The lawyer said he had filed a brief on behalf of 4,701 Coinbase customers for no charge as part of his advocacy work in the crypto space.

Cryptocurrency Financial News

The lawyer said he had filed a brief on behalf of 4,701 Coinbase customers for no charge as part of his advocacy work in the crypto space.

Arkham Research notified DeFi wallet owners to look at the addresses and try to retrieve their funds, which have been stuck for months in bridge contracts.

Lawyer-turned-politician John Deaton further reinforced his credentials as an outspoken crypto ally on Friday, filing a friend-of-the-court brief in Coinbase Inc.’s (COIN) effort to get a higher U.S. court to rule on a central question about when a digital token qualifies as a security.

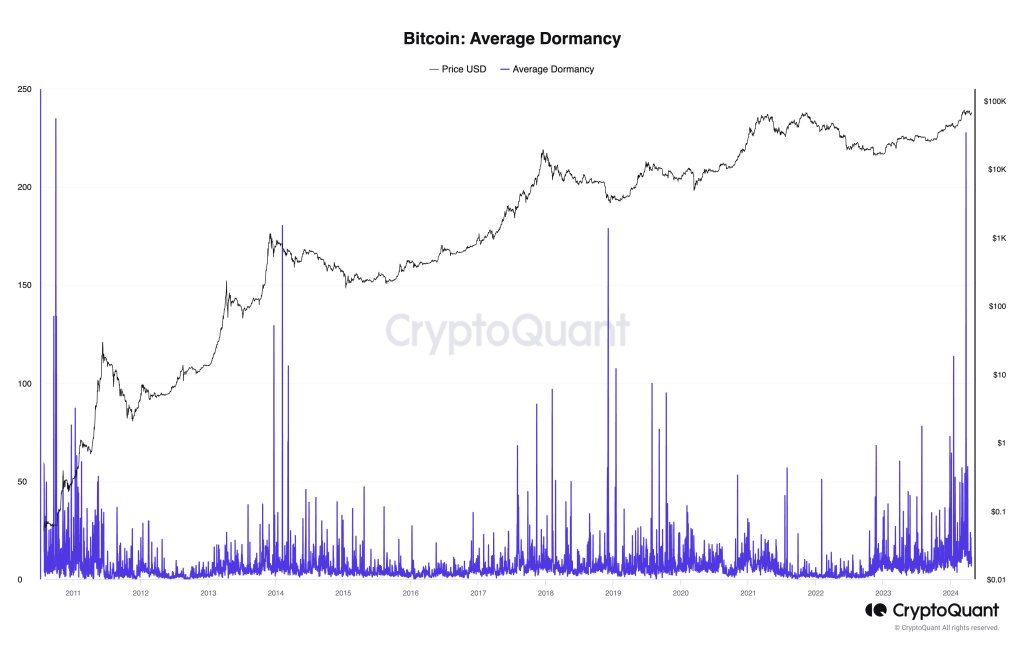

While Bitcoin struggles to extend gains, on-chain data shared by Ki Young Ju, the founder of CryptoQuant, on X shows increased movement of old coins. As the Bitcoin Average Dormancy chart shows, this trend recently hit a 13-year high.

The Bitcoin Average Dormancy shows the average number of days each BTC has been dormant. On-chain data indicates that coins held for 3 to 5 years have changed hands and moved to new owners.

While there was movement, interestingly, data shows that they were not transferred to exchanges. Instead, it is highly likely that they were traded over the counter (OTC).

Usually, any transfer to centralized exchanges like Binance or Coinbase could suggest the intention of selling. The more coins hit these exchanges, especially from whales, the higher the chance of price dumping. However, if trades are made via OTC, the impact on spot rates is negligible, which is a positive for bulls.

Further analysis of these transfers using the Spent Output Profit Ratio (SOPR) indicator suggests that whales moving them made decent profits. Historically, whenever whales dump and register profits, prices tend to dip.

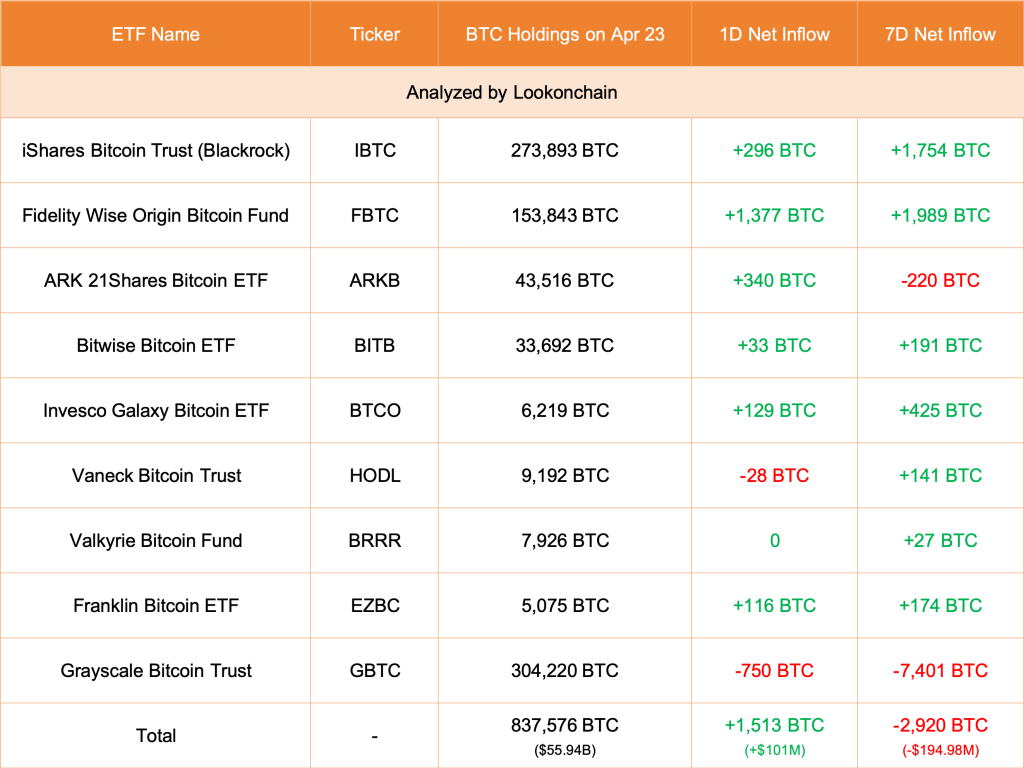

However, in a post on X, one analyst says prices will likely increase because of the impact of spot Bitcoin exchange-traded funds (ETFs). These derivatives are like a buffer against price drops, considering the pace of inflows in the past weeks.

Spot ETFs allow institutions to gain regulated exposure to BTC. Coupled with decreasing outflows from GBTC, the odds of prices rising remain elevated.

According to Lookonchain data, GBTC unloaded 750 BTC on April 23. However, Fidelity and other eight spot ETF issuers bought 1,513 BTC on behalf of their clients. Spot Bitcoin ETF issuers sell shares representing BTC holdings. These coins can be purchased from secondary markets like Binance, via OTC platforms, or directly from miners.

BTC prices remain muted and capped below $68,000, representing April 13 highs.

To define the uptrend, there must be a high volume expansion above this liquidation line, reversing recent losses.

Even so, looking at the BTCUSDT candlestick arrangement in the daily chart, bulls must break above all-time highs for a clear trend continuation. Ideally, the uptick above $73,800 and the current range should be with expanding volumes, confirming the presence of buyers.

The next era of Web3 will be defined by the ability of projects to attract and retain users, says Kelly Ye of Decentral Park Capital. Coinbase’s Ethereum Layer 2 is showing the way forward.

Arkham Research tagged and notified wallet owners to look at the addresses and retrieve their funds, which have been stuck for months.

According to a blog post shared with CoinDesk, the new Kraken Wallet will be the first from a major exchange to be open-sourced.

CFG, the protocol’s native token, spiked as much as 14% after the announcement before paring gains and outperformed other DeFi tokens.

Coinbase is seeking to rip the bandage off of a legal impasse at the center of the crypto industry’s fight with the U.S. Securities and Exchange Commission (SEC), filing an interim appeal on Friday that would ask a higher federal court to drill into the heart of the regulator’s stance on digital assets, even as the broader SEC case proceeds through the judicial system.

The crypto exchange’s off-shore arm will open perpetuals market for the popular meme coin on April 18.

Coinbase’s expansion into Canada has cleared the hurdle of a “restricted dealer” registration, the company said on Thursday, making it the biggest registered crypto exchange in that jurisdiction.

Wormhole, a cross-chain communication protocol enabling the transfer of assets between blockchains, recently launched an airdrop campaign for its newly issued governance token, W. Early users were rewarded with 617 million W tokens, and the protocol also released a roadmap outlining its plans.

According to the protocol’s roadmap, W aims to become a native multi-chain token, leveraging the advantages of both the Solana and Ethereum Virtual Machine (EVM) chains.

Initially launched as a native SPL token on Solana, W will reportedly leverage Solana’s performance, offering increased performance, scalability, low transaction costs, and fast settlement times.

After the Solana debut, W will be extended to all Wormhole-connected EVM chains using Wormhole Native Token Transfers (NTT). This framework allows W to continuously roll out across Solana, the Ethereum mainnet, and Layer 2 (L2s) without liquidity fragmentation.

The open-source NTT framework allows projects to control token behavior on each chain, including token standards, metadata, ownership/upgradability, and custom features.

Wormhole also introduces a governance system where token holders on any supported chain can create, vote on, and implement governance proposals. This approach allows maximum participation in the Decentralized Autonomous Organization (DAO) by providing a frictionless user experience for token holders distributed across multiple chains.

As announced, W holders can lock and delegate their tokens on Solana and EVM chains, allowing them to participate in governance decisions. The Wormhole DAO, composed of W token holders, will oversee the Solana, Ethereum mainnet, and EVM L2s governance system.

Wormhole, developed by Jump Crypto, a division of Jump Trading Group, has been under development for several years. Despite encountering challenges, including a significant hack in February 2022 resulting in a loss of approximately $320 million, the protocol has continued to evolve.

Furthermore, the recent listing of the W token on major exchanges such as Crypto.com and the future support planned by Coinbase on April 4 further validate its progress.

W’s Debut On OpenBook

The W token debuted on the Solana-based decentralized exchange (DEX) OpenBook at $1.66, with a market capitalization of $2.98 billion and a fully diluted value of $16.5 billion.

However, the token’s market capitalization and fully diluted value have since fallen to $2.2 billion and $12.5 billion, respectively, according to updated data from CoinGecko. Trading volume for W has remarkably increased, reaching $555,937,593 in the last 24 hours, representing a staggering 25,732,359.60% surge.

Following the airdrop, some users openly shared their sell-offs of the W token on social media platforms, resulting in a 23% price drop. At the time of writing, the token is trading at $1.32.

Featured image from Shutterstock, chart from TradingView.com

The broker raised its price target to $230 from $160 and maintained its market perform rating.

Coinbase and Custodia both lost early and preliminary court fights. The Coinbase loss was more or less expected – companies rarely win much on a motion for judgment at such an early stage – but still pretty enlightening.

The crypto market is abuzz with speculation as the US government recently moved significantly regarding seized Bitcoin (BTC) linked to the infamous Silk Road dark web marketplace. This development comes at a critical time for the Bitcoin price, which has struggled to maintain its position above the $70,000 threshold after hitting its current all-time high (ATH) of $73,700 on March 14.

As the largest cryptocurrency experiences yet another round of price correction, the movement of these seized funds has triggered intense speculation about a potential sell-off by the US government.

According to on-chain data, a wallet linked to the US government recently transferred 30,175 Bitcoin, seized from the Silk Road dark web marketplace.

This transfer follows the earlier seizure of over 50,000 Bitcoin from James Zhong, who illegally obtained the cryptocurrency from the Silk Road in 2012. The US Department of Justice’s (DOJ) seizure of these funds marked the largest cryptocurrency seizure in its history.

This is not the first instance of the US government moving Bitcoin obtained from criminal cases. In March 2022, the government sold 9,800 Bitcoin, with plans to sell an additional 41,500 BTC. However, the recent transfer of the 30,175 BTC from Silk Road-related addresses has raised questions about the fate of these funds and their potential impact on the Bitcoin price correction.

Benjamin Skew, an on-chain data expert, took to social media to offer insights into the situation. Skew clarified that although there is chaos surrounding the Silk Road Bitcoin being sent to Coinbase for sale, a closer examination reveals that the main funds were transferred to a newly created wallet that remains inactive.

However, Skew stated that 2,000 BTC of the total amount was transferred to the alleged Coinbase wallet for undisclosed purposes, while the rest was sent to a newly created wallet.

The Bitcoin price is currently witnessing a lack of bullish momentum as the cryptocurrency continues to face resistance in consolidating above the crucial $70,000 threshold. However, there is still hope on the horizon.

Crypto analyst Ali Martinez highlights the importance of the 200-epimetric moving average (EMA) on the 4-hour chart of BTC. According to Martinez, this indicator has acted as formidable support since early February and continues to play a crucial role in preventing further downward movement.

The focus on the 200EMA stems from its potential to either catalyze a rebound or trigger more losses for Bitcoin. Martinez stated that if the 200EMA continues to hold as strong support, it signifies a significant probability of a price rebound. This scenario would provide renewed bullish momentum and potentially propel Bitcoin’s price above the $70,000 mark.

However, if the 200EMA is broken, as it was in mid-January, as seen in the chart below, the analyst suggests that this could expose the Bitcoin price to further downward pressure and potentially lead to further losses.

Bitcoin (BTC) is trading at $65,390, continuing its recent price correction. Over the past 24 hours, BTC has experienced a 5% decline; over the past seven days, it has seen a significant drop of over 6%.

The market closely monitors whether the current key support level can sustain further price drops or if a potential bounce will occur before reaching that point. The outcome of these scenarios remains uncertain.

Featured image from Shutterstock, chart from TradingView.com

On-chain data shows Coinbase has just witnessed its largest USD Coin (USDC) inflow. Here’s why this may be relevant for Bitcoin.

As pointed out by analyst Maartunn in a post on X, a large amount of USDC has flowed into Coinbase during the past day. The on-chain indicator of interest here is the “exchange inflow,” which keeps track of the total amount of a given asset entering into the wallets associated with a centralized exchange or group of platforms.

A spike in the exchange inflow can indicate that investors are interested in trading away the cryptocurrency. In the case of an asset like Bitcoin, such a trend can naturally be a bearish signal for the price.

In the context of the current discussion, though, a stablecoin is of focus. While USDC exchange inflows would also imply that the holder wants to sell the asset, the transaction wouldn’t affect the price since, by nature, the coin always remains stable at around $1.

This doesn’t mean that the sale of USD Coin isn’t of interest to the cryptocurrency sector as a whole, however. If investors are swapping stable coins in favor of volatile coins like BTC, then the prices of these latter assets would observe a buying effect.

Now, here is a chart that shows the trend in the USDC exchange inflow over the past month:

The above graph shows that the USDC exchange inflow has just registered a huge spike. According to Maartunn, this inflow was headed towards the cryptocurrency exchange Coinbase.

In total, $1.4 billion worth of the stablecoin has entered the platform’s wallets with this inflow, the largest the exchange has ever observed. Given the extraordinary scale, this could prove to be quite bullish for Bitcoin and others if the entity behind the inflow is planning to go on a buying run with this dry powder.

There also exists the scenario, however, where the whale actually intends to trade away the USD Coin stack in favor of fiat rather than using it to buy other cryptocurrencies. In such a case, a net amount of capital would be exiting the sector, which would be a bearish sign.

It now remains to be seen whether the massive USDC deposit indeed ends up causing any noticeable fluctuations in the volatile side of the market, particularly in the price of Bitcoin.

Bitcoin had observed sharp bullish momentum earlier to cross above the $70,000 level, but since then, the asset has fallen back to sideways movement, with its price remaining unchanged.

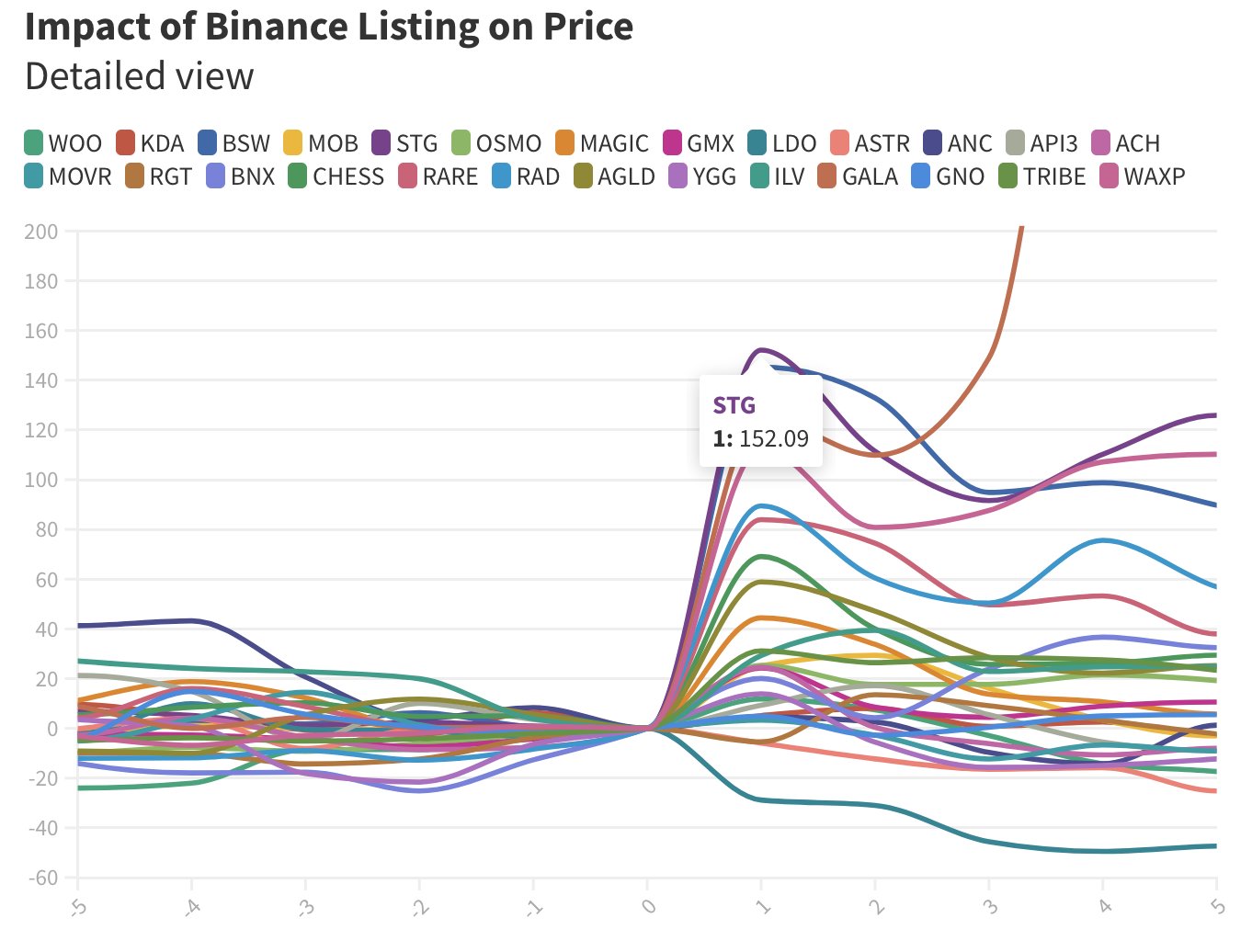

Popular crypto analyst Xremlin, known on social platforms as @0x_gremlin, told his 104,000 followers that the altcoin season in 2024 could eclipse the monumental gains seen in 2021. Reflecting on the historical significance of major exchange listings, Xremlin emphasized, “Altseason 2024 > Altseason 2021. Your bags are headed to Valhalla.”

During the 2021 altseason, altcoins such as Polygon (MATIC) and Solana (SOL) saw a staggering 300x increase, largely attributed to listings on Tier-1 centralized exchanges (CEXs) like Binance and Coinbase, according to him. “MATIC and SOL’s 300x was fueled by Tier-1 CEX listings. Binance/Coinbase listings = Billions in retail liquidity,” the crypto analyst remarked.

The core of Xremlin’s analysis hinges on the demonstrable impact that listings on premier exchanges such as Binance and Coinbase have on the valuation of cryptocurrencies. According to the analyst, “These 8 altcoins [are] likely to be tradable there next → Pump by 10-50x,” highlighting the potential for immediate and substantial price increases.

Listings often trigger price surges ranging from 3 to 10 times the pre-listing value, primarily due to the vast user bases of these platforms engaging with the newly available tokens. Xremlin further elucidated the critical role of liquidity for the long-term success of a cryptocurrency project, stating, “In the long run, having access to billions in liquidity is crucial for a project’s success.”

This perspective underlines the strategic advantage gained from being listed on Tier 1 centralized exchanges (CEXs). Xremlin has identified eight altcoins that not only show promise of being listed on such exchanges but also possess the potential for dramatic value appreciation. Here’s a detailed look at the altcoins spotlighted by Xremlin:

NGL (ENTANGLE): Operating as an omnichain infrastructure, Entanglefi aims to revolutionize data provision to smart contracts across any blockchain. With a current market cap of $232 million and trading at $1.96, its position as a Layer 1 (L1) protocol underscores its foundational potential in the blockchain ecosystem.

ALPH (ALEPHIUM): Priced at $2.75 with a market cap of $203 million, Alephium stands out as a Layer 1 blockchain solution tackling the critical issues of accessibility, scalability, and security faced by decentralized applications (dApps), according to the crypto analyst.

NORMIE: As a memecoin designed for mainstream appeal, Normie carries a market valuation of $120 million, with its price at $0.1237. Notably, Normie is based on Coinase’s Base protocol, which is speculated to be ready to replicate the success of the Solana memcoin craze.

CPOOL (CLEARPOOL): Clearpool distinguishes itself as a decentralized credit marketplace in the real-world-asset (RWA) sector focused on providing single borrower liquidity pools for institutional borrowers. It is currently valued at $140 million, with its tokens trading at $0.30.

BALLZ (WOLFWIFBALLZ): Inspired by a daring wolf, this memecoin is trading at $0.045 with a market cap of $45 million. BALLZ is trying to ride the wave of success of Solana memcoins, especially Dogwifhat (WIF).

IXS (IX SWAP): Ix Swap offers a secure platform for the trading of real-world assets and security tokens, supported by licensed custodians and broker-dealers. With a market cap of $140 million and a current price of $0.8425.

DEGEN: Another meme-centric token, Degen also operates on the Base chain and is currently priced at $0.01696, boasting a market cap of $211 million. Its appeal lies in the vibrant culture of crypto enthusiasts who identify with the “degen” lifestyle.

NMT (NETMIND): Netmind leverages blockchain technology to decentralize computing power for AI models globally. With a price of $6.96 and a market cap of $240 million, it aims to embody the cutting-edge intersection of artificial intelligence and blockchain.

At press time, @0x_gremlin’s top pick NGL traded at $1.87.

MicroStrategy and Coinbase’s stock prices could shoot up if short sellers bail out, according to a report by data analytics firm S3 Partners.

A federal judge ruled the U.S. Securities and Exchange Commission (SEC) brought enough of a case arguing that Coinbase is operating an unregistered broker, exchange and clearinghouse that its suit against the crypto trading company should move forward.

The positive Bitcoin Coinbase Premium that drove the latest rally above $70,000 has dissipated, suggesting buying has already slowed down.

CryptoQuant Netherlands community manager Maartunn explained in a post on X that the Bitcoin Coinbase Premium Gap has declined back toward the neutral line.

The “Coinbase Premium Gap” here refers to a metric that keeps track of the difference between the BTC prices listed on cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

When the value of this metric is positive, it means that the price listed on Coinbase is greater than that on Binance right now. Such a trend implies that the buying pressure on the former is higher than that on the latter platform (or alternatively, the selling pressure on there is just lower).

On the other hand, a negative value can imply the selling pressure on Coinbase is higher than on Binance as the price of the cryptocurrency listed there is lower.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the past few days:

The chart shows that the Bitcoin Coinbase Premium Gap had taken to notably positive values as the latest upward push in the asset’s price had occurred. Since then, though, the metric has fallen, with its value approaching zero.

It would seem that the buying pressure on the platform contributed to the surge. The fact that the rally has slowed since the metric returned to neutral levels may add further evidence.

This isn’t unnatural for this year, however, as the Bitcoin price and Coinbase Premium Gap have shown a pretty tight relationship since the start of 2024.

Coinbase is popularly known as the preferred platform of American institutional investors, while Binance hosts more global traffic. As such, the premium’s value provides insight into how the behavior of the US-based large holders differs from that of world users.

Since the Coinbase Premium Gap has been the driver of the recent price surges, buying from these institutional entities could potentially have provided the fuel.

As the indicator’s value has now neared the neutral mark, it would imply that these whales have lifted their foot off the gas. Given the close relationship the metric and BTC price have held recently, it may be worth keeping an eye on how things develop in the coming days.

BTC may register some decline if the premium flips into the red from here. Naturally, a continuation of positive values would be a bullish sign instead.

At the time of writing, Bitcoin is trading around the $70,100 level, up more than 11% over the past week.