BC Technology may elect to sell parts of OSL’s business rather than the whole entity, according to the report, citing people familiar with the matter.

GameFi Token BIGTIME Rallies 250% in First Week; Analysts Raise Supply Concerns

BIGTIME debuted on select exchanges, including OKX and Coinbase, last Wednesday.

XRP On The Cusp Of Redemption? Unveiling Data-Backed Insights

XRP, the cryptocurrency at the center of a high-stakes legal clash between Ripple and the US Securities and Exchange Commission (SEC), has remained under the cloud of uncertainty, with its price trajectory impacted by the twists and turns of the legal battle.

Ripple, the company behind XRP, celebrated a legal win when a court ruled that XRP was not a security, providing a temporary reprieve for the embattled cryptocurrency. Nonetheless, market participants are acutely aware that the final resolution of this case could hold the key to XRP’s future value and trajectory.

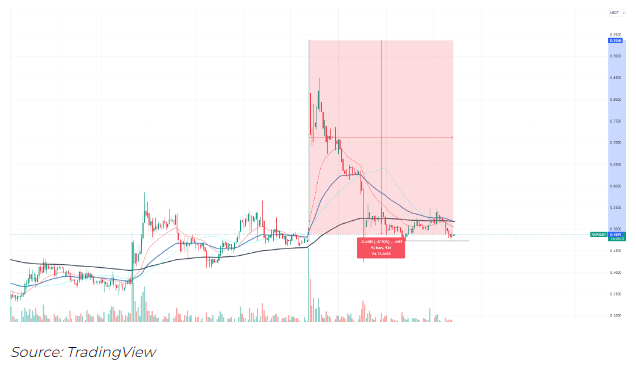

Recent analysis of the XRP price chart suggests a potential shift in the market sentiment, indicating that XRP might be on the cusp of an upward trend after a prolonged period of decline spanning over three months.

XRP Current Support Level As Short-Term Optimism

The examination of the recent price movements has unveiled a critical finding—XRP has gravitated towards a pivotal support level, steadfastly hovering around the $0.473 mark. Market observers are closely monitoring this level, recognizing its significance in determining the short-term trajectory of the cryptocurrency.

Historically, such support levels have proven instrumental in preventing further plunges, acting as a barrier against steep declines. A sustained position above this critical line could signal the presence of a strong buying interest, potentially fueling an optimistic outlook for XRP.

However, a concerning element has emerged from the analysis of the price chart—the ominous “death cross” phenomenon, which has been looming on the horizon. In technical analysis, the death cross occurs when a security’s short-term moving average crosses below its long-term moving average, suggesting a potential bearish turn for the asset.

XRP enthusiasts and traders are now closely scrutinizing this development, cautiously considering its implications for the future price movements of the cryptocurrency.

XRP’s Resilience Amid Legal Uncertainty

Meanwhile, a closer examination of the volume bars presents a more nuanced perspective. These bars represent the volume of XRP traded on specific days, offering insights into the buying and selling patterns associated with the cryptocurrency.

Despite the tumultuous legal environment and the price fluctuations, the volume bars do not reflect an overwhelming surge in selling volumes, providing a glimmer of assurance for XRP holders and market participants.

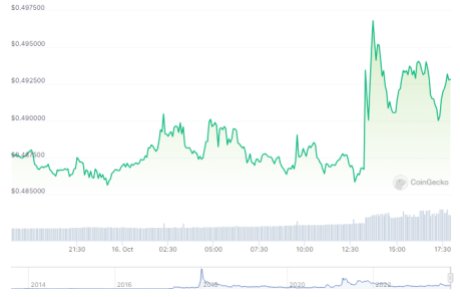

As of the latest market data, the current XRP price, as per CoinGecko, stands at $0.482482, showcasing a 24-hour gain of 1.4% despite a seven-day loss of 4.2%. These fluctuations, though reflective of the ongoing market volatility, underline the resilience of XRP in the face of the regulatory storm, as well as the cautious optimism brewing among traders anticipating a potential upward shift.

While the legal battle continues to cast its shadow over XRP, market participants remain cautiously optimistic, eagerly awaiting further developments that could shape the future trajectory of this resilient cryptocurrency.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

Australia open to idea of CBDC as future of money — RBA

The assistant governor of the Reserve Bank of Australia noted that pilot projects have highlighted several key areas where CBDCs could be of great use.

California ‘BitLicense’ Bill Signed by Gov. Newsom

The Digital Financial Assets Law will take effect on July 1, 2025.

Scammers prefer banking customers over crypto investors in Ireland: Report

To date, Irish authorities managed to recover approximately 4 million euros of the 20 million euros lost in banking scams since January 2023.

Bitcoin Gains Spark Bullish Call of ‘$15T Asset;’ BTC Forks Jump

One bull said bitcoin is “more valuable than gold” and will become a $15 trillion asset.

By The Numbers: Bitcoin Hashrate Poised To Complete 100% Growth In 2023

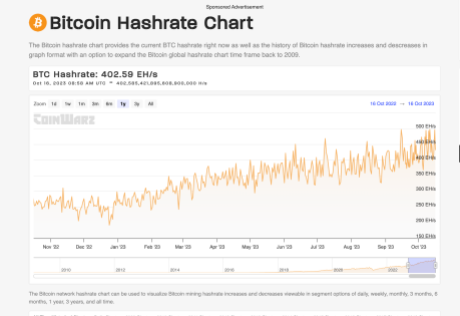

As analysts continue to debate the future of the flagship cryptocurrency, Bitcoin, the network’s hashrate has seen exponential growth, with this key indicator poised to experience an 100% increase (from the beginning of the year) before the year runs out.

How Bitcoin’s Hashrate Has Grown

The hashrate, which is used to measure the computational power used to mine and process transactions on the network, currently (at the time of writing) stands at 445 exahashes per second (EH/s). This figure represents a significant increase, considering that the network hashrate stood at 255 EH/s on January 1, 2023.

These figures mean that the network hashrate has grown by 190 EH/s since the year began, and at this rate, it could well hit 510 EH/s by the end of the year, signaling a 100% increase from when the year began. These figures also suggest that more miners have jumped on the Bitcoin blockchain, with it being faster and more secure as a result of this.

At this rate, the hashrate could also well be on the way to fulfilling some of the predictions made by analysts. In March, A research analyst at River Financial, Sam Wouters, noted the impressive growth rate and predicted that Bitcoin’s hashrate could reach a “Zettahash by the end of 2025.” A Zettahash is equivalent to 1,000 EH/s.

Going by this current rate, some have noted that Wouters’ prediction could become a reality by December 23, 2025, or the beginning of 2026.

Despite this significant growth rate, it is worth mentioning that Bitcoin’s hash price has remained rather tepid during this same period. Hash Price refers to the revenue generated by miners on a per tera-hash basis.

The hash price currently stands at close to $60, almost the same figure as at the beginning of the beginning of the year. Notably, Miners’ biggest payday came on May 8, 2023, when the hash price was $125.

Where The Bitcoin Hashrate Is Coming From

In his tweet back in March, Wouters also tried to analyze where the growth in Bitcoin’s hashrate could be coming from. He shared his belief that it was unlikely that the added hashrate was coming from nation-states, as some people may suggest. According to him, the odds of nation-states providing computing power to the network and remaining a secret is low as “there are far too many people involved in running massive operations.”

He concluded by stating that the source of the added hashrate was “nuanced” as it could simply be a result of factors like new models being put on the market, unused inventory going online, more facilities going live, and also entrepreneurs who are finding cheap sources before regulators step in.

SBF Trial: What Did FTX’s Terms of Service Say About Customer Funds?

A filing last week suggests Sam Bankman-Fried’s defense wants to get back to the argument that Bankman-Fried did not technically commit wire fraud because FTX’s terms of service were worded in such a way that there’s no case to argue funds were misappropriated.

Crypto payment option for Honda cars only works via third-party platform

FCF Pay’s X account has been suspended amid circulating misreporting about its “partnership” with Honda, which has never happened.

Ferrari to Start Accepting Crypto Payments in U.S: Reuters

Ferrari will subsequently extend the scheme to Europe in response to demand from its wealthy customers.

Shiba Inu Price Spiral: 91% Of Investors Brace For Significant Losses

Shiba Inu (SHIB) holders are not exempt from the turbulence of the market in recent weeks. Analyzing the current state of affairs for holders of the meme coin, it becomes apparent that the profitability of investing in this particular asset type has been a rollercoaster journey.

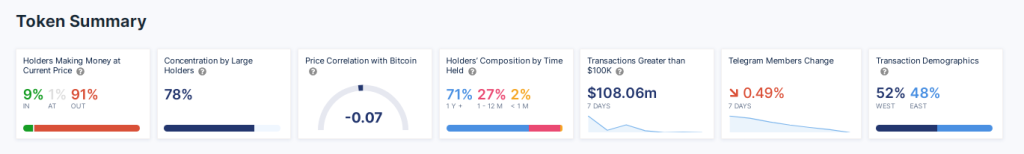

Data derived from IntoTheBlock, an analytics firm, reveals a striking fact: a mere 9% of the current SHIB holders find themselves in a profitable position at the current value of roughly $0.0000069 per coin. This figure is indicative of the challenges that many SHIB investors are currently grappling with.

Moreover, an additional 1% find themselves at a break-even point, while a staggering 91% face the harsh reality of being at an overall loss.

Shiba Inu’s Price Plunge: A Tale Of Highs And Lows

One of the key contributing factors to this landscape of varying profitability is the undeniable influence of Shiba Inu’s price volatility and the composition of its holder base.

Over the past few months, SHIB’s market value has been subject to dramatic oscillations, largely propelled by substantial trading volumes. This volatility has undoubtedly played a pivotal role in shaping the current financial positions of SHIB holders.

It is also worth noting that an overwhelming 78% of the circulating supply of SHIB is concentrated within the wallets of the so-called ‘whale’ holders, emphasizing the significant influence of a few major players within the SHIB ecosystem.

The plunge of Shiba Inu’s price, a staggering 92% drop from its all-time high of $0.00008616 in October 2021, has left many investors who bought at or near peak prices in a precarious position, facing significant losses. However, on the flip side, those who entered the market at relatively lower prices are potentially reveling in the positive returns yielded by their investments.

At the time of writing, SHIB’s price stands at $0.00000700, as per CoinGecko, showing a 1.2% gain over the past 24 hours, though still nursing a 1.0% loss over the past seven days.

Can Shiba Inu Overcome Resistance?

Despite the apparent challenges faced by SHIB holders, a glimmer of hope emerges from the analysis of the price trends. It is evident that every significant dip in SHIB’s value is consistently followed by a period of recovery, creating what appears to be a repetitive “zig-zag” pattern.

This pattern is indicative of a healthy correction process, a natural phenomenon within the realm of cryptocurrency markets. It speaks to the resilience of SHIB and its ability to bounce back from adversities, offering a ray of optimism amidst the prevailing uncertainty.

Furthermore, the current market dynamics suggest that SHIB is grappling with a local resistance level, posing a formidable challenge to its upward trajectory. The interplay of reduced activity among the whale holders and the ongoing battle to overcome this resistance level implies that if SHIB manages to break through this barrier, a bullish trend could be on the horizon.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

Investor Demand for Ether Staking Yields Has Slowed: Coinbase

Staking yields have dropped to 3.5% from above 5% in the last few months, the report said.

Binance Burns $450M BNB in Quarterly Move

The burn mechanism is based on BNB’s price and the number of blocks generated on the BNB Smart Chain (BSC) during the quarter.

Mining BTC is harder than ever — 5 things to know in Bitcoin this week

Bitcoin wakes up to near $28,000 ahead of a jump to a new BTC mining difficulty record as billionaire investor Ray Dalio conjures the chilling thought of “World War III.“

Solana becomes ecosystem partner of Dubai free zone

The Solana Foundation has become an ecosystem partner for the Dubai Multi Commodities Centre, one of the free economic zones within the UAE.

US government among largest Bitcoin hodlers with over $5B in BTC: Report

The $5-billion estimation is based on three major seizures linked to the Bitfinex hack and Silk Road, meaning the actual holdings could be much larger.

Bitcoin Price Soars To $28,000, Here’s Why

The world’s leading cryptocurrency, Bitcoin (BTC), has seen a significant surge in its price today, reaching $28,004. While several factors have contributed to this jump, here are the primary reasons:

#1 SEC’s Non-appeal On Grayscale Spot Bitcoin ETF

Late on Friday night, the market became aware of the US Securities and Exchange Commission’s decision not to appeal the verdict which favored Grayscale’s conversion of the Grayscale Bitcoin Trust (GBTC) into a spot ETF. This decision wasn’t perhaps fully priced in on Friday, as Bitcoin’s price rose by a mere 1.2% on Friday ((followed by a fast retracement), in stark contrast to the 8% spike on August 29 when the initial ruling was announced.

The move signifies the SEC’s potential readiness to green-light a Bitcoin ETF in the imminent weeks. As one Grayscale spokesman pointed out, “The Federal Rules of Appellate Procedure’s 45-day period to seek rehearing has now passed. The Grayscale team remains operationally ready to convert GBTC to an ETF upon the SEC’s approval.”

James Seyffart from Bloomberg Intelligence highlights the probable talks between Grayscale and the SEC in the near future, stating, “Dialogue between Grayscale and SEC should begin next week. Hoping for more info on next steps sometime next week or week after?”

As for when a Spot ETF is coming, Bloomberg Intelligence analysts predict a staggering 90% chance of the SEC’s approval by around January 10.

#2 BTC’s Correlation With Gold

Renowned analyst MacroScope recently provided in-depth insights into the complex relationship between gold and Bitcoin which may have contributed to today’s price move. Gold has soared by more than 6.5% from October 6 till Friday last week, driven by a combination of elements such as central bank policies, the US’s fiscal challenges, and unfolding geopolitical events like the Israel-Hamas war.

Remarkably, the Gold market has been witnessing a discernible pattern: savvy investors, often labeled as the ‘smart money’, have been strategically capitalizing on price dips to augment their long positions. This behavior has been particularly pronounced around the $1820-1860 price marks, suggesting a foundational shift in gold’s pricing trajectory.

Related Reading: Analyst Predicts Next Bitcoin Cycle Top – Is It $89,000 Or $135,000?

This evolving dynamic in the gold market bears significant implications for Bitcoin. Historically, gold often pioneers a trend, with Bitcoin tailing behind to emulate it. This lead-lag relationship, as highlighted by MacroScope, might have been pivotal in forecasting Bitcoin’s move today. As gold appears to be charting a bullish course, Bitcoin, while influenced by its distinct set of catalysts like the spot ETF approval, could be poised to mirror gold’s trajectory.

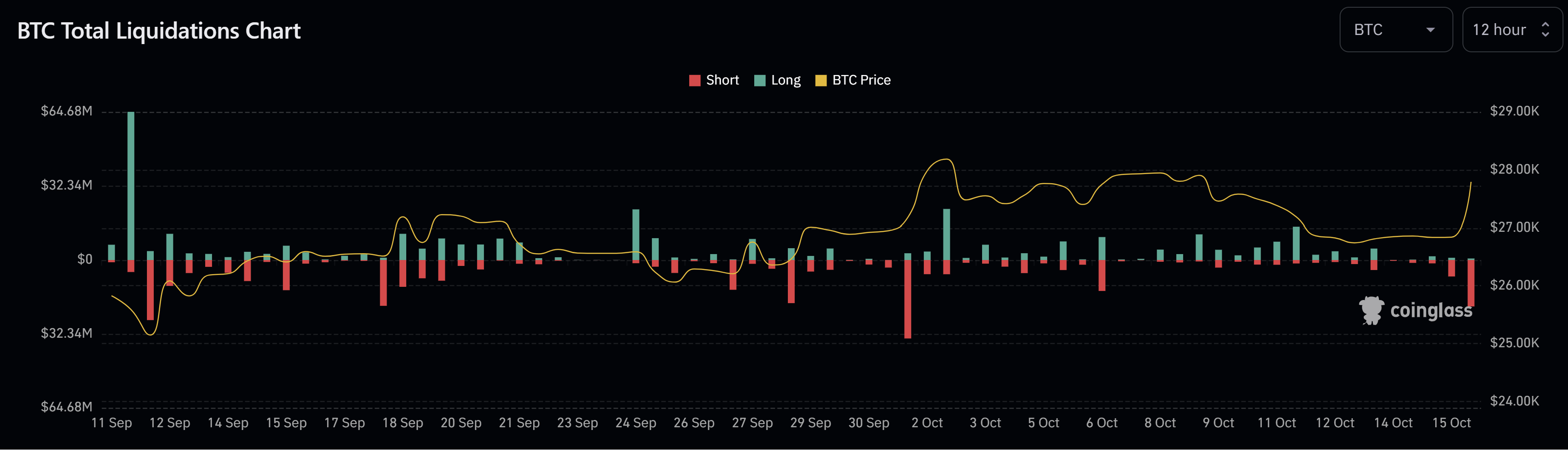

#3 Short Squeeze

Finally, on a more technical note, there has been significant activity in the BTC futures market that played a part in the soaring price. Thus far today, about $20 million in short positions have been liquidated, the highest amount since October 1, when $37.5 million in shorts were liquidated and BTC rose 4% from $27,000 to nearly $28,100 in a very short period of time.

In conclusion, Bitcoin’s impressive surge to $28,000 can be attributed to a combination of regulatory developments, its correlation with gold, the increasing influence of big holders or ‘whales’, and significant futures market activity.

At press time, BTC traded at $27,880.

FTX Bankruptcy Estate Stakes $150M SOL and ETH as Sam Bankman-Fried’s Trial Continues

Addresses tied to the bankrupt crypto exchange controlled by a creditors’ group have apparently staked the tokens to earn yield, blockchain data suggests.

Grayscale ‘GBTC Discount’ Narrows to Near 2-Year Low as SEC Misses ETF Appeal Window

The narrowing of the discount likely represents increased likelihood that Grayscale will be able to convert its close-ended bitcoin trust into a spot-based exchange-traded fund.