The two Binance executives held in Nigeria after being invited for consultations filed suit against two government agencies for allegedly violating their human rights.

Crypto Analyst Predicts Top 8 Altcoins With 50x Potential Not Yet On Binance

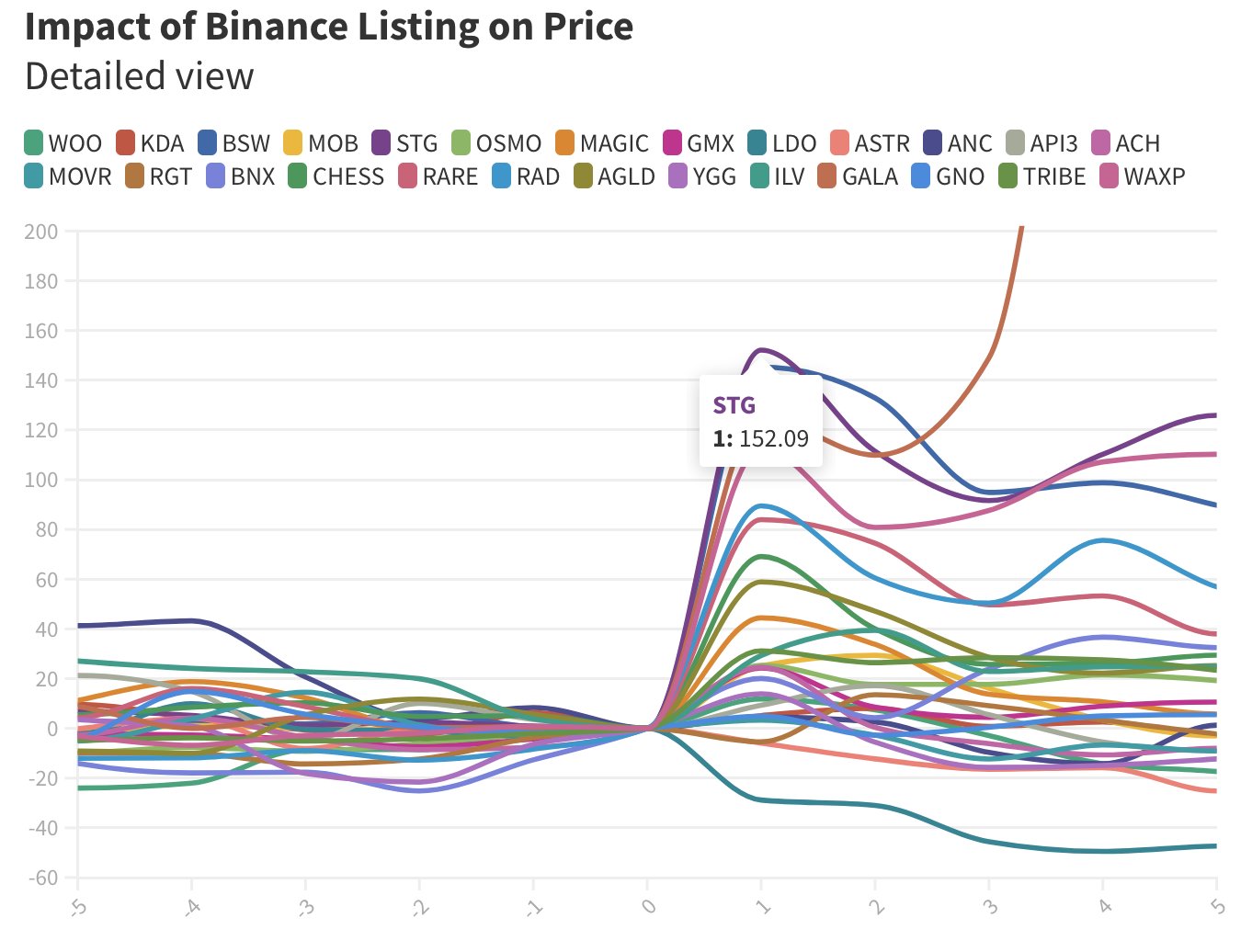

Popular crypto analyst Xremlin, known on social platforms as @0x_gremlin, told his 104,000 followers that the altcoin season in 2024 could eclipse the monumental gains seen in 2021. Reflecting on the historical significance of major exchange listings, Xremlin emphasized, “Altseason 2024 > Altseason 2021. Your bags are headed to Valhalla.”

During the 2021 altseason, altcoins such as Polygon (MATIC) and Solana (SOL) saw a staggering 300x increase, largely attributed to listings on Tier-1 centralized exchanges (CEXs) like Binance and Coinbase, according to him. “MATIC and SOL’s 300x was fueled by Tier-1 CEX listings. Binance/Coinbase listings = Billions in retail liquidity,” the crypto analyst remarked.

The core of Xremlin’s analysis hinges on the demonstrable impact that listings on premier exchanges such as Binance and Coinbase have on the valuation of cryptocurrencies. According to the analyst, “These 8 altcoins [are] likely to be tradable there next → Pump by 10-50x,” highlighting the potential for immediate and substantial price increases.

Listings often trigger price surges ranging from 3 to 10 times the pre-listing value, primarily due to the vast user bases of these platforms engaging with the newly available tokens. Xremlin further elucidated the critical role of liquidity for the long-term success of a cryptocurrency project, stating, “In the long run, having access to billions in liquidity is crucial for a project’s success.”

This perspective underlines the strategic advantage gained from being listed on Tier 1 centralized exchanges (CEXs). Xremlin has identified eight altcoins that not only show promise of being listed on such exchanges but also possess the potential for dramatic value appreciation. Here’s a detailed look at the altcoins spotlighted by Xremlin:

Top 8 Altcoins Not Listed On Tier-1 Crypto Exchanges

NGL (ENTANGLE): Operating as an omnichain infrastructure, Entanglefi aims to revolutionize data provision to smart contracts across any blockchain. With a current market cap of $232 million and trading at $1.96, its position as a Layer 1 (L1) protocol underscores its foundational potential in the blockchain ecosystem.

ALPH (ALEPHIUM): Priced at $2.75 with a market cap of $203 million, Alephium stands out as a Layer 1 blockchain solution tackling the critical issues of accessibility, scalability, and security faced by decentralized applications (dApps), according to the crypto analyst.

NORMIE: As a memecoin designed for mainstream appeal, Normie carries a market valuation of $120 million, with its price at $0.1237. Notably, Normie is based on Coinase’s Base protocol, which is speculated to be ready to replicate the success of the Solana memcoin craze.

CPOOL (CLEARPOOL): Clearpool distinguishes itself as a decentralized credit marketplace in the real-world-asset (RWA) sector focused on providing single borrower liquidity pools for institutional borrowers. It is currently valued at $140 million, with its tokens trading at $0.30.

BALLZ (WOLFWIFBALLZ): Inspired by a daring wolf, this memecoin is trading at $0.045 with a market cap of $45 million. BALLZ is trying to ride the wave of success of Solana memcoins, especially Dogwifhat (WIF).

IXS (IX SWAP): Ix Swap offers a secure platform for the trading of real-world assets and security tokens, supported by licensed custodians and broker-dealers. With a market cap of $140 million and a current price of $0.8425.

DEGEN: Another meme-centric token, Degen also operates on the Base chain and is currently priced at $0.01696, boasting a market cap of $211 million. Its appeal lies in the vibrant culture of crypto enthusiasts who identify with the “degen” lifestyle.

NMT (NETMIND): Netmind leverages blockchain technology to decentralize computing power for AI models globally. With a price of $6.96 and a market cap of $240 million, it aims to embody the cutting-edge intersection of artificial intelligence and blockchain.

At press time, @0x_gremlin’s top pick NGL traded at $1.87.

What Binance’s Exit From Nigeria Means for P2P Bitcoin

The exchange was forced to leave Nigeria, and I’m sure it will happen to other crypto companies in other countries, Ray Youssef, CEO of NoOnes, writes.

Binance Is Having an Odd Time

Binance is having a weird moment, perhaps most clearly illustrated by the fact that a national government detained two of its executives for a month now – and one is only free because he seemingly escaped custody.

Is Nigeria Strong-Arming Binance?

Two mid-levels executives were detained without charge for more than a month, one escaped. Here’s what we know so far about Nigeria’s legal battle with Binance.

Binance Blocked by Philippines Securities Watchdog

The Philippines Securities and Exchange Commission warned in November that the company was operating in the country without the necessary licenses.

Nigeria Charges Binance, Detained Executives With Tax Evasion: Reports

One of two senior Binance executives in government custody has escaped, local media reported over the weekend.

Bitcoin Brief Bounce Back Above $67,000: Triggers Nearly $300 Million In Total Liquidations

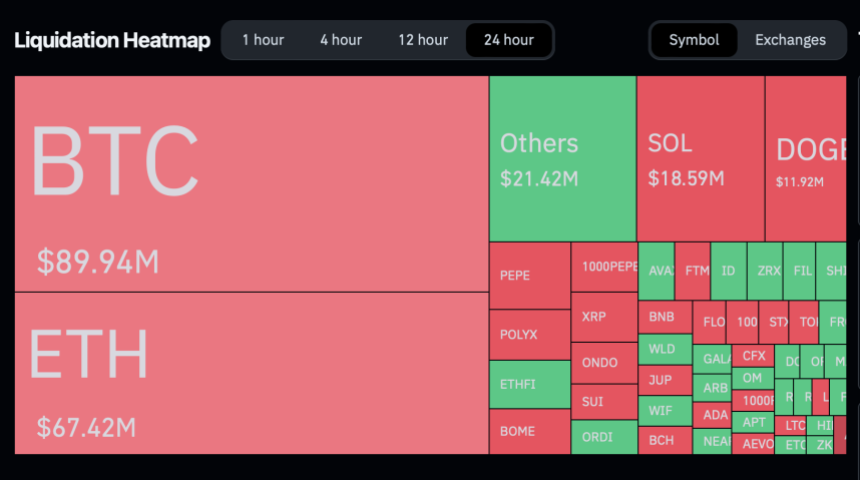

The crypto market has recently experienced a wave of liquidations, amounting to nearly $300 million, closely following Bitcoin’s sharp reclaim of the $67,000 mark.

This surge in Bitcoin’s value, a stark reversal from its previous downtrend, caught many traders off guard, especially those who had placed bets on the continuation of the market’s decline.

Over 80,000 Traders Faces Liquidation

The data provided by Coinglass sheds light on the magnitude of the liquidations, revealing that approximately 86,047 traders suffered losses exceeding $250 million within a mere 24-hour period.

Major exchanges like Binance, OKX, Bybit, and Huobi were the arenas for these significant financial setbacks, with Binance traders bearing the brunt of the liquidations.

Particularly, Binance recorded $128.7 million in liquidations, while other major platforms such as OKX, Bybit, and Huobi also experienced significant liquidations, amounting to $99.87 million, $33.18 million, and $17.70 million, respectively. Meanwhile, despite also facing liquidations, the smaller exchanges had a comparatively minor impact.

Most affected positions were short trades, reflecting a widespread anticipation of a market downturn that did not materialize as expected. Short positions recorded an estimated 57.55% of the liquidations, equivalent to $164.10 million, from traders betting against the market.

On the flip side, long position holders also faced their share of losses, contributing to nearly 40% of the total liquidations, amounting to $121.07 million.

Bitcoin Recovery And Future Prospects

The sharp recovery of Bitcoin, momentarily reclaiming highs above $67,000, has reignited interest in its market behavior and future trajectory.

Despite a 6.6% dip in its market capitalization over the past week, Bitcoin’s value saw a notable 6% increase in the last 24 hours, with its market cap presently sitting above $140 billion. This resurgence in trading activity, with daily volumes climbing from below $60 billion to heights above this mark, signifies renewed investor confidence and heightened trading interest.

Adding to the discourse, cryptocurrency analyst Willy Woo presents an optimistic outlook for Bitcoin, suggesting the possibility of a “double pump” cycle reminiscent of the market patterns observed in 2013.

According to Woo, this pattern could herald two significant price surges for Bitcoin in the coming years, with the first peak anticipated by mid-2024 and a subsequent, more substantial rise in 2025.

While such dual surge scenarios are rare, Woo’s analysis, based on current market conditions and Bitcoin’s growth potential, offers a glimpse into the future of the world’s leading cryptocurrency.

At the rate the #Bitcoin Macro Index is pumping, I wouldn’t be surprised if we get a top by mid-2024, which would hint at a double pump cycle like 2013… a second top in 2025. pic.twitter.com/i2a0V5ytPv

— Willy Woo (@woonomic) March 19, 2024

Featured image from Unsplash, Chart from TradingView

Solana Whale Makes Massive 1,000,000 SOL Deposit To Binance, Bearish Sign?

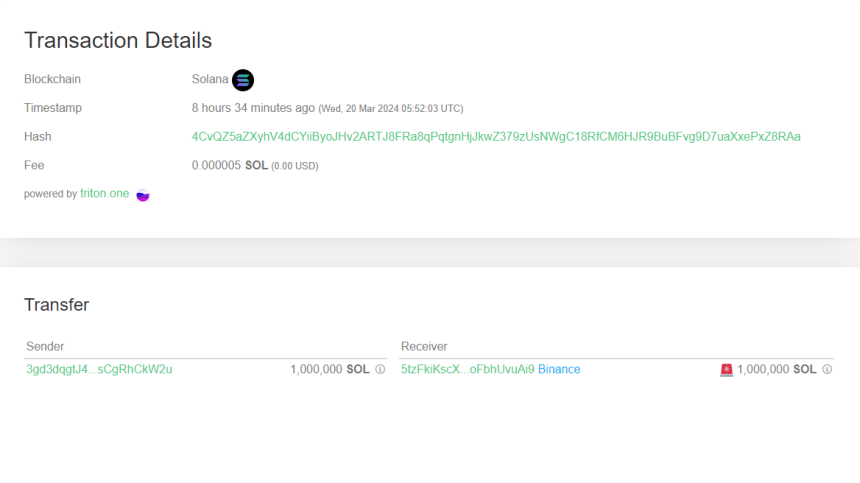

On-chain data shows a Solana whale has just moved a massive SOL stack to Binance, which could prove to be bearish for the asset’s price.

Solana Whale Has Deposited 1 Million SOL To Binance Today

According to data from the cryptocurrency transaction tracker service Whale Alert, several large SOL transactions have occurred on the blockchain during the past day.

More specifically, six massive transfers have been spotted on the network. Out of these, two transactions were gigantic, with tokens worth $362 million and $498 million involved.

These extraordinary transfers, though, were both between unknown wallets. Addresses like these are those unattached to any known centralized exchange, so they are usually the users’ personal, self-custodial wallets.

Due to this, transfers between unknown wallets are generally hard to say anything about. Often, they can be as simple as the investor moving to a fresh wallet, which is naturally of no particular consequence for the wider market.

The other four whale transactions from the past day, however, did involve central entities on one end, so speculation around them can have a bit more ground to stand on.

Out of these four, one transaction in particular stands out. In this move, a whale shifted 1 million SOL on the network, worth more than $166 million at the transfer time. Below are some additional details regarding this transfer.

As is visible, the receiver in the case of this transaction was a wallet affiliated with the cryptocurrency exchange Binance, implying that the whale transferred coins from their address to the platform.

Such transactions are known as exchange inflows. Users make these transfers when they want to use one of the exchange services, which can include selling.

As such, exchange inflows may sometimes be bearish for the cryptocurrency. In particular, massive inflows made by the whales can exert some visible fluctuations on the market.

Just like this huge SOL transfer, the other three transactions mentioned before were also exchange inflows. They were significantly smaller in scale, though, with their average value being $33.2 million.

Two of these transactions also went to Binance, while the third (and the latest) headed to Coinbase. Interestingly, the address pairs in these two Binance transfers were the same, hinting that the same whale may have been responsible for them.

With the four exchange inflows, Solana, worth $265.6 million, has now found its way to exchanges. This is clearly a notable amount, so it may impact the asset’s price.

There is no guarantee, however, that any of the whales involved made these transactions for selling; it’s possible that they made the moves for some other purpose that’s not directly relevant to the market.

Although Solana has been sliding off over the past few days, the possibility of these whales deciding to exit certainly exists.

SOL Price

Following the recent drawdown Solana has seen, the asset’s price has come down to the $174 level.

The Institutional Era of Crypto Brings Fresh Innovation

After the scandals and regulatory headaches of the last market cycle, crypto is growing and embracing the needs of institutions entering the digital assets space.

Binance Asks Prime Brokers to Enhance KYC to Block U.S. Nationals: Bloomberg

The presence of U.S. nationals on the platform has been a contentious issue for authorities as, officially, they are banned but continue to pop up.

Nigerian Court Orders Binance to Relinquish Data of All Nigerians Trading on its Platform: Report

A Nigerian court has ordered Binance to provide Nigeria’s Economic and Financial Crimes Commission (EFCC) with comprehensive information on all persons from the nation trading on its platform.

Binance CEO Richard Teng Sees Bitcoin Crossing $80K by Year End

Binance’s fairly new boss Richard Teng has said Bitcoin (BTC) will exceed his previous expectations of hitting the $80,000 mark by the end of this year, according to Bloomberg.

Nigeria’s SEC Proposes 400% Increase to Crypto Firm Registration Fees

The regulator proposed increases to all supervision fees as the country cracks down on the crypto industry.

Binance Spun Off Venture Capital Arm Earlier This Year: Bloomberg

Binance Labs now has a disclaimer on its website describing it as “an independent venture and not part of the Binance Group.”

Solana Chasing BNB Chain, Race To 5% Market Dominance Heats Up

The dominance war is on. CoinMarketCap data shows that Solana and BNB Chain, two popular smart contracts platforms after Ethereum, are emerging as strong contenders.

In a post on X, one crypto analyst notes that SOL and BNB, the native currencies of Solana and BNB Chain, respectively, have been growing, subsequently expanding the market caps of their respective platforms. However, even with this price uptick, it has yet to attain the 5% level, a target for proponents of the two platforms.

Will Solana Flip BNB To Fourth?

When the analyst shared the screenshot on March 14, BNB Chain, powered by Binance Coin (BNB), held a slight lead with a 3.34% dominance, while Solana trailed behind at 2.72%.

However, Solana has been on a tear. Not only is the coin outperforming Bitcoin and Ethereum, but it has been expanding rapidly, faster than BNB in the past few trading weeks. When writing, CoinMarketCap data shows that SOL is trading above $170, a multi-month high.

Moreover, it is up 11% on the last trading day and 20% in the previous trading week. At this valuation, SOL’s market cap is up 12% to over $75 billion, cementing its position at fifth, trailing BNB.

On the other hand, BNB remains at fourth, behind USDT–the most liquid stablecoin whose market cap stands at over $103 billion. BNB is up 2% the previous day but double digits in the past week of trading. Overall, the lack of inactivity, especially on the last trading day, means its total market cap, at over $90 billion, is stable, only adding 2% on the last day.

When comparing the performances of Solana and BNB, the former has the upper hand. For example, from September 2023, SOL gained over 200% versus BNB. BNB pared losses from January, but the revival in Solana, considering the success of meme coins, means SOL might extend gains in the future.

Solana Rally On FTX’s Bankruptcy Case Proceedings, BNB Shakes Off Regulatory Woes

As the competition intensifies, the future remains uncertain. It’s unclear whether SOL will overtake BNB to claim the second most dominant smart contract spot after Ethereum.

However, at the time of writing, what’s certain is that the spike in on-chain activity on Solana and the unfolding events around the FTX bankruptcy case could bolster SOL prices. Therefore, it’s highly probable that Solana’s dominance might catch up with BNB as the race to the 5% level intensifies.

In November 2023, Binance settled with United States regulators, including the Securities and Exchange Commission (SEC), agreeing to pay a $4.3 billion fine. As part of the deal, their co-founder, Changpeng Zhao, also had to resign as CEO. While BNB prices initially plunged, the token recovered steadily from the $300 level.

BNB Price Soars As Binance Smart Chain Implements “BEP 336” Upgrade, Inspired By Ethereum’s Dencun

Binance Smart Chain (BSC), commonly known as BNB Chain, has announced the “BEP 336 upgrade”, inspired by Ethereum’s Dencun upgrade (EIP 4844), which aims to optimize data storage and processing on the blockchain.

The upgrade is expected to significantly reduce transaction costs, improve network performance, and drive the price of Binance Coin (BNB) towards its previous all-time high (ATH) of $686, reached in May 2021.

BNB Smart Chain Cost-Effective Data Solution

According to the protocol’s announcement, BEP 336 introduces an innovative concept called “Blob-Carrying Transactions” (BlobTx) that will change how large data blocks are handled.

These temporary and cost-effective memory segments, known as blobs, can capture data blocks as large as 128 KB. By streamlining the transaction verification process, the network only needs to verify that the attached blob contains the correct data rather than verifying each transaction within a block.

The introduction of blob transactions within the BSC, which is particularly beneficial for opBNB – the layer 2 network of the BNB ecosystem – offers several advantages. Blobs reduce network space consumption, resulting in lower storage costs and more affordable gas fees for users, similar to Etherem’s Dencun upgrade. This storage strategy allows for efficient data handling while managing blockchain bloat, ensuring data integrity and availability throughout its lifetime on the chain.

BEP 336 also includes two additional components. The Blob Market establishes a fee market for blobs, ensuring regulated storage and transmission costs based on network demand. The Precompile Contract adds a layer of security by verifying that the data in a blob matches the reference in the blob-bearing transaction.

While BEP 336 draws inspiration from Ethereum’s EIP 4844, it is tailored to meet BSC’s unique requirements. Notably, BSC’s design mandates that blobs be managed exclusively by the BSC client, distinguishing it from Ethereum’s approach. Moreover, BSC implements a dynamic gas pricing mechanism for blobs, ensuring reasonable transaction costs with minimum and maximum thresholds.

BEP 336 Integration With Phased Roadmap

BSC has outlined a phased roadmap for the integration of BEP 336. Beginning with the Testnet launch in April, developers can test and interact with the upgrade in a “controlled environment” to address potential issues.

The subsequent Magnet phase in May will focus on further testing and optimization to ensure the “robustness” and “scalability” of BEP 336. Finally, in June, the mainnet hard fork will mark the official deployment of BEP 336 on the BSC mainnet, ushering in a new era of efficiency and cost-effectiveness for the network.

According to the announcement, the benefits of BEP 336 are expected to impact developers and users within the BSC ecosystem significantly. Gas fees will be reduced considerably as certain data types no longer require permanent storage, making transactions more affordable.

The temporary storage mechanism will keep the blockchain lean and bloat-free, enhancing overall network performance. With lower costs and improved efficiency, BEP 336 aims to make the BSC ecosystem more accessible to a wider audience, including developers and newcomers to blockchain technology.

The announcement has boosted Binance Coin’s (BNB) price by over 8%, resulting in a current trading price of $588, just 15% below its all-time high of $686.

In case of further price gains, the next resistance walls for the BNB price are placed at the $600 level and the $608 mark, which could prevent the token from further price appreciation in its mission to reach its current ATH.

Featured image from Shutterstock, chart from TradingView.com

BNB On The Rise: Analysts Predict Easy Path To New ATH As It Nears $600

Binance Coin (BNB) has been on a bullish run despite the regulatory scrutiny that Binance has faced over the last several months. The token registered an impressive 13.7% price surge after almost reaching $600, and analysts predict that a new all-time high (ATH) might be coming in the next couple of months.

Is The Cost Clear For A New ATH?

As the crypto market rallies, Bitcoin continues to hit ATH after ATH, and altcoins’ prices keep regaining the levels of the previous bullish run. BNB has not been the exception; it surged over 13.7% in the last 24 hours and is near a crucial support level that could propel the token even higher during this cycle.

The price increase could be attributed to market dynamics and BTC’s performance. However, the recent announcement of ether.fi (ETHFI)’s introduction to the Binance Launchpool also seems to fuel the price since it will allow users to farm ETHFI by staking their BNB.

$BNB: This one goes to ATH easily and this was kind of obvious IMO. Expecting some sort of small pullback before all time highs but I think it breaks it soundly in the next few months pic.twitter.com/Ipt66lWKOH

— Altcoin Sherpa (@AltcoinSherpa) March 13, 2024

Crypto analyst Altcoin Sherpa shared his forecast for the token as the price was nearing $600. The analyst considers that, given the current BNB’s performances, the path to the previous ATH level is clear: “This one goes to ATH easily, and this was kind of obvious IMO.”

In the post, the analyst shared a chart that displays BNB’s performance since its ATH of $686.3, which is currently only 13.51% away. The token has registered mostly green candles every week since 2024 and only weekly green candles since February.

In the past month, BNB’s price went from oscillating between the $300-$320 price range to hovering between $520-$590, representing an increase of over 80%.

Despite the sunny forecast, Altcoin Sherpa doesn’t rule out cloudy days. The analyst expects pullbacks along the way but foresees BNB breaking the ATH “soundly” in the next couple of months.

Similarly, pseudonym crypto trader and analyst Captain Faibik highlighted that the token has gained over 120% since his ATH timeline prediction at the end of 2023. In late December, the trader forecasted that BNB would reach a new ATH in the first half of 2024, and the current performance seemingly reaffirms this stance.

BNB Price Performance

Despite the recent legal scrutiny faced by Binance, BNB has been able to sustain its recovery path. According to the crypto hedge fund Split Capital, the token has added more than $50 billion in market capitalization since the exchange settled with the Department of Justice (DOJ) for $4 billion in November.

BNB’s market cap of $91.22 billion represents a 10% increase in the last 24 hours. By this metric, the token is the fourth largest cryptocurrency in the market. Similarly, its trading volume significantly increased by 50% on the last day.

Earlier today, the price reached $599.8, just cents away from hitting the $600 price range, according to CoinMarketCap data. At the time of writing, BNB has been trading at $595.6, a price surge of 38.6% in the last seven days.

Detained Binance Executives to Remain in Nigerian Custody Until Hearing: WSJ

The two men were arrested on Feb. 26 after arriving in Abuja to meet with Nigerian leaders who accused the crypto exchange of crashing the country’s currency, the naira.

Binance-Nigeria Brawl Continues As Country Asks Exchange to Submit List of Top 100 Users

Nigeria wants Binance to give information regarding its top 100 users in the country and all transaction history spanning the past six months, the Financial Times reported on Tuesday.