The final Beatles song “Now and Then” has been released and made possible with a little help from AI to produce John Lennon’s vocal track.

Cryptocurrency Financial News

The final Beatles song “Now and Then” has been released and made possible with a little help from AI to produce John Lennon’s vocal track.

The recent surge in FTX claims is attributed to its early investment in AI companies, which have jumped in valuation.

Web3 business models based around NFTs, blockchain and crypto have slowly been gaining ground in the mainstream, to mixed success.

A pro-XRP lawyer known for advocating for the cryptocurrency has outlined reasons why he believes Ripple would not abandon the XRP token.

Pro-XRP lawyer and Managing Partner of the Deaton Firm, John E. Deaton has taken to X (formerly Twitter) to assuage concerns raised about Ripple’s commitment and plans for the XRP token.

Following the recent announcement of XRP’s expansion into Dubai after gaining approval from the Dubai Financial Services Authority (DFSA), Deaton boldly stated in his post that Ripple was not planning to ditch the XRP token and would not be for years. He said that the crypto payments network had a strong financial responsibility to the token, having invested billions in XRP.

“As I’ve said for more than 3 years, Ripple is not going to abandon XRP. It has a fiduciary duty not to,” Deaton stated.

Deaton highlighted Ripple’s financial journey revolving around the XRP token. He stated that in its Series A funding in 2015, Ripple was valued at $128 million. In Series B, the crypto payments network’s value rose again in the following year to $410 million and by 2020, Ripple had attained a value of $10 billion in its Series C valuation.

Deaton also mentioned Ripple’s Series C buyback valuation last year, which saw the crypto network purchasing its Series C shares at a 50% higher price.

According to Deaton, Ripple’s growing value and large-scale investments regarding XRP are proof enough that the crypto network would continue its support for XRP.

The pro-XRP lawyer disclosed that Ripple owned $48 billion to $50 billion worth of XRP, which makes it inconceivable for the crypto network to abandon XRP. He also stated that Ripple has more to gain than lose, especially if the XRP token price surges to $2.

“Ripple’s pre-IPO shares clearly trade at a valuation significantly less than $15B. Owning 48B-50B XRP makes it insane to abandon XRP. If #XRP reaches $2, Ripple has an asset valued at $100B,” Deaton stated.

While many XRP community members have commemorated the recent successes in the XRP ecosystem, an XRP enthusiast has chosen to voice out concerns about the lingering question of why the price of XRP has not been affected by its new achievements.

XRP Cryptowolf took to X on Thursday to publish XRP’s newest development of partnering with the National Bank of Georgia (NBG) and why the token has not shown any significant price surges following the announcement.

“Anyone else wondering why $XRP didn’t skyrocket to the news of Ripple partnering with a central bank?” XRP Cryptowolf stated.

Additionally, following John Deaton’s statement that Ripple would not abandon the XRP token, an XRP community member disclosed that the XRP token had shown only a slight price change when a larger surge was expected.

“And yet here we are up 3 pennies haha any other coin would have jumped $15 bucks in a day with this kind of news,” an XRP community member stated.

While the present price of XRP has displayed a slower price growth than its past, many crypto enthusiasts believe that the cryptocurrency’s ongoing legal battle with the United States Securities and Exchange Commission (SEC) has been the primary source of its growth stunt.

In response to XRP Cryptowolf’s question about the slack in the price of XRP, a community member stated that “for XRP to truly be free and demonstrate its potential, it will only happen after it clears all the SEC lawsuits.”

Ethereum founder Vitalik Buterin stated something called the Blockchain Trilemma. A blockchain tries to be secure, fast and decentralized.

Interest rates have fallen sharply this week across the U.S. yield curve, in part as traders place bets the Fed is finished tightening monetary policy.

The latest price moves in bitcoin [BTC] and crypto markets in context for Nov. 3, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

The jobless rate is forecast to hold steady at 3.8%, while the year-on-year growth in average hourly earnings likely slowed to 4% from 4.2%.

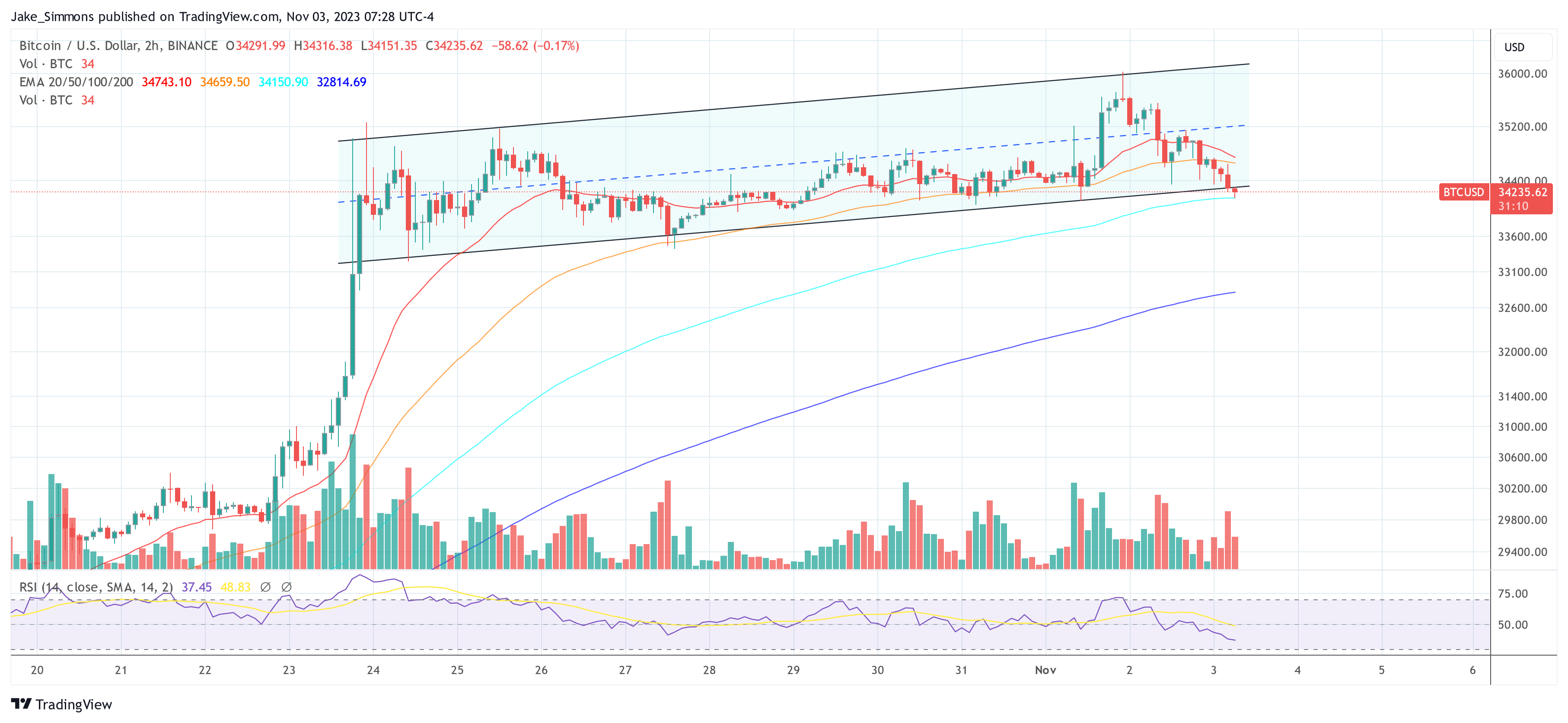

In their latest market update, QCP Capital, a crypto asset trading firm headquartered in Singapore, has dissected the recent Bitcoin price movements, attributing the rally to macroeconomic factors rather than the much-anticipated approval of a spot ETF. To recall, the Bitcoin surged from $34,500 to almost $36,000 on Wednesday.

The firm’s technical analysis highlighted that Bitcoin reached the 38.2% Fibonacci retracement level at $35,912 and touched the upper channel trendline before retreating, a move that was keenly observed by market participants.

QCP Capital’s report states, “This latest rally, however, was less about spot ETF developments and more about macro forces.” These macro forces were identified following a dovish stance from the Federal Open Market Committee (FOMC) and a smaller than expected Treasury Q1 supply estimate, which led to a significant drop in bond yields. This, in turn, has had a bullish effect on risk assets, including Bitcoin and the broader crypto market.

However, the firm also had a word of caution, saying, “Whether this marks the start of a new global equity and bond uptrend remains to be seen, as the macro picture essentially remains unchanged, outside a correction of overly bearish bond sentiment.”

The firm also noted the Bitcoin derivatives market, where “perp funding, and term forwards, implied volatility and risk reversals across the curve continue to remain or extend further at extreme elevated levels.” This suggests a market bracing for a significant move, with derivative traders positioned for a potential upside breakout that hinges on the approval of a spot ETF.

Looking at the broader financial landscape, the bond market has been experiencing notable fluctuations. Recently, the 30-year Treasury yield has reached another 16-year high, climbing above 5%. This level of yield has not been seen since 2007, and it represents a rise of over 4 percentage points in just three years. Such movements in the bond market are critical for the Bitcoin and crypto market as they affect the risk sentiment among investors.

However, Bitcoin is currently following the example of gold as a safe haven asset. ”The market is starting to price in the Fed’s overtightening and weakening economics. Combined with geopolitical tensions + war, the need for QE in the future is increasing rapidly. This is causing insurance assets (Gold, Bitcoin) to absolutely rip in unison,” Carpriole Investment’s Charles Edwards remarked recently.

In summary, QCP Capital’s insights into Bitcoin market dynamics versus current bond market trends suggest that while the Bitcoin market is influenced by a variety of factors, including speculation about exchange-traded fund approval, macroeconomic indicators such as bond yields play a larger role in determining market sentiment and price action than other pundits believe.

At press time, Bitcoin was trading at $34,235 and at risk of breaking out of the established uptrend channel to the downside. If that happens, low price levels could come next.

The social engineering attacks trick community members into downloading a malicious ZIP archive named “Cross-platform Bridges.zip” — imitating an arbitrage bot designed for automated profit generation.

Abu Dhabi aims to become a crypto hub alongside Dubai in a move that’s part of a larger goal to foster initiatives in the blockchain and digital asset realm.

The second day of the UK AI summit featured a one-on-one talk between Prime Minister Rishi Sunak and Elon Musk that discussed the future of the job market, China and AI as a “magic genie.”

The ‘Alameda gap’ refers to the worsening of order-book liquidity following the collapse of the FTX group a year ago.

Bitcoin (BTC) is currently experiencing a notable surge in its value, effectively propelling the entire cryptocurrency market upwards. The recent upswing has drawn the attention of various experts in the field, one of whom is the pseudonymous crypto strategist known as TechDev.

In a recent post on the popular social media platform X, TechDev emphasized that Bitcoin, often referred to as the king of cryptocurrencies, is poised to enter an “explosive” phase, citing the reversal of the king crypto’s long-term metrics as evidence.

According to TechDev, a specific signal occurs approximately every 3 to 3.5 years, indicating an impending period of several months during which the market capitalization of Bitcoin is expected to grow significantly.

Every 3 to 3.5 years, this signal says the next several months will be explosive for #Bitcoin. pic.twitter.com/OQkoCVgbwH

— TechDev (@TechDev_52) October 28, 2023

Analyzing the intricate dynamics at play, TechDev’s chart highlights an intriguing correlation between China’s 10-year yield on its bond and the US dollar index, suggesting that as China’s bond yield decreases in relation to the US Dollar Index, Bitcoin’s price is predicted to rise.

10 degree $BTC/#NASDAQ breakouts are not ones to miss. pic.twitter.com/NmW7n5kiKe

— TechDev (@TechDev_52) November 1, 2023

Simplifying this, it implies that as the yield on China’s long-term bonds decreases in comparison to the strength of the US dollar, there is an increased likelihood of Bitcoin’s value escalating, possibly due to shifting investor sentiment and a growing appetite for alternative assets.

Furthermore, TechDev underlines Bitcoin’s historical breakouts against the NASDAQ over the years, emphasizing the significance of these breakthrough moments.

These instances serve as a strong indication for investors, signaling the importance of not overlooking Bitcoin’s potential to break out significantly against the renowned stock exchange.

In addition to the optimistic sentiments surrounding Bitcoin, prominent financial figure Cathie Wood, the head of Ark Investment, has expressed unwavering confidence in Bitcoin as a hedge against the potential risks of deflation.

In a recent interview on Bloomberg’s Marin Talks Money podcast, Wood responded to a question regarding her preferred asset class to hold for a decade. Without hesitation, she unequivocally favored Bitcoin over gold or cash, highlighting its unique characteristics that make it an effective safeguard against both inflation and deflation.

Wood emphasized Bitcoin’s inherent resilience against counterparty risk, along with its decentralized nature, which tends to discourage excessive institutional interference. Describing Bitcoin as the “digital gold” of the contemporary financial realm, Wood’s endorsement adds further credibility to Bitcoin’s position as a resilient and promising investment option.

The current price of Bitcoin according to CoinGecko stands at $34,557, with a slight 24-hour dip of 1.8% countered by a modest seven-day gain of 1.3%. These fluctuations further underscore the dynamic nature of the cryptocurrency market and the ongoing developments that continue to shape the trajectory of Bitcoin’s value.

Amidst these fluctuations, the overarching sentiment remains bullish, emphasizing the growing recognition of Bitcoin’s significance in the global financial landscape.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Freepik

Bitcoin is due to hit $45,000 by the end of 2023, with post-halving BTC price targets reaching a giant $250,000.

Block didn’t incur any impairment loss on its Bitcoin holdings, and Bitcoin revenue contributed as much as 43% of its total revenue.

Twelve jurors spent less than five hours deciding the facts. They asked for portions of transcripts from Paradigm’s Matt Huang and Third Point’s Robert Boroujerdi testimony, as well as highlighters and Post-it Notes, and when they didn’t immediately receive the version of the indictment, they requested that too. And yet, they quickly decided that Bankman-Fried was guilty on all seven counts.

The J5 generates significant leads through events, which, in the past, has helped uncover multimillion-dollar crypto Ponzi schemes, such as the BitClub Network.

ProShares, one of the biggest issuers of exchange-traded funds (ETFs), has added another Ethereum-related ETF to its growing offerings following the launch of the “world’s first Short Ether-Linked ETF” on November 2.

In its announcement, the asset manager mentioned that the ProShares Short Ether Strategy ETF trading under the ticker ‘SETH’ will provide an avenue for investors to profit from declines in the price of the second largest cryptocurrency, Ether.

With the launch of this Ethereum investment vehicle, the company believes that its clients have an opportunity to “profit both on days when Ether increases and when it drops.” It is worth mentioning that the asset manager was one of those who recently launched their Ethereum futures ETF, offering investors the chance to bet on the prices of the crypto token.

The Asset manager mentioned that the Short Ether Strategy ETF will be listed on the New York Stock Exchange and will deliver the opposite of the daily performance of the S&P CME Ether Futures Index. As to exposure, SETH, like other ProShares crypto-related ETFs, will gain exposure through Ether futures contracts.

ProShares is no newcomer when it comes to offering crypto-related ETFs and can even be said to be a trailblazer in that regard. The firm was the first to launch a Bitcoin futures ETF and the first US Bitcoin-linked ETF (ProShares Bitcoin Strategy ETF) back in 2021.

It also launched the first US short Bitcoin-Linked ETF (ProShares Short Bitcoin Strategy ETF) in June 2022. Similar to the SETH, the Short Bitcoin Strategy provides investors an avenue to make profits off declines in the price of the flagship cryptocurrency, Bitcoin.

ProShares has also enjoyed immense success in its ventures thanks in a big way to the first-mover advantage by being the first to launch funds. The ProShares Bitcoin Strategy ETF (BITO) and the ProShares Short Bitcoin Strategy ETF (BITI) are reported to be the two largest Bitcoin ETFs with $1.1 billion and $80 million assets under management (AuM) respectively.

Other crypto-linked ETFs offered by the firm include ProShares Ether Strategy ETF (EETH), which is said to be “the first US ETF that targets the performance of Ether,” and the Bitcoin & Ether Market Cap Weight Strategy ETF and Bitcoin & Ether Equal Weight Strategy ETF which tracks both the performance of Bitcoin and Ether.

Considering how bullish the firm seems to be on crypto-related ETFs, it is surprising that it isn’t part of the asset managers that have filed to offer a Spot Bitcoin ETF.

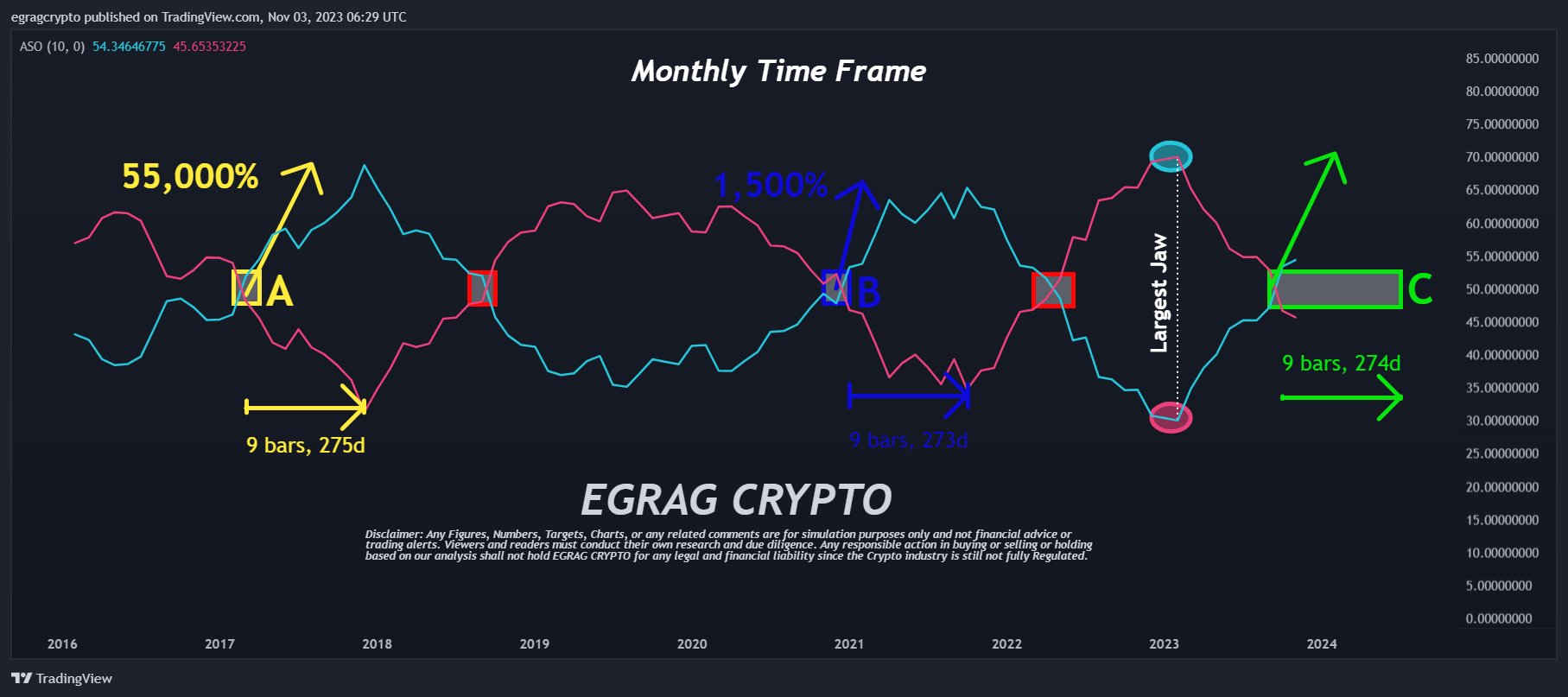

Crypto analyst Egrag recently delved into the XRP price charts and spotlighted signs that suggest a possible rally of more than 1,500% is on the horizon. The focus of this analysis is the ASO (Average Sentiment Oscillator), a metric that traders employ to determine market sentiment.

Egrag’s monthly XRP/USD chart showcases the convergence of the blue line, symbolizing bulls, and the red line, representing bears. A month ago, Egrag had marked a yellow box on his chart, predicting the bullish crossover to take place between the end of 2023 or the onset of the latter half of 2024.

Today, Egrag noted, “XRP ASO Update: The journey is only heading UP! I’ve been eagerly awaiting the bullish crossover of the ASO since February 2023. And guess what? It’s finally here!” Should XRP mimic its historical patterns, and if Egrag’s predictions hold true, the XRP price might witness some considerable price movements in the coming months.

Historically, the cryptocurrency experienced this bullish crossover twice before. The 2017 event led to a staggering 55,000% increase in XRP’s price, while the one from late 2020 to April 2021 resulted in a 1,500% appreciation. Given the “largest jaw” ever observed on the chart, Egrag has sparked discussions suggesting that the forthcoming rally could even outpace its predecessors.

By connecting the dots from the historical data and the recent crossover, Egrag further elaborated, “Looking at historical data, we can see that it typically takes around 275 days to reach the peak after this event.” If XRP follows its historical trends, as Egrag suggests, the XRP price might be gearing up for some substantial price action within the next 7-10 months.

Ending his tweet on a rallying note for the vast community of supporters, commonly referred to as the ‘XRP Army’, Egrag encouraged, STAY STEADY and keep on wearing your space suit.”

To provide more context, the ASO acts as a momentum oscillator, giving averaged percentages of bull/bear sentiment. It’s particularly potent in discerning sentiment during specific candle periods, assisting in trend identification or pinpointing entry/exit moments. The tool was conceived by Benjamin Joshua Nash and modified from its MT4 version. The oscillator’s design, showcasing Bulls % with a blue line and Bears % with a red line, illuminates the prevailing sentiment in the market.

At press time, XRP traded at $0.5990. Upon examining the 1-day chart, it’s evident that the XRP price faced a second rejection at the 0.382 Fibonacci retracement level, which stands at $0.625.

Although the RSI has settled somewhat, it remains elevated in the overbought zone at 71. This suggests that the price might gear up for another shot at overcoming this resistance. However, if it doesn’t succeed, a pullback to the 0.236 Fibonacci retracement level, priced at $0.553, may be on the horizon. On the upside, the 0.5 Fibonacci retracement level, pegged at $0.683, represents the next potential price target.