On Thursday night, Algorand CEO Staci Warden’s X Account (formerly known as Twitter) was compromised. Since then, the crypto community and the hacker have been having a back-and-forth conversation.

Justin Sun Will Boost Algorand To “New Heights”

Algorand Foundation’s X account was the first to inform about the hack and advised users to be careful when interacting with the compromised account or any link promoted by it. The hacker then took Staci Warden’s compromised account to start a series of controversial posts and replies.

The hacker called Algorand’s community “poor” in the initial post, later suggesting it would be better for the community if they “sold ALGO and instead bought Ether.” Both posts have amassed a combined total of 150,000 views and, as it’s worth noting, contain racial slurs.

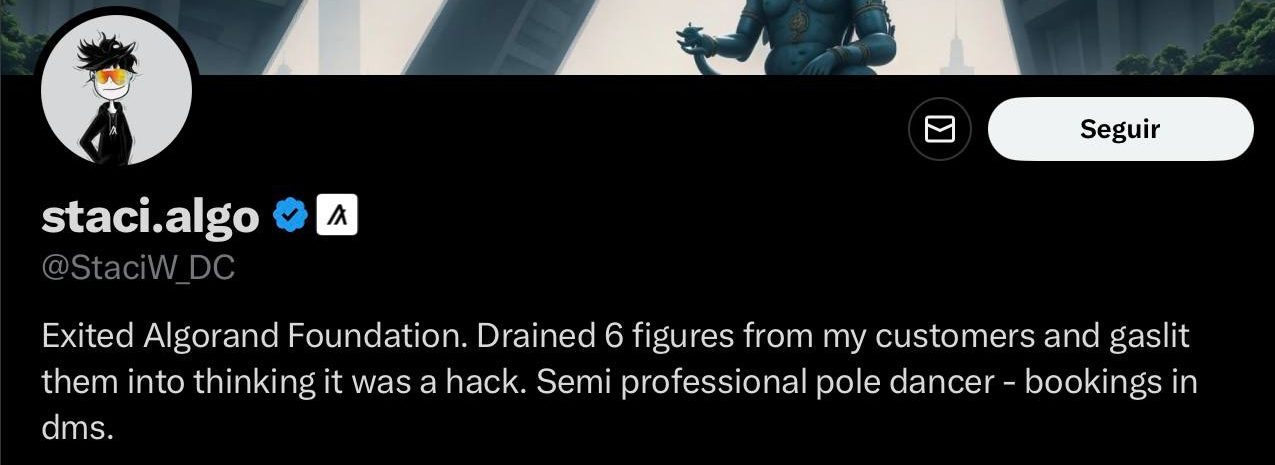

Additionally, the hacker offered a fake airdrop giveaway, claiming they would send “1 $ETH for every % $ALGO drops this week.” While following some users’ petitions, the hacker shared music and changed the account’s bio, claiming that Warden had exited Algorand Foundation and had become a “semi-professional pole dancer.”

Most notably, a fake story was shared in the account narrating a call with Tron founder Justin Sun, referred to as “his excellency” by the hacker. In the fake story, Sun promised to take Algorand to “new heights” under the condition that Algorand’s CEO gave total control over the network and allowed Sun to mint any token to back TRUE USD (TUSD).

A sarcastic comment insinuating that Sun’s projects will be the reason behind “the next major financial collapse in crypto” closed the story.

Just when I thought it was all over for Algorand — my phone rang — it was his excellency. Justin told me that he would boost Algorand to new heights by launching TUSD (TRUE USD) and VRUSD (VERY REAL USD) on Algorand, and all I had to do was agree to give him total control over… pic.twitter.com/Rr9K28uGwh

— staci.algo (@StaciW_DC) January 26, 2024

Algorand CEO Criticized By The Community

The original announcement about the hack and the different posts shared on the compromised account ignited comments from the crypto community. Most users took the incident with humor, while others have taken the opportunity to express their discontent with the CEO.

One user claimed that Algorand CEO “qualifies to be an intern” at the Securities and Exchange Commission (SEC), clearly referencing the recent hack to the SEC’s X account suffered and resulted in a false report about the approval of spot Bitcoin ETFs.

Similarly, known crypto sleuth ZachXBT shared his thoughts about the hack, “Unpopular opinion: Staci hacker would make a better CEO for Algorand Foundation.” To which the hacker jokingly replied, “Hey bro, I just send you $10,000. Keep up the good work for this industry, buy your mom some flowers, and take your father out for a nice dinner,” referencing a previous X post informing the crypto detective of a donation made about a week ago.

No further posts have been shared in the last hours, but the account appears to still be under the hacker’s control, as none of the posts have been taken down, and there’s no official statement about the account’s recovery.

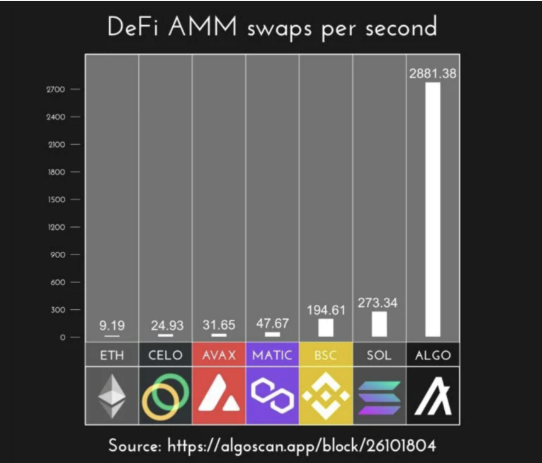

As reported by NewsBTC, ALGO outperformed the general crypto market growth in Q4 2023, experiencing an increase in market capitalization, transaction volume, revenue, and user adoption. ALGO’s prince trades at $0.1652, a 3.18% surge in the last 24 hours.

Welcome AlgoKit 1.8.2

Welcome AlgoKit 1.8.2

INDEXED:

INDEXED: