GRIID commenced trading on the Nasdaq Global Market on Monday under the ticker symbol “GRDI” while continuing to trade on Cboe Canada under the same ticker.

Bitcoin ETFs: What to Expect on Day One

Spot bitcoin ETFs are launching in the U.S. on Thursday. Here’s what the issuers and exchanges behind these products have to say.

Bitcoin ETFs: What to Expect on Day One

Spot bitcoin ETFs are launching in the U.S. on Thursday. Here’s what the issuers and exchanges behind these products have to say.

Bitcoin Decouples From Nasdaq Amid ETF Speculation

The 40-day correlation between the two has declined to zero.

Bitcoin Correlation To Nasdaq Continues To Be Negative: What It Means

Data shows the Bitcoin correlation to the Nasdaq has continued to be negative since December. Here’s what this means for the cryptocurrency.

Bitcoin 60-Day Correlation To Nasdaq 100 Is Negative Right Now

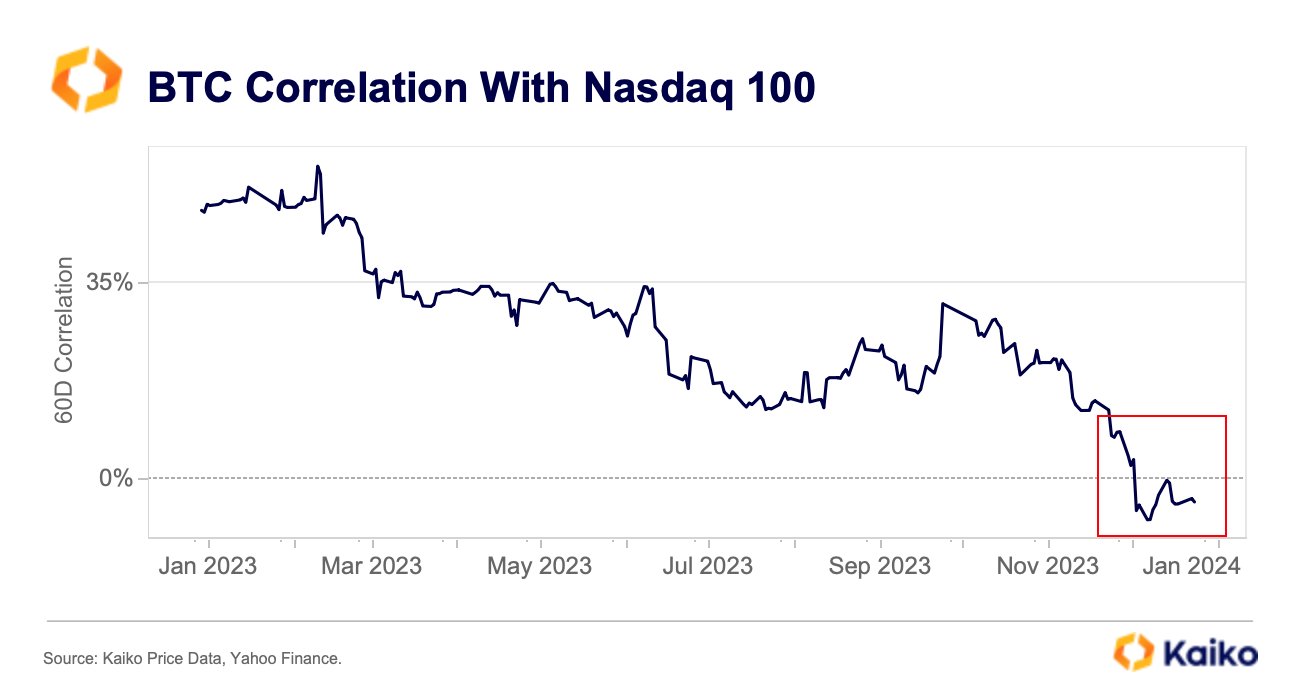

In a new post on X, the analytics firm Kaiko has discussed what the trend in the correlation between BTC and Nasdaq has looked like recently. The “correlation” here refers to a metric that keeps track of how tied together the prices of two commodities have been over a given period.

This period can naturally be of any length, but in the context of the current topic, the 60-day correlation is of interest. This indicator version measures the prices’ dependence on each other during the past two months.

When the value of this metric is greater than zero, it means that the price of one asset has been reacting to the other by moving in the same direction. The closer the indicator is to one, the stronger this relationship.

On the other hand, values under zero suggest some correlation between the two assets, but it has been a negative one. This means that the assets have reacted to each other by moving in the opposite direction. In this case, the extreme point is -1, so the closer the indicator is to this mark, the stronger the correlation between the prices.

Lastly, the correlation being exactly zero implies that there is no correlation whatsoever between the two assets. In mathematics, such a condition occurs when two variables are independent.

Now, here is a chart that shows the trend in the 60-day correlation between Bitcoin and Nasdaq 100 over the past year:

As the above graph shows, the 60-day correlation between Bitcoin and Nasdaq is shown in percentage here, with 100% corresponding to a value of 1.

From the chart, it’s apparent that the metric’s value was in a state of overall gradual decline during 2023, up until the final couple of months of the year, when the metric took an especially sharp dive.

Some amount of positive correlation had existed between the two assets before this plummet, but following it, the 60-day correlation took to negative values. However, the indicator remained close to the 0% mark, implying that the two only had a slight negative relationship.

The correlation had started surging and reached almost exactly 0% for a brief period just earlier, but the metric has since again come down and assumed slight negative values.

It would appear that BTC has kicked off 2024 slightly, moving against the traditional markets, which could set the stage for the cryptocurrency to go on and explore its territories this year.

BTC Price

At the time of writing, Bitcoin is trading around the $44,800 mark, up over 5% over the past week.

BlackRock’s spot Ethereum ETF plan is confirmed after Nasdaq filing

Earlier in the day, BlackRock registered corporate entity “iShares Ethereum Trust” in Delaware, the first hint that a filing for a spot Ethereum ETF filing was imminent.

Bitcoin’s 14% Weekly Gain Signals ‘End of an Era’ as Big Tech Dumps, Analyst Says

Bitcoin’s advance this week coupled with gains across all digital asset sectors, highlighting the breadth of the crypto rally.

Stocks fall, yields rise as inflation data comes in hotter than expected

The stock market declined on October 12 as the US BLS released new data showing prices rose faster than expected.

US stocks rise as traders wait for inflation data

All US stock indices rose on October 11, as traders awaited consumer price index data to be released on the 12th.

US Stocks rise for third straight day as bond yields fall

Treasury yields declined, giving stock market bulls new momentum.

US Stocks Overcome Early Decline Amid Israeli-Gaza Tensions to Close Higher

The Dow and S&P 500 fell early in the day, but rebounded to end the day positive.

Why The NASDAQ’s Latest Move Is Important For Fund Managers Filing Ethereum ETFs

Traditional financial institutions that have filed crypto ETF applications have focused on a particular market (spot or futures). However, a recent NASDAQ application suggests that the asset manager Hashdex is taking a different approach, which could be a game changer in the Ethereum ETF race.

NASDAQ Proposes To List Ethereum ETF

According to the application filed with the US Securities and Exchange Commission (SEC), the stock exchange plans to list and trade shares of the Hashdex Nasdaq Ethereum ETF, which will be managed and controlled by Toroso Investments LLC.

Interestingly, the fund will hold both Ether futures contracts and Spot Ether. This move from asset manager Hashdex is novel, considering that other asset managers have either applied to offer a Spot Ether ETF or Ether futures ETF or filed applications to offer both separately. However, Hashdex wants to offer a fund holding both Ether futures contracts and a Spot Ethereum ETF.

The fund’s sponsors believe that combining Ether Futures Contracts and Spot Ether will help mitigate the risk of market manipulation (a major concern of the SEC) and provide the market with a “regulated product” that tracks Ethereum’s price. This fund will help US investors gain exposure to Spot Ether without relying on “unregulated products, offshore regulated products, or indirect strategies such as investing in publicly traded companies that hold Ether.”

In fulfillment of the requirement of having a surveillance-sharing agreement (SSA) for the proposed ETF, Nasdaq stated in the application that the Chicago Mercantile Exchange (CME) will be used to track the price of Ethereum as the CME represents a “regulated market of significant size.”

Furthermore, the fund is expected to hold physical Ether. However, the sponsors do not intend to purchase these tokens from “unregulated ether spot exchanges” but from the CME Market’s Exchange for Physical (EFP) transactions.

This move is similar to Hashdex’s application to combine a spot Bitcoin ETF with its existing Bitcoin futures ETF. Hashdex, in its application, stated that the CME will be used to track Spot Bitcoin’s price and that all Bitcoin purchases will be from the CME’s EFP.

Hashdex Throwing Other Asset Managers Under The Bus?

Nasdaq’s application mentions the phrase “unregulated spot exchanges” multiple times in what seems to be a direct attack on Coinbase and the applications of other asset managers. It is worth mentioning some of the other asset managers, including Ark Invest, who have filed to offer an Ethereum-related ETF, have chosen Coinbase as their custodian.

As such, Hashdex labeling Coinbase as an “unregulated spot exchange” doesn’t seem right, as this could undoubtedly influence the SEC’s decision when dealing with these applications.

Furthermore, asset managers like BlackRock picking Coinbase for their SSA and custodian had already sparked controversy as many had stated that the SEC would not be so inclined to approve an application in which Coinbase is directly or indirectly involved since it has an ongoing lawsuit against the crypto exchange.

While many may commend Hashdex’s “innovative approach,” there is a need to be wary of how this approach could hinder the application of others and the eventual effect on the crypto industry in general.

Nasdaq’s Hashdex mixed Ether ETF filing joins crypto ETF race

Known as the Hashdex Nasdaq Ethereum ETF, this investment fund is the first filing for futures and spot Ether holdings under the ‘33 Act and is overseen and supervised by Toroso Investments.

Nasdaq receives SEC approval for AI-based trade orders

The artificial intelligence-based order type could make stock trading even more efficient.

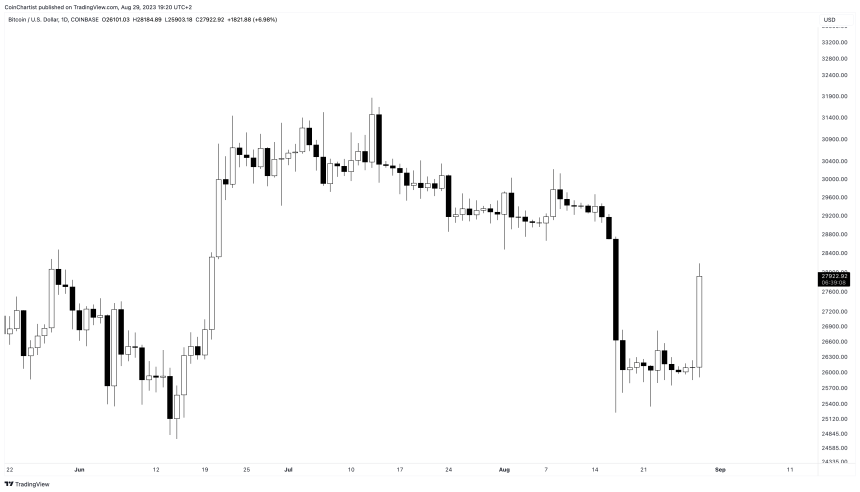

Bitcoin Price Taps $28,000 On Grayscale Ruling, Soaring Stock Market

Bitcoin price has thus far made a 7% intraday move following news that a US court ruled in favor of Grayscale against the SEC. At the same time, the stock market is surging.

Could a perfect storm for the top cryptocurrency by market cap be building?

Back At $28,000: Grayscale Court Ruling Causes BTC To Bounce

In an asset class as volatile as crypto, prices — and moods — can change in a flash. That’s exactly what we’ve witnessed on a small scale today, moments after news broke that a US court is forcing the SEC to reconsider Grayscale’s Bitcoin ETF.

The news is significant because not only does it increase the chance Grayscale can move ahead with an ETF, but it also improves the likelihood of other ETFs like

BlackRock getting the green light.

Green is definitely the color of the day, with BTCUSD climbing back to $28,000 per coin on the heels of the news.

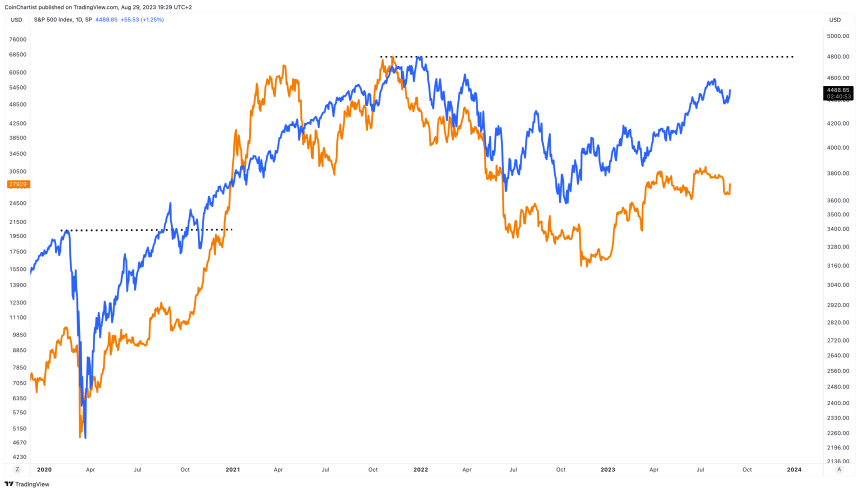

Bitcoin Price Could Benefit From A New Stock Market High

It isn’t just crypto getting a major boost today. US stock indexes are also soaring today. The S&P 500 is up over 1.2%, the tech-heavy Nasdaq over 1.88%, and the Dow Jones Industrial Average at 0.63%. The latest bounce in stocks puts traditional markets within striking distance of a new all-time high.

This is important because if Bitcoin price is already turning bullish in the wake of the Grayscale news, then a simultaneous stock market all-time high could cause crypto to go ballistic.

Cryptocurrencies have a ton of catching up to do relative to the stock market. Furthermore, back in 2020, after the S&P 500 made a new all-time high, Bitcoin price followed in the weeks to come and set a record of its own. Is this what we can expect if the stock market sets new record highs, and a slew of ETFs are approved?

Bitcoin Depot Q2 revenue jumps 18% YOY, eyes growth after Nasdaq listing

Bitcoin Depot records $197.5 million in revenue in the second quarter of 2023, spurred on by partnerships with various U.S. retail stores.

Why Nasdaq Backing Out of Custody Is Bad, Bad News for Crypto

If a financial giant can’t navigate the red tape, who can?

Nasdaq halts launch of cryptocurrency custody service

Nasdaq said it remains committed to the digital asset business development and will be monitoring the market events in the near future.

Nasdaq Halts Plan for Crypto Custody Service Due to U.S. Regulatory Conditions

The stock market operator had said in March, that it was putting together infrastructure and regulatory approval for the custodian service.

Valkyrie ‘BRRR’ spot Bitcoin ETF enters SEC’s Nasdaq rulemaking list

The SEC has accepted for review the Valkyrie spot Bitcoin ETF filing named “BRRR,” which is a reference to a popular meme in the Bitcoin community.