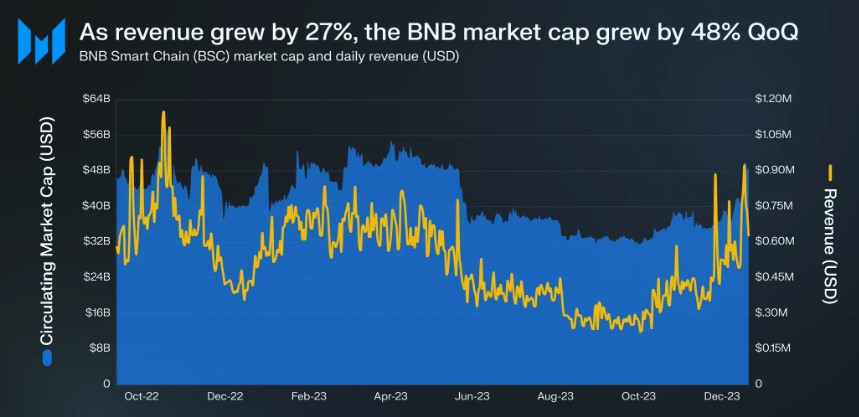

The captivating Binance Smart Chain (BSC) Network has morphed into a powerful force within the blockchain ecosystem, offering various benefits and opportunities for users and developers alike. Introduced by Binance, a top player in the global cryptocurrency exchange realm, BSC provides a robust and efficient infrastructure for decentralized applications (dApps) and digital asset transactions.

The key advantage of the BSC network is its high-speed and low-cost transactions. With its standout consensus mechanism, BSC achieves fast block confirmations, enabling quick and seamless transfers of digital assets. This scalability advantage makes BSC an attractive choice for users who value speed and efficiency in their transactions.

Advantages Of The Binance Smart Chain (BSC) Network

The Binance Smart Chain (BSC) offers several advantages that have contributed to its popularity and growth within the blockchain ecosystem. Here are some key advantages of the BSC network:

High Speed and Low Transaction Fees: BSC is known for its fast block confirmations, which result in quick transaction processing times. This speed is achieved through its unique consensus mechanism. Additionally, BSC’s low transaction fees have made it a preferred platform for developers and users.

Compared to other popular blockchain networks, BSC offers significantly lower transaction costs, making it more accessible for individuals and businesses of all sizes. This cost-effective system has aided the exponential growth of decentralized finance (DeFi) applications on the BSC network by providing a wide range of financial services to users around the world.

Scalability: BSC has been designed to handle high transaction volumes, allowing for the smooth and efficient execution of decentralized applications (dApps). This advantage enables BSC to accommodate the growing demands of users and developers without compromising performance.

Compatibility with Ethereum: The compatibility of BSC with the Ethereum Virtual Machine (EVM) has made it easy for developers to port their existing Ethereum-based projects to BSC, expanding the pool of available applications.

This opens up a world of possibilities, as it expands the range of applications available on BSC, offering users a greater selection of innovative and diverse decentralized applications to choose from. This interoperability has fostered innovation and attracted a diverse range of projects, including decentralized exchanges, yield farming platforms, and NFT marketplaces.

The close integration between BSC and the Binance exchange also creates a host of advantages for users. The seamless connection between these two platforms facilitates effortless token swaps and transfers.

Related Reading: Celestia Network: How To Stake TIA And Position For 5-Figure Airdrops

This integration enhances overall liquidity, ensuring that users have quick and convenient access to a diverse range of digital assets. Whether it’s trading, diversifying portfolios, or exploring new investment opportunities, the close relationship between BSC and Binance empowers users with a seamless and detailed experience in the world of digital assets.

Trading On The BSC Network

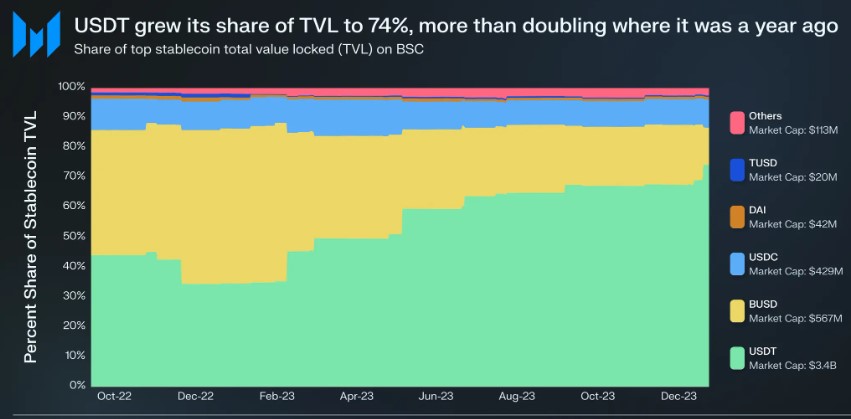

Decentralized exchanges (DEXs) on the Binance Smart Chain (BSC) network provide traders with a range of features and opportunities to enhance their trading experience. Here’s an elaboration on the features of DEXs on BSC:

Automated Market Makers (AMM): DEXs on BSC leverage AMM protocols to enable token swaps. AMM algorithms automatically set token prices based on supply and demand dynamics within liquidity pools. This feature eliminates the need for traditional order books and enables continuous liquidity, allowing traders to execute swift and efficient trades.

Yield Farming: Yield farming is a popular practice in the decentralized finance (DeFi) space, and many BSC DEXs offer yield farming opportunities where traders provide liquidity to specific token pairs by depositing their assets into smart contract-based liquidity pools. In return, they receive liquidity provider (LP) tokens, which represent their share of the pool.

Traders can then stake these LP tokens in yield farming programs to earn additional tokens or rewards. Yield farming enables traders to earn passive income by utilizing their idle assets effectively.

Liquidity Pools: These are fundamental components of DEXs on BSC which consist of pairs of tokens that are used for trading. Traders can contribute their assets to these pools and become liquidity providers.

By providing liquidity, traders help ensure that there is sufficient liquidity available for trading. In return for their contribution, liquidity providers earn a portion of the trading fees generated by the DEX. This incentivizes traders to provide liquidity, as they can earn fees from the trading activity in the pool.

Token Trading: DEXs on BSC offer traders the ability to trade a wide range of tokens. These tokens can include native tokens of projects built on the BSC network, as well as tokens that have been bridged from other blockchains, including Ethereum.

Traders have access to various trading pairs, allowing them to buy and sell tokens directly from their wallets. The availability of diverse tokens and trading pairs provides traders with abundant opportunities to explore various markets and investment opportunities.

Additionally, the Binance Smart Chain (BSC) is a modified Ethereum fork which simply means that it is compatible with the Ethereum network. Both of these blockchain networks have similar infrastructure, which is why they have the same address in your wallet.

This is to ensure that your funds are not permanently lost when you send them via the wrong network. Simply put, if you send a token to your ETH via the BSC network, the funds will still be on the blockchain and you’ll be able to retrieve them.

How To Get Started On The BSC Network

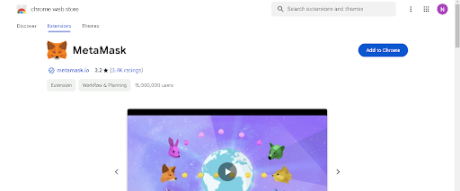

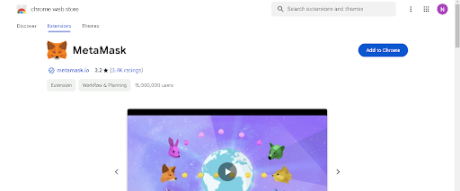

To buy and sell tokens on the Binance Smart Chain (BSC) network, you will first need to get a Metamask wallet and fund it with BNB tokens. MetaMask is a popular browser extension wallet commonly used for interacting with blockchain networks like Ethereum and Binance Smart Chain (BSC). It is available as a browser extension for popular browsers such as Google Chrome.

Ensure your Metamask Wallet has been added to your browser as an extension by clicking on the “Add to Chrome” icon on the top right as shown below:

Once installed and set up, MetaMask allows users to manage their cryptocurrency wallets, interact with decentralized applications (DApps), and securely execute transactions on supported blockchain networks directly from their browsers. (Make sure to write down your seed phrase on a piece of paper and keep it safe. Do not store it online).

Next, add the BSC network to your Metamask wallet by following the instructions provided on the Metemask website here.

Getting BNB Tokens To Trade On The BSC Network

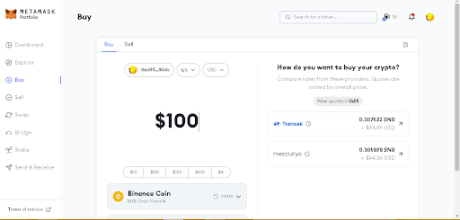

Once that is done, you need to fund your wallet with BNB before you can begin trading on the BSC network. You can buy BNB on centralized exchanges such as Binance, copy your wallet address from Metamask, and then send the BNB from Binance to your Metamask wallet.

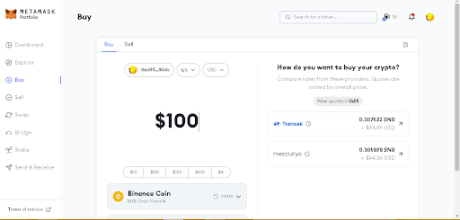

You can also purchase BNB directly within the Metamask wallet using traditional payment methods such as credit or debit cards, PayPal, bank transfer, CashApp, etc.

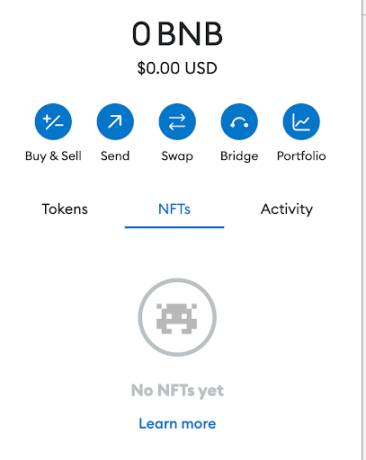

Just click on the “Buy/Sell” button within Metamask which will open up the interface. Here, you can put how much BNB you want to buy in terms of dollar terms, pick your payment method, and then click “Buy”.

Note that to buy crypto directly within Metamask, you will need to provide info such as your country and state. However, it is a straightforward process that only takes a minute.

It’ll only take a couple of minutes at most for your BNB to arrive in your wallet. Once the BNB arrives, you are all set to begin trading tokens on the BSC network. So head over to Pancakeswap to get started on your trading journey.

How To Trade Tokens On The BSC Network Using PancakeSwap

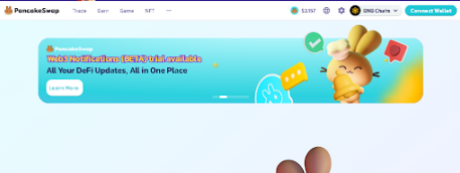

PancakeSwap is the leading decentralized exchange on the BSC network. Here, users are able to buy and sell a large range of tokens, and it is a straightforward process.

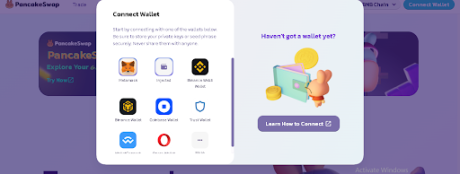

Make sure you are on the correct Pancakeswap website to prevent your wallet from being drained. The next step is clicking on the “Connect Wallet” option on Pancakeswap at the top right corner as illustrated below:

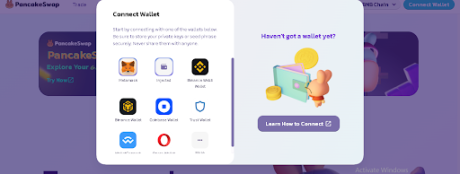

Connect to your preferred wallet as shown below. (In this case, it’s Metamask):

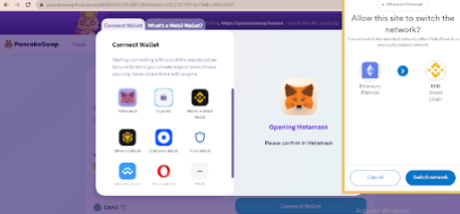

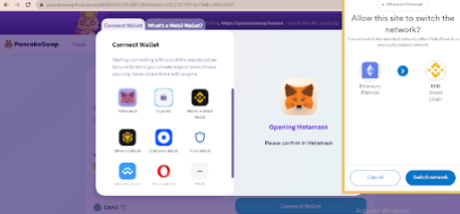

Once connected, switch Metamask to the BSC network. (If you’re already on the BSC network, you do not need to switch):

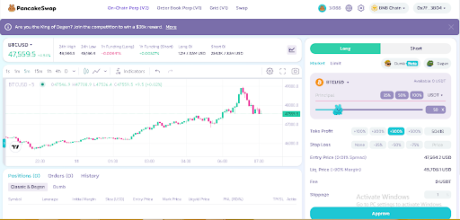

With MetaMask connected to the BSC network, go to PancakeSwap, then you can start trading on the BSC network using PancakeSwap. Search for the token you want to purchase using the name or the contract address.

Set slippage to auto to avoid having to manually set it with each swap. Once done, pick how much BNB (at the top) you want to convert to the new token (at the bottom), click on “Swap,” and confirm the transaction in your Metamask wallet.

Once the transaction is confirmed, the tokens will be sent to your wallet. To convert your tokens back into BNB, repeat this process by putting the new token at the top and picking BNB at the bottom. Click Swap and BNB will be sent to your wallet.

Buying And Selling Tokens With The Metamask Wallet

BSC Network users can also buy and sell tokens using the Metamask extension wallet already connected to the BSC network.

To do this, make sure you’re connected to the BSC network and have BNB to swap and pay for gas fees. Then navigate to the “Swap” button as shown below. This will take you to the Swap interface inside Metamask.

Here, you can also search for tokens using the name or the contract address, just like on Pancakeswap. Input the amount of BNB you want to swap, confirm that you have the correct token, and then click “Swap.” Once the transaction is confirmed, the tokens you just bought will be sent to your wallet.

Tracking Token Prices On The BSC Network

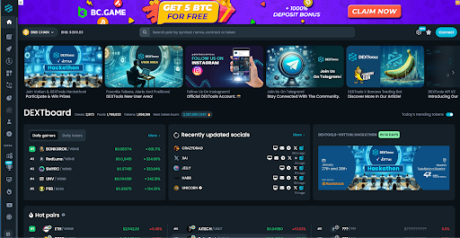

BSC network users can leverage on-chain tools such as Dextools to access detailed market insights about a particular token such as price and contract information to enable them to make informed trading decisions.

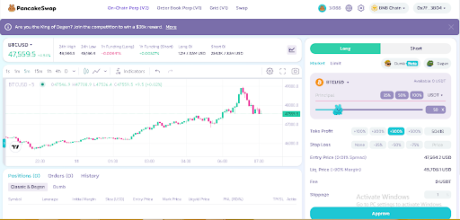

Dextools offers a range of features that are particularly beneficial for users on the BSC network. One notable feature is the ability to check charts, providing real-time and historical price data for various tokens. These charts enable users to analyze price trends, trading volumes, and other relevant metrics, helping them identify potential entry or exit points for their trades, as shown below:

In addition to charting capabilities, Dextools provides a “Contract Audit” feature that is especially valuable for BSC users. This feature allows users to check the audit score of a smart contract before investing in a token. Audits assess the security and reliability of a contract’s code, highlighting potential vulnerabilities or risks.

By accessing the audit score through Dextools, users can evaluate the level of trustworthiness and credibility of a token’s underlying smart contract, minimizing the chances of falling victim to scams or vulnerabilities.

Conclusion

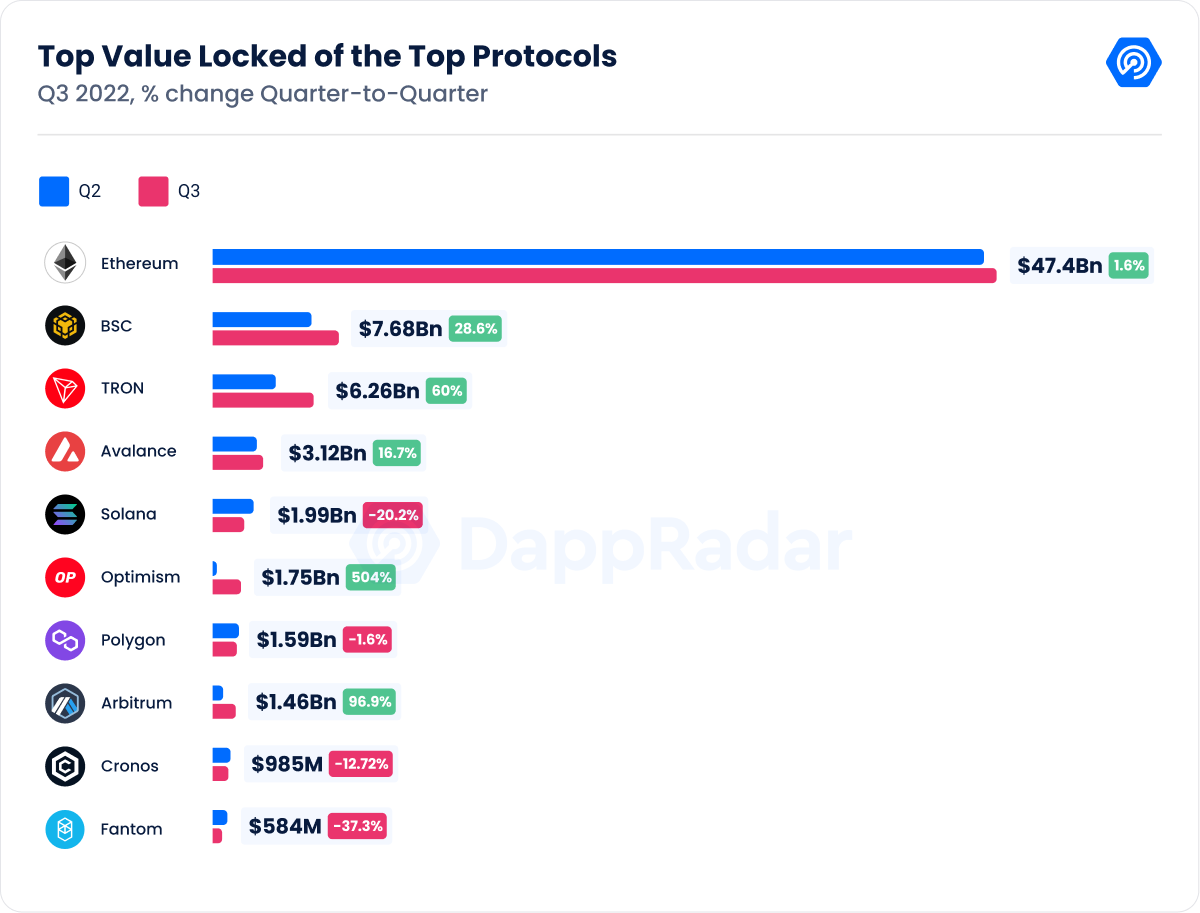

The BSC network has become popular within the blockchain ecosystem due to its advantages and has attracted a diverse range of projects and users. BSC’s compatibility with Ethereum facilitates seamless token transfers between the two networks, enhances diversification of development and usage, and promotes collaboration within the broader blockchain ecosystem.

Additionally, it offers interoperability, allowing developers to easily port existing Ethereum-based applications and assets to BSC. This compatibility grants access to the extensive Ethereum ecosystem, enabling users to leverage the infrastructure and liquidity of Ethereum while benefiting from BSC’s faster transactions and lower fees.

BSC’s combination of interoperability, accessibility to liquidity, and enhanced transaction efficiency makes the BSC network a compelling choice for both developers and users, solidifying its position as a prominent player in the evolving blockchain landscape.