Federal law enforcement has seized $54 million worth of cryptocurrencies from the leader of a notorious New Jersey drug ring, U.S. Attorney Philip R. Sellinger said Thursday in a statement.

Solana Price’s 70% Rally Persuades Detractor, Arthur Hayes Makes Confession

Supported by a spike in volatility, the Solana price has skyrocketed from its yearly lows into a new high. The bullish momentum left some players in disbelief, while others capitulated to the price action and tried to capture some of the profits.

As of this writing, SOL trades at $40 with sideways movement in the last 24 hours. Over the previous week, the cryptocurrency recorded a 30% profit, but the monthly chart saw a 70% increase, while other tokens hardly saw double-digit gains.

Solana Rally Changes Arthur Hayes’ Mind

SOL’s recent bullish price action is even more impressive when considering higher timeframes. At the end of 2022, due to the collapse of its most prominent supporter crypto exchange, FTX, the cryptocurrency lost almost all its yearly profits.

During the 2021 bull run, Solana climbed to an all-time high of around $250. In the last days of FTX and Sam Bankman Fried (SBF), the cryptocurrency declined below $10. Now that the token approaches the $50 mark, critics like the former CEO of crypto exchange BitMEX, Arthur Hayes, have reconsidered their position.

Hayes has been vocal about its stance regarding FTX, Bankman-Fried, and the other bankrupted companies in 2022 and the tokens associated with these entities. However, regarding SOL, the BitMEX Co-Founder said:

Fam I have something embarrassing I must admit. I just bot $SOL, I know its a Sam-coin piece of dogshit L1 that at this point is just a meme. But it is going up, and I’m a degen. Let’s Fucking Go!

Arthur Hayes Expects Further Gains

The former BitMEX CEO has publicly expressed his position regarding Bitcoin’s potential to reach new all-time highs. A rally in the number one cryptocurrency would inevitably spill over to Solana.

As NewsBTC reported, in a detailed analysis, Hayes highlighted the intricate connection between global financial trends and Bitcoin’s future, emphasizing the influence of government policies and financial disturbances on investment strategies.

The former BitMEX CEO anticipates a period of market turbulence, with Bitcoin’s value chopping around $25,000 to $30,000, driven by negative real rates and a shift towards diversified investment portfolios. This, he believes, will particularly favor cryptocurrencies, such as Solana.

Looking ahead, Hayes projects a bullish trend for Bitcoin, estimating its value could reach approximately $70,000 by the end of 2024, influenced by the Bitcoin Halving event and potential Exchange Traded Fund (ETF) launches. His long-term vision extends even further, predicting an extraordinary financial boom across various markets, potentially driving Bitcoin’s value between $750,000 and $1,000,000 by 2026.

This optimistic forecast is rooted in his belief that major financial indices, like the NASDAQ and S&P, alongside other significant assets, will experience unprecedented growth, marking a historic boom in the financial markets.

On a related note, Hayes also speculated that a return to aggressive money printing strategies by the US Federal Reserve could act as a substantial catalyst for Bitcoin’s ascent, further fueling the anticipated financial euphoria.

Cover image from Unsplash, chart from Tradingview

Marathon Digital will use landfill methane to mine Bitcoin in Utah pilot project

The BTC miner has partnered with startup Nodal Power for a green, off-grid project that is a small start for a potentially big advancement.

The Other FTX Case

Most of the charges facing SBF this week won’t ever be relevant to most crypto companies. But charges the government cannot pursue today could be, say Andrew C. Adams and Kane Smith, at Steptoe & Johnson LLP.

Analyst Raises Red Flag On Bitcoin Rally, Predicts Imminent Retreat After 35% Spike

As Bitcoin (BTC) continues to consolidate above the $34,000 mark, aiming to surpass and reclaim its yearly high, theories suggest that a retracement may follow the current upward spike in the coming weeks.

On this matter, the renowned crypto analyst known by the pseudonym “Crypto Soulz” recently shared insights on the potential short-term retracement for Bitcoin in a recent post on X (formerly Twitter).

BTC’s Local Top At $36,000 Signals Potential Reversal

According to Crypto Soulz, a key resistance level for Bitcoin is identified at $37,370. The analyst suggests that this resistance level will not likely be retested from the current position.

Additionally, Soulz highlights that liquidity has been absorbed around $36,000, which he considers a “trigger” for taking short positions.

The analyst points out that the local top for BTC was observed at $36,000, where a long wick was formed, followed by a retracement. This price action is seen as a potential indication of a reversal.

Moreover, Crypto Soulz emphasizes using on-chain data as a confluence for BTC positions. Soulz highlights that the spot market showed an uptrend before the perpetual futures contracts followed suit.

The spot order book (OB) is stated to be increasing but expected to decrease, along with the perpetual market. If $36,000 indeed serves as a local top, the analyst suggests that both spot and perpetual should subsequently decrease.

Furthermore, Soulz highlighted that BTC successfully broke through key technical indicators, such as the 200-day simple moving average (SMA), the 200-week SMA, and the 365-day SMA, which is currently acting as support.

Ultimately, Soulz further states that there is no substantial liquidity available above $38,000. The analyst identifies two liquidity pools, as seen in the chart above: the first at $33,000, which he considers its initial target, and the second at $31,000, where a slight bounce may occur.

Bitcoin Potential As Store Of Value

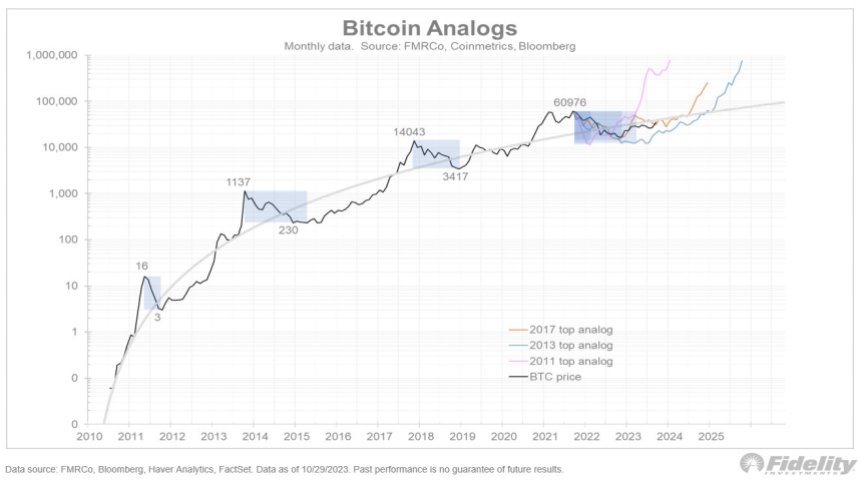

In another development, Jurrien Timmer, Fidelity’s Director of Global Macro, delved into the characteristics of Bitcoin and its potential to serve as a store of value and hedge against monetary debasement.

Drawing parallels to gold, Timmer highlighted Bitcoin’s “unique attributes” and its ability to potentially gain market share in times of inflation and excessive money supply growth.

Timmer acknowledged that Bitcoin had followed a pattern of “boom-bust cycles,” much like its previous market behavior. However, he also emphasized Bitcoin’s evolving role as a commodity currency that aspires to be a store of value.

Furthermore, Timmer described Bitcoin as “exponential gold,” suggesting that it shares similarities with gold but with additional growth potential.

While gold has traditionally been recognized as a store of value, Timmer noted its limitations as a medium of exchange due to its deflationary nature and lack of efficiency.

Timmer drew attention to historical periods, such as the 1970s and 2000s, when gold exhibited strength and gained market share. These periods coincided with structural regimes marked by high inflation, negative real rates, and excessive money supply growth.

Timmer hinted that Bitcoin, with its potential to serve as a hedge against inflation and debasement, could play a similar role in such environments.

Considering Bitcoin’s attributes and the changing macroeconomic landscape, Timmer expressed optimism about its potential to join the ranks of gold as a valuable asset.

While acknowledging the volatility and speculative nature of cryptocurrencies, Timmer believes that Bitcoin’s unique characteristics position it as a viable contender in the store of value space.

Currently, BTC is trading at $34,700, reflecting a 1.5% increase over the past 24 hours as it persists in reaching the $35,000 mark.

Featured image from Shutterstock, chart from TradingView.com

NIST establishes AI Safety Institute Consortium in response to Biden executive order

Documentation from NIST states the consortium will adopt a “broad human-centered focus” with “specific policies.”

Bitcoin price cools off, but ‘You can never have too much Bitcoin, says Saylor

BTC price cooled off after an impressive 30% monthly gain, but MicroStrategy CEO Michael Saylor made the case for why he remains bullish on Bitcoin.

Coinbase Beats Q3 Earnings Estimates While Trading Volume Falls

The crypto exchange’s third quarter transaction revenue rose/fell short from previous quarter.

Solana Is Down 15% Since Hitting a 14-Month High. Is the Rally Over?

Solana’s [SOL] spectacular comeback – up over 300% this year – has captivated crypto market participants after being one of the most beaten-down assets during the bear market.

Altcoins At Turning Point? Analyst Says ‘Time To Load On The Dips, It’s A Different Sentiment’

The crypto market is bullish, with several altcoins charting notable gains. Solana (SOL) leads this charge, which has seen a roughly 35% increase in value over the past week.

This uptrend is not isolated to Solana alone; other major altcoins like XRP and Cardano (ADA) also enjoy significant upticks. This trend signals a potentially broader market recovery and offers a positive outlook for investors who have weathered a prolonged bear market.

Buying On The Dip: A Strategy For Growth

Michaël van de Poppe, a renowned analyst in the crypto analysis sphere, has recently spoken out about the shift in market dynamics. In his view, altcoins are not just rising; they are breaking out, signaling a more profound change in the crypto ecosystem.

This breakout could be the indicator of an even more substantial growth phase for these digital assets, according to the analyst.

Amid this resurgence, Michaël van de Poppe has offered strategic advice to the crypto investment community. The analyst believes that the current prices of altcoins represent a dip in the market, presenting a prime opportunity for buying. With a clear shift in sentiment, the analyst encourages investors to capitalize on these lower entry points.

The analyst also draws an alignment between the current market conditions and the end of the bear market cycle 2018, suggesting that we may be on the cusp of a similar reversal.

With the US monetary policy tightening phase seemingly coming to an end, there’s an air of optimism that the bearish grip on the market may be loosening, according to the analyst.

Van de Poppe’s analysis also posits that the market is transitioning, setting the stage for the conclusion of the bear cycle and the beginning of sustained growth.

#Altcoins are breaking out significantly and I think majors are going to follow suit.

Time to load on the dips, it’s a different sentiment. Hiking policy is coming to an end -> end of bear market in 2018. End of bear market as we speak.

Enjoy the ride!

— Michaël van de Poppe (@CryptoMichNL) November 1, 2023

Altcoins: SOL And XRP Record Double Digit Gains Except For ADA

Meanwhile, before Van de Poppe’s analysis, Solana and XRP had recorded double-digit gains, with Solana taking the lead, recording a massive gain of 35% in the past 7 days. XRP saw a 10.5% gain over the same period.

Both assets currently trade at $41.51 and $0.60, respectively, at the time of writing, with SOL recording a mere increase of 0.2% over the past 24 hours and XRP gaining 1.4% in the same period.

While ADA has only seen a slightly lesser gain of just 5.8% in the past 7 days, the altcoin records the highest gain among these three top altcoins in the past day. ADA trades at $0.30, up by 6.5%, over the past 24 hours.

Featured image from Unsplash, Chart from TradingView

XRP, TON win approval in Dubai International Financial Centre free trade zone

The new tokens join the ranks of BTC, ETH and LTC for use by the 4,000-plus companies located in the zone, which is considering new legal measures as well.

Discredited Crypto Terrorist Funding Figures Gain Fresh Life in House Hearing

Despite a raging online debate discrediting the scale of crypto support for terrorist groups, the story continues to resonate in important places. Most recently on Thursday, the ranking Democrat at a hearing in the U.S. House of Representatives quoted a figure of $130 million in digital assets flowing to terrorists.

Aragon Association to dissolve, will disburse $155M in assets to token holders

The governing body for the aragonOS DAO-creation tool will wind down, transferring its assets to token holders.

Celestia Price Prediction as TIA Pumps 15%; Which Cryptos Could Surge Next During the Bull Run

The price of Celestia (TIA) has surged over 15% since yesterday, making it one of the biggest gainers on CoinMarketCap.

With the TIA token now hovering around $2.50, early investors are wondering just how high its price could go in the remaining weeks of 2023.

This article will take a closer look at Celestia’s price action, forecast where the token could be headed next, and highlight some of the most promising new cryptocurrencies that could be primed for a significant breakout.

Celestia’s TIA Token Surges After Mainnet Launch – Can the Momentum Continue?

It’s been a great start to life for Celestia, with the project’s mainnet going live on October 31 and TIA tokens airdropped to 580,000 users.

The hype around this event has resulted in a surge in demand for TIA, making it the 20th most-traded cryptocurrency globally.

Although the token is only a few days into its lifespan, investors are speculating that the uptrend could continue throughout November and beyond.

The token’s high of $2.86 on Wednesday is a natural target for bulls and may act as a minor resistance zone.

If TIA can breach this level, the token will be in uncharted territory.

The next level to watch will be the $3.00 and $5 marks, likely representing psychologically important barriers for TIA holders.

With the current momentum and hype around the token, TIA could certainly aim for these levels in the coming weeks.

However, sustainability remains a concern, given the likelihood of profit-taking after such an explosive debut.

Regardless of what happens, it’s clear that Celestia has captured the attention of the crypto community, with its rapid rise highlighting the enthusiasm for new projects.

Which New Cryptos Could Be Next to Surge?

While Celestia’s TIA token has been in the spotlight recently, several other emerging cryptocurrencies could be poised for a breakout.

As investors seek the next hot altcoin, the three projects below could have the ingredients needed to attract significant demand before the end of the year:

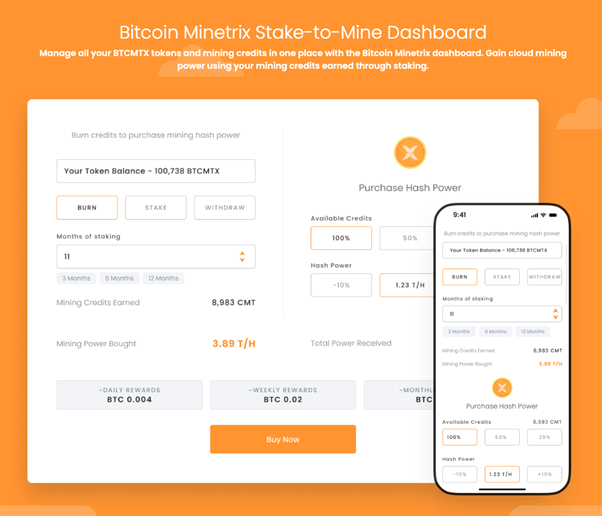

Access Cloud BTC Mining & Staking Using Innovative Bitcoin Minetrix Platform

First up is Bitcoin Minetrix (BTCMTX), a revolutionary platform that allows users to mine Bitcoin and earn rewards simply by staking their BTCMTX tokens.

This mechanism, called “Stake-to-Mine,” provides a more accessible way for users to participate in the mining process without needing expensive computing equipment.

Bitcoin Minetrix’s platform is still in development, although interested investors can buy BTCMTX tokens in advance through the project’s tier-based presale phase.

The price per BTCMTX token is currently $0.0114, although it will increase by 10% in just over four days.

Through this setup, those who invest the earliest are rewarded with a more attractive entry point – which could prove fruitful once BTCMTX is listed on the open market.

Alongside speculative potential, BTCMTX investors can also benefit from staking rewards of over 185% APY, with 222 million tokens pledged already.

If the development team can deliver on their roadmap goals, including a mobile app launch and partnerships with industry-leading cloud mining providers, then BTCMTX could be primed for an end-of-year surge.

Visit Bitcoin Minetrix Presale

Meme Kombat Gamifies Meme Culture with High Yields & Battling Mechanic

Next up is Meme Kombat (MK), a brand-new meme coin project that draws inspiration from the famous Mortal Kombat franchise.

Meme Kombat’s flagship feature is its Ethereum-based battle arena, where users can place bets using MK tokens on the outcomes of AI-powered battles.

These battles feature famous meme coin characters like Wojak and DOGE – providing an engaging gameplay experience for crypto enthusiasts.

On top of the battle mechanic, Meme Kombat offers a high-yield staking protocol whereby MK holders can generate APYs of 112%.

Notably, these yields begin accruing during the presale, with rewards able to be withdrawn once the platform officially launches.

From a tokenomics perspective, Meme Kombat’s team has allocated 50% of the MK supply to presale buyers and 30% for staking/battling rewards.

This highlights their community-focused approach – one of the main reasons that Meme Kombat’s presale has generated such traction in recent weeks.

The presale has already raised over $1 million and offers MK tokens at the low price of $0.1667.

With DEX listings scheduled for once the presale concludes, MK could be another exciting altcoin primed for a price surge.

Groundbreaking TG.Casino Offers Anonymous Crypto Gambling Integrated Into Telegram App

Lastly, TG.Casino (TGC) is a fully-fledged cryptocurrency casino integrated directly into the Telegram app.

By integrating with Telegram, TG.Casino can provide users with a seamless and intuitive gambling experience.

Users don’t need to download additional software or applications and can place bets anonymously since TG.Casino doesn’t require KYC verification.

Moreover, users can fund their accounts using crypto, including TG.Casino’s native TGC token.

Those who opt to place bets using TGC will be rewarded with 25% cashback on any sustained losses.

These elements are underpinned by a full gaming license from Gaming Curacao, along with end-to-end encryption to ensure user data remains secure.

TGC holders can even stake their tokens and earn yields exceeding 313% annually.

Like the two projects mentioned above, TG.Casino is still in its presale phase, yet it allows investors to buy TGC tokens before their open market debut.

TGC tokens are currently available for $0.15, although with over 66% of the allocation snapped up already, there’s a growing belief that the presale could sell out soon.

Bitcoin’s 108% YTD Surge Highlights Crypto’s Growing Prominence

Bitcoin (BTC) witnessed a remarkable surge in its price, nearing the $36,000 mark, sending ripples across the cryptocurrency market. While multiple factors contributed to this price rally, one significant driver appears to be the decision by the US Federal Reserve to halt interest rate hikes, albeit with the potential for future increases.

Additionally, the overall sentiment in the crypto market remains bullish, with a collective market cap of approximately $1.36 trillion, bolstered by the expectation of positive regulatory developments.

Institutional Focus

The recent listing of exchange-traded funds (ETFs) by prominent financial giants such as ARK Invest, BlackRock, and Invesco on the Depository Trust & Clearing Corporation (DTCC) site has ignited speculation about their strategic intentions. These ETF listings are a clear indicator that these financial powerhouses are aiming at capturing the attention of money-loaded investors and institutional players.

Such ETFs are designed to cater to the needs of larger investors who prefer a more regulated and mainstream entry into the crypto market. They offer exposure to Bitcoin without the need for direct ownership, making it an attractive proposition for institutions seeking to diversify their portfolios.

The move to list these ETFs on the DTCC, a crucial infrastructure provider for the financial industry, signals a growing acceptance and integration of cryptocurrencies within the traditional financial ecosystem.

Federal Reserve’s Influence On Bitcoin Price

The current BTC price, as reported by CoinGecko, stands at $35,365, reflecting a notable 24-hour gain of 2.5% and a seven-day increase of 2.0%.

The decision made by the US Federal Reserve to maintain interest rates without further increases plays a pivotal role in the current state of the crypto market.

Federal Reserve Chairman Jerome Powell kept the possibility of future rate hikes on the table, dependent on macroeconomic conditions. While this move has provided temporary relief to crypto enthusiasts, the uncertainty about future rate increases still looms.

Historically, raising interest rates has been perceived as a bearish signal for risk-on assets, including cryptocurrencies. Investors often seek safer options when interest rates rise, as these assets are considered more stable and provide a better return on investment.

Therefore, the Federal Reserve’s decision to pause interest rate hikes has provided a favorable environment for BTC and the broader crypto market to flourish.

Can you spot the outlier? pic.twitter.com/y5IIY1fVyx

— ecoinometrics (@ecoinometrics) November 1, 2023

BTC’s Phenomenal Year-To-Date Growth

BTC’s meteoric rise since the beginning of the year cannot be understated, with a staggering 108% increase in value to date. This remarkable growth significantly outpaces other major investment options in the financial world. The implications of this metric are profound, as it highlights Bitcoin’s growing prominence as an investment asset, even surpassing traditional options like stocks and bonds.

Investors are drawn to BTC not only for its potential for substantial returns but also as a hedge against inflation and economic uncertainty. The year-to-date performance underscores the sustained interest in Bitcoin, driven by both retail and institutional investors, who recognize its long-term value and potential to reshape the financial landscape.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock

Law professor says blockchain tech could ‘revolutionize’ copyright offices

According to the research, blockchain provides several game-changing benefits for intellectual property licensing and management.

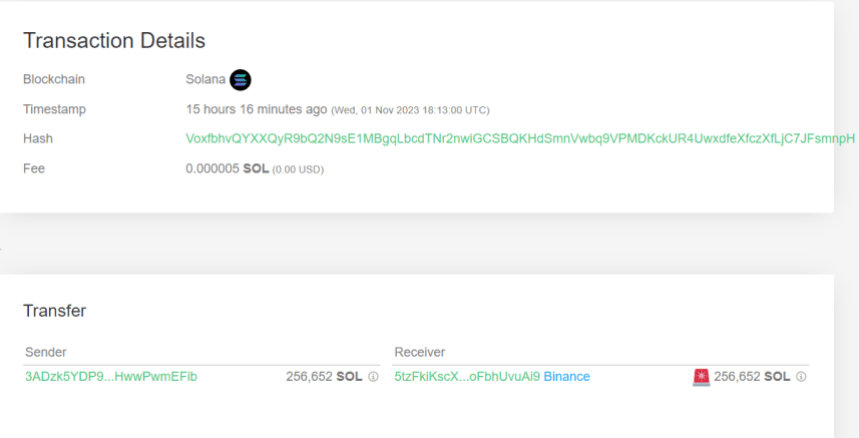

Solana Whales Deposit To Exchanges, Selloff Incoming?

Data shows Solana whales have made large transactions towards exchanges during the past day, which could signal a selloff.

Solana Whales Have Deposited Tokens Worth $34.1 Million To Binance

According to data from the cryptocurrency transaction tracker service Whale Alert, a few large SOL transfers have occurred on the Solana blockchain during the past day.

Three of the transactions were all headed towards a centralized exchange: Binance. The first of these saw the movement of 256,652 SOL (worth about $11.3 million at the time of the transfer), the second 249,999 SOL ($10.8 million), and the third 282,695 SOL ($12 million).

As the amounts involved in these transfers are substantial, it’s safe to assume that whale entities were behind them. Since the whales are influential beings in the cryptocurrency ecosystem, their transactions can be worth keeping an eye on, as they may precede volatility in the price.

How their transfers may affect Solana depends on what they intend to do with them. As the details of the first of these transactions show below, it would appear that the transfer originated from an unknown wallet (which is possibly the whale’s personal, self-custodial address).

As the whale has moved their coins from self-custody to this central entity, they likely wanted to make immediate use of one of the services the platform provides. This includes selling, of course, but it’s hard to say from the transaction data alone whether that is the case here.

When looking at the surrounding price action, though, selling would appear like a reasonable possibility after all, as the SOL price has enjoyed a sharp rally recently that has put the asset 34% in the green for the past week.

It’s not unusual to see whales jumping at substantial profit-taking opportunities like this rally has provided. As such, if profit-taking is indeed the goal, then the rally could feel some impedance from the deposit.

Interestingly, the data of the other two Binance deposits from today reveals the addresses involved were the same as the ones in this transfer, implying that the same entity could be behind them.

The latest of these moves was made just a few hours ago, which might add merit to the theory that the whale is participating in selling, as Solana has seen an additional 10% uplift in the past 24 hours, so this humongous investor may be capitalizing on the opportunity.

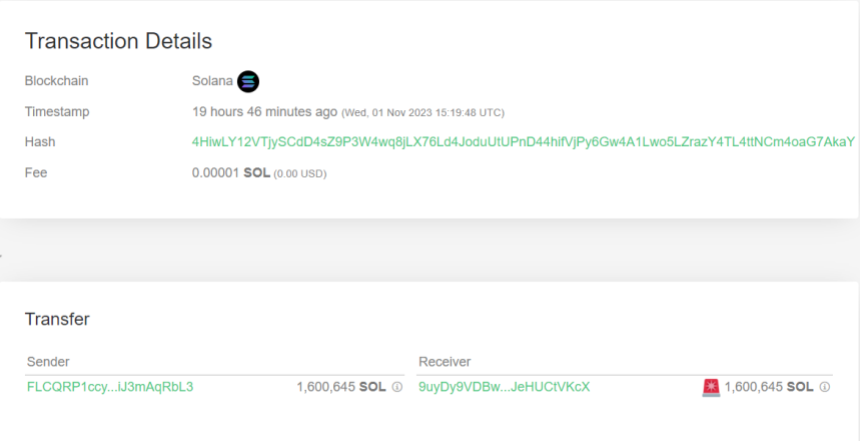

Another whale has also made a large Solana transfer inside the window of the last day, but this move is between two unknown wallets, making it hard to guess what the purpose behind it could have been.

This $66.2 million move could have been for selling through a P2P deal, or perhaps it was something as simple as the whale changing addresses. Whatever the case might have been with this and the other transfers, though, Solana has managed to keep up its climb just fine so far.

SOL Price

Following the latest leg in the Solana rally, the asset has claimed the $43 mark for the first time in more than a year.

If PayPal’s Stablecoin Is a Security, Anything Could Be

Here’s Why Bitcoin Will 10X From Here: Michael Saylor

The MicroStrategy executive chairman appeared on CNBC on day after the company reported its Q3 earnings.

Will Hashdex’s ‘Undeniable’ Distinctions Help Win Bitcoin ETF Race? Some Analysts Think So

ETF analysts watching the spot-bitcoin ETF race appear to be backing Hashdex’s modified application more than any other.