A BlackRock spokesperson confirmed the firm wasn’t directly involved in Archax and Ownera’s decision to tokenize shares of BlackRock’s ICS Treasury Fund on Hedera.

Cryptocurrency Financial News

A BlackRock spokesperson confirmed the firm wasn’t directly involved in Archax and Ownera’s decision to tokenize shares of BlackRock’s ICS Treasury Fund on Hedera.

Hedera’s native HBAR token surged by more than 107% on Tuesday as investors believed that BlackRock was involved in a fund tokenization project on the Hedera blockchain, the token then slumped by more than 25% as BlackRock turned out to have no involvement in the launch.

A widely misinterpreted announcement from the HBAR Foundation has sparked confusion among crypto influencers and sent the price of HBAR token soaring.

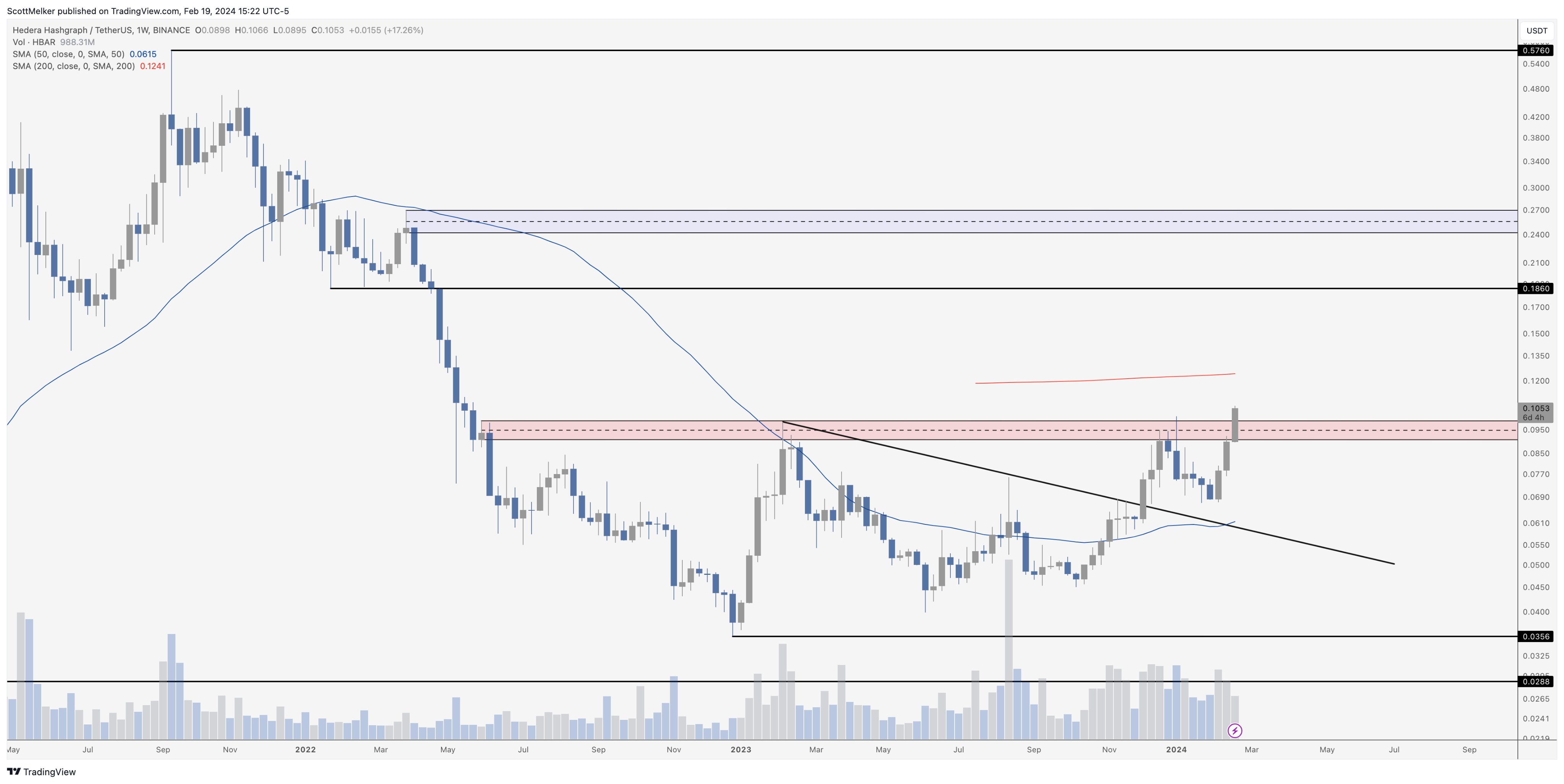

Hedera (HBAR) has surged by 13.7% in the past 24 hours and a notable 31.5% over the last week. This uptick is part of a broader “altcoin season,” where select altcoins are experiencing significant gains. Scott Melker, a prominent figure in the crypto analysis space, today shared his insights into the altcoin market and specifically on HBAR’s potential for growth.

Melker, also known as the “Wolf of all Streets,” has highlighted the significance of the Total 3 market cap, which excludes Bitcoin (BTC) and Ethereum (ETH), to gauge the health of the altcoin market. According to Melker, Total 3 reaching a new cycle high of approximately $550 billion on a weekly close is a clear indicator of a robust altcoin market poised for further expansion.

He stated, “Looking at it generally gives us a clearer picture of what is happening with altcoins. […] With that in mind, it is important to note that TOTAL 3 just made a new cycle high on the weekly close, around $550B. This indicates that the altcoin market remains healthy and likely to continue to grow.”

This dynamic is the basis for HBAR (1-week chart, HBAR/USDT), for which Melker’s analysis shows a very optimistic scenario. Currently, the Hedera price is challenging a significant resistance zone. Melker has identified the $0.10 level as pivotal for HBAR’s potential uptrend.

This resistance zone, highlighted by Melker in red, is crucial because a consistent close above this level on the daily and weekly charts would signal a shift in momentum favoring the bulls. At press time, HBAR was trading just above this key resistance zone, with yesterday’s daily candle closing above $0.10 for the first time since May 2022. The price closed at approximately $0.1117. Melker states:

HBAR is pushing hard into the key resistance zone that I discussed many months ago. To keep it more simple, a push above 10 cents should do the trick. Bulls want to see daily and weekly closes above the red zone. A retest of that zone as support would be an ideal entry.

Two Simple Moving Averages (SMAs) are plotted on the chart: the 50-day SMA at around $0.0615, which HBAR is currently well above, and the 200-day SMA at approximately $0.1241, which is slightly above the current price action. The price positioning between the two SMAs can be interpreted as a consolidation zone where the price needs to establish a firm direction.

Melker points out that past the $0.10 resistance zone, there appears to be minimal historical resistance until nearly a 2x increase around the $0.186 level. This lack of resistance suggests that if HBAR can maintain its position above the red zone, there is potential for a relatively unobstructed upward trajectory.

“As you can see on the left of the charts, there is almost NO RESISTANCE until nearly 2x, around .186. This coin dropped hard, leaving a vacuum. It should do well if it can push through here,” Melker remarks.

However, if HBAR manages to break through the $0.186 resistance zone, Melker’s final target is the blue zone around $0.25. This would net investors more than a 2x on their investment.

At press time, HBAR traded at $0.10647.

Hedera (HBAR), a decentralized public network known for its near real-time consensus and developer-friendly environment, has emerged as one of the top-performing altcoins in the cryptocurrency market.

As the overall market experiences a resurgence of bullish sentiment, HBAR has demonstrated impressive growth, positioning itself as one of the leaders among the top 100 cryptocurrencies by market capitalization.

Over the past fourteen days, HBAR has recorded substantial gains, surging by nearly 50%. This upward momentum extends to the thirty-day and year-to-date time frames, with gains of 36.8% and 15%, respectively.

In the past seven and twenty-four hours alone, HBAR’s price has continued its bullish trajectory, skyrocketing by 33.5% and 17%, respectively. These price movements have propelled HBAR beyond its previous 19-month high of $0.1015, reaching a new 20-month high of $0.1060.

The surge in trading volume, which currently stands at $218,438,657 in the last 24 hours, reflects the increased market activity surrounding HBAR, representing a 204.90% increase from one day ago, according to CoinGecko data.

Despite HBAR’s impressive performance, the road to its all-time high (ATH) of $0.5759, achieved in September 2021, presents a formidable challenge. Currently facing an almost two-year downtrend structure, HBAR would require a staggering 443% uptrend to reclaim its previous milestone.

In the near term, HBAR faces a crucial hurdle at the $0.110 level, which must be defended to prevent further gains. A breach of this level would open the door for testing the $0.1148 and $0.1285 resistance walls.

Should bullish momentum persist, attention will then shift to the resistance at $0.1506, followed by $0.1690 and $0.1822. These levels represent the final obstacles before potentially reaching the $0.2000 mark, a threshold not surpassed since April 2022.

On the downside, the $0.0855 level is expected to act as a support, preventing HBAR from establishing a lower low within the current market uptrend structure.

As the adoption of cryptocurrencies gains momentum among major companies worldwide, the Hedera Council, responsible for overseeing the Hedera public network, has recently announced a series of significant partnerships.

One notable addition to the Council is Mondelēz International (Nasdaq: MDLZ), a prominent multinational food company renowned for its global brands, including Oreo, Ritz, LU, Clif Bar, Cadbury Dairy Milk, Milka, and Toblerone.

On February 14, the Hedera Council revealed that Mondelēz International had joined its ranks. This collaboration marks a significant milestone as Mondelēz International, with its mission to empower people to “snack right”, sets its sights on leveraging distributed ledger technology (DLT)-based solutions on the Hedera network.

Per the announcement, the initial focus of the partnership will revolve around digital transformation initiatives, supply chain management, and enhancing core business processes to deliver elevated customer experiences.

With an emphasis on digital transformation, Mondelēz International seeks to streamline processes, enhance transparency, and optimize supply chain management using the Hedera infrastructure.

All around, the Hedera protocol and its native token HBAR have experienced substantial growth in market capitalization, trading volume, and partnerships, reflecting the increasing interest from investors in the protocol’s offerings. This positive environment sets the stage for future growth and development of the protocol.

However, it remains to be seen whether HBAR can sustain investor attention and continue to achieve price gains, considering the possibility of market corrections following the significant gains recorded in the past 30 days. Nonetheless, HBAR appears well-positioned to emerge as one of the top-performing altcoins in the current bull run.

Featured image from Shutterstock, chart from TradingView.com

The company will use the Hedera Hashgraph technology to improve business efficiencies.

Hedera (HBAR), the open-source Proof-of-Stake (PoS) blockchain network, has made significant strides in the fourth quarter (Q4) of 2023, according to a recent report by Messari. The network’s performance showcased notable growth in key metrics, outpacing the crypto market.

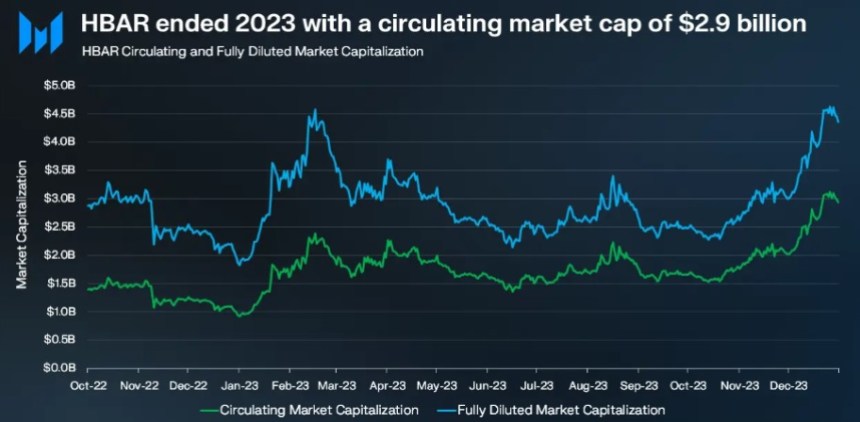

During Q4 2023, Hedera’s circulating market cap experienced a 78% quarter-over-quarter (QoQ) increase, reaching $2.9 billion. This growth surpassed the overall crypto market’s growth rate of 54%, signifying Hedera’s growing influence. The year-on-year (YoY) change for HBAR stood at 211%, reflecting the network’s progress and adoption.

In the same line, Hedera Network’s revenue witnessed a substantial 59% QoQ increase, amounting to $1.6 million in Q4 2023, primarily driven by a 66% QoQ surge in transactions, notably propelled by the Hedera Consensus Service.

Furthermore, the revenue generated from Token and Smart Contract Services contributed approximately 14% of the total revenue, exemplifying a healthy distribution in Hedera’s revenue streams.

With a fixed total supply of 50 billion HBAR, Q4 2023 saw 33.6 billion HBAR, or 67% of the total supply, in circulation.

The quarterly distribution of HBAR, reported through the Hedera Treasury Management Report, anticipates an additional 10% of the total supply to be unlocked in Q1 2024, including new ecosystem grants.

While the number of addresses experienced a decline in Q4 2023, with average daily active addresses decreasing by 22% QoQ to 6,600 and average daily new addresses dropping by 39% QoQ to 5,200, there was still substantial YoY growth. Active addresses were up 90% YoY, and new addresses witnessed a 123% YoY increase.

Hedera Network achieved a new record in transaction volume for the sixth consecutive quarter, with an impressive daily average of 164 million transactions in Q4 2023, marking a 66% QoQ surge. The Hedera Consensus Service remained the primary driver of this activity, accounting for 99% of all transactions on the network.

In Q4 2023, the Hedera network reported 28 billion HBAR staked, representing 85% of the circulating and 56% of the total supply.

Entities such as Swirlds and Swirlds Labs played a significant role in staking their HBAR allocations, and the Hedera Treasury supported validators in meeting the minimum staking threshold for network consensus.

The Hedera network’s Total Value Locked (TVL) demonstrated positive growth, reaching $64 million by the end of 2023, reflecting a significant YoY increase of 169%. The TVL denominated in HBAR reached 733 million, indicating a 16% QoQ and YoY increase. Interestingly, Hedera’s TVL ranked among the top 40 blockchain networks.

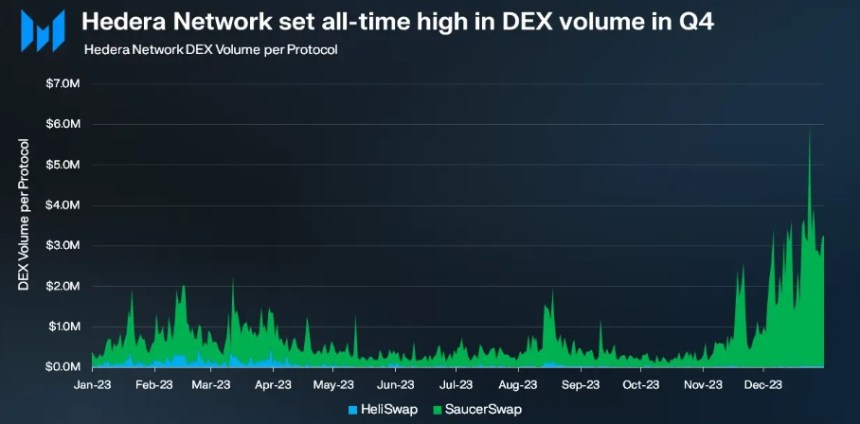

Moreover, Hedera Network experienced a 164% QoQ increase in average daily decentralized exchange (DEX) trading volume, reaching $1.3 million, an all-time high. SaucerSwap dominated DEX trading volume on the Hedera network, accounting for most of the trading activity, as seen in the chart below.

Lastly, the stablecoin market cap on the Hedera network grew by an impressive 73% QoQ, culminating in a year-end total of $6.3 million. Circle’s USDC stood as the sole stablecoin available on Hedera.

The network’s rank in the stablecoin market cap among blockchain networks improved by four spots QoQ, solidifying Hedera’s position in the stablecoin market.

Under current market conditions, the price of HBAR stands at $0.0736, showcasing substantial growth in the past 24 hours, with a 5% increase.

Featured image from Shutterstock, chart from TradingView.com

Both protocols have seen their tokens drop more than ether in daily trading as the next unlocks inch closer.

HBAR has soared with momentum after the US Federal Reserve adopted the Hedera Hashgraph-based Dropp micropayments platform. According to the announcement, Dropp is now on the list of service providers on Fed’s FedNow instant payment system.

Following this news, HBAR’s market sentiment improved, causing a rapid price surge that propelled the token from $ 0.0561 to $0.06544. This represents an over 16% increase in the last 24 hours. However, HBAR price has crossed the overbought region, raising questions about how long the current rally can last.

On July 20, the US Federal Reserve launched the FedNow instant payment system. This payment system allows banks and credit unions to transfer money for customers any time, any day, instantly.

However, according to the latest development, FedNow adopted Dropp, a micropayment platform built on Hedera as a service provider. Dropp allows users to use micropayments for small-valued transactions in USD Coin (USDC), HBAR, and US dollars.

Related Reading: SHIB, PEPE, APE Gain Against Bitcoin, Santiment Explains What This Means

Adopting Dropp as a FedNow service provider implies that banks and other financial service providers can use the micropayment platform for real-time payments. This feat marks a milestone for Hedera as FedNow indirectly supports the token, granting the Hedera blockchain support from traditional finance companies.

Similarly, Hedera is already benefiting from this partnership as its price has increased by over 16% in the last 24 hours. Also, Hedera garnered massive investor attention in the past week due to increased partnerships, such as South Korean automobile companies Kia and Hyundai, which have adopted Hedera’s infrastructure to track vehicle carbon emissions.

HBAR soared over 16% within a few hours after the FedNow support announcement. That brought the token’s seven-day price increase to nearly 17%.

In addition, HBAR’s valuation is now 25% higher than its price 30 days ago. HBAR trades at $0.065, with a day high of $0.06625 and a low of $0.05046.

One remarkable thing about HBAR’s performance is the massive surge in trading volume, which signifies increased network activity and investor interest. As of the time of writing, HBAR has recorded an over 1,219% surge in 24-hour trading volume, after securing its position as the highest-gaining cryptocurrency today.

According to the daily chart, HBAR trades above two key support levels at $0.063035 and $0.06005. Moreover, the bulls have formed green bars above the support levels as they vie to push HBAR to higher highs.

The Relative Strength Index is at 72. But while this signifies increased buying pressure, the sideways movement of the RSI graph suggests a weakening trend. So HBAR buyers have reached saturation and are probably about to lose momentum.

Additionally, the faded green histogram bars show the buying demand for HBAR tokens has dwindled slightly. If this continues, the HBAR rally could stall, allowing the bears to push prices downward.

The token has now rallied nearly 50% over the past two months.

Hedera Hashgraph’s native cryptocurrency, HBAR, is shining following the slight boost in the crypto market today, August 8. Hedera briefly broke through the one-month-long $0.5 resistance, climbing above $0.6, while top coins like Bitcoin bleed with losses.

Even though the overall crypto market cap gain affected many assets positively, HBAR owes most of its gains to the latest ecosystem developments and partnerships.

Despite a drop in trading volume, HBAR has soared over 6%, attaining a peak of $0.06032 on Tuesday morning. This sharp spike represents a nearly 10% increase from the day low of $0.05483. But the token has now receded from its peak value and currently trades at $0.05951.

Related Reading: Valkyrie Unveils Double-Barreled Approach To Launch An Ethereum ETF Alongside A Bitcoin ETF

Moreover, the HBAR price has soared over 16% in a week, bucking the bearish trend that snatched all of Bitcoin and Ethereum’s past week’s gains. The token’s value is now over 22% higher than the price recorded 30 days ago.

However, HBAR’s trading volume is south of its price trajectory. The over 16% decline in 24-hour trading volume raises questions about whether the bulls had reached saturation and capitulated to the bears even before the rally grew strong.

Hedera’s network advancements and strategic partnerships have helped to boost HBAR’s current market position. In August, the Hedera network recorded notable deals with leading banking and financial institutions and automobile companies.

On August 2, Korean automobile firms Hyundai and KIA announced the launch of a new blockchain and AI-powered Supplier co2 Emission Monitoring System (SCEMS) on the Hedera network. This integration allows Hedera to record the carbon emission data from suppliers while AI will predict future emissions following the data provided.

Similarly, on August 4, Hedera announced a partnership with FreshSupplyCoAu in a groundbreaking move that could reshape the digital finance landscape. The strategic partnership allows users to connect with conventional banking and the Mastercard network for a seamless, safe, and wider range of cross-border payments.

Through Mastercard’s payment gateway, Hedera will connect traditional banking infrastructure with decentralized finance technology, bridging the gap between blockchain and traditional finance.

These strategic partnerships mark significant milestones for the network. They could boost HBAR’s usability and trading activity as more investors adopt the token.

This move could amplify HBAR’s reach and market presence, potentially increasing network activities and the token’s price.

HBAR Market Outlook, Will The Bulls Sustain?

Hedera’s dwindling 24-hour trading volume, however, raises questions about the longevity of the ongoing rally since a trading volume decline often signifies bearish market activities.

The HBAR’s price chart reveals that technical indicators suggest a bearish trend reversal for HBAR as the token trades above the 50-day moving average, confirming the bullish momentum on its price today. But the Relative Strength Index has receded from 62 to 57, demonstrating weakening momentum as buyers exit the market.

Also, the Moving Average Convergence/Divergence has converged with the signal line and now moves below, while the faded green histogram bars have birthed red ones.

This observation shows HBAR could face downturns in the next few hours unless the bulls regain control.

BTC price could remain range-bound in the near term, but MATIC, HBAR, LDO and BIT could continue higher.

The price of Hedera Hashgraph (HBAR) has continued to show its strength as price trends with a key breakout from a downtrend range against tether (USDT). With the crypto market cap bouncing from its weekly low as the market continued to look promising, the Hedera Hashgraph (HBAR) price was not left out as the price broke out of its long daily range, with the price trending to a higher height. (Data from Binance)

Hedera Hashgraph (REEF) Price Analysis On The Weekly Chart.

The crypto market received relief, as most crypto altcoins expected. However, despite the recent price surge in most crypto assets, some altcoins have remained range-bound.

As the price of HBAR could not break out with real volume in previous months, it was stocked in a range-like box. HBAR’s price continued to move between $0.05 and $0.077 before breaking out and trending higher.

After a long-term movement, and with the month looking good for most altcoins, as many refer to it as the month of Uptober, the price of HBAR could be set for a break out as the price aims to rally to the $0.1 region.

HBAR’s use case has attracted a lot of traders, investors, and huge organizations, which could also be a huge catalyst to influence the price of HBAR shortly as many tips the price to rally to a high of $1.

Weekly resistance for the price of HBAR – $0.1.

Weekly support for the price of HBAR – $0.050.

Price Analysis Of HBAR On The Daily (1D) Chart

Daily HBAR Price Chart Analysis | Source: HBARUSDT On Tradingview.com

On the daily timeframe, the price of HBAR continues to show strength as it pulls some gains despite the market appearing to have stalled in price movement; after hitting a daily low of $0.05, the price of HBAR rallied to a high of $0.082 before being rejected into a downtrend channel as it struggled to break out.

The price of HBAR is attempting to break out of this downtrend channel; if successful, the price of HBAR could rally aggressively as bulls would be ready to send the price to $0.1, gaining significant price control.

The Relative Strength Index (RSI) for HBAR shows low buy order as the value is below the 50 mark area on the daily timeframe.

Daily resistance for the HBAR price – $0.1.

Daily support for the HBAR price – $0.055.

Featured Image From Zipmex, Charts From Tradingview

Here are some of the leading environmentally-conscious projects within the crypto industry and how they are utilizing their technological influence to good effect.

According to the announcement, the fund is “designed to strengthen accountability and transparency in ecological markets”, with an inherent adherence of contributing towards the 2030 UN Sustainable Development Goals.

Distributed ledger service, Hedera Hashgraph is expected to deploy a panoply of upgrades in 2022 in line with their long-term pursuit of decentralization.

A new proof-of-concept will be tested to send fiat-backed stablecoins between banks to reduce fees and transaction times on international payments.

We hear and read about small cryptos and tokenized projects exploding over night, and many never hear of them weeks, days and hours before they got their success. We often wonder where these coins come from, and how many people don’t hear about them until they are mainstream.

We’ll take a look at a few mid-cap cryptos that are on the radar, but have potential to become mainstays:

No Need To Fear, The Underdogs Are Here

Vechain

Market cap: ~$11.29B

VeChain is a blockchain platform designed to enhance supply chain management and business processes. It’s goal is to streamline these processes and information flow for complex supply chains through the use of distributed ledger technology (DLT). Vechain was founded in 2015 by Sunny Lu, the former chief information officer of Louis Vuitton China. The platform started as a subsidiary of Bitse, one of China’s largest blockchain companies, and is among the few blockchains that already have a substantial customer base among established companies.

Vechain has recently surged into the top 25 of largest market caps amount crypto tokens.

VECHAIN: vechain currently trading at $0.13 vechain-USD on TradingView.com

Related Reading | GreedSwap: Super Producers Cool And Dre Help Launch New Coin & Crypto Label

More Cryptos To Keep An Eye On…

StormX

Market cap: ~$289M

StormX is a decentralized platform where online shoppers can earn crypto in shopping rewards, with $STMX being the platform’s governance token. It is also used to store value in the upcoming line of StormX Debit Cards. The Seattle-based platform has been introducing people into the world of cryptocurrencies through a unique approach. By introducing the idea of “cashback via cryptos,” online shoppers can gain gradual exposure to cryptos by earning as they shop. This allows users to earn cryptocurrencies such as Bitcoin, Ethereum, stablecoin Dai, and also StormX’s native token. Stormx has partnered with world banks and has alot to look for in the years to come.

Hedara Hashgraph

Market cap: ~$4.07B

Hashgraph is a distributed ledger technology that some call the alternative to blockchains; the technology is currently patented, and the only authorized ledger is Hedera Hashgraph. The native cryptocurrency of the Hedera Hashgraph system is $HBAR. The Hedera Consensus Service offers applications direct access to the native speed, security, and fair ordering guarantees of the hashgraph consensus algorithm; using this service, clients can submit messages to the Hedera public ledger for time-stamping and ordering. The platform is anticipating a mainnet upgrade next week.

With about 6,000 cryptos active today, it can be difficult to draw the line between meme tokens and established tokens. Additionally, projects constantly change and grows – what’s hot today isn’t by the end of the night, but this leads to new and awesome discoveries.

Related Reading \ DRepublic Launches World’s First Combinable NFT Platform, ‘MetaCore’ Using EIP-3664

Gamestop may be working on its own NFT marketplace, while Rookie of the Year candidate LaMelo Ball is set to drop 500 Dynamic NFTs.

At $80 for minting an NFT on Ethereum versus $1 on Hedera, it was a matter of cost, said SUKU.