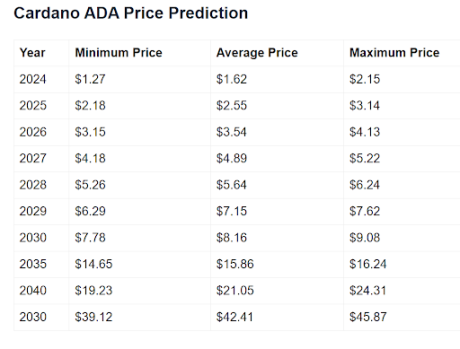

Crypto prediction website Telegaon has provided insights into when Cardano (ADA) will hit $45. A rise to that price level represents an 8.900% price gain from its current price level, which will appeal to ADA holders, especially given the crypto token’s recent unimpressive price action.

When Cardano Will Rise To $45

Telegaon predicted in a blog post that Cardano will reach $45 by 2050. They highlighted $45.87 as the maximum price the crypto token will likely attain that year. Meanwhile, $39.12 and $42.41 are predicted to be ADA’s minimum and average prices that year. The prediction site claims that Cardano’s parabolic rise will occur due to several factors.

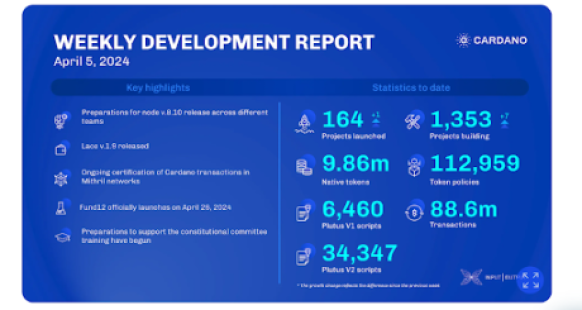

These factors include “trading volume, market trends, investor sentiment, technological developments, and external influences.” It is worth noting that the Cardano has performed incredibly well in terms of technological advancements as the network has continued to rank among the top blockchains by development activity.

This factor is expected to play a massive role in Cardano’s attainment of this price prediction, especially considering that the crypto projects likely to survive until 2050 are the ones that can adapt and progress with the times. Cardano has shown such quality, seeing how the team has continued to build actively, especially with the implementation of the network’s smart contract functionality.

Meanwhile, Telegaon also outlined its price predictions for Cardano in the years leading up to 2050. In the short term, they do not seem bullish on Cardano as they predict that the highest price the crypto token could rise to this year is $2.15. Based on their prediction, Cardano will likely surpass its all-time high (ATH) of $3.10 in 2025, as they predict that $3.14 is the maximum price the crypto token will hit next year.

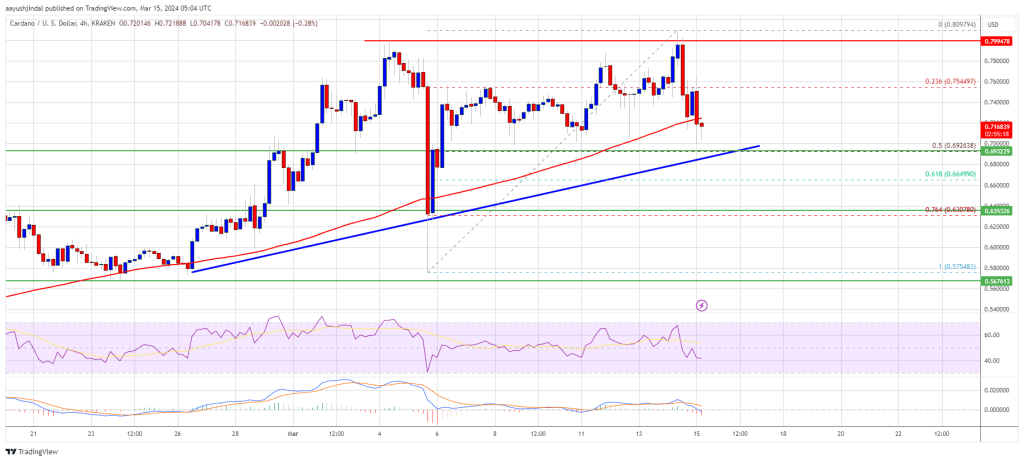

More Bullish Price Predictions For ADA This Year

Last year, Dan Gambardello, the founder of Crypto Capital Venture, suggested that Cardano could rise to as high as $11 this year. Specifically, he mentioned that the crypto token will rise to this level when the bull run returns after the Bitcoin halving. With the halving already taking place, Cardano could be primed for such a run.

Crypto expert Jason Appleton made a more bullish prediction, stating that Cardano would rise to $32 in this bull market. Appleton added that this price level is attainable in the “most prime of conditions by the peak of this bull market cycle.” The crypto expert claimed that this parabolic rise would make Cardano one of the most valuable altcoins during this cycle.

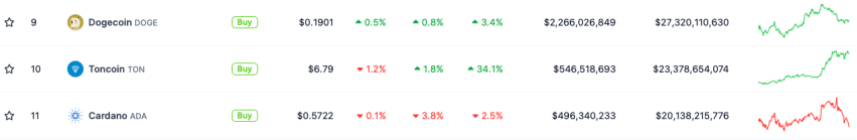

At the time of writing, Cardano is trading at around $0.44, up over 4% in the last 24 hours according to data from CoinMarketCap.