The amount raised by crypto firms in Q3 fell to just under $2.1 billion, across 297 deals, the lowest on both counts since Q4 2020

Crypto community reacts to Biden’s proposed crypto tax reporting rules

Many prominent crypto commentators are concerned that this will make crypto firms even more reluctant to do business in the United States.

XRP Emerges As Top Performing Crypto With 55% Surge – Messari Report

Amid the prevailing bearish trend in the crypto market, XRP has stayed afloat above other assets with impressive gains. A report from a leading crypto market intelligence product provider, Messari, revealed the Ripple native currency XRP took the lead in the overall crypto market in Q1.

XRP Takes The Lead In Overall Crypto Market

According to data from Messari, XRP outperformed other crypto assets with a 55% surge on a quarter-on-quarter (QoQ) basis.

From the report, the market cap of XRP grew by a whopping 59.9% in the first quarter of the year. The value increased from $17.4 billion on January 1 to $27.4 billion on March 31.

Notably, the growth rate for XRP’s market cap exceeded the cumulative crypto market cap that witnessed a 46% surge within the same period.

Messari’s report also showed that XRP kicked off the year with a trading price of $0.35 as of January 1. With the increasing volatility in the crypto market during the beginning of 2023, XRP rallied progressively through the days. As of January 23, XRP’s price hit $0.43 before retracting due to the influence of the bears. The token closed in January with a 19.71% increase in value.

The second month wasn’t quite eventful for XRP as the price gradually dipped to $0.36 amid the downtrend in the overall crypto market. However, XRP ended February with a 7.27% drop as the price hit $0.37.

Then XRP’s price rally took a more aggressive look in March. The price of XRP ranged from the beginning of March. But it gained momentum from March 21 as XRP broke the resistance level at $0.400.

XRP sustained its volatility and pushed higher with a more bullish stance through the remaining days in March. The token rallied beyond the $0.500 region and progressed higher.

Messari noted that XRP hit a 10-month high of $0.5850 on March 29, following a two-week price surge of 56%. This price rally was peculiar to XRP, although most crypto assets posted a decline during the period.

Finally, XRP closed with a price of $0.54 on March 31, a 43% price surge for the month. The feat pushed the token to an overall price gain of 55% in Q1 2023.

XRP Performance Analysis In Q1 2023

Besides the XRP’s price performance, the Messari report also highlighted other performance indicators for the token.

The data shows an increase in XRP’s overall network activity metrics in Q1. The total active addresses and average daily transactions surged by 13.9% and 10.7%, respectively, on a QoQ basis.

The total active addresses grew from the receiving addresses, which increased from 47,000 to 55,000 through a 17.1% surge. But XRP sending addresses dropped by 7.2%.

-Featured image from Pixabay and chart from Tradingview.com

Crypto Analytics Firm Messari Cuts 15% of Workforce as Part of Restructuring

The crypto intelligence firm, which is led by Ryan Selkis, had closed a $35 million Series B last year.

Bitcoin price more correlated to FTX developments than macro events: Research

While inflation has an effect on the price of Bitcoin, researchers were bewildered by bitcoins resilience to other macroeconomic factors.

Solana Price Surge Attracts Investors, What’s Driving It?

Solana’s price has achieved an unexpected week-long rally, causing it to significantly outperform almost all other cryptocurrencies. As the price of the centralized smart contract token stabilizes, investors are showing interest in how high it can go.

In the first week of 2023, the price of Solana (SOL) soared in value, going from $9.7 to $17.50. As a result, trade volume in SOL has increased, and Wallet Investor predicts that SOL will hit new highs in 2023.

The current Solana price, as reported by CoinMarketCap, is $15.87. The value has decreased by 0.50% over the past 24 hours. There are currently 370,184,196 SOL in circulation, which gives it a market cap of $5,915,802,434 and a position in the top 12 of CoinMarketCap’s rankings.

SOL Dominates The Market

In the weeks following the FTX crash, the price of SOL had taken numerous beatings, eventually falling to single-digit values for the first time in two years. However, Solana beat the market by coming back from the dead and seeing a price hike again.

With daily volume near its average of $6 million, the price of SOL has settled at the new rally’s top boundaries. This indication is bullish, as buying and selling have not yet grown in a bearish direction. As a result of these considerations, the next bullish goal is the $20 level, as it touched $17.50, representing a 30% increase from the current price.

The historical correlation between an overbought RSI and buyer exhaustion has led many traditional investors to view an overbought RSI as a probable sell signal. So, to get the RSI back below 69, the price of SOL may go through a correction or a sideways consolidation phase.

Messari Outlines Solana’s Growth Factors

A recent tweet from Vitalik Buterin and the enthusiasm in the protocol’s meme coin Bonk (BONK) are just two of the many variables that have contributed to the rise of SOL, according to crypto analytics service Messari. And when more individuals buy than sell, the value of digital currency increases.

Despite its rising transaction volume, SOL’s declining gas fees were cited by Messari’s senior analyst Tom Dunleavy as one of the two most likely fundamentals fueling the coin’s continuous growth.

According to the update released by Messari, the protocol no longer appears to be facing the outages it had been experiencing.

The price of Solana’s native coin dropped last year due to a couple of factors, including multiple network disruptions and the harsh crypto winter. The downtime was bad enough to get Cardano’s founder, the outspoken Charles Hoskinson, to criticize the protocol publicly.

100%: Public Bitcoin miners sold almost everything they mined in 2022

Publicly listed Bitcoin miners sold off nearly everything they mined in 2022 but appear to have started accumulating reserves once again.

Calls for regulation get louder as FTX contagion continues to spread

The FTX saga has made some crypto executives, researchers, analysts, and politicians more aligned on regulation than ever.

Tron Transaction Volume Balloons To 5.3 Million In Q3, But There’s Still Doubts Ahead

Once a week, the official Tron Twitter account would tweet out an update for the world to see. The events of the past week, the post claims, have provided Tron with new possibilities. Also during the quarter, Messari published their own report on Tron’s performance.

As more data on the token’s side are investigated, the research claims that the future of the protocol is bright, but that mixed signals are spreading doubt to fans and investors.

This can be worrisome since low confidence can lead to a sell-off, which can further drive the token’s price down.

Even while there is hope for the token’s future in the Messari research, investors in cryptocurrencies appear to be more concerned with the continued decline in development activity and other factors.

The report points out that:

#TRON #TVL grew by 61% QoQ.

The total transactions grew by 12.4% to 5.3M over Q3.

#TRON network activity reached a refreshed foundational user base after the launch of #USDD in May.

Read the full report

https://t.co/BOxQzatH9M

— TRON DAO (@trondao) November 5, 2022

In addition, the amount of DeFi territory on Tron ballooned dramatically. There was a 61% rise in TVL (total value locked). Total TRX transactions also increased by 12.4% year over year in the third quarter to 5.3 million.

How high may TRX go in the next several days, and will bears in the TRX market eventually prevail?

Tron: Mixed Signals And Price Forecast

As of this writing, the Tron looks like this: CoinGecko claims that TRX did not experience any price growth throughout the last three months. However, at the time of writing, it appears that token prices are on the rise.

TRX is exhibiting a descending triangle formation, which is a bullish indicator for investors and traders. This has the potential to restore the token’s confidence. Currently, TRX is trading in the green at $0.0627, and a bullish breakout is possible during the next several days.

Soaring Stoch RSI data will be the indication for investors and traders to monitor, as continued rising movement on this indicator indicates a possible pullback in the coming days or weeks.

Yet, this is counterbalanced by the bearish CMF and CCI indicators, which indicate either partial or complete bear dominance over the TRX market.

TRX Holders Brace For Next Price Movement

As the breakout nears, the EMA ribbon signal suggests opening a long position now. TRX’s trading range has shrunk from $0.0523 to $0.0724 during the last weeks to the current range of $0.0588 to $0.0670.

Along with the rising behavior of the Stoch RSI data, this significantly validates the EMA ribbon’s price movement prediction.

As this day approaches, the market will finally take into account Messari’s previous optimistic quarterly report.

While this day has not yet arrived, TRX holders should continue to hold until the rally occurs.

TRXUSD pair trading at $0.062489 on the daily chart | Featured image from Forbes, Chart: TradingView.com

Hedera: A Quick Evaluation Of The Network – And How HBAR Performed This Week

According to Messari, the performance of Hedera in the third quarter this year defied the prevailing market mood and is currently witnessing growth not seen on other protocols.

DefiLlama claims that the protocol’s TVL increased by an impressive 137%. For comparison, Hedera’s quarterly network expansion occurred during a period when other networks were contracting.

In addition to boosting the value of its native coin HBAR, this quarterly report also helped it do so in the past few days.

As of this writing, HBAR is trading at $0.060236, down 3.7 percent in the last seven days, data from Coingecko show, Wednesday.

Based on data, we can see that while HBAR’s value decreased on weekly and biweekly timescales, these losses are totally wiped out when looking at the cryptocurrency’s price over a 24-hour period or an entire month. This bodes well for the network’s investor confidence.

Hedera On Solid Footing

Investors and dealers were impressed by the network’s rapid expansion because it ran counter to the existing bear market trend. While comparable networks experienced user declines during the quarter, Hedera saw no such trend.

The report states that the network’s weekly active user base increased from 7,598 in Q2 to 14,601 in Q3. This represented a rise in the metric of 92.2%. More good news in terms of expansion follows.

HBAR’s transfer volumes and overall network fees have also increased. HBAR’s overall transfer volume was up from 42,623,168,658 in Q2 to 53,523,008,558 in Q3, which is a total increase of 25.6%.

Chart: TradingView

From Q2 to Q3, total network fees climbed by approximately 543%. NFTs led the network’s expansion shift. As stated in the report:

“The Hedera NFT sector (a component of the Hedera Token Service) has been an engine of growth for the network. During Q3, NFT active users (+90% QoQ) and transactions (+107% QoQ) each set all-time-highs.”

What To Anticipate In HBAR

Even though the network lags behind Ethereum and Solana in the NFT industry, Hedera could become a big player if its expansion continues.

The price movement of HBAR conforms to a descending triangle pattern. As the price fluctuated between $0.0556 and $0.0671, this might be interpreted as a bullish indicator for investors and traders.

This narrow range affords the coin the possibility of a bullish breakout.

These favorable outcomes will certainly attract more people to invest in the network and token, resulting in a price increase.

HBAR total market cap at $1.3 billion on the daily chart | Featured image from The Daily Hodl, Chart: TradingView.com

Disclaimer: The analysis is based on the author’s personal knowledge and should not be construed as investment advice.

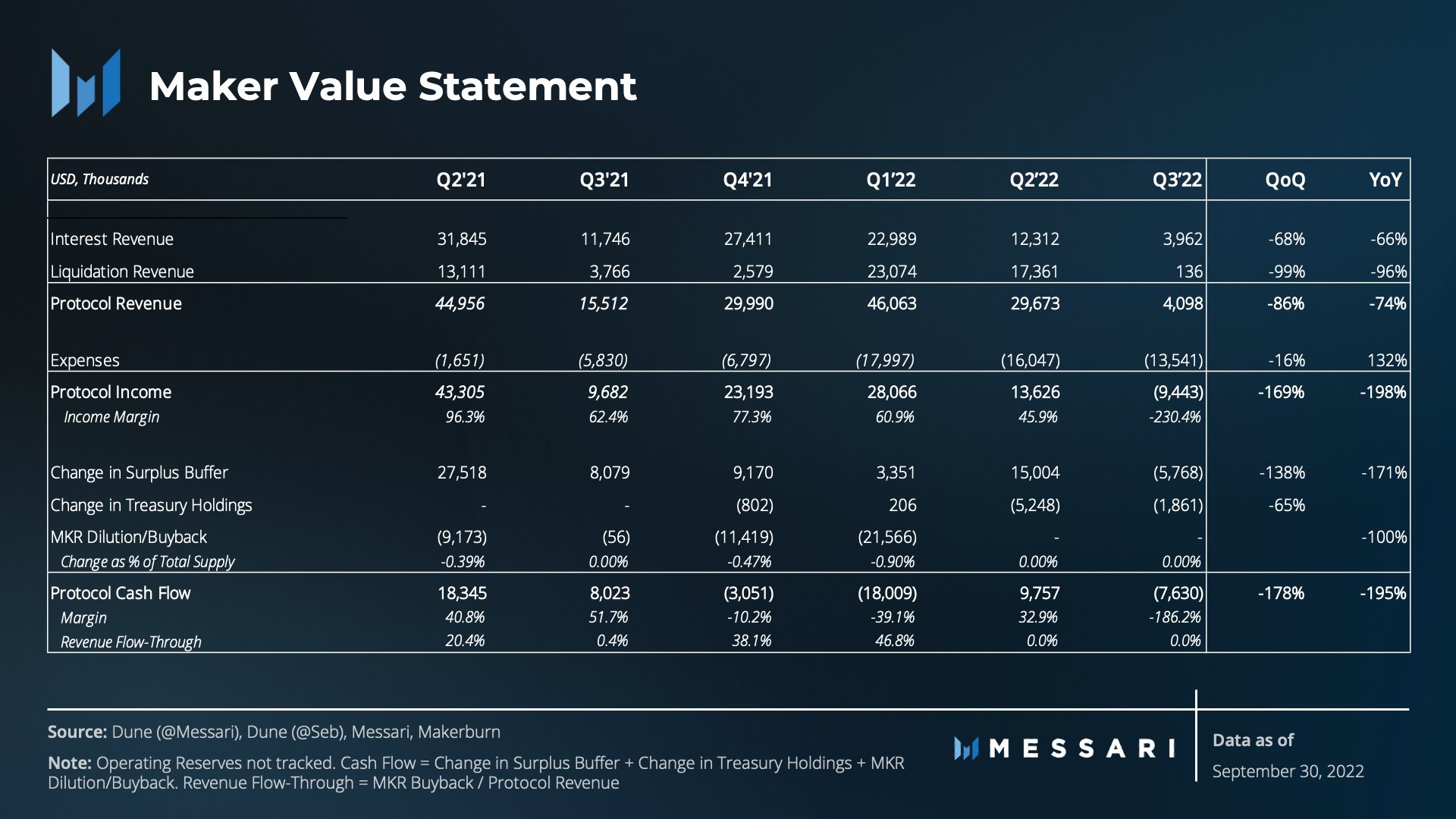

MakerDAO revenue tumbles 86% on Ether and Wrapped BTC woes

Messari research shows MakerDAO has experienced its first quarter of net income loss since 2020 following a huge fall in loan demand and few liquidations.

Crypto fundraising already outpacing all of 2021: Report

The Messari report noted that more than $30 billion was raised from 1199 funding rounds in the first half of 2022.

Is Axie Infinity overheating? AXS price hits record high following 100% QTD rally

The gaming token, which reached $150 in the early UTC hours of Monday, risks correcting below $90 as a key technical indicator identifies its overbought conditions.

Ethereum supply shock: Exchange ETH reserves continue to fall after a 26% drop in 2021

To date, 92,595 ETH have been burned following Ethereum’s London hard fork upgrade.

OpenSea trading volume explodes 76,240% YTD amid NFT boom

The nonfungible token marketplace processed 1.18 million transactions worth $1.06 billion in the last 30 days alone.

Crypto Company Circle Seeks To Become Global Digital Currency Bank

The company behind the increasingly popular USDC stablecoin dreams big. Circle wants to leverage its know-how and good reputation to become “a global digital currency bank.” That means it’s also looking into becoming a digital currency bank in the US. Their plan’s announcement focused on that region of the planet, but the wording makes it clear that they’re ultimately looking for worldwide domination.

Related Reading | Is USDC’s Billion Dollar Growth A Sign Crypto Smart Money Is Ditching Tether?

According to Coindesk, “this would be an industry first, with a scope far beyond the OCC banking charter already conditionally issued to Anchorage, Paxos and other crypto-native financial services firms.” The company’s aim is to provide “frictionless, instant and nearly free payments that combined fiat reserve currencies with open, permissionless blockchains, and eventually building on these open networks to support new forms of capital formation and intermediation.”

It’s the project ready for prime time or in its infancy? Did they file the documents already? Will they be able to pull this off? Keep reading for extra clues and info.

USDC price chart for 08/10/2021 on Bitbay | Source: USDC/USD on TradingView.com

Circle Played Nice With Governments From The Get-Go

The USDC stablecoin is issued by CENTRE, a joint venture between Circle and Coinbase. Their aim is “to conform with stringent U.S. money transmission supervisory and regulatory standards.” In contrast Tether, their main competition, is famous for the probe that the US Department Of Justice launched against them.

The main point of contention against Tether is the reserves they hold to back up their USDT. Attacking their competition’s weak spot, Circle claims, “Establishing national regulatory standards for dollar digital currencies is crucial to enabling the potential of digital currencies in the real economy, including standards for reserve management and composition.”

Since regulatory compliance is their forte, Circle spends half of their announcement praising their own transparency and USDC’s liquidity even “in times of intense demand to redeem USDC”. To prove that, they provide an independent accountant report that highlights the “composition of USDC reserves, including the credit quality of the underlying assets.”

Related Reading | Tether (USDT) To Face Do or Die Situation in 2021: Messari Report

Why does all of that have to do with their plans to become a national digital currency bank? It proves that they’re in tune with the US Government.

Now, with USDC at more than $27.5 billion in circulation, and building on our long-standing commitment to trust, transparency and accountability in the dollar-denominated reserves backing USDC, we are setting out to become a U.S. Federally-chartered national commercial bank.

Circle intends to become a full-reserve national commercial bank, operating under the supervision and risk management requirements of the Federal Reserve, U.S. Treasury, OCC, and the FDIC.

Other Big Plans For The Crypto Company

Recently, Circle announced its intention to go public before the end of the year. According to Coindesk, the company “partnered with a special purpose acquisition company (SPAC) to go public later this year. The deal valued Circle at $4.5 billion.” Also, their USDC project will soon go live in multiple blockchains. As NewsBTC informed:

It will soon be available in, “Avalanche, Celo, Flow, Hedera, Kava, Nervos, Polkadot, Stacks, Tezos, and Tron.” That will bring the total to 14; since USDC is already functional in Ethereum, Algorand, Stellar, and Solana.

In related news, NewsBTC recently highlighted a Messari report that shows USDC is the most used stablecoin in DeFi.

From what Ryan Watkins, a credible researcher, predicted, the stablecoin share for Tether on Ethereum could dip below 50%. In addition, Watkins revealed that more than half of USDC’s total supply is now in smart contracts.

The equivalent value for this USD Coin supply is about $12.5 billion. According to Messari, CoinMetrics data estimates show that USDC’s stablecoin supply is over 40% on Ethereum.

However, none of that guarantees that their plans to become a global digital currency bank will come true. Keep the NewsBTC tab open for further information on this developing story.

Featured Image by Chaitanya Tvs on Unsplash – Charts by TradingView

Harmony Organizes $1M Hackathon To Bridge DeFi and Traditional Finance

According to the information available, Harmony Hackathon will last for six weeks. The Hackathon will commence on August 15, 2021, and ends on September 30, 2021.

Related Reading | Ether EFT Gets Approval From Brazilian Securities Regulator

There will be three categories, and each one will have four challenges for the experts to complete.

🚀 1/ We are happy to announce the Bridging #TradFi to #DeFi #hackathon where Harmony, along with prize partners, will be giving up to $1,000,000 in prize money and non-dilutive seed funding. Why are we doing this?https://t.co/qeq6U9M0LV

— Harmony (@harmonyprotocol) July 15, 2021

Presently, the organizers, Harmony blockchain, have disclosed that the registration for the event will start in August. Also, there are more than one million dollars available in seed funds and participant prizes. The company made the announcement on Thursday through Twitter.

According to the announcement, the hackathon aims to achieve cooperation between traditional finance and decentralized finance.

Furthermore, the team aims at bringing more people from the traditional finance sector to tackle the challenges affecting both their industry and the DeFi sector.

A Brief On Upcoming Hackathon

According to what Harmony revealed, the Hackathon will come in three categories. These categories will have four challenges, including cross-chain & trustless bridges, cross-border with fintech integration, social wallets & keyless security.

Harmony also made some statements on Twitter saying that blockchain finance is where there’s product-market fit. However, many people who created decentralized finance are not of traditional finance.

Therefore, Harmony aims at bringing more traditional finance experts to add their knowledge to decentralized finance.

Harmony also mentioned that traditional finance experts have many things to teach them in DeFi. Likewise, DeFi practitioners can also help them understand the sector more and learn how to utilize it. So, it will be a mutually beneficial event for both TradiFi and Defi.

Related Reading | Nifty’s Inc. Partners With Warner Bros To Roll Out A Social NFT Platform

Concerning the event, Harmony disclosed some people who will speak in the event or serve as judges for the participants.

According to the blockchain, these people include, Omakase, the core developer of SushiSwap, Lily Liu, the co-founder of Earn.com, the lead for DeFi Alliance Imran Khan, and other prominent people in the industry.

Also, the event sponsors include Messari, SushiSwap, CoinGeckom, Unstoppable Domains, DoraHacks, DappRadar, Hummingbot, and The Defiant, a news platform.

A Brief on Harmony

Harmony is a Sharding protocol that uses a “Trustless Ethereum Bridge” to separate its blockchain into different segments. These segments are responsible for the processing and storage of data in parallel.

The mainnet launched in 2019, and since then, the company has partnered with many others to push its operations further. Also, Harmony has completed many integrations since then as well. For instance, it added Terra to its blockchain to use the token on the apps in the ecosystem.

Related Reading | Binance CEO Changpeng Zhao States, “Compliance Is A Journey.”

The blockchain disclosed that it would sponsor the Hackathon in June. According to the blockchain, it aims to reach 10 billion users, which is a way to achieve it.

The registration will end on August 15, and teams can only be 5 people. Once they reached the submission deadline, the event will kick-off.

Featured image from Pixabay

Fidelity launches institutional cryptocurrency analytics platform Sherlock

Sherlock will provide fundamental and technical analysis for fund managers and investors.

Messari researchers slam Binance Smart Chain over centralized validators

With Binance Chain’s 11 validators hand-selecting Binance Smart Chain’s validators daily, analysts are warning of the protocol’s centralization.

‘No loss’ lottery protocol PoolTogether among most utilized protocols in DeFi: Messari

Since launching its V3 iteration in October, PoolTogether has paid out more than $750,000 in risk-free lottery returns.