USDT, also known as Tether, has become an integral part of cryptocurrency markets since its launch in 2014. Pegged 1:1 to the US dollar, it is the most widely used stablecoin with a market capitalization of over $83 billion as of October 2023. But it is also controversial, with opaque reserves and questions around its long-term viability.

Here is an in-depth look at how USDT works, its importance in crypto, and the risks it presents.

What is USDT? Overview of Tether Stablecoin Cryptocurrency

At its core, Tether functions as a stablecoin, meaning each token is backed by an equivalent amount of traditional fiat currency.

This peg to the dollar aims to minimize volatility compared to other cryptocurrencies like Bitcoin and Ethereum. USDT operates on different blockchains like Bitcoin, Ethereum, Tron and others, allowing it to be transferred seamlessly between different networks.

Crypto traders rely on USDT as a stable store of value when trading between different digital assets. It is also widely used on decentralized finance (DeFi) platforms for lending, borrowing, and making payments.

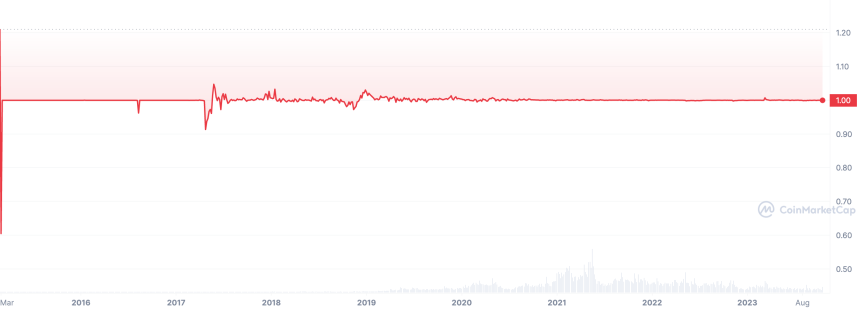

USDT price: $1

USDT Market Cap: ~$83 billion (as of October 2023)

Key Features of USDT Crypto

The key features that define Tether include:

- Pegged 1:1 to the US dollar – USDT aims to maintain parity with the dollar

- Operates on different blockchains – Enables transfer between networks

- Hedges against crypto volatility – Acts as a stable haven when markets are fluctuating

- Wide adoption – Used extensively in crypto trading and DeFi protocols

How Does USDT Maintain Its Dollar Peg?

According to Tether Limited, the company behind USDT, every token in circulation is backed 1:1 by their reserves, which include both traditional currency and cash equivalents. When buyers purchase USDT by depositing $1 per token, new tokens are issued while the dollars are held in reserves.

This mechanism theoretically allows users to redeem each USDT to USD. By allowing two-way convertibility between USDT and dollars, the supply can adjust to maintain the 1:1 parity.

However, Tether’s reserves have been shrouded in secrecy over the years, leading to allegations that the company does not hold sufficient dollar reserves to back all USDT in circulation. Tether settled a case with the New York Attorney General in 2021, agreeing to release periodic reports on its reserves.

So far, the redemptions have generally maintained the dollar peg. But questions linger over the breakdown of reserves and their adequacy as USDT supply has ballooned.

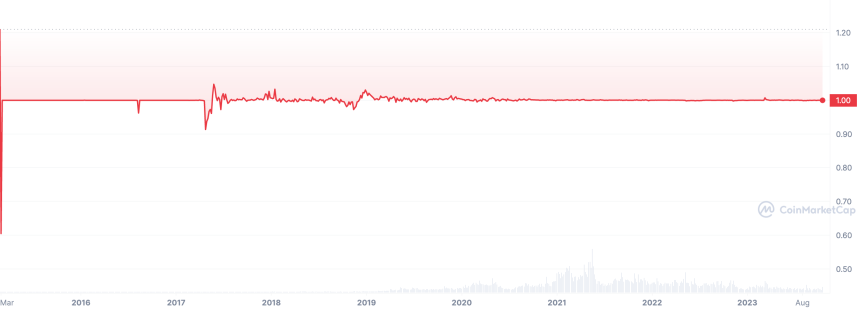

USDT Price Chart from CoinMarketCap

The Role and Importance of USDT in Crypto

Despite the opacity, USDT continues to play a hugely important role in cryptocurrency markets. It is one of the most widely traded crypto assets, with daily trading volumes in the billions of dollars against assets like Bitcoin.

Exchanges rely on stablecoin trading pairs like BTC/USDT to enable traders to hedge risk during times of high volatility.

USDT is also widely integrated into DeFi protocols like lending and borrowing platforms, decentralized exchanges, yield farms, and more. It provides stability in an otherwise volatile environment for decentralized finance.

The demand for USDT trading, transactions, and parking value in a stable asset continues to drive increasing adoption.

Future Outlook for Tether Stablecoin

Going forward, the biggest threat to USDT is the risk of losing its 1:1 dollar peg and collapsing in value if its reserves are inadequate. Tether also faces potential regulatory crackdowns from authorities who may threaten its viability. Competing stablecoins like USDC and BUSD are more transparent about reserves and could gain share.

However, USDT retains first-mover advantage and the network effects of wider integration in crypto infrastructure. It continues to maintain peg stability through redemptions so far. If Tether can provide greater transparency and embrace compliance, USDT may retain its dominant position for some time. But traders should exercise caution and understand the risks of relying too much on USDT long-term.

Despite controversies around reserves and regulation, Tether remains an integral cog in the crypto economy machine. But as the market matures, stablecoins built on greater transparency and compliance are likely to emerge as leaders.

How Does USDT Work?

There are a few key mechanisms that enable USDT to function as a stablecoin pegged to the US dollar:

Minting and Issuing New USDT

Tether mints new USDT when buyers deposit $1 per token with the company. The dollars are added to reserves, while an equivalent amount of USDT is issued on the blockchain ledger. This USDT enters circulation when transferred to the buyer’s wallet address. The minting helps adjust supply to match demand.

Sending and Receiving USDT Transactions

Once issued, USDT can be transacted between addresses on its supported blockchains like any other cryptocurrency. Senders can broadcast transactions and pay small network fees to send USDT to recipients’ wallet addresses. These peer-to-peer transactions are recorded transparently on public blockchain explorers.

Trading USDT on Exchanges and DeFi

USDT is listed as a trading pair on most major centralized crypto exchanges as well as decentralized exchanges. Traders can use USDT to buy and sell other cryptos like Bitcoin in a stable manner when volatility is high. In decentralized finance, USDT also serves as a stable currency for lending, borrowing, liquidity provision, and more.

Redeeming USDT for Dollars

In theory, USDT holders can redeem each token for exactly 1 US dollar from Tether Limited. This is made possible by the underlying reserves that back each token. Redemptions help maintain the 1:1 peg when USDT falls below $1 on exchanges. However, Tether reserves the right to delay or deny redemptions in some circumstances.

Pros and Cons of USDT Stablecoin

USDT provides stability amid crypto volatility but also carries risks:

Pros

- Avoid volatility by parking value in USDT

- Seamless transfers between blockchains

- Wide acceptance in crypto ecosystem

- Useful for decentralized trading and finance

Cons

- Opaque reserves raise viability concerns

- Regulatory crackdowns could threaten operations

- Reliant on Tether’s redemption policy to maintain peg

- Vulnerable to bank runs if reserves are inadequate

Tether pioneered stablecoins in crypto but transparent alternatives like USDC are emerging. Regulatory direction will play a key role in determining whether USDT maintains dominance long-term.

In conclusion, USDT remains indispensable for crypto trading and finance today. But prudent users should assess risks of relying extensively on USDT if its opaque operations and reserves raise too many questions about its sustainability. As the sector develops, the stability and transparency offered by its competitors could make them a safer bet over the coming years

USDT FAQ: Tether Frequently Asked Questions & Answers

What is USDT TRC20?

USDT TRC20 is the version of Tether stablecoin issued on the Tron blockchain as a TRC20 token. It allows faster transactions and lower fees compared to USDT on Ethereum. USDT ERC20 is available only on Ethereum.

What does USDT mean?

USDT stands for United States Dollar Tether. It is a cryptocurrency issued by Tether that is pegged 1:1 to the US dollar. Each USDT token is backed by $1 in reserves according to Tether Limited.

What is the difference between USDC and USDT?

USDC is issued by Circle while USDT is issued by Tether. USDC has greater transparency on reserves and audits compared to the more opaque USDT. However, USDT currently has wider adoption in crypto trading and DeFi applications.

What is Tether USDT?

Tether USDT is a stablecoin cryptocurrency whose value is pegged to the US dollar on a 1:1 basis. It allows crypto traders and users to avoid volatility by storing value in USDT tokens backed by equivalent USD reserves.

What does USDT stand for?

USDT stands for United States Dollar Tether. It is the ticker symbol used to designate the Tether stablecoin whose value is pegged to the US dollar.

Is USDT a cryptocurrency?

Yes, USDT is a cryptocurrency token issued on various blockchains. However, unlike volatile cryptos, USDT is a stablecoin designed to have a stable value through US dollar reserves.

What is the USDT token contract address?

The USDT token address allows users to verify USDT transactions on block explorers. For example, the USDT Ethereum contract address is 0xdac17f958d2ee523a2206206994597c13d831ec7.

What is the current price of USDT?

The price of USDT is pegged to $1.00 USD. It aims to maintain parity with the dollar through Tether Limited’s dollar reserves that back each USDT token 1:1.

What is USDT crypto used for?

USDT provides stability versus volatile crypto assets. It is used for trading, payments, earning yield, loans, and other financial activities where dollar-pegged stability is preferred.

Where can I buy USDT coins?

USDT can be purchased on most major crypto exchanges like Binance, Coinbase, Kraken, KuCoin etc. You can trade dollars or cryptos like BTC for USDT tokens on these centralized platforms.

Is it safe to invest in USDT stablecoin?

USDT does carry risks related to transparency and reserves that should be considered. Stablecoins like USDC with more transparency could potentially be safer long-term investments.