With the halving and new tech set to give Ordinals a further lift, Bitcoin-based inscriptions are demonstrating staying power and some advantages over NFTs. Christie’s is taking notice with a new initiative.

Influential Trader GCR Buys Original Dogwifhat Meme for $4M; WIF Rises

WIF pieces have surged in the past hour as X users found out the trader user now holds the original image.

Solana NFT Marketplace Tensor to Issue TNSR Governance Token

Solana-based NFT trading platform Tensor said Tuesday it will issue a token, $TNSR, whose holders will govern the protocol.

Robert Alice Made NFT History, Now He’s Writing About It

If Bitcoin Clears $70,000, How Fast Will Ethereum Ease Past $5,000?

As Bitcoin surges towards its all-time high (ATH) of nearly $70,000, analysts are closely watching Ethereum, the world’s second-largest cryptocurrency, wondering how quickly it will follow suit and break its record ATHs of approximately $5,000 printed in late 2021.

How Will Ethereum React When Bitcoin Breaks Above $70,000?

One analyst, posting on platform X, highlights the difference in the two coins’ positions compared to the last time Bitcoin broke above 2017 highs of $20,000 in December 2020. Then, Ethereum was trading at $600, a full 57% below its previous ATH of about $1,400.

As Bitcoin nears its record peak of around $70,000 registered in December 2021, Ethereum is approaching $4,000. However, the difference between then and now is that ETH is about 36% shy of its ATH of around $5,000.

The question in the analyst’s mind is, considering historical performance, how fast ETH will ease past $5,000. When Bitcoin broke above $20,000 in late December 2020, the analyst notes that it took approximately two months for ETH to sweep past $1,400 and record new highs.

The boom after this breakout lifted ETH to around $5,000, accelerated mainly by retail activities cycling around decentralized finance (DeFi) and non-fungible token (NFT) minting.

Looking at the Ethereum price action in the daily chart, it is clear that buyers are in control. ETH prices, CoinMarketCap data reveals, are up roughly 7% in the past 24 hours and 15% in the previous week. However, how quickly ETH might repeat the prior 2020-2021 feat remains to be seen.

Exploring ETH’s Chances

Like in the past, the Ethereum price action benefits from the Bitcoin expansion. The revival in Bitcoin prices has seen capital flow to Ethereum, priming its broader ecosystem comprising DeFi and NFT protocols. DeFiLlama data shows that Ethereum manages over $56 billion worth of assets.

Notably, almost all top DeFi protocols in Ethereum, including Lido, Maker, Uniswap, and EigenLayer, have posted strong inflows in the past day, week, and month.

Aside from market-related factors, Ethereum prices are also steadied by hopes around the eventual approval of a spot Ethereum exchange-traded fund (ETF). BlackRock is among the leading asset managers to file with the United States Securities and Exchange Commission (SEC).

However, the agency postponed a ruling on BlackRock’s application for a spot Ethereum ETF, citing concerns about the network’s new proof-of-stake consensus mechanism. The SEC expressed worries that staking, a core aspect of proof-of-stake, could create opportunities for manipulation.

The clear reservation regarding proof-of-stake cast a shadow on Ethereum’s near-term outlook despite the current uptick in prices. Still, the community finds relief realizing that the Commission rejected approving a spot Bitcoin ETF for roughly ten years before January 2024.

Bitcoin NFT NodeMonkes Sells for $1M as BTC Inches Towards $69K

Bitcoin-based collections traded more volume than Ethereum collections in the past 24 hours, which shows network adoption as bitcoin prices inch closer to highs.

Solana Gaming Project MixMob Bags Stormtrooper NFT Licensing Rights

MXM, MixMob’s governance token on the Solana blockchain, operates the MXM Esports League and incentivizes players.

Satoshi-Era Bitcoin Function ‘OP_CAT’ Dusted Off as Development Fervor Grows

Developers Ethan Heilman and Armin Sabouri view OP_CAT as a simple opcode that offers some of the general purpose functionality currently missing in Bitcoin.

Sandbox’s SAND Slides, ApeCoin Steady Ahead of $125M in Unlocks

Token unlocks refer to the release of previously locked or restricted tokens into the market.

As EtherRocks Hit Sotheby’s, Who Is Laughing Hardest?

Literally clipart of rocks, the NFTs are a popular joke on digital art. Now the storied auction house is selling them, they may become even more collectible, says Daniel Kuhn.

Ethereum Has Gatekeepers (for Good Reason)

A new, non-standard token standard called ERC-404 circumvented the usual token approval process and is capitalizing on a term with an actual definition.

Taproot Wizards’ New Bitcoin NFTs Already Trading at Twice the Initial Sale Price

With almost two hours left for whitelisted buyers to claim the digital-art collectibles, at least 2,560 of the series of 3,000 had been claimed, at a fixed price of 0.1 BTC ($4,274 each).

Taproot Wizards Recovers From Tech-Marred Debut, Selling $11M of Bitcoin NFTs

With almost two hours left for whitelisted buyers to claim the digital-art collectibles, at least 2,560 of the series of 3,000 had been claimed, at a fixed price of 0.1 BTC ($4,274 each).

How To Create And Mint Your Own NFTs On The Ethereum Network

The allure of creating your own NFTs and BRC-20 tokens is undeniable. For artists, owning and monetizing their digital creations through NFTs offers a new level of control and potential financial reward. Beyond the realm of art, NFTs can foster passionate communities, grant exclusive access to events, and even act as fundraising tools.

However, stepping into the world of token creation isn’t without its challenges. It demands both a technical understanding of blockchain technology and smart contracts, along with a careful consideration of financial risks and potential regulatory implications. Before diving in, it’s crucial to assess your goals, resources, and risk tolerance. While the possibilities are vast and exciting, responsible and informed action is key to navigating this rapidly evolving landscape.

NFTs, or Non-Fungible Tokens, are digital assets that represent ownership or proof of authenticity for specific items or content. Unlike fungible cryptocurrencies like Bitcoin or Ethereum, NFTs cannot be exchanged on a one-to-one basis due to their unique nature.

NFTs are typically created and traded on blockchain platforms such as Ethereum, Binance Smart Chain, and decentralized marketplaces like OpenSea. These platforms utilize smart contracts to establish ownership and enable transparent and immutable transactions for NFTs.

NFTs can represent a wide range of digital items, including artwork, music, videos, virtual real estate, and collectibles. Each NFT has metadata describing the item it represents and a unique identifier that sets it apart from other NFTs

Creating NFTs On The Ethereum Network

The primary stage in the creation of NFTs involves identifying the content you wish to associate with your NFT. Consider the specific representation you desire for your NFT, whether it be digital artwork, collectibles, virtual real estate, or any other distinct digital item.

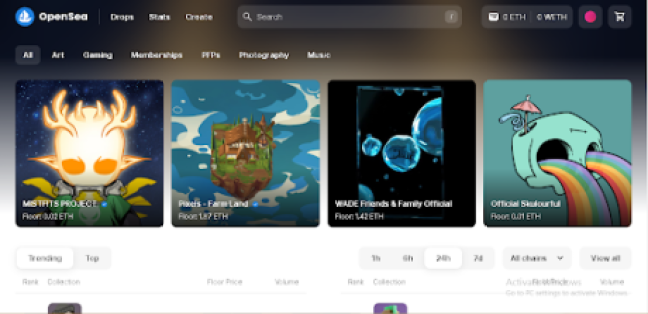

In this article, we will use illustrations from OpenSea to guide you on the steps you need to create your own NFTs. OpenSea stands as a leading decentralized marketplace built on the Ethereum blockchain, dedicated to NFTs. It creates a space where users can engage in buying, selling, and discovering an extensive array of digital assets, encompassing artwork, virtual real estate, collectibles, and more.

OpenSea delivers a user-friendly interface, showcasing a vast selection of NFT listings curated from diverse creators and projects. Through OpenSea, users gain the ability to explore the NFT community, partake in auctions, and securely manage their digital assets. With a commitment to fostering the expansion and accessibility of the NFT market, OpenSea ensures a seamless experience for enthusiasts and collectors alike.

This step-by-step guide covers how to create an NFT collection and mint directly to your wallet.

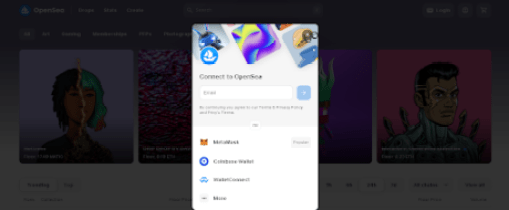

First, visit the original OpenSea website, and click on the “Login” button at the top to connect your preffered wallet.

To figure out the best wallet to use on the Ethereum network, check here.

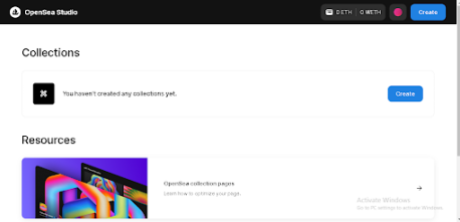

Next, click on your “Profile Icon” at the top right of your OpenSea interface in order to deploy a smart contract and select “Studio” through the pop-up options.

To initiate the creation of a fresh NFT, simply click the “Create” button located at the top right corner.

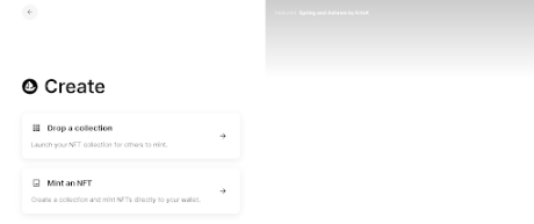

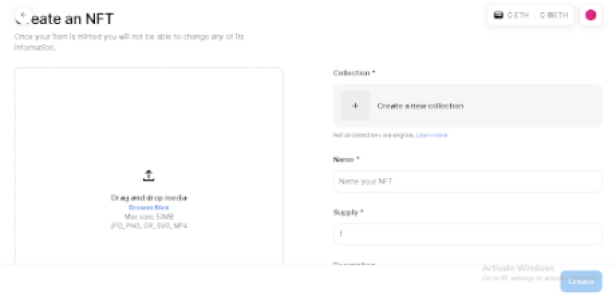

When you explore the options, you will find the choice to either Drop a collection or Create/Mint an NFT. Selecting “Create an NFT”. This will enable you to mint an NFT directly into your wallet.

Once you proceed, a fresh “Create an NFT” screen will be presented. If you are using OpenSea Studio tools for the first time to create an NFT, select “Create a new collection.” You will be able to add one NFT to this collection initially, with the option to include more NFTs at a later stage.

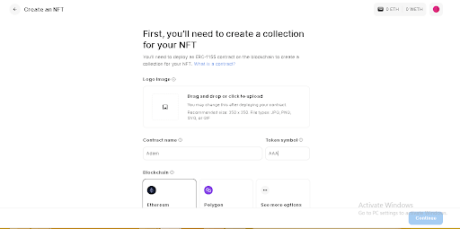

After selecting “Create a new collection,” you will be guided through the steps on your screen to deploy a smart contract. This process will enable you to create NFTs for your newly created collection.

To customize your contract, you need to add a logo image, choose a contract name, and designate a token symbol. Additionally, you will need to choose an EVM blockchain. It’s important to note that deploying a smart contract incurs gas fees, and the estimated fees for each blockchain will be displayed. If the fees are higher than anticipated, you can revisit the process at a later time, as they are subject to change based on network activity.

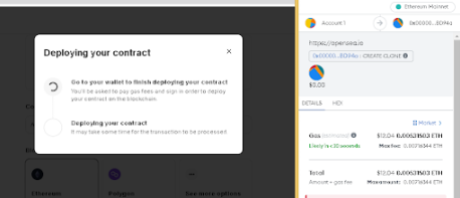

When you are prepared, proceed by clicking on “Continue”. This action will prompt a transaction signature request in your wallet, which will necessitate gas.

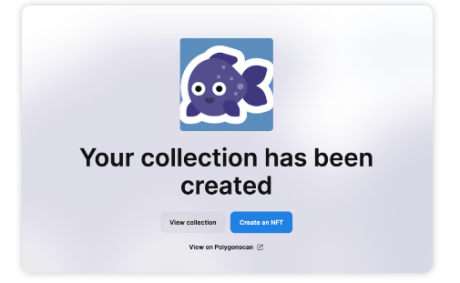

Once the process is finalized, you will receive a confirmation message. Proceed to the next step by selecting “Create an NFT” as shown below. :

Having successfully created a smart contract, you are now prepared to generate an NFT. It is important to note that once your item is minted, further editing becomes impossible as it permanently resides on the blockchain. In this case, you will be creating an ERC-1155 NFT, which allows for the creation of multiple copies of the same item.

To begin this phase, upload the media for your NFT, which represents the artwork associated with it. Next, choose the collection in which you wish to mint your NFT.

Subsequently, provide a name for your item and set the desired item supply. The item supply determines the number of copies you wish to mint for the NFT. If you choose 1, then the item will be a one-of-one.

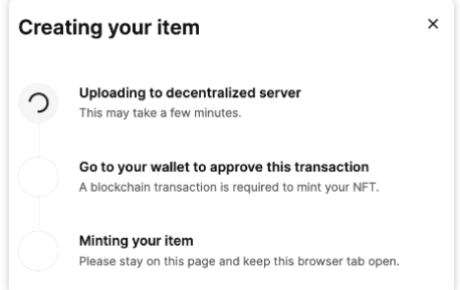

Next, click on the “Create” button at the bottom right, as shown in the above image. A loading message will appear as the item is being minted. To proceed with the minting process, you will need to approve the transaction using your wallet.

Congratulations! You have successfully minted your very first NFT!

Conclusion

Although NFTs and BRC-20 tokens have distinct functions and operate on separate blockchains, they both contribute to the growing realm of blockchain-based digital assets. NFTs have captured widespread interest for their exceptional nature and capacity to represent ownership of digital assets.

If ZK Is The ‘End Game,’ Is Polygon (MATIC) Ready For $3?

With zero knowledge (ZK) proofs expected to be a game changer for blockchain scaling, Polygon may be on the brink of a major rally. Taking to X on February 2, crypto market commentator Polynya, asserts that ZK technology is the “endgame” as its “1,000x efficiency upside is irresistible for networks.”

Will “ZK” Technology Be The “End Game”?

This forecast on ZK adoption is massive for Polygon and its native token, MATIC, which has been under significant selling pressure in the past few trading months. As it is, Polygon Labs, the developer of the Ethereum sidechain, has been at the forefront, advocating for the development of ZK scaling solutions.

In 2021, Polygon began assembling a team to develop zkEVM, a technique relying on zero knowledge to scale Ethereum cheaply while being compatible with the EVM. Recent Polygon Labs documentation shows that their zkEVM is in beta and being tested.

However, this hasn’t stopped the team from striking deals with layer-1 protocols interested in harnessing this technology.

In mid-January, NEAR Protocol’s Data Availability (DA) solution was integrated with Polygon’s custom blockchain development kit (CDK). The goal was to make it easier for developers to create ZK rollup solutions suitable for their needs while leveraging NEAR Protocol‘s infrastructure. All this is when ensuring the integration lowers cost and improves performance.

Polygon Labs has also partnered with other platforms, including Immutable–a layer-2 web3 solution for NFTs; Ankr–an infrastructure provider; and QuickSwap–a decentralized exchange (DEX). Most of these platforms plan to operate as layer-2s for Ethereum.

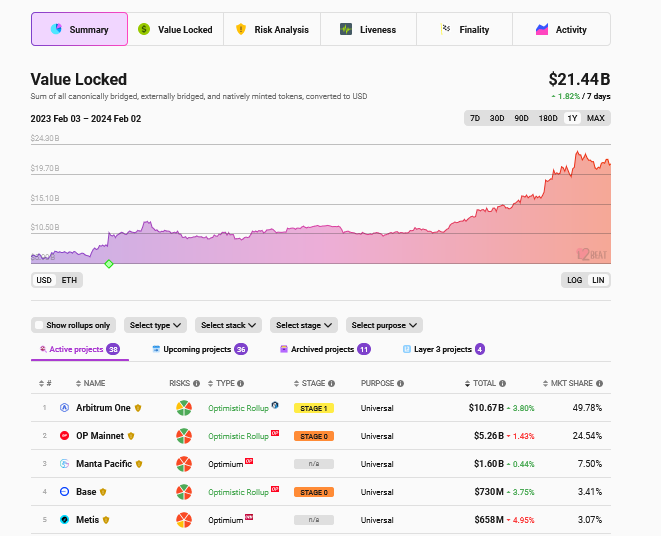

The total value locked (TVL) in layer-2 protocols remains in an uptrend, according to L2Beat. These platforms command over $21 billion. So far, the largest layer-2 protocols, Arbitrum, Optimism, and Base, use Optimistic Rollups.

Is Polygon (MATIC) Ready For $3?

This is a bullish development for Polygon. Moreover, at this pace, it is likely to cement Ethereum, the pioneer layer-1 and smart contract platform, as a dominant settlement layer despite on-chain scaling concerns and relatively high fees.

From a price point perspective, MATIC will likely benefit as more platforms adopt Polygon’s zkEVM solutions. So far, MATIC is stable but firm when writing on February 2. From the daily chart, MATIC has support at around $0.70. On the upper end, the immediate resistance level is at $1.

Spurred by partnerships as more platforms use zkEVM, fundamental developments might drive MATIC even higher in the coming sessions. If MATIC finds momentum, the medium- to long-term target will be $3, or a 2021 high.

Taproot Wizards Delays ‘Quantum Cats’ for 3rd Time as Mint Site Gets Fixed, Tested

Taproot Wizards struggled with technical issues during Monday’s initial attempt to sell about 3,000 of the “NFTs on Bitcoin.” The team says they underestimated demand, and says the minting site is now fixed but needs more time for testing.

The Protocol: Bitcoin NFT Debacle, Vitalik’s 30th, Farcaster Frames, ‘Private Mempools’

In this week’s issue of The Protocol newsletter, our Sam Kessler writes about the “private mempools” that Ethereum users are increasingly relying on to avoid front-running MEV bots. PLUS: Margaux Nijkerk explores the growing use of “councils” to oversee adolescent networks.

DOGE Bull Mark Cuban Talks Crypto, NFTs, And More In Community AMA

On January 29, Mark Cuban, the businessman and television personality, took to the X platform (formerly known as Twitter) to have a conversation with his audience and the crypto community online.

What Projects Does Mark Cuban Invest in?

The Ask Me Anything (AMA) session asked about Cuban’s thoughts on various crypto-related topics. Notably, his replies to the community suggested the importance of a project’s utility for the Shark Tank investor.

When asked about his thoughts on crypto, Cuban stated “I hate the speculation but love when there is utility,” similarly replying to a different question about on-chain finance “needs new ideas with more utility.” Additionally, he explained that Bitcoin’s Layer 2 solution aimed at scaling “doesn’t matter at all,” and emphasized his belief that “It’s applications with unique utility that matter.”

Cuban believes blockchain technology is here to stay but identifies two issues. The first concerns the existence of “too many blockchains,” and the second is the lack of an application that makes the technology “indispensable” for all generations.

For these reasons, the businessman thinks blockchain technology’s future is in the air but reaffirms that “it will always have a place.” However, he doesn’t consider blockchain security one of the biggest problems.

During the AMA session, the Shark Tank investor listed Polygon (MATIC), and Injective (INJ) as two projects he’s interested in outside the flagship cryptocurrency and the largest altcoin. When asked about his concerns on the project and growth of injective, Cuban said he didn’t have any, but he hopes “they do well” as he is an investor.

The Doge community took part in the questions, and Cuban admitted that he enjoys being part of the community. He also confirmed that The Dallas Mavericks continue to accept DOGE as a payment method.

I don’t think about it

— Mark Cuban (@mcuban) January 29, 2024

What Emerging Technology Will Thrive in The Next Decade?

Regarding non-fungible tokens (NFTs), the investor explained “They are a collectible in most cases but can be used for other things,” and suggested that people should buy them to collect and not to speculate. Similarly, he expresses the challenges of selling these assets as he hasn’t found “a compelling aspect yet.”

Similarly, Cuban indicated that he is “not a fan” of tokenizing assets, such as sports teams and real estate, as he doesn’t think it “adds enough value.”

Entrepreneurs

— Mark Cuban (@mcuban) January 29, 2024

Cuban shared his views on the future of emerging technologies, affirming that he only sees Artificial Intelligence (AI) significantly impacting entrepreneurship in the next decade. Saying, “There will be two types of companies in the USA. Those who are great at AI and everyone else.”

Lastly, he was constantly asked about his thoughts on X owner and Tesla founder Elon Musk. He addressed their relationship by simply replying: “I don’t not get along with him. I don’t know him. He likes to talk shit on here and so do I.”

Bitcoin NFT Bubble Bursts: Values Plummet 60% After Holiday Frenzy

The short-lived reign of Bitcoin as the leading NFT platform came to an end this month, with Ethereum reclaiming the top spot as NFT sales on the Bitcoin network plummeted over 60% compared to December’s record highs.

Data from NFT analytics platform CryptoSlam reveals a stark reversal in fortunes. After surpassing Ethereum in December with $881 million worth of NFT sales, Bitcoin’s January volume has sunk to $314 million as of two days before month-end. Meanwhile, Ethereum has maintained a steadier pace, registering $328 million in sales over the past 28 days.

Bitcoin NFT Loses Its Appeal

This shift can be attributed to the fading fervor surrounding Ordinals, a technology enabling inscriptions and non-fungible tokens directly on the Bitcoin blockchain. The December surge in Bitcoin NFT activity was largely driven by Ordinals-related hype, leading to high fees for inscription minting. For instance, on December 10th, Bitcoin saw a single-day high fee of $10 million due to inscription transactions.

However, with the broader digital asset market facing turbulence, interest in Ordinals has waned significantly. Minting fees have plummeted by 83% since peaking at $5 million on January 14th, now standing at just $848,000 as of January 28th. This decline reflects a drop in demand for blockspace for non-traditional Bitcoin transactions, further suggesting a diminished appetite for Ordinals-based NFTs.

Ethereum, on the other hand, benefits from its established ecosystem and diverse functionalities. Its NFT landscape encompasses a wider range of projects and applications compared to the nascent Ordinals scene on Bitcoin. This, coupled with the relative stability of the Ethereum network, likely contributed to its ability to retain user interest and NFT trading volume throughout December and January.

NFT Landscape Shifts: Adaptability Crucial

The rapid change in the NFT landscape highlights the need for adaptability and innovation within the industry. While Ordinals brought a novel use case to Bitcoin, its technical limitations and niche appeal may hamper its long-term sustainability. Conversely, Ethereum’s flexibility and established infrastructure position it well to adapt to evolving market trends and user preferences.

Furthermore, the broader decline in digital asset class interest likely impacted both Bitcoin and Ethereum NFTs. However, Ethereum’s larger and more diverse user base, along with its established NFT ecosystem, suggest it may be better equipped to weather the current market downturn.

The future of the NFT market remains uncertain, but one thing is clear: the landscape is constantly shifting, and players must be able to adapt to stay ahead of the curve.

Featured image from Pixabay, chart from TradingView

Taproot Wizards Delays ‘Quantum Cats’ Sale for 2nd Time, After Messy Bitcoin NFT Debut

“We had big plans for mint day and we didn’t live up to your expectations of us and to our expectations of ourselves,” Taproot Wizards co-founder Udi Wertheimer posted on X.