For the past week, a controversial celebrity token trend has emerged. Mainstream media figures began launching Solana-based memecoins and seemingly showing interest in cryptocurrencies.

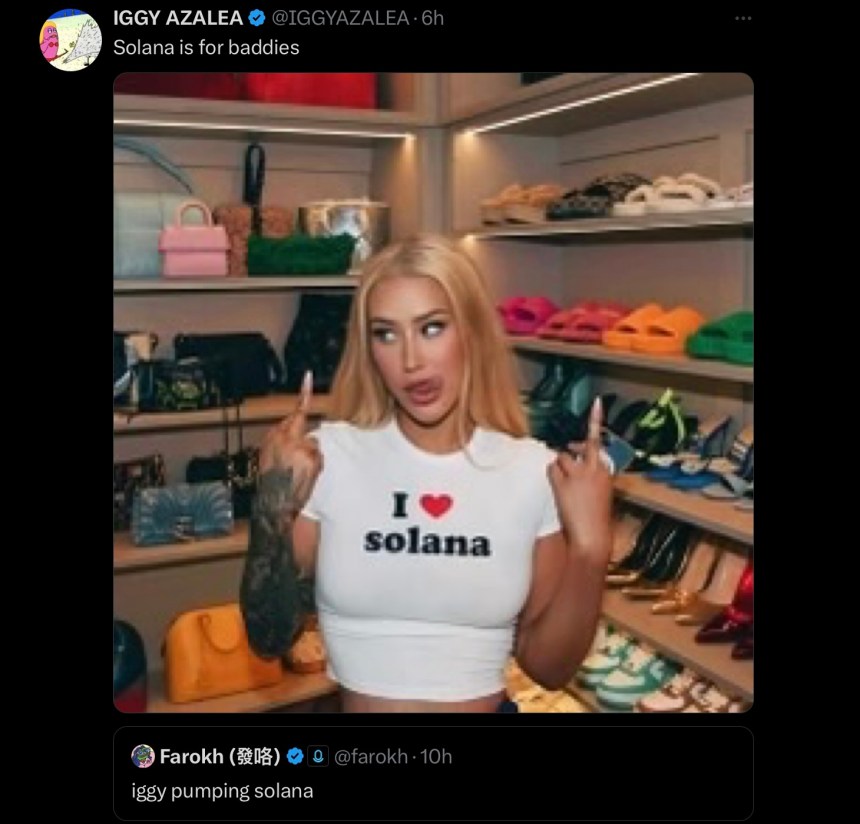

The latest star to join the celebrity token frenzy is Australian rapper Iggy Azalea, who saw a controversial launch similar to Caitlyn Jenner’s JENNER token.

Who Is Solana?

On Monday, Azalea surprised the crypto community by showing interest in cryptocurrencies. The rapper and model posted on X asking, “Who is Solana? I don’t know that bitch.”

The post has gathered over 1.8 million views and caused controversy in different communities. “Stan Twitter” interpreted the post as a drag to American R&B singer SZA, which caused many fans to attack Azalea. However, the rapper quickly clarified the issue, replying, “Girl, I’m talking about crypto.”

After that, Azalea found her introduction to the crypto community overshadowed by the allegations of her involvement with alleged scammer Sahil Arora. As reported by NewsBTC, Arora was allegedly responsible for the launch of several celebrity and influencer tokens, which he ultimately rugged.

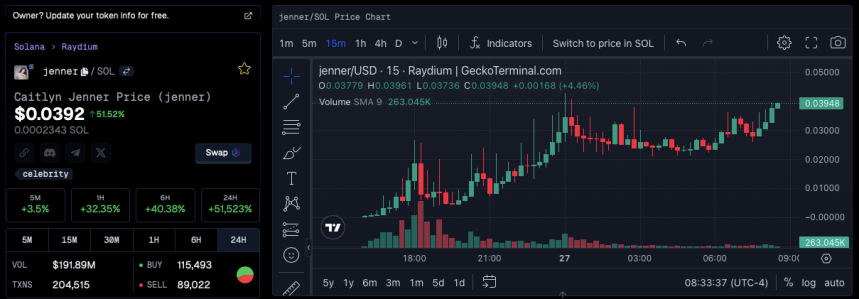

Rapper Rich The Kid and Olympian Caitlyn Jenner called him out for scamming them and taking advantage of their followers. Both celebrities continued their crypto journey, promoting their tokens and engaging with community members.

Following the scam allegations, Arora seemingly has continued to take advantage of crypto investors. Azalea is accusing the alleged serial scammer of “using her image” as the rapper distances herself from his practices.

In The Fastlane From Music To Crypto

Azalea explained that Arora and her team had a conversation regarding crypto, but her recently launched token was unrelated to him. Allegedly, Arora had fabricated fake screenshots and used the rapper’s name to raise over $380,000 in a presale for a token named IGGY.

As an X user reported, Arora claimed to be working with the Australian rapper on Telegram. He stated that his next “mega launch” would happen in the next 12-24 hours.

After raising 2.246 Solana (SOL), the alleged scammer told investors they would get “automating WL to all further launches.” Additionally, investors would receive a “10% SOL airdrop rationally” from Arora’s profits on each launch and an “airdrop of $iggy when we hit $10m market cap.”

However, Azalea launched a different Solana-based token called MOTHER on Tuesday. The token references the LGTBQ+ culture term that got popularized in recent years in online stan culture.

Azalea’s token was launched only a few hours after Arora’s IGGY token, which confused investors. After being asked, the rapper explained that she launched her Solana-based token to stop Arora from taking advantage of her name:

I never had a date to, it was something I had interest in hence the convo with my ppl. He made a weird presale yesterday and said I was making a coin with him today so I decided to drop one so he couldn’t use me for his weird scam. If I have a coin of my own figured his would die. It’s that simple.

The community continued questioning her links to Arora after posting an Instagram story with a man looking like him. However, it was later revealed that the individual was Azalea’s brother, Mathias Kelly.

MOTHER Beats IGGY

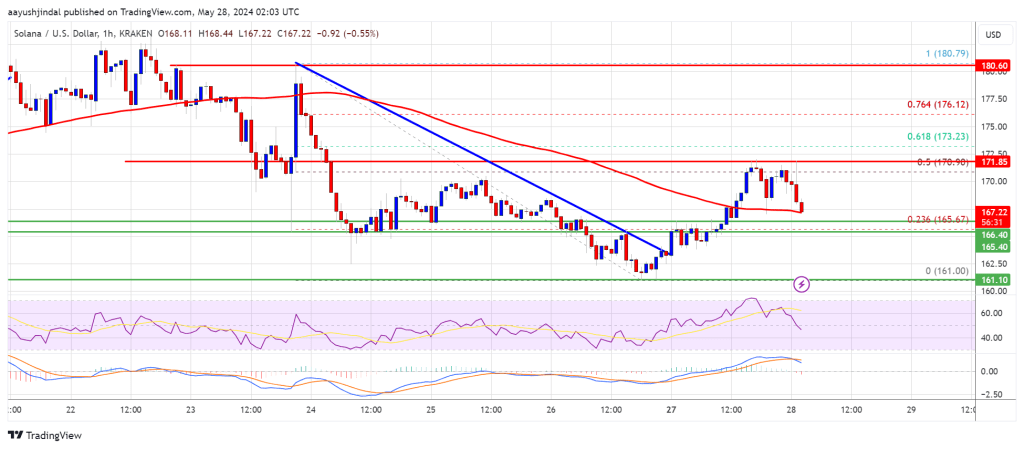

According to Solana Floor, MOTHER reached a market cap of $50 million at its peak. The token soared by 63,000% in the following hours, going from $0.00004968 to $0.03179.

In the last 16 hours, the token has amassed a trading volume of $126.8 million. At writing time, MOTHER is trading at $0.01634, representing a 21,000% surge from its launch price.

In comparison, Arora’s IGGY token saw its price soar to $0.009288 after launch before plummeting below the $0.00020 range. Currently, the scam token trades at $0.0001354 and has a market capitalization of $134,000.

to wallet

to wallet