The SEC and Binance.US filed a joint status report detailing ongoing discovery efforts on Tuesday.

If Bitcoin Clears $70,000, How Fast Will Ethereum Ease Past $5,000?

As Bitcoin surges towards its all-time high (ATH) of nearly $70,000, analysts are closely watching Ethereum, the world’s second-largest cryptocurrency, wondering how quickly it will follow suit and break its record ATHs of approximately $5,000 printed in late 2021.

How Will Ethereum React When Bitcoin Breaks Above $70,000?

One analyst, posting on platform X, highlights the difference in the two coins’ positions compared to the last time Bitcoin broke above 2017 highs of $20,000 in December 2020. Then, Ethereum was trading at $600, a full 57% below its previous ATH of about $1,400.

As Bitcoin nears its record peak of around $70,000 registered in December 2021, Ethereum is approaching $4,000. However, the difference between then and now is that ETH is about 36% shy of its ATH of around $5,000.

The question in the analyst’s mind is, considering historical performance, how fast ETH will ease past $5,000. When Bitcoin broke above $20,000 in late December 2020, the analyst notes that it took approximately two months for ETH to sweep past $1,400 and record new highs.

The boom after this breakout lifted ETH to around $5,000, accelerated mainly by retail activities cycling around decentralized finance (DeFi) and non-fungible token (NFT) minting.

Looking at the Ethereum price action in the daily chart, it is clear that buyers are in control. ETH prices, CoinMarketCap data reveals, are up roughly 7% in the past 24 hours and 15% in the previous week. However, how quickly ETH might repeat the prior 2020-2021 feat remains to be seen.

Exploring ETH’s Chances

Like in the past, the Ethereum price action benefits from the Bitcoin expansion. The revival in Bitcoin prices has seen capital flow to Ethereum, priming its broader ecosystem comprising DeFi and NFT protocols. DeFiLlama data shows that Ethereum manages over $56 billion worth of assets.

Notably, almost all top DeFi protocols in Ethereum, including Lido, Maker, Uniswap, and EigenLayer, have posted strong inflows in the past day, week, and month.

Aside from market-related factors, Ethereum prices are also steadied by hopes around the eventual approval of a spot Ethereum exchange-traded fund (ETF). BlackRock is among the leading asset managers to file with the United States Securities and Exchange Commission (SEC).

However, the agency postponed a ruling on BlackRock’s application for a spot Ethereum ETF, citing concerns about the network’s new proof-of-stake consensus mechanism. The SEC expressed worries that staking, a core aspect of proof-of-stake, could create opportunities for manipulation.

The clear reservation regarding proof-of-stake cast a shadow on Ethereum’s near-term outlook despite the current uptick in prices. Still, the community finds relief realizing that the Commission rejected approving a spot Bitcoin ETF for roughly ten years before January 2024.

U.S. Judge Enters Default Ruling Against Ex-Coinbase Insider, Says Secondary Market Sales are Securities Transactions

In an insider trading case involving Coinbase’s former product manager Ishan Wahi, his brother Nikhil Wahi and their friend Sameer Ramani, a U.S. court ruled on March 1, 2023, that the trading of certain crypto assets on a secondary market, which Coinbase is, are securities transactions.

The Catch-22 of U.S. Crypto Regulation

The SEC is asking crypto and fintech firms to do the impossible. Only Congress can stop that.

SEC Overstepped Bounds in Kraken Lawsuit, State AGs Charge

SEC in ‘Enforcement-Only Mode’ for Crypto, Commissioner Peirce Says at ETHDenver

“What I reflect is the fact that you all are spending part of your brainpower” wondering how to avoid getting sued, she said during a panel at EthDenver.

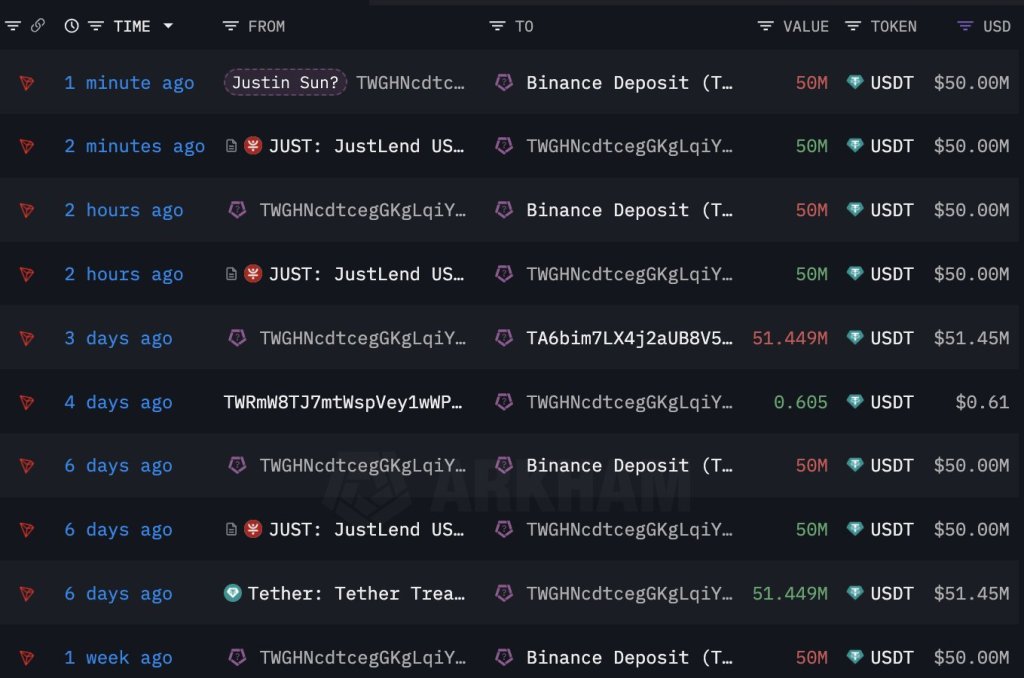

Justin Sun Moves $100M To Binance, Stacking Ethereum?

Justin Sun, the co-founder of Tron–a smart contracting platform for deploying decentralized applications (dapps), is once again moving and shuffling millions of dollars. According to Lookonchain data on February 29, Sun reportedly transferred 100 million USDT to Binance, days after moving huge sums earlier this week.

Justin Sun Holds Millions Of ETH: Will The Co-founder Buy More?

From February 12 to 24, a wallet associated with Sun acquired 168,369 ETH for an average price of $2,894. This purchase, valued at roughly $580.5 million, currently holds an unrealized profit of around $95 million. Profitability could increase considering the sharp demand for crypto, especially top coins like Bitcoin and Ethereum, in recent days.

The Ethereum price chart shows that ETH has been on a clear uptrend, rising from around $2,200 in early February to over $3,450 when writing. At this pace, and considering the institutional interest in potent crypto assets, including ETH, the odds of the second most valuable coin stretching gains will be highly likely.

As Bitcoin inches closer to $70,000, the probability of Ethereum also tracking higher toward its all-time high of around $5,000 will be elevated.

Since ETH already owns a big stash of coins, there is speculation that the co-founder will double down, buying even more coins. The crypto community will continue watching the address until this happens and there is solid on-chain data to support the purchase.

Spot Ethereum ETFs And The Dencun Upgrade Are Key Updates

So far, optimism is high, especially among the broader altcoin community. As Bitcoin races to register new all-time highs pumped by institutional billions, eyes will be on the United States Securities and Exchange Commission (SEC). There are multiple applications for a spot Ethereum exchange-traded fund (ETF).

The agency has not provided a definitive timeline for approving or rejecting the derivative product. There is regulatory uncertainty around the status of ETH, a significant headwind that might delay or even prevent the timely authorization of this product.

Still, the community is looking forward to the next communication in May. If the spot Ethereum ETF is a go, the coin will likely rally to new all-time highs, following Bitcoin.

However, before then, eyes are on the expected implementation of Dencun. The upgrade addresses challenges facing Ethereum, including scalability. Through Dencun, Ethereum developers hope to lay the base for further throughput enhancements in the coming years.

With higher throughput, transaction fees drop, overly improving user experience. This upgrade might go a long way in cementing Ethereum’s role in crypto, wading off stiff competition from Solana and others, including the BNB Chain.

U.S. House Panel Votes to Disapprove of Controversial SEC Custody Guidance

The House Financial Services Committee also seemed inclined to adopt a bill giving the U.S. Secret Service more resources to investigate crypto crimes.

SEC Objects to Terraform’s $166M Retainer of Law Firm Dentons: Reuters

The U.S. Securities and Exchange Commission (SEC) has raised objections to a $166 million retainer payment to lawyers of Terraform, according to Reuters.

Altcoin Market Cap Break From “Wyckoff Accumulation Phase”: Will Ethereum, XRP Fly?

In a post on X, one analyst observes that the altcoin market capitalization has broken from the Wyckoff accumulation phase. With this upswing, the trader expects altcoin prices to move higher.

This refreshing breakout coincides with Bitcoin’s (BTC) stellar performance when writing on February 28. At spot rates, the coin is trading above $60,000, a psychological round number- now supported- and is closely approaching $70,000.

The Altcoin Breakout From Accumulation

The “Wyckoff accumulation pattern” is a concept developed by technical analysts to pick out potential buying opportunities, in this case, altcoins. Whenever prices are in this phase, it is widely believed that the so-called “smart money” or large institutional players are accumulating at low prices.

Currently, prices consolidate at tight ranges and with low trading volumes. A signal marking the end of this accumulation is a sharp breakout, lifting prices above the defined range. Often, this upswing is with rising trading volume.

Looking at the chart, the altcoin market cap has broken above the accumulation phase. With previous resistance and support, the altcoin market cap will likely continue floating higher. As such, top altcoins, including Ethereum (ETH), Solana (SOL), and XRP, will follow suit, posting fresh 2024 highs.

Why Spot Bitcoin ETFs Give BTC Edge In This Bull Run

So far, Bitcoin is leading the way, posting over $10,000 in less than a week. However, with the coin trading above $60,000, its demand-side drivers differ entirely from what’s influencing altcoins. The approval of spot Bitcoin exchange-traded funds (ETFs) by the United States Securities and Exchange Commission (SEC) has seen billions of dollars flow to the world’s first cryptocurrency.

Therefore, while altcoins have historically outperformed BTC when crypto prices rally, there is an edge with spot Bitcoin ETFs. As such, this bull run will likely differ from 2017 and 2021. This forecast is because institutions will likely favor a regulated asset over altcoins whose status remains undefined.

As of late February 2024, the United States SEC has not approved spot ETFs of any altcoin, including that of Ethereum. Additionally, the agency has labeled several top altcoins, including Cardano (ADA), unregistered securities. The agency even filed lawsuits against major exchanges like Binance and Coinbase, accusing them of facilitating the trading of what the commission described as “unregistered securities.”

It is not immediately clear whether the United States SEC will change their preview of leading altcoins, especially Ethereum (ETH), which has a market of over $400 billion. Wall Street heavyweights like BlackRock and Fidelity remain interested in launching spot Ethereum ETFs.

Bitcoin Price Soars: Analyst Sets 2025 Price Target At $200,000

Bitcoin, the largest cryptocurrency asset by market cap, suddenly took off on Monday, reaching the $57,000 price mark for the first time in the last 26 months, prompting several predictions of a new all-time high before the end of 2025.

Bitcoin Could Hit $200,000 Before 2025 Closes

Amid the recent market surge, cryptocurrency analyst and Chief Executive Officer(CEO) of Factor LLC, Peter Brandt, has expressed his optimism towards Bitcoin, while sharing an intriguing prediction with the crypto community on the social media platform X (formerly Twitter).

Peter Brandt’s analysis delves into Bitcoin’s recent price action and how high the crypto asset could go before 2025 closes. With BTC’s current bull market cycle, Brandt has set an ambitious goal of $200,000 next year.

Brandt’s initial Bitcoin price target for 2025 was $120,000, but with the recent rally, he has placed his mark at the aforementioned price. His modifications came in light of BTC exhibiting a bullish trend, surpassing the “upper boundary of the 15-month channel.”

Furthermore, he highlighted that the current market bull cycle might “end in August or September 2025” if this bullish trend continues. However, according to him, this interpretation will be void if there is a Bitcoin “close below last week’s low.”

The post read:

With the thrust above the upper boundary of the 15-month channel, the target for the current bull market cycle scheduled to end in August or September 2025 is being raised from $120,000 to $200,000. A close below last week’s low will nullify this interpretation.

The analyst’s daring predictions have since caused quite a stir within the crypto space. Several community members have expressed their pleasure in the crypto expert’s analysis.

A pseudonymous X user commented on Brandt’s forecast, saying his overview shares “fascinating insights into Bitcoin’s market projection.” They asserted that “the upward momentum breaking through barriers is indeed intriguing.”

Additionally, they also believe that a close below last week’s low would change Brandt’s narrative, which will highlight the fragile balance in the cryptocurrency space.

Factors That Could Be Responsible For BTC’s Rally

BTC’s current rally is believed to be buttressed by several developments that have garnered attention in the crypto market today. These include increased demand from investors through Exchange-Traded Funds (ETFs) and additional BTC purchases by Microstrategy.

It is noteworthy that since the start of the year, investors’ demands through ETFs have served as a major support for BTC. On January 11, the United States Securities and Exchange Commission (SEC) approved 11 Bitcoin spot ETFs, which has triggered confidence ever since.

Meanwhile, Michael Saylor’s Microstrategy made an additional 3,000 BTC purchase, valued at $155 million before the uptick. This development suggests institutional interest in BTC, indicating confidence in its long-term potential.

Over the past day, the price of Bitcoin has increased by more than 9%, and it is presently trading at $56,321. Its market cap is up by 9% and its trading volume is up by over 235% in the last 24 hours.

Looking at Kraken’s Motion to Dismiss an SEC Lawsuit

In Lejilex vs. SEC, Crypto Goes on Offense in the Courts

The Texas-based crypto firm’s new suit shows how the industry can use “impact litigation” to get regulatory clarity, lawyers Jake Chervinsky and Amanda Tuminelli write.

Crypto Exchange Kraken Files to Dismiss SEC Lawsuit Against It

The U.S. Securities and Exchange Commission didn’t allege fraud and stretched the definition of a contract in its lawsuit against Kraken, the exchange said in a motion to dismiss the case Thursday.

Is Ethereum Overvalued, Similar ‘To Meme Coins Like Shiba Inu’?

A crypto investor, Fred Krueger, thinks Ethereum is overvalued at spot rates. Referring to X, Krueger added that Ethereum supporters are “detached from reality” after ETH, the native currency, recently broke above $3,000.

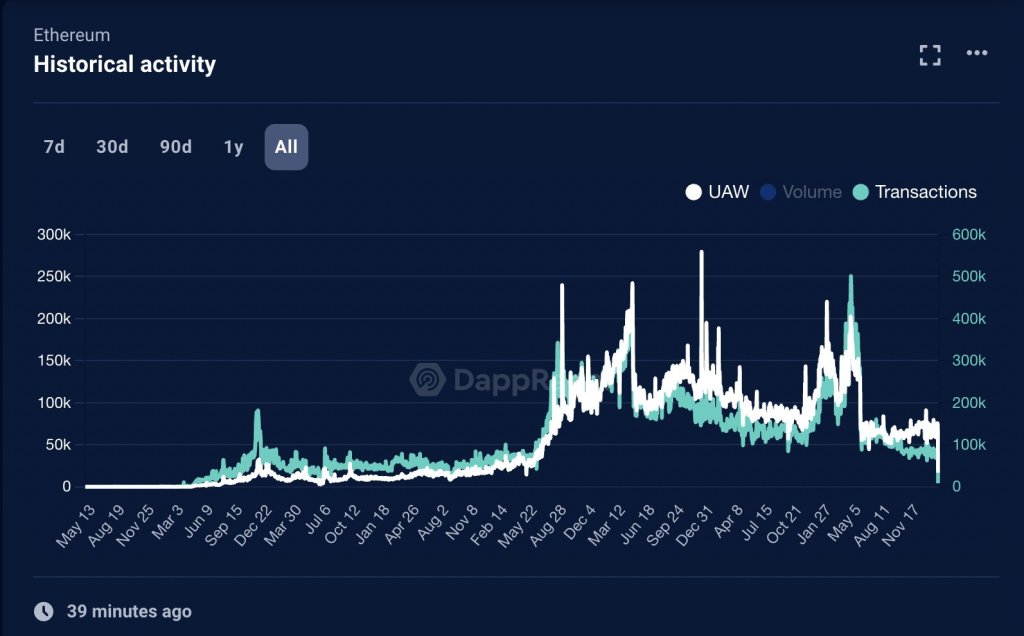

The investor pointed to the general declining on-chain activity, fierce competition from alternatives like Solana and Avalanche, for instance, and regulatory uncertainty that makes holding the coin risky.

Ethereum Is Slow And Usage Is Shrinking

Krueger argues that Ethereum’s on-chain transactions could be faster and cheaper. In the current landscape marked with scalable and low-fee alternatives, either built on Ethereum or existing as independent chains, the chain’s challenges no longer justify ETH trading at spot rates of about $3,000.

Beyond scaling and throughput challenges, the investor also refers to the sharp decline in daily active users (DAUs) on the mainnet. Since 2021, Ethereum and altcoin prices have peaked, and active DAUs have fallen from around 120,000 to approximately 66,000 in February 2024.

Though network supporters said there had been developments like layer-2 platforms like Arbitrum pinning their security on Ethereum, Krueger notes that even the most active and largest protocols by total value locked (TVL) have seen user losses.

To illustrate, Uniswap V3, the third version of one of Ethereum’s largest decentralized exchanges, Uniswap, now records around 16,000 daily active users, significantly lower than previous years.

Alternatives Like Solana Offer Better: Is ETH Expensive?

The investor argues that the decline in DAUs, pointing to active usage, sharply contrasts with Ethereum’s rising market capitalization and spot rates. In Krueger’s opinion, this emerging state of affairs is why Ethereum has become a bloated “meme coin like Shiba Inu,” looking at its high market cap.

It in the investor’s assessment that faster and cheaper alternatives like Solana, Avalanche, and Near Protocol offer better value for specific use cases like decentralized finance (DeFi) and games.

Krueger also took issue with the lack of regulatory clarity on Ethereum. The United States Securities and Exchange Commission (SEC) recently approved the first spot Bitcoin exchange-traded funds (ETF) batch. Primarily, this is because SEC officials recognize Bitcoin as a commodity.

Gary Gensler and the SEC have failed to classify ETH in the same category as BTC. Accordingly, though the broader crypto community is optimistic about the eventual authorization of a spot Ethereum ETF, Krueger thinks it is unlikely.

Still, time will only tell how Ethereum and its market valuation will evolve in the coming months. Supporters are optimistic, despite criticism, that rising adoption and ETH’s deflationary nature will lift prices towards 2021 highs of $5,000.

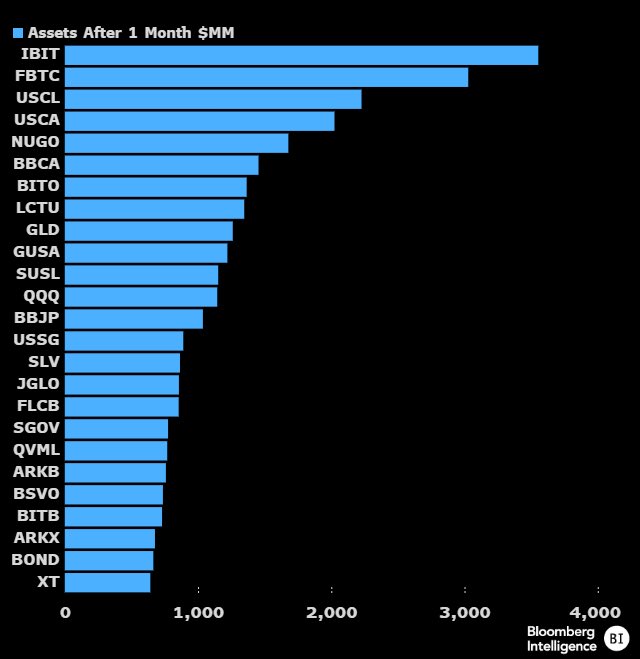

Bitcoin ETF Surges: Last 4 Days Inflows Outpace Initial Weeks

Bitcoin (BTC) Spot Exchange-Traded Funds (ETFs) are currently in the limelight as the products have seen massive net inflows in the past few days than in the initial weeks of introduction, dominating the market of crypto investment products.

Bitcoin ETF Inflows Surges In The Last 4 Days

Thomas Fahrer, the co-founder of Bitcoin tracking platform Apollo, took to the social media platform X (formerly Twitter) to share the development with the community. Fahrer pointed out that BTC spot ETFs are presently experiencing a “total acceleration” of inflows.

Meanwhile, the products in the past 4 days have witnessed an inflow of 43,000 BTC tokens valued at $2.3 billion. This latest surge in inflows suggests renewed adoption of the products from crypto players and investors.

Data from Apollo reveals that Grayscale is the leading firm in Assets Under Management (AUM). Registered as Grayscale Bitcoin Trust (GBTC), the company boasts a whopping $23.7 billion AUM.

However, this is a notable drop from $28 billion in assets it had on January 11, after transitioning to an ETF. This is due to the daily net outflows the fund has seen since it was approved by the US Securities and Exchange Commission (SEC).

Blackrock comes in second after Grayscale, with an asset under management of over $5 billion since it started trading. It is followed by Wise Origin Bitcoin Trust (FBTC) and Ark/21Shares Bitcoin Trust (ARKB), which come in third and fourth place, respectively.

Investment firm Bitwise’s Bitcoin ETF (BITB) is the latest company to reach the billion-dollar milestone. As of the press, the company’s BTC ETF is the fifth largest behind the aforementioned asset management companies.

Blackrock Records Its Largest Inflow

On Tuesday, Blackrock recorded its largest inflow day ever since Bitcoin ET products were approved. A senior Bloomberg Intelligence analyst, Eric Balchunas, revealed information regarding the update on X.

He stated that Blackrock’s BTC ETF was booming on Tuesday, seeing almost “half a billion” inflow. According to the data shared by Balchunas, IBIT made $493 million in revenue during the trading day.

IBIT’s previous largest daily net inflow was $386 million, recorded on the second trading day of January 12. Consequently, Blackrock’s Bitcoin ETF overall inflow exceeded the $5 billion mark after the Tuesday event. So far, of all ETFs, Blackrock’s IBIT leads by “7% by size in just 23 days of trading.”

These developments came in light of the recent rally around Bitcoin in the past few days, which took BTC’s price above $ 50,000. Many market enthusiasts believe that a major factor in the rally is the reason surrounding the BTC ETF flows.

Tiger Global Exited Coinbase Stake Late Last Year, Filing Shows

Tiger sold 38,850 shares during the fourth quarter.

The SEC Takes on Dealer Definitions

The U.S. Securities and Exchange Commission published a new definition for securities dealers, capturing crypto.

Bitcoin Continues To Break Wall Street Records: The Whales Are Here

Bitcoin is making waves on Wall Street, with BlackRock and Fidelity, two of the popular spot Bitcoin exchange-traded funds (ETF) issuers shattering records. Looking at recent trends, spot Bitcoin ETFs are surging in popularity, indicating that institutional investors, or “whales,” are diving headfirst.

Fidelity And BlackRock Spot Bitcoin ETFs Break Wall Street Record

Mark Wlosinski, a crypto commentator, took to X on February 12, highlighting the meteoric rise of BlackRock (IBIT) and Fidelity (FBTC) Bitcoin spot ETFs. Both have amassed a staggering $3 billion in assets under management (AUM) within 30 days. This feat is historic, marking the first time an ETF of any product has achieved such rapid growth in such a short period.

This unprecedented demand for spot Bitcoin ETFs comes amidst a broader trend of institutional adoption. Wlosinski notes that over 5,500 ETFs have been launched throughout history. However, none have yet witnessed the level of enthusiasm currently surrounding spot Bitcoin ETFs.

The pace at which BTC AUM of spot ETF issuers continues to grow suggests a significant shift in investor sentiment. Specifically, Wall Street is increasingly recognizing BTC’s potential as a viable asset class.

For years, leading Wall Street executives, including Jamie Dimon, the head of JP Morgan, dismissed the coin, saying it was speculative and a scam. However, with the United States Securities and Exchange Commission (SEC) approving spot Bitcoin ETFs after more than ten years of rejecting the product, there appears to be a seismic shift in the investment landscape.

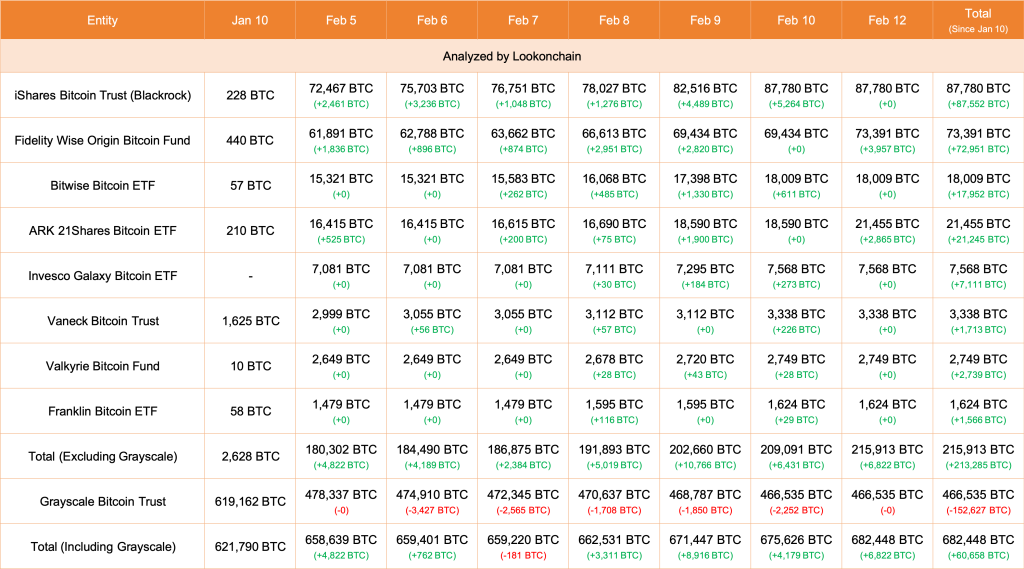

As of February 12, Lookonchain data shows that Fidelity and Ark21 Shares bought an additional 6,822 BTC worth over $339 million. BlackRock’s IBIT remains the largest spot BTC ETF by AUM, controlling over 87,780 BTC. However, spot ETF issuers continue to accumulate, pushing their total haul to 682,448 BTC.

BTC Retests $50,000, Path To November 2021 Highs?

Since spot Bitcoin ETFs track the spot price, the more spot ETF issuers buy, the higher the demand for the coin becomes. Accordingly, rising demand has significantly impacted prices, as the daily chart shows. So far, Bitcoin is trading close to the psychological $50,000 mark, the highest level since 2024.

Technically, the uptrend remains, and buyers are firmly in control. If buyers double down, buy more, and take more coins out of the reach of spot ETF issuers, Bitcoin will likely float to $70,000 or better in the sessions ahead.

Related Reading: SOL Price Surges To $115 – Why Solana Could Rally Another 10%

Ethereum ETF: Franklin Templeton Enters The Fray As ETH Rallies

Wall Street titan and Asset manager Franklin Templeton has applied for an Ethereum Spot Exchange-Traded Funds (ETF) after a struggle to gain approval for their Bitcoin Spot ETF in early January.

Asset Manager Files For Spot Ethereum ETF

Asset managers have gravitated toward the Ethereum spot ETF since the United States Securities and Exchange Commission (SEC) approved the Spot Bitcoin ETF. Franklin Templeton is the latest manager to apply with the SEC to get approval for this financial product.

The asset manager’s move came after successfully introducing the BTC spot ETFs. This is a notable step toward making more crypto investment products accessible to institutional and individual investors.

James Seyffart, a senior analyst from Bloomberg Intelligence, also shared the update with the crypto community on X (formerly Twitter). Seyffart’s X post included a screenshot of the asset manager’s filing and data regarding other applicants.

According to the post, Franklin Templeton is the eighth company in the cryptocurrency market to file for product approval. Previous asset managers to file applications for Ethereum ETFs include Hashdex, BlackRock, Fidelity, Ark and 21Shares, Grayscale, VanEck, Invesco, and Galaxy.

Per the official filing, a Delaware statutory trust is how the Franklin Ethereum Trust is set up. The ETF aims to give investors access to ETH in a regulated manner by allowing them to store it directly through a custodian.

It states in the company’s S-1 filing that the proposed “Franklin Ethereum Trust” will hold ETH and “may, from time to time, stake a portion of the fund’s assets through one of the more trusted staking providers.”

Staking is the act of locking up digital currency to maintain the operations of a blockchain network. They plan to stake some of the ETF’s ETH holdings to supplement its income through staking rewards.

The Price Of ETH Rallies Amidst The Update

Franklin Templeton’s spot Ethereum ETF application was made in light of the price of ETH experiencing an uptick. However, no solid proof exists that the latest development impacted the price of crypto assets.

Related Reading: Ethereum ETFs Approval Date Set For May 23, Forecasts Suggest ETH Could Reach $4,000

Ethereum was trading at $2,661 as of press time, indicating an increase of over 7% in the past 24 hours. Data from CoinMarketCap shows that its market capitalization is also on the upside, marking an increase of over 7%.

Meanwhile, its trading volume has increased significantly by over 172% in the past day. Due to the rise, ETH now ranks third in the entire crypto market by trading volume.