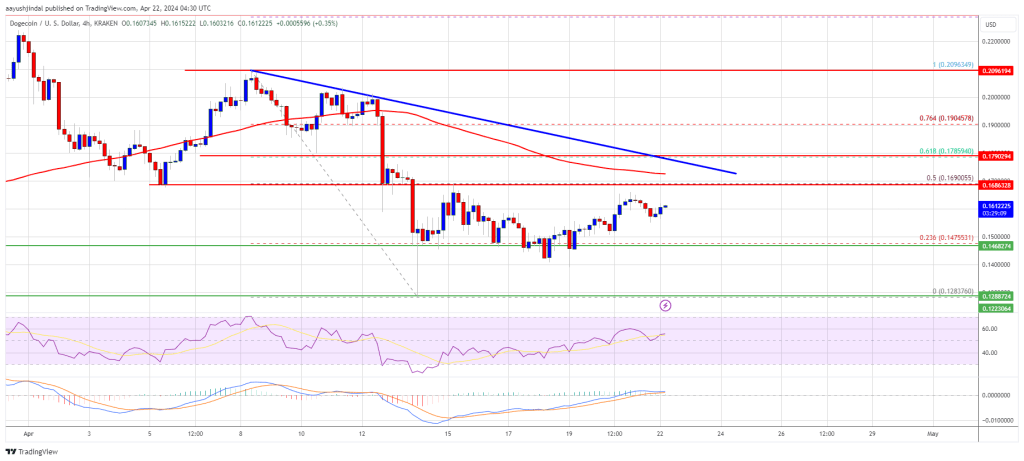

Dogecoin is struggling to rise above the $0.1650 resistance zone against the US Dollar. DOGE could decline heavily if it settles below the $0.140 support.

- DOGE is facing many hurdles near the $0.1650 and $0.170 levels against the US dollar.

- The price is trading below the $0.1620 level and the 100 simple moving average (4 hours).

- There is a major bearish trend line forming with resistance at $0.1620 on the 4-hour chart of the DOGE/USD pair (data source from Kraken).

- The price must settle above $0.170 to move into a positive zone and start a fresh surge.

Dogecoin Price Signals Downturn

After a major decline, Dogecoin price started a recovery wave from the $0.1280 zone. A low was formed at $0.1283 and DOGE climbed above $0.1350, like Bitcoin and Ethereum.

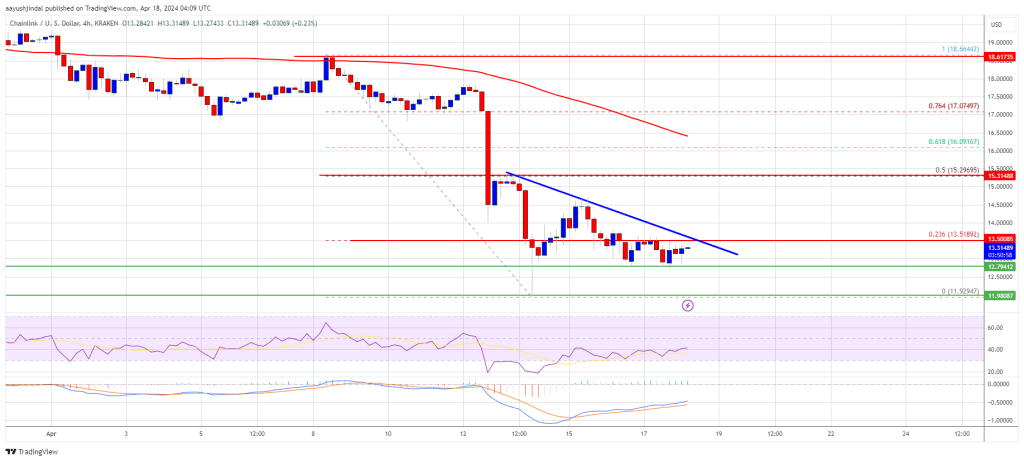

There was a move above the $0.1385 and $0.140 resistance levels. The price climbed above the 23.6% Fib retracement level of the downward move from the $0.2092 swing high to the $0.1283 low. However, the bears protected more gains above the $0.170 resistance.

The price failed to test the 50% Fib retracement level of the downward move from the $0.2092 swing high to the $0.1283 low. There is also a major bearish trend line forming with resistance at $0.1620 on the 4-hour chart of the DOGE/USD pair.

Dogecoin is also below the $0.160 level and the 100 simple moving average (4 hours). On the upside, the price is facing resistance near the $0.160 level.

Source: DOGEUSD on TradingView.com

The next major resistance is near the $0.1680 level. The main hurdle is at $0.170. A close above the $0.170 resistance might send the price toward the $0.1850 resistance. Any more gains might send the price toward the $0.20 level.

More Losses in DOGE?

If DOGE’s price fails to gain pace above the $0.160 level, it could start another decline. Initial support on the downside is near the $0.1475 level.

The next major support is near the $0.1400 level. If there is a downside break below the $0.1400 support, the price could decline further. In the stated case, the price might decline toward the $0.120 level.

Technical Indicators

4 Hours MACD – The MACD for DOGE/USD is now gaining momentum in the bearish zone.

4 Hours RSI (Relative Strength Index) – The RSI for DOGE/USD is now below the 50 level.

Major Support Levels – $0.1475, $0.1400 and $0.1200.

Major Resistance Levels – $0.1600, $0.1680, and $0.1700.