The winds of change are swirling around Ethereum (ETH), the world’s second-largest cryptocurrency. While the Ethereum network itself is buzzing with activity, the price of ETH has taken a tumble in recent days, leaving investors scratching their heads.

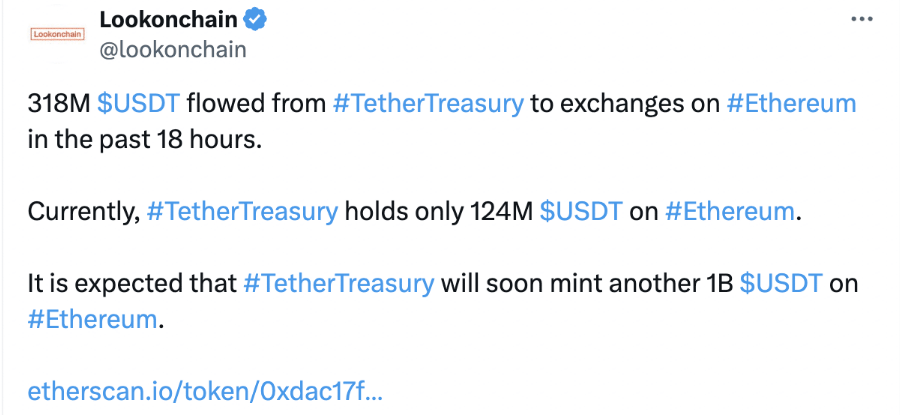

A glimmer of hope emerged with Tether’s (USDT) recent movement. Tether, the issuer of the world’s most popular stablecoin pegged to the US dollar, transferred a whopping $318 million worth of USDT from its treasury wallet directly to exchanges on the Ethereum network.

This outflow suggests potential anticipation of increased demand for USDT, which could, in turn, signal rising investor interest in the broader cryptocurrency market.

Historically, Tether has minted large amounts of USDT during periods of heightened crypto activity, and the rumor mill now churns with speculation that another billion USDT might soon be minted specifically on Ethereum.

However, analysts caution against blind optimism. While an increase in USDT activity could bode well for Ethereum, it’s not a guaranteed path to prosperity.

Other blockchains, like Tron, are also capable of handling USDT transactions, offering investors alternative avenues.

Price Woes And Investor Sentiment

Meanwhile, the price of ETH has stubbornly refused to cooperate. As of today, ETH is trading below the crucial $3,000 mark, having dropped by nearly 3% in the last 24 hours.

Ethereum has lost 11% of its value in the last seven days, data from Coingecko shows.

Related Reading: Toncoin Unleashes DeFi Monster Growth: TVL Soars 300% In A Month

A further price drop below $3,000 could trigger panic selling, exacerbating the downward spiral.

The current situation presents a complex picture for Ethereum. While Tether’s recent move and steady network activity offer slivers of optimism, the declining price and NFT market correction paint a contrasting picture.

A Hive Of Activity Despite Stress On Price

While the price of ETH might be feeling the heat, the Ethereum network itself is humming with activity. Unlike the recent slump in the NFT (Non-Fungible Token) market, overall network usage has remained remarkably consistent.

This suggests a shift in focus within the Ethereum ecosystem. While the flamboyant world of NFTs might be experiencing a temporary correction, other sectors within Ethereum are picking up the slack.

The rise in DeFi (Decentralized Finance) transactions, stablecoin swaps, and general token activity could be the hidden forces keeping the network busy.

Featured image from Pexels, chart from TradingView