DOGE’s new-found stability reflects a lack of investor interest in trading alternative cryptocurrencies.

Bitcoin And Crypto Face Turbulence As 10-Year US Treasury Yield Hits 15-Year High

In an environment of soaring interest rates and economic unpredictability, Bitcoin and the broader crypto market face increased headwinds. The shift in the financial landscape was recently underscored by the Benchmark 10-year US Treasury yield, which hit a 16-year high this Thursday.

Longest Yield Curve Inversion Ever

Historically, an inverted yield curve, where short-term yields are higher than long-term ones, has been a harbinger of economic downturns. Notably, the 10-Year minus the 3-Month Treasury Yield curve has been inverted for a record 217 trading days. Past data indicates that the longer the delay between the inversion and the start of a recession, the more severe the recession is likely to be.

Joe Consorti, Market Analyst at The Bitcoin Layer, underscored this concern, remarking on Twitter: “The yield curve is re-steepening at breakneck speed. Up by 10 bps or more today across the curve. Do you know what happens when the yield curve steepens, every single time? Hint: not economic expansion.”

The Fed’s recent signals and policy stance have taken the financial world by storm. Charlie Bilello, Chief Market Strategist at Creative Planning, noted, “The 10-Year Treasury Yield moved up to 4.49% today, highest since October 2007. The Real 10-Year Yield (adjusted for expected inflation) of 2.11% is now at the highest level since March 2009.” Bilello also pointed out the significant reduction in the Fed’s balance sheet, which is currently “over 10% below its April 2022 peak.”

The two largest drawdowns over the last 20 years were between December 2008 and February 2009 with 18.2% (balance sheet hit a new high in Jan 2010), and from January 2015 to August 2019 with -16.7% (balance sheet hit a new high in March 2020).

The rise in the 10-Year Treasury Yield was reiterated by the analysts from “The Kobeissi Letter,” who stated: “BREAKING: 10-Year Note Yield officially hits our 4.50% target… The 10-Year Note Yield is up an incredible 20 basis points in less than 24 hours… With supply side inflation out of control and oil prices back to $90+, the Fed has no choice. Higher for longer is back.”

The Federal Reserve’s Stand

During Wednesday’s FOMC meeting, the US central bank and chairman Jerome Powell have made clear its intentions, signaling the potential for an additional rate hike this year and forecasting fewer cuts next year. It now forecasts half a percentage point of rate cuts in 2024. Prior, the dot plot showed cut rates by a full percentage point next year.

This “higher for longer” strategy seems to diverge from the market’s prior expectations, despite three months of seemingly positive inflation data. Moreover, Powell conveyed confidence in the US. economy, emphasizing the need to ensure interest rates are adjusted correctly to achieve the central bank’s 2% inflation target.

However, the market remains uncertain, with the CME Group’s FedWatch Tool indicating only a 32% chance of another rate hike in November and a 45% likelihood by December.

Implications For Bitcoin And Crypto

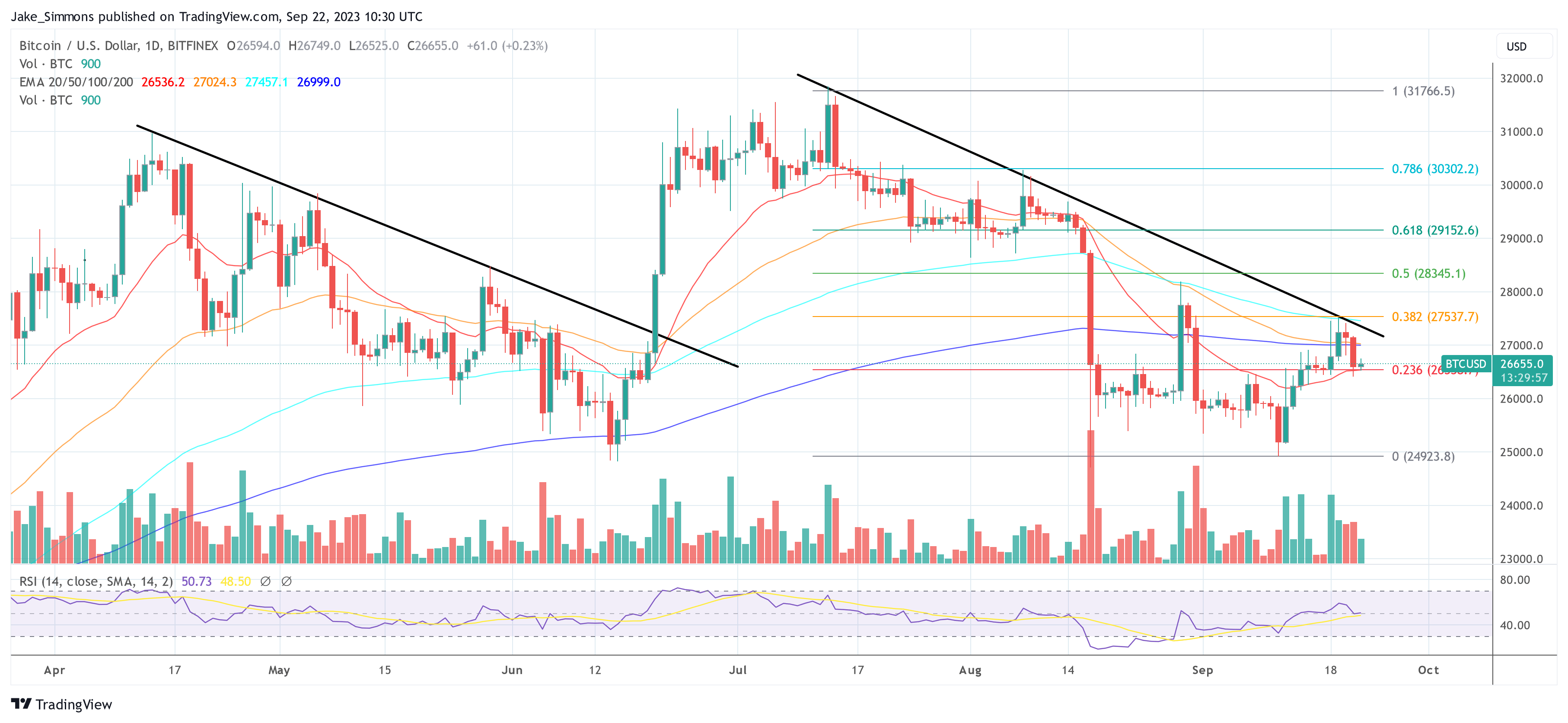

Risk assets, including Bitcoin and other cryptocurrencies, have historically been sensitive to increases in the 10-Year Treasury Yield. Charles Edwards, founder of Capriole Investments, highlighted the challenges for the Bitcoin and crypto sector:

The Fed wants more unemployment. The job market is still too strong. They’ve raised the expected 2024 rates as a result and the 10YR has broken out to new decade highs. As long as the 10YR is breaking upwards like this, risk assets are going to see further headwinds.

Historically, rising yields are indicative of an expectation of higher interest rates, which increase the cost of borrowing. This scenario often leads to a reduction in speculative investments, with investors favoring more stable, yield-bearing assets over riskier options such as Bitcoin and crypto.

Another problem for the market is the “higher for longer” approach and the massive reduction of the Fed’s balance sheet. Risk assets like Bitcoin are traditionally a “sponge” for high liquidity, but when this dries up in the financial market, they usually suffer the most.

In addition, concerns about a possible recession will continue to rise due to the inverted yield curve. Remarkably, Bitcoin and crypto have never traded in a recession, the reaction is uncertain.

At press time, Bitcoin traded at $26,655.

Bitcoin mining can help reduce up to 8% of global emissions: Study

The report highlighted that Bitcoin mining can convert wasted methane emissions into less harmful emissions.

Core Scientific cracks $77M Bitmain deal for 27K Bitcoin mining rigs

The deal was first finalized in August with Anchorage as another party agreeing to equity stake in the bankrupt crypto miner.

XRP Hurdle In The Run-Up To ‘Proper Party’ – Will Altcoin Price Slip?

XRP, a cryptocurrency Ripple Labs uses to facilitate transactions on its network, has been making headlines recently for all the right reasons. The digital asset has emerged as one of the top performers in the crypto market in recent months, largely owing to Ripple’s significant legal victory against the US Securities and Exchange Commission in July. This victory marked a turning point in the ongoing legal battle that has been unfolding since December 2020.

As XRP enthusiasts eagerly anticipate Ripple’s “Proper Party” scheduled for September 29, the crypto’s price remains a point of interest for investors and traders. The community of XRP holders is curious as to whether the company would reveal anything significant regarding the SEC litigation at the party.

Currently, XRP is trading comfortably above the critical support level of $0.5, indicating the resilience of its bullish momentum.

XRP’s Current Price Position

As of the latest data from CoinGecko, XRP is valued at $0.508916. While the past 24 hours have seen a minor decline of 0.6%, the cryptocurrency has exhibited a seven-day gain of 1.3%. These figures suggest that XRP remains firmly within the spotlight, even amidst the recent market turbulence caused by the Federal Reserve’s decision to pause the interest rate hike for September.

However, it’s not all smooth sailing for XRP. As shown in a recent price analysis, the coin faces a significant hurdle in the form of the 200-day Exponential Moving Average (EMA). For more than a month, this EMA has acted as a formidable barrier, thwarting XRP’s attempts to break through to higher price levels. The consistent rejections at this line have solidified its reputation as a formidable resistance zone for XRP.

For XRP bulls, the key focus now is to maintain the critical support level at $0.5. Failure to do so could expose the cryptocurrency to further downside pressure and the risk of a bear flag breakout. In such a scenario, XRP might be compelled to retest the $0.4 and $0.3 price levels, respectively.

Anticipating Bullish Momentum

If support at $0.5 holds steady and bulls manage to break through the confluence resistance at $0.5239, XRP could be poised for substantial gains. Enthusiasts and investors are eyeing a potential uptrend that could lead XRP to the $0.85 and $1 price levels in the near future.

XRP’s recent performance and its legal victory against the SEC have undoubtedly rejuvenated the cryptocurrency’s prospects. While hurdles remain, the XRP community hopes the upcoming celebration and sustained market support will propel the digital asset to new heights in the crypto landscape.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock

FTX opens lawsuit against former employees of Hong Kong affiliate

Bankrupt crypto exchange FTX has opened a lawsuit against former employees of its Hong Kong affiliate company, Salameda, to recover $157.3 million.

Crypto’s Lehman moment: Investors buy $250M of FTX claims — Report

It’s hard to know how much a collapsed crypto firm like FTX would be worth by the time its bankruptcy is resolved.

Investment Firm Founder Has An Important Message For Bitcoin Holders

SkyBridge Capital founder Anthony Scaramucci recently shared positive views on the flagship cryptocurrency, Bitcoin, which could provide some comfort to BTC holders as the bear market lingers.

Scaramucci Says HODL Bitcoin

According to a report by Business Insider, the investment firm founder advised Bitcoin holders not to sell their BTC as they already made it through the winter. Interestingly, he mentioned that the worst of the bear market is over. Despite this being a bold assertion, there is evidence to suggest that he might be right.

There is the likelihood that Bitcoin has bottomed as the co-founder of Delphi Digital, Kevin Kelly once noted. Following past trends, BTC usually bottoms 18 months before the Bitcoin Halving (with the next coming in April 2024). As such, the worst part of this current market cycle might truly be over.

Scaramucci made this known while speaking at the Messari Mainnet conference in New York. He stated that he was still bullish on Bitcoin despite the cryptocurrency trading far below the highs it reached in 2021. Bitcoin peaked at $68,789 in November 2021 but has since declined by about 61%.

Meanwhile, he has singled out Wall Street’s adoption of BTC as one of the factors that will drive the cryptocurrency’s mainstream adoption. Wall Street giants, like the biggest asset manager, BlackRock, have applied to offer a Spot Bitcoin ETF, and he believes that once these firms have that in their “arsenal,” the Bitcoin market is going to widen as it is expected that institutional investors will be looking to invest in it.

Scaramucci also likened the potential growth of BTC to the Internet boom, as he stated that the younger generation would be “mainstreaming Bitcoin” the same way his generation mainstreamed the Internet (most likely about when there was massive growth in Internet adoption).

Factors That Could Affect BTC’s Growth

Despite his optimism about Bitcoin’s future, Scaramucci noted certain macro factors that could hamper Bitcoin’s growth. These factors include the higher interest rates, negative sentiment around crypto, and the SEC Chief Gary Gensler with Gensler recently stating that there are so many “hucksters” and “fraudsters” in the crypto space.

However, his opinion on the higher interest rates seems to contrast with that of Crypto analyst Nicholas Merten, who stated that the Fed isn’t doing enough (regarding the interest rate hike) to keep inflation down. According to him, re-inflation is on the rise, and this could be one of the factors that could affect Bitcoin’s price going forward.

India to develop dark net monitoring tool to combat crypto fraud: Report

The tool will monitor crypto wallets and alert the Indian Ministry of Home Affairs about irregular transactions, according to a report.

EU Parliament research recommends non-EU nations tighten crypto regulation

Potential implications around financial stability, lower market appeal and mainstream use of stablecoins were the main concerns highlighted by the author of the report.

Shiba Inu Developers Floated a Dummy Token and Now Activist Traders Are Making It a Real Thing

A token meant for testing purposes wasn’t intended to be traded, yet some traders have pounced on the supposed opportunity.

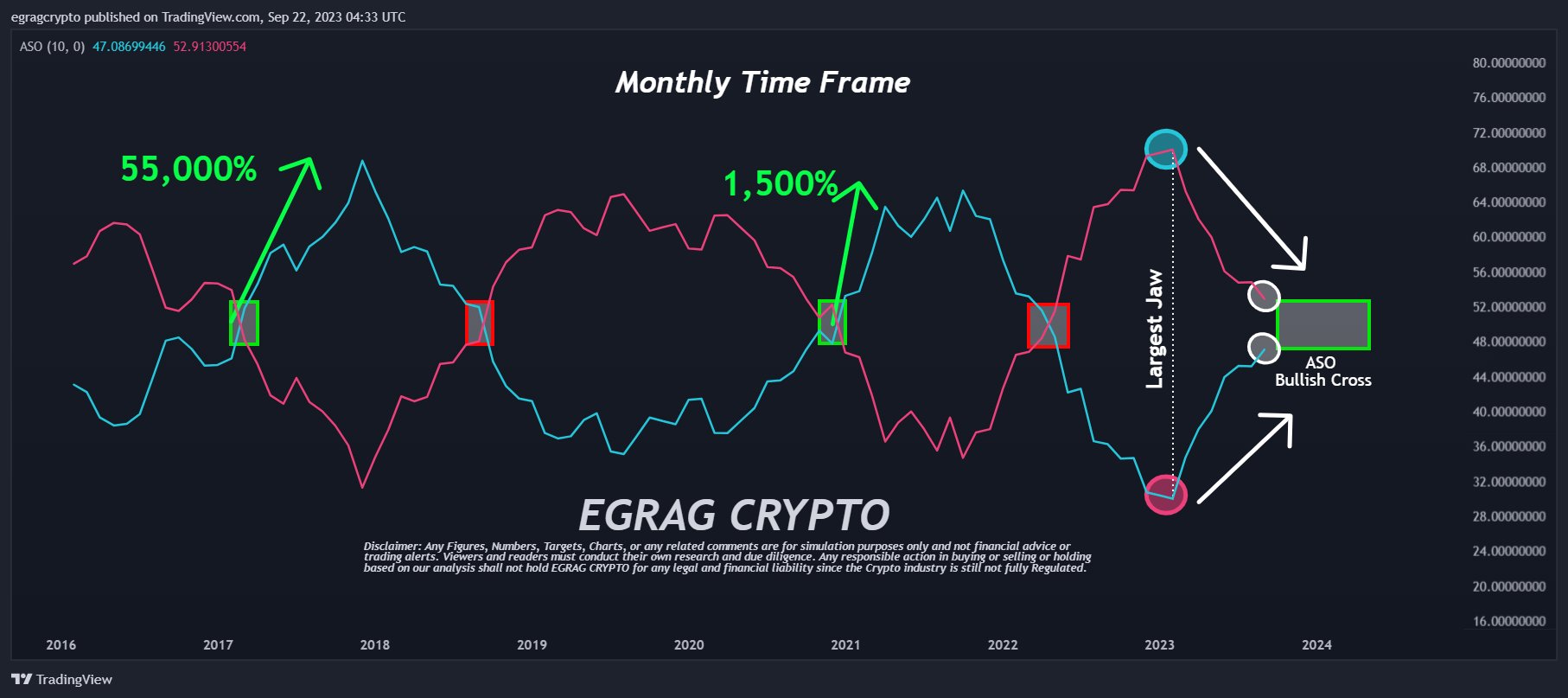

ASO Bullish Cross Reveals Bull Run Start For XRP: Crypto Analyst

Renowned crypto analyst EGRAG Crypto has unveiled a fresh XRP price prediction, introducing the community to a less-known indicator, the “Average Sentiment Oscillator” or ASO. Commenting on its significance, EGRAG explained on Twitter today: “Exciting ASO Update Alert! Check out the post from September 9th to witness the impressive ascent and curve of the bullish trend! The momentum is ablaze, with an unstoppable surge toward that coveted bullish cross! #XRPArmy, HOLD STEADY! The imminent ASO bullish cross is the spark that will ignite the upcoming XRP bull run!”

Here’s When The Next XRP Bull Run Could Start

From the chart presented by EGRAG, the convergence of the blue line (representing bulls) and the red line (representing bears) is evident. By demarcating a yellow box on this chart, EGRAG anticipates the bullish crossover to manifest between the conclusion of 2023 and the commencement of the second half of 2024.

Historical data reveals that XRP has already undergone this bullish crossover on two prior occasions. The first, in 2017, witnessed a meteoric 55,000% rise in XRP’s price. The subsequent occurrence, spanning late 2020 to April 2021, saw XRP appreciate by a commendable 1500%. EGRAG underscores the magnitude of the current situation by noting the presence of “the largest jaw” ever, leading to speculation that the ensuing XRP rally could dwarf previous ones.

EGRAG’s September update brought substantial insights, underscoring the notable shift in the ASO and the build-up of undeniable momentum towards the bullish cross. In his words, “there’s an undeniable momentum building towards that coveted bullish cross.”

First, EGRAG had outlined the oscillator’s remarkable potential in March, describing it as the harbinger of a monumental bullish setup, showcasing the depth of market volatility and the contrasting strength/weakness of an asset. He emphasized, “The Mother of all #Bullish Set-Ups is upon us,” pointing to the impressive setups building in both the 3 Weeks Time Frame (TF) and Monthly TF.

A Deep Dive Into ASO

The ASO serves as a momentum oscillator, providing averaged percentages of bull/bear sentiment. This tool is recommended for accurately gauging the sentiment during a specific candle period, aiding in trend filtering or determining entry/exit points.

Conceptualized by Benjamin Joshua Nash and adapted from the MT4 version, the ASO employs two algorithms. While the first algorithm evaluates the bullish/bearish nature of individual bars based on OHLC prices before averaging them, the second assesses the sentiment percentage by considering a group of bars as a single entity.

The ASO displays Bulls % with a blue line and Bears % with a red line. The dominance of sentiment is represented by the elevated line. A crossover at the 50% centreline indicates a power shift between bulls and bears, offering potential entry or exit points. This is particularly efficacious when the average volume is significant.

Further insights can be derived by observing the strength of trends or swings. For instance, a blue peak surpassing its preceding red one. Any divergence, like a second bullish peak registering reduced strength on the oscillator but ascending in the price chart, is clearly visible.

By setting thresholds at the 70% and 30% marks, the oscillator can function similarly to Stochastic or RSI for trading overbought/oversold levels. As with many indicators, a shorter period provides advanced signals while a longer period reduces the likelihood of false alerts.

At press time, XRP traded at $0.5097.

Bitcoin blasts past its 2021 all-time high in Argentina, but hyperinflation outpaces gains

Bitcoin’s 150% gains over the last two years in Argentine pesos is no match for the country’s 300% inflation in the period.

FTX Sues Former Employees of Hong Kong Affiliate, Seeks $157 Million

The bankrupt crypto exchange has sued former employees of Salameda, a Hong Kong-incorporated affiliate, to recover about $157.3 million.

Bankrupt Bitcoin Miner Core Scientific to Buy 27K Bitmain Servers for $77M

Bitcoin miner Core Scientific (CORZQ) has agreed to exchange $23.1 million in cash and $53.9 million in common stock for 27,000 Bitmain S19J XP 151 TH bitcoin mining servers, according to a press release.

Ethereum’s Shanghai Upgrade Has Failed to Boost Network Activity, JPMorgan Says

Daily transactions, daily active addresses and total value locked on the blockchain have all fallen since the upgrade, the report said.

Japanese Exchange GMO to Offer XRP Users Yen for Delayed Songbird Airdrop

The handouts are part of a token airdrop whose snapshot took place in 2020.

MakerDAO (MKR) Recent Rally Signals Potential For New Highs – $1,700 On The Horizon?

The MakerDAO native token, MKR, has surged toward its early August highs, sending bullish signals rippling through the cryptocurrency market. This resurgence has reignited optimism among investors and speculators alike, suggesting that MKR may be poised to explore uncharted territory.

One of the pivotal factors driving this remarkable rally is the significant accumulation of MKR tokens by a group of crypto whales.

This acquisition, confirmed by on-chain data from Santiment, reflects the growing interest in the cryptocurrency among large holders. Such whale activity is often seen as a bullish signal, suggesting confidence in the asset’s long-term potential.

Whale Activity And Its Impact On MakerDao (MKR) Price

Evidence of the burgeoning optimism surrounding MKR comes in the form of substantial whale activity. In a recent revelation, Lookonchain disclosed that two prominent crypto whales made a foray into the MKR market in September, injecting millions of dollars into the token.

A price report further corroborates this narrative, showcasing a discernible increase in MKR accumulation across the network.

2 whales are accumulating $MKR.

Whale “0x3737” spent 1,194 $ETH($1.95M) to buy 1,700 $MKR at $1,147 since Sept 4.https://t.co/1kBo03U5Us

Whale “0xaD0” spent 992 $ETH($1.63M) to buy 1,261 $MKR at $1,291 since Sept 18.https://t.co/aYVTJkgA1s pic.twitter.com/XojIUQrSGk

— Lookonchain (@lookonchain) September 20, 2023

The infusion of substantial capital by these whales has restructured the market dynamics, steering it into a bullish trajectory. This bullish momentum has propelled MKR’s price action, raising hopes for a sustained upward trajectory.

Supply Dynamics And The Road Ahead

A separate report resonates with the prevailing bullish sentiment, highlighting an intriguing observation. The supply of MKR tokens held by top addresses has exhibited a gradual uptick since September 6.

This intriguing development suggests that the recent price gains witnessed by MKR are more than just a fleeting phenomenon and may indeed have the potential for longevity.

MKR Sustains Weekly Advance

As of the latest data from CoinGecko, MKR is currently priced at $1,294, marking a 3.7% decline over the past 24 hours but still maintaining a seven-day surge of 9.1%. These price movements underscore the cryptocurrency’s recent resilience, giving investors optimism the token can hit the vaunted $1,700 target.

Related Reading: Bitcoin Enjoys Growing Favorable Conditions, Top Analyst Says

Maker DAO’s MKR token has experienced a remarkable resurgence, driven in part by the accumulation of tokens by influential crypto whales. The bullish sentiment has sparked hopes of new all-time highs, but caution is advised, as weak buying volume could jeopardize the sustainability of the rally.

As MKR continues its journey, investors and traders will keenly watch for signs of genuine demand to ascertain the token’s true potential in the weeks to come.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from iStock

Poland probing OpenAI, ChatGPT following GDPR complaint

Poland’s data protection watchdog has confirmed it has opened an investigation into OpenAI over a complaint it received from an applicant.

Bitcoin ETFs or not, don’t expect a ‘sexy’ crypto bull run: Concordium founder

Experts remain divided on when the next bull market is set to kick off, but they all agree on one thing: the next big rally won’t look like the last one.