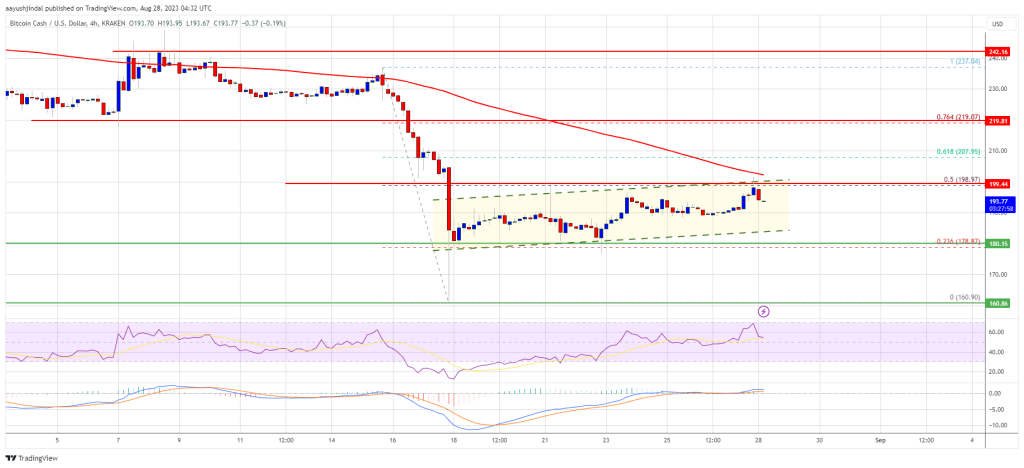

Bitcoin Cash (BCH) is stirring excitement in the cryptocurrency community after respected analyst Rekt Capital posted a potentially game-changing analysis. The analysis suggests BCH might be on the cusp of overcoming a long-standing downtrend and achieving a “monumental milestone.”

For BCH enthusiasts, this potential breakout represents more than just a technical victory. It could be a turning point that ushers in a new era for the cryptocurrency. Historically, BCH has flirted with overcoming the downtrend, only to fall back within its boundaries. However, Rekt Capital believes this time might be different.

The key takeaway from my analysis is the possibility of Bitcoin Cash finally closing a monthly candle above the macro downtrend line, Rekt Capital stated in the analysis.

$BCH / USD – #BCH #BitcoinCash

Bitcoin Cash is on the cusp of making history

BCH formed upside wicks past this Macro Downtrend in the past

But it is very likely we will soon see BCH Monthly Candle Close beyond the Macro Downtrend for the first time ever#BTC #Crypto #Bitcoin https://t.co/v6gA4Wisti pic.twitter.com/IP7OB0F2OJ

— Rekt Capital (@rektcapital) March 29, 2024

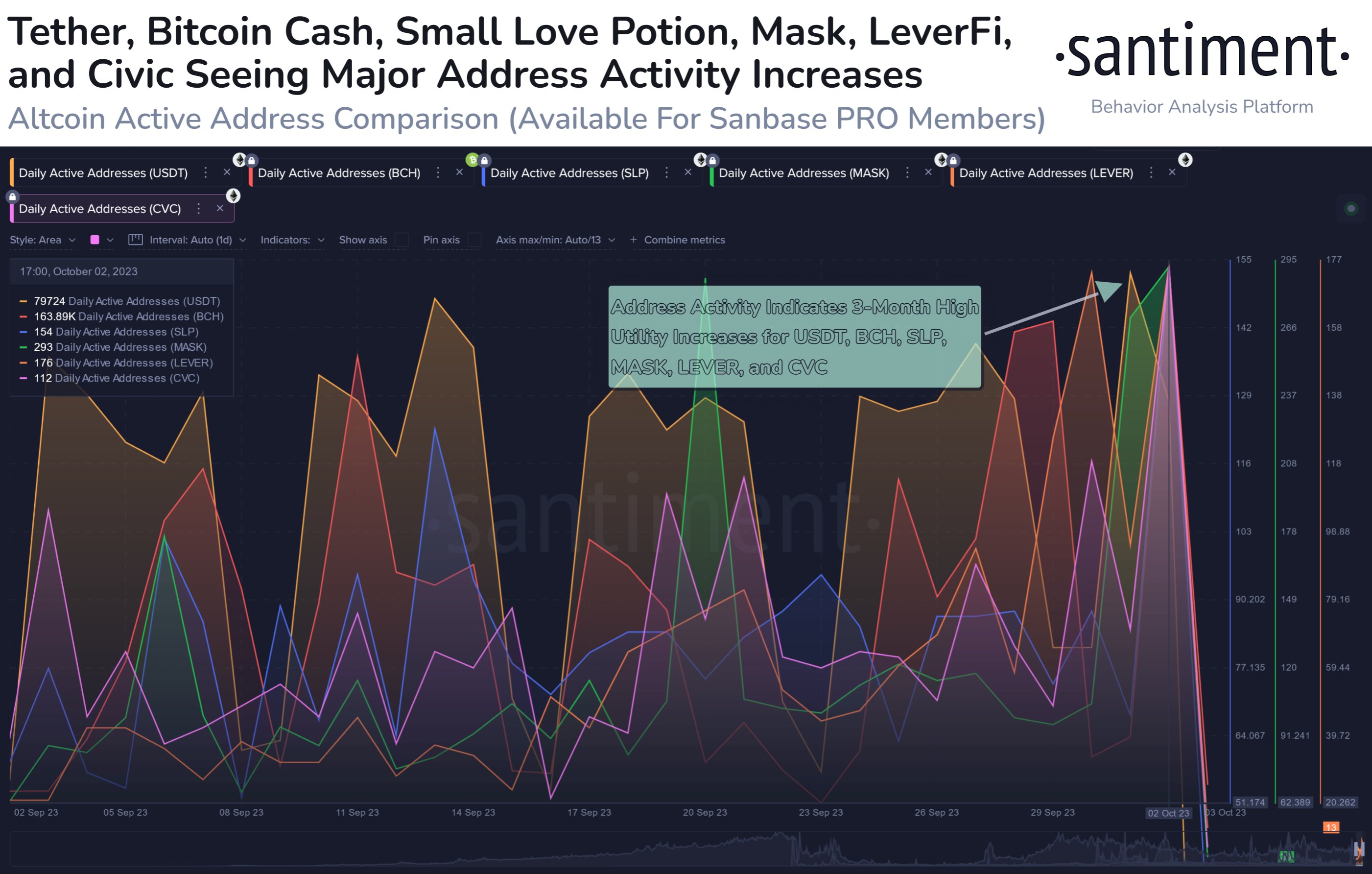

The significance of such a move lies in its potential to attract new investment. A confirmed breakout would be a strong bullish signal, potentially swaying investors who have been hesitant about BCH’s future. This, in turn, could lead to a rise in BCH’s valuation and solidify its position in the ever-evolving cryptocurrency landscape.

Industry leaders point to a successful breakout as a major vote of confidence for Bitcoin Cash. It would demonstrate BCH’s underlying strength and resilience in a notoriously volatile market.

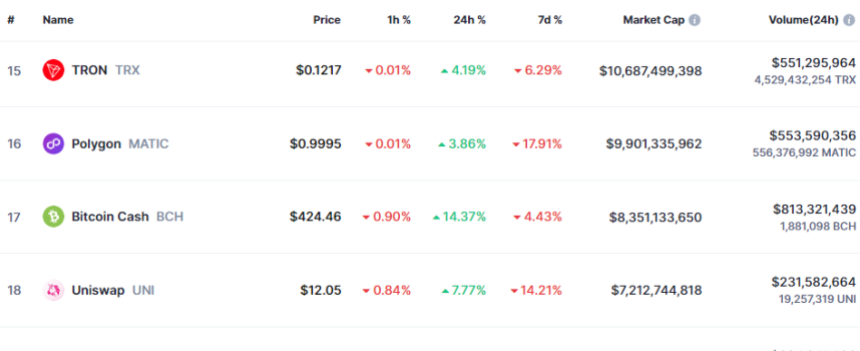

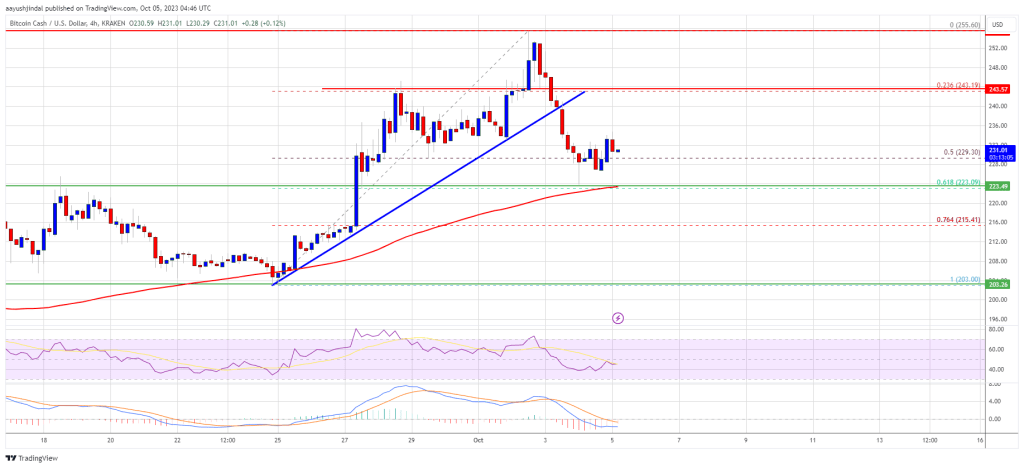

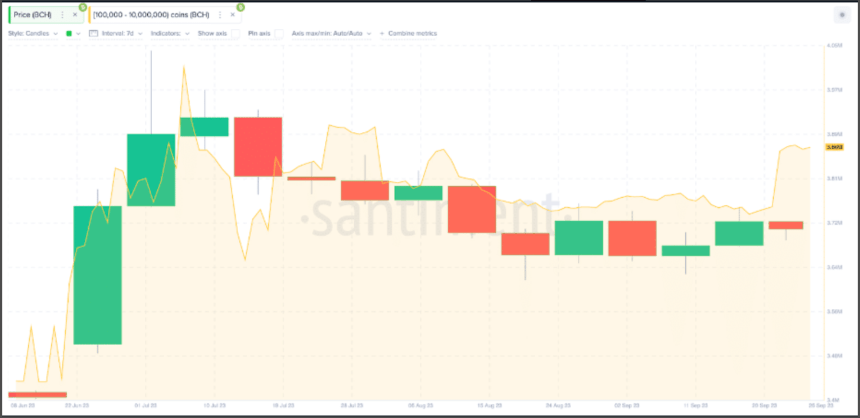

While the anticipation surrounding BCH is palpable, some caution remains. The cryptocurrency market is known for its unpredictable nature, and BCH is currently experiencing a short-term price dip of 1.6% and is currently trading at $645. However, this needs to be viewed in context of a recent 30% weekly surge, highlighting the market’s inherent volatility.

The next few weeks will be crucial for BCH. If the monthly candle closes above the downtrend line, it would be a significant confirmation of bullish sentiment. However, failure to do so could lead to a pullback and dampen the current optimism.

The potential breakout for BCH underscores the dynamic nature of the cryptocurrency space. Trends can shift rapidly, and what appears certain one day can quickly change course. This is precisely what makes the industry so captivating, with innovation and progress constantly pushing boundaries.

The story of Bitcoin Cash is a testament to the relentless pursuit of progress in the crypto sphere. Whether BCH breaks out or not, its trajectory serves as a reminder of the ever-evolving nature of this exciting and unpredictable market.

With all eyes on the upcoming monthly candle close, the cryptocurrency community waits to see if Bitcoin Cash can finally turn the corner and etch its name in the crypto history books.

Featured image from Pixabay, chart from TradingView