Losses in the NFT markets have exceed ether’s decline, which is down 9.6% on-month.

SOL, ADA Lead Crypto Majors’ Gains as Bitcoin Traders Move Past $1B Liquidation Event

Both tokens rose 3%, bitcoin and ether added as much as 1.2%, while bnb (BNB) rallied 1% after staving off concerns about contagion risks in the BNB Chain ecosystem.

Optimism Reverses From Range Low With 10% Gain – How Far Can Bulls Go?

Optimism (OP) is proving to be a beacon of stability amidst the tumultuous fluctuations of the cryptocurrency market, particularly Bitcoin (BTC). While Bitcoin’s price swings have left investors on edge, Optimism’s weekly rally seems poised to extend its resilience.

The cryptocurrency’s price trajectory has demonstrated a notable rebound, bouncing back from its range-low of $1.41. This steadfast performance has entrenched Optimism within a trading range bordered by $1.80 at the upper limit and $1.41 at the lower threshold.

As bulls and bears lock horns in a battle for supremacy, the question looms: who will emerge victorious?

OP Bulls Eye $1.8 Resistance As Momentum Grows

As of the latest update, OP is priced at $1.57 according to CoinGecko, reflecting a slight 0.8% decline over the past 24 hours. However, the coin managed to register an impressive 10% increase in the last week.

The momentum appears to favor the bullish contingent, as they prepare for a renewed assault on the formidable $1.8 resistance. A glimpse into historical data suggests that the bulls’ determination might yield success in their second attempt.

According to this price analysis, favorable outcomes could propel Optimism towards take-profit levels ranging from $2.1 to $2.3. Investors and analysts are keenly observing this showdown, ready to gauge whether Optimism’s resilience will once again hold strong against market turbulence.

Related Reading: Polygon (MATIC) At June Lows Again – Prospects For Bullish Recovery?

However, the coin’s fate is by no means set in stone. A faltering attempt to breach the $1.8 resistance would spell an extension of the range-bound pattern, giving the bears an opportunity to regain dominance by targeting the critical $1.41 support.

Network Growth Amidst Challenges

Amidst these price fluctuations, Optimism has been strategically focusing on enhancing its network growth. A separate report reveals a remarkable upswing, with a 47% surge in daily transactions since mid-July.

Moreover, the count of daily active addresses within the Optimism ecosystem has surged by an impressive 28% over the past month. This steady expansion indicates a growing user base and heightened engagement, boding well for the platform’s future prospects.

However, recent concerns have cast a shadow over Optimism’s growth trajectory. The exploit of Exactly Protocol, a credit market operating on the Optimism network, has sparked worry among investors. This incident serves as a reminder of the challenges that even robust platforms face in a landscape characterized by innovation and risk.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Turbo and Stance

Binance to halt crypto debit card in Latin America, Middle East

Binance didn’t reveal the exact reason behind the suspension but claimed it would only impact 1% of users in the affected regions.

UK considers blanket ban on crypto investment cold calls

The U.K. Treasury has released a consultation paper to understand the grassroots-level impact of a blanket ban on cold calls related to financial services and products.

Bitcoin halving can take BTC price to $148K by July 2025 — Pantera Capital

BTC price is right on track when it comes to cycle top and bottom timing, Bitcoin bull Pantera says.

Why Is Bitcoin Price Up Today?

The Bitcoin price experienced a resurgence yesterday, reaching a high of $26,843, a 3.7% increase after its recent crash from $29,000. The reasons behind this uptick are manifold.

Why Is Bitcoin Up?

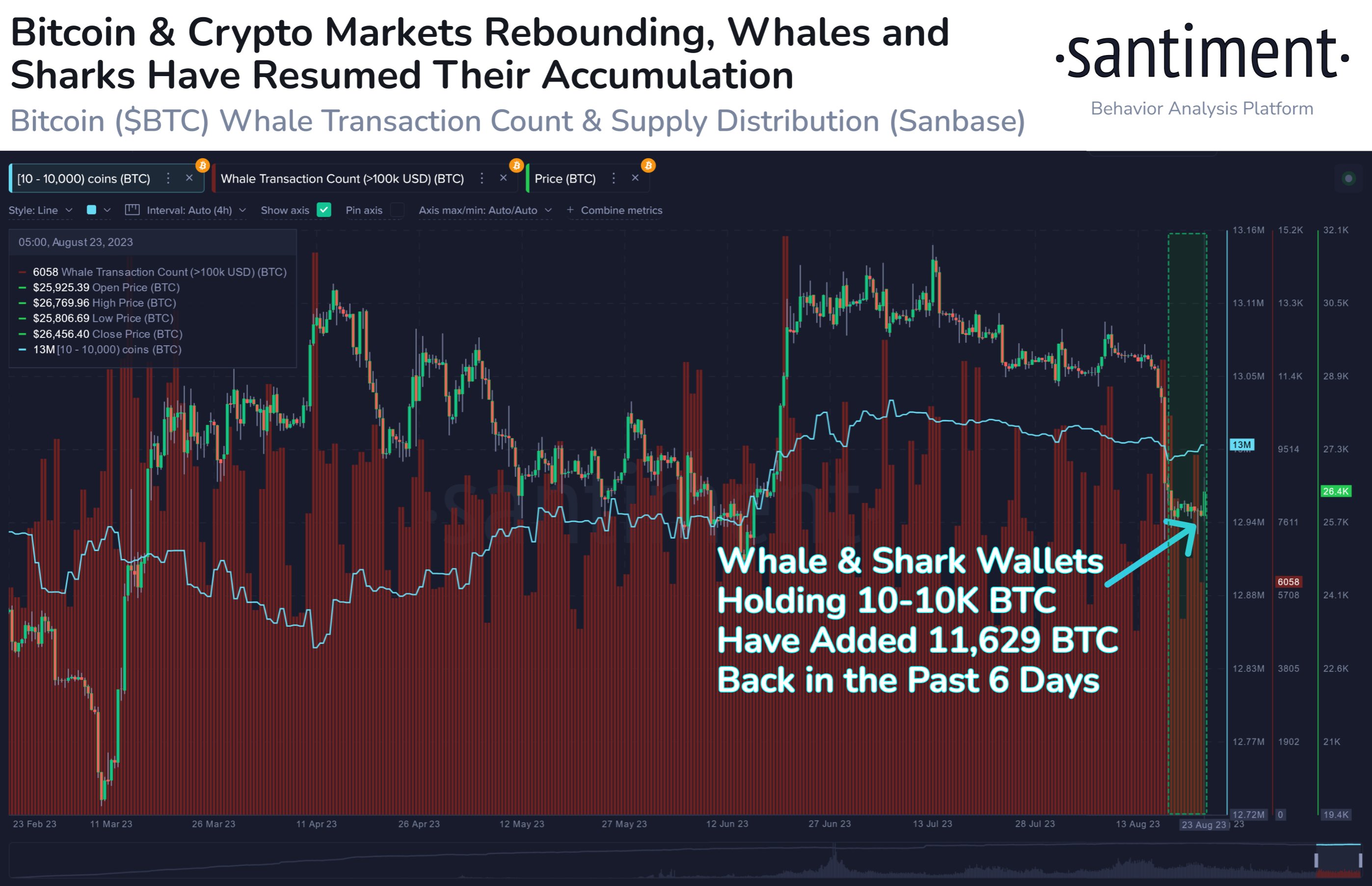

According to on-chain analytics firm Santiment, significant Bitcoin holders, often referred to as whales and sharks, have been actively adding to their holdings. As of now, there are 156,660 wallets holding between 10 to 10,000 BTC, with a collective accumulation of $308.6M since August 17th. Whale and shark wallets have added 11,629 BTC in the past six days.

Michaël van de Poppe, a well-regarded crypto analyst, drew attention to the strength shown by Silver & Gold, especially after the disappointing PMI rates yesterday. He believes that as yields appear to be topping out, Bitcoin might follow the trajectory of these commodities.

Recent economic indicators from the US private sector provide further context. The S&P Global Composite PMI for early August showed a decline, falling to 50.4 from 52 in July. Both the Manufacturing and Services PMI indices also registered drops from 49 to 47 and 52.4 to 51 respectively.

Moreover, the Bitcoin futures market certainly played a certain role in yesterday’s Bitcoin price movement. Yesterday, $28.06 million in short positions were liquidated on this market. After all, this is the third largest amount in August so far, surpassed only by August 17 ($120 million) and August 8 ($37 million).

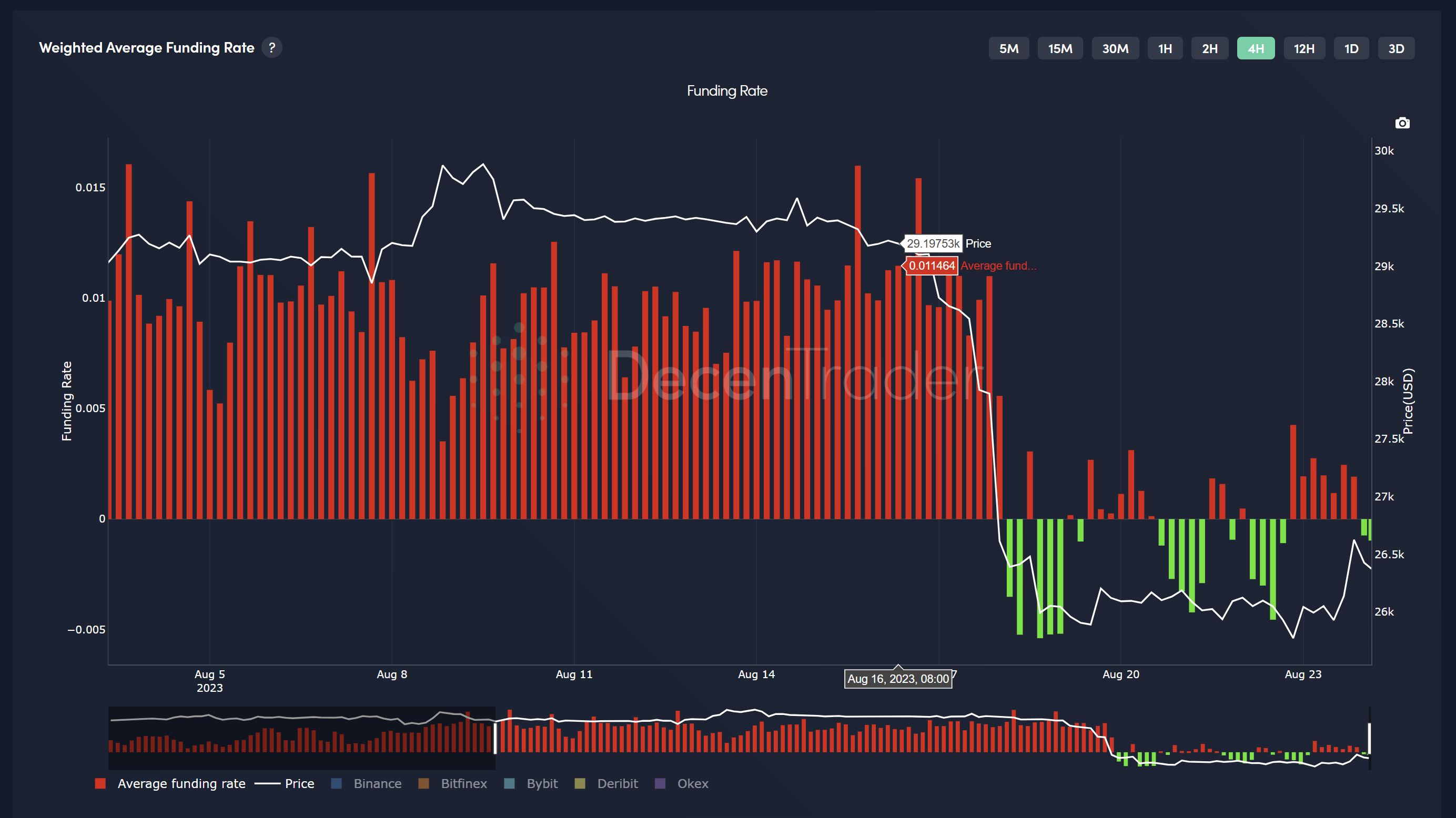

Market intelligence platform Decentrader highlighted the prevailing market sentiment, noting that despite Bitcoin’s price rise, there’s still a sense of uncertainty and fear. This sentiment is further underscored by the continuing negative dip in average funding rates. While this means that sentiment is still bad, it opens up the possibility for more short squeezes if traders are raging into shorts.

The Dollar-Index (DXY) and its inverse relationship with Bitcoin also played a part. DXY was rejected just below 104 yesterday and dropped back to 103.5. The SPX showed a nice relief bounce with USD coming off 103.96.

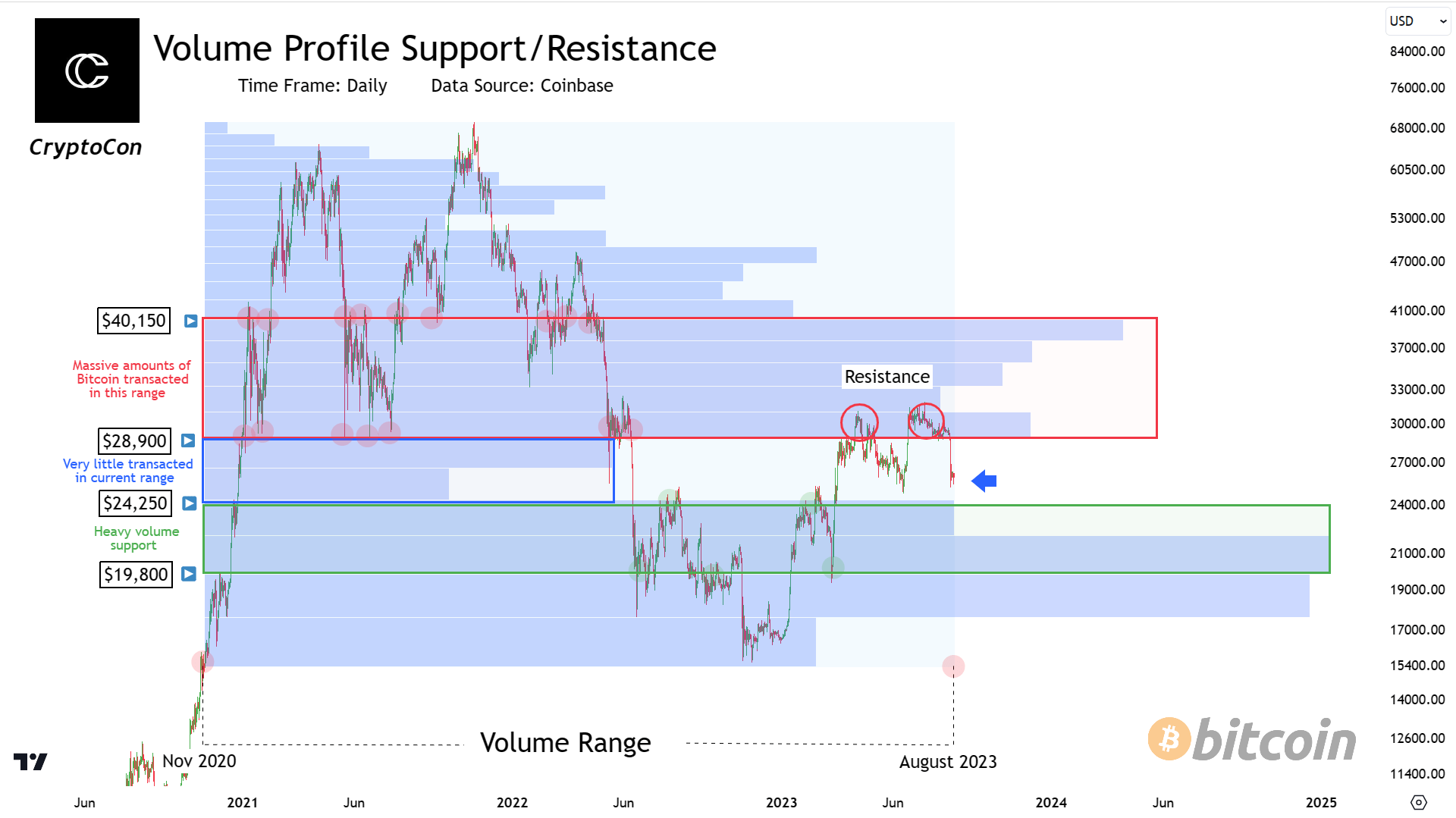

CryptoCon’s volume analysis offers a broader perspective on Bitcoin’s price movement. Since November 2020, the volume of Bitcoin transacted reveals why the price halted at its current position. The volume past $28,900 acts as a significant barrier. However, the current range of 24,000 to 29,000 for Bitcoin is relatively uncharted, suggesting that Bitcoin is searching for new support and preparing for a potential move to the next resistance zone.

What’s Next For BTC?

The upcoming Jackson Hole Economic Symposium tomorrow, Friday, where the Federal Reserve will discuss its future strategies, is a pivotal event on the horizon. Keith Alan of Material Indicators recalled the impact of last year’s symposium on Bitcoin, emphasizing, “Remember when FED Chair Powell spoke from Jackson Hole last year and his hawkish tone triggered a 29% BTC dump?”

While there are parallels in Bitcoin’s price action leading up to this year’s event, it’s crucial to note that market reactions can be unpredictable and hinge on various factors. With the Bitcoin market poised for the events of tomorrow, the prevailing mood is one of anticipation mixed with caution.

At press time, BTC traded $26,464.

Pendle Finance Users Can Now Profit From Real World Assets

Pendle will use MakerDao’s boosted Savings (sDA) and Flux Finance’s fUSDC in its first real-world assets (RWA) based product.

FTX Taps Galaxy to Sell, Stake and Hedge Its Crypto Billions

The bankrupt exchange wants to return funds to creditors in dollars without denting value.

Bitstamp to Stop Ether Staking in U.S. Amid Regulatory Scrutiny

The Luxembourg-based exchange said that all other services will remain unaffected.

Bitcoin, Ether Trade Below ‘Maximum Pain’ Levels Ahead of $2.7B Options Settlement

A lot of put options are in-the-money, crypto options exchange Deribit’s Lin Chen said.

SBI-Owned B2C2 Eyes European Expansion With Acquisition of Rival Trading Firm Woorton

London-based liquidity provider B2C2 has acquired French market making firm Woorton in a deal that will grants B2C2 access to licenses, allowing it to operate in the EU.

Tron Price Prediction: TRX Outperforms Bitcoin and Could Rally To $0.082

Tron price is rising and trading above $0.0760 against the US Dollar. TRX is outperforming Bitcoin and could rally further toward the $0.0820 resistance.

- Tron is moving higher from the $0.0720 support zone against the US dollar.

- The price is trading above $0.0760 and the 100 simple moving average (4 hours).

- There is a key bullish trend line forming with support near $0.0762 on the 4-hour chart of the TRX/USD pair (data source from Kraken).

- The pair could continue to climb higher toward $0.080 and $0.0820.

Tron Price Starts Fresh Increase

This past week, Tron’s price saw a sharp decline below the $0.0760 support against the US Dollar, similar to Bitcoin and Ethereum. TRX tested the $0.0715 zone where the bulls took a stand.

A low was formed near $0.0713 and the price started a fresh increase. There was a decent increase above the $0.0740 and $0.0750 resistance levels. It even outperformed Bitcoin in the past couple of sessions and broke the $0.0760 resistance.

There was a move above the 76.4% Fib retracement level of the downward move from the $0.0775 swing high to the $0.0713 low. TRX is now trading above $0.0760 and the 100 simple moving average (4 hours).

There is also a key bullish trend line forming with support near $0.0762 on the 4-hour chart of the TRX/USD pair. On the upside, an initial resistance is near the $0.0790 zone. The first major resistance is near $0.080, above which the price could rise toward the $0.0820 resistance or the 1.618 Fib extension level of the downward move from the $0.0775 swing high to the $0.0713 low.

Source: TRXUSD on TradingView.com

A close above the $0.0820 resistance might send TRX further higher. The next major resistance is near the $0.0850 level, above which the bulls are likely to aim a larger increase toward the key $0.0900 zone in the coming days.

Are Dips Limited in TRX?

If TRX price fails to clear the $0.080 resistance, it could start a downside correction. Initial support on the downside is near the $0.0760 zone and the trend line.

The first major support is near the $0.0745 level, below which the price could accelerate lower. The next major support is $0.0715.

Technical Indicators

4 hours MACD – The MACD for TRX/USD is gaining momentum in the bullish zone.

4 hours RSI (Relative Strength Index) – The RSI for TRX/USD is currently above the 50 level.

Major Support Levels – $0.0760, $0.0745, and $0.0715.

Major Resistance Levels – $0.0790, $0.0800, and $0.0820.

Naver Corp unveils South Korea’s answer to ChatGPT and generative AI

South Korean internet giant Naver Corp. has released CLOVA X, a Korean language chatbot similar to ChatGPT that can have conversations and summarize text.

Ethereum Price Could See “Liftoff” if It’s Able to Clear One Crucial Level

Ethereum price is recovering above the $1,650 resistance against the US Dollar. ETH could rise further if there is a clear move above the $1,700 resistance.

- Ethereum is moving higher above the $1,650 and $1,660 levels.

- The price is trading above $1,670 and the 100-hourly Simple Moving Average.

- There was a break above a key bearish trend line with resistance near $1,660 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could continue to rise if it clears the $1,700 and $1,720 resistance levels.

Ethereum Price Eyes Steady Recovery

Ethereum’s price formed a support base above the $1,580 and $1,600 levels. ETH started a recovery wave and was able to rise above the $1,650 resistance, like Bitcoin.

There was a break above a key bearish trend line with resistance near $1,660 on the hourly chart of ETH/USD. The pair is now struggling to clear the $1,700 resistance zone. A high is formed near $1,698 and the price is consolidating gains.

Ether is trading above $1,670 and the 100-hourly Simple Moving Average. It is also near the 23.6% Fib retracement level of the recent increase from the $1,580 swing low to the $1,698 high.

Source: ETHUSD on TradingView.com

On the upside, the price might face resistance near the $1,700 level. The next resistance is near the $1,720 zone. A successful close above the $1,700 and $1,720 levels could start a fresh lift-off. The next major resistance is near the $1,780 level. Any more gains might send the price toward the $1,820 resistance.

Another Drop in ETH?

If Ethereum fails to clear the $1,700 resistance, it could start another decline. Initial support on the downside is near the $1,670 level and the 100-hourly Simple Moving Average.

The first major support is near the $1,550 zone. The next key support is near the 50% Fib retracement level of the recent increase from the $1,580 swing low to the $1,698 high at $1,640. If there is a downside break below $1,640, there could be more losses. The next major support is near the $1,600 support level. Any more losses might send the price toward the $1,580 level or even to a new low below $1,550.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $1,640

Major Resistance Level – $1,700

Bitcoin Price Starts Recovery But Can Bulls Clear This Hurdle?

Bitcoin price started a recovery wave above the $26,250 resistance. BTC could gain bullish momentum if there is a close above the $27,000 resistance.

- Bitcoin is slowly moving higher above the $26,250 support zone.

- The price is trading above $26,250 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support near $26,250 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to rise if it clears the $27,000 resistance.

Bitcoin Price Recovers

Bitcoin price remained well-bid above the $25,800 level. BTC formed a base and started a recovery wave above the $26,050 level. The bulls were able to push the price above the $26,250 level.

There was also a break above the $26,500 resistance. Finally, the price tested the $26,780 zone. A high is formed near $26,779 and the price is now consolidating gains. It is trading just below the 23.6% Fib retracement level of the recent wave from the $25,360 swing low to the $26,779 high.

Bitcoin is trading above $26,250 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support near $26,250 on the hourly chart of the BTC/USD pair.

Source: BTCUSD on TradingView.com

On the upside, immediate resistance is near the $26,600 level. The first major resistance is now near the $26,780 level, above which the price might rise toward the $27,000 resistance. A close above the $27,000 resistance could start a decent increase toward the $27,500 resistance zone. Any more gains might set the pace for a larger increase toward $28,200.

Are Dips Supported In BTC?

If Bitcoin fails to clear the $26,780 resistance, it could start a downside correction. Immediate support on the downside is near the $26,250 zone and the trend line.

The next major support is near the $26,050 level or the 50% Fib retracement level of the recent wave from the $25,360 swing low to the $26,779 high. A downside break below the $26,050 level might push the price again into a bearish zone. In the stated case, the price could drop toward $25,550.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $26,250, followed by $26,050.

Major Resistance Levels – $26,780, $27,000, and $27,500.

Betrayal In Blue: Former NJ Officer Charged With Crypto Fraud

In a major development, the US Securities and Exchange Commission (SEC) has charged former New Jersey State Correctional Police Officer, John A. DeSalvo, for allegedly orchestrating a fraudulent crypto fraud scheme that specifically targeted law enforcement personnel.

DeSalvo stands accused of raising funds through the unregistered offering of the Blazar Token, a crypto asset he created, which eventually collapsed in May 2022.

The SEC’s complaint further alleges misappropriation of investor funds, including diverting substantial amounts to his crypto asset wallets and using them for personal expenses, such as a bathroom renovation.

Crypto Scam Targeting Cops?

According to the SEC, DeSalvo managed to raise a minimum of $620,000 from around 220 investors between the launch of the Blazar Token in November 2021 and its subsequent collapse.

The complaint reveals that DeSalvo made “false claims” to investors, stating that the Blazar Token was registered with the SEC and that it would replace existing state pension systems. He further “deceived” investors by falsely assuring them that automatic payroll deductions would facilitate their investment and guarantee extraordinary returns.

Ultimately, DeSalvo allegedly misused and misappropriated the funds entrusted to him. Notably, the SEC’s complaint highlights DeSalvo’s deliberate targeting of fellow law enforcement and first responders in his fraudulent schemes.

In addition to the Blazar Token scheme, the SEC’s complaint also exposes an earlier fraud initiated by DeSalvo. Beginning in late January 2021, he allegedly solicited investors, primarily through social media, for an investment venture that involved trading stocks, options, and crypto asset securities.

Within weeks of raising $95,000 from 17 investors, DeSalvo reportedly lost a significant portion of the funds through speculative investments and misappropriated the rest. He proceeded to inform investors that poor market conditions led to the complete devaluation of the securities.

SEC Accuses Former Officer Of Exploiting Trust

Gurbir S. Grewal, Director of the SEC’s Division of Enforcement, condemned DeSalvo’s actions, stating:

We allege that DeSalvo orchestrated several fraudulent investment schemes that targeted law enforcement personnel and promised astronomical returns, including one involving a crypto asset security that would somehow replace traditional state pension systems. Rather than producing any returns or revolutionary technology, he instead misappropriated and misused investor money.

Grewal further emphasized the breach of trust perpetrated by DeSalvo, who “exploited” his former position as a corrections officer to gain the confidence of fellow law enforcement professionals, many of whom invested their “hard-earned” savings with him.

The SEC’s complaint, filed in the U.S. District Court for the District of New Jersey, charges DeSalvo with violating antifraud and offering registration provisions of the securities laws. The SEC seeks injunctive relief, disgorgement of ill-gotten gains with prejudgment interest, and imposition of civil penalties.

Simultaneously, the U.S. Attorney’s Office for the District of New Jersey has announced criminal charges against DeSalvo, further underscoring the severity of the allegations and the commitment to holding him accountable for his actions.

At the time of writing, Bitcoin (BTC) maintains its upward trajectory in price, currently trading at $26,700, reflecting a notable increase of over 3% within the past 24 hours.

Featured image from iStock, chart from TradingView.com

Tornado Cash indictment fails to show ‘clear violation’ of certain laws: Coin Center

Coin Center research director Peter Van Valkenburgh argued that crypto mixer Tornado Cash is an anonymizing software provider, not a money transmitter.

NFT marketplace Rarible sees uptick after commitment to royalties

NFT aggregator Rarible said by October it would cut off aggregate orders from competitors that don’t enforce royalties, such as OpenSea.

The Jackson Hole Effect? Powell’s Speech Sparks Bitcoin Fears Amid Similar 2022 Price Action

As Jerome Powell, the Federal Reserve (Fed) Chair, prepares to return to Jackson Hole this Friday, the Bitcoin (BTC) market is experiencing a sense of anticipation due to the similarities in the current price action compared to the period leading up to last year’s speech.

Key moving averages have been tested and lost over the past two weeks, followed by a period of consolidation, reminiscent of previous events.

However, it is important to note that these similarities do not guarantee a repeat of the past, as market conditions and Powell’s stance have since evolved.

Déjà Vu In The Bitcoin Market?

According to Keith Alan, co-founder of analysis and crypto research firm Material Indicator, last year, in the two weeks preceding Powell’s speech, BTC’s price broke through crucial technical support levels represented by the 21-day, 50-day, 100-day, and 200-week Moving Averages (MA).

Subsequently, a period of consolidation ensued, followed by a significant price drop in response to Powell’s hawkish tone during the speech. Alan stated:

Remember when Fed Chair Powell spoke from Jackson Hole last year and his hawkish tone triggered a 29% BTC dump that took 5 months to recover?

Notably, the recent price action in the Bitcoin market has displayed similarities to last year’s pattern. Over the past two weeks, Bitcoin has tested and lost these same key moving averages, and it is currently undergoing a phase of consolidation, mirroring the events leading up to Powell’s previous address.

Keith Alan emphasizes that since last year’s Jackson Hole event, there have been notable changes. Core inflation has decreased, and Powell’s approach to communication has become more “measured”.

It is uncertain whether Powell will adopt a hawkish or dovish stance in his upcoming speech, making it challenging to predict the market’s reaction with certainty. What is evident, however, is that the market is primed for a significant move.

Additionally, Alan suggests that the formation of a lower low in price increases the likelihood of an extension of the existing downtrend. Market participants should be prepared for the possibility of further testing of support levels.

As the Bitcoin market awaits Powell’s speech, market sentiment remains dynamic. Traders and investors are anticipating potential market-moving cues from the event.

As the date of Jerome Powell’s return to Jackson Hole approaches, Bitcoin has displayed a notable recovery of 2.1% within the past 24 hours, marking a positive upward movement that brings it closer to the $27,000 threshold.

However, it is crucial to note that if the outcome of Jerome Powell’s speech on Friday proves favorable for crypto investors and propels Bitcoin’s price to higher levels, the cryptocurrency may encounter a significant obstacle in the form of its 200-day moving average positioned at $27,200.

Featured image from iStock, chart from TradingView.com