The U.S. Securities and Exchange Commission wants more information about the assets of the former crypto lender, which is reorganizing through bankruptcy, a person familiar with the matter said.

ARK, 21Shares update spot Bitcoin ETF application as next SEC deadline looms

The latest update is the third amendment to the Bitcoin ETF prospectus by ARK and 21Shares after the firms first filed for a spot Bitcoin ETF in April 2023.

Fidelity Wants to Create an Ether ETF, Joining BlackRock in Doubling Down on Crypto

SEC Delays Decision on Global X Spot Bitcoin ETF

The move was expected and isn’t having any immediate effect on the bitcoin price.

Crypto for Advisors: Cryptocurrency Transparency Truths vs. Myths

Darwood Khan from Alix Partners looks at on-chain analytics, tracing tools and just how much illicit activity leverages crypto and discusses why advisors should learn about blockchain technology.

US Congress members urge financial authorities to invalidate SEC’s SAB 121

In a memo, Congress members state that Federal banking agencies should not require financial institutions providing custody services for digital assets to maintain capital against the assets.

BlackRock files S-1 form for spot Ether ETF with SEC

BlackRock filed a Form S-1 with the U.S. SEC a week after registering its iShares Ethereum Trust with Delaware’s Division of Corporations.

What an SEC Proposal Means for RIAs in Crypto

The SEC’s Custody Rule requiring advisors to safeguard digital assets has big implications for advisors working in the crypto industry, says Nathan McCauley, CEO and Co-Founder of Anchorage Digital.

Is Buying FTT Now A Once-In-A-Life Opportunity For FTX Believers?

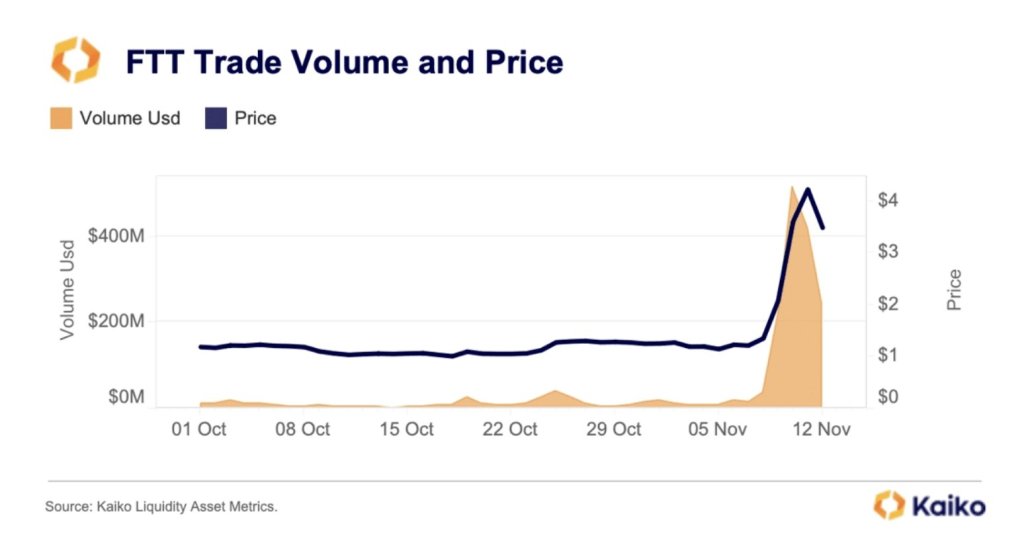

FTT, the native token of the FTX ecosystem, rallied by 180% last week, emerging as one of the top performers. The rally, Kaiko, a blockchain analytics platform observes, was primarily due to comments by the stringent United States Securities and Exchange Commission (SEC) leader that the FTX 2.0 relaunch is possible.

FTT Soaring On Hopes Of FTX Relaunching

In an X post on November 14, Kaiko also notes that related FTT trading volume soared, signaling possible accumulation by traders and believers of FTX. At spot rates, FTT trading volume, looking at how the token performs in Binance, one of the leading cryptocurrency exchanges, remains elevated at November 2022 levels.

In November 2022, FTX, led by Sam Bankman-Fried, filed for Chapter 11 bankruptcy protection at the United States Bankruptcy Court for the District of Delaware.

Related Reading: BlackRock’s XRP ETF Filing, Everything You Need To Know

Before this bankruptcy filing, FTT, which served several purposes in the FTX ecosystem, acting as a governance token and providing access, plunged in early November following allegations that the exchange had misappropriated user funds. There was a significant collapse on November 8 when FTT fell by 90%, taking the coin from around $22 to as low as $2.

FTT is trading at around $3.22, up 232% from October 2023 lows, looking at the performance in the daily chart. As fundamental events around FTX unfold, FTT’s trading volume also rises.

Compliance With The Law Is Crucial: SEC Chairperson

There could be more gains for FTX in the days ahead should there be more solid news of an FTX 2.0 relaunch following Gary Gensler’s comments last week. Then, Gensler told CNBC that a revived FTX could see the light of day if only leaders taking over clearly understood existing laws.

The SEC chairperson’s comments follow speculations that the former New York Stock Exchange (NYSE) president, Tom Farley, is among the three bidders planning to buy FTX.

“If Tom or anybody else wanted to be in this field, I would say, ‘Do it within the law. Build investors’ trust in what you’re doing and ensure that you’re doing the proper disclosures — and also that you’re not commingling all these functions, trading against your customers. Or using their crypto assets for your purposes.”

A jury in early November found Sam Bankman-Fried, the former CEO of FTX, guilty of all criminal charges, including wiring fraud and money laundering. Bankman-Fried is set for sentencing in March 2024.

First deadline window looms for SEC to approve Bitcoin ETFs: Law Decoded

Even if approved by Nov. 17, the spot Bitcoin ETFs are unlikely to come to market for at least a month after approval.

CBOE to launch BTC, ETH margin futures trading in January with 11 firms supporting

The new trading capability comes simultaneously with a surge in interest in crypto financial products in the United States.

Ripple faces slim odds of $770M disgorgement – XRP holder Attorney

Deaton underscores that the legal action against Ripple is not centered on fraud but rather constitutes a regulatory disagreement.

Ethereum Price Propels To 52-Weeks High, Here’s What Behind It

Ethereum (ETH) has been experiencing an upward trajectory for quite a while now, reaching its highest yearly price point in the week and presenting an impressive 52-week high.

Ethereum’s Price Supported By Latest Developments

The Ethereum’s price surge can be traced back to several factors that have propelled the cryptocurrency’s growth. The asset reached its 52-week high of $2,137 on Thursday, November 9, as seen in the chart below.

One of the factors that has contributed to the crypto asset’s price surge is the number of ETH staked. A rise in ETH staked, which stood at over 28 million, according to data from Beaconscan.

As of August, the number of validators in the Beacon Chain was approximately 786,000, but today that number is currently at 884,000. This indicates confidence in Ethereum’s long-term stability, which can be promising to investors.

In addition, the token’s on-chain volume has also increased significantly over time. Recent data shows that the asset’s volume now sits at approximately 2.62 billion from 1.5 billion as of September. This indicates an over 70% increase since September.

Blackrock’s Spot Ethereum ETF Sparks Increase

The most recent development that has propelled the asset’s price is BlackRock‘s registration of a spot Ethereum Exchange Traded Fund (ETF). Since the firm made known its registration of a Spot Ethereum ETF, there has been quite an improvement encompassing the cryptocurrency.

Blackrock is the world’s largest asset manager with trillions of dollars in assets under management, the firm that has also applied for a Bitcoin spot ETF. The firm applied for a Bitcoin spot ETF in June 2023. However, it is awaiting a decision from the United States Securities and Exchange Commission (SEC).

Bitcoin briefly tops $37K amid market optimism for pending spot ETF approvals

The price of Bitcoin has surpassed $37,000 for the first time since May 2022.

Bitcoin ETF launch could be delayed more than a month after SEC approval

A total of 12 asset managers have filed for a spot Bitcoin ETF with the U.S. SEC, with the first window for approval from the SEC opening on Nov. 8.

Rep. Tom Emmer proposes to defund SEC’s crusade against crypto

Rep. Tom Emmer added a provision in the House GOP spending bill that would block the SEC from using government funds to pursue crypto companies until Congress weighs in on who has jurisdiction over crypto.

Binance used ‘tortured’ interpretation of law in bid to toss suit, says SEC

The SEC derided Binance’s request to have the regulator’s suit thrown out, claiming the crypto exchange hasn’t correctly applied the law.

Binance Has No Real Argument for Dismissing SEC Suit, Regulator Says

Bitcoin Pushes Towards $36K Ahead of Last Approval Period For Spot ETFs This Year

The Securities and Exchange Commission (SEC) has one last short window, an eight-day period starting Thursday, if it wants to approve all 12 spot bitcoin (BTC) ETF applications this year, Bloomberg analysts wrote in a note on Wednesday.

XRP News: Ripple CEO Teases Major Announcements At Swell Event

Ripple CEO Brad Garlinghouse has expressed his anticipation for the upcoming DC Fintech week, dropping major hints and teasers about significant announcements and heated discussions slated for the event.

Ripple Swell Event Sparks Community Interest

Chief Executive Officer of Ripple, Brad Garlinghouse has teased the X (formerly Twitter) community with hints of discussions and ideas about the upcoming Ripple Swell 2023 event scheduled for November 8th and 9th in Dubai.

Garlinghouse stated that he was always excited about the DC Fintech Week which occurred every year. He emphasized the importance of the event in bringing together different people with similar interests in one room interacting and sharing their different ideas and perspectives on substantial topics and issues in the finance and blockchain industry.

In his post, Garlinghouse dropped a cryptic message, likening the Ripple Swell event to a “proverbial cage match.”

“Every year I look forward to DCFintechWeek — everyone from the public to private participants in one room, discussing (and sometimes debating) the substantive issues with no holds barred. wondering…a proverbial cage match?!” Garlinghouse stated.

Some of the headlining speakers excluding Garlinghouse appearing at the DC Fintech Week include United States Under Secretary of the Treasury for Domestic Finance, Nellie Liang, CEO of Grayscale Investments, Michael Sonnenshein, Chairman of the United States Securities and Exchange Commission (SEC), Gary Gensler, Vice Chair of Supervision at the Federal Reserve, Michael Barr, and others.

As the Ripple Swell event approaches, many crypto enthusiasts are looking forward to witnessing what could be a defining moment in the Ripple ecosystem as the event may provide more insight into Ripple’s future developments and present challenges.

Garlinghouse To Share Stage With Gensler At Swell Event

Following the conclusion of one of the most heated high-stakes legal battles in the crypto space, Garlinghouse and SEC Chair Gary Gensler are set to share a stage in the DC Fintech Week, discussing and possibly debating on various topics in the fintech and blockchain space.

The legal battle between Gensler and Ripple’s top Executives Chris Larsen and Garlinghouse has been one of the most closely watched conflicts in the crypto space. The SEC sued both executives, accusing them of violating US securities laws by supporting the sales of XRP tokens in unregistered security offerings to investors.

The regulator eventually dropped all charges and claims against Larsen and Garlinghouse earlier in October, earning Ripple a partial win against the agency.

Many XRP community members have rallied behind Garlinghouse’s label of the Ripple Swell event as a “proverbial cage match.” This sentiment is particularly strong when considering participants like Gensler and Garlinghouse who have a history of legal disagreements and Grayscale and US SEC who are currently in a legal dispute concerning the approval of Spot Bitcoin ETFs.