In June the exchange was ordered by the Financial Services and Markets Authority to stop serving Belgium clients.

CZ appoints Binance security team to track Huobi HTX stolen funds

To minimize the damage, HTX proactively offered 5% of the drained funds as a “white-hat bonus,” which would amount to nearly $400,000.

Taiwan’s major crypto exchanges form association to advance industry interests

MaiCoin Group, BitoGroup and Ace Exchange became the first three founders of the Taiwan Virtual Asset Platform and Transaction Business Association.

Crypto exchange Binance among firms eyeing new stablecoins in Japan

Binance and Mitsubishi UFJ Trust and Banking Corporation (MUTB) are exploring the issuance of Yen and other foreign currency-denominated stablecoins in Japan.

Binance exit aftershock: Can one resignation tip the crypto trust scales?

The announcement of yet another top figure departing Binance coincided with an increased outflow of funds from the crypto platform. But can one executive resignation really have such an impact?

CRV Spikes 22% In 2 Weeks As Whale Withdraws From Binance

CRV, the native currency of Curve Finance, the decentralized exchange focused on stablecoins, is shaking off August’s weakness and printing higher highs when writing on September 22. Trackers reveal that CRV is up 22% in the past two weeks, adding 10% in the last week alone.

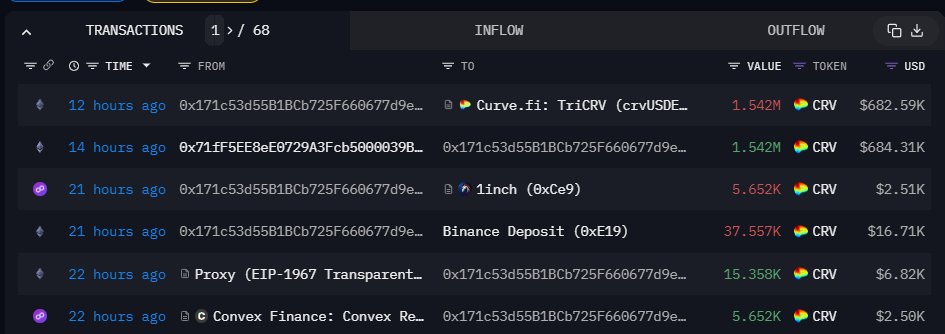

Coincidentally, there has been increased activity from a whale moving CRV from Binance, the world’s largest crypto exchange by client count.

Whale Offloads CRV From Binance To Curve Finance

According to The Data Nerd, a tracker, a whale transferred 1.542 million CRV, worth roughly $684,000, from Binance. Afterward, the whale, only identified as “0x171,” added liquidity to Curve Finance.

Over the last week, the whale has been actively supplying liquidity to Curve Finance, providing 5.36 million CRV worth $2.27 million.

CRV is the governance token in CurveDAO, the decentralized autonomous organization (DAO) behind Curve Finance. Since the exchange is decentralized, CRV holders have voting rights. Moreover, they can receive rewards whenever they supply liquidity to any of Curve Finance’s pools.

Curve Finance used an automated market maker (AMM) model for the trustless swapping of stablecoins, including DAI, USDT, USDC, and other tokens like ETH and wrapped Bitcoin (wBTC). However, to function optimally, Curve Finance relies on liquidity pools where users can supply liquidity and get a share of fees distributed in CRV.

The withdrawal of coins from Binance to a non-custodial wallet is a vote of confidence for CRV. The token has been free-falling in Q3 2023. To illustrate, CRV crashed by 32% in August alone.

The draw-down was worsened by the broader contraction in crypto occasioned by waning momentum around the approval of several complex derivatives for Bitcoin and Ethereum. At the same time, regulatory actions, especially from the Securities and Exchange Commission (SEC), significantly impacted sentiment and token prices.

CRV Sold Off After Hack

The free-fall of CRV can be directly pinned to an exploit of multiple Curve Finance liquidity pools in late July 2023. In a re-entrancy attack, a hacker exploited a vulnerability in the older version of a Vyper compiler, draining over $61 million worth of tokens from Curve Finance’s pools.

Through the re-entrancy attack, the hacker could infinitely withdraw deposited tokens from Curve Finance’s pools, resulting in losses.

Curve Finance has since patched the vulnerability, but CRV prices are yet to recover despite the recent pump. Also, its co-founder and CEO, Michael Egorov, had to liquidate a big chunk of CRV that he had used to secure loans on multiple platforms, including Aave.

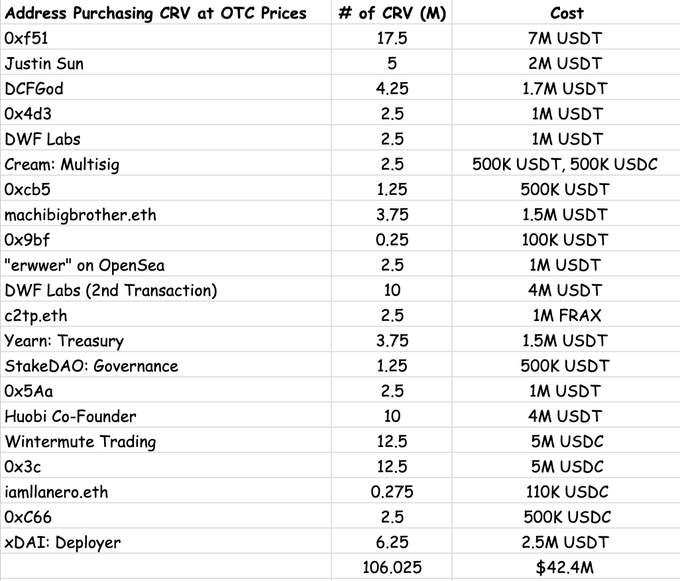

By early August, Egorov had sold 106 million CRV via over-the-counter (OTC) trades at a discount to multiple entities. Top buyers included Justin Sun, the co-founder of Tron, who bought 2 million CRV, and Jeffrey Huang, who acquired 3.75 million CRV.

81 Binance Wallets Withdraw $31 Million In LINK, What This Mean For The Altcoin

Recently, Binance, one of the world’s leading crypto exchanges, witnessed an unusual pattern of withdrawals. Particularly, 4.7 million LINK tokens, equivalent to roughly $31.58 million, were suddenly withdrawn over a brief period by 81 newly minted wallets.

The event is noteworthy due to the large number of tokens moved and the swift, simultaneous action across newly created accounts. This pattern of withdrawals raises questions about the strategies and intentions behind these movements and what they could spell for the token, LINK.

A Timeline Of The Puzzling LINK Withdrawals

On September 18, 2023, Lookonchain, an on-chain analytics platform, identified a bizarre spree of LINK withdrawals. Initially, the observation was limited to approximately 35 new wallets on Binance that had extracted 755,687 LINK, valued at roughly $5.08 million.

However, in just a day, the number of LINK tokens and the participating wallets increased, culminating in 81 wallets drawing out 4.7 million tokens.

It is worth noting that for those who follow the pulse of the cryptocurrency market, such huge withdrawals, especially from new wallets, don’t go unnoticed and could hint at the beginning of a bullish trend.

There are a total of 81 fresh wallets created on Sept 15 started withdrawing $LINK from #Binance on Sept 18.

And these wallets have withdrawn a total of 4.7M $LINK ($31.58M) from #Binance so far.

Details: https://t.co/hSdkoncNgZhttps://t.co/AzUM8VleQQ pic.twitter.com/4IxdSHtv6C

— Lookonchain (@lookonchain) September 22, 2023

The details were further elaborated in a Google document shared by Lookonchain, which itemized every transaction, breaking down the amount of tokens withdrawn and their equivalent value in US dollars.

Among these transactions, the most substantial withdrawal saw a single wallet moving 280,567.67 LINK, translating to $1.88 million—moreover, four of these accounts extracted over 200,000 tokens over the monitored period. The list also highlighted that all the wallets had withdrawn only 5,000 LINK tokens.

Decoding The Implications For Chainlink

Given the sequence of events, Lookonchain hypothesized that there might be an ongoing whale accumulation. To Clarify, ‘whale accumulation’ refers to large-volume holders or “whales” acquiring a significant amount of cryptocurrency, typically indicative of their bullish sentiment.

However, it’s essential to approach such hypotheses with a balanced perspective. While the intent behind these transactions remains elusive, the broader implications for Chainlink and its native token, LINK cannot be ignored.

Such movements could influence market sentiment, either buoying confidence among potential investors or creating cautionary tales for the more risk-averse. But as with all crypto dynamics, one event seldom dictates the long-term trajectory.

Meanwhile, LINK currently trades for $6.74 at the time of writing. The asset has been up by nearly 10% in the past week and currently has a market cap of $3.7 billion and a 24-hour trading volume of $146.8 million.

Featured image from iStock, Chart from TradingView

Binance and CEO Chanpgeng Zhao asks court to dismiss SEC suit

Binance Holdings and its CEO Changpeng Zhao have filed a petition seeking to have the lawsuit made against them by the US Securities and Exchange Commission (SEC) dismissed.

Ethereum Whales Unfazed By Prices, Pulls $8.1 Million Of ETH From Binance And Buys NFTs

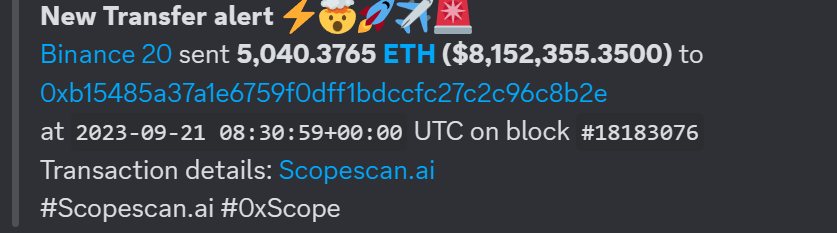

Ethereum is under pressure and has just dropped below $1,600. However, on-chain data shows that a crypto whale, “0xb154”, has moved more coins from Binance, a cryptocurrency exchange, to a non-custodial wallet.

On September 21, the ETH whale transferred over $8.1 million of the coin.

Whale Moves More Ethereum From Binance, Buying NFTs

When crypto prices contract, outflows from non-custodial wallets to centralized ramps, including Binance and Coinbase, tend to rise. This is because centralized exchanges supporting stablecoins or fiat, including the Euro or JPY, offer an interface where they can easily swap for the “safety” of the less volatile fiat currencies or tokens designed to mirror them, including USDT.

That the holder is shifting tokens away from Binance regardless of the heightened volatility can signal confidence for ETH and the broader Ethereum ecosystem. It is not immediately clear what could have motivated the whale to move coins away from the exchange at this point.

However, what’s evident is that ETH is down roughly 4% from September 21’s peak and moving further away from April 2023 highs when it rose to over $2,100.

Records show this is not the first time the whale moved funds. On September 6, the investor withdrew 9,688 ETH worth $15.8 million from Binance. Less than two weeks earlier, the whale notably transferred 22,340 ETH, worth $41.2 million, to Binance.

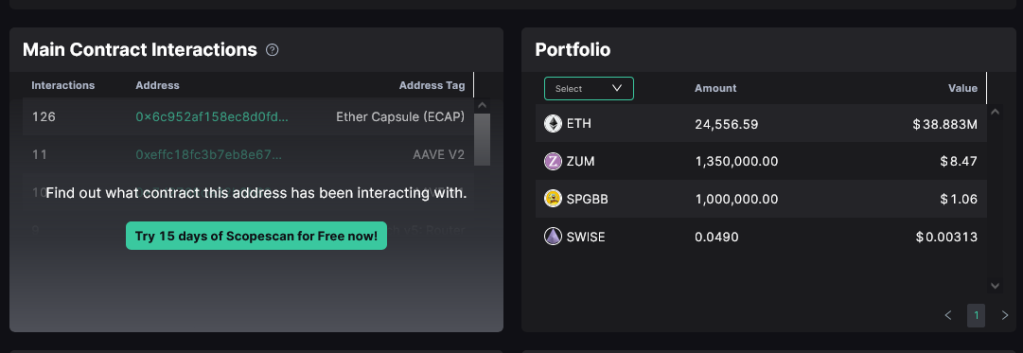

A closer examination of the same address shows it has 24,556.59 ETH worth over $38.8 million at spot rates. Besides ETH, the address controls dust amounts of other periphery altcoins, including ZUM and SWISE.

Apart from simply HODLing ETH, the whale has also been active on the non-fungible token (NFT) scene, looking at historical purchases. Over time, the investor has held over 100 NFTs where, on average, spent 0.2641 ETH; the latest purchase was on September 21.

The investor has been actively accumulating NFTs since early April 2023 and has spent over 35 ETH.

ETH And NFTs Are Fragile

The whale has accumulated more ETH and NFTs when the crypto market is fragile. To illustrate, NFT trading volume is over 90% down from 2021 peaks.

Presently, ETH prices are down 25% from April 2023 peaks. When writing, bears have successfully forced the coin below June 2023 lows as the coin moves further away from the psychological $2,000 level. Candlestick arrangement points to weakness, suggesting that ETH could dump even lower to $1,400—or March 2023 lows, if sellers press on.

Binance, U.S. Affiliate, Changpeng ‘CZ’ Zhao File to Dismiss SEC Lawsuit

Binance, Binance.US and Changpeng Zhao filed to dismiss a Securities and Exchange Commission (SEC) lawsuit Thursday, claiming the regulator hadn’t “plausibly alleged” various securities-related violations.

This Binance Wallet Triggered A Temporary 30X Surge In Ethereum Gas Fees

A cryptocurrency wallet associated with the prominent trading platform, Binance, has seen massive activity in the last 24 hours, leading to abnormally high transaction fees on the Ethereum network.

Binance Wallet Incurs Nearly $850,000 Gas Fees In One Day

A crypto wallet labeled “Binance 14” witnessed a significant transaction surge on September 21, rising above 140,000. As a result of this activity surge, transactions of the Binance-owned wallet consistently incurred gas fees of over 300 gwei, even though the network’s average fee was around 10 gwei.

This gas fee jump and significant wallet activity have resulted in around 530 ETH (equivalent to nearly $850,000) in gas used on the Binance 14 address today.

The increase in transactions on the Binance wallet had a broader, albeit temporary, impact on the Ethereum network. Gas fees on the blockchain momentarily jumped from less than 10 gwei to above 330 gwei per transaction, according to blockchain data tracker Etherscan.

Gas fees refer to the cost blockchain users incur or pay validators to conduct transactions or execute contracts on the Ethereum network. Fees depend on the blockchain’s demand and supply of processing power. This means when a network has many transactions, there is often a high demand for processing power, which increases gas fees.

Possible Reasons For The Gas Fee Spike

In the wake of this incident, Wu Blockchain reported that Binance said it was carrying out its wallet aggregation process when the gas fees were low to facilitate withdrawals and ensure the safety of user funds. Nonetheless, some prominent crypto community members have weighed in on the situation, offering possible explanations for the gas fee spike.

Martin Koppelmann, cofounder of the Gnosis chain, said on the X (formerly Twitter) platform that Binance might be using a “really inefficient script” to consolidate, leading to high transaction costs.

Gas prizes spiking because of a ton of regular ETH transfers related to Binance.a) they are using a really inefficient script to consolidate funds and are massively overpaying transaction costsb) something fishy is going on

— Martin Köppelmann

(@koeppelmann) September 21, 2023

Blockchain analysts at Scopescan gave a similar prognosis on the gas incident. The on-chain analytics platform said:

Due to Binance consolidating funds from long-inactive deposit addresses, the Ethereum network is experiencing congestion, causing Gas fees to surge to 300 gwei.

Adam Cochran, a popular crypto investor, suggested that the abnormally high transaction fees might have been due to Binance’s subpar APIs. In his X post, Cochran criticized the exchange’s technological infrastructure while casting doubts on its capacity to safe-keep “hundreds of billions in coins across multiple protocols.”

According to CoinGecko data, the price of Ethereum currently sits below $1,600, reflecting a 2.8% decline in the past 24 hours. Nevertheless, Ether maintains its position as the second-largest cryptocurrency, with a market capitalization of over $190 billion.

Binance & Deribit Traders Aggressively Short Bitcoin, Squeeze Incoming?

Data shows Bitcoin shorts have been piling up on cryptocurrency exchanges Binance and Deribit during the past few days.

Bitcoin Funding Rates On Binance & Deribit Are Deep Red Right Now

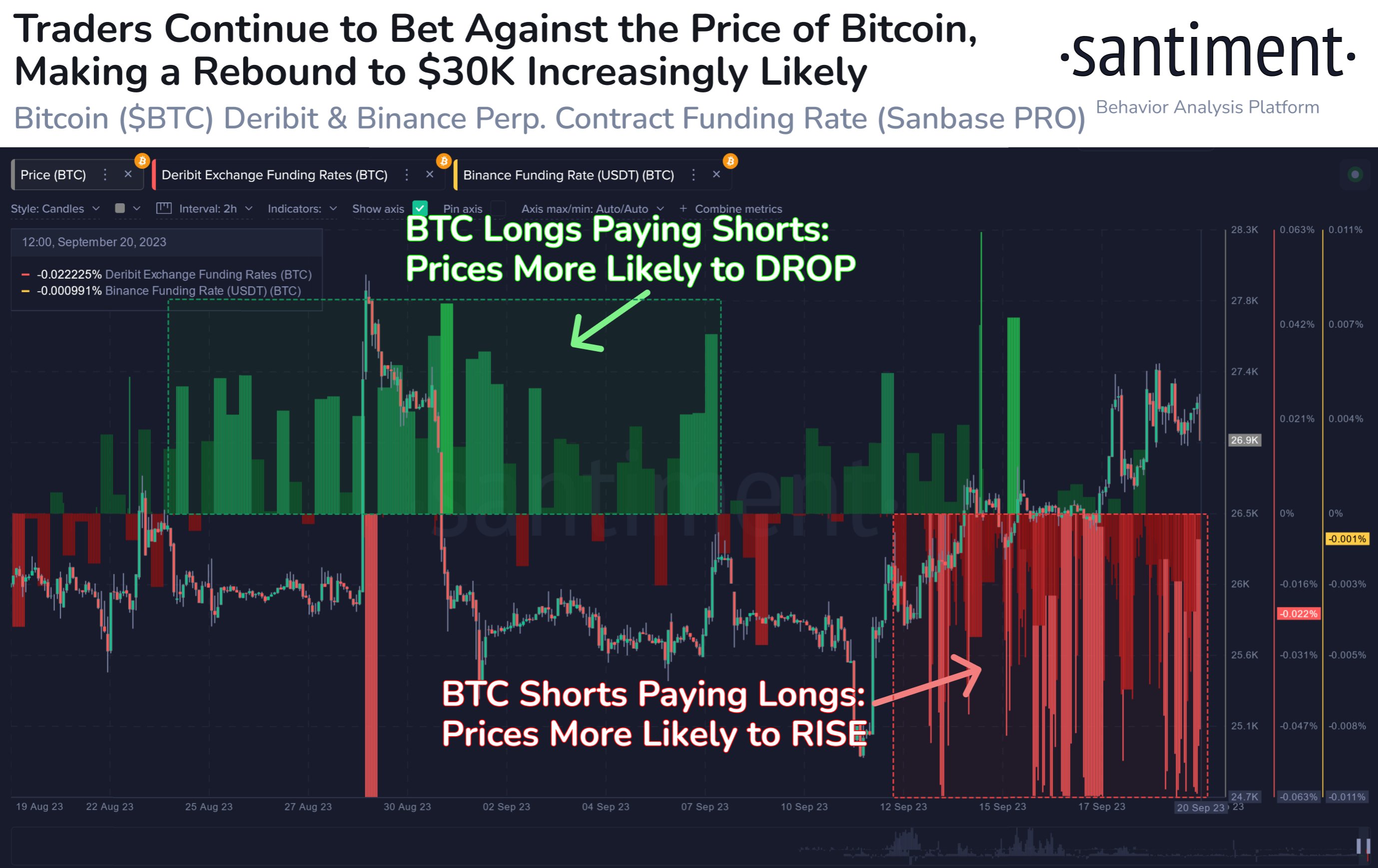

According to data from the analytics firm Santiment, traders on the derivative market have continued to bet against the cryptocurrency recently. The relevant indicator here is the “funding rate,” which keeps track of the periodic fee that derivative contract holders on an exchange are paying each other right now.

When this metric has a positive value, it means that the long traders are paying a premium to the short traders in order to hold onto their positions. Such a trend suggests that the majority sentiment on the given exchange is bullish currently.

On the other hand, the metric being under the zero mark implies the traders on the platform hold a bearish mentality at the moment, as the shorts are the dominant force.

Now, here is a chart that shows the trend in the Bitcoin funding rates for Binance and Deribit over the past month:

As displayed in the above graph, the Bitcoin funding rate for both of these exchanges had been mostly positive during the last third of August and the starting third of this month, implying that the majority of the traders had been longs.

The bets of these holders had failed, however, as the price had seen an overall downtrend in this period. Since the rebound earlier this month, though, the sentiment has flipped in the market as shorts have piled up on both of these platforms.

These short traders haven’t been successful so far, either, as the value of the cryptocurrency has seen net growth since they have appeared. Historically, the market has actually been more likely to go against the expectation of the majority, so this pattern may be in line with that.

The reason why the asset would move against the bets of these contract holders is that mass liquidation events, called squeezes, become more likely to happen the more lopsided the sector is.

A large amount of long liquidations can amplify crashes, while short liquidations can provide the fuel for upward surges. Since Bitcoin is still seeing aggressive shorting, it may be a positive sign for the cryptocurrency’s current price rise, as a potential short squeeze could help it extend further.

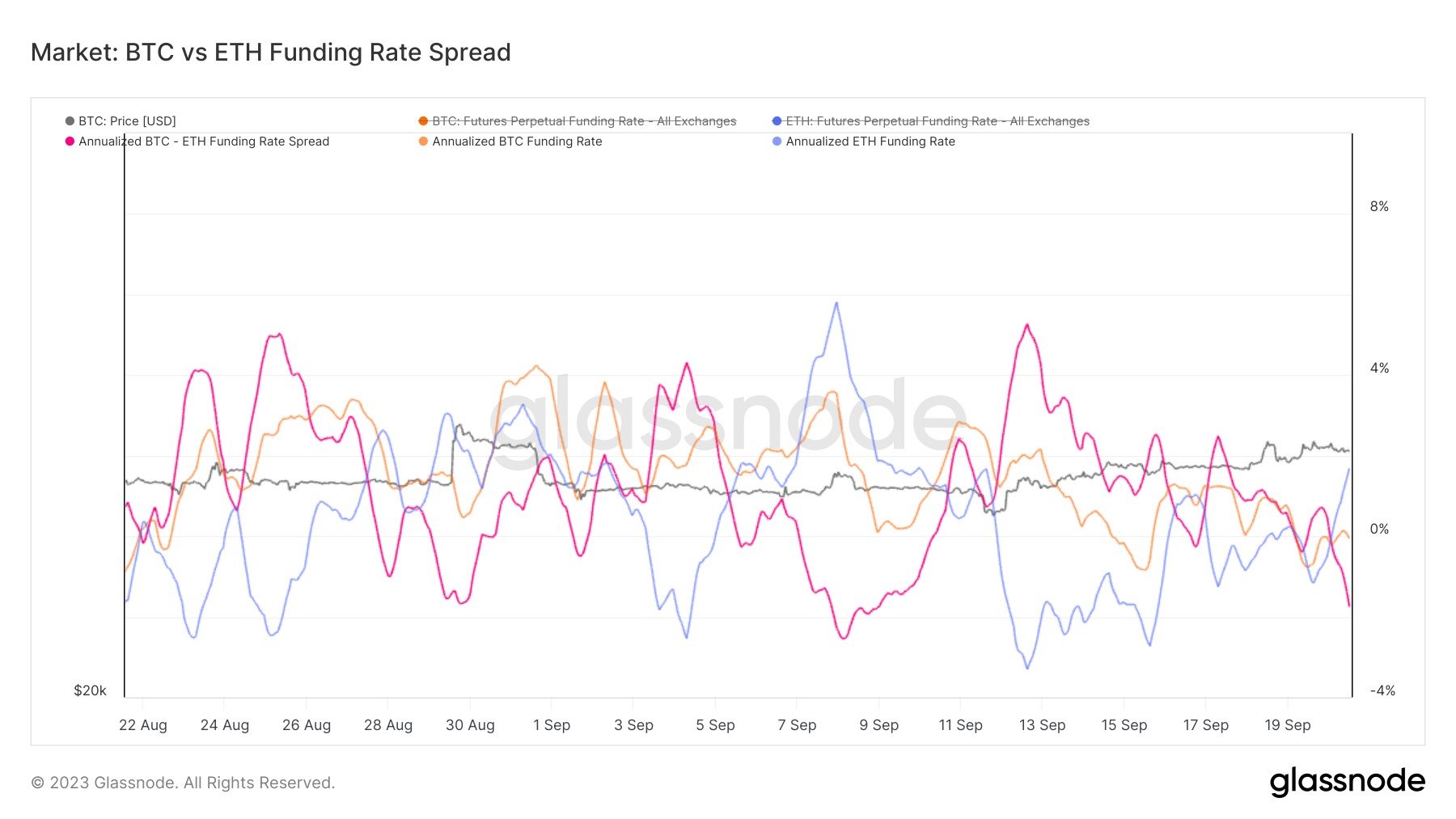

Interestingly, while Bitcoin is being bet against right now, Ethereum’s funding rates are positive, as pointed out by analyst James V. Straten in a post on X.

From the graph, it’s visible that the funding rates of the top two assets in the sector have gone opposite ways recently. This means that while BTC may be able to build an uptrend off the shorts, ETH could face the opposite effect if the longs end up being liquidated.

BTC Price

Bitcoin has seen a drawdown of about 1.5% today as the asset’s price has now dropped towards the $26,700 level.

Binance plans to delist stablecoins in Europe citing MiCA compliance

A Binance executive said the cryptocurrency exchange plans to delist stablecoin in the European market by June 2024 in order to comply with standards laid out by MiCA.

Binance plans to delist stablecoins in Europe citing MiCA compliance

A Binance executive said the cryptocurrency exchange plans to delist stablecoin in the European market by June 2024 in order to comply with standards laid out by MiCA.

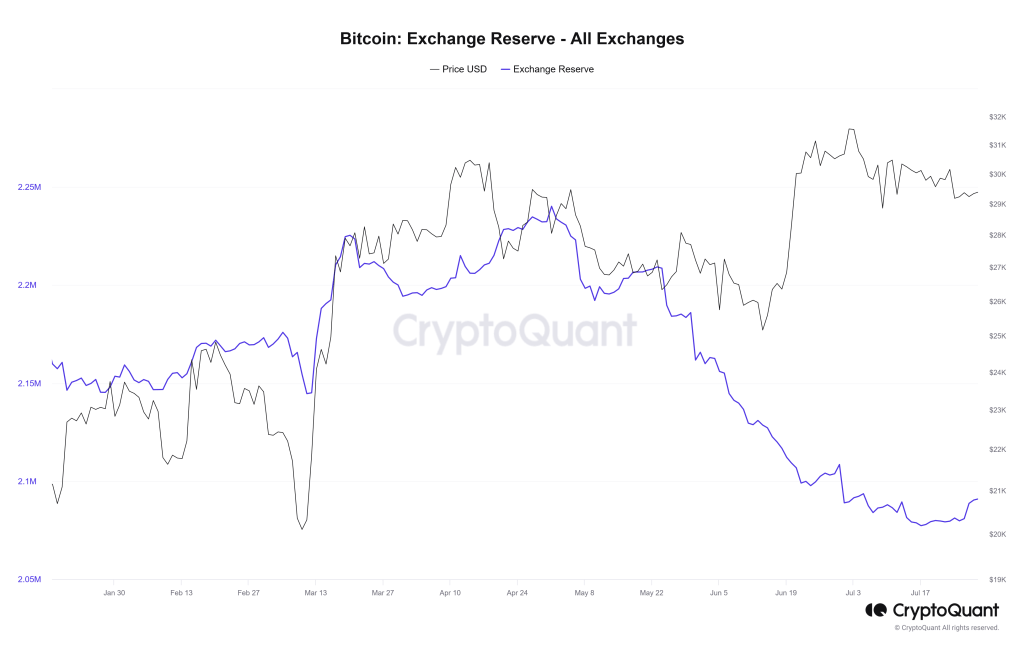

Bitcoin Reserves On Exchanges Approaching A 6-Year Low, Good For Price?

Bitcoin (BTC) held by leading crypto exchanges like Coinbase, Binance, and Kraken are near a six-year low, CryptoQuant data on September 20 reveals.

The contraction was recorded when the broader market steadied after posting sharp losses in the better part of August and the first half of September. As of September 20, BTC prices are still below $30,000, but with important sideways movement over the past few weeks.

Bitcoin Reserves On Exchanges Falling

According to trackers, exchanges control 2.09 million BTC when writing. In total, the Bitcoin network will issue 21 million coins.

However, as of 2023, over 19.7 million are in circulation, and public firms such as Tesla—the electric car automaker—and MicroStrategy—the business intelligence firm—have been loading up. Generally, entities can hold cryptocurrencies in non-custodial wallets or exchanges like Binance or Coinbase.

Exchanges offer custodial wallets where users can store their coins to trade or even HODL. Users who hold their coins on exchanges can easily swap them for USDT or other altcoins. As mentioned, the number of coins held in exchanges continues to contract—which, while on the surface can be bullish, doesn’t necessarily mean prices will recover.

Typically, coin outflows from exchanges can signal a firming market and expectation of price expansion. However, considering the current regulatory environment, traders and Bitcoin holders might prefer taking control of their coins as fear sets in.

Accordingly, more holders secure their coins in their non-custodial wallets as a protective measure, possibly explaining the dropping Bitcoin exchange reserves.

SEC, Regulators Tough On Exchanges

The number of Bitcoin held in exchanges has been falling throughout 2022 but appeared to have dropped faster in late 2022. Around that time, FTX, a popular crypto exchange, collapsed, locking billions worth of clients’ funds.

Outflow slowed down in Q1 2023 following the collapse of some regional banks in the United States but has since continued falling. The dip can be attributed to the bear market but primarily because the United States Securities and Exchange Commission (SEC) is cracking the whip on Binance and Coinbase, accusing them of non-compliance.

In June, Binance and Coinbase were sued by the SEC. The regulator claimed that the two exchanges were issuing unregistered securities, citing some, like Cardano (ADA), as examples.

Amid this crackdown, Binance US became a focal point. Since then, there have been major staff resignations, layoffs, and disruption of operations. Trading volume in Binance US is now down by over 95%.

Bitcoin price eyes $28K as Binance legal battle spurs bullish momentum

Discover how margin and option metrics hint at Bitcoin’s path to $28,000 amid the Binance legal battle.

U.S. SEC’s Crypto Enforcement Chief Warns More Charges Coming to Exchanges, DeFi

The U.S. Securities and Exchange Commission (SEC) isn’t done chasing down crypto exchanges and decentralized finance (DeFi) projects it sees as violating securities laws in the same vein as Coinbase Inc. (COIN) and Binance, said David Hirsch, head of the agency’s Crypto Assets and Cyber Unit.

Interest rate hikes may pause very soon — Here’s why

This week, The Market Report discusses Bitcoin’s recent price action and the upcoming FOMC meeting, where some speculate interest rates might be paused.

CZ post on X about Ceffu and Binance.US contradicts SEC claims, adds to confusion

“It is more than likely that BAM still doesn’t understand what Ceffu is,” the SEC stated after trying to untangle the web of relationships between entities.

Binance’s Bitcoin Trading Volume Plunges 57% as Regulatory Pressure Mounts

As legal challenges against Binance mount, the average spot BTC trading volume on the platform has decreased 57% since Sep. 1