Bitcoin is set to break its eight-week winning streak, but that has not affected the prospects of ATOM, FIL, EGLD, and ALGO, which look strong on the charts.

Cryptocurrency Financial News

Bitcoin is set to break its eight-week winning streak, but that has not affected the prospects of ATOM, FIL, EGLD, and ALGO, which look strong on the charts.

Chief analyst of Singaporean exchange Bitget, Ryan Lee, has laid out some interesting Bitcoin price predictions for 2024. This forecast comes after BTC’s negative performance in the last week, where the maiden cryptocurrency declined by 4%, falling below the $42,000 price mark.

In an X post on December 17, crypto data platform Brave New Coin shared Ryan Lee’s projections for Bitcoin in the new year, which were presented in three phases.

For the short term, Lee anticipates Bitcoin’s price to fluctuate between $32,000-$50,000 as determined by the outcome of the spot ETF approval saga in the US. Currently, many crypto enthusiasts are highly optimistic about the SEC finally granting a green light to the launch of a spot Bitcoin ETF, following multiple meetings between the regulator and several asset managers involved.

Bitcoin Predictions For 2024 – Bitget Chief Analyst Ryan Lee picks some price ranges for BTC and other winners next year

#Bitcoin2024 pic.twitter.com/LPlhJwgm9w

— Brave New Coin (@bravenewcoin) December 17, 2023

According to Bloomberg analyst James Seyfarrt, there is a 90% chance that this potential approval order will come between January 8th and January 10th, 2024, meaning Bitcoin’s price may be set for a major movement in the coming weeks.

In regards to the mid-term phase, Ryan Lee predicts Bitcoin prices to range between $38,000 – $75,000 based on the effects of the halving event, which is historically known to cause a rise in BTC prices. This is because the halving event causes a reduced rate of new Bitcoin minting, which leads to scarcity, in turn boosting the token’s demand and price.

In the long term, Bitget chief analyst projects Bitcoin to trade between $40,000 and $120,000 in 2024. He believes the major determinant in BTC price at this time would be US policy and regulations guiding the use of cryptocurrency.

At the time of writing, Bitcoin trades at $41,874.33, with a decline of 0.12% in the last hour. Meanwhile, the token’s daily trading volume is down by 16.99% and valued at $14.85 billion.

Alongside Bitcoin, Lee has also given some interesting predictions on the top tokens in the altcoin market for 2024. The Bitget executive expects Ethereum (ETH) could outperform BTC and trade between $3,000 and $3,500. By the end of 2024, Lee predicts ETH could attain a historic price point of $4900.

Meanwhile, the analyst expects XRP to trend in a similar fashion as BTC, hitting a price range of $1-$1.5 in 2024. In addition, Lee also projects that ADA could reach $1.2-$1.8 pending a significant growth of the Cardano ecosystem.

Bitcoin miners are the main beneficiaries of current sky-high transaction fees, data shows, but many longtime market participants have little time for complaints.

Bitwise, a crypto index fund manager, has forecasted a bullish price for Bitcoin that would take it past its current all-time high. Bitcoin is currently in a bullish sentiment, and the price has doubled this year. But according to this fund manager, this sentiment will continue into next year. In a recently released report, Bitwise predicted BTC will hit $80,000 in 2024, identifying two major catalysts that will send the crypto soaring.

In its report, Bitwise laid out 10 things to look out for in the crypto industry in 2024, one of which included the crypto’s price trajectory. The world’s largest crypto has outperformed other asset classes in terms of price performance this year. Data shows Bitcoin is currently up more than 125% this year, and many analysts think this growth isn’t stopping soon. For comparison, the S&P 500 returned 21% this year.

2023 was a great year for crypto. But we see even brighter things ahead. In this must-read report, the Bitwise research team lays out ten bold predictions for 2024. https://t.co/d8Pa4NkzJU

— Bitwise (@BitwiseInvest) December 13, 2023

In its first prediction, Bitwise predicted Bitcoin would trade above $80,000 in 2024, setting a new all-time high. A major catalyst for this growth is the highly anticipated launch of spot Bitcoin ETFs in the US. A spot ETF would allow mainstream investors to gain direct exposure to the coin through traditional investment companies.

Bitcoin has mostly reacted positively to various news surrounding spot ETFs this year. The launch is poised to be the most successful ETF launch, with many analysts estimating that a spot ETF could push Bitcoin over $100,000 in its first year.

The other potential catalyst is the next bitcoin halving, one of the most anticipated events in the crypto industry. The next Bitcoin halving is set for April 2024, reducing mining rewards from its current 6.25 BTC to 3.175 BTC per block. According to Bitwise, at the current price of Bitcoin, the next halving will lead to a $6.2 billion reduction in new Bitcoins entering the market every year until another halving.

The halving, coupled with the anticipated frenzy after spot Bitcoin ETFs are approved, is expected to significantly tip the balance between supply and demand. We could even see the price of Bitcoin surge as the halving approaches, as investors buy in hoping to get ahead of a price rally.

Other predictions in the Bitwise report paint a picture of a prosperous year for the crypto industry in 2024, mainstream acceptance, and increased institutional interest. A particular bullish prediction is the growth of stablecoins, with Bitwise estimating more payments in stablecoins than Visa.

Other predictions include JP Morgan, the world’s largest bank, launching a tokenized fund using blockchain technology, Ethereum’s annual revenue doubling as transactions increase, and crypto becoming the native currency of the internet.

Featured image from Shutterstock

Investors moved the highest amount of BTC to exchanges since March, IntoTheBlock noted, signaling profit-taking after bitcoin’s first eight-week streak of gains since 2017.

Jason Pizzino, a seasoned macro investor and swing trader, has recently put forward his analysis indicating a potential pullback for Bitcoin.

His observations, informed by a deep understanding of market dynamics, suggest that Bitcoin’s prolonged rally could soon give way to further correction.

Pizzino’s analysis is grounded in a comprehensive review of various market indicators. The analyst has been closely monitoring the altcoin sector, noting an accumulation of upside potential which could lead to impactful market movements, especially with the upcoming Bitcoin halving in view.

This anticipation of a shift in market sentiment is further supported by his examination of the US Dollar Index Futures chart, which shows a downward trend and recent significant drops in a single trading day.

Pizzino interprets these movements as indicators of further downside, influenced by the general macroeconomic conditions.

While Bitcoin braces for potential setbacks, Pizzino’s analysis reveals a silver lining for the broader cryptocurrency market, particularly altcoins. His study of the Total3 chart, excluding Bitcoin and Ethereum, shows a latent potential for growth in the altcoin sector.

This observation aligns with the cyclic nature of the crypto market, characterized by alternating periods of fear and greed. According to Pizzino, the market is currently experiencing one of its lengthiest stretch of positive sentiment, a trend he expects to shift in alignment with historical market behaviors.

In parallel, another prominent crypto analyst, Ali Charts, has identified a critical support zone for Bitcoin. Between $37,150 and $38,360, a substantial number of Bitcoin transactions have occurred, with roughly 1.52 million addresses purchasing around 534,000 BTC.

In case of a deeper correction, #Bitcoin finds solid support between $37,150 and $38,360. This zone is backed by 1.52 million addresses holding 534,000 $BTC.

Also, watch out for two resistance walls that could keep the #BTC uptrend at bay: one at $43,850 and another at $46,400. pic.twitter.com/NGm1XpMOLf

— Ali (@ali_charts) December 11, 2023

This significant level of accumulation has established a strong foundation, potentially curtailing any further decline in Bitcoin’s value below that level.

Despite the correction, Bitcoin has shown resilience in its recovery from recent dips. Although the asset is still down by 2.7% over the past week and nearly 1% in the past 24 hours, it has managed to surpass the $42,000 mark after previously falling below $41,000 on Tuesday.

However, a noticeable decline in Bitcoin’s daily trading volume, from $30 billion earlier this week to $13.6 billion, hints at a shift in investor focus towards the altcoin market. This aligns with Pizzino’s prediction and could be the harbinger of a new phase in the crypto market, where altcoins demonstrate significant rally alongside Bitcoin.

Featured image from Unsplash, Chart from TradingView

Bitcoin and select altcoins are witnessing profit-booking on rallies, increasing the likelihood of a short-term pullback.

Bitcoin bulls face a battle for support on multiple timeframes as BTC price action stays volatile.

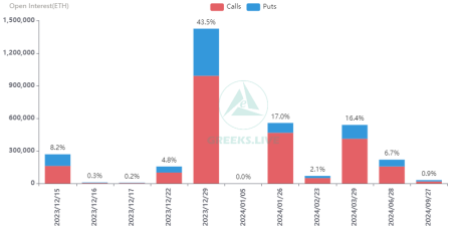

A recent report has revealed an upcoming significant event that will see the expiration of a notable amount of Bitcoin (BTC) and Ethereum (ETH) options contracts.

Global options trading service platform Greeks.live, took to X (formerly Twitter) to share data regarding the expiration of the crypto assets.

According to the platform, about 37,000 BTC options with a notional value of $1.58 billion are set to expire. In addition, Bitcoin’s current put-call ratio stands at 1.02 with a “Maxpain” point of $42,000.

Meanwhile, for Ethereum, the data shows that about 268,000 options valued at $610 million are set to expire soon. In addition, the current put-call ratio for ETH stand at 0.66, with a “maxpain” point of $2,250. The post read:

Dec. 15 Options Data. 37,000 BTC options are about to expire with a Put Call Ratio of 1.02, a Maxpain point of $42,000, and a notional value of $1.58 billion. 268,000 ETH options are due to expire with a Put Call Ratio of 0.66, a Maxpain point of $2,250, and a notional value of $610 million.

Notably, the put-call ratio, to put it simply, contrasts the trading volume of put and call options. A ratio higher than 1 signifies a higher number of puts (sell) than calls (buy) options, implying a negative outlook among traders.

Furthermore, the price at which the highest number of options would expire worthless is known as the maximum pain (Maxpain) point.

Greeks.live asserted that this week saw a decline in the market, with BTC dropping close to $40,000 at one point. As a result, many hedge their positions, which led to a greater proportion of Put than Call positions this week. The bulk of trading is still concentrated on Bitcoin options even with the decline.

The platform also highlighted that the Implied Volatility (IV) has remained quite flat for about a month now. In addition, significant option moves are still going on.

Cryptocurrency analyst Ali has recently revealed that billions of inflow are set to be poured into Bitcoin and Ethereum. The analyst shared this crucial information with the crypto community in an X post on Thursday, December 14.

According to Ali, over $19.7 billion is about to flow into the two major players in the cryptocurrency market. He also added that this capital inflow is comparable to what we observed in December 2020.

The X post was accompanied by a chart showing a virtual explanation of a similar scenario. Ali further highlighted that after the scenario, the price of BTC moved from $18,000 to $65,000.

With billions of dollars flooding into the two major crypto, the market might be poised for further profits.

The latest price moves in bitcoin [BTC] and crypto markets in context for Dec. 15, 2023. First Mover is CoinDesk’s daily newsletter that contextualizes the latest actions in the crypto markets.

Iris Energy will receive mining hardware orders from Bitmain in the first six months of 2024, taking its operational mining capacity above 10 EH/s.

Iris Energy will receive mining hardware orders from Bitmain in the first six months of 2024, taking its operational mining capacity above 10 EH/s.

Iris Energy will receive mining hardware orders from Bitmain in the first six months of 2024, taking its operational mining capacity above 10 EH/s.

Resolving recent systemic failures in the cryptocurrency ecosystem and the prospect of spot Bitcoin ETF approvals could drive Bitcoin to $100,000 in 2024.

Resolving recent systemic failures in the cryptocurrency ecosystem and the prospect of spot Bitcoin ETF approvals could drive Bitcoin to $100,000 in 2024.

Bitcoin miners’ revenue has reached all-time highs in part due to increased on-chain fees.

Bitcoin miners’ revenue has reached all-time highs in part due to increased on-chain fees.

A crypto analyst who correctly predicted that Bitcoin would hit the heights it is currently enjoying has once again given projections as to Bitcoin’s future trajectory. As part of his predictions, he highlighted the best and worst-case scenarios for the flagship cryptocurrency going forward.

In a live stream on his TechnicalRoundup YouTube channel, crypto analyst DonAlt noted that Bitcoin could rise to the resistance level of $60,000 based on historical patterns. The analyst had highlighted a bullish setup on the quarter timeframe, which had occurred both in 2018 and 2021. He also mentioned that the current quarterly is strikingly similar to those periods.

The analyst believes that the road to $60,000 would be fuelled by the Spot Bitcoin ETF rumors (as has been the case so far) before an approval possibly comes in January. However, it is not all good news from the $60,000 price level, as DonAlt believes that the approval will be a ‘sell-the-news’ event.

If that were to be the case, he predicts that Bitcoin will drop to $35,000 before it trends upward afterward. He also provided a bearish side to the quarterly timeframe setup as he suggested that this is more likely to happen as it is more “accurate.” For the bearish setup, he projects a close below the resistance level of $35,000.

He stated that this would suggest a bearish restest and that investors could expect lower prices as a result of this.

DonAlt further elaborated on his stance of a possible Spot Bitcoin ETF approval in January being a ‘sell-the-news’ event. He explained that the reason for this belief is because Bitcoin has ridden high (up about 3x from the bottom) on the back of these rumors. As such, this would naturally suggest that it is already priced in.

He further noted that he would have had a different opinion if Bitcoin had, for example, traded at around $25,000 and then an approval came. He believes that would have been an easy trade as the flagship cryptocurrency will undoubtedly fly high on the back of such development.

Renowned Economist Peter Schiff shares similar sentiments as he once noted how Bitcoin has rallied significantly on the back of the ETF rumor. According to him, there will be no more “good news” to spark a Bitcoin rally once the pending Spot Bitcoin ETFs are approved.

However, trading firm QCP Capital recently highlighted what could prevent this from happening. The firm stated that a significant amount of inflows into these ETFs in the first few weeks of trading could prevent the classic sell-the-news event from happening. If these funds see enough liquidity, they project that Bitcoin could hit its all-time high (ATH) of $69,000 instead.

A crypto analyst who correctly predicted that Bitcoin would hit the heights it is currently enjoying has once again given projections as to Bitcoin’s future trajectory. As part of his predictions, he highlighted the best and worst-case scenarios for the flagship cryptocurrency going forward.

In a live stream on his TechnicalRoundup YouTube channel, crypto analyst DonAlt noted that Bitcoin could rise to the resistance level of $60,000 based on historical patterns. The analyst had highlighted a bullish setup on the quarter timeframe, which had occurred both in 2018 and 2021. He also mentioned that the current quarterly is strikingly similar to those periods.

The analyst believes that the road to $60,000 would be fuelled by the Spot Bitcoin ETF rumors (as has been the case so far) before an approval possibly comes in January. However, it is not all good news from the $60,000 price level, as DonAlt believes that the approval will be a ‘sell-the-news’ event.

If that were to be the case, he predicts that Bitcoin will drop to $35,000 before it trends upward afterward. He also provided a bearish side to the quarterly timeframe setup as he suggested that this is more likely to happen as it is more “accurate.” For the bearish setup, he projects a close below the resistance level of $35,000.

He stated that this would suggest a bearish restest and that investors could expect lower prices as a result of this.

DonAlt further elaborated on his stance of a possible Spot Bitcoin ETF approval in January being a ‘sell-the-news’ event. He explained that the reason for this belief is because Bitcoin has ridden high (up about 3x from the bottom) on the back of these rumors. As such, this would naturally suggest that it is already priced in.

He further noted that he would have had a different opinion if Bitcoin had, for example, traded at around $25,000 and then an approval came. He believes that would have been an easy trade as the flagship cryptocurrency will undoubtedly fly high on the back of such development.

Renowned Economist Peter Schiff shares similar sentiments as he once noted how Bitcoin has rallied significantly on the back of the ETF rumor. According to him, there will be no more “good news” to spark a Bitcoin rally once the pending Spot Bitcoin ETFs are approved.

However, trading firm QCP Capital recently highlighted what could prevent this from happening. The firm stated that a significant amount of inflows into these ETFs in the first few weeks of trading could prevent the classic sell-the-news event from happening. If these funds see enough liquidity, they project that Bitcoin could hit its all-time high (ATH) of $69,000 instead.

A crypto analyst who correctly predicted that Bitcoin would hit the heights it is currently enjoying has once again given projections as to Bitcoin’s future trajectory. As part of his predictions, he highlighted the best and worst-case scenarios for the flagship cryptocurrency going forward.

In a live stream on his TechnicalRoundup YouTube channel, crypto analyst DonAlt noted that Bitcoin could rise to the resistance level of $60,000 based on historical patterns. The analyst had highlighted a bullish setup on the quarter timeframe, which had occurred both in 2018 and 2021. He also mentioned that the current quarterly is strikingly similar to those periods.

The analyst believes that the road to $60,000 would be fuelled by the Spot Bitcoin ETF rumors (as has been the case so far) before an approval possibly comes in January. However, it is not all good news from the $60,000 price level, as DonAlt believes that the approval will be a ‘sell-the-news’ event.

If that were to be the case, he predicts that Bitcoin will drop to $35,000 before it trends upward afterward. He also provided a bearish side to the quarterly timeframe setup as he suggested that this is more likely to happen as it is more “accurate.” For the bearish setup, he projects a close below the resistance level of $35,000.

He stated that this would suggest a bearish restest and that investors could expect lower prices as a result of this.

DonAlt further elaborated on his stance of a possible Spot Bitcoin ETF approval in January being a ‘sell-the-news’ event. He explained that the reason for this belief is because Bitcoin has ridden high (up about 3x from the bottom) on the back of these rumors. As such, this would naturally suggest that it is already priced in.

He further noted that he would have had a different opinion if Bitcoin had, for example, traded at around $25,000 and then an approval came. He believes that would have been an easy trade as the flagship cryptocurrency will undoubtedly fly high on the back of such development.

Renowned Economist Peter Schiff shares similar sentiments as he once noted how Bitcoin has rallied significantly on the back of the ETF rumor. According to him, there will be no more “good news” to spark a Bitcoin rally once the pending Spot Bitcoin ETFs are approved.

However, trading firm QCP Capital recently highlighted what could prevent this from happening. The firm stated that a significant amount of inflows into these ETFs in the first few weeks of trading could prevent the classic sell-the-news event from happening. If these funds see enough liquidity, they project that Bitcoin could hit its all-time high (ATH) of $69,000 instead.