Crypto investment products are up again in terms of inflows, giving the crypto industry a much-needed breather. Recent market dynamics have seen Bitcoin leading the surge of inflows into crypto investment products, signaling a possible resumption of bullish sentiment.

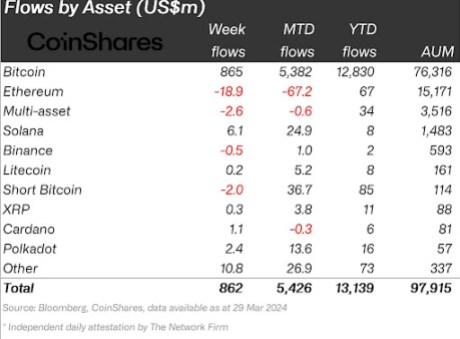

James Butterfill, head of research at Coinshares, reported this inflow in a social media post. The statistics indicate that crypto investment products received inflows of $862 million over the timeframe spanning from March 23 to March 29 to reverse the record net outflows of $942 million set in the prior week. Unsurprisingly, most of the inflow went into Bitcoin, hinting at a potential buying opportunity for investors still waiting to get in on the asset during this bull run.

Institutional Investors Pump $862 Million Into Crypto Market

James Butterfill termed the inflow registered last week as a “recovery for ETFs.” This is rightly so, as these US-based Spot Bitcoin ETFs gave investors a scare in the prior week with lackluster inflow, hinting at the possibility that the bull run could be coming to an end. This led to crypto investment products bleeding for the first time after seven consecutive weeks of inflows.

However, it would seem the sentiment regarding Spot Bitcoin ETFs is now back to a very bullish outlook. As a result, Bitcoin registered $865 million in inflows to bring its year-to-date inflow to $12.83 billion. On the other hand, Ethereum and multi-asset products registered $18.9 million and $2.6 million in outflows, respectively, to offset some of the inflows registered by Bitcoin.

Inflows of $6.1 million, $0.2 million, $0.3 million, $1.1 million, and $2.4 million were recorded for Solana, Litecoin, XRP, and Polkadot, respectively. Polkadot also registered an inflow of $2.4 million. Short Bitcoin products, on the other hand, witnessed outflows of $2 million.

Buying Opportunity For Bitcoin?

Bitcoin’s price surge for the past few months has largely been due to action surrounding Spot Bitcoin ETFs. Interestingly, last week’s inflow activity saw Bitcoin breaking into the $70,000 price territory multiple times last week. This bullish momentum wasn’t sustained, allowing the bears to create a resistance at around $71,000.

Nevertheless, the inflow indicates something bullish might be brewing behind the scenes. Fundamentals surrounding the crypto point to a bullish price action throughout April, particularly as the next halving approaches.

Bitcoin went through bearish price action over the weekend, correcting by almost 7% from $71,285. At the time of writing, Bitcoin has broken below a support at $68,500 and is now trading at $66,510. According to Santiment, the price dip has given crypto traders a sense of buying opportunity with calls of “buy and bullish” spiking across social media.