Bitcoin and altcoins could be en route to retest their recent strong support levels as bears try to extend the correction.

Cryptocurrency Financial News

Bitcoin and altcoins could be en route to retest their recent strong support levels as bears try to extend the correction.

Memecoins in the Solana ecosystem defy the recent bearish downtrend in the crypto market by managing to generate double-digit gains.

Solana attempted a recovery wave above the $140 level. SOL price is now struggling to clear the $160 and $170 resistance levels.

Solana price started a major decline below the $170 and $160 support levels. SOL tested the $115 zone and recently started an upside correction, like Bitcoin and Ethereum.

There was a decent increase above the $130 and $140 levels. The price climbed above the 23.6% Fib retracement level of the downward wave from the $205 swing high to the $115 low. It even spiked above the $155 zone and the 100 simple moving average (4 hours).

However, the bears are active near the $160 zone and the 50% Fib retracement level of the downward wave from the $205 swing high to the $115 low. The price struggled and corrected gains.

Source: SOLUSD on TradingView.com

Solana is now trading below $160 and the 100 simple moving average (4 hours). There is also a key bullish trend line forming with support at $146 on the 4-hour chart of the SOL/USD pair. Immediate resistance is near the $155 level. The next major resistance is near the $160 level. A successful close above the $160 resistance could set the pace for another major increase. The next key resistance is near $170. Any more gains might send the price toward the $188 level.

If SOL fails to rally above the $160 resistance, it could start another decline. Initial support on the downside is near the $145 level and the trend line.

The first major support is near the $132 level, below which the price could test $120. If there is a close below the $120 support, the price could decline toward the $100 support in the near term.

Technical Indicators

4-Hours MACD – The MACD for SOL/USD is gaining pace in the bearish zone.

4-Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $146, and $132.

Major Resistance Levels – $155, $160, and $170.

Bitcoin and altcoins continue to be rocked by macroeconomic and geopolitical uncertainty, but data shows bulls continue to buy each dip.

Solana, like many Proof-of-Stake (PoS) cryptocurrencies, relies on a decentralized network of validators who secure the network by staking their SOL coins. In exchange for staking, validators earn rewards.

However, as Solana’s price began its recent ascent, a noticeable decline in staked SOL was observed. This suggests that some validators are choosing to unstake their coins, potentially to capitalize on the price surge and book some early profits.

Meanwhile, on Tuesday, Solana enjoyed a stellar day, surging 17% and adding over $11 billion to its market capitalization, which now stands at over $70 billion. This impressive performance saw Solana outperform industry giants like Bitcoin (BTC) and Ethereum (ETH), which remained entangled in their own price gyrations. With its market capitalization now totaling an impressive $80.7 billion, Solana’s surge has caught the attention of the crypto world.

This unstaking activity has drawn the attention of analysts, with the unstaked amount reaching a significant 5 million SOL over the past week. With Solana currently trading around $157 per coin, this translates to roughly $780 million worth of tokens re-entering the market. The influx of such a large volume in a short period could lead to a temporary oversupply situation on exchanges.

The potential impact of unstaked SOL on the price is a matter of debate. Without a corresponding surge in demand to absorb this additional supply, there’s a risk of an initial price correction in the coming days. This could see Solana retreat from its current perch and settle around the $150 mark before potentially resuming its upward trajectory towards $200.

The $200 Target

The coming days will be crucial for Solana. The bulls need to maintain strong buying pressure to absorb the unstaked coins and push the price above the $160 resistance zone. If successful, this could propel Solana towards its $200 target. However, a failure to do so, coupled with a large-scale sell-off from unstaked SOL, could trigger a correction down to $150.

Solana Breakpoint 2024

In another development, Solana Breakpoint 2024 is set to take place in Singapore, from September 20 to September 21. This event will provide attendees with full access to the heart of the Solana community, including insightful talks and exclusive events.

Special subsidized rates are available for developers, creators, artists, and students, ensuring that a diverse range of individuals can participate in this transformative event. The Solana Campus, located just a short 15-minute journey from downtown Amsterdam, offers a variety of stages for insightful talks, networking areas to build connections, and complimentary transportation for attendees’ convenience.

Solana Breakpoint is an important event for the Solana community, providing a platform for developers, validators, and other ecosystem participants to discuss the latest developments, share insights, and showcase their achievements. The annual conference highlights the network’s potential and its role in the broader blockchain space, with a focus on performance, reliability, and innovation.

Featured image from Pexels, chart from TradingView

Two Solana-based memecoins, Bonk (BONK) and Dogwifhat (WIF), have registered substantial gains over the past 24 hours. BONK recorded a 35% increase, while WIF climbed by 19%, positioning them among the top three gainers in the top 100 cryptocurrencies by market cap today. Only Hedera Hashgraph (HBAR) surpassed them, with a notable 44% rise during the same period.

The significant uptick in these Solana memecoins is closely linked to the recent improvements in the Solana network’s performance. A tweet from SolanaFloor earlier today indicated, “BREAKING: Solana’s congestion issues have been completely resolved, with block production back to normal. Transactions confirming in under 2 seconds.” This announcement marks a pivotal moment for the network which had been plagued by congestion issues.

Source A: https://t.co/2TVnbaPNlHSource B: https://t.co/GfHxy8dC1B

— SolanaFloor | Powered by Step Finance (@SolanaFloor) April 24, 2024

On April 15, Solana developers rolled out crucial updates designed to alleviate these problems, urging validators to adopt version v1.17.31. This version introduces changes in the treatment of validators based on their stakes. Further enhancements are anticipated with the release of version v1.18 next month, which will include a new scheduler, albeit disabled by default.

Andrew Kang, founder of Mechanism Capital, remarked a few days before the fix, “Let’s also not forget that the Solana congestion issues have weighed down SOL and Solana-based memecoins significantly. It’s not a question of if but when the network is significantly improved. That’s your springboard.” Kang’s comments now seem prophetic as the resolution of network issues has indeed acted as a springboard for memecoin valuations.

Specifics On Rally Of Dogwifhat (WIF) And BONK

The price of WIF soared to a 24-hour high of $3.43 on April 24, buoyed by an impressive 96% increase in trading volume. This influx was fueled by notable acquisitions from whales like Ansem, who capitalized on the positive market sentiments.

The breakout above the resistance level at $3.18, after a week of sideways trading between $1.97 and $3.18, was a significant trigger. WIF formed a two-week-long ascending triangle, a bullish chart pattern that indicated a continuation of the previous upward trend. The breakout was widely discussed in the crypto community, with trader Bluntz Capital confirming the pattern’s resolution and sparking further bullish sentiment.

2 week long ascending triangle forming here on $WIF, i think the breakout is imminent pic.twitter.com/S0OZWBsq6u

— Bluntz (@Bluntz_Capital) April 24, 2024

BONK is registering a dramatic 35% rise, with a remarkable 304% increase in trading volume. The price action successfully breached the 0.236 Fibonacci retracement level at $0.000020727, and continued its upward trajectory to the 0.5 Fibonacci level, signaling strong buying interest and bullish momentum.

This rally probably gained additional support from the recent listing of BONK by the global neobank Revolut, which was announced on April 22. This inclusion in Revolut’s trading platform, which features over 150 digital currencies, provided significant exposure and legitimacy, further enhancing investor interest and market activity around BONK.

The Wild West of cryptocurrency just got a little wilder. Solana, the blockchain known for its lightning-fast transactions, recently became a breeding ground for a peculiar phenomenon: the meme coin frenzy.

While these dog-themed, cat-inspired, or just plain nonsensical tokens promised moon landings, many investors landed face-first in a crater of lost cash.

Fueled by social media hype and the fear of missing out (FOMO), a stampede of investors poured money into meme coin presales. A project with a name like “I Like This Coin” (LIKE) sprouted like weeds, promising outlandish returns.

The “I Like This Coin” story, however, turned out to be a classic case of “buyer beware.” Despite an initial market cap of a staggering $577 million, the token’s value plummeted by a disastrous 90% within a mere eight hours of launch.

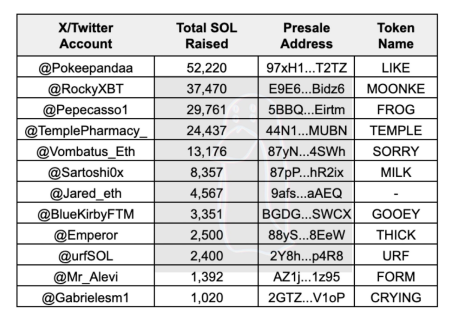

The party didn’t stop there. Blockchain investigator ZachXBT uncovered a particularly galling trend: a dozen meme coin projects vanished into thin air after their presales, taking a combined $26.7 million from investors with them.

Only 1 month has passed and 12 of the Solana presale meme coins have been completely abandoned after raising >180,650 SOL ($26.7M).

Would avoid any future projects launched by these founders. https://t.co/J0zFldRIa6 pic.twitter.com/K610MAEPMn

— ZachXBT (@zachxbt) April 21, 2024

The meme coin craze wasn’t without collateral damage. The massive influx of transactions clogged the Solana network, leading to transaction failures and frustrating delays. This highlighted a fundamental issue with meme coins: they often lack real-world applications and contribute little to the underlying blockchain’s development.

Solana’s founder, Anatoly Yakovenko, wasn’t shy about expressing his skepticism. He questioned the very concept of meme coin presales, suggesting they were better suited for projects with strong tech foundations. Yakovenko’s comments resonated with many who saw the meme coin frenzy as a speculative bubble fueled by empty promises and social media hype.

Meme Coin Meltdown: A Cautionary Tale For Crypto Curious Investors

The rise and fall of Solana’s meme coins serves as a stark reminder of the inherent risks associated with investing in unregulated, highly speculative assets. While the allure of quick riches might be tempting, the potential for scams and rug pulls (where developers abandon a project after raising funds) is significant.

The fallout from the meme coin frenzy could have lasting repercussions. Regulatory bodies might take a closer look at this corner of the crypto world, potentially leading to stricter measures to protect investors.

For those interested in exploring the exciting world of cryptocurrency, the lesson is clear: conduct thorough research, prioritize projects with real-world use cases, and always remember what the sages mean when they say if it sounds too good to be true…

Featured image from Pexels, chart from TradingView

Renowned crypto analyst Lark Davis recently shared insights into the world of altcoin and decentralized finance (DeFi), offering high-risk, high-reward options and established projects.

During a live stream, Davis discussed his current portfolio holdings, while emphasizing the volatility inherent in these markets.

During his discussion, Davis advised against investing in Bitcoin SV (BSV), expressing doubts about Craig Wright’s claim to be Satoshi Nakamoto. He emphasized the importance of doing thorough research before investing in cryptocurrencies.

Additionally, he mentioned Bitcoin Cash (BCH) as a potential candidate for the next ETF approval in the US due to its slight variations from Bitcoin.

Regarding altcoins and DeFi, Davis highlighted different projects in his portfolio, including “Puff, Benji, and Foxy,” which he categorized as “high-risk, high-reward ventures.” Davis also mentioned DeFi projects like “Jup and Arrow,” which are known for their governance features and staking rewards.

Furthermore, Davis discussed projects with considerable potential for growth, such as Solana, Trader Joe, and Mantle. However, he emphasized these investments’ volatile nature and recommended that viewers approach them cautiously.

In addition to Davis’s insights, Solana has recently become the fourth-largest cryptocurrency by market capitalization, surpassing XRP and Dogecoin. With a market cap of $68.7 billion and a price of $154.66 at the time of writing, Solana’s rise reflects growing interest in the project.

Meanwhile, analysts offer contrasting views on the future of altcoins. Altcoin Sherpa suggests that these alternative tokens may stagnate for 1-4 months, needing time to consolidate after a significant run.

It’s quite possible that altcoins are done for the next 1-4 months. There are certainly going to be outliers but I think that the majority need time to chill out and consolidate after such a big run.

The scary thing is that many alts didn’t even run that hard over the last few… pic.twitter.com/sGke8PT5yw

— Altcoin Sherpa (@AltcoinSherpa) April 16, 2024

However, Crypto Jelle presents an opposite outlook, suggesting that altcoins could rally massively in the coming months.

Crypto Jelle points to historical patterns, noting that altcoins typically consolidate after breaking out from a resistance zone before entering a new bull run. If history repeats itself, altcoins could demonstrate significant growth potential shortly.

It’s about time for #Altcoins to remind everyone what they’re capable of.

Looks primed to go on a massive rally in the coming months.

I’m ready. pic.twitter.com/qru4GksczF

— Jelle (@CryptoJelleNL) April 12, 2024

Featured image from Unspalsh, Chart from TradingView

Already a multi-billion-dollar sector of the crypto industry, the DePIN narrative is a promising one, according to experts.

Some surprise winners in Drift’s road to decentralization include MetaDAO.

Solana’s price saw a notable recovery on Monday after a steep decline over the past seven days. This was supported by positive developments in the Bitcoin (BTC) and Ethereum (ETH) markets, which came alongside the approval of exchange-traded funds (ETFs) for both cryptocurrencies in Hong Kong.

Additionally, Solana addressed its ongoing network congestion issues with a new update, aiming to rectify transaction failures and outages.

According to Mert Mumtaz, CEO of Helius Labs, Solana’s recent network congestion issues were attributed to an implementation bug rather than a fundamental design flaw. Mumtaz clarified that Solana’s current predicament results from a flaw in implementing a specific protocol.

According to Anza, a spin-off of Solana Labs, Solana has released a new update to its validator client software to combat this. The update, v1.17.31, aims to reduce network congestion and will be followed by further improvements in v1.18.

Anza emphasized the update’s significance, urging MainnetBeta validators to adopt it. The enhancements introduced in the update are expected to mitigate Solana’s ongoing network congestion issues.

Furthermore, validators were advised to upgrade their systems when there is less than 5% delinquent stake, ensuring they have sufficient time to monitor the node after the upgrade.

Any issues encountered during the upgrade were to be reported to mb-validators. Solana Status, a trusted source, corroborated the announcement, recommending the v1.17.31 release for general use.

Trent.sol, Solana’s developer and operations manager, emphasized that the effectiveness of the update would be proportional to its adoption across the network.

While the improvements primarily target Solana’s Stake Weighted Quality of Service (SWQOS) and may not result in significant changes to the reliability of unstacked Tensor processing units (TPU) traffic, Solana users were advised to keep delinquency below 5% during the upgrade process.

Furthermore, Anza hinted at additional enhancements in the pipeline, urging users to stay tuned for further updates.

After unveiling updates to enhance network efficiency, the Solana price has surged by over 7%. This surge has helped offset the ongoing downtrend experienced by Solana, which amounted to nearly 21% over the past month.

In addition, the Hong Kong SFC has officially approved several spot Bitcoin and Ethereum ETFs, including asset managers such as China Asset Management, Bosera Capital, HashKey Capital Limited, and an in-principle approval for Harvest Global Investments.

This regulatory approval has not only positively impacted the prices of Bitcoin and Ethereum but has also instilled a sense of positivity in the overall cryptocurrency market. As a result, the top 10 cryptocurrencies have witnessed significant uptrends, riding on the wave of these developments.

Despite the recent surge in Solana’s price, SOL’s trading volume has decreased by -44.70% in the last 24 hours, indicating a recent decline in market activity, according to CoinGecko data.

Solana’s current trading price of $151.40 presents the first obstacle in the cryptocurrency’s path toward further price gains. If this hurdle is surpassed, the next significant resistance lies at $170, which would signify a recovery of SOL’s gains recorded over the past month.

On the other hand, the $130 mark has proven to be a strong support level for Solana, representing the foundation of SOL’s one-month bullish structure, which propelled its price rally to nearly three-year highs of $210 on March 18.

Featured image from Shutterstock, chart from TradingView.com

A meme coin trading frenzy and a rapid spike in users has stressed the network in recent months.

Solana tumbled and declined toward $110. SOL price is now correcting losses above $140 and facing hurdles near the $160 resistance zone.

Solana price started a major decline below the $180 and $160 support levels. SOL declined over 20% and even tumbled below the $150 level. Finally, the bulls appeared near $110.

A low was formed at $115.04 and the price is now attempting a recovery wave like Bitcoin and Ethereum. There was a decent increase above the $125 and $132 levels. The price cleared the 23.6% Fib retracement level of the downward move from the $204 swing high to the $115 low.

Solana is now trading below $150 and the 100 simple moving average (4 hours). Immediate resistance is near the $150 level. The next major resistance is near the $160 level.

Source: SOLUSD on TradingView.com

There is also a key bearish trend line forming with resistance at $160 on the 4-hour chart of the SOL/USD pair. The trend line is near the 61.8% Fib retracement level of the downward move from the $204 swing high to the $115 low. A successful close above the $160 resistance could set the pace for another major increase. The next key resistance is near $182. Any more gains might send the price toward the $200 level.

If SOL fails to rally above the $160 resistance, it could start another decline. Initial support on the downside is near the $140 level.

The first major support is near the $132 level, below which the price could test $125. If there is a close below the $125 support, the price could decline toward the $115 support in the near term.

Technical Indicators

4-Hours MACD – The MACD for SOL/USD is gaining pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $140, and $132.

Major Resistance Levels – $150, $160, and $182.

A cryptocurrency analyst, who accurately foresaw the market’s bottom in 2018, is now focusing on Solana, foreseeing a price bottom for the cryptocurrency and identifying its next target after reaching it.

In a Wednesday X (formerly Twitter) post, a crypto analyst identified as ‘Bluntz’ has highlighted a potential price bottom for Solana. Following up on the previous forecast on April 4, where he predicted that Solana would hit a bottom at or below $160 before pushing back up, Bluntz revealed in his new post that the next price bottom would be $162.

The crypto analyst anticipates that Solana’s price will hit a bottom at $162 before it begins to move higher, suggesting a possible bullish rebound for the cryptocurrency. Sharing several price charts illustrating Solana’s price movements between March and April 2024, Bluntz uses the Elliot wave theory as a technical pattern to guide his predictions.

The Elliott wave theory is a unique form of technical analysis which predicts price movements by observing and identifying recurrent long-term price patterns related to persistent changes in investor sentiment and psychology.

In his earlier post, Bluntz shared a price chart which indicated that Solana’s next leg up after hitting the predicted price bottom would be $224. He estimated the timeline for this significant surge, predicting that the cryptocurrency could jump to $224 before April 22.

Lately, the price of Solana has been on a major downward trend, recording double-digit losses for the past few weeks. At the time of writing the cryptocurrency is trading at a price of $151.15, marking a 12.32% decrease in the last 24 hours and a 13.93% drop in the past week, according to CoinMarketCap.

This continuous decline has been attributed to the congestion issues Solana’s network currently faces. Earlier in April, Solana had fallen victim to a network outage, resulting in about 75% of transactions on the network failing. This caused a major disruption in the blockchain’s operations, raising concerns among investors and the broader crypto community.

Following the blackout, the price of Solana plummeted significantly and has continued on a downward trend. Despite scheduling April 15 for a network resolution, the cryptocurrency’s value has not shown any positive response.

It’s also important to note that Solana’s current price has dropped way below the previously stipulated bottom of $162 predicted by Bluntz. The possibility of a bullish rebound for the cryptocurrency remains uncertain, as more doubts have been raised concerning the network’s ability to handle significant transaction volumes.

Featured image from Pexels, chart from TradingView

Shakeeb Ahmed, a security engineer who stole over $12 million from two different decentralized cryptocurrency exchanges built on Solana, was sentenced to three years in prison and three years of supervised release by a federal judge on Friday.

Solana (SOL) has recently become a focal point of discussion among investors and analysts. After surging from below $22 to a high of $210 within six months, and currently trading at around $174—a nearly 700% increase—questions arise about the sustainability of its price rally.

Despite the impressive surge, SOL remains 50% shy of its November 2021 all-time high of $260. The recent consolidation pattern over the past four weeks suggests a cooling off period. As the market looks forward, understanding the underlying fundamentals becomes crucial.

Jamie Coutts, Chief Crypto Analyst (CMT) at Real Vision, notes in an analysis, “While Solana’s outperformance has waned in the past month, it is still the best-performing network in the past 12–18 months by a country mile. […] Solana’s price adjustment seems abrupt but is aligned with fundamental indicators that suggest a stabilizing rather than diminishing value proposition,” Coutts explains.

Solana’s Daily Active Users (DAUs) have risen dramatically, up more than 400% over the last nine months. This growth places Solana in a rarefied group of networks boasting over 1 million DAUs. Despite not reaching its 2021 peak DAUs, which may have been inflated by synthetic activities linked to the FTX exchange, the nature of engagement on Solana has evolved.

“The ecosystem is maturing; the engagement we see today is fundamentally different—more diverse and significantly more integrated with real-world applications,” Coutts remarked. He highlighted the burgeoning sectors contributing to this growth, including artificial intelligence, decentralized finance, consumer applications, and the burgeoning memecoin and NFT spaces.

With a significant retracement from its 2021 peak price, Solana’s market capitalization has still managed to hit new highs this cycle, suggesting a broadening base of investment and valuation recalibration. “The Network Value to User (NVU) ratio indicates that while the asset appreciation is notable, it’s the user growth that provides a compelling story for Solana,” Coutts notes.

At present, Solana’s NVU ratio fluctuates between 50-100, reflective of a balanced growth-to-value dynamic when compared with other networks where speculative value often outstrips user growth.

One of the standout metrics for Solana this cycle has been its fee revenue, which has seen a sixfold increase in a nine-month period. Daily fees now average $1.8 million, a fortyfold increase. This surge is largely attributable to the network’s increasing utilization across various applications.

“Fee income not reaching its peak is a misnomer; what’s crucial is that the financial underpinnings of the network—highlighted by fee income—are stronger than ever,” Coutts emphasized. He also compared Solana’s fee income, which reached about 20% of Ethereum’s in March, demonstrating its growing financial stature within the ecosystem.

Solana Vs. Ethereum And Future Outlook

While Solana still lags behind Ethereum in terms of total dApps, its economic indicators are robust. With 134 dApps, compared to Ethereum’s 2,702, Solana’s dApp cash flow intensity is second only to Ethereum, indicating a high monetization capability per application. “Solana’s smaller, more potent suite of applications is driving economic efficiency that rivals even the largest networks,” states Coutts.

Despite the speculative components associated with memecoins and airdrops driving part of the transaction volume, Solana’s adjusted fee growth metric isolates and highlights genuine economic activity. With a staggering real fee growth rate of 3,259.7%, Solana leads all networks in this metric.

“While some underlying activities might be transitory, the intense and growing usage of Solana’s blockchain is undeniable evidence of its utility and viability,” Coutts concludes.

As Solana continues to develop and expand its ecosystem, the fundamental analysis underscores a network that not only maintains robust health and economic vigor but is also poised for future growth. This paints a picture of a blockchain platform that, despite market volatilities, remains a leading player in the crypto landscape, backed by strong fundamentals and promising growth metrics.

At press time, SOL traded at $173.47.

Trader and market analyst Peter Brandt has provided valuable perspectives on the recent price movement of Solana (SOL), suggesting the completion of a notable chart pattern.

In particular, Brandt has noted a descending triangle pattern forming on Solana’s 4-hour price chart.

The descending triangle pattern identified by lower highs and a horizontal support line is often interpreted in technical analysis as a signal of a potential downtrend continuation. Brandt’s recent post highlighted the completion of this pattern, drawing attention to a crucial development for SOL traders.

Brandt’s analysis extends beyond the mere identification of the pattern. He underscores the significance of pattern validation over its completion.

According to Brandt, a pattern’s failure to fulfill its expected role carries more weight than its mere completion.

With the descending triangle pattern now confirmed for SOL, market participants’ anticipation is palpable as they await potential price movements, whether to the upside or downside.

A descending triangle has been completed in $SOL

I am only the messenger, not the message

Remember, a pattern failure (to do what it is supposed to do under classical rules) is more important than a pattern completion pic.twitter.com/ezershgA5A— Peter Brandt (@PeterLBrandt) April 10, 2024

While Solana’s price performance has fluctuated over the past week, recent network challenges have added another layer of complexity to the asset’s situation. Despite a 12.7% decline in SOL’s value over the past week, there has been a slight uptick of 4% in the last 24 hours.

However, ongoing network congestion has presented obstacles. Solana developers are actively addressing these issues, with efforts underway to resolve network congestion experienced on April 15.

Mert Mumtaz, CEO of Helius Labs, a key contributor to Solana’s maintenance and enhancement, clarified that the current network challenges stem from implementing a specific protocol rather than an inherent design flaw in Solana.

solana’s current issue is not a design flaw, it’s an implementation bug

it is now hitting me that some folks might not understand what we’ve been trying to say by this for the past week

I’ll simplify it (intended for non-technical people)

it is important to make this… pic.twitter.com/fNZzu9f90S

— mert | helius.dev (@0xMert_) April 8, 2024

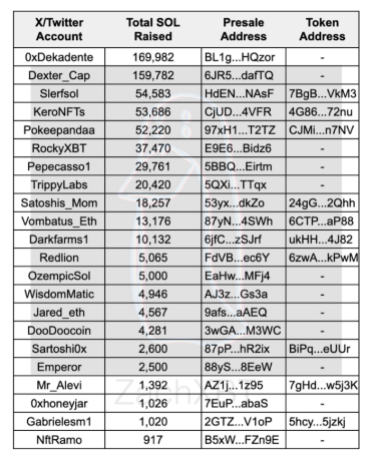

Meanwhile, Solana’s open interest in the futures sector, a metric used in derivatives markets referring to the total number of outstanding contracts, has experienced fluctuations in recent times.

While it saw steady growth from January to April, reaching an all-time high of $2.86 billion on April 1, recent network issues have led to a decline. Coinglass data indicates that Solana’s open interest has fallen to $2.4 billion since April 11, reflecting a 5% decline in just over a week.

Featured image from Unsplash, Chart from TradingView

Solana (SOL) faced difficulties the past week after the network’s transaction failure rate reached over 75%. Since then, Solana’s core contributors have been working to find the congestion problems.

SOL’s price tumbled 7.8%, and users seemed worried about the network’s state. Despite this, some analysts predict a more optimistic performance for SOL soon.

According to crypto analyst Bluntz, Solana’s drop has reached its bottom. When the news of network congestion broke, the analyst predicted that SOL’s price would likely fall to $160 before seeing a bounce.

According to his chart, the performance was starting to show an ABC zig-zag pattern. At the time, the token was trading around the $184 price range, which meant that the C wave of $160 had yet to be confirmed.

The analyst remained open to the “possibility of a sideways correction.” Nonetheless, he considered it “would make no sense for sol/usd to sweep down lower below 160.”

On Wednesday, SOL reached a low of $162, sweeping the “A wave low.” To the analyst, this seems to be the bottom for SOL’s price despite being $2 short of his prediction. As a result, Bluntz considers that the token’s price will go “higher from here.”

Another analyst, Immortal Crypto, pointed out that SOL has shown a “good range” between $210 and $160. According to the analyst, “a deviation from here is a fat long, 100%.”

Despite the possible bounce forecast, analyst Altcoin Sherpa expects SOL to drop to $140, a level it has not seen in almost a month.

In the last 24 hours, Solana’s price has risen 6%, recovering from the drop to the $162 range. Despite a 7.8% drop in the past week, the price surged 13.5% in the last 30 days.

Similarly, the daily trading volume increased by 28% in the past 24 hours, suggesting a surge in the token’s market activity.

Nonetheless, investors remain concerned about the network as the problems continue, with some suggesting that the token’s price won’t start pumping until the “tech is sorted out.”

Solana is widely recognized for its fast transactions and low fees. However, the current on-chain failure rate presents problems for both users and developers.

Responding to the critics and concerns, Austin Federa, Head of Strategy at the Solana Foundation, gave insights into the problem.

Developers from Anza, Firedancer, Jito, and other core contributors are working diligently (and not sleeping much) to shore up Solana's networking stack to meet the unprecedented demand the network is seeing today.

There's been a lot of threads on what exactly is causing the…

— Austin Federa |

(@Austin_Federa) April 10, 2024

According to Federa, developers from the core contributors to the Solana chain are “working diligently to shore up Solana’s networking stack to meet the unprecedented demand the network is seeing today.”

The developer explained that “the implementation of a software system is today not robust enough to handle the amount of traffic being thrown at it.” As a result, the core protocol developers are working to test and implement improvements, leaving “increasing fees as a last resort.”

At the time of this writing, SOL is trading at $174.57.

Solend and Kamino were the biggest winners in the Solana DeFi landscape.

Blockchain security firm Blockaid said 50% of recent pre-sale token launches on Solana have been malicious.