Binance.US added Martin Grant, a one-time New York Federal Reserve Bank official who spent 17 years as its chief compliance and ethics officer, to its board of directors.

Binance.US Slashed Two-Thirds of Its Workforce as Revenue Plunged After SEC Lawsuit: Court Transcript

“The allegations of the SEC severely undermined institutional trust in our platform,” Binance.US executive Christopher Blodgett said during a deposition.

Binance.US Not Being Totally Forthcoming, SEC Complains in New Filing

The SEC and Binance.US filed a joint status report detailing ongoing discovery efforts on Tuesday.

Changpeng ‘CZ’ Zhao Steps Down From Binance.US Board

SEC still looking for potential FTX-style fraud at Binance.US: Report

Binance.US attorney Matthew Laroche has asked a federal judge to consider putting an end to the SEC’s investigation for potential fraud.

Binance Has No Real Argument for Dismissing SEC Suit, Regulator Says

Binance.US Halts Direct Dollar Withdrawals

Dollar deposits in user wallets are no longer eligible for FDIC insurance protection, according to the updated terms of use.

Binance and CEO Chanpgeng Zhao asks court to dismiss SEC suit

Binance Holdings and its CEO Changpeng Zhao have filed a petition seeking to have the lawsuit made against them by the US Securities and Exchange Commission (SEC) dismissed.

Binance, U.S. Affiliate, Changpeng ‘CZ’ Zhao File to Dismiss SEC Lawsuit

Binance, Binance.US and Changpeng Zhao filed to dismiss a Securities and Exchange Commission (SEC) lawsuit Thursday, claiming the regulator hadn’t “plausibly alleged” various securities-related violations.

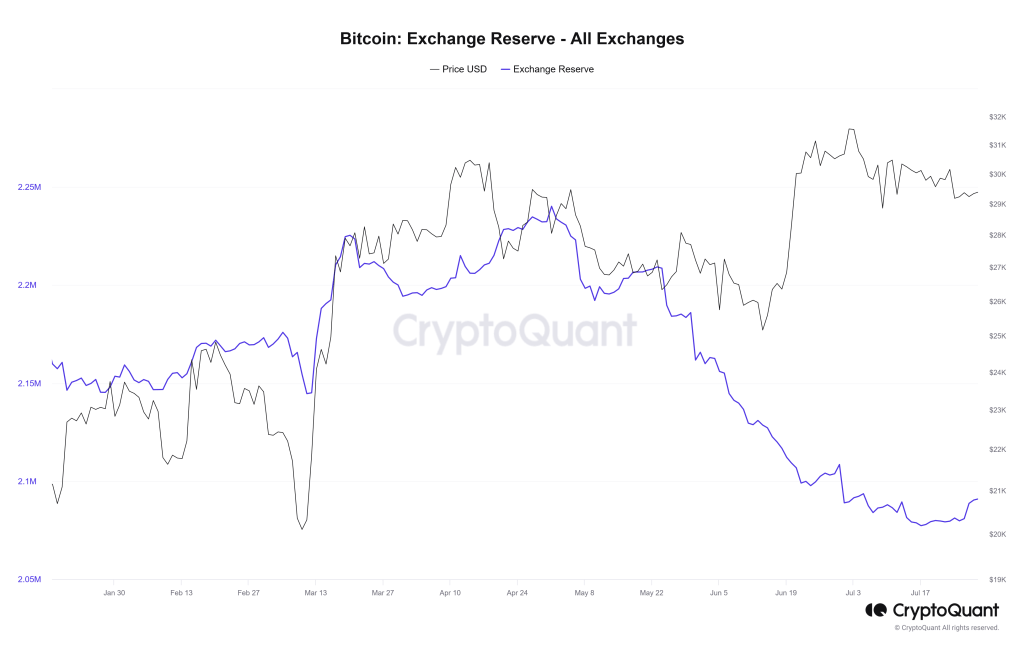

Bitcoin Reserves On Exchanges Approaching A 6-Year Low, Good For Price?

Bitcoin (BTC) held by leading crypto exchanges like Coinbase, Binance, and Kraken are near a six-year low, CryptoQuant data on September 20 reveals.

The contraction was recorded when the broader market steadied after posting sharp losses in the better part of August and the first half of September. As of September 20, BTC prices are still below $30,000, but with important sideways movement over the past few weeks.

Bitcoin Reserves On Exchanges Falling

According to trackers, exchanges control 2.09 million BTC when writing. In total, the Bitcoin network will issue 21 million coins.

However, as of 2023, over 19.7 million are in circulation, and public firms such as Tesla—the electric car automaker—and MicroStrategy—the business intelligence firm—have been loading up. Generally, entities can hold cryptocurrencies in non-custodial wallets or exchanges like Binance or Coinbase.

Exchanges offer custodial wallets where users can store their coins to trade or even HODL. Users who hold their coins on exchanges can easily swap them for USDT or other altcoins. As mentioned, the number of coins held in exchanges continues to contract—which, while on the surface can be bullish, doesn’t necessarily mean prices will recover.

Typically, coin outflows from exchanges can signal a firming market and expectation of price expansion. However, considering the current regulatory environment, traders and Bitcoin holders might prefer taking control of their coins as fear sets in.

Accordingly, more holders secure their coins in their non-custodial wallets as a protective measure, possibly explaining the dropping Bitcoin exchange reserves.

SEC, Regulators Tough On Exchanges

The number of Bitcoin held in exchanges has been falling throughout 2022 but appeared to have dropped faster in late 2022. Around that time, FTX, a popular crypto exchange, collapsed, locking billions worth of clients’ funds.

Outflow slowed down in Q1 2023 following the collapse of some regional banks in the United States but has since continued falling. The dip can be attributed to the bear market but primarily because the United States Securities and Exchange Commission (SEC) is cracking the whip on Binance and Coinbase, accusing them of non-compliance.

In June, Binance and Coinbase were sued by the SEC. The regulator claimed that the two exchanges were issuing unregistered securities, citing some, like Cardano (ADA), as examples.

Amid this crackdown, Binance US became a focal point. Since then, there have been major staff resignations, layoffs, and disruption of operations. Trading volume in Binance US is now down by over 95%.

CZ Denies Binance.US Used Ceffu or Binance Custody in Apparent Contradiction

Binance.US previously told a DC court it used custody software offered by Binance’s international arm that was later rebranded Ceffu.

‘I Just Want to Keep Things Moving’: Judge Makes No Ruling in SEC-Binance Document Dispute

A U.S. judge declined to order Binance.US to make its executives more available for depositions, or for the U.S. Securities and Exchange Commission (SEC) to back down in its demands for more documents during a hearing Monday.

Binance Is Supposedly Separate From Crypto Custodian Ceffu. The SEC Has Questions

As regulators prepare to square off with one of the world’s biggest crypto exchanges in court, Ceffu has denied any ties to Binance or U.S. operations. The reality is murkier.

SEC Rips Into Binance.US Over ‘Shaky’ Asset Custody, Asks Court to Order Inspection

The regulator asked a U.S. court to reject Binance’s “half-hearted” objections to its motion seeking depositions, an inspection and communication from the exchange.

Binance CEO responds to rumors, says US executive is ‘taking a deserved break’

Despite Brian Shroder resigning as CEO of the exchange’s US wing amid SEC and CFTC lawsuits, Binance CEO Changpeng Zhao claimed that the departure was normal.

Binance.US Not Playing Ball With Probe, SEC Says, as Focus Turns to Custody Arm Ceffu

Securities regulators have complained the exchange is unregistered, and worry about assets being shifted overseas.

Binance.US Plagued By Staff Exodus: Legal And Risk Executives Abandon Ship

In recent developments, Binance.US, the American affiliate of cryptocurrency giant Binance, is engulfed in a storm of legal challenges and a wave of executive departures.

Binance.US Rocked By Legal Woes And Executive Exodus

As regulatory scrutiny intensifies, key risk and legal executives have chosen to part ways with the company, adding to the growing list of personnel changes within its ranks.

Following this trend, according to a Wall Street Journal report, Krishna Juvvadi, the head of legal, and Sidney Majalya, the chief risk officer, have also decided to leave Binance.US.

These departures come in the wake of CEO Brian Shroder’s recent exit, further exacerbating the leadership vacuum at the company. Earlier this week, Binance.US announced the departure of CEO Brian Shroder and disclosed plans to reduce its workforce by approximately one-third, amounting to over 100 job cuts.

These moves underscore the operational challenges faced by the company following legal action taken against it by the US Securities and Exchange Commission (SEC) and the Department of Justice (DOJ)

Norman Reed, the general counsel who joined Binance.US in December 2021, will serve as the interim CEO, taking over from Shroder. However, Binance.US has not provided any specific reasons for Shroder’s departure.

The legal troubles for Binance and its subsidiaries intensified when the US SEC filed a civil complaint in June. The complaint accuses Binance and its founder, Changpeng Zhao, of creating Binance.US as part of a deceptive scheme to evade US securities laws designed to protect American investors.

While Binance and Binance.US maintain that they operate separately, the legal challenges faced by the global exchange have had a ripple effect across its affiliated entities.

The departure of key executives, including Mayur Kamat, the global head of product, and Patrick Hillmann, the chief strategy officer, further underscores the turbulent environment within the company.

As the departures of high-ranking executives continue to disrupt Binance.US, the firm’s spokesperson has emphasized the need to ensure uninterrupted customer service while operating as a crypto-only exchange.

Nevertheless, the ongoing legal battles and the departure of experienced leaders present significant challenges for Binance.US as it seeks to navigate the complex regulatory landscape and regain stability.

Binance.US will have to address the legal allegations against it and make strategic decisions to rebuild its leadership team, strengthen compliance measures, and restore trust among regulators, investors, and users. The outcome of these efforts will undoubtedly shape the future trajectory of the exchange and its ability to operate within the highly regulated US crypto market.

Despite the recent news, Binance Coin (BNB) has remained relatively unaffected and has experienced minimal impact on its price. The token has closely followed the overall market trend, exhibiting a slight uptick of 0.5% over the past 24 hours.

Featured image from iStock, chart from TradingView.com

Binance.US cuts third of staff as CEO Brian Shroder leaves: Report

The staff cut and departure comes amid legal action from United States regulators.

Binance.US CEO Has Left, Crypto Exchange Cuts 1/3 of Workforce

Binance Says SEC’s Request for Depositions is ‘Overbroad’ and ‘Unduly Burdensome’

Binance says the SEC has no evidence to support its allegations that imply investor assets have been wrongfully diverted.