The U.K. AI Safety Summit concluded its first day with a common declaration, the U.S. announcing an AI safety institute, China willing to communicate on AI safety and comments from Elon Musk.

Cryptocurrency Financial News

The U.K. AI Safety Summit concluded its first day with a common declaration, the U.S. announcing an AI safety institute, China willing to communicate on AI safety and comments from Elon Musk.

During the test, HSBC was connected to the blockchain platform developed by Ant Group and supported by Ant Group’s banking partners.

Project mBridge has put together a slick publication with lots of new information to let the world know what the hottest project in CBDC is.

Project mBridge has put together a slick publication with lots of new information to let the world know what the hottest project in CBDC is.

e-HKD Phase 1 trial was dedicated to full-fledged payments, programmable payments, offline payments, tokenized deposits, settlement of Web3 transactions and settlement of tokenized assets.

Luke Bryoles, a Bitcoin advocate who thinks the world’s most valuable network will save people’s energy, is bullish. On October 30, Bryoles said the coin could rally to $3 million, and all it needs is to be “100X from today.” For this reason, the crypto supporter thinks users engaging with the coin are “still early.”

The Bitcoin defender said the coin has “indescribable future value,” especially compared to other centralized finance (CeFi) market metrics like market capitalization. Bitcoin is changing hands at around 2023 highs, trading above the $34,500 level, with traders and coin holders expecting more gains.

The expansion of last week saw the coin extend gains, lifting higher above the $32,000 level recorded in July. Considering the associated trading volume and resulting activity following the BTC jump, more supporters expect another rally in the next few sessions.

Bitcoin is down 50% from the November 2021 peak, when prices surged to approximately $70,000. However, the coin has more than doubled after dropping to as low as $16,000 in November 2022. At spot rates, BTC has more than 100% from 2022 lows, emerging as “one of the top-performing assets.”

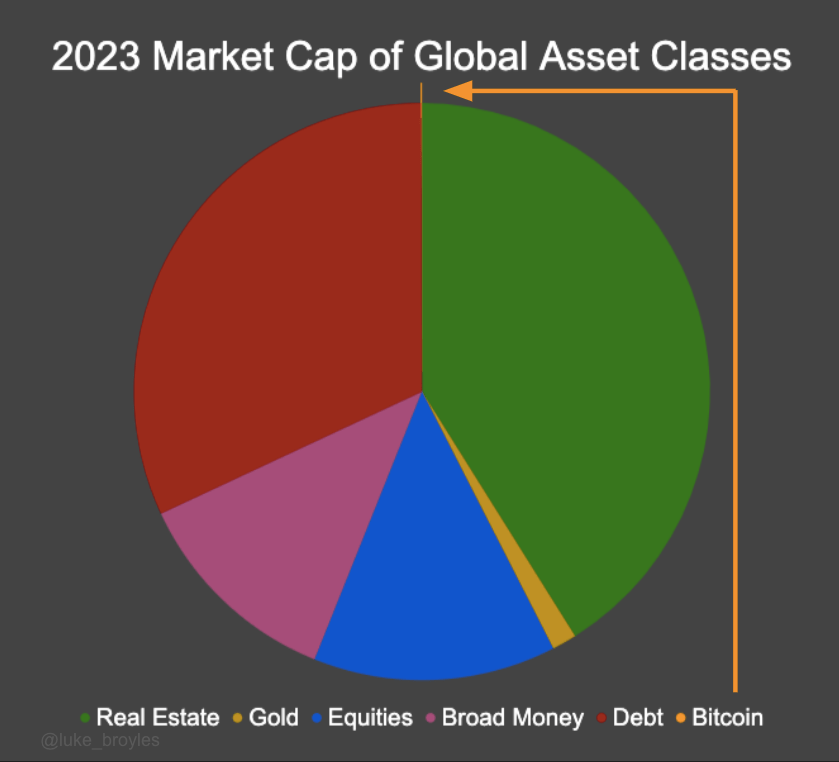

This stellar performance, Bryoles adds, is despite Bitcoin maintaining a market cap of around $500 billion in 2023 while remaining “TINY in comparison to the world’s largest asset classes,” most of which include debt, equities, and gold.

To support the hyperbolic prediction, the supporter pointed to the low Bitcoin adoption level of “0.05% and 0.5%.” An eventual increase to 10% means there will be 100X users, easily driving the coin to $3 million, though even this remains a “misleadingly pessimistic prediction,” according to Bryoles.

At this valuation, the analyst added that the coin’s market cap will be “unfathomable.” Even so, all that is required is “4% of the global adult population to demand 1 million sats to exhaust exchanges.”

Bitcoin remains the world’s most valuable crypto asset. At the same time, the United States Securities and Exchange Commission (SEC) might authorize the first spot Bitcoin Exchange-Traded Fund (ETF). Analysts expect this to drive prices towards the 2021 high at around $69,000.

Meanwhile, Federal Reserve’s Jerome Powell and SEC’s Gary Gensler think the coin is a “speculative asset.” These sentiments have also been shared by Senator Elizabeth Warren, who once said, “Bitcoin is a scam.”

When crypto mining is discussed in the U.S. Congress, it’s often tied to claims that mining operations are environmental parasites, sapping finite energy resources. But representatives of that sector flooded offices on Capitol Hill this week to argue their businesses can help stabilize the power grid, tie into renewable resources and foster domestic technology.

CBDC and de-dollarization saw major strides last week with the 1-million barrel deal on the Shanghai Petroleum and Natural Gas Exchange.

The confirmation comes as tensions between the United States and China continue to rise.

PetroChina bought 1 million barrels of crude oil settled in e-CNY at the Shanghai Petroleum and Natural Gas Exchange.

The summit scheduled for Nov. 1–2 will place significant emphasis on the potential existential threat that AI represents, a concern shared by several legislators.

China developers are active and willing to build on leading blockchain platforms if statistics from Solana Hyperdrive Hackathon submission details are anything to go by. In an X post on October 17, Matty Taylor, the Head of Growth at the Solana Foundation, said there were far more developers from China who submitted applications, willing to participate in the Solana Hyperdrive hackathon than from the United States.

The hackathon has a prize pool of $1 million, and all submissions had to be submitted by October 15. It is an online event aiming to “nurture and expand” the Solana ecosystem.

Developers from 68 countries submitted, with the highest numbers coming from China and Vietnam. The rest were mainly from the United States, India, Mexico, Turkey, and Germany.

That notable participation from Chinese developers can be a massive boost for Solana, indicating that the blockchain could be popular in the Asian economic powerhouse. China remains pro-blockchain and believes that the technology can give them an edge and even improve efficiency in some critical sectors, like agriculture, healthcare, governance, and finance, that the country seeks to enhance gradually.

However, China has banned crypto trading and mining, citing the “need to go green, protect consumers, and ensure financial stability.” The Chinese central bank, PBoC, said cryptocurrencies could pose a risk to the country’s financial system.

Unlike Ethereum, Solana permits fast transaction processing and is relatively scalable with decent activity. Although the project suffered following the collapse of FTX in November 2022, there has been a revival in price and on-chain activity.

To illustrate, non-fungible token (NFT) trading activity on Solana has steadily risen over the past few months. While there was a spike, the network didn’t halt, as in previous instances, especially in 2022.

Instead, the high reliability seems to have inspired activity, directly helping revive SOL prices that collapsed by over 90%, worsened by news that Sam Bankman-Fried and Alameda Research allegedly embezzled customer funds. FTX had invested in Solana and has a considerable share of SOL, which will be liquidated and reimbursed to impacted clients.

At spot rates, SOL is up 36% from September 2023 lows and overly firm. Looking at the candlestick arrangement in the daily chart, SOL is trading at October and 2023 highs and could break higher if bulls press on. The October 16 bull bar is wide-ranging, has marked trading volumes, and could anchor the next leg towards July 2023 highs of around $32.

The expanded export controls of AI semiconductor chips include a new performance threshold, licensing requirements expansions and a notification requirement, among others.

The Chinese megacorporation claims its newest model rivals OpenAI’s popular model in generating text, images, and video.

The new system, FPA-1200NZ2C, can produce semiconductors matching a 5nm process and scale down to 2nm, surpassing the capabilities of the A17 Pro chip found in Apple’s iPhone 15 Pro and Pro Max.

A crypto mining operation near a Microsoft facility that supported the Pentagon was reportedly under scrutiny by U.S. officials.

The draft regulations emphasize that data subject to censorship on the Chinese internet should not serve as training material for these models.

The additional restrictions being considered by the Biden administration would try to target ways Chinese developers could access U.S.-made AI semiconductor chips.

The government is incentivizing new residents to come develop payment solutions, smart contracts, hard wallets and promotions for the digital yuan.

The plaintiff, Mr. Ming, will have no judicial relief to recoup his 80,000 Tether loan after its borrower defaulted.