According to Gauntlet, the move offers the potential for more money with greater flexibility.

Aave Joins Binance’s BNB Chain Ecosystem – Here’s How Users Benefit

In a significant development for the Binance Smart Chain (BSC) ecosystem, Aave (AAVE), one of the largest decentralized finance (DeFi) market protocols, has announced its integration with BNB Smart Chain. Aave joins prominent projects such as Uniswap, Ambit Finance, PancakeSwap, and Lista DAO.

BNB Chain Welcomes Aave

According to the announcement, this latest development opens up new opportunities for BNB Chain users, giving them access to what the protocol calls “top-tier lending platforms” and enhanced liquidity.

With the launch of First Digital USD (FDUSD), users can now leverage “robust” liquidity, allowing them to explore different applications and opportunities in the Binance ecosystem.

On the other hand, Aave users can now benefit from BNB Chain’s fees and the ability to integrate with one of the largest DeFi ecosystems, fostering increased collaboration between the two communities. The announcement also noted the following about the Aave integration:

This not only complements but strategically aligns with BNB Chain’s 2024 outlook. Focused on mass adoption, high-frequency DeFi applications, and network efficiency improvements, the ecosystem is set for an exciting evolution.

2024 Goals

Looking ahead, BNB Chain has set numerous goals for 2024. The introduction of opBNB – the Layer 2 (L2) scaling solution for the BNB Smart Chain – aims to achieve a transaction processing capacity of 10,000 transactions per second (TPS) by doubling the gas limit to 200 M/s.

Enhanced security measures accompany this increase in capacity through multi-proof mechanisms. In addition, implementing Ethereum’s EIP4844 and Greenfield’s data availability upgrades will reduce gas fees by 5-10 times, providing users with a more cost-effective experience.

In a move called “BNB Chain Fusion,” the BNB Beacon Chain will be merged with the BSC, further enhancing the efficiency and security of the network. The expansion of the number of validators, which will increase from 40 to 100 by 2024, is also expected to contribute to the stability of the network.

Market Cap And Token Holders On The Rise

According to Token Terminal data, the BNB chain has experienced significant growth, evidenced by several key metrics.

One notable metric is the fully diluted market cap, which stands at $75.71 billion, representing a significant increase of 23.9% over the past 30 days, highlighting the confidence in the protocol.

The circulating market cap, another crucial indicator, currently sits at $54.73 billion, showing a solid 11.6% growth over the same 30-day period.

On the other hand, the number of BNB token holders has shown a positive trend, reaching 113.51 million, with a significant increase of 3.5% in the last 30 days, demonstrating interest in the ecosystem.

Featured image from Shutterstock, chart from TradingView.com

Risk Manager Gauntlet Terminates Relationship with Aave, Citing DAO Dysfunction

Gauntlet co-founder John Morrow said his team “found it difficult to navigate the inconsistent guidelines and unwritten objectives” of Aave’s “largest stakeholders.”

Whale Rapidly Accumulating Chainlink: What’s Going On With LINK?

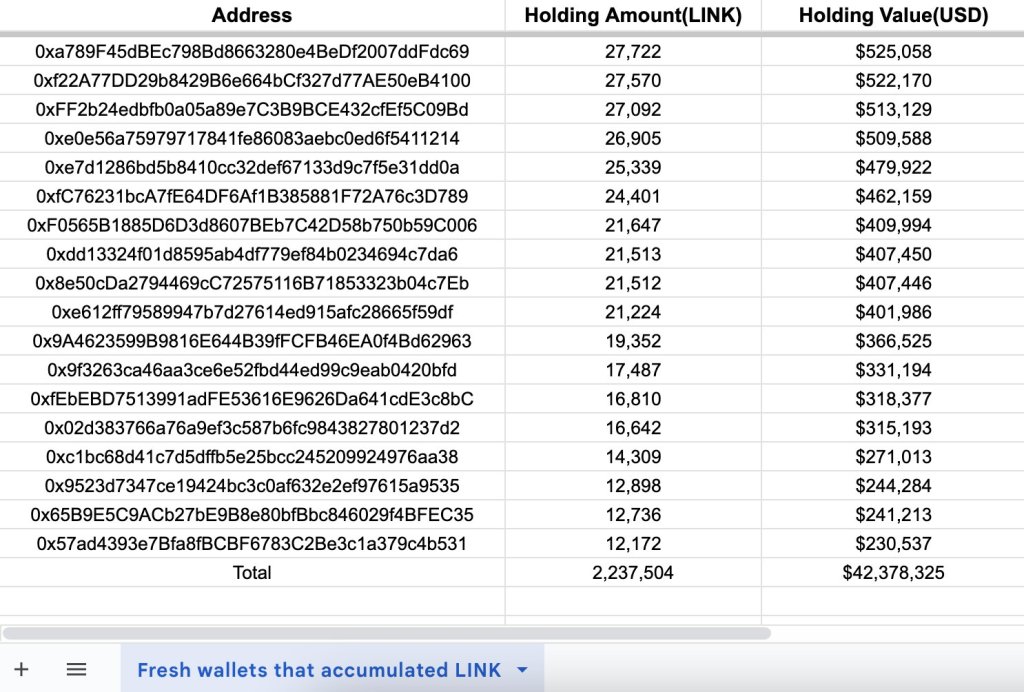

A mysterious whale is rapidly accumulating Chainlink (LINK). According to Lookonchain, the unknown entity, possibly an institution, withdrew over 2.2 million LINK (worth $42.38 million) via 47 new wallets from Binance, the world’s largest crypto exchange by trading volume, in two days.

This sudden block withdrawal now raises questions about what’s driving the whale’s interest and what it could mean for LINK in the coming days.

Chainlink Is Key In DeFi And NFTs, Gradually Improving

Chainlink is a popular project that provides secure middleware services and allows smart contracts to access tamper-proof external data. For this role, the platform has been adopted by multiple protocols offering decentralized finance (defi) services in Ethereum and beyond.

Additionally, Chainlink plays a role in non-fungible tokens (NFTs) through its random number generator (RNG). It continues to release new products and enhance its features.

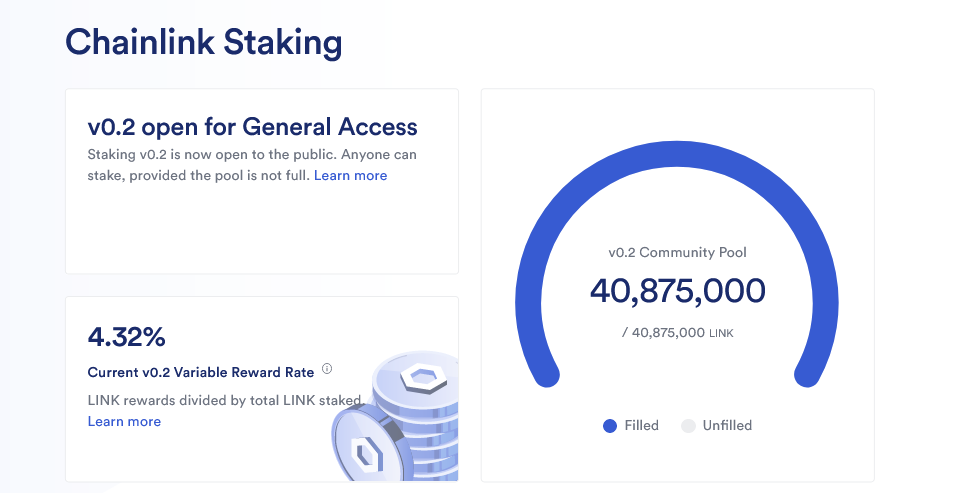

To illustrate, in November, Chainlink upgraded its staking mechanism, releasing v0.2, which significantly increased the pool size to 45 million LINK.

The platform noted that the decision was to attract more investors and, more importantly, bolster its security while concurrently aligning with its broader objective of attaining the “Economics 2.0” plan.

Initially, staking began in December 2022. The goal was to incentivize participation by expanding the utility of LINK and allowing stakers to receive rewards.

The release of v0.2 in November means more tokens can be locked, helping make LINK scarce, considering the role of the token in the vast Chainlink ecosystem.

Trackers show that over 40.8 million LINKs have been locked so far. Chainlink confirms that anyone can earn a variable reward rate of 4.32%.

Beyond staking, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is gaining adoption. To illustrate, the Hong Kong Monetary Authority (HKMA) initiated its first phase of e-Hong Kong Dollar (e-HKD) trials in November, integrating CCIP.

As part of this trial, the regulator wanted to illustrate the capabilities of programmable payments enabled by Chainlink via its solution, CCIP. In DeFi, protocols such as Synthetix and Aave have adopted CCIP.

Will LINK Breach $20?

With more protocols and traditional institutions leveraging the technology, the demand for LINK (and prices) will likely increase as the fear of missing out (FOMO) kicks in.

While the whale’s motives remain unknown, their large-scale LINK accumulation suggests they might be bullish on the token. Notably, it coincides with the sharp expansion of LINK prices in the past 48 hours.

So far, the token is changing hands slightly below the $20 psychological resistance. Any breakout above this level might lift the token to around $35 in Q3 2021.

Whales Accumulating Maker And Aave, Path To 2024 Highs?

On-chain data suggests that whales are accumulating large amounts of Maker (MKR) and Aave (AAVE), two leading decentralized finance (DeFi) tokens. This accumulation trend coincides with a broader cooling-off period in the crypto scene days after the United States Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs.

Whales Accumulate MKR And AAVE

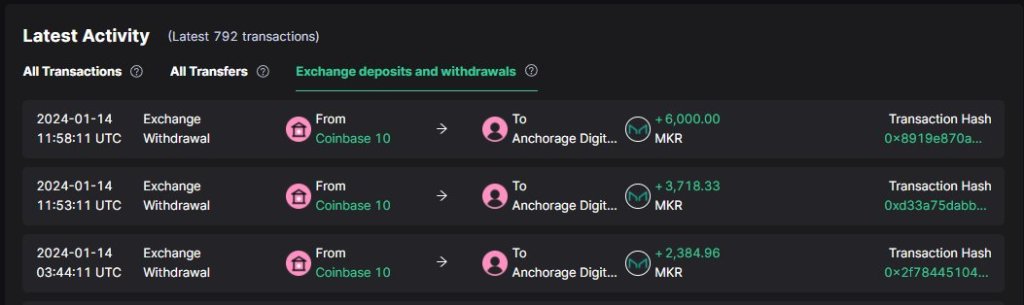

According to ScopeScan data, Anchorage Digital, a digital asset custody firm, purchased a significant amount of MKR on January 15. The firm acquired 12,103 MKR tokens, valued at approximately $24.7 million, from Coinbase, a leading crypto exchange in the United States.

Two whales, “0xbb5f” and “0x4a7,” also accumulated large quantities of MKR and AAVE. Specifically, “0xbb5f” bought 50,000 AAVE and 2,452 MKR worth around $5.03 million and $4.95 million from Binance, a leading cryptocurrency exchange. Meanwhile, 0x4a7 purchased 39,000 AAVE and 2,350 MKR, valued at approximately $3.95 million and $4.75 million, also from Binance.

These whale purchases signal a strong belief in the long-term potential of MKR and AAVE. Maker and Aave are two of the world’s leading decentralized lending and borrowing protocols across DeFi. MKR serves as the governance token for MakerDAO, which also manages the DAI decentralized stablecoin. On the other hand, AAVE is the governance token of Aave, a top decentralized lending platform.

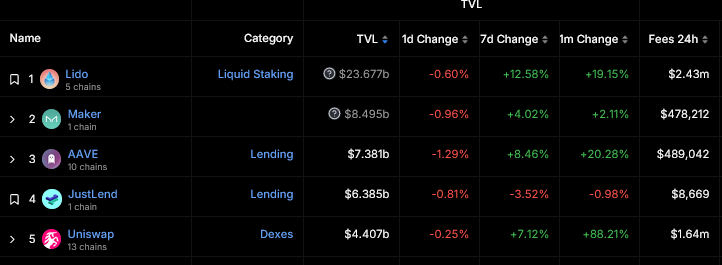

According to the latest DeFiLlama data, Maker and Aave have total value locked (TVL) of over $8.4 billion and $7.3 billion, respectively.

Notably, whales are accumulating MKR and AAVE when the DeFi scene is recovering following the sharp contraction from 2022. The industry manages over $56 billion, with Ethereum hosting more liquid DeFi protocols, including Lido DAO when writing in mid-January 2024.

Will Maker and Aave Rally To New 2024 Highs On Recovering DeFi?

Last year, MKR and AAVE were among the top-performing DeFi tokens, with MKR rising by over 200% and AAVE appreciating by more than 150%. Protocol-specific fundamentals, including the launch of Spark in Maker, partly drove this strong performance.

Aave launched the GHO stablecoin and the Lens protocol on the Ethereum sidechain, Polygon. Moreover, expectations of the spot Bitcoin ETF forced aggressive traders to consider top DeFi protocols, lifting altcoins.

As whales accumulate, there is more headroom for these tokens to grow. Presently, AAVE and MKR are lower, based on their respective performance in the daily chart. However, overly, the uptrend remains. To illustrate, MKR is within a bullish breakout formation with a critical support level of around $1,560. Any surge past $2,300 might ignite demand, lifting the token to new 2024 highs.

Aave Community Votes To Integrate PayPal’s Stablecoin

Majority of token holders favor onboard PYUSD in AAVE’s Ethereum pool, the ongoing vote shows.

Stani Kulechov Defied Crypto Winter

With upgrades to the Aave lending/borrowing protocol and Lens, an open-source social media protocol, the Estonian native kept BUIDLing in a down-market.

Aave’s GHO Stablecoin Nears Elusive Dollar Peg

Lens, Aave’s Decentralized Social Media Platform, Launches Major Upgrade on Polygon

The open source protocol spearheaded by DeFi giant Stani Kulechov has released a bevy of new monetization features.

Aave V2 Operational, Will Bulls Break The 15-Month Resistance At $110?

All Aave v2 markets are now operational, the team behind the non-custodial liquidity protocol announced in a November 13 post on X. This a day after v3 markets were unfrozen following the approval from the community.

Aave is a platform where users can supply liquidity in exchange for rewards while borrowers are free to take loans while paying interest in a trustless environment.

Aave v2 Markets Unfrozen, Security Is “Non-Negotiable”

In the post, Aave said the security of the decentralized finance (DeFi) protocol remains a “priority and is non-negotiable for the community.”

On November 4, Aave said they received a report “of an issue on a certain feature.” After being validated, the protocol decided to take a step and pause the operation of their v2 markets on Ethereum. At the same time, some v2 markets on Avalanche were frozen. Even so, the v2 markets on Polygon were unaffected.

Aave also froze operations on Aave v3 on Polygon, Arbitrum, and OP Mainnet. However, v3 markets on Ethereum, Base, and Metis were unaffected.

While Aave v2 and v3 markets were frozen, the protocol clarified that users supplying or borrowing affected assets could still withdraw and repay their positions but couldn’t supply or borrow more. With those markets unfrozen, they can now continue as it was before.

Will Bulls Ease Past $110?

The resumption of services, looking at the AAVE candlestick arrangements in the daily chart, has not impacted prices. However, the token is trading at around 2023 highs and remains within a bullish formation as optimistic traders expect the uptrend to continue.

Despite the uptrend, bulls have failed to break above the $110 resistance level. As it is, this reaction level marks August 2022 highs and has not been breached in the past 15 months.

The token has more than doubled at spot rates, rising from $50, a critical support level marking January and June 2023 lows. For trend continuation, there must be a solid breakout above $110 and the $60 range from where prices have been moving horizontally in a multi-month accumulation.

Still, it is unclear how the token will react in the days ahead and whether there will be more upside momentum as liquidity increases as activity resumes on Aave v2 markets.

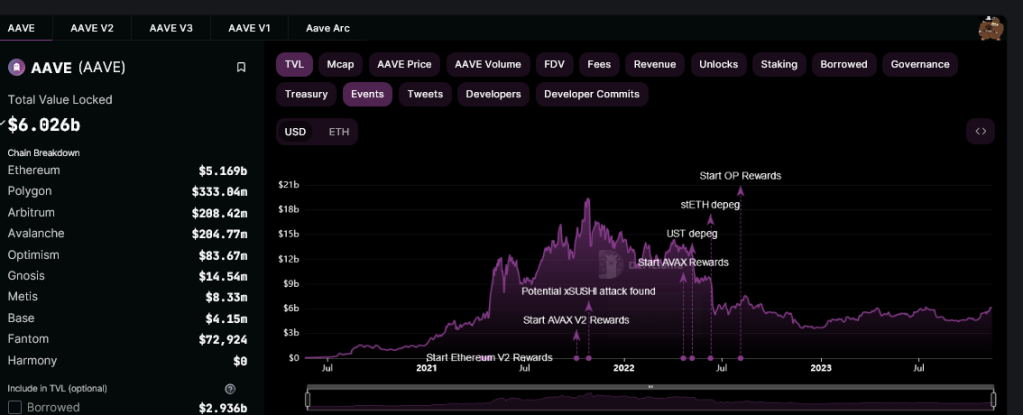

According to DeFiLlama data, Aave is one of the largest DeFi protocols, with over $6 billion in total value locked (TVL). Most of these assets are locked in Ethereum, where over $5.1 billion of tokens are under management.

Mango Markets’ exploiter to face trial in April, and Coinflux shuts multichain: Finance Redefined

The Mango Markets exploiter’s trial was first scheduled for December 2023; however, during one of the court hearings, the accused convinced the judge to delay the trials for a few months.

Radiant Capital’s Earnings Exploding, Time To Load The RDNT Bag?

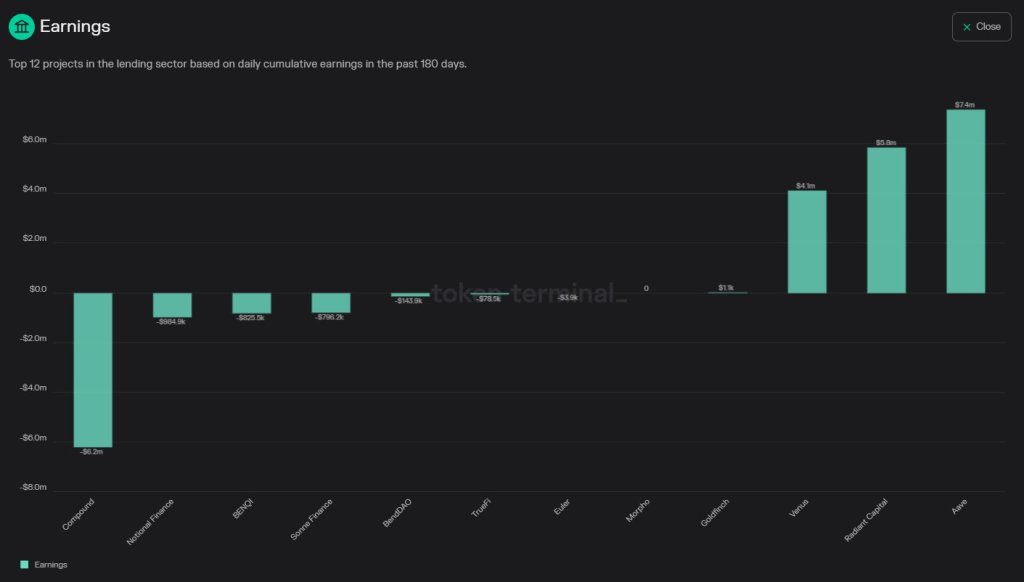

Radiant Capital, a lending and borrowing protocol for users to borrow various assets across multiple chains, is rapidly closing in on Aave, looking at earnings data over the past six months.

Radiant Capital Earnings Rising: What’s The Trigger?

According to Token Terminal statistics on November 8 shared by one user on X, @Flowslikeosmo, Radiant Capital generated $5.8 million in revenue despite a relatively lower level of liquidity than Aave. @Flowslikeosmo, who claims to be a crypto researcher, said Radiant Capital’s earnings will likely explode in the upcoming sessions, especially once the 2.8 million ARB begins to be deployed.

Radiant Capital is a popular cross-chain decentralized money market through which users, regardless of their choice blockchain, can either lend their assets and earn passive income or borrow assets trustlessly. This way, the decentralized finance (DeFi) protocol has opened up liquidity and boosted access to multiple blockchains.

Related Reading: Dogecoin In Tight Zone: Why A Rally Will Happen If DOGE Clears $0.076

To perform effectively, the protocol relies on LayerZero, which enables trustless and decentralized communication between blockchains using Oracle Relays, allowing platforms to be more interconnected and ledgers to be more interoperable. As Radiant Capital offers services, the DeFi protocol generates earnings or revenue primarily from fees.

The platform charges a protocol fee on all transactions. Earnings from this allow the team to be operational while allowing the protocol to generate revenue.

However, it should be noted only 15% of this fee is used to cover operational expenditure, with the rest redistributed to users as yield. Besides, there are fees billed to users taking flash loans. The protocol rewards providers with RDNT to incentivize liquidity provision, depending on the amount provided and the duration locked.

ARB Airdrop, Will RNDT Rally To New 2023 Highs?

Earnings generated depend on the activity level, directly influencing protocol fees accrued and the number of users taking flash loans. Following Radiant Capital’s recent announcement that it plans to airdrop 2 million ARB following the Arbitrum DAO‘s approval of a proposal first floated in late September, activity could skyrocket in the coming months, boosting earnings.

Moreover, the protocol’s liquidity is expected to increase with this approval. The ARB airdrop will be used to incentivize liquidity provision. Additionally, Radiant Capital will strike more partnerships, allowing it to expand to other chains, including Ethereum and Arbitrum.

According to Dune Analytics data, the number of RDNT holders continues to rise, mirroring its general price performance. Thus far, RDNT is up 40% from October lows. The immediate resistance level at $0.33 must be broken for the coin to rally, even registering new 2023 highs.

Aave Protocol Halts Certain Market Operations Due To Bug Report

Decentralized finance (DeFi) platform Aave has suspended operations in a number of markets after receiving a problem report on a certain function of the protocol.

DeFi Protocol Discovers Vulnerability; Is User Funds At Risk?

On Saturday, November 4, decentralized lending protocol Aave announced – via a post on X (formerly Twitter) that it has paused the Aave V2 Ethereum market and suspended certain assets on Avalanche. In addition, the protocol has frozen specific assets on Aave V3 on Polygon, Arbitrum, and Optimism.

Today we received a report of an issue on a certain feature of the Aave Protocol. After validation by community developers, the guardian has taken the following temporary prevention measure (no funds are at risk):

— Aave (@aave) November 4, 2023

According to the protocol’s announcement, these actions serve as a temporary precautionary measure following a problem report on a specific feature.

Furthermore, Aave said in the post that the Aave V3 markets on Ethereum, Base, and Metis and the V2 markets on Polygon and Avalanche are unaffected. Meanwhile, no funds on any of the markets were at risk, according to DeFi lending protocol.

On 11-04 17:38:35 UTC, Aave Guardian has taken necessary protection measurements to pause AaveV2 protocol (and all Aave pools are safe): https://t.co/3xJzfiejig

Given the protocol is “forked” by multiple third parties and the exact details are not disclosed yet, it is… pic.twitter.com/OkO1EZv6pW

— PeckShield Inc. (@peckshield) November 4, 2023

While Aave did not specify what the issue is or the feature that caused the problem, the protocol said it would release a detailed explanation once there is a full resolution. The statement read:

A governance proposal to restore the normal operation of the protocols will be submitted shortly. A detailed postmortem will be released once the issue is fully resolved.

Aave further clarified that users supplying or borrowing from a frozen assets pool can still withdraw and repay positions. However, these users can’t supply or borrow more funds from the frozen assets pool until the issue is resolved. The protocol added:

On paused assets, no action can be done until unpaused.

AAVE Price Remains Steady Despite Protocol Vulnerability

There is no evidence to suggest that the problem has had any impact on the value of the protocol’s native token, AAVE. As of this writing, the token is valued at $90.15, reflecting a negligible 0.9% price dip in the past 24 hours.

Nevertheless, the token is outperforming on a bigger timeframe. Over the past week, AAVE’s price has swelled by more than 10%, touching the $100 mark – for the first time since February – at some point during the week.

Although the price of AAVE has been moving mostly sideways in the past few days, a resolution of the current issue might trigger renewed momentum for the token. Hence, there is a chance that the cryptocurrency might revisit $100 again, especially considering the optimistic climate of the crypto market.

Aave pauses several markets after reports of feature issue

The pause affects multiple markets, including Aave V2 Ethereum Market and certain assets on Aave V2 on Avalanche. In addition, certain assets on Polygon, Arbitrum, and Optimism have been frozen.

Bitcoin price cracks $30K, possibly clearing a path for SOL, LINK, AAVE and STX

Bitcoin’s strong rally to $30,000 may have kick started a sharp recovery in SOL, LINK, AAVE and STX.

This Trader Is On The Brink Of Losing Money, Will Selling WBTC On Aave V2 Help?

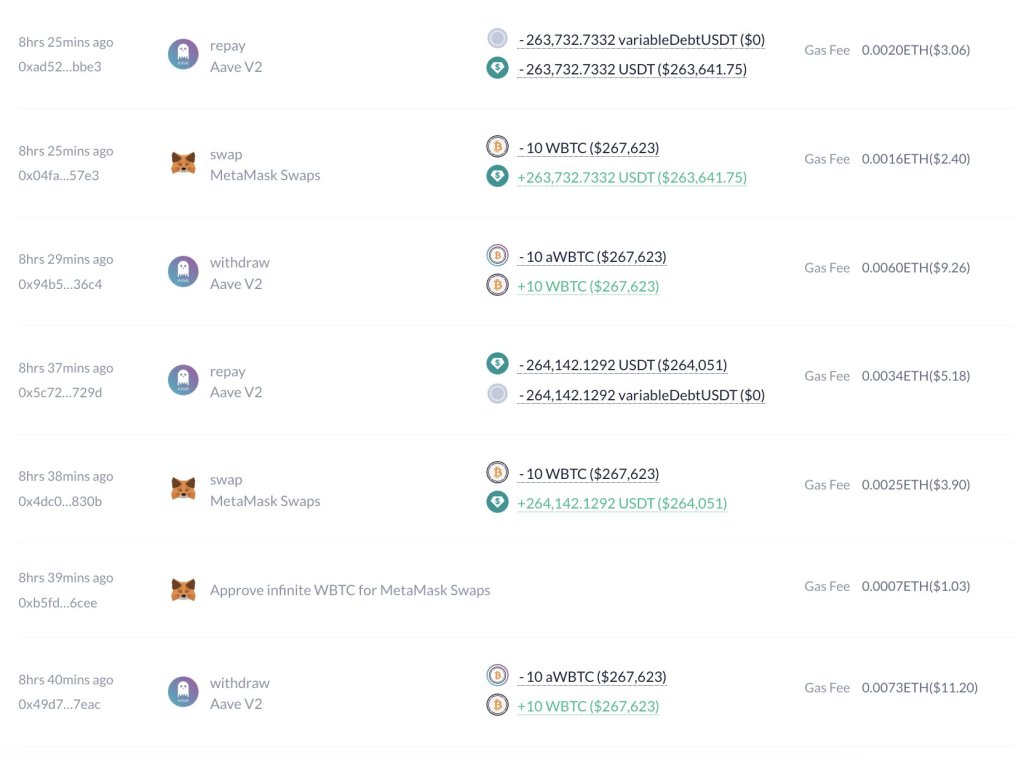

A trader on Aave, a decentralized liquidity protocol operating on multiple platforms, including Ethereum and OP Mainnet, has begun selling wrapped Bitcoin (WBTC) to repay outstanding debt, records on October 13 reveal. WBTC is a tokenized version of Bitcoin issued on Ethereum that allows holders to engage in decentralized finance (DeFi) activities.

Trader Selling WBTC To Repay Debt On Aave v2

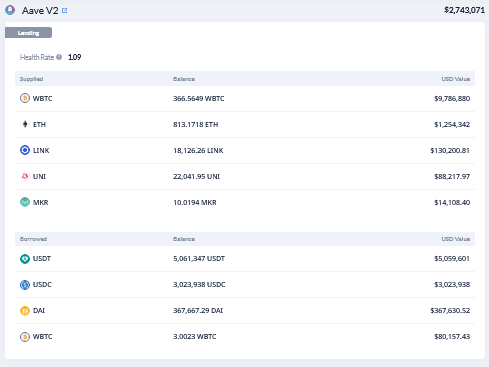

According to Lookonchain data, the unidentified trader marked with address “0x47ab” borrowed roughly $8 million worth of multiple stablecoins, including USDC, USDT, and DAI, Maker’s stablecoin, on Aave v2 after depositing various assets, including WBTC, Maker (MKR), and Ethereum (ETH) worth approximately $11 million.

When writing, the health factor of borrowed assets stands at 1.09, teetering close to liquidation. According to Aave’s documents, the health factor is a metric that compares the safety of collateral and borrowed loans to the underlying value. Technically, the higher it is, the safer the funds are from liquidation. If the health factor exceeds $1, deposited collateral will be liquidated to borrow outstanding loans.

Aave is a popular decentralized finance (DeFi) protocol where token holders can choose to supply liquidity and earn passive income. At the same time, users can deposit collateral and borrow overcollateralized loans, which they can repay at any time, provided the health factor is around 1. Since loans are overcollateralized, the collateral is usually higher than the borrowed amount.

Volatile Bitcoin Prices To Blame?

As it is, the trader, Lookonchain shows, has started selling WBTC to repay outstanding debt. A big chunk of what the trader supplied is in WBTC, standing at 366.56 WBTC, worth roughly $9.1 million at spot rates.

However, considering market prices have fluctuated recently, the contraction has impacted the health factor, increasing the risk of collateral liquidation. To counter this, the trader sold 3 WBTC for roughly $80,000.

The address still owes Aave V2 approximately $8.08 million, mostly in USDT, at around $5 million. There are $3 million of USDC and around $368,000 of DAI. It is unclear whether the trader will seek to borrow more, especially if Bitcoin prices increase.

The address remains long on MKR, the governance token of the MakerDAO protocol; Uniswap’s UNI; Chainlink’s LINK; and Ethereum. Besides WBTC, the trader’s second-largest holding is in ETH, while the smallest is MKR. Ironically, MKR has been one of the top-performing assets, rallying by over 160% in H2 2023 alone. The token peaked at $1,600 in early October before cooling off to spot rates.

Will Bitcoin ‘Uptober’ bring gains for MKR, AAVE, RUNE and INJ?

Bitcoin tends to rally in October, possibly opening the door for MKR, AAVE, RUNE, INJ and other altcoins.

Curve Founder Michael Egorov Deposits $35M CRV to Settle Debt on Aave

Curve founder Michael Egorov has deposited 68 million CRV tokens ($35 million) to settle his entire debt position on DeFi lending platform Aave, according to blockchain analytics firm Lookonchain.

Bitcoin price holds $26K as MKR, AAVE, RUNE and RNDR flash bullish signals

Bitcoin looks ready to start a relief rally and this could trigger interest in MKR, AAVE, RUNE and RNDR.

DeFi economic activity drops 15% in August —VanEck

According to an analysis from investment manager firm VanEck, exchange volume across DeFi protocols declined to $52.8 billion in August, 15.5% lower than in July.