As reported last week, the burn removes 2% of the tokens from the circulating supply.

Uniswap founder burns $650B HayCoin against speculation

Uniswap’s Hayden Adams burned 99% of the HayCoin (HAY) supply on Oct. 20 over concerns about price speculation.

Flare Network Will Burn 2.1B FLR to Support Ecosystem Health

Some 198 million FLR will be burned immediately with a further 66 million set to be burned monthly until January 2026.

Shiba Inu Community Burn Sees Another 350 Million Meme Coins Incinerated

The world of digital currency has brought some challenges to the Shiba Inu (SHIB) ecosystem. The ups and downs in this digital money landscape have caused the value of many coins connected to SHIB to drop, making things a bit shaky. But here’s something good: the SHIB token burn is happening faster than before.

This means they’re getting rid of more tokens, which is a positive thing. It’s like a bright spot in the midst of all these changes, showing that there’s something strong and good still happening in the SHIB world.

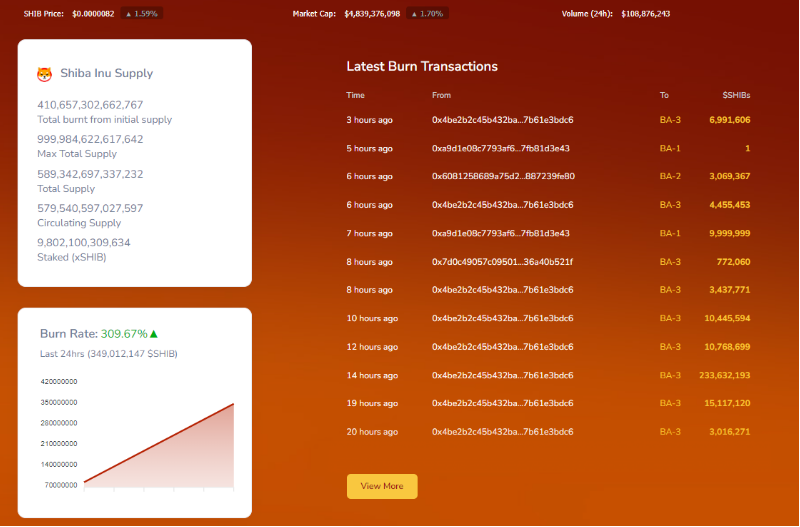

Based on the data provided by the Shibburn explorer, it is evident that the SHIB community has been effectively engaging in the process of burning substantial quantities of these meme coins, thereby transferring them to wallets that are rendered unspendable.

Shiba Inu: Optimism Amid Market Volatility

Even though the SHIB token has had some failures and its price has gone down, its burn rate has gone up by about 80% in the last 24 hours, according to Shibburn.

Today, the SHIB army has successfully facilitated the removal of around 350 million Shiba Inu meme coins, which were previously rendered inaccessible and excluded from circulation.

Last week, over 1.84 billion SHIB tokens were burned in approximately 255 transitions, according to Shibburn. This reduced the weekly SHIB consumption rate by 38.76%.

It took 19 transfers for the community to successfully remove 349,012,147 SHIB during the course of the last 24 hours. Burns frequently involved two or three SHIB pieces and occurred virtually hourly.

Increasing Scarcity And Value

Burning tokens, or reducing the supply of a cryptocurrency, is a common practice in the blockchain and crypto communities. As the number of coins in circulation increases, both their demand and value tend to decrease.

This activity is considered a deliberate method to increasing scarcity, which may lead to an increase in the value of the remaining tokens. This strategy is especially significant for Shiba Inu because of their abundant starting supply.

Meanwhile, as the Shibarium relaunch draws near, Lucie, a Shiba Inu team representative, has revealed some exciting news.

Lucie updates her followers on the status of Shibarium in a new tweet, letting them know that Shiba Inu Layer 2 is now operational and functioning well in private mode.

Exciting news from Shibarium (L2) update!

It’s officially live and running smoothly in private mode. The team just needs to make it public, and rest assured, all funds are safe!

Some people have already received their bridged $BONE #ShibariumUpdate #Shibarium pic.twitter.com/yk5L1ELMch

— 𝐋𝐔𝐂𝐈𝐄 | Summer of Shibarium (@LucieSHIB) August 24, 2023

The enormous flood of users forced Shibarium to suspend soon after its launch on August 16. The group got to work right away scaling its operations and starting network deep testing.

At the time of writing, SHIB was trading at $0.00000818, down 1.4% in the last 24 hours and sustaining a 3.8% loss in the last seven days, data from crypto market tracker Coingecko shows.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Gothamist

KIN Token Surges Over 20% After Vote to Burn 70% of Supply Passes

The token climbed on news that about 7 trillion KIN tokens worth $156 million will be burned.

Crypto Exchange OKX Burns $258M of OKB Tokens in Record Move

OKX periodically buys back and burns the tokens to gradually reduce their supply on the open market.

LUNC Burn Tax Set To Rise To 0.5% As KuCoin Proposal Receives Approval

After garnering the required votes, a major proposal has just passed in the KuCoin network. The proposal aimed at raising Terra Classic LUNC burns tax to 0.5%.

Following the positive results, KuCoin declared increasing the LUNC network burn rate from 0.2% to the proposed 0.5%.

LUNC Network Burn Tax Spikes On KuCoin

KuCoin took to Twitter to announce the increase in the burn tax. In its announcement, KuCoin stated that it would facilitate the Terra Classic LUNC and TerraClassicUSD (USTC) increase on its platform following the burn tax activation.

Notably, the activation will occur at the designated Terrra Classic block height of 12,902,399 and take effect on May 23.

Once activated, KuCoin will pay users more for transactions involving the two crypto assets, LUNC and USTC. Apart from the increased payments, the burn rate tax will reduce LUNC supply.

But there’s still a downside to the increased burn rate tax as it will reduce the trading volume. This is why many exchanges rejected such proposals in the past.

Notably, KuCoin has always supported such increases even when other exchanges delay. For instance, the exchange first supported a September 2022 Terra Classic burn tax of 1.2% even before the proposal passed.

Other exchanges, including Crypto.com, MEXC, and Binance, only later declared support for the burn tax.

But after the proposal passed, data implied that the increase reduced the trading volume for LUNC. Many investors stopped trading with the asset due to the spike in fees.

Following the outcome, the LUNC community voted to reduce the burn tax to 0.2%, attracting the support of crypto exchanges such as Binance.

After the reduction, the Terra Classic community brought up another proposal to increase the burn tax rate, but it wasn’t implemented.

Latest Burn Tax Increase Proposal, 3 Others Gain Massive Support

While other proposals to increase the burn tax after reducing it from 1.2% to 0.2% failed due to several debates and arguments, the latest one received massive support.

One of the reasons proposal 11515 passed was the conservative increase, which wouldn’t spike fees and discourage investors.

The proposal focused mainly on reducing the excess supply of LUNC tokens in the market to prevent oversaturation and its associated risks.

But, it is not the only proposal submitted to the LUNC community. An active member raised 3 other proposals, plus the burn tax increase to enhance economic policies on the network.

The three others aimed at augmenting demand by increasing staking rewards, whitelisting smart contracts to enhance chain utility and volume, and increasing community pool funding to bolster developer funding.

-Featured image from Pexels, chart from Tradingview

Ripple CTO Reveals Facts About Present XRP Burn Debate

The Chief Technology Officer (CTO) of Ripple, David Schwartz, has provided valuable information about the ongoing debate surrounding the burning of XRP tokens.

The debate about burning XRP tokens has been hot within the XRP community, and Schwartz’s insights shed light on the XRPL’s governance structure and the decentralized nature of the network.

The discussion primarily revolved around the authority and decision-making process concerning the XRP held in escrow and the role of validators on the XRP Ledger (XRPL).

Burn Debate Insight From Schwartz

Schwartz highlighted the importance of understanding the fundamental principles and mechanisms behind the XRPL. He explained that the XRPL operates on a consensus protocol where validators, distributed across the network, play a crucial role in maintaining the ledger’s integrity. And validators are responsible for verifying transactions and reaching a consensus on the XRPL.

Regarding the burning of XRP tokens, Schwartz emphasized that the XRPL’s design does not include a built-in mechanism for burning XRP.

The CTO also stated that changes to the XRPL’s code are governed by a decentralized process, ensuring that all participants have a voice in determining the network’s future.

So altering the XRPL’s code to incorporate such a feature would require extensive consensus and agreement from the majority of validators, around 80%.

One of the key points raised during the conversation was the claim made by an XRP community member, suggesting that the XRPL would become a permissioned network if validators had the power to determine the fate of the XRP in escrow.

This statement sparked a significant amount of discussion within the XRP community, as the decentralized nature of the XRPL has always been a critical aspect of its design.

Regarding that, Schwartz clarified that while validators play a crucial role in the XRPL’s consensus process, the network’s nodes can accept or decline amendments voted into effect by validators.

This system ensures that the power to influence the fate of the XRP held in escrow is not concentrated solely within the validators’ hands.

Instead, it allows for a decentralized decision-making process that considers the perspectives and interests of various participants.

XRP Price Dips In Recent Days

Amid the discussion in the community, the token’s price has experienced a minor decline in recent trading sessions. Over the past seven days, XRP’s price has seen a marginal decrease of 0.56%, indicating a relatively stable trend.

Within the past 24 hours, the coin has witnessed a slight downward movement, with a decline of 1.36%. This modest dip reflects the current volatility in the token market.

Related Reading: DOJ Crypto Task Force Goes After DeFi Hackers As Illicit Activity Soars

The coin is changing hands at $0.422, with a market cap and a 24-hour trading volume of $21,883,129,482 and $765,847,908, respectively.

Featured image from Pixabay and chart from Tradingview.com

NFT investor accidentally burns $135k CryptoPunk trying to borrow money

While going through the unfamiliar process of wrapping NFTs, Riley accidentally sent the asset to a burn address, permanently deleting the NFT from circulation.

Ethereum price at $1.4K was a bargain, and a rally toward $2K looks like the next step

ETH’s correlation with tech stocks, its increasing total value locked and its deflationary token economics all suggest that the path to $2,000 is programmed.

Alameda tried to redeem 3,000 wBTC days before bankruptcy: BitGo CEO

The CEO of Bitgo stated that the Alameda representative failed the security verification process required to convert wrapped-BTC into BTC.

Damien Hirst livestreams the burning of $10M in art for NFT project

“The Currency” is the name given to Hirst’s NFT project which examines the value of digital art versus physical art.

Terra Classic Notches 5% Spike In Last 24 Hours – Can LUNC Maintain Positive Momentum?

Terra Classic is showing some signs of life thanks to a system that is being implemented by leading cryptocurrency exchange platform, Binance.

- Binance burns another 3 billion LUNC, brings total of burned units to 17.9 billion

- LUNC briefly exhibits upward price rally, up by 5% in the past 24 hours at one point

- A 12% dip might bring Terra Classic price all the way to $0.00018

It can be recalled that on September 26, 2022, the company decided to burn all spot and margin trading fees on LUNC transactions by sending them to a specific wallet address.

This was Binance’s response to the proposal of the Terra Classic community to maintain good trading experience for its users.

Since then, around 17.9 billion LUNC tokens have been burned. The latest process initiated by the crypto exchange led to the destruction of 3 billion units of the crypto.

There was an apparent positive response to this development, as Terra Classic notches 5% spike in the last 24 hours. But can LUNC step up and gain more?

Not A Smooth Sailing For Terra Classic

It would appear the digital token failed to capitalize on what is now considered short-lived gain following another massive burning courtesy of Binance.

LUNC rice is now eyeing a 12% discount and investors are now wondering if they should buy the dip.

At press time, according to tracking from Coincodex, LUNC is changing hands at $0.000277 and is now down by 7.55% for the past 24-hours as it quickly relinquished its 5% spike earlier.

Source: TradingView

The recent Binance burn activity made buyers busy as they exerted effort in trying to rally the asset to continue its price recovery and close in on the $0.00036 resistance level.

Sellers, however, were quick to make their counter move by putting a lot of selling pressure. As a result, the LUNC coin once again exhibited bearish signals.

The crypto could be looking at a 12% drop all the way to the $0.000271-$0.00026 demand zone. Failure to hold this level would mean significant price slashing, putting the asset’s trading price to $0.00018.

LUNC’s Lingering Struggles

Over the past year, Terra Classic dealt with a lot of struggle. Aside from the given fact that it has been outperformed by heavyweights Bitcoin and Ethereum, it has also been outperformed by all of the top 100 crypto assets.

It has also lost 100% of its all-time high value of $119.01 that was attained on April 5 this year and is sitting on a yearly inflation rate that is 1,534,969.16%.

Its investors are currently pinning their hopes on the idea that LUNC is trading on Binance and is oversold and thus may rise soon.

However, if the current burning mechanism being implemented by the crypto exchange doesn’t successfully push the token’s price, investors might start to move away from it no matter how much discount there is.

LUNC market cap at $1.7 billion | Featured image from Criptokio, Chart: TradingView.com

Binance burns $1.8M in LUNC trading fees following community proposal

According to the crypto exchange, the burn was the equivalent of 1,863,213.47 USDT — roughly 5.5 million LUNC.

LUNC investors react to CZ’s 1.2% trading tax recommendation on Binance

Changpeng Zhao, the CEO of Binance, recommended a flat 1.2% trading tax on LUNC trades that could be burned to reduce the token’s total supply and improve its price performance.

Do Kwon shares LUNA burn address but warns ‘LUNAtics’ against using it

Upon a persistent request from the Terra community, Kwon went against his initial plan and publicly shared a burn address for LUNA on May 21.

Terra to burn $1.4B UST and stake 240M LUNA to ‘stop the bleeding’

The Terra Money Twitter account shared the finer points on Do Kwon’s initial rescue plan: expanding the base pool, burning UST and staking LUNA.

LUNA drops 20% in a day as whale dumps Terra’s UST stablecoin — selloff risks ahead?

Excessive Terra supply coupled with UST supply contraction coincides with LUNA’s price decline.

Shiba Inu has a new use case — Buying land in SHIB: The Metaverse

Memecoin Shiba Inu can officially be used to purchase land in the SHIB Metaverse using the native SHIB token, as the development team continues to provide utility for holders.

Binance introduces BNB Auto-Burn to replace quarterly burn protocol

BNB tokens will now be burned automatically based on a formula that includes blocks generated and BNB’s price.