AAVE has been showing hints of recovery today which is quite the opposite of its figures a few hours ago.

- AAVE shows signs of recovery as price climbs by 7.35%

- Coin generally bearish but the bulls are now attempting to take over

- AAVE breaches $77.53 level

This could be due to the general crypto market recovering too as of press time. Will this be for long term?

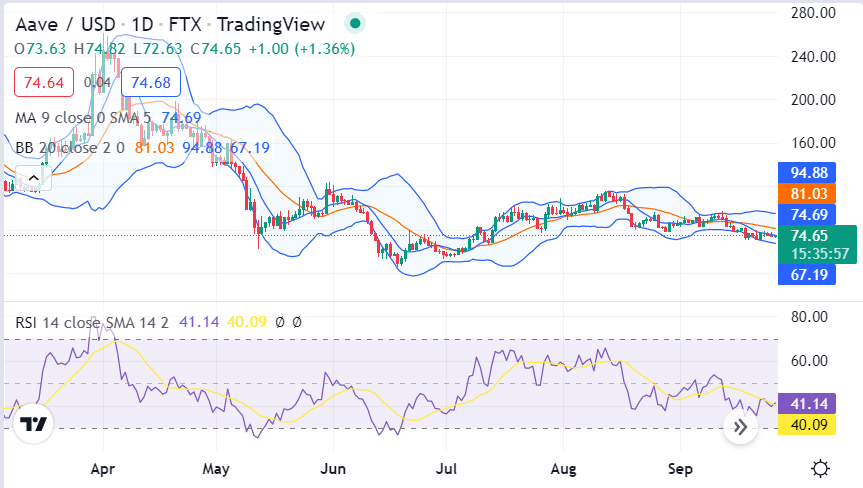

The coin has been generally bearish as it resist falling into the $74 level. Key support is now spotted at the $73.65 level and resistance is present at $77. 52.

Evidently, AAVE is seen to be moving downhill earlier as it failed miserably in breaching the $77.53 level. At this point AAVE is treading the bearish route for short term.

Judging by the 1-day price analysis, it is moving downwards as triggered by the uptick in selling pressure. If the selling pressure subsides, then AAVE price could shoot way up which is happening right now.

Chart: TradingView.com

AAVE Price Climbs By 7.35%

According to CoinMarketCap, the coin’s price has skyrocketed by 7.35% or trading at $79.64 as of press time which means it has successfully breached the $77.53 level that it has been trying to do so for the past couple of days.

The Bollinger Bands Indicator higher band is now seen at the $78.63 mark which is now the key resistance for AAVE while the lower band is seen at the $73.83 mark.

More so, RSI has previously manifested a decline to 40 but has shown recovery and is now looking more balanced.

The 4-hour price chart reveals that the bears have been dominant for many hours but the bulls are now taking over.

Previously, the sharp decline of AAVE has caused a devaluation of price down to the $73.22 level which has been a good sign to the sellers.

Price Likely To Build Momentum

AAVE price is seen to be generally bearish due to its sideways consolidation but is seeing an uptick now and making some room for the bulls.

The price has plummeted by $74.34 yesterday but it has now found its mojo and on its way to making more gains. Momentum will likely build up in the coming days.

At this point, AAVE is expected to continue trading in its current range for the next 24 hours.

However, the scenario with AAVE/USD still looks like a tug-of-war and anything can happen at this point as either the bears or the bulls can get exhausted and propel the coin to move either way in the coming days.

AAVE total market cap at $1.12 billion on the daily chart | Source: TradingView.com

Featured image from AMBCrypto, Chart: TradingView.com