After the U.S. House of Representatives postponed proceedings on a resolution overturning an SEC policy affecting crypto, President Joe Biden said he would veto the measure.

Cryptocurrency Financial News

After the U.S. House of Representatives postponed proceedings on a resolution overturning an SEC policy affecting crypto, President Joe Biden said he would veto the measure.

The United Kingdom’s FCA has been combining different approaches to regulating the crypto market to see which one would work best.

XRP price fell over 14% year-to-date pressured by Ripple’s ongoing legal battle with the SEC so a bounce is in order, analysis suggests.

Former SEC official John Reed Stark has criticized the misuse of “regulation by enforcement” claims in a hearing before U.S. Congress.

In a post on X, crypto analyst Miles Deutscher laid out his strategic predictions for high-performing cryptocurrencies in the upcoming week to his 501,700 followers. His analysis delved deep into Bitcoin’s trading patterns, the surging AI-driven altcoin sector, and specific tokens that are displaying considerable potential due to recent developments and broader market dynamics.

At the forefront of Deutscher’s analysis, Bitcoin has recently returned to its previous trading range between $60,000 and $69,400 after experiencing a sharp drop. This movement was characterized as a significant deviation, suggesting manipulation or a shakeout of weak hands before a potential rally.

“Bitcoin is at the top of my watchlist for this week. Had a big fakeout/deviation to the downside, and now back within the range,” Deutscher stated. He pointed out that the key factor to watch is whether the current range’s lower boundary will hold, which could serve as a strong foundation for an upward trajectory.

Moreover, the AI sector has been particularly resilient and robust recently, bouncing back significantly amidst broader market recoveries. Deutscher highlighted the sector’s potential for outperformance, driven by several upcoming major events.

These include Apple’s Worldwide Developers Conference (WWDC), NVIDIA’s earnings announcement, and the anticipated release of ChatGPT 5. “AI is one of those unique narratives that retains constant mindshare due to its endless real-life news flow/hype,” Deutscher explained.

One specific AI token which Deutscher watches closely due to its alleged partnership with Apple is Render (RNDR), making it a prime candidate for speculation around the upcoming Apple event. Historically, RNDR has also led the AI token sector during market rotations.

Furthermore, Deutsches focuses on Near Protocol (NEAR), Fetch.ai (FET), AIOZ Network (AIOZ). He grouped these tokens together due to their correlation but noted their recent technical performance, where they bounced cleanly off daily support levels and established higher lows.

More Altcoins To Watch

TON: Recently the center of attention, TON experienced a drop after the Token2049 event in what Deutscher described as a “sell-the-news” scenario. However, recent investments by firms like Pantera signal continued interest and potential undercurrents of growth.

Ethena (ENA): With the market sentiment turning bullish again, Deutscher anticipates a return to positive funding rates, which typically benefit tokens like Ethena. Recent activity from the Ethena team, including increased reward boosts and optimistic social media posts from its founders, further bolster the bullish case. “Also hearing rumors of a T1 exchange listing,” Deutscher added, suggesting an impending increase in liquidity and exposure.

Jito (JTO): Jito is reportedly developing what Deutscher referred to as the “Eigen Layer of Solana,” aiming to replicate the success and hype surrounding the Eigen project’s layer solutions. Despite the challenges of a recent airdrop, Deutscher sees potential if the team executes well, particularly as the restaking narrative has not yet fully penetrated the market.

PopCat (POPCAT): Despite facing some fear, uncertainty, and doubt (FUD) related to copyright issues over the weekend, POPCAT continues to exhibit strong price action, pushing toward new highs. “POPCAT seems the best contender, for now, not a single cat meme coin has yet to hit a $1B market cap,” noted Deutscher, highlighting its standout performance.

Ethereum Finance (ETHFI): In the realm of liquidity reward tokens (LRT), ETHFI remains a notable mention despite a broader sector sell-off post-Eigen. Deutscher believes the selling may have been overreactive, and with total value locked (TVL) still on the rise, a reversion to mean on prices could be imminent.

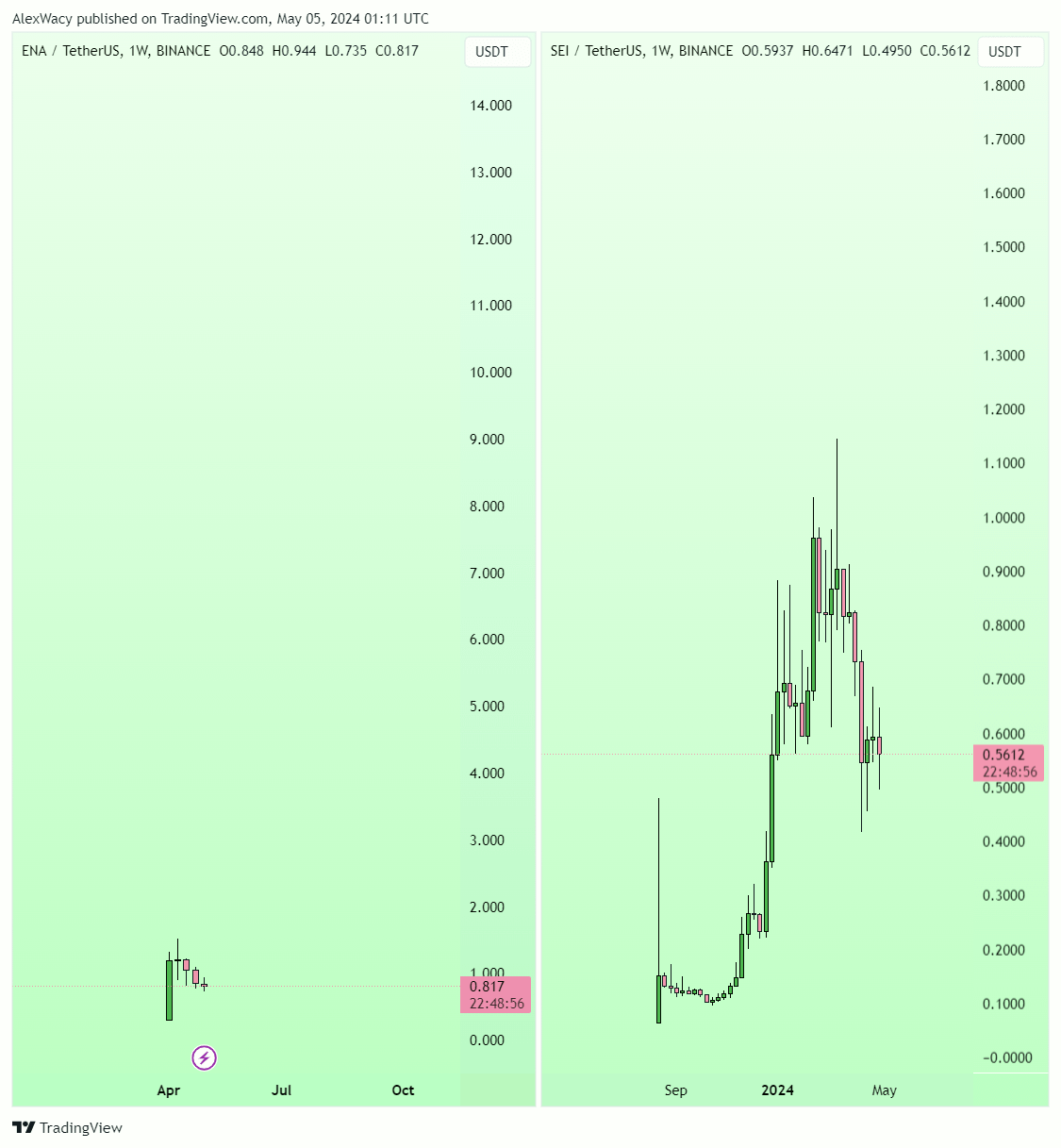

SEI Network (SEI): As anticipation builds for the launch of the new layer one blockchain, Monad, later this year, SEI is seen as a strategic play. Categorized within the parallelized Ethereum Virtual Machine (EVM) narrative, SEI experienced a substantial sell-off but is poised for recovery as the market focus shifts towards upcoming launches.

Friend (FRIEND): After recommending FRIEND at $1.30, Deutscher continues to see upside potential, particularly as it approaches more significant centralized exchange listings. He advises keeping an eye out for major pullbacks as opportunities to buy.

The in-principle approval enables QCP Capital to offer regulated digital asset activities in the region.

Bitcoin’s post-halving “danger zone” is over as Bitcoin establishes a firm footing above the $60,000 re-accumulation range, new analysis suggests.

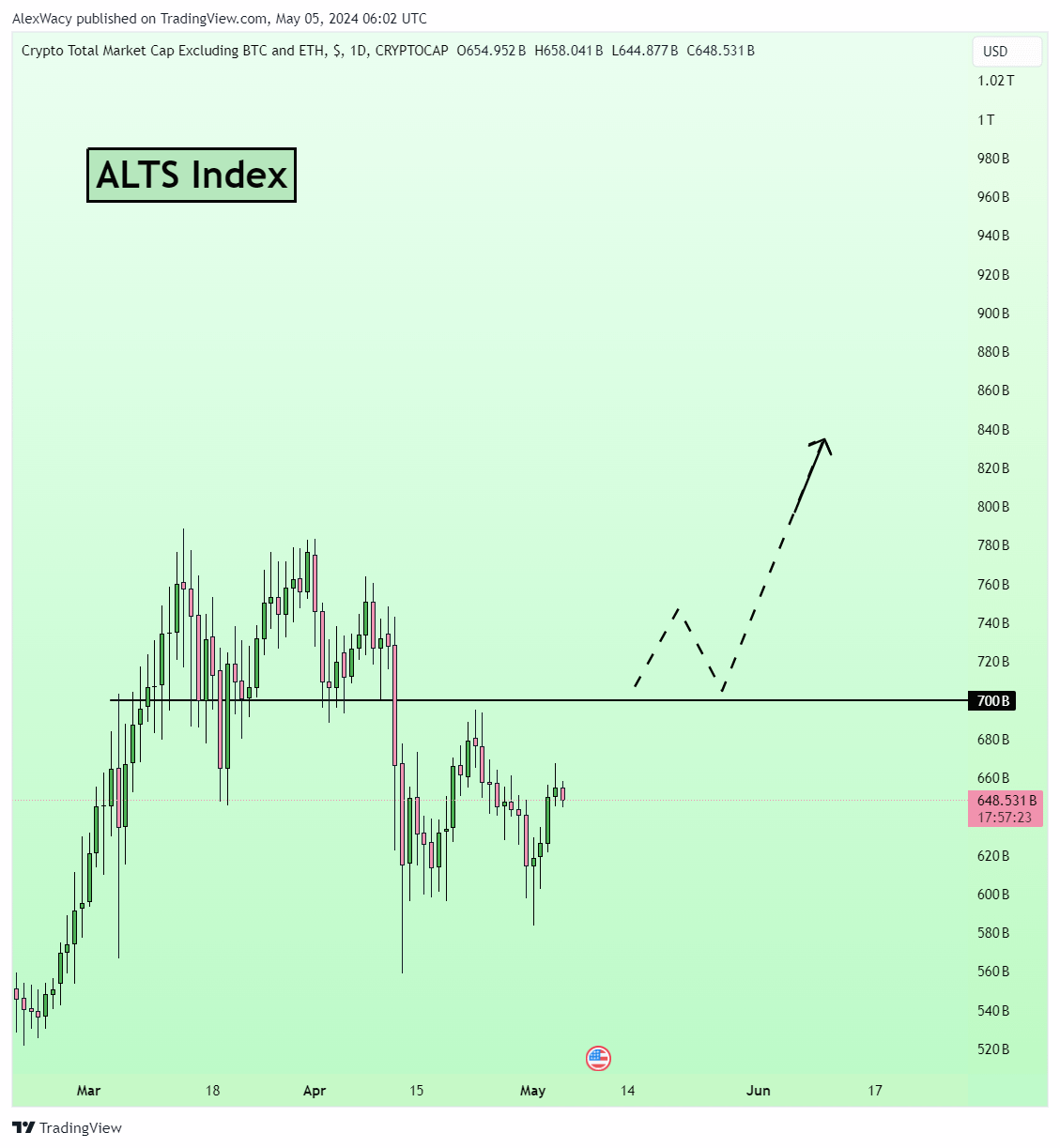

As the crypto market exhibits signs of a burgeoning altseason, crypto analyst Alex Wacy has shared a strategic forecast with his 175,000 followers on X. Wacy predicts a selective yet explosive growth phase for altcoins, emphasizing the critical nature of asset selection and market timing.

Wacy’s recent thread underscores the anticipation of a massive altseason: “Only ~15% of altcoins will bring 10-100x in this hyper growth. Asset selection matters more than ever. One slip-up, and you’re out.” His analysis highlights the potentially selective nature of the upcoming market phase, suggesting significant disparities in performance among altcoins.

Wacy believes the market is currently undervalued and primed for a significant uptick. He suggests that the consolidation of the total altcoin market cap above $700 billion would confirm the bull trend, signaling the onset of altseason. This perspective is rooted in current market behaviors where sentiment remains largely bearish, presenting a contrarian opportunity for growth.

He categorizes the current sentiment into three types of capitulation—price, time, and growth—indicating varied investor behaviors that often precede market recoveries. The prevailing fear of further drops, according to Wacy, will likely clear out weak hands, setting the stage for a supercycle driven by Fear of Missing Out (FOMO) and subsequent strong buying activities.

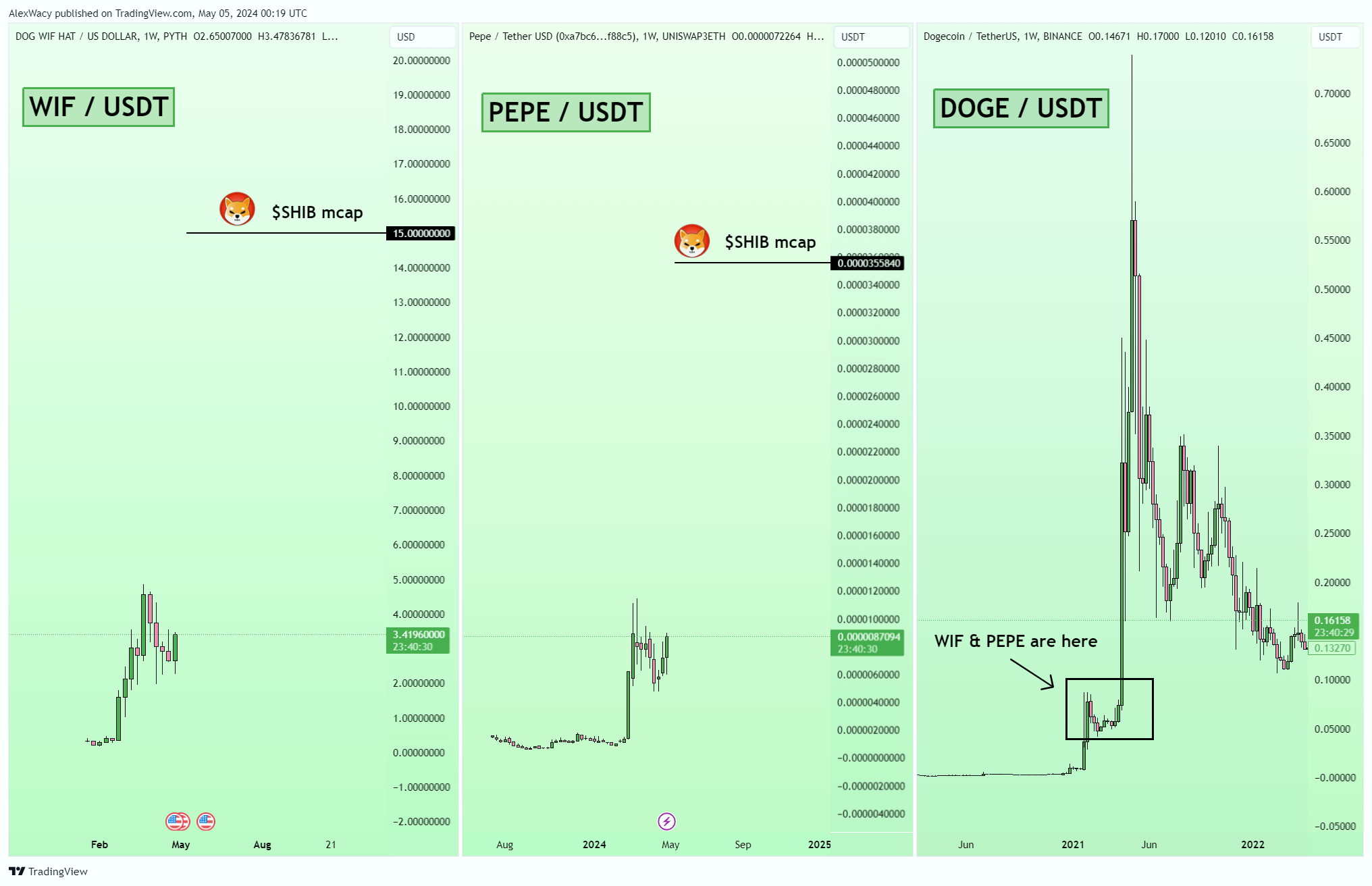

#1 And #2: WIF as well as PEPE are the memecoins highlighted by Wacy as potential early movers in the anticipated altseason. “Look at WIF and PEPE, structurally similar to DOGE during its meteoric rise. These coins have cultivated a community and meme appeal that could very well parallel SHIB’s market cap in the previous cycle,” Wacy asserts. He notes that PEPE appears particularly poised for a breakout, whereas WIF, though currently weaker, has the potential for quick shifts in market sentiment.

#3 Ondo Finance (ONDO): This Real World Asset (RWA) focused coin is characterized by its robust buy support during price dips. Wacy sees ONDO as an undervalued asset with a significant upside. “ONDO has a resilient buy floor; even slight retractions to around $0.64 could offer lucrative entry points ahead of substantial upward trajectories,” he advises. His first target is the $1.62 price zone.

#4 Arweave (AR): Known for its decentralized data storage solutions, Arweave is praised by Wacy for its strong market structure and resilience during downturns. Moreover, Arweave is building AO, a decentralized computer network which can be run from anywhere. “Arweave isn’t just storage; it’s a foundational technology in a decentralized future. A consolidation above $49 would likely be the catalyst for an explosive growth phase,” he predicts.

#5 Echelon (PRIME): Wacy discusses PRIME’s multifaceted ecosystem, which encompasses a trading card game and an AI-powered game, both of which are gaining traction. “Echelon stands at the confluence of gaming and blockchain technology, attracting a broad audience with its innovative gameplay and decentralized features,” he remarks. From a technical analysis perspective, the PRIME price is near a favorable buying zone from $14.97 to $17.5. “Hoping that altcoins are already entering the altseason, would like to see a V-shaped reversal,” Wacy states.

#6 Ethena (ENA): This synthetic dollar protocol offers an alternative to traditional banking and is poised for growth. “Ethena’s pattern on the weekly charts typically precedes major price movements. With the next major unlock event slated for April 2025, the buildup could be substantial,” Wacy explains. He likens ENA’s current price trajectory with the one of SEI.

Strategic Profit-Taking

Wacy also provides strategic advice on profit-taking, anticipating that the altcoin market index, TOTAL3, could ascend to between $2 trillion and $2.3 trillion during the altseason. He suggests considering partial profit-taking once the market reaches approximately $1.6 trillion. His rationale is based on historical patterns where many investors fall prey to greed, resulting in substantial losses.

The analyst further advises preparing a profit-taking strategy in advance, advocating for the reservation of 10-15% of positions for potential further growth beyond initial targets. He warns that the last surge in a growth phase often triggers excessive greed, suggesting that recognizing such signals could be crucial for timely exits before the onset of bear market conditions.

At press time, WIF traded at $3.58.

The Uniswap CEO strongly disapproved of low float tokens, considering them malicious and his biggest pet peeve.

The plaintiffs claim Solana (SOL), Polygon (MATIC), Near Protocol (NEAR), Decentraland (MANA), Algorand (ALGO), Uniswap (UNI), Tezos (XTZ), and Stellar Lumens (XLM) are securities.

According to Sui Network feedback, the Sui Foundation manages the main wallet with locked tokens released strategically to enhance the ecosystem.

The telecom company is reportedly seeking $1.8 billion in loans amid a plan to raise a total of $2.9 billion in debt

In a detailed analysis shared with his 788,000 followers on X (formerly Twitter), renowned analyst Pentoshi has forecasted a more restrained outlook for the current crypto bull run, suggesting that it may not mirror the explosive growth seen in previous cycles. His insights provide a deep dive into the underlying factors that could temper the market’s performance.

Pentoshi began his analysis by stating, “This cycle should have the largest diminishing returns of any cycle,” attributing this prediction to several key market conditions. Primarily, he noted that the base market capitalization for cryptocurrencies has increased significantly in each successive cycle, setting a higher starting point that makes further exponential growth increasingly challenging.

“Each cycle has set a floor about 10x the previous lows in terms of market cap,” Pentoshi explained. He provided a historical context, recounting that when he entered the crypto market in 2017, the market cap for altcoins was only around $12-15 billion, a figure that ballooned to over $1 trillion during peak periods. He argued, “That growth isn’t repeatable,” pointing out that the decentralized finance (DeFi) sector, which was then nascent, played a significant role in driving previous cycles’ exceptional returns.

Another significant factor Pentoshi highlighted is the dramatic increase in the number of altcoins and the corresponding market dilution. “Today, however, there are a lot more alts, and a lot more dilution,” he remarked, indicating that the proliferation of new tokens spreads investment thinner across the market, reducing the potential for individual tokens to achieve substantial price increases.

Pentoshi also touched upon the demographic shifts in crypto ownership. He contrasted the early days of crypto adoption, when approximately 2% of Americans were involved in the market, to the present, where over 25% of Americans have some form of crypto investment. “It just requires more capital to move the markets, and there will continue to be a lot more alts, spreading it out further,” he noted, emphasizing the logistical and financial challenges of replicating past growth rates in a much more saturated market.

An often-overlooked aspect of market dynamics, according to Pentoshi, is the role of token liquidity and its impact on price stability. He detailed that recently, tokens amounting to about $250 million were unlocked daily, though not necessarily sold. “Assuming they all got sold, that is the inflows you’d need just to keep prices stable for 24 hours,” he explained, highlighting the delicate balance required to maintain current market levels, let alone drive prices upward.

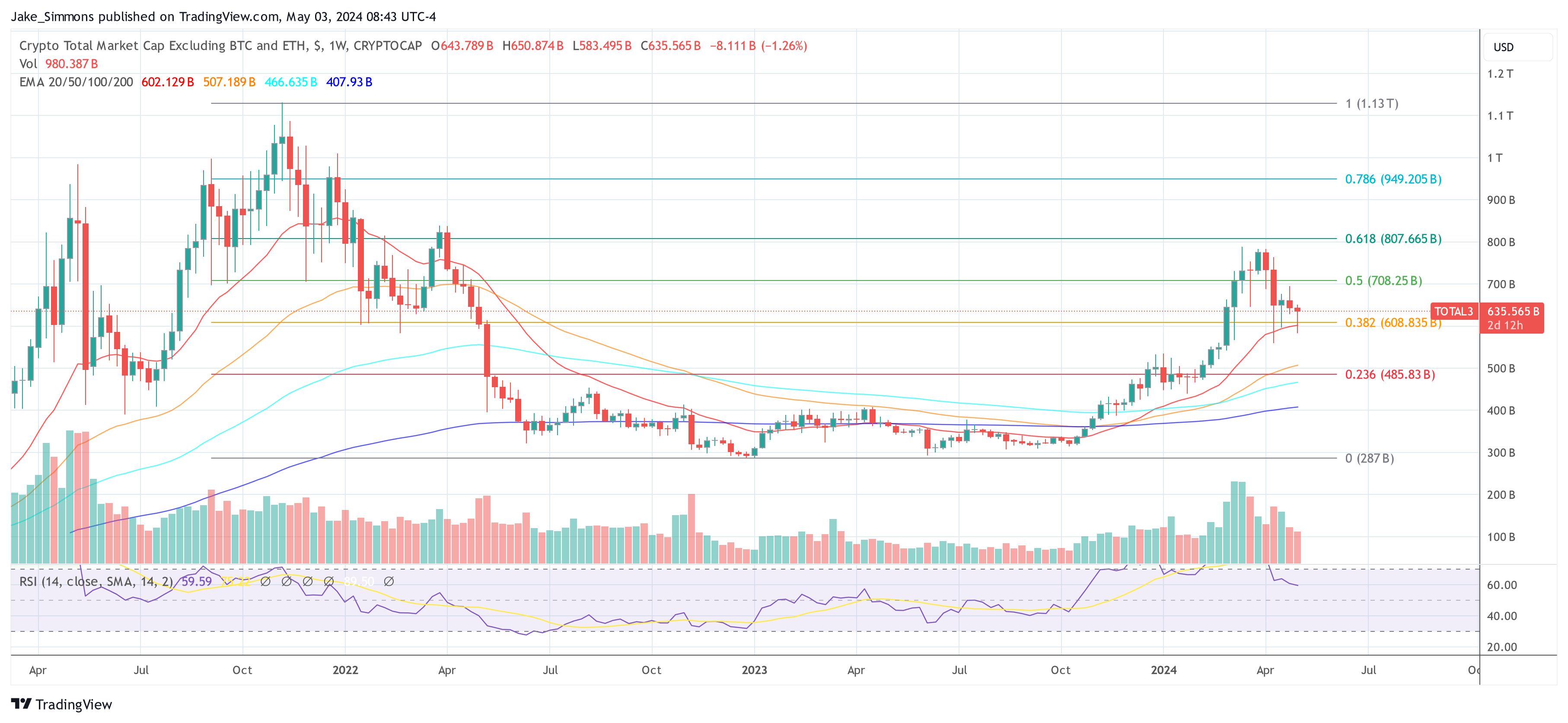

Looking forward, Pentoshi was conservative in his expectations for the Total3 index, which tracks the top 125 altcoins (excludes Bitcoin and Ethereum). He estimated, “My best guess is that this cycle we don’t see Total 3 go 2x past the 21′ cycle ATH. So 2.2T max for Total3.” This projection underscores his broader thesis that while the market continues to offer daily opportunities, the era of “easy, outsized gains” might be behind us.

Pentoshi concluded his analysis with advice for investors, suggesting a more cautious approach to market participation. “If you believe the cycle is 50% over, you should be taking out more than you are putting in and building up some cash and buying other assets with lower risk in the meantime,” he advised, stressing the importance of securing gains and diversifying holdings to mitigate risk.

Reflecting on the psychological aspects of investing, he added, “Most people never really learn. Because if you can’t control your greed, and defeat it, you are destined to give back your gains repeatedly.” His parting words were a reminder of the cyclical and often predatory nature of financial markets, urging investors to secure profits and protect themselves from foreseeable downturns.

At press time, TOTAL3 stood at $635.565 billion, which is still more than -43 % below the last cycle high.

The attack caused the unknown trader to lose over 97% of their crypto holdings.

Authorities seized $12.2 million worth of digital assets, real estate, and luxury cars during the arrest.

In his most recent publication dated May 2, 2024, Arthur Hayes, the founder of exchange BitMEX, shared his insights into the crypto market’s recent tumultuous behavior and the broader macroeconomic signals shaping potential future trends. Titled “Mayday,” his essay directly addresses the crypto market, which has experienced significant volatility since mid-April.

Hayes begins by noting the observable distress in the crypto markets, which he attributes to a confluence of factors including the end of the US tax season, anticipatory fears about Federal Reserve policy decisions, the Bitcoin halving event, and stagnating growth in the assets under management (AUM) for US Bitcoin exchange-traded funds (ETFs).

He interprets these factors as a necessary purge of speculative excess, stating, “The tourists will sit out the next phase on the beach… if they can afford it. Us hard motherfuckers will hodl, and if possible, accumulate more of our favorite crypto reserve assets such as Bitcoin and Ether, and/or high-beta shitcoins like Solana, Dog Wif Hat, and dare I say Dogecoin (the OG doggie coin).”

A significant portion of Hayes’ analysis focuses on the Federal Reserve’s recent adjustment to its quantitative tightening (QT) program. Previously set at a reduction of $95 billion per month, the Fed has dialed this back to $60 billion.

Hayes interprets this as a covert form of quantitative easing, injecting an additional $35 billion per month into the dollar liquidity pool. He explains, “When you combine the Interest on Reserve Balances, RRP payments, and interest payments on US Treasury debt, the reduction in QT increases the amount of stimulus provided to the global asset markets each month.”

Hayes also scrutinizes actions by the US Treasury, particularly under Secretary Janet Yellen. He discusses the Treasury’s Quarterly Refunding Announcement (QRA), which outlines the expected borrowing and cash balances for upcoming quarters. For Q2 2024, the Treasury anticipates borrowing $243 billion, a figure Hayes points out is $41 billion higher than the previous forecast, due to lower-than-expected tax receipts.

He predicts this increased supply of Treasuries could lead to higher long-end rates, a situation Yellen may counter with yield curve control measures—a scenario that could catalyze a significant rally in Bitcoin and crypto prices.

Hayes touches on the failure of Republic First Bank, emphasizing the response by monetary authorities as a key indicator of systemic fragility. He criticizes the federal safety net that ensures all depositors are made whole, arguing that it masks deeper vulnerabilities within the US banking system and leads to a stealth form of money printing, as uninsured deposits are effectively guaranteed by the government. This, Hayes argues, is a fundamental misalignment that could lead to significant inflationary pressures.

Hayes is candid about his investment strategies in the current environment. He advocates buying now. “I’m buying Solana and doggie coins for momentum trading positions. For longer-term shitcoin positions, I’m upping my allocations in Pendle and will identify other tokens that are ‘on sale.’ I will use the rest of May to increase my exposure. And then it’s time to set it, forget it, and wait for the market to appreciate the inflationary nature of the recent US monetary policy announcements.”

He concludes with a broad prediction that, despite the market’s recent volatility, the underlying liquidity conditions created by US monetary and fiscal policies will provide a floor for crypto prices, leading to a gradual upward trend. “While I don’t expect crypto to fully realize the recent US monetary announcements’ inflationary nature immediately, I expect prices to bottom, chop, and begin a slow grind higher,” he states, signaling his bullish outlook.

For Bitcoin, Hayes predicts that the premier cryptocurrency will recapture the key $60,000 level and then move in a range between $60,000 and $70,000 until August because of the annual summer lull.

At press time, BTC traded at $59,393.

In his most recent publication dated May 2, 2024, Arthur Hayes, the founder of exchange BitMEX, shared his insights into the crypto market’s recent tumultuous behavior and the broader macroeconomic signals shaping potential future trends. Titled “Mayday,” his essay directly addresses the crypto market, which has experienced significant volatility since mid-April.

Hayes begins by noting the observable distress in the crypto markets, which he attributes to a confluence of factors including the end of the US tax season, anticipatory fears about Federal Reserve policy decisions, the Bitcoin halving event, and stagnating growth in the assets under management (AUM) for US Bitcoin exchange-traded funds (ETFs).

He interprets these factors as a necessary purge of speculative excess, stating, “The tourists will sit out the next phase on the beach… if they can afford it. Us hard motherfuckers will hodl, and if possible, accumulate more of our favorite crypto reserve assets such as Bitcoin and Ether, and/or high-beta shitcoins like Solana, Dog Wif Hat, and dare I say Dogecoin (the OG doggie coin).”

A significant portion of Hayes’ analysis focuses on the Federal Reserve’s recent adjustment to its quantitative tightening (QT) program. Previously set at a reduction of $95 billion per month, the Fed has dialed this back to $60 billion.

Hayes interprets this as a covert form of quantitative easing, injecting an additional $35 billion per month into the dollar liquidity pool. He explains, “When you combine the Interest on Reserve Balances, RRP payments, and interest payments on US Treasury debt, the reduction in QT increases the amount of stimulus provided to the global asset markets each month.”

Hayes also scrutinizes actions by the US Treasury, particularly under Secretary Janet Yellen. He discusses the Treasury’s Quarterly Refunding Announcement (QRA), which outlines the expected borrowing and cash balances for upcoming quarters. For Q2 2024, the Treasury anticipates borrowing $243 billion, a figure Hayes points out is $41 billion higher than the previous forecast, due to lower-than-expected tax receipts.

He predicts this increased supply of Treasuries could lead to higher long-end rates, a situation Yellen may counter with yield curve control measures—a scenario that could catalyze a significant rally in Bitcoin and crypto prices.

Hayes touches on the failure of Republic First Bank, emphasizing the response by monetary authorities as a key indicator of systemic fragility. He criticizes the federal safety net that ensures all depositors are made whole, arguing that it masks deeper vulnerabilities within the US banking system and leads to a stealth form of money printing, as uninsured deposits are effectively guaranteed by the government. This, Hayes argues, is a fundamental misalignment that could lead to significant inflationary pressures.

Hayes is candid about his investment strategies in the current environment. He advocates buying now. “I’m buying Solana and doggie coins for momentum trading positions. For longer-term shitcoin positions, I’m upping my allocations in Pendle and will identify other tokens that are ‘on sale.’ I will use the rest of May to increase my exposure. And then it’s time to set it, forget it, and wait for the market to appreciate the inflationary nature of the recent US monetary policy announcements.”

He concludes with a broad prediction that, despite the market’s recent volatility, the underlying liquidity conditions created by US monetary and fiscal policies will provide a floor for crypto prices, leading to a gradual upward trend. “While I don’t expect crypto to fully realize the recent US monetary announcements’ inflationary nature immediately, I expect prices to bottom, chop, and begin a slow grind higher,” he states, signaling his bullish outlook.

For Bitcoin, Hayes predicts that the premier cryptocurrency will recapture the key $60,000 level and then move in a range between $60,000 and $70,000 until August because of the annual summer lull.

At press time, BTC traded at $59,393.

Making the token non-transferable could force users to pay the 1.5% Friend.tech platform fee in an “ironic” shift from the platform’s non-venture capitalist approach.

Fans want to journey alongside their favorite musicians as they explore their creativity and expand their catalog. FanSociety hopes to be the Web3 platform that makes this possible.

The amount stolen through crypto hacks, along with the number of successful attacks, has seen a sharp decline in April.