Suggested fines the securities watchdog suggested for Terraform Labs and Ripple are out-of-line with what it has collected from crypto firms in the past.

Analyst Singles Out VeChain And XRP For Parabolic Surge, Here Are The Targets

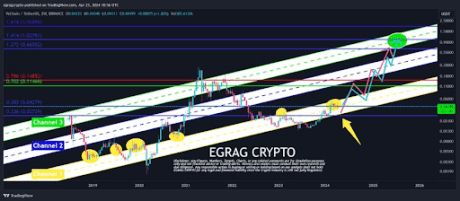

Crypto analyst Egrag Crypto has singled out VeChain (VET) and XRP as two crypto tokens that could soon witness significant price surges. The analyst also outlined price targets crypto investors can expect these tokens to attain.

VeChain Could Rise To As High As $2.5

From the chart Egrag shared in his X (formerly Twitter) post, one could see that he was hinting that VeChain hit $2.5 at its market peak. He also elaborated on how the crypto token will rise to that level by breaking its price action into three targets. The first target was the yellow channel, which he highlighted on the chart.

VeChain is expected to rise to as high as $0.18 when this target is fully achieved. Egrag noted that this will mark the “forging of the MACRO-Bottom.” The second target will see the crypto token rise to almost $0.9. The analyst pointed out that this channel “aligns with the Fib 0.702 & 0.786 levels,” forming what he referred to as the “Mid-Bull-Cycle.”

VeChain is expected to rise to as high as $2.5 when the last target is achieved. Egrag remarked that this target aligns with “key Fib levels 1.236, 1.414, & 1.618, suggesting the potential cycle top for #VET.” This isn’t the first time the crypto analyst has laid a bullish narrative for the VeChain token.

In February, he predicted that the crypto token could witness a 140x price increase if it repeats its price action from around 2021 when it rose by 14.638%.

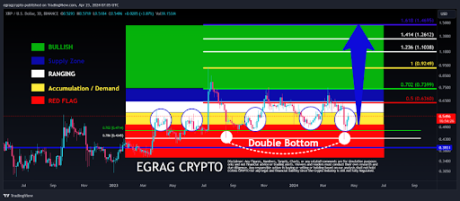

XRP Run To $1.4 Still In Play

Egrag provided his bullish analysis of XRP in a separate X post. He stated that the crypto token’s double formation was giving a “strong bullish signal.” He added that he is confident that the “thrust will soon.” This recent analysis was an update to a previous one where he predicted that XRP would rise to $1.4 soon enough.

Back then, he was also confident that this move to the upside was imminent, noting that the bulls had accumulated all the XRP tokens that the bears had dumped. He urged XRP holders to “stay steady” in anticipation of the life-changing opportunities that may arise due to the crypto token’s parabolic surge.

Egrag has remained bullish on the XRP token despite its unimpressive price action. He has predicted at different times that the crypto token could rise to as high as $27 at its market top.

At the time of writing, XRP is trading at around $0.54, up in the last 24 hours, according to data from CoinMarketCap.

Price analysis 4/24: BTC, ETH, BNB, SOL, XRP, DOGE, TON, ADA, AVAX, SHIB

Bitcoin and altcoins continue to be rocked by macroeconomic and geopolitical uncertainty, but data shows bulls continue to buy each dip.

XRP: 600 Million Token Influx As Whales Make Their Presence Felt

The cryptocurrency market continues to grapple with volatility, and XRP has been no exception. After a promising start to the year, the price of XRP has mirrored the broader market slump triggered by Bitcoin’s correction. However, amidst the bearish sentiment, a different story is unfolding underwater – one involving deep-pocketed investors, or “whales,” accumulating the altcoin at a significant clip.

XRP Whales Accumulate Millions Despite Price Drop

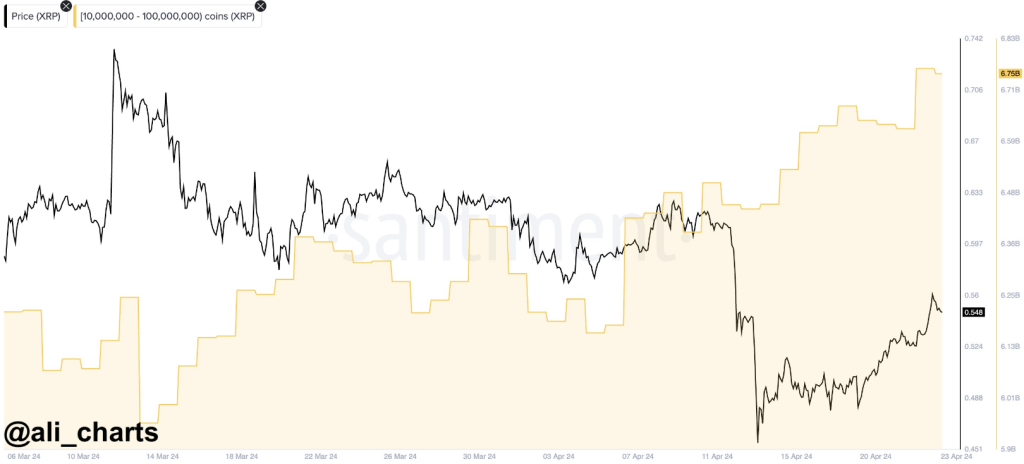

While the price of XRP has dipped considerably from its highs in March, whale addresses have been quietly going on a buying spree. According to data from market intelligence platform Santiment, analyzed by market researcher Ali Martinez, addresses holding between 10 million and 100 million XRP have been steadily adding to their holdings since early April.

This buying frenzy intensified after XRP’s sharp price drop in mid-April, with whales capitalizing on the lower prices in a classic “buy-the-dip” strategy.

$XRP dropped from $0.62 to $0.41, and #crypto whales took notice. They’ve bought over 31 million #XRP in just the past week! pic.twitter.com/3FCA3PR3hi

— Ali (@ali_charts) April 23, 2024

The data reveals that these whales have scooped up a staggering 30 million XRP tokens in the past week alone, bringing their cumulative holdings to a hefty 6.75 billion units. This buying spree indicates a potential shift in sentiment among these large investors, who seem unfazed by the short-term price fluctuations and might be betting on XRP’s long-term prospects.

Deeper Dive: Whale Activity Hints At Bullish Sentiment

Taking a deeper dive, latest data suggests that this accumulation trend began even earlier, on April 5th. Interestingly, this coincides with the tail end of a selling period by these same whales, where they offloaded some of their holdings.

However, since April 5th, the buying spree has been relentless, with whales amassing over 600 million XRP in just two weeks. This significant accumulation suggests a renewed confidence in XRP, potentially signaling a bullish outlook from these key market players.

Further bolstering this notion is the recent surge in the number of addresses holding at least 1 million XRP. These “mid-tier whales” have been steadily increasing, with their ranks reaching a near-record high of 2,013 on Tuesday. This broader participation from various tiers of large investors adds weight to the idea that XRP might be undervalued at its current price point.

The price of #XRP has jumped ahead of the #altcoin pack, jumping +6% and as high as $0.5687 today. The amount of wallets, 2,013, holding at least 1M $XRP has been surging over the past six weeks (rising 3.1%), and is within 1 wallet of the #AllTimeHigh. https://t.co/2ZfC9v79x9 pic.twitter.com/rqKgcOYJJx

— Santiment (@santimentfeed) April 22, 2024

XRP Outperforms Other Altcoins

Meanwhile, Santiment disclosed that XRP is outpacing the other altcoins in terms of wallet size. Wallets holding 1 million or more coins have increased, with a 3% gain over the last six weeks. The increase of significant XRP holdings indicates that investors’ interest and confidence are rising.

While whale activity can be a significant indicator of sentiment, it shouldn’t be the sole factor driving investment decisions. However, the recent buying spree by XRP whales is a noteworthy development, suggesting a potential shift in sentiment and a possible turning point for the coin’s price.

Featured image from Pixabay, chart from TradingView

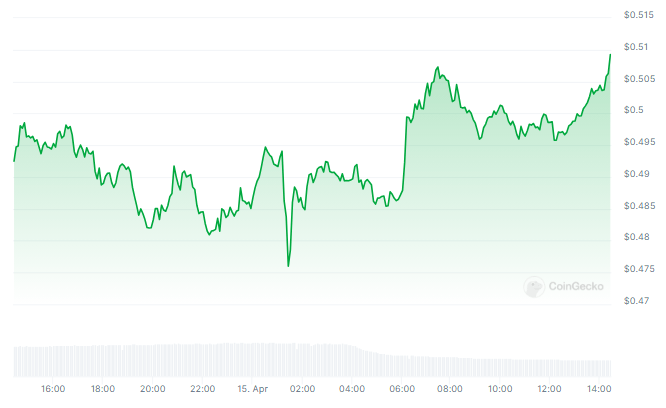

XRP Price Reclaims $0.50 and Indicators Suggest Fresh Surge To $0.70

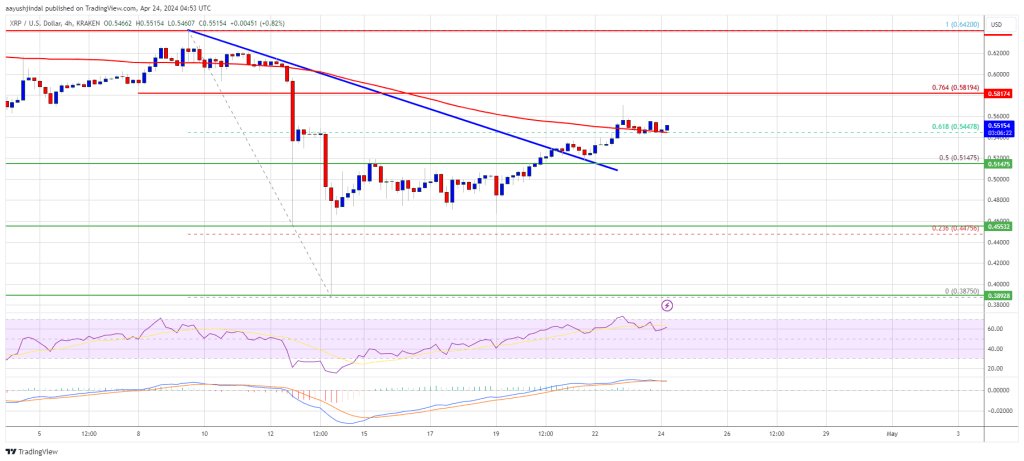

XRP price is recovering higher above the $0.500 resistance. The price is signaling a positive bias and might rally above the $0.580 and $0.600 levels.

- XRP is attempting a recovery wave above the $0.50 zone.

- The price is now trading above $0.5150 and the 100 simple moving average (4 hours).

- There was a break above a key bearish trend line with resistance at $0.5220 on the 4-hour chart of the XRP/USD pair (data source from Kraken).

- The pair could gain bullish momentum if there is a close above the $0.580 resistance.

XRP Price Aims Higher

After a sharp decline, XRP price found support near the $0.3880 zone. It formed a base and started a fresh increase above the $0.450 resistance, like Bitcoin and Ethereum. The bulls were able to push the price above the $0.50 resistance.

The price climbed above the 50% Fib retracement level of the downward move from the $0.6420 swing high to the $0.3875 low. Besides, there was a break above a key bearish trend line with resistance at $0.5220 on the 4-hour chart of the XRP/USD pair.

The price is now trading above $0.5150 and the 100 simple moving average (4 hours). Immediate resistance is near the $0.5650 level. The next key resistance is near $0.5820 or the 76.4% Fib retracement level of the downward move from the $0.6420 swing high to the $0.3875 low.

Source: XRPUSD on TradingView.com

A close above the $0.5820 resistance zone could spark a strong increase. The next key resistance is near $0.620. If the bulls remain in action above the $0.620 resistance level, there could be a rally toward the $0.680 resistance. Any more gains might send the price toward the $0.700 resistance.

Another Drop?

If XRP fails to clear the $0.5820 resistance zone, it could start another decline. Initial support on the downside is near the $0.540 level.

The next major support is at $0.5150. If there is a downside break and a close below the $0.5150 level, the price might accelerate lower. In the stated case, the price could retest the $0.4650 support zone.

Technical Indicators

4-Hours MACD – The MACD for XRP/USD is now gaining pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $0.540, $0.5150, and $0.4650.

Major Resistance Levels – $0.5650, $0.5820, and $0.6200.

Analyst Says XRP Price Will Reach $100, But This Needs To Happen First

Crypto analyst JackTheRippler has raised the possibility of the XRP price rising to $100 soon enough. As part of his prediction, he mentioned what needs to happen for the crypto token to attain such ambitious heights.

How XRP Price Could Rise To $100

JackTheRippler suggested in an X(formerly Twitter) post that the XRP price hitting $100 was “inevitable” once the case between the Securities and Exchange Commission (SEC) and Ripple came to an end. Furthermore, he predicted that XRP could rise to as high as $10,000, claiming that the crypto token hitting five figures was achievable after the lawsuit.

Related Reading: Brazil Wants BTC: 7,400 Bitcoin Futures Contracts Created On First Day Of Trading

The analyst’s remarks again highlight the belief among members of the XRP community that the SEC’s lawsuit against Ripple has greatly hindered XRP’s growth. Specifically, the lawsuit is believed to be why XRP underperformed in the 2021 bull run, having made remarkable strides in the 2017 bull run (long before the lawsuit was instituted).

Meanwhile, in his remarks, JackTheRippler alluded to XRP gaining regulatory clarity once the case between the SEC and Ripple was over. This statement caught the attention of some of his followers, who pointed out that it had gotten clarity following Judge Analisa Torres’ ruling that XRP isn’t a security.

Interestingly, XRP has failed to mount any significant run despite gaining this clarity last year. This is one reason why some XRP holders seem to have lost faith in the crypto token, as expectations were high following Judge Torres’ ruling. However, nothing much happened as the crypto token briefly rose on the back of the ruling but steadily declined in the following weeks.

Therefore, these holders will likely be cautious about getting their hopes high despite JackTheRippler’s optimism since XRP could still maintain its unimpressive price action even after the SEC’s lawsuit is over.

The SEC’s Lawsuit May Not Be Ending Anytime Soon

Meanwhile, it is worth noting that the case between the SEC and Ripple could even drag on beyond this year, irrespective of the outcome of the penalties stage, as both parties are likely to appeal certain rulings. This means that XRP holders might have to wait a while to see if the crypto token hits $100 based on JackTheRippler’s prediction.

If the case is prolonged beyond this year, XRP could miss out on achieving its true potential in this bull run if the lawsuit is indeed acting as a stumbling block to its progress. The lawsuit has, however, not stopped crypto analysts like Egrag Crypto from making bullish predictions for XRP in this bull run. He predicts the crypto token could rise to as high as $27 at this market peak.

At the time of writing, XRP is trading at around $0.54, up over 2% in the last 24 hours, according to data from CoinMarketCap.

XRP Wallets Holding At Least 1 Million Coins Nears All-Time High As Sentiment Improves

With the crypto market on the rise once again, XRP has seen positive headwinds and this has triggered an improvement in sentiment among investors. This positive recovery has seen more crypto investors move to acquire the altcoin, pushing a very important holder cohort toward new all-time high levels.

Wallets Holding More Than 1 Million XRP Nears ATH

Over the last year, there has been a lot of selling among XRP investors as the price continued to struggle. This poor performance continued despite Ripple securing multiple partial victories against the United States Securities and Exchange Commission (SEC), prompting investors to jump ship.

One XRP holder cohort that witnessed a lot of selling is the addresses holding at least 1 million XRP tokens. At current prices, it would mean that these wallets are holding at least $500,000 on the lower end of the cohort, making this the cohort that includes the dolphins and whales.

The number of addresses holding at least 1 million tokens had hit its all-time high back in June 2023. But with the price falling, these large holders began to sell, and at one point, the number of wallets sat around 50 wallets below its all-time high of 2,014.

However, with the crypto market moving toward another bull market, expectations are that the price of XRP will follow the rest of the market, prompting large investors to return. Data from Santiment, an on-chain data aggregation platform, shows that over the course of 2024, the number of wallets holding 1 million tokens or more rose steadily and by April, this figure is now sitting at 2,013, one wallet away from reaching its previous all-time high, and two wallets away from setting a new record.

Why Are Large Investors Returning?

One reason why large investors are returning to XRP could be that the indicators are finally turning bullish for the altcoin. There was also an opportunity for these investors to buy the tokens for cheap when the market crashed and altcoins like XRP suffered almost 40% losses.

Related Reading: 3 Major Metrics To Watch Out For That Can Impact Ethereum Prices

Popular crypto analyst TonyTheBull took to X (formerly Twitter) to reveal the significance of this price crash. According to the analyst, it was the final capitulation shakeout for the altcoin. Comparing it to a similar shakeout in 2017 shows that after this, XRP could go on a massive rally.

No, this was the final capitulation shakeout in $XRP https://t.co/Z0uQ2GhS7v pic.twitter.com/qfWC6H8DNv

— Tony “The Bull” Severino, CMT (@tonythebullBTC) April 23, 2024

The large investors could be expecting this rally as well, hence, why they have been buying up large amounts of coins. If the 2017 rally is anything to go by, then the XRP price could quickly barrel through $1, printing significant returns for investors.

Ripple Vs. SEC Update: Is The Lawsuit Finally Coming To An End With A Settlement?

The legal battle between Ripple and the Securities and Exchange Commission (SEC) is getting heated and, following recent developments, looks far from over. This is due to the disagreement between both parties on the appropriate remedy for Ripple’s violation of securities laws.

Ripple Proposes $10 Million Fine Instead

In opposition to the SEC’s motion for remedies and entry of final judgment, Ripple has proposed that the court should not impose a civil penalty of not more than $10 million. This figure represents a far cry from the SEC’s proposed judgment. The Commission had earlier asked the court to order Ripple to pay the sum of $1,950,768,364 as a pecuniary fine for violations relating to its institutional XRP sales.

Specifically, the SEC proposed that Ripple pay a civil penalty of $876,308,712 alongside a prejudgment interest of $198,150,940 and disgorgement of $876,308,712, which represents the profits from its violation of the Securities Act. However, Ripple asked the court to deny the requests for disgorgement and pre-judgment interest and only focus on the civil penalty, which shouldn’t be more than $10 million.

Ripple’s lawyers also laid out arguments as to why the civil penalty should not exceed $10 million. Firstly, they stated that the first tier of the statutory maximum penalties is what applies to this case “because the SEC has never alleged fraud, deceit, or manipulation and has failed in its belated attempt to show that Ripple recklessly disregarded the law.”

Therefore, Ripple argued that the Commission’s request for a civil penalty of over $876 million isn’t the appropriate remedy for the first-tier structure. They added that the company’s revenue from pre-complaint institutional sales should be the only earnings considered when deciding on a remedy, which makes a civil penalty of not more than $10 million more appropriate.

Accounting Error From The SEC

Ripple suggested that the SEC made an error in calculating the company’s earnings while deciding on the right amount for which the crypto firm should be fined. According to the company’s lawyers, the Commission failed to “analyze or even consider any other categories of Ripple’s expenses.”

Meanwhile, they allege that the SEC didn’t offer any evidence or explanation “for why cost if revenue is the only category of Ripple’s deductible expenses.” Simply put, Ripple argues that the regulator, while calculating Ripple’s earnings, didn’t consider how much the company expended before deciding that almost $2 billion was an appropriate fine.

Ripple’s lawyers made this argument while stating that the SEC also erred in relying on the declaration of Andrea Fox, an accountant at the agency. They claim that the SEC never disclosed Fox as a fact or expert witness and that she wasn’t deposed during the initial discovery or supplemental remedies discovery. Therefore, they moved to strike her declaration as an “untimely disclosed expert report.”

Ripple Also Opposes SEC’s Proposed Injunction

As part of its entry for final judgment, the SEC had asked the court to “permanently” restrain and enjoin Ripple from “directly or indirectly conducting an unregistered offering of Institutional Sales.” Understanding how this could affect their ODL transactions, Ripple has asked the court to deny the request for an injunction.

The crypto firm argues that the Commission has failed to show why an injunction is warranted. Injunctions are usually granted when there is a fear of future violations. Ripple claims that the SEC has failed to show a “reasonable likelihood of future violations.”

The crypto firm’s lawyers further revealed that Ripple has “changed the way it sells XRP and changed its contracts to avoid any future violations.” To show good faith, they submitted a declaration by Ripple’s President, Monica Long, which describes the steps the company has taken to avoid future violations.

Ripple Says $10M Penalty Enough, Rejects SEC’s Ask of $1.95B Fine in Final Judgment

Ripple Labs filed its opposition on Monday against the U.S. Securities and Exchange Commission’s (SEC) proposal to ask a New York judge to impose a nearly $2 billion fine against the company behind the XRP Ledger blockchain.

Analyst Outlines XRP Price Scenarios Ahead Of Ripple-SEC Case Update

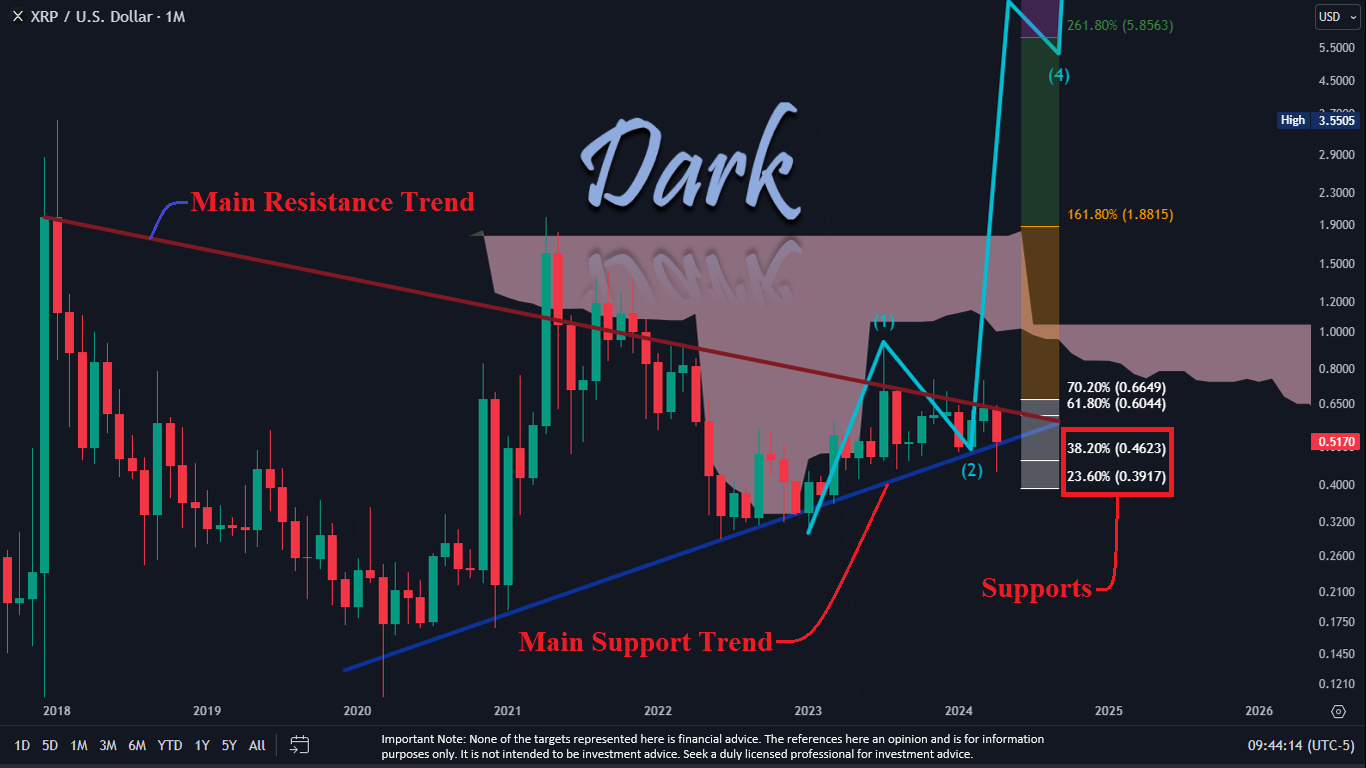

In a chart analysis shared via X, the crypto analyst Dark Defender provided insight into the potential price movements of XRP ahead of this week’s Ripple-SEC case update. The analysis, conducted on a monthly time frame, reveals that XRP has been holding above a critical support trend marked in blue. With the crypto community’s eyes set on the new Ripple filings expected next week, there’s a mix of anticipation and caution.

XRP Price Enters Potentially Crucial Week

Dark Defender notes that although market news does not typically have a direct correlation with price movements, the “last puzzle piece” pertaining to the Ripple case may add a layer of enthusiasm to the market sentiment surrounding XRP. The question posed is: What could happen if XRP fails to maintain its position above the blue support line?

According to the analysis, if XRP breaks below this blue support line, it will likely approach the two critical Fibonacci retracement levels at $0.4623 (38.2% retracement level) and $0.3917 (23.6% retracement level). These figures are derived from the swing high and low points on the chart, traditionally considered potential support levels where the price could stabilize or bounce back.

In the context of the current chart, a drop below these levels, particularly if the price closes under $0.3917 for two to three days consecutively, would invalidate the bullish five-wave structure that Dark Defender suggests could propel XRP to a high of $5.85. On the flip side, should XRP reclaim the 61.8% Fibonacci level at $0.6044, it could signify a first step towards a strong upward move.

Between the price range of $0.6649 and $0.3917, any price movement is considered a sideways trend. A breakout above the 70.2% level at $0.6649 would likely confirm a bullish trend, with the analyst highlighting this as a significant threshold for a positive price trajectory. Above this level, XRP would then eye the next Fibonacci extension levels of $1.8815 (161.8% extension) and potentially $5.8563 (261.8% extension), which are ambitiously projected targets.

The chart also highlights a “Main Resistance Trend” line that has capped the price since the peak of early 2018, and the current price action is pinched between this descending resistance and the ascending support trend lines, forming a converging pattern that traders often interpret as a potential breakout signal.

A breakout could be the first bullish indication of a larger rally, with at least one monthly close above the line required. In the past, several attempts at a breakout have failed, and even one monthly close was followed by a fall back below the trendline the following month.

Ripple Vs. SEC: What To Expect This Week

Ripple Labs is gearing up to file its response to the US Securities and Exchange Commission’s (SEC) remedies briefing on April 22, a pivotal moment in their protracted legal battle. This response from Ripple is in reaction to the SEC’s briefing that put forth potential remedies including disgorgement of profits derived from XRP sales and civil penalties. The financial stakes are high, with the SEC calculating fines that could reach around $2 billion, claiming that Ripple engaged in an unregistered securities offering with its XRP sales.

The legal and financial communities expect Ripple to mount a formidable defense against the SEC’s claims. Key to this counter-argument will be undermining the SEC’s assertion of the necessity for disgorgement, given the alleged lack of demonstrable financial harm to XRP purchasers. Furthermore, Ripple is likely to leverage favorable recent legal decisions and regulatory developments, aiming to weaken the SEC’s position.

According to the schedule, Ripple is expected to submit a public redacted version of its opposition brief along with associated declarations and exhibits today, if these materials are devoid of any SEC-designated confidential information. If confidentiality is a concern, Ripple will file the documents under seal and submit a redacted public version by April 24. Following this, the SEC will have the opportunity to reply, with their response anticipated to be filed under seal by May 6.

At press time, XRP traded at $0.53.

Ripple CEO Walks Back $5 Trillion Crypto Marker Prediction, Unveils New Target

The Chief Executive Officer (CEO) of Ripple, Brad Garlinghouse, has revised his earlier ambitious prediction on the crypto industry’s future market capitalization, acknowledging that he had underestimated the market’s potential surge.

Ripple CEO Underpredicts Crypto Market Cap

Appearing in a recent interview with Fox Business, Garlinghouse shed light on the growth potential of the cryptocurrency market as well as its performance since the beginning of the year.

The Ripple CEO was questioned about his previous optimistic forecast for the crypto industry’s market capitalization, in which he projected that the market cap would double to approximately $5 trillion by the end of the year. According to CoinMarketCap, the current global cryptocurrency market capitalization stands at roughly around $2.25 trillion.

In response to the inquiry, Garlinghouse expressed his belief that his previous predictions were not overly ambitious, emphasizing the market’s potential for further growth. He admitted to underpredicting the industry’s potential market capitalization by the end of 2024, citing factors such as the current supply and demand dynamics driving additional increases.

Garlinghouse noted that the current market conditions are characterized by increased demand and reduced supply, with these dynamics playing a significant role in the performance of cryptocurrencies.

He disclosed that the Spot Bitcoin ETF market and the overall sentiment regarding Bitcoin’s value have significantly boosted demand for the cryptocurrency. Meanwhile, Bitcoin’s supply is diminishing due to the increasing number of large-scale investors purchasing the cryptocurrency rapidly. Additionally, the impending Bitcoin halving event is expected to further decrease the cryptocurrency’s supply.

Assessing the current state of the crypto market, Garlinghouse stated that since the last six months, Bitcoin has been up by more than 250%, with further increases anticipated. He also asserted that this overperformance was largely driven by the approval and launch of Spot Bitcoin ETFs as well as the upcoming Bitcoin halving.

Regulations Are Vital For Market Development

Garlinghouse has disclosed that establishing proper regulatory frameworks for the cryptocurrency market would yield positive outcomes for the market in the future.

He explained that one of the primary factors hindering the growth of this evolving market was the United State’s prevailing anti-crypto stance, suggesting that the country’s enforcement actions on the developing industry were “problematic.”

The Ripple CEO highlighted several countries, including Dubai, Singapore and the United Kingdom, which have been proactively embracing cryptocurrencies and implementing proper regulatory systems to foster further growth in the market.

Garlinghouse has asserted that the US has significantly lagged in recognizing the transformative and innovative impact of the cryptocurrency market, attributing this setback to the United States Securities and Exchange Commission (SEC) and its current Chair, Gary Gensler.

XRP Bulls Roar: Analyst Foresees Explosive Surge With ‘God Candle’ On The Horizon

XRP investors are eyeing a potential price surge, and one analyst forecasts an optimistic outlook for the cryptocurrency.

Dark Defender, a prominent figure in the XRP community, has drawn parallels between the current market movement and the 2017 historic rally.

According to Dark Defender, this resemblance suggests a significant upward trajectory for XRP, potentially culminating in what he refers to as a “God Candle.”

Market Analysis And Forecast: A Closer Look At XRP’s Future

Dark Defender’s analysis centers around the observation that the current market dynamics echo the 2017 cryptocurrency boom, characterized by substantial shifts in digital asset valuations.

During this time, XRP experienced a notable ascent from mere fractions of a cent to over $3, reaching an all-time high in January 2018.

Drawing from this historical context, Dark Defender suggests that XRP’s current sideways movement may indicate an impending surge, highlighting consistent Fibonacci points as evidence of potential price targets.

This moment is not just a coincidence, it’s a Deja Vu. A Deja Vu that takes us back to 2017, a time of significant shifts in the cryptocurrency market.

We had one of the most extended sideways but the targets and the support Fibonacci points are still the same.

I have added the… pic.twitter.com/rnWanciV1i

— Dark Defender (@DefendDark) April 17, 2024

While recent market activity has seen XRP’s value decline by approximately 22% over the past week, with prices dipping from last Thursday’s $0.60 to as low as $0.44 during the weekend, there are signs of resilience within the altcoin.

In the early hours of today, XRP exhibited a modest uptick, posting a marginal increase of around 1.2% and reaching a 24-hour high of $0.50. However, at the time of writing, the altcoin has retraced back down by 0.4% with a current market price of $0.49.

XRP Market Sentiment

Amidst this fluctuation, XRP whales have demonstrated a bearish sentiment. Particularly, Whale Alerts, a whale transaction tracker, has recently shared significant transactions on social media platform X, highlighting the movement of large volumes of tokens.

One notable transaction involved the transfer of 158 million tokens valued at $77 million from a private wallet to the Binance crypto exchange. This sizable transfer raised concerns among investors anticipating a shift from a bearish trend to a bullish surge.

Additionally, another transaction involved the transfer of 28.9 million XRP, equivalent to $14.2 million, to Bitstamp. Despite the prevailing bearish sentiment, cryptocurrency analyst Javon Marks, similar to Darkdefender, has revealed his optimistic outlook on the altcoin.

Marks, previously recognized for his bullish stance on the altcoin, recently adjusted his predictions, envisioning a 400x surge in XRP’s price. His forecast projects the altcoin to soar to roughly $288.

With a Full Logarithmic Follow through, prices of $XRP (Ripple) may be more than poised for $200+.

Prices of Ripple went on an over +108,000% run in the 2017-2018 run and has since setup and broke out of its largest resisting structure EVER!

A mind-boggling, +33,030% run from… https://t.co/RWklG3ALh0 pic.twitter.com/r1Jie98X9s

— JAVON

MARKS (@JavonTM1) April 5, 2024

Featured image from Unsplash, Chart from TradingView

XRP Whales Are On The Move Again, But Are They Bullish Or Bearish?

XRP could continue a price correction in the short term as recent price action has put it rebounding against a resistance level of $0.5. On-chain data has also revealed a row of transactions from whales of the cryptocurrency in the past 24 hours, but are they bullish or bearish on XRP? These large transactions have been a mix of both, although the trading volume of each transaction could point to them being bearish rather than bullish.

XRP Whales On The Move

Large XRP transactions, often indicators of whale activity, have spiked recently. XRP has seen some major whale movements over the past few weeks that point to a bearish sentiment among big players amidst a price correction for the cryptocurrency in the past seven days. However, while some of these big transfers are going into crypto exchanges for a potential selloff, some are also anonymous wallets shifting huge amounts of tokens from crypto exchanges into private wallets.

Whale transaction tracker Whale Alerts posted on social media platform X (formerly Twitter) instances of enormous transactions on April 16. The first notable transaction was the transfer of 158 million tokens worth $77 million from a private wallet into the crypto exchange Binance. This massive transfer into the exchange ignited worrying signs for holders hoping for a reversal from bearish momentum into a price surge. Similarly, there was a transfer of 28.9 million XRP worth $14.2 million into Bitstamp.

On the other hand, Whale Alerts also indicated the outflow of XRP from Binance into private wallets. Particularly, the tracker noted the transfer of 100 million XRP, worth around $48 million, into private wallets. These transfers were made with three transfers in rapid succession, with each transfer of 33.33 million XRP worth $16.2 million.

Interestingly, the tracker also noted the movement of large amounts of tokens on April 15. Overall, there were transfers of 457 million XRP worth over $234 million into crypto exchanges Bithumb, Bitvavo, and Bitstamp. The largest transaction was the transfer of 390 million tokens worth $201 million into Bithumb.

What’s Next For The Altcoin?

Whale transactions are very important in the world of cryptocurrencies. Prices could swing massively at any time based on the actions of a few big players. For regular XRP investors, these whale transfers highlight the volatility and uncertainty in the current price of XRP. At the same time, their movement into crypto exchanges is bearish, and they give investors a glimpse of the the altcoin’s price trajectory in the short term.

At the time of writing, XRP is trading at $0.4986. Although currently up by 1.79% in the past 24 hours, XRP seems to be reversing after hitting $0.5 again. The altcoin is still in a price correction on the larger timeframe, as it is currently down by 18% and 20% in the past seven and 30 days, respectively.

According to a crypto analyst, XRP is set to go on a massive rally to $22. Additionally, many experts believe that the price of the altcoin will experience an enormous price increase after the next Bitcoin halving.

Analyst Keeps Faith In XRP, Targets $288 Despite Price Retreat

In the tumultuous world of cryptocurrency, where prices can soar to unprecedented heights one day and plummet to new lows the next, XRP, the digital asset associated with Ripple, finds itself at the center of attention once again. Despite recent dips in its value, XRP enthusiasts remain steadfast in their optimism, fueled by the unwavering confidence of cryptocurrency analyst Javon Marks.

Analyst’s Bold Prediction

Marks, known for his bullish outlook on XRP, has boldly predicted a jaw-dropping 400x surge in the price of XRP, envisioning the digital asset reaching the remarkable territory of $288. This audacious forecast comes in the face of recent challenges for XRP, including a notable dip in value and ongoing market turbulence.

With a Full Logarithmic Follow through, prices of $XRP (Ripple) may be more than poised for $200+.

Prices of Ripple went on an over +108,000% run in the 2017-2018 run and has since setup and broke out of its largest resisting structure EVER!

A mind-boggling, +33,030% run from… https://t.co/RWklG3ALh0 pic.twitter.com/r1Jie98X9s

— JAVON

MARKS (@JavonTM1) April 5, 2024

Resilience Amidst Challenges

XRP has weathered its fair share of storms in recent weeks, experiencing a 24% decline from April 11 to 13, sending it to its lowest value since May 2023. Despite this setback, the digital asset showed resilience, bouncing back with a 5% rise on April 14. However, this recovery was short-lived as bearish sentiments regained control.

At the time of writing, XRP was trading at $0.50, up a measly 0.7% in the last 24 hours, but sustained an 18.2% loss in the weekly timeframe, data from Coingecko shows.

A psychological support, the $0.5 level tends to keep people comfortable if the price stays above it; a decline below it can alarm them. A breakdown below this level is significant because it may encourage traders to sell more because they think the price will drop even further.

Analyzing The Trends

Marks’ analysis hinges on XRP’s historical performance, particularly its ability to break out of downward trendlines. He points to a significant breakout in July 2023 following a pivotal ruling in the SEC vs. Ripple case.

Despite subsequent corrections and occasional bearish pressure, XRP has managed to remain above these trendlines, signaling a strong bullish trend that Marks believes will pave the way for a monumental price surge.

Short-Term Challenges

Despite the long-term optimism, XRP faces immediate challenges in the form of resistance and bearish sentiments. Trading below the 50-day Exponential Moving Average (EMA) and struggling to surpass the $0.50 mark, XRP must navigate through short-term obstacles before realizing its full potential.

As XRP enthusiasts eagerly await the fulfillment of Marks’ bold prediction, it’s essential to acknowledge the inherent volatility and uncertainty that characterizes the cryptocurrency market. Factors such as regulatory developments, market dynamics, and broader trends within the cryptocurrency space can all influence XRP’s price trajectory.

Featured image from Pexels, chart from TradingView

XRP Price Recovery Could Soon Fade, These Are Key Levels To Watch

XRP price is struggling to recover above the $0.5140 resistance. The price must stay above the $0.4550 support to attempt a fresh increase in the near term.

- XRP is attempting a recovery wave above the $0.450 zone.

- The price is now trading below $0.550 and the 100 simple moving average (4 hours).

- There is a key bearish trend line forming with resistance at $0.5440 on the 4-hour chart of the XRP/USD pair (data source from Kraken).

- The pair could gain bearish momentum if there is a close below the $0.4550 support.

XRP Price Turns Red

After a steady increase, XRP price struggled to clear the $0.6420 resistance. It started a fresh decline below the $0.600 support, like Bitcoin and Ethereum. There was a sharp move below the $0.500 support.

Finally, the price tested the $0.3880 zone. A low was formed at $0.3875 and the price started a recovery wave. There was a move above the $0.40 and $0.450 levels. The price climbed above the 23.6% Fib retracement level of the downward move from the $0.6420 swing high to the $0.3875 low.

The price is now trading below $0.550 and the 100 simple moving average (4 hours). Immediate resistance is near the $0.5140 level and the 50% Fib retracement level of the downward move from the $0.6420 swing high to the $0.3875 low.

The next key resistance is near $0.540. There is also a key bearish trend line forming with resistance at $0.5440 on the 4-hour chart of the XRP/USD pair. A close above the $0.540 resistance zone could spark a strong increase. The next key resistance is near $0.600.

Source: XRPUSD on TradingView.com

If the bulls remain in action above the $0.600 resistance level, there could be a rally toward the $0.6240 resistance. Any more gains might send the price toward the $0.700 resistance.

Another Decline?

If XRP fails to clear the $0.5440 resistance zone, it could start another decline. Initial support on the downside is near the $0.480 level.

The next major support is at $0.4550. If there is a downside break and a close below the $0.4550 level, the price might accelerate lower. In the stated case, the price could retest the $0.420 support zone.

Technical Indicators

4-Hours MACD – The MACD for XRP/USD is now losing pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for XRP/USD is now below the 50 level.

Major Support Levels – $0.480, $0.4550, and $0.420.

Major Resistance Levels – $0.5140, $0.5440, and $0.600.

XRP Price Set For 3,000% Rally To $22, Analyst Predicts

Crypto analyst Crypto Egrag has provided an update on his recent analysis, where he predicted that XRP would experience a significant price decline. Having called that correctly, Egrag has now predicted what the next move will be for the crypto token.

XRP Price Could Rise To As High As $22

Egrag mentioned in an X (formerly Twitter) post that XRP’s next move “could be between 1000% and 3000%.” He acknowledged that the current market conditions might make it hard for anyone to envisage XRP seeing such a move. However, he added that the chart indicates that XRP would rise to between $10 and $22 if historical moves from 2017 or 2021 repeat themselves.

Egrag also noted that XRP had hit the lower target he had predicted for the crypto token, suggesting it was well primed for such a parabolic rise due to this price correction. In his earlier analysis, the analyst had predicted that XRP could drop to as low as $0.44, which it eventually did on April 13. Since then, the token has recovered and is looking to break the $0.50 resistance level in preparation for its parabolic rise.

Meanwhile, crypto analyst Lunc Maxi’s recent analysis also echoes sentiments similar to those shared by Egrag Crypto. The crypto analyst shared XRP’s daily chart and noted that it looks exactly like 2017 and “even had the same drop.” If XRP’s current price action follows 2017, then there is a greater likelihood of XRP hitting $22 than just stopping at $10 since Egrag’s chart showed that a similar move to 2017 will take the crypto token to that price level.

XRP’s Short-Term Price Target

In a subsequent X post, Egrag suggested that XRP might be headed to $1.4 in the short term. While he admitted that there could be further price declines before this move occurs, he added that XRP bulls have shown that they are willing to match the selling pressure from the bears. Therefore, it shouldn’t be long before the bulls take control and cause XRP’s price to surge.

He further urged XRP holders not to be deterred, stating that these price dips are “just opportunities for your bids to be filled, and these bids could be life-changing opportunities.” XRP’s rise to such price levels would indeed be life-changing for XRP investors. However, considering its unimpressive price action so far, it remains to be seen if the crypto token will attain such heights.

At the time of writing, XRP is trading at around $0.49, down almost 4% in the last 24 hours, according to data from CoinMarketCap.

XRP Poised For Takeoff: Analysts Predict Huge Gains After Bitcoin Halving

The cryptocurrency community is abuzz with speculation as the next Bitcoin halving event approaches. While all eyes are naturally on Bitcoin itself, XRP, Ripple’s native token, has emerged as a surprising source of intrigue. Historical price movements, recent legal developments, and a range of expert predictions are fueling a sense of cautious optimism for XRP’s future.

XRP And The Halving Halo Effect

Historically, altcoins like XRP have often mirrored Bitcoin’s price movements. Following significant events in the Bitcoin market, particularly halving events that cut the mining reward in half, altcoins have frequently experienced surges in value. This has led some analysts to believe that it could be poised for a similar rise in the wake of the upcoming halving.

However, the narrative surrounding XRP has been complicated by the ongoing legal battle between Ripple Labs and the US Securities and Exchange Commission. The SEC alleges that the altcoin is an unregistered security, a classification that has cast a shadow over the token’s legitimacy and dampened investor enthusiasm.

Legal Clarity Buoys Sentiment

A recent development in the lawsuit has injected a dose of optimism into the XRP market. In July 2023, a judge issued a ruling declaring XRP as a non-security. This long-awaited legal clarity has provided much-needed regulatory certainty for XRP, boosting confidence among investors who now view its potential with renewed faith.

Expert Opinions Offer A Range Of XRP Price Predictions

As the halving draws closer, prominent market analysts have weighed in on XRP’s potential price trajectory. Predictions vary considerably, reflecting the inherent volatility of the cryptocurrency market.

Leb, a respected analyst with a strong track record, believes XRP could reach its previous all-time high of $3.84 either before or immediately after the halving. This bullish prediction highlights the potential for significant gains.

Looking towards the longer term, analyst Jake Gagain presents a more conservative yet optimistic outlook. He predicts XRP could reach $5.85 by 2025. This aligns with the views of Dark Defender, another analyst who anticipates a steady upward trend for XRP in the coming years.

While some investors find these long-term projections overly ambitious, others believe they are achievable given the evolving regulatory landscape and XRP’s underlying utility as a cross-border payment solution.

Market Dynamics And XRP’s Position

Despite the recent short-term price fluctuations, XRP maintains its position as a top cryptocurrency by market capitalization, currently sitting at number seven with a total market cap of nearly $30 billion. Traders and investors are closely monitoring market trends and expert predictions as they prepare for the potential volatility and opportunities that the post-halving period may bring.

Featured image from Pixabay, chart from TradingView

Ripple’s 500 Million XRP Escrow Unlock Threatens Price As Bulls Struggle To Hold $0.61

XRP has struggled to a higher degree compared to the others in the top 10 cryptocurrencies by market cap and it seems like the bearish sentiment is far from over. Ripple just unlocked a massive amount of tokens from escrow, which could threaten the price further.

Ripple Unlocks 500 Million XRP

In the early hours of Friday, on-chain whale tracking platform Whale Alert posted two transactions carrying a notable number of XRP tokens. The first transaction saw 200 million tokens unlocked from the escrow wallet, worth $122.63 million at the time of the transfer.

The second transaction came minutes later when a total of 300 million XRP tokens were also unclosed from escrow. This second tranche of tokens, being larger than the first, was worth $183.89 million at the time, bringing the total number of unlocked tokens to 500 million. Together, both transactions were worth over $300 million.

These unlocks have, unsurprisingly, stirred concern in the Ripple community for a number of reasons. One of the reasons is that Ripple never does unlocks in the middle of the month. Rather, they do scheduled unlocks at the start of each month. So, these transactions have drawn the attention of the crypto community.

Another cause for concern is the fact that Ripple could be selling these XRP tokens. Hence, putting more tokens in circulation and adding more selling pressure to the already struggling digital asset. However, Ripple has not shown any indication of what these unlocks could be for as there have been no transfer transactions since then, just the unlock transactions.

Unlocks Can Send Price Crashing?

XRP unlocks are not new to the Ripple community, as scheduled unlocks take place every month. These unlocks see 1 billion XRP tokens unlocked from the escrow according to schedule. But most times, the majority of the unlocked tokens are sent back to escrow.

Usually, these unlocks do not negatively affect the altcoin’s price, but that’s when the unlocks are expected. This time around, the unlocks are unplanned, leading to speculation as to why Ripple would be unlocking XRP tokens outside of the unlock schedule.

So far, the XRP price seems to not be reacting to the unlock at all. It continues to trend around $0.61, with small losses of 0.91% in the last day. However, the altcoin is still seeing 4.74% gains in the last week, showing the positive upside that it saw earlier in the week.

The Era Of Flippenings: Can Dogecoin Take XRP’s Spot?

In the last few weeks, there has been uncertainty in the crypto market, but that has not stopped the likes of Dogecoin and XRP from making moves. One of the most notable developments, however, was the entry of Toncoin (TON) into the top 10 cryptocurrencies by market cap, and then dethroning Cardano (ADA). Following this, Dogecoin looks ready to carry out a flippening of its own, eyeing XRP’s spot on the list.

Dogecoin Gearing Up To Take Over XRP

Dogecoin has performed rather well at a time when the crypto market has remained indecisive. Even though there has been times when the price has dipped, it has managed to reclaim $0.2, although the majority of bearish resistance is being mounted at this junction.

Nevertheless, Dogecoin’s ability to hold most of its gains from March has seen its market cap increase rapidly. From less than $15 billion at the start of the year 2024, the meme coin’s market cap has now climbed above $28.6 billion, putting it dangerously close to the market cap of XRP.

At the time of writing, XRP’s market cap is sitting at $33.9 billion, spurred by the decline in its price over the last week. This means that the market cap of XRP is now only 15.6% higher than that of Dogecoin, a perilously small gap given how quickly prices of cryptocurrencies can rise.

In this case, if Dogecoin continues to perform well and XRP fails to keep up, it could easily lose the sixth spot on the list to DOGE. A 20% rise in the DOGE price to $0.24 would put its market cap above $34 billion, putting it ahead of XRP. And if XRP’s continues to fall, then the gap could tighten over the next week.

DOGE Price Projected To Explode

Dogecoin currently boasts one of the strongest crypto communities, and some would argue even stronger than the XRP army, as DOGE’s support base has strengthened due to its outperformance in the past. This support base and rapid adoption are two of the foremost factors that promise an interesting future for the meme coin.

There have been many predictions for where the future price of DOGE might be, with some going as high as $100. However, according to crypto Analyst Ali Martinez, Dogecoin could do quite well in this bull market. The analysis posted by Martinez reveals multiple price targets, with $12 at the top.

These targets, if they play out correctly, will see the DOGE market cap rise rapidly, and unless XRP pulls some equally bullish moves, it will soon be behind DOGE on the list of largest cryptocurrencies by market cap. But for now, both cryptocurrencies at maintaining their places with XRP in 6th position and Dogecoin in 8th position behind stablecoin USDC.

XRP Sees An Alarming 1,800% Surge In Liquidations, Whats Going On?

XRP has witnessed an alarming amount of liquidations in the last 24 hours. This has no doubt caused concerns in the XRP community, considering the impact that the derivatives market has on a crypto’s price.

$1.32 Million XRP Positions Get Liquidated

Data from Coinglass shows that $1.32 million has been liquidated from the XRP market in the last 24 hours. Long positions account for a majority of these liquidations, with $1.04 million in long positions being wiped out during this period. This underlines the bearish sentiment plaguing the XRP ecosystem, with the bears firmly in control.

This bearish outlook is also evident in several other key metrics in the XRP derivatives market. For instance, the total trading volume and open interest have dropped by 36.90% and 2.69%, respectively, which suggests that crypto investors are choosing to stay out of the XRP market.

Meanwhile, there has also been a decline in the options volume, further suggesting that crypto investors have reduced their bets on the the altcoin. This is, however, not surprising considering how XRP has maintained a tepid price action despite the broader crypto market enjoying significant price gains at different times.

Despite XRP’s current market conditions, there are still those betting heavily on a bullish future trajectory for the crypto token. This includes crypto expert Zach Rector, who has stated that the altcoin will “not miss the bull run” despite its current price action. He alluded to XRP’s fundamentals as one reason for his belief.

More recently, he mentioned that XRP will soon experience a supply shock with increased token burns on the horizon. These token burns help reduce the number of tokens in circulation and can help drive up the token’s value through scarcity.

Time To Accumulate More Tokens

Crypto analyst Egrag Crypto recently mentioned in an X (formerly Twitter) post that it was time to accumulate more XRP. He made this statement while highlighting an ascending triangle on XRP’s monthly timeframe, which “screams bullish.” In anticipation of this bullish move, the analyst urged crypto investors to “accumulate more, and then just sit back and wait for the magic to happen.”

As to how high XRP could rise, Egrag stated that “the measured move of the Ascending Triangle could potentially reach either $17 or $27.” The analyst had also recently claimed that the altcoin would rise to $5 by July.

At the time of writing, XRP is trading at around $0.6, up in the last 24 hours according to data from CoinMarketCap.