FTX’s so-called “Backstop Fund” figure was a big lie, according to the former chief technology officer of the crypto exchange

Cryptocurrency Financial News

FTX’s so-called “Backstop Fund” figure was a big lie, according to the former chief technology officer of the crypto exchange

During an episode of The Joe Rogan Experience, Altman expressed his excitement for Bitcoin and also said he was “super against” CBDCs.

Whales are some of the most relevant entities in the Bitcoin market because of their potential influence on the Bitcoin price through large-volume transactions. Investors and traders often look out for whale transactions, which can trigger a domino effect on the market.

In one of such developments, recent on-chain data revealed that a particular whale has woken up from a three-year slumber, moving their BTC for the first time since 2020.

According to data from blockchain analytics platform Arkham Intelligence, a particular Bitcoin whale became active after years of dormancy and transferred out 5,000 BTC (worth around $137 million) on Saturday, October 7.

The whale address initially received the 5,000 BTC from “Poolin mining pool” on June 23, 2020. At the time, the Bitcoin price was around $9,700, putting the total value of the transaction at approximately $48.5 million.

The Bitcoin price has experienced significant growth since 2020, with one BTC trading for $27,903 as of this writing. Consequently, the whale address’ holdings had swelled to approximately $137 million when all 5,000 BTC was moved on Saturday.

On-chain data shows that this whale split and transferred the 5,000 to two separate addresses. Some 4,000 BTC were transferred to one address, and 1,000 BTC were sent to the other address, both of which are new and unmarked.

This latest whale action seems to be provoking a sense of caution in the Bitcoin market. This is no surprise, considering that the movement of a large BTC amount (especially a sell-off) often sparks interest or fear in other investors, leading to momentary price fluctuations.

Nevertheless, it is worth noting that the reason behind this whale transfer is currently not known. It remains to be seen whether the owner wants to sell or just move their assets into another wallet.

If the whale intends to sell off all their BTC holdings, then this latest action could potentially threaten the Bitcoin price. Large-scale selling could negatively impact Bitcoin’s value, as it often puts downward pressure on the cryptocurrency and could trigger a temporary price dip.

It may be worth mentioning that the Bitcoin price has not experienced any significant or abrupt changes in the past 24 hours. According to CoinGecko data, the value of BTC has dipped by 0.1% in the past day.

Bitcoin has made a relatively healthy start to October, with the premier cryptocurrency recording a 3.3% price gain since the start of the month. The BTC price has been moving mostly sideways in the past few days as it looks to break through the $28,000 mark.

Prominent crypto exchange Coinbase has emerged as the second largest ETH staking entity based on a recent scoop by Chinese reporter Colin Wu. This development comes amidst growing concerns about network centralization in regard to Lido’s dominance in the ETH staking market.

According to Wu, a report from Dragonfly data scientist hildobby, using data from Dune analytics, reveals that Coinbase presently has 3.873 million staked ETH, representing 14.1% of all staked ETH.

Coinbase dominance in the ETH staking sphere is only superseded by that of the liquid staking platform, Lido DAO, which accounts for one-third of all staked ETH.

Other platforms with a significant staking percentage include the Binance and Kraken exchanges, with a 4.2% and 3.0% market share, respectively. Meanwhile, the Figment staking pool comes third with a 4.9% market dominance.

Notably, Coinbase experienced a 44% increase in ETH staking activity over the last six months. Coincidentally, this development falls within the period during which the Ethereum Shanghai upgrade has been active.

Contrary to fears that the last Ethereum network update may induce a decline in staked ETH due to the ability to finally withdraw staked assets, the Shanghai upgrade has so far boosted stakers confidence, resulting in a net positive flow of 7.84 million ETH since its implementation in April.

At the time of writing, the total amount of staked ETH stands at 27.42 million ETH, representing 22.81 of ETH’s circulating supply.

In other news, Wu stated there are community concerns about centralization in regard to Lido’s ETH staking dominance. Due to the Proof-of-Stake Consensus model, a higher amount of staked ETH translates to a higher voting power during governance processes.

Data from Dune Analytics shows that Lido accounts for 8.80 million staked ETH, representing 32.11% of the ETH staking market. Notably, the liquid staking platform experienced a 55% rise in staking activity over the last six months.

According to information from Ethereum’s official blog, concerns about centralization are quite valid, as any validator controlling a minimum of 33% of staked ETH can prevent the network from finalizing any block, even in the presence of a 66% majority.

Moreover, if a validator acquires 55% of the staked ETH, they could theoretically split the Ethereum chain into two forks. All these are speculations, as there is no evidence indicating that Lido DAO has any malicious intentions toward the Ethereum network.

At press time, ETH trades at $1,620.18, with a 1.36% decline in the last day, based on data from CoinMarketCap. In tandem, the token’s daily trading volume is down by 36.41% and valued at $2.86 billion.

Dogecoin, which began as a meme cryptocurrency, has demonstrated that it can compete successfully in the crypto market. Although Dogecoin is still the biggest meme crypto, on-chain data points to the crypto losing steam among whale investors.

According to data from IntoTheBlock, the number of Dogecoin transactions valued at $100,000 or more has declined sharply over the past few months. Data also shows that the number of daily transactions has been on a steady decline since May.

Dogecoin seems to be losing interest from whale traders. A deep dive into on-chain data from IntoTheBlock has shown Dogecoin witnessed only 651 whale transactions in the past 24 hours and 4.85k whale transactions throughout the week.

This metric follows transactions above $100,000, but its current level is a pale reflection of Dogecoin’s past performance. At the height of the Dogecoin hype in 2021, whale transactions made up a sizable portion of all Dogecoin transfers, reaching as high as 39.3k transactions in one week.

A metric following the number of overall transactions has shown similar results of low volume. Dogecoin recorded a staggering increase of 8,220% in daily transactions to reach 2.08 million on May 27, but this count has since fallen to just 38,000 transactions in the past 24 hours. When daily active addresses decline this rapidly, it’s usually a sign that interest in the crypto asset is waning.

Dogecoin has been on a downtrend for quite some time, although it is still the 9th largest crypto in terms of market cap. At the time of writing, Doge is trading at $0.06133, down by 3.59% in a monthly timeframe. The crypto has also witnessed a 22.24% drop in trading volume in the past 24 hours.

The value of meme cryptocurrencies is highly dependent on hype and popularity rather than real-world utility. So, declining interest and activity among users and investors can be an issue.

Shiba Inu has taken the attention of the crypto industry in the past few months, as it looks to elevate itself from being just a meme crypto. Other meme coins like Dogecoin and Dogelon Mars have struggled to receive interest from investors. According to on-chain analytics firm Santiment, social media talks about meme coins are now at their lowest level since 2020.

Though the drop in transaction count is worrying, Dogecoin has defied the odds before. There’s a good chance that X (formerly Twitter) could incorporate Dogecoin payments into its platform. If this is implemented, it could serve as the next catalyst for Dogecoin’s growth.

Featured image from Getty Images

Dogecoin, which began as a meme cryptocurrency, has demonstrated that it can compete successfully in the crypto market. Although Dogecoin is still the biggest meme crypto, on-chain data points to the crypto losing steam among whale investors.

According to data from IntoTheBlock, the number of Dogecoin transactions valued at $100,000 or more has declined sharply over the past few months. Data also shows that the number of daily transactions has been on a steady decline since May.

Dogecoin seems to be losing interest from whale traders. A deep dive into on-chain data from IntoTheBlock has shown Dogecoin witnessed only 651 whale transactions in the past 24 hours and 4.85k whale transactions throughout the week.

This metric follows transactions above $100,000, but its current level is a pale reflection of Dogecoin’s past performance. At the height of the Dogecoin hype in 2021, whale transactions made up a sizable portion of all Dogecoin transfers, reaching as high as 39.3k transactions in one week.

A metric following the number of overall transactions has shown similar results of low volume. Dogecoin recorded a staggering increase of 8,220% in daily transactions to reach 2.08 million on May 27, but this count has since fallen to just 38,000 transactions in the past 24 hours. When daily active addresses decline this rapidly, it’s usually a sign that interest in the crypto asset is waning.

Dogecoin has been on a downtrend for quite some time, although it is still the 9th largest crypto in terms of market cap. At the time of writing, Doge is trading at $0.06133, down by 3.59% in a monthly timeframe. The crypto has also witnessed a 22.24% drop in trading volume in the past 24 hours.

The value of meme cryptocurrencies is highly dependent on hype and popularity rather than real-world utility. So, declining interest and activity among users and investors can be an issue.

Shiba Inu has taken the attention of the crypto industry in the past few months, as it looks to elevate itself from being just a meme crypto. Other meme coins like Dogecoin and Dogelon Mars have struggled to receive interest from investors. According to on-chain analytics firm Santiment, social media talks about meme coins are now at their lowest level since 2020.

Though the drop in transaction count is worrying, Dogecoin has defied the odds before. There’s a good chance that X (formerly Twitter) could incorporate Dogecoin payments into its platform. If this is implemented, it could serve as the next catalyst for Dogecoin’s growth.

Featured image from Getty Images

Schwartz stated that if the majority supports the amendment, the changes could be implemented in as little as two weeks.

Bitcoin might have difficulty breaking through a key resistance zone of its own accord, end-of-week analysis predicts.

He suggested that such sympathizers should not be considered for interviews with prominent television shows like CBS’s 60 Minutes.

HTX was drained of 5,000 ETH in late September, and moved swiftly to get the funds back from the hacker.

Stars Arena was hacked for roughly $3 million worth of AVAX tokens, with the hacker reportedly sending the funds to the Fixed Float crypto exchange.

Sam Bankman-Fried trial is underway, Alex Mashinsky trial data is set, and Binance’s market share shrinks.

Binance, the largest crypto exchange in the world, just released its 11th report for its reserves, and the numbers are staggering as always. According to the report, Binance’s XRP holdings, in particular, have increased in the past month. This is evident, as there have been reports of investors depositing XRP into exchanges in the past month.

According to Binance’s Proof of Reserves report, the exchange holds a staggering amount of XRP to cover 104.15% of customer balances.

Binance currently has over 2.738 billion XRP tokens worth more than $1.35 billion against customer deposits of 2.629 billion XRP tokens. This marks a rise of almost 50 million XRP in its reserve as compared to the previous month’s total of 2,686,407,725 XRP.

As one of the first major exchanges to list XRP in 2017, Binance has been known to be one of the major places for XRP trading. Data from Coingecko shows a trading volume of $84 million of Binance’s XRP/USDT trading pair in the past 24 hours, representing over 16.9% of the total XRP trading volume. This massive XRP stash cements Binance as one of the top holders of XRP and the amount of XRP trading on the exchange.

The latest reserve report shows Binance is fully backed on other cryptocurrencies. Based on the report, the exchange has a BTC ratio of 104.67%, ETH ratio of 107.29%, BNB ratio of 113.72%, USDT ratio of 118.45%, BUSD ratio of 106.99%, USDC ratio of 104.09%, and LTC ratio of 101.31%.

The Proof of Reserves report is part of Binance’s push for more transparency. By disclosing its reserves, it aims to assure users that client funds are backed 1:1. While some have backed the reserve data to be consistent with on-chain data, regulators have expressed concerns about the legitimacy of Binance’s reserve audit.

XRP has also witnessed movement into other exchanges in the past few months, as recent sporadic updates regarding Ripple have always put the cryptocurrency in the limelight. According to NewsBTC, XRP witnessed a 1,300% surge in trading volume on exchanges at some point.

According to predictions from crypto analysts, XRP is set for massive gains in the near future. A new forecast by an analyst predicts that a recently formed 39-month cycle could push XRP as high as $1,000. At the time of writing, XRP is trading at $0.5228, up by 4.92% in the past month.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Pandaily

Finality ensures irreversible transactions — crucial for trust and security — prevents double-spending and fraud, and keeps blockchain records immutable.

A bearish Ethereum fractal meets lower network activity as Ether’s price struggles to break above $2,000.

On day four of the criminal trial of former FTX CEO Sam Bankman-Fried, Gary Wang, who co-founded the now-bankrupt crypto exchange and served as its former chief technology officer (CTO), testified. During his testimony, the former FTX executive revealed details about the connection between the cryptocurrency exchange and Alameda Research.

According to various reports, on Friday, October 6, Wang appeared again in court and testified that Alameda Research’s account on FTX was allowed to trade more funds than it had available. The former FTX CTO reportedly said that Sam Bankman-Fried authorized the integration of a “allow negative” feature, which afforded Alameda “special privileges” on FTX.

Wang reportedly revealed that the “allow negative” feature enabled Alameda to hold a negative balance more than FTX’s revenue at some point in 2020 ($200 million against $150 million). According to reports, Wang claimed that he increased Alameda’s line of credit several times and up to $65 billion under Bankman-Fried’s instructions.

When the government’s prosecutors questioned where the money came from, Wang reportedly affirmed that it came from FTX’s customers’ funds. Based on the co-founder’s testimony, Bankman-Fried claimed that the “allow negative” feature was all about FTT, a native cryptocurrency “created to act as equity in FTX.”

Wang reportedly acknowledged that the customers never authorized their funds to be used by Alameda Research. “The customers did not give us permission to use their accounts like this,” the former FTX chief technology officer allegedly said.

During his testimony, Wang was asked whether he remembered Bankman-Fried making public statements about Alameda’s unusual connections with the FTX exchange. “Yes, he (SBF) said they (Alameda Research) were treated equally and didn’t use FTX funds,” the FTX cofounder allegedly affirmed.

Furthermore, the prosecutors showed Wang – and the court – a 2019 tweet from SBF claiming that Alameda was not using funds from FTX. Interestingly, Wang affirmed that Bankman-Fried ordered the addition of “allow negative” in the exchange’s codebase on the same day the tweet was made.

It appears that is not the only time Bankman-Fried lied about Alameda’s activities on the FTX exchange. The former FTX CTO testified that Bankman-Fried subsequently claimed on Twitter (now X) and on phone calls that customer funds were kept safe.

On Thursday, October 5, Gary Wang reportedly admitted to committing fraud-related crimes while at the FTX exchange alongside Sam Bankman-Fried, former Alameda CEO Caroline Ellison, and former engineering director Nishad Singh. With the trial expected to continue till November, it remains to be seen whether or when the other former top FTX and Alameda executives will take the stand.

Solana experienced a significant surge of approximately 20% during the last few days of September and into the first week of October. This sudden price increase has piqued the interest of investors and enthusiasts alike, sparking discussions about its underlying causes.

One prominent question on people’s minds is whether this uptick in SOL’s value is directly correlated with Bitcoin’s performance during the same period or if there are distinct factors driving SOL’s price rise independently of Bitcoin’s movements.

Before this increase, SOL had a tough time because a U.S. court allowed the sale of $1.3 billion worth of SOL from the bankrupt exchange FTX. So, there’s curiosity about whether SOL’s recent price jump is connected to Bitcoin or if there are other factors behind it.

The Solana (SOL) blockchain network has seen recent difficulties, however it has garnered significant attention and demand in the market. Despite the lackluster price performance of its native token, the proof-of-stake (PoS) network has utilised the bear market to improve its technological capabilities and forge important alliances with prominent entities in the realm of traditional banking.

The bankruptcy court has implemented mechanisms to mitigate the potential adverse impact of FTX asset liquidation on the cryptocurrency market. These measures involve mandating the sale of assets through a financial advisor in weekly installments, adhering to predetermined regulations.

At the time of writing, SOL was trading at $23.43, down a measly 0.3% in the last 24 hours, but gained sustained an 18% rally in the last seven days, data from crypto market tracker Coingecko shows.

Nansen, an on-chain analytics firm, recently published a report on Solana, highlighting its key strengths and potential. Solana is known for its cost-efficiency and high-speed transactions, earning it the nickname “The Ethereum Killer.” It boasts a transaction processing speed of over 3,000 transactions per second, which is nearly 30 times faster than Ethereum.

The chain’s liquidity improved as a result of the dramatic increase in network stability. At press time, the TVL in terms of SOL was $27.12 million, more than double what it was at the start of the year.

Solana’s Rise Fueled by DApps And NFTs, Targets 5th-Largest Crypto Spot

The surge of SOL was further bolstered by the expansion in the adoption of decentralized applications (DApps) and the rise in nonfungible token (NFT) volumes on the Solana blockchain.

The current price of SOL is now making efforts to establish a support level at $23, aiming to solidify its position as the fifth-largest cryptocurrency (excluding stablecoins) in terms of market capitalization.

In the recent Epoch 512, 19.637 million SOL were unstaked, with a net unstake of 16.516 million SOL (about $372 million). Most belonged to a16z and the previous Alameda (now or ftx estate).

a16z: BZpEFk…oPPBm7 unstaked 5.006 million SOL, a16z-2: GCmFQL…ozXMwY unstaked 2.033…

— Wu Blockchain (@WuBlockchain) October 6, 2023

Meanwhile, recent updates to Solana Compass have revealed details about recent activities on the Solana network, particularly during the 512 epoch.

The website that keeps tabs on SOL staking activity suggests that there were around 19.637 million SOL coins that were unstaked during this time.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock

Stars Arena, a decentralized social media platform built on the Avalanche network, has suffered a major security breach, resulting in the loss of a significant amount of cryptocurrency. This comes barely a day after the decentralized application (dApp) reportedly fixed a loophole in its smart contract.

On Thursday, October 5, the Stars Arena team said – via a post on X (formerly Twitter) – that it has averted a security exploit, which could have led to the loss of over $1 million worth of funds.

On Saturday, October 7, a pseudonymous X user raised the alarm about the suspicious movement of Avalanche (AVAX) tokens from the Stars Arena contract.

A few minutes after this, the protocol’s team confirmed – via a post on X – that there has been a “major security breach with its smart contract.”

There has been a major security breach with the smart contract.

We're actively checking the issue.

DO NOT deposit any funds.

Stay tuned for updates.

— Stars Arena (@starsarenacom) October 7, 2023

This exploit has also been flagged by blockchain security firm PeckShield, who disclosed that around $2.9 million in AVAX has been drained from the decentralized social media application.

An initial breakdown by the security company identified a reentrancy issue on the Stars Arena Shares contract. “The reentrancy is abused to update the weight when the share/ticket is issued so that 1 share can be sold at a much higher price of approximately 274,000 AVAX,” PeckShield said.

As earlier noted, Stars Arena has been gaining some popularity in the past few days. In fact, the recent activity uptick on the Avalanche network has been attributed to the rise of the decentralized social application.

However, this latest hack represents a significant deterrent to Stars Arena’s growth. According to data from DeFiLlama, the protocol’s total value locked has plummeted from $1.26 million to $0.47 in the past day, reflecting a 100% decline.

Stars Arena went live on Avalanche C-Chain – the blockchain component specifically designed for running smart contracts on Avalanche – in late September. Although the Friend.tech-like platform experienced some traction after launch, recent security concerns seem to be stirring skepticism around its growth.

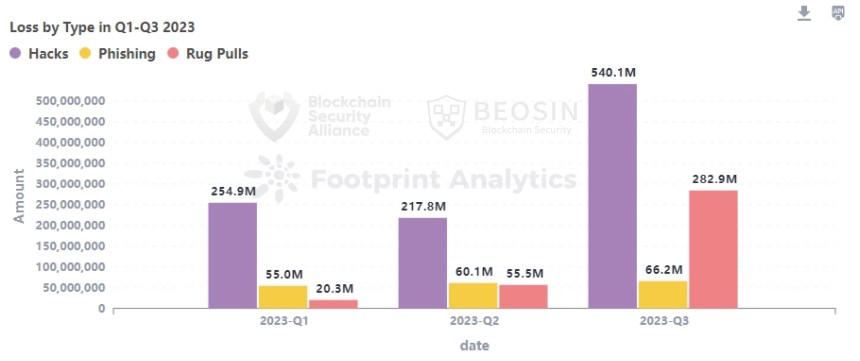

This latest exploit will serve as an unfriendly reminder of the growing security concerns in the crypto space. Particularly, the cryptocurrency industry saw a significant surge in exploits and security breaches in the third quarter of 2023.

According to a quarterly report by blockchain security firm Beosin, the losses incurred only in Q3 2023 were larger than the total for the year’s first half. A total of $889.26 million was lost to various attacks in the last quarter, compared to the $663 million lost in 2023’s first six months.

Beosin’s report revealed that $540.1 million was lost to hacks, with decentralized finance (DeFi) accounting for 18% of this value. Notably, DeFi peer-to-peer service Mixin Network lost $200 million due to a compromise in its cloud service provider database.

Long positions involve buying assets to profit from price increases, while short positions entail selling borrowed crypto, aiming to repurchase it cheaper for profit.

According to multiple reports, iToken, formerly known as Huobi Wallet, fell victim to a crypto heist in the last week, leading to the loss of $263,000 worth of users’ assets. The incident draws much attention following recent police investigations into some of Huobi’s former staff.

Providing more insight on this latest exploit, prominent security firm Peckshield reported that this event occurred on October 3, with the drainer stealing a total of $263,000 USDT and 92 TRX minted on the Tron network.

Thereafter, the bad actor proceeded to swap these stolen funds for approximately 2.9 million TRX, of which 1.4 million TRX was transferred to the ChangeNOW exchange, and 1.5 million TRX was moved to Binance.

#PeckShieldAlert @iToken, formerly known as Huobi Wallet was suspected to have been drained of ~263K $USDT & 92 $TRX on #Tron ~3 days ago.The drainer swapped these stolen funds for ~2.9m $TRX and subsequently transferred them out. ~1.4m $TRX was sent to #ChangeNow, and ~1.5m… pic.twitter.com/yv4sTfj8cV

— PeckShieldAlert (@PeckShieldAlert) October 7, 2023

Currently, there are speculations that this heist was orchestrated by the internal staff of Huobi as such development would be unprecedented. In September, the Chinese Police were reported to have arrested a former Huobi team member for implanting a Trojan horse virus that resulted in the exposure of the private keys and mnemonic phrases of some iToken users.

Launched in 2018, iToken functions as a professional DeFi wallet, which enables the storage of various digital assets across multiple networks. It was initially known as the Huobi wallet, as earlier stated, but was rebranded iToken in 2022, following a $200 million investment from the Huobi Group.

In addition to speculations of insider involvement in this recent heist, Huobi, now rebranded as HTX, has been in the news recently and not for positive reasons.

On September 25, the exchange fell victim to a hack that drained 5,000 ETH worth $7.9 million. However, the exchange’s advisor and Tron founder, Justin Sun, soon came out to assure users of total asset recovery and security of the exchange’s operation.

However, this week, crypto expert Dylan LeClair wrote a thread on X accusing the Tron Visioneer of creating a “web of deception.” This marks the second time in recent weeks Justin Sun has been accused of malicious dealings involving users’ assets on Huobi.

According to LeClair, ever since Sun acquired a controlling stake in Huobi in late 2022, the amount of USDT held on the exchange has been gradually replaced by stUSDT, a receipt token for staking USDT.

The stUSDT token is controlled by Justin Sun and is supposedly designed to invest in real-world assets such as US government bonds. However, LeClair stated that on-chain analysis and transactions show no such investment.

The crypto analyst also drew attention to “worrying” transactions by Justin Sun involving JustLend, a Tron-based DeFi lending platform, and other stablecoins, including USDT and USDC, before concluding that the Tron Founder is maliciously moving USD liquidity out of the crypto space.

At the time of writing, HTX’s native token, HT, hovers around $2.36 with a 0.74% gain in the last day, according to data from CoinMarketCap. Meanwhile, HT’s daily trading volume is up by 10.64% and is valued at $3.47 million