The crypto market has recently experienced a wave of liquidations, amounting to nearly $300 million, closely following Bitcoin’s sharp reclaim of the $67,000 mark.

This surge in Bitcoin’s value, a stark reversal from its previous downtrend, caught many traders off guard, especially those who had placed bets on the continuation of the market’s decline.

Over 80,000 Traders Faces Liquidation

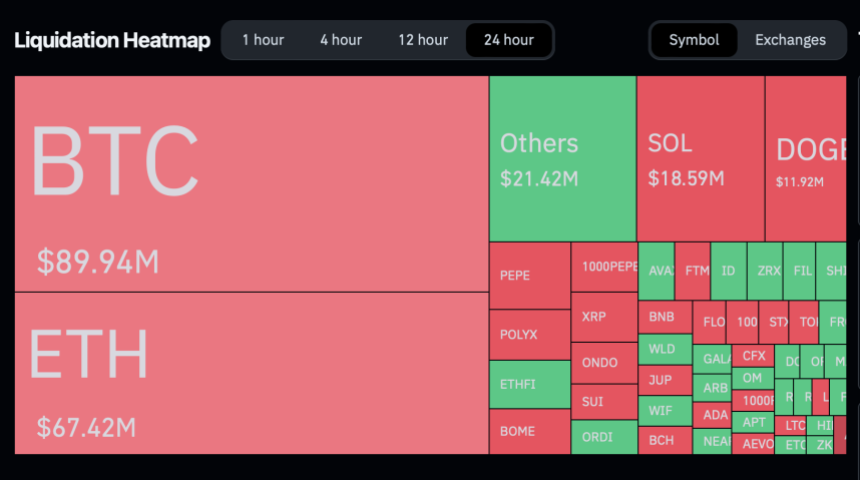

The data provided by Coinglass sheds light on the magnitude of the liquidations, revealing that approximately 86,047 traders suffered losses exceeding $250 million within a mere 24-hour period.

Major exchanges like Binance, OKX, Bybit, and Huobi were the arenas for these significant financial setbacks, with Binance traders bearing the brunt of the liquidations.

Particularly, Binance recorded $128.7 million in liquidations, while other major platforms such as OKX, Bybit, and Huobi also experienced significant liquidations, amounting to $99.87 million, $33.18 million, and $17.70 million, respectively. Meanwhile, despite also facing liquidations, the smaller exchanges had a comparatively minor impact.

Most affected positions were short trades, reflecting a widespread anticipation of a market downturn that did not materialize as expected. Short positions recorded an estimated 57.55% of the liquidations, equivalent to $164.10 million, from traders betting against the market.

On the flip side, long position holders also faced their share of losses, contributing to nearly 40% of the total liquidations, amounting to $121.07 million.

Bitcoin Recovery And Future Prospects

The sharp recovery of Bitcoin, momentarily reclaiming highs above $67,000, has reignited interest in its market behavior and future trajectory.

Despite a 6.6% dip in its market capitalization over the past week, Bitcoin’s value saw a notable 6% increase in the last 24 hours, with its market cap presently sitting above $140 billion. This resurgence in trading activity, with daily volumes climbing from below $60 billion to heights above this mark, signifies renewed investor confidence and heightened trading interest.

Adding to the discourse, cryptocurrency analyst Willy Woo presents an optimistic outlook for Bitcoin, suggesting the possibility of a “double pump” cycle reminiscent of the market patterns observed in 2013.

According to Woo, this pattern could herald two significant price surges for Bitcoin in the coming years, with the first peak anticipated by mid-2024 and a subsequent, more substantial rise in 2025.

While such dual surge scenarios are rare, Woo’s analysis, based on current market conditions and Bitcoin’s growth potential, offers a glimpse into the future of the world’s leading cryptocurrency.

At the rate the #Bitcoin Macro Index is pumping, I wouldn’t be surprised if we get a top by mid-2024, which would hint at a double pump cycle like 2013… a second top in 2025. pic.twitter.com/i2a0V5ytPv

— Willy Woo (@woonomic) March 19, 2024

Featured image from Unsplash, Chart from TradingView