Two personal crypto wallets belonging to Jeff “Jihoz” Zirlin, the co-founder of Sky Mavis, the company behind the popular play-to-earn (P2E) game Axie Infinity, have been compromised, reports on February 23 show.

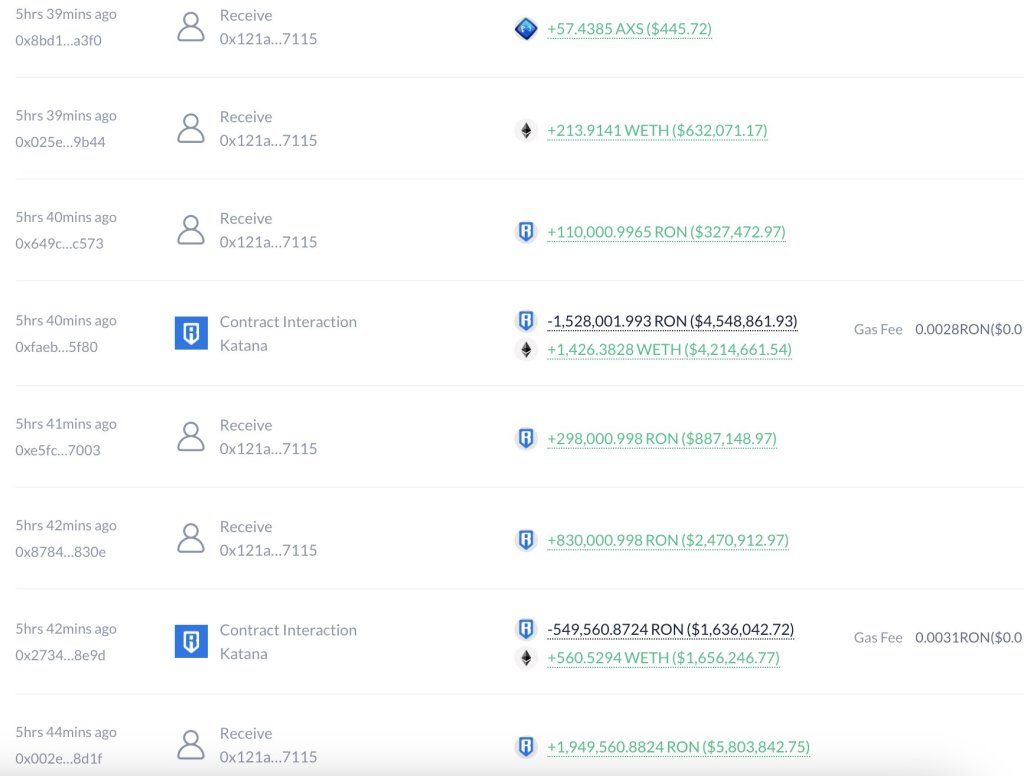

Following this hack, over $10 million worth of various crypto assets were stolen, primarily RON, the native token of Ronin Chain, the Ethereum sidechain designed explicitly for Axie Infinity.

Axie Infinity Co-Founder Losses Over $10 Million In Hack

According to Lookonchain data, the hacker got away with 3.2 million RON worth over $9.53 million. The co-founder also lost over $834,000 worth of Wrapped Ethereum (ETH). There were other small amounts of PIXEL, the native token of Pixels–a gaming platform; SLP, the coin priming Axie Infinity’s metaverse; and USDC, a stablecoin.

Zirlin held around 164 AXS worth less than $1,300. The hack has shown an unexpected holding pattern, especially among project founders. That the co-founder only held 164 AXS is strange, considering the role played in Axie Infinity. The P2E game has distributed billions of assets since its popularity peaked in the last bull cycle.

Stolen assets, Lookonchain data reveals, were reportedly converted to ETH and deposited into Tornado Cash, a crypto mixer whose co-founders have an ongoing court case in the United States.

In charges brought forward in August 2023, the prosecution team alleges that North Korean hackers used Tornado Cash to launder millions, if not billions, of dollars worth of stolen coins. Some of these tokens were from the Ronin hack, which lost over $600 million in March 2022.

Dedicated To Mission; RON And AXS Post Minor Losses

Zirlin confirmed the hack on X on February 23, emphasizing that it was “limited to my accounts.” The hack did not affect the Ronin chain or Sky Mavis operations. The co-founder also added that the compromised private keys were not connected to the company’s internal systems.

Zirlin said they have “strict security measures in place for all chain-related activities to assuage fears.” The co-founder also remains upbeat, assuring concerned crypto community members that the project will continue pursuing its mission of bringing “economic freedom” to all users.

So far, AXS and RON prices remain stable but lower, looking at the performance in the daily chart. AXS and RON have been edging lower since February 21, cooling off after sharp gains from early Q4 2023.

Source: TradingView

Source: TradingView