Investors in the cryptocurrency space are eagerly awaiting the halving of Bitcoin in order to fuel future market growth. However, top cryptocurrency expert and trader Benjamin Cowen cautions that if the price of BTC follows a previous pattern, there may be a correction.

Bitcoin Halving Could Impact Price Negatively

Cowen has highlighted a trend that could potentially lead to a significant decline in the crypto asset’s price when the Bitcoin halving event commences, which suggests that BTC could be poised for a decline in the coming days.

According to Cowen, should Bitcoin continue to follow the same trajectory as it entered the spot ETF during the halving, BTC may witness a trend toward the downside. The crypto expert advocates that these patterns typically do not repeat precisely. However, he believes putting the idea out there is crucial in case it happens again in a similar manner.

In response, a pseudonymous user commented on Cowen’s post and reminded the expert that he forgot the arrow backup. Responding to the user, Cowen stated that he believes the outcome of the next phase will depend on whether or not ALT/BTC pairs have collapsed by then.

Furthermore, he affirms there could be a move on the upside if they have not broken down. Meanwhile, in the event that they have broken down, the pattern can transit to something new.

It is worth noting that the Bitcoin halving event is forecasted to take place within the next 11 days. Given Bitcoin’s halving previous significant impact on price, BTC could be positioned for a notable price surge in the coming days. However, if Cowen’s recent prediction manifests, it could paint a different picture for the crypto asset during the halving event.

The expert’s prediction has sent quite a frenzy in the crypto community, with analysts like Peter Brandt supporting his insights. Peter Brandt acknowledged Cowen’s projections noting that previous Bitcoin bull markets have exhibited a similar fundamental trend.

What To Expect During The Halving Event

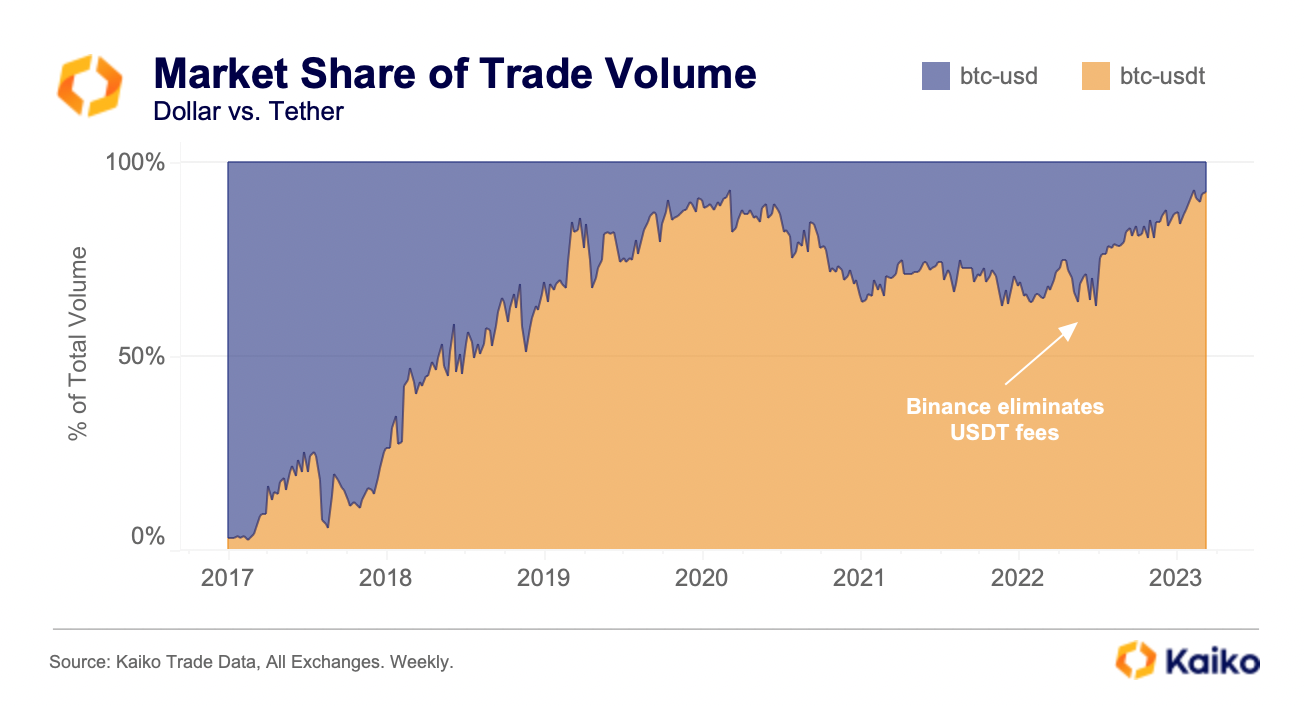

As the halving event approaches, the cryptocurrency data analytics platform Kaiko has laid out a perspective to watch out for. Kaiko’s perspective delves into the impact the halving has had on BTC’s price in the short term over the years.

According to the platform, in the past, the short-term price effect of Bitcoin halvings has been inconsistent. Nonetheless, historical data reveals that the coin tends to rise 9-12 months after halving, making it a generally bullish development.

At the time of writing, Bitcoin’s price was up by 8% in the past 7 days, valued at $70,770. Its overall market cap is down by over 2%, however, while its trading volume is up by over 8% in the past day.