Bitcoin started the week with a bang, but the real question is, what is driving the move and is it sustainable?

Cryptocurrency Financial News

Bitcoin started the week with a bang, but the real question is, what is driving the move and is it sustainable?

Paul Brody, a prominent figure in the blockchain community and the Global Blockchain Leader at Ernst & Young (EY), recently shed light on the burgeoning demand for crypto, with Bitcoin taking the limelight. Earlier today, during a CNBC interview, Brody emphasized the heightened interest, particularly from family offices.

According to Brody, family offices, which typically manage the vast wealth of affluent families, are increasingly diversifying their portfolios with cryptocurrencies. This is not entirely surprising, given the meteoric rise of Bitcoin and its potential as a hedge against inflation and economic uncertainty.

However, while family offices are diving headfirst into the crypto pool, institutional investors are more cautious.

Brody mentions that these larger entities, controlling over 200 trillion dollars in assets, are awaiting regulatory clarity, such as the approval of a Bitcoin ETF by the US Securities and Exchange Commission, before committing significant resources.

Bitcoin, despite comparisons, is distinctly different from traditional assets like gold. Brody highlights a unique trait of Bitcoin: its price does not result in increased issuance. Instead, the issuance of new Bitcoin reduces over time due to halving events.

This property makes its price more “rigid,” especially compared to other assets traditionally used as inflation hedges.

Moreover, the purpose behind acquiring Bitcoin varies among its buyers. Brody points out:

If you look at people who are buying Bitcoin, they are buying it as an asset. They are not buying it as a payment tool.

Brody further notes that Ethereum, another major cryptocurrency, is mostly acquired for its utility as a computing platform, particularly for business transactions and decentralized finance (DeFi) solutions.

So far, Bitcoin has showcased a bullish trend, witnessing a near 10% increase over the past week and a 4.7% uptick in the last 24 hours. This surge has propelled Bitcoin to trade beyond the $31,000 mark, reaching $31,824 recently.

Observing the asset’s chart in the 1-day timeframe, BTC seems poised for even higher gains. As shown below, the asset has recently tapped into an order block and could continue its reversal to the upside, reaching a notable high.

Additionally, considering the strong institutional demand for BTC, as revealed by Brody, coupled with the potential approval of a spot BTC ETF, a rally to the $40,000 mark seems to be on the horizon.

Furthermore, peering into the future of the financial landscape, Brody believes that traditional fiat currencies will continue to hold their ground.

However, with the ongoing discussions around Central Bank Digital Currencies (CBDCs) and the growing adoption of payment stablecoins, the crypto realm may be poised for evolution.

With global political developments unfolding and pivotal elections on the horizon, Brody foresees Bitcoin and the broader crypto space experiencing accelerated growth in adoption and recognition.

Featured image from iStock, Chart from TradingView

Exchange-traded fund analyst Eric Balchunas said the addition was “all part of the process” of a crypto ETF being listed and traded and a positive sign for SEC approval.

The tool is currently in the research stage but the team plans to integrate it with its existing artist protection tools.

Usage is down, but the future of crypto looks bright thanks to adoption in up-and-coming economies, according to Chainalysis.

Solana has gained the favor of institutional investors recently which has seen a marked increase in the amount of inflows that the altcoin has recorded. This trend has continued with last week’s numbers which show a significant amount of inflows for Solana compared to the likes of Ethereum.

According to data from the latest CoinShares report, the inflows into Solana for the last week came out to $15.5 million. This came while some altcoins such as Ethereum saw outflows for the week. For context, Ethereum outflows reached $7.4 million in the same time frame.

As a result of the latest round of inflows, the total Solana Asses under Management (AuM) has reached $74 million. This means that the Solana AuM is up 47% year-to-date, compared to Ethereum’s which has dropped continuously this year, climbing to $119 million in outflows year-to-date.

Cardano is another altcoin that saw inflows for the week but to a lesser degree. Its inflows were $0.1 million, bringing its total AuM to $24 million, with a $6 million increase year-to-date. Other investment products saw $0.9 million, leading their AuM to reach $76 million.

Multi-asset products, however, went the way of Ethereum with outflows of $0.6 million. This brings its AuM to $1.17 billion, a $31 million decrease year-to-date.

For the same week, Bitcoin once again came out ahead in terms of inflows, with numbers topping that of Solana. The leading cryptocurrency saw $55.3 million in inflows, bringing its AuM to $24.205 billion. The asset’s month-to-date inflows are currently sitting at an impressive $111.9 million.

In the same vein, Bitcoin’s year-to-date inflows have also remained on the high side with $315 million in inflows so far. This has further solidified its position as the leading asset with the most interest from institutional investors so far.

Short Bitcoin products were also not left out of the inflow trend. Its weekly inflows sit at $1.6 million, while the month-to-date inflows came out to $4.5 million. Its year-to-date inflows sit at $46 million, bringing its AuM to $99 million. In total, the AuM of crypto investment products is nearly $33 billion.

“Following recent price appreciation, total Assets under Management (AuM) have risen by 15% since their lows in early September, now totalling nearly US$33bn, the highest point since mid-August,” the CoinShares report said.

CoinShares also notes that the inflows could be linked to the excitement and anticipation of a Spot Bitcoin ETF being approved by the US Securities and Exchange Commission (SEC). However, the numbers are much lower compared to when asset manager BlackRock first announced that it had filed for a Spot Bitcoin ETF.

A deal was secured to pay those who had money at defunct FTX as much as 90% of the assets that remain, and now the lawyers representing some creditors are trying to get enough of those investors on board to make it happen.

The court decision was expected by many after the SEC did not appeal an Aug. 29 ruling requiring Grayscale’s Bitcoin ETF application to be reviewed.

From Hong Kong to Europe and the United States, regulators are pushing for more oversight and control over digital assets.

Cryptocurrency derivatives traders endured over $150 million liquidations over the past 24 hours Monday as rapidly surging digital asset prices caught many market participants off-guard.

The SEC failed to appeal the court’s initial ruling in favor of Grayscale.

Bitcoin has now broken the $31,000 mark with its latest rally. According to on-chain data, the level could be the next major milestone for BTC.

In a new post on X, analyst James V. Straten has discussed the profit/loss situation of the different yearly Bitcoin buyer cohorts. The indicator of interest here is the “realized price,” which keeps track of the average price at which investors in the BTC market bought their coins.

When the asset’s spot price is below this metric, the average holder in the sector is at a loss right now. On the other hand, it being above the indicator suggests the dominance of profits among the investors.

Here, Straten hasn’t shared the chart for the ordinary realized price for the entire circulating supply but rather a few versions of the metric that only consider buyers since the start of a particular year. The chart below shows the trend in the Bitcoin realized price for each year since 2017.

As is visible in the graph, the Bitcoin realized price for all years except 2021 is below the current spot price of the cryptocurrency. This implies that the different yearly cohorts of the asset are holding their coins at some net unrealized profit.

The latest groups to enter into a state of profit have been the 2022+ and 2023+ ones. The 2021+ group has a realized price of about $35,000 at the moment, which is still a significant distance away, but as Straten has noted, the gap between the spot price and the metric is now the narrowest since the two diverged back at the start of the bear market.

Interestingly, during the peak in 2021, this group’s cost basis was around $48,000. The analyst suggests their realized price, since decreasing significantly, indicates some impressive Dollar-Cost Averaging (DCA) in the market.

In on-chain analysis, major cost basis levels have always played an important role, as the BTC spot price has often observed support or resistance on retests of them.

The chart shows that the Bitcoin price had found support at the 2023+ realized price back in June. The recent seemingly endless consolidation that BTC saw before the latest rally happened around the 2022+ and 2023+ metrics after they had overlapped.

Given the historical examples, the 2021+ may realize price will cause the price to react somehow when it eventually reaches there. Thus, the $35,000 level would be a significant milestone for the asset, as successfully claiming it could imply clear waters ahead for the cryptocurrency.

At the same time, however, the chances of participants buckling and harvesting their gains are increasing with all these groups coming into profits. Such profit-taking can lead to a pullback in the price, at least in the short term.

At the time of writing, Bitcoin is trading at around $31,200, up 11% in the past week.

The IRS is looking to require crypto service providers to collect unprecedented swaths of data about their users — including names and Social Security numbers.

CBDC and de-dollarization saw major strides last week with the 1-million barrel deal on the Shanghai Petroleum and Natural Gas Exchange.

All applications to the U.S. Securities and Exchange Commission for spot bitcoin exchange-traded-funds (ETFs) may be approved together, predicts crypto ETF expert Stuart Barton, who, along with his company, pulled off two regulatory firsts recently.

Bitcoin (BTC)surged past $31,000 Monday for the first time since mid-July as cryptocurrency markets continued their October bull run.

Bitcoin is showing renewed strength and targeting yearly highs. Will altcoins follow suit?

Pieces of legislation aimed at establishing clarity on certain crypto policies are unable to move forward with half of the legislative branch of the U.S. government lacking leadership.

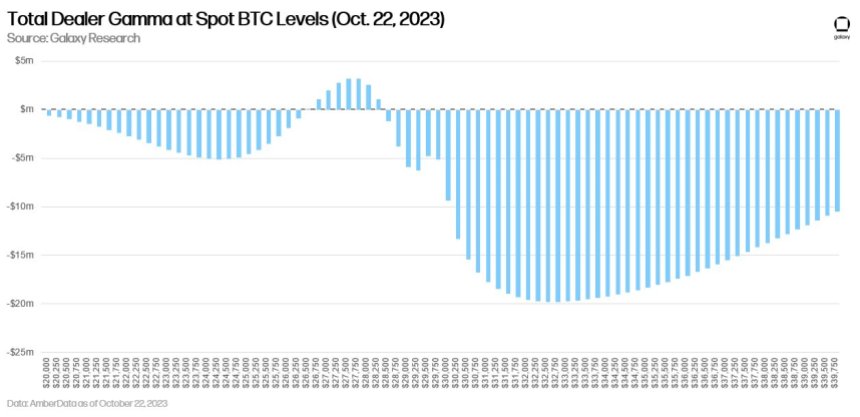

The Bitcoin market dynamics have recently taken an interesting turn, suggests Alex Thorn, Head of Firmwide Research at Galaxy. According to his recent thread on X, the options market makers in BTC are currently operating in a position that could significantly amplify any upward movement in its price.

“Options market makers in Bitcoin are increasingly short gamma as BTC spot price moves up. […] This should amplify the explosiveness of any short-term upward move in the near term,” Thorn notes.

This implies that as the spot price of Bitcoin rises, these market makers have to buy back more of the cryptocurrency to maintain their positions, a phenomenon that could potentially amplify price surges.

Moreover, he highlighted that data from Amber indicates that dealers are increasingly moving into a short gamma position, especially when the BTC price is above $28.5k. In more explicit terms, Thorn explains, “At $32.5k, market makers need to buy $20 million of delta for every subsequent 1% move higher.” Such positioning suggests that market makers might have to make substantial purchases of Bitcoin as the spot price continues to ascend.

However, it’s not just upward movements that are impacted. Thorn sheds light on the flip side of the coin as well. “Dealers are long gamma in the $26,750-28,250 range. When you’re long gamma & spot declines, you also have to buy back spot to stay delta neutral,” he comments. This means that any minor downward adjustment in price might find resistance as options dealers make necessary purchases to realign their positions.

For bullish investors, these dynamics present an attractive landscape. Thorn elucidates, “This is a great setup for bulls because if spot moves moderately higher, short gamma covering could make it rip much higher pretty quickly, but if it moves lower, long gamma covering could provide some support and limit near-term downside.”

Highlighting potential catalysts that might set the Bitcoin spot price in motion, Thorn pointed to the growing anticipation surrounding Bitcoin ETF approvals. Most recently, renowned personalities and institutions such as Cathie Wood, Paul Grewal, JP Morgan, and several analysts from Bloomberg Intelligence have expressed positive sentiments on the odds for approval.

Eric Balchunas and James Seyffart of Bloomberg predict that the odds of a spot Bitcoin ETF are 75% by the end of this year and 95% by the end of 2024. Additionally, Thorn mentions the recent surge in Bitcoin’s price above $31,000, suggesting it surpassed last month’s highs following the fake news of an ETF approval.

Beyond market sentiments and speculations, fundamental supply, and liquidity dynamics also play a role. Thorn mentions, “Bitcoin’s currently constrained supply and liquidity could also serve to amplify upward moves.” Notably, exchange balances of Bitcoin have plummeted to levels not seen since 2018.

Simultaneously, smaller entities are accumulating Bitcoin, while larger holders, often termed “whales,” appear to be reducing their positions. He underscores the strength of the Bitcoin community with a note on hodlers: “70% of supply has not transacted in 1+ years, 30% in 5+ years… ATHs both.”

With all these dynamics at play, Thorn aptly sums up the current state of the Bitcoin market: “The next several months will be very interesting — Bitcoin is the greatest show on earth.”

At press time, BTC traded at $30,676.

The confirmation comes as tensions between the United States and China continue to rise.