Bored Ape Yacht Club and Mutant Ape Yacht Club NFTs were returned to their owners after Yuga Labs’ Greg Solano and Boring Security DAO paid a bounty.

Crypto Scam Alert: Fraudsters Impersonate Forbes Journalists In Plot To Rob BAYC Holders

In the non-fungible tokens (NFTs) sector, scammers are constantly devising new methods to exploit unsuspecting collectors. The latest incident involves fraudsters posing as journalists from Forbes magazine, specifically targeting Bored Ape Yacht Club (BAYC) NFT holders.

One BAYC owner, “Crumz,” recently shared his encounter with these scammers, detailing the elaborate scheme designed to steal his digital assets.

BAYC Collector’s Close Encounter With Scammers

According to Crumz, the scam began when he received a direct message on X (formerly Twitter) from someone claiming to be a Forbes editor named Robert Lafranco.

Intrigued by the prospect of being featured in an article about BAYC, Crumz proceeded cautiously, conducting a cursory online search that seemingly confirmed the person’s identity. Unbeknownst to him, the scammers had meticulously crafted a “facade of credibility.”

The supposed Forbes journalist informed Crumz of their interest in gathering firsthand accounts from BAYC owners regarding their experiences within the club. Despite initial surprise at being approached, Crumz agreed to participate in a scheduled Zoom call.

Crumz further stated that the scammers failed to show up for the initial call, citing a fabricated family emergency as the reason for their absence. They rescheduled the meeting for a later date.

When the rescheduled call finally took place, Crumz noticed several red flags. The individuals on the call refused to activate their cameras, claiming technical difficulties.

Another person claiming to be Steven Ehrlich, Forbes’ research director, joined the conversation. Crumz shared his BAYC journey, recounting the early days and highlighting the club’s unique features.

During the call, Crumz alleges that the scammers exhibited further suspicious behavior. They lacked a premium Zoom account and insisted on using multiple call links.

Additionally, they requested permission to record the screen using a separate recording bot. Although Crumz initially thought nothing of it, alarm bells rang when they asked him to find a banana and say something that resembled his Bored Ape character.

Unable to produce a banana on the spot, Crumz excused himself momentarily, muting his screen. During this momentary lapse, the scammers attempted to take control of his computer, prompting him to intervene when they navigated to the website delegate.cash.

Ultimately, all of Crumz’s valuable NFTs were securely stored in cold storage, safeguarding them from potential theft. He promptly shut down his computer to ensure his safety, hoping to sever any remote access the scammers may have gained. Crumz concluded:

Hopefully I’m safe now. Don’t think they can still control my computer when I turn it back on. Please be safe out there, it could’ve been a dreadful day today

Decline In Sales And Market Engagement

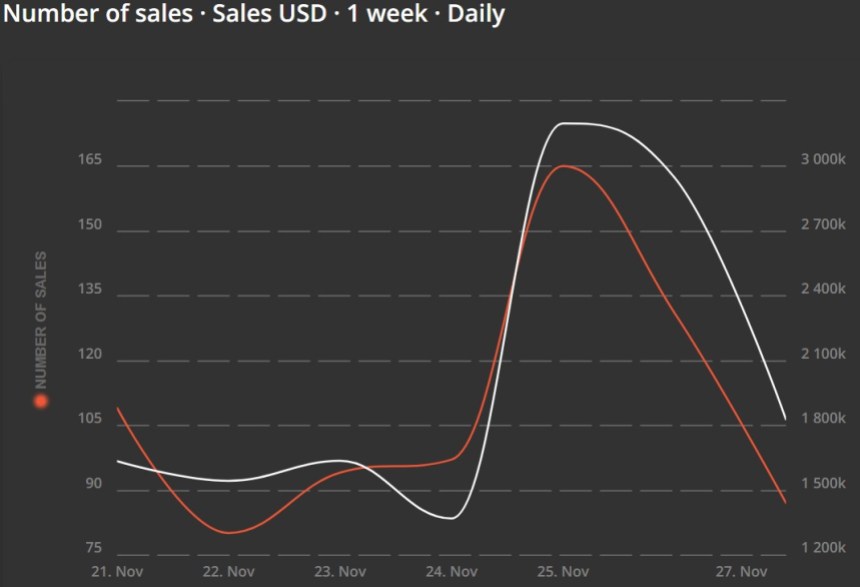

BAYC has recently witnessed a notable decline in various key metrics. The latest NFT data reveals a decrease in the number of sales, sales volume, and primary sales.

According to the latest figures, the number of sales has seen a significant drop of 33.59%, with 87 sales reported at present compared to 131 sales recorded the previous day.

This decrease in sales has also resulted in a decline in sales in USD, with a decrease of 38.02%. The current sales volume is $2 million, compared to $3 million on Sunday.

In terms of sales volume, primary sales have experienced a 100% decrease, with no current sales reported. In contrast, primary sales generated $12,000 in USD the previous day. Secondary sales volume has also declined 37.76%, with the current figure at $2 million, compared to $3 million from the previous day.

Featured image from Shutterstock, chart from TradingView.com

Asked to get a banana, a BAYC owner narrowly avoids a fake Forbes scam

Scammers posing as Forbes journalists have been targeting BAYC holders to set up interviews and distract them while they attempt to steal their apes.

Yuga Labs confirms UV lights likely cause of eye issues at ApeFest

The Bored Ape Yacht Club’s official Twitter account said an investigation confirmed suspicions that UV lights were the likely cause of the reported eye and skin issues suffered by some attendees.

Yuga Labs Confirms UVA-A Emitting Lights Cause of ApeFest Eye Issues

Numerous participants exhibited signs of photokeratitis, an ailment resulting from ultraviolet (UV) light exposure, after last weekend’s event.

The Simpsons Take a Dig at NFTs, Crypto in ‘Treehouse of Horror’ Episode

“Remember how we were always saying we wish Bart was less fungible,” Homer asks Marge after he puts his son on-chain.

LooksRare Monthly NFT Trading Volume Flash Crashes 97% In October: What’s Next?

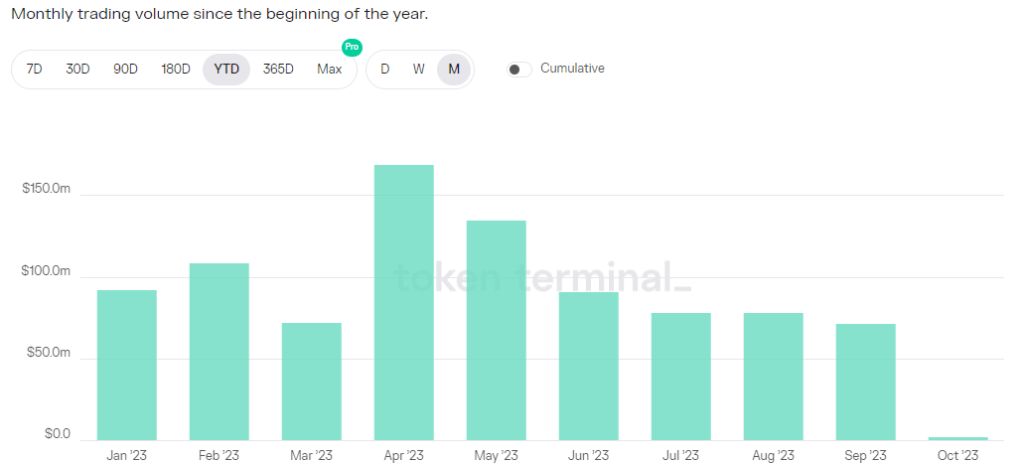

The monthly trading volume of LooksRare, a decentralized non-fungible token (NFT) and digital collectible marketplace, is down 97%, crashing from $71.9 million registered in September 2023 to just $2.1 million in October, Token Terminal data shared by Web3 Academy on October 26, via X shows.

LooksRare’s Monthly Volume Tanking, Falls To $2.1 Million In October

The unprecedented drop in activity couldn’t be pinned on any particular LooksRare-related event when writing on October 26. This contraction is despite the broader cryptocurrency market recovering, rising as seen by the welcomed expansion of leading assets, including Bitcoin (BTC) and Ethereum (ETH).

According to trackers, monthly volume has been falling steadily since April 2023. Then, the average volume exceeded $150 million, pointing to rising interest, especially from traders. At that time, it should be noted that most crypto assets were also growing.

Specifically, Bitcoin broke higher, touching $30,000, triggering demand and reviving hopes that the market was looking up again following the collapse in 2022. By June through September, the average monthly volume in LooksRare had more than halved before plunging to less than $3 million in October 2023.

The spike in monthly trading activity in April coincided with the release of LooksRare v2, which saw the platform’s developers reduce trading fees by 75% from 2% to 0.5%. The updated version is also more gas efficient, allowing traders to save up to 30% on gas compared to the previous edition. Moreover, with LooksRare allowing traders to place bulk orders when buying or selling, monthly volume rapidly rose in April.

NFT Bull Run Postponed, Will LOOKS Break Resistance Line?

With activity rapidly contracting, LOOKS, the native token of LooksRare, has also been flat-lining, looking at price action. The token trades around the $0.070 level at spot rates, retesting August highs. However, an inverted hammer suggests that the uptrend momentum could wane, and bears might reverse gains.

Despite concerns, LOOKS is up 60% from H2 2023 lows and may still rally in the months ahead. Looking at the candlestick arrangement in the daily chart, a close above $0.070 with expanding volumes could set the ball rolling for buyers who expect the token to retest 2022 lows at around $0.12.

Overall, NFT and digital collectible trading activity remains relatively lower, even with bullish traders expecting prices to turn around and rally in 2024. Recently, there was a brief increase in the floor prices of leading NFT collections like Bored Ape Yacht Club (BAYC), Azuki, and CryptoPunk. However, with trading volume and the number of new owners still at record lows, researchers put off the chance of an NFT bull run starting in Q4 2023.

‘I’m still not seeing it’ — Judges skeptical of Ryder Ripps’ BAYC appeal

The lawyer representing Ryder Ripps and Jeremy Cahen struggled to convince a panel of judges that Yuga Labs’ case against his clients should be thrown out under California’s anti-SLAPP statute.

Major NFT Collections Post Double-Digit Monthly Losses as Floor Prices Drop

Losses in the NFT markets have exceed ether’s decline, which is down 9.6% on-month.

OpenSea Makes Shift To Optional Royalty Model – A Deal-Breaker For Yuga Labs?

Yuga Labs – creators of the popular Bored Ape Yacht Club (BAYC) NFT collection – has unveiled its plans to cut ties with NFT marketplace OpenSea. This comes as a response to the platform’s proposed shift to an optional royalty system.

On Thursday, August 17, OpenSea announced that it is changing its creator fees framework, making royalties optional for new collections after August 31, 2023. The NFT marketplace also disclosed that it would disable the Operator Filter, a feature that enforces creator royalties.

According to the announcement, NFT collections that utilized the Operator Filter up until August 31 will have their creator royalties enforced till February 29, 2024, when the fees will become optional.

In the blog post, OpenSea explained the rationale behind its decision, saying the Operator Filter was designed to empower creators with greater control. However, the marketplace claims that it has not received the much-needed acceptance in the web3 ecosystem.

Yuga Labs Responds To OpenSea’s Decision

On Friday, August 18, Yuga Labs published an open letter on X (formerly Twitter), subtly criticizing OpenSea’s decision to make creator fees optional on all secondary sales for all collections by February 2024. The BAYC creator also disclosed its plans to wind down support for OpenSea’s SeaPort, a marketplace protocol that enables the buying and selling of NFTs.

Daniel Alegre, CEO of Yuga Lab, said in the response:

Yuga Labs will begin the process of sunsetting support for OpenSea’s SeaPort for all upgradable contracts and any new collections, with the aim of this being complete in February 2024 in tandem with OpenSea’s approach.

Alegre noted that while the purpose of NFTs has been to revolutionize true ownership of digital assets, it has also been about empowering artists and creators. “Yuga believes in protecting creator royalties so creators are properly compensated for their work,” he added.

Yuga Labs’ stance will likely be a significant blow to OpenSea, but perhaps not one the marketplace wouldn’t have foreseen. In January, the BAYC creators blacklisted about four marketplaces – with an optional royalty model – from its Sewer Pass collection.

OpenSea Halts Support For The BNB Smart Chain

OpenSea also recently announced its decision to disable the minting and listing of NFTs on the BNB smart chain. According to the post on X, this move was informed by the marketplace’s “need to align resources with the most promising efforts”.

The NFT platform wrote in the announcement:

Starting today (August 18, 2023), you will no longer be able to create new listings for or make new offers on BSC NFTs. However, you will still be able to view, discover, and transfer BSC NFTs on our site.

This latest development brings OpenSea’s total supported chains down to 10, including Arbitrum, Avalanche, Ethereum, Optimism, Polygon, Solana, and the recently-added Base and Zora.

Collectors Are Bored of Apes and Don’t Want to Pay Royalties

This week, the floor price of the Bored Ape Yacht Club NFT collection dropped to its lowest price in nearly two years, leading to questions about the collection’s value. But floor price is just one metric used to value NFTs – experts explain that there are other important factors in assessing what an NFT is worth.

Nifty News: Blue chip NFT prices wobble, Credit Suisse tries tokens and more

The floor prices for some of the largest NFT collections sunk to nearly two-year lows, but have started to edge up in the past 24 hours.

Judge Rules Bored Ape Yacht Club Ripoff NFTs Violated Yuga Copyright

Use of BAYC trademarks by Ripps’ RR/BAYC was intended to confuse consumers, a U.S. judge in California has ruled

Bored Ape Yacht Club Floor Price Slides to Five-Month Low as Prominent Investor Dumps Holdings

The floor price of the Bored Ape Yacht Club (BAYC) collection has slumped to a five-month low of 55.59 ether (ETH), according to Cryptowatch data.

‘Scammers dream’ — Yuga’s auction model for Bitcoin NFTs sees criticism

Yuga Labs’ first Bitcoin NFT collection saw some backlash from the crypto community over the weekend, pointing to flaws in the way it’s conducting the auction.

Whale sells 1,010 NFTs in 48 hours in ‘largest NFT dump ever’

With the Blur marketplace set for a second airdrop soon, Nansen’s Andrew Thurman theorized that this major NFT dump could be a play to reap extra BLUR token rewards while also booking some profits.

NFTs will act as high-end property during boom cycles: Real Vision CEO

The former hedge fund manager suggested that top-tier NFTs essentially serve as status symbols, and should see significant upside during crypto boom cycles.

BAYC copycat files opposition to 10 Yuga Labs trademark applications

A Yuga Labs spokesperson has played down the significance of the opposition notice and suggested that the RR/BAYC co-founder is just trying to cause trouble.

Yuga Labs settles lawsuit with developer involved in copycat BAYCs

The BAYC creators have settled with developer Thomas Lehman over his role in selling a copycat collection of BAYC NFTs.

Nifty News: Trump NFTs surge 800%, Yuga Labs blacklists NFT exchanges, and more

Donald Trump’s NFT collection started out strong but then started looking lifeless up until a few days ago.