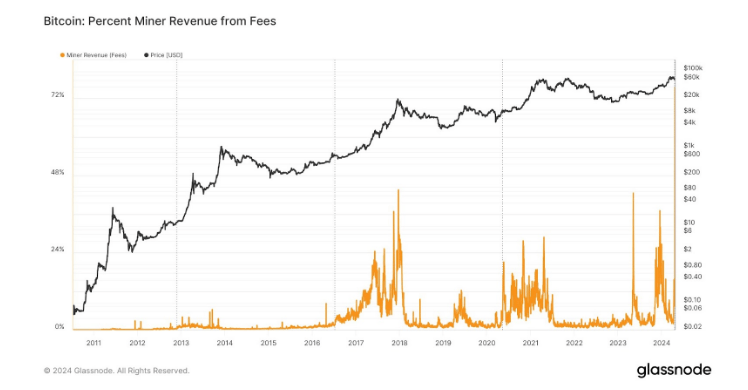

Bitcoin miners have struck a proverbial goldmine, reaping an astonishing $107 million in profits, according to data from Glassnode, a leading analytics platform. This unprecedented windfall, amassed on April 20th, underscores a significant shift in the revenue dynamics of Bitcoin mining operations.

The meteoric rise in transaction fees serves as a bellwether for the evolving economic landscape of Bitcoin mining. As the network adapts to new market demands and technological advancements, transaction fees have emerged as a crucial revenue stream for miners. This trend is particularly noteworthy given the scheduled reductions in block rewards, highlighting the resilience and adaptability of Bitcoin’s economic model.

According to glassnode, affected by the Runes minting activity, on April 20, Bitcoin miner revenue reached US$106.7 million, of which 75.444% came from network transaction fees, both reaching record highs. https://t.co/lVSyqn1UaE pic.twitter.com/xjkkTor2I9

— Wu Blockchain (@WuBlockchain) April 21, 2024

Runes-Fueled Minting Spree Boosts Miner Revenue

Driving this surge in profitability is a recent minting spree focused on Runes, a pivotal development that has left a tangible mark on the network’s dynamics. Reports indicate that a staggering 75% of the total profits stemmed from transaction fees, marking a new pinnacle in the distribution of revenue among BTC miners.

Runes is similar to Ordinals; they both let users permanently store data directly on the Bitcoin blockchain, like an inscription etched in stone. But there’s a key distinction in what they store: Ordinals are one-of-a-kind digital collectibles, similar to fancy trading cards.

Runes, on the other hand, are designed to act more like meme coins, those widely tradable and often humorous tokens that have been a recent craze in the crypto world.

This paradigm shift in income composition underscores the growing importance of transaction fees as a vital income source, especially as block rewards face planned reductions in the context of Bitcoin’s halving system.

This financial triumph comes amidst ongoing debates surrounding the sustainability and profitability of mining activities. With escalating energy demands and mounting regulatory scrutiny, the viability of mining operations has been called into question. However, the recent data paints a reassuring picture of the economic vitality of Bitcoin mining, demonstrating its resilience in the face of external pressures.

Implications For Bitcoin’s Future

Beyond the immediate financial gains, the surge in transaction fees holds profound implications for the future trajectory of Bitcoin. The unprecedented collection of fees signifies robust network activity and user engagement, indicating strong demand and utilization of the Bitcoin blockchain.

This bodes well for the long-term sustainability and development of Bitcoin as a prominent digital currency, bolstering confidence among stakeholders and enthusiasts alike.

Featured image from VistaCreate, chart from TradingView

Bitcoin Miners May Shift Focus to AI After Halving, CoinShares Says

Miners will be faced with substantial cost increases as a result of the halving, with electricity and bitcoin production costs almost doubling, the report said.

Bitcoin Transaction Fees Come Crashing Down Post Halving

After the halving, fees spiked to $146 for a medium-priority transaction and $170 for a high-priority transaction.

Bitcoin Miners Reap Windfall as ‘Runes’ Debut Sends Transaction Fees to Record Highs

The Bitcoin “halving” was supposed to dramatically chop revenue of bitcoin mining companies. Instead, the simultaneous launch of Casey Rodarmor’s Runes protocol has ignited a flurry activity on the oldest and largest blockchain, driving up fees.

Battle For The Halving Block: Bitcoin Users Spend Record $2.4 Million On Block 840,000

With Bitcoin finally completing its fourth-year halving cycle, many users are aggressively competing for halving blocks, paying exorbitant amounts of fees to mine a single block.

Bitcoin Mining Pool Pays Over $2.4 Million In Block Fees

Earlier today, the 840,000th block was added to the Bitcoin blockchain, triggering the onslaught of the highly anticipated halving event. While the price of BTC did not witness a dramatic change following the halving, transaction fees spiked to unprecedented highs.

Amidst the massive competition, a mining pool identified as ViaBTC had successfully mined the 840,000th Bitcoin block. Cumulatively, BTC users had spent a staggering $37.7 BTC in mining fees, equivalent to $2.4 million, recording the highest fee ever paid for a Bitcoin block.

According to reports from mempool, after ViaBTC had produced the 840,000th block, the protocol had initiated an automated reduction of miners’ reward by half, from 6.25 BTC to 3.125 BTC per block. In addition to the fees, ViaBTC had received a total payout of 40.7 BTC, valued at approximately $2.6 million, for mining the historic block.

While it may seem that Bitcoin miners had thrown caution to the wind by spending over $2.4 million on a single block, the 840,000th block had a major significance within the cryptocurrency space. The historic Bitcoin block is said to hold the first Satoshis, ‘sats,’ the smallest units of BTC following the halving.

There are several of these “epic sats,” that appear after the halving event, coveted as a rare collector’s item among cryptocurrency enthusiasts. Some even speculate that these Bitcoin fragments could be potentially worth millions of dollars.

Including the hype surrounding these fragmented BTC, much of the competition for the Bitcoin blocks, following the halving has been attributed to the new Runes Protocol which launched at the same time as the Bitcoin halving.

Degens Rush To Secure Infamous Rune Tokens

The Runes Protocol, created by Casey Rodamor, a Bitcoin developer, has sent shockwaves through the cryptocurrency community, as degens are avidly competing to etch and mint tokens directly on the Bitcoin network.

While mining pools were mining new Bitcoin blocks, degens had paid over 78.6 BTC valued at $4.95 million to mint the rarest Runes. This exponential surge in fees has been an unprecedented event, highlighting the increased adoption and participation of the Bitcoin network.

According to reports from Ord.io, a Rune labeled as ‘Decentralized’ was acquired for a fee of 7.99 BTC, equivalent to $510,760. While another titled ‘Dog-Go-To-The-Moon’ was obtained for a fee of 6.73 BTC, worth approximately $429,831.

Leonidas, protocol developer and host of the groundbreaking Ordinals, a system for numbering “epic sats,” has declared the Runes Protocol a remarkable success as degens have “single-handedly offset the drop in miner rewards from the halving.” He concluded that Runes have significantly impacted Bitcoin’s security budget, potentially playing a major role in ensuring the network’s sustainability.

Fourth Bitcoin Halving Completed – Here Are The Implications

The long-awaited fourth Bitcoin halving finally occurred after BTC posted its 840,000th block. This event is significant as it is expected to have several implications for the Bitcoin ecosystem and the crypto market going forward.

What To Expect Following The Bitcoin Halving

The Bitcoin halving slashed miners’ rewards from 6.25 BTC to 3.125 BTC for each block mined. This means that Bitcoin miners are set to earn a reduced income of 450 BTC instead of the 900 BTC they earned before the fourth halving. This development is expected to have a dire effect on their operations, as NewsBTC reported that they could lose a whopping $10 billion following the halving.

While the effects of the halving are not so pleasant for BTC miners, the halving is deemed necessary for the growth of the Bitcoin ecosystem. It makes Bitcoin (BTC) deflationary by reducing the rate at which more tokens come into circulation. This could make the flagship crypto more scarce and ultimately drive up its value, as it has done in the past three halvings.

In anticipation of history repeating itself, crypto analysts and experts have made several predictions about how high Bitcoin could rise this time post-halving. So far, the most bullish price prediction remains by Samson Mow, the CEO of Jan3 and Bitcoiner, who predicts that the flagship crypto could rise to $1 million this year.

He added that this unprecedented price surge was possible considering that BTC’s demand is expected to continue outpacing the supply, with more institutional investors recently getting on board through the Spot Bitcoin ETFs. The imbalance between Bitcoin’s supply and demand is also why crypto analyst MacronautBTC believes Bitcoin could rise to $237,000.

Billionaire Tim Draper also agrees that Bitcoin could attain such heights based on his prediction that the flagship crypto will hit $250,000 in 2025.

Implications On The Broader Crypto Market

Crypto analyst Michaël van de Poppe recently predicted a narrative shift post-halving. He expects Bitcoin to take months to consolidate while altcoins significantly move to the upside during this period. This is plausible, considering Bitcoin doesn’t experience that parabolic price surge until about six months after the halving.

During this period, altcoins like XRP and Cardano (ADA), which have underperformed up until now, will be closely monitored as investors wait to see if they will show any sign of bullish momentum in them. Ethereum (ETH) will also be the focus of many in the crypto community as they watch how the second-largest crypto token by market cap will perform while Bitcoin (BTC) consolidates.

Interestingly, Van de Poppe expects the narrative to shift to Ethereum and projects in the Decentralized Physical Infrastructure Networks (DePIN) and Real World Assets (RWA) sector. Therefore, such projects are also worth keeping an eye on.

Bitcoin Blockchain Undergoes Fourth Halving in 15-Year History, in Show of Monetary Policy Set by Code

Soccer has the World Cup. Athletics and many other sports have the Olympics. Crypto has the halving. The milestone in the blockchain’s 15-year history technically means a cut in rewards for crypto miners with each block – a feature designed to minimize inflation.

Crypto Expert Predicts A Narrative Shift Post-Bitcoin Halving

Crypto expert Michaël van de Poppe has provided insights into what to expect when the Bitcoin halving occurs on April 19. As part of his analysis, van de Poppe suggested that the attention might shift from Bitcoin once the event occurs.

A Narrative Shift To Occur Post-Halving

Van de Poppe mentioned in an X (formerly Twitter) post that narratives will change as the halving event approaches but failed to specify what the new narrative will be when this happens. However, in a previous X post, the crypto expert laid out some of his expectations for the crypto market going forward, which included what he expected the new narrative to be.

According to Van de Poppe, the narrative will shift to Ethereum (ETH) and projects that are focused on Decentralized Physical Infrastructure Networks (DePIN) and Real World Assets (RWA). These sectors, along with Artificial Intelligence (AI) and meme coins, have been projected to be among the leading narratives in this bull run.

Meanwhile, the crypto expert, who has so far continued to state that altcoins are greatly undervalued, expects these crypto tokens to bounce “in their Bitcoin pairs” once the hype around the halving is over. Furthermore, Van de Poppe mentioned that altcoins will show bullish strength from this second quarter until the summer after which a correction will come in the third quarter of the year.

Before now, the crypto expert listed ten altcoins he believes could make the most price gains when the altcoin season begins in full force. These tokens include Chainlink (LINK), Celestia (TIA), Arbitrum (ARB), Polkadot (DOT), Cosmos (ATOM), DYDX (DYDX), WooNetwork (WOO), Sei (SEI), Skale Network (SKL), and Covalent (CQT).

Expectations For Bitcoin

In the short term, Van de Poppe expects Bitcoin to experience a relief bounce to around $70,000. However, he didn’t sound so bullish about the flagship crypto’s long-term trajectory, predicting that Bitcoin will face a period of consolidation that he doesn’t expect to change in the “coming months.”

In another X post, he said, “It’s a waiting game on Bitcoin currently, as momentum is relatively gone.” He added that he expects Bitcoin to continue “the retracement and consolidation,” while altcoins will bounce up in their BTC pairs during this period.

This predicted consolidation period looks to be the re-accumulation phase in the stages of Bitcoin halving, which crypto analyst Rekt Capital once referred to. Elaborating on what this period is like, Rekt Capital stated back then that many investors get “shaken out in this stage due to boredom, impatience, and disappointment with lack of major results in their BTC investment in the immediate aftermath of the Halving.”

Once this period is over, Bitcoin is expected to make its “parabolic uptrend,” a phase that Rekt Capital noted historically lasts just over a year. In line with this, it is worth noting that most of Bitcoin’s price gains usually come between six months to a year after the Bitcoin halving has occurred.

Goldman Sachs On Bitcoin Halving: ‘It doesn’t Matter If It’s A Buy The Rumor, Sell The News Event’

Analysts at Goldman Sachs, a leading global banking and investment management firm, have offered valuable insights into the anticipated effects of the forthcoming Bitcoin halving, on the price of the cryptocurrency. They emphasize that while the Bitcoin halving is a noteworthy event, other major factors will likely exert greater influence on Bitcoin’s future value.

Bitcoin Halving To Play Lesser Role In BTC’s Outlook

In a note to clients, Goldman Sach’s analysts have cautioned against reading too much into the past Bitcoin halving cycles and their impact on the cryptocurrency. Based on historical trends, the Bitcoin halving cycles tend to have a favorable effect on the value of Bitcoin, often triggering a bull run.

The bank noted that whether the Bitcoin halving scheduled for April 20, becomes a “buy the rumor, sell the news event,” it would hold less significance for the cryptocurrency’s medium-term outlook.

They argue that the future performance of the pioneer cryptocurrency would be more heavily influenced by the supply and demand dynamics within the current market. Additionally, the analysts highlighted that the growing interest and demand for Spot Bitcoin Exchange Traded Funds (ETFs) combined with the self-reflexive nature of the crypto market would be the primary contributing factor to Bitcoin’s price action and future outlook.

Sharing a similar perspective, analysts at CryptoQuant disclosed earlier in April that the 2024 Bitcoin halving was no longer a primary catalyst for Bitcoin’s bullish surge. They highlighted that factors such as increasing demand from large-scale investors and diminishing supply were now the key drivers of Bitcoin’s upward momentum.

Analysts Warn Of Macroeconomic Influence On New Halving Cycle

Analysts at Goldman Sachs have predicted that macroeconomic factors such as inflation could have a significant influence on the upcoming Bitcoin halving event.

“Caution should be taken against extrapolating the past cycles and the impact of halving, given the respective prevailing macro conditions,” Goldman Sachs analysts noted.

Unlike previous halving cycles, the present economic conditions display high inflationary pressures and interest rates, which could cause the 2024 Bitcoin halving cycle to diverge from historical patterns. In other words, the analysts have suggested that for Bitcoin’s historical halving bull runs to occur, macro conditions need to be supportive of investor risk-taking.

Currently, the United States faces challenges with high inflation, while interest rates stand above 5%. These conditions may exert pressure on Bitcoin’s market dynamics. However, despite the prevailing circumstances, many see the digital currency as a formidable inflation hedge and a beacon of hope against escalating inflationary pressures.

Bitcoin Halving Is Not a Bullish Event, Says 10x Research Analyst

Bearish signals are looming over the crypto market these days and will almost certainly push prices down in the short term, well-known research analyst Markus Thielen said.

Bitcoin Halving Partially Priced In With No Big Rally Expected Afterward: Deutsche Bank

Crypto prices are likely to stay high in anticipation of spot ether ETF approvals, central bank rate cuts, and regulatory changes, the report said.

Bitcoin Dominance Increases as Halving Nears and BTC Price Lingers Near $61K

BTC dominance is creeping upwards as Layer-1s and Artificial Intelligence tokens had a rough week, while Google search interest in the halving skyrockets.

Historical Trends Show What To Expect For Bitcoin Price Following The Halving

The 2024 Bitcoin halving is only two days away, and there are already varying expectations of what might happen to the BTC price once the event is completed. One way to get an idea of how it could play out for the Bitcoin price, though, is through historical data and how the cryptocurrency has performed at times like these.

Bitcoin Price Trends For Previous Halvings

There have been three halvings so far since Bitcoin was first launched in 2009 and with each one, Bitcoin has demonstrated various reactions to the event. The first halving took place on November 28, 2012, the second happened on July 9, 2016, and the last one was on May 11, 2020.

For the purpose of this report, only the last two halving will be referenced given that adoption had began to climb at the time that these two happened. The 2016 halving happened when Bitcoin was trading around $650, but in the weeks following the halving, the BTC price would drop another 30%, reaching as low as $460 before climbing back up once again.

Then, during the 2020 halving, the BTC price was trending just under $10,000, and following the halving, would see a drop in price as well. However, this drop was not as significant as the 2016 drop, with the BTC price only falling around 15% during this time.

This has formed quite a trend with the halving, where the Bitcoin price falls after the event, which is expected to be bullish. Therefore, if this trend continues, then BTC could see a sharp drop in price despite the expectation that the halving will be bullish for price.

However, it is important to consider that subsequent halvings have seen a lower post-halving crash compared to their predecessors. So, if this holds this year, Bitcoin could still be looking at a crash but to a much lesser degree. For example, the 2020 post-halving crash was half of the 2016 post-halving crash, so holding this trend, the crash this time around could only be an around 7-8% crash.

BTC Deviates From Established Halving Trends

While the historical data does suggest where Bitcoin could be headed following the crash, it is also important to note that the digital asset has deviated from a number of pre-halving trends. One of these deviations is the fact that the Bitcoin price hit a new all-time high before the halving, something that has never happened before. This could suggest that there will be a complete deviation from these established trends, meaning that a crash may not follow the halving after all.

Another deviation is that the few weeks leading up to the last two Bitcoin halvings have been green. However, in 2024, the last three weeks leading up to the halving have been red as the BTC price has been in decline. This also lends credence to the fact that there could also be a deviation from its post-halving trends.

One thing to keep in mind though, is that the crypto market has always been uncertain and Bitcoin has a habit of doing what no one expected. The Bitcoin Fear & Greed Index has seen a pull back from the extreme greed territory, but it continues to remain in greed, which means investors are still bullish. In this case, if Bitcoin were to do the opposite of what is expected, then it could follow the established trend and crash back down.

Crypto Exchanges Bitcoin Supply Can Only Last For 9 Months, ByBit Report

Cryptocurrency exchange and trading platform, Bybit has released a new report highlighting the impacts of the upcoming Bitcoin halving event on the supply dynamics of Bitcoin within exchanges in the crypto space. The crypto firm has provided valuable insights on how the halving event would enhance scarcity and considerably influence the price of BTC.

Exchanges Set To Face Bitcoin Supply Crunch

On Tuesday, April 16, Bybit published a new report, providing a detailed analysis of the Bitcoin halving event set to take place this month. The crypto firm disclosed that the Bitcoin reserves within the world’s crypto exchanges have been depleting at a rapid pace, leaving only nine months of BTC supply left on exchanges.

For a clearer perspective, Bybit explains that with just two million Bitcoin left in its total supply, a daily influx of $500 million into Spot Bitcoin ETFs would result in approximately 7,142 BTC leaving exchanges daily. This suggests that it would take only nine months to completely consume all of the remaining BTC reserves on exchanges.

Bybit has stated that a major contributor to this supply squeeze would be the upcoming Bitcoin halving event, which would reduce the cryptocurrency’s total supply by 50% by cutting Bitcoin miners’ rewards in half.

The crypto exchange has also disclosed that after the halving event, the sell-side supply of BTC flowing into Centralized Exchanges (CEXs) will become grossly reduced. Additionally, Bitcoin’s “supply squeeze will ostensibly be worse.”

BTC To Become “Twice As Rare As Gold”

In its report, Bybit compared Bitcoin’s supply after the halving event with that of gold. The crypto exchange revealed that Bitcoin was steadily growing to become one of the safest investment choices, even for the most seasoned and sophisticated investors within the crypto space.

According to the exchange, the Bitcoin halving event would significantly impact the cryptocurrency’s scarcity factor, making it an even rarer asset than gold.

Basing this analysis on the Stock-to-Flow (S2F) ratio, Bybit disclosed that Bitcoin’s S2F ratio is around 56 currently, while gold’s ratio is 60. After the halving event this April, Bitcoin’s S2F ratio is projected to increase to 112.

“Each Bitcoin halving sharpens the narrative of Bitcoin as not just a currency, but a scarce digital asset, akin to digital gold. This upcoming halving in 2024 will thrust BTC into an era of unprecedented scarcity, making it twice as rare as gold,” the Co-founder and CEO of Bybit, Ben Zhou stated.

While highlighting the significance of Bitcoin’s rarity following the halving event, another report also disclosed that the price of Bitcoin would experience significant upward pressure post-halving. This suggests that BTC’S supply squeeze could potentially propel its price to new heights during this period.

Furthermore, the report revealed that several crypto analysts predict that the post-halving increase in Bitcoin’s price would be less remarkable than the early pre-halving surge which saw the price of Bitcoin hitting new all-time highs of more than $73,000.

Bitcoin’s Outperformance Means Some of Expected Post-Halving Rally May Have Come Early: JPMorgan

Recent weakness in bitcoin mining stocks ahead of the reward halving offers an attractive entry point for investors, the report said.

Buy Bitcoin Miners Ahead of the Halving, Bernstein Says

Bitcoin’s bullish trajectory is expected to resume after the halving once mining hashrates have adjusted to the lower rewards and ETF inflows resume, the report said.

Goldman Cautions Against Extrapolating Previous Bitcoin Halving Cycles for Price Predictions

Bitcoin’s fourth mining reward halving is just two days away.